DIpil Das

Introduction

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on May 27. This report explores the trends we are seeing from week to week, following prior surveys on May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.Looking Beyond Lockdown

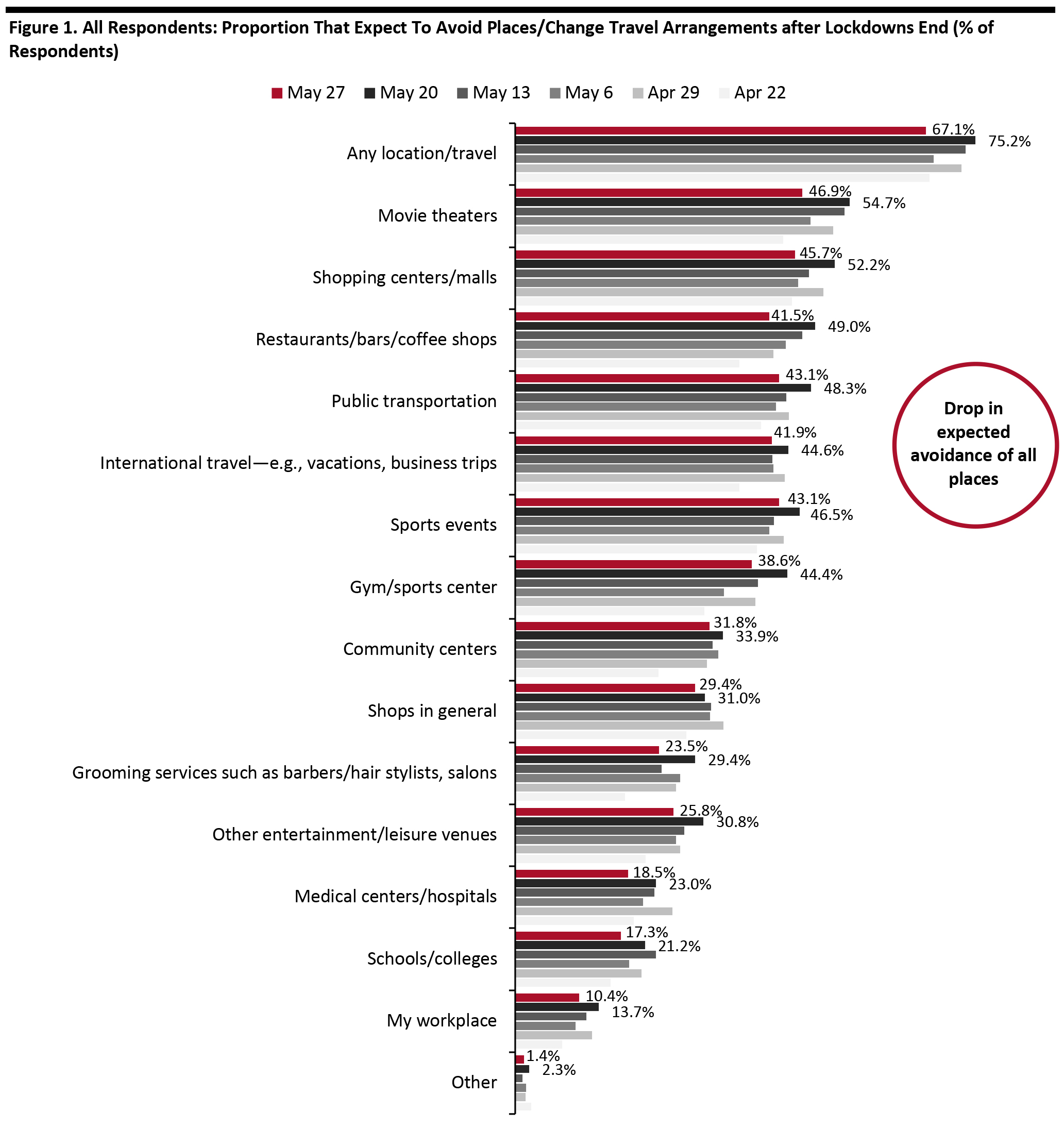

Consumers’ Expectation To Avoid Public Spaces Declines Consumers’ concern about returning to public places eased meaningfully in the past week: 67.1% of all respondents now anticipate avoiding some kind of public place or travel after lockdowns end, down from 75.2% last week. This week’s figure is the lowest proportion of respondents since we started asking the question.- We saw a decline of avoidance in all 14 options we provided. A notable change this week was in the expected avoidance of movie theaters, which saw a decrease of almost eight percentage points.

- Restaurants/bars/coffee shops saw a week-over-week reduction of 7.5 percentage points. This is aligned with our finding that dining in a restaurant is ranked among the top activities to do post lockdown (discussed below; see Figure 3).

- Shopping centers/malls saw a six-percentage-point decrease, week-over-week, which suggests a slight increase in consumers’ willingness to shop in brick-and-mortar stores after lockdown. Less than half of all consumers now expect to avoid shopping centers/malls.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

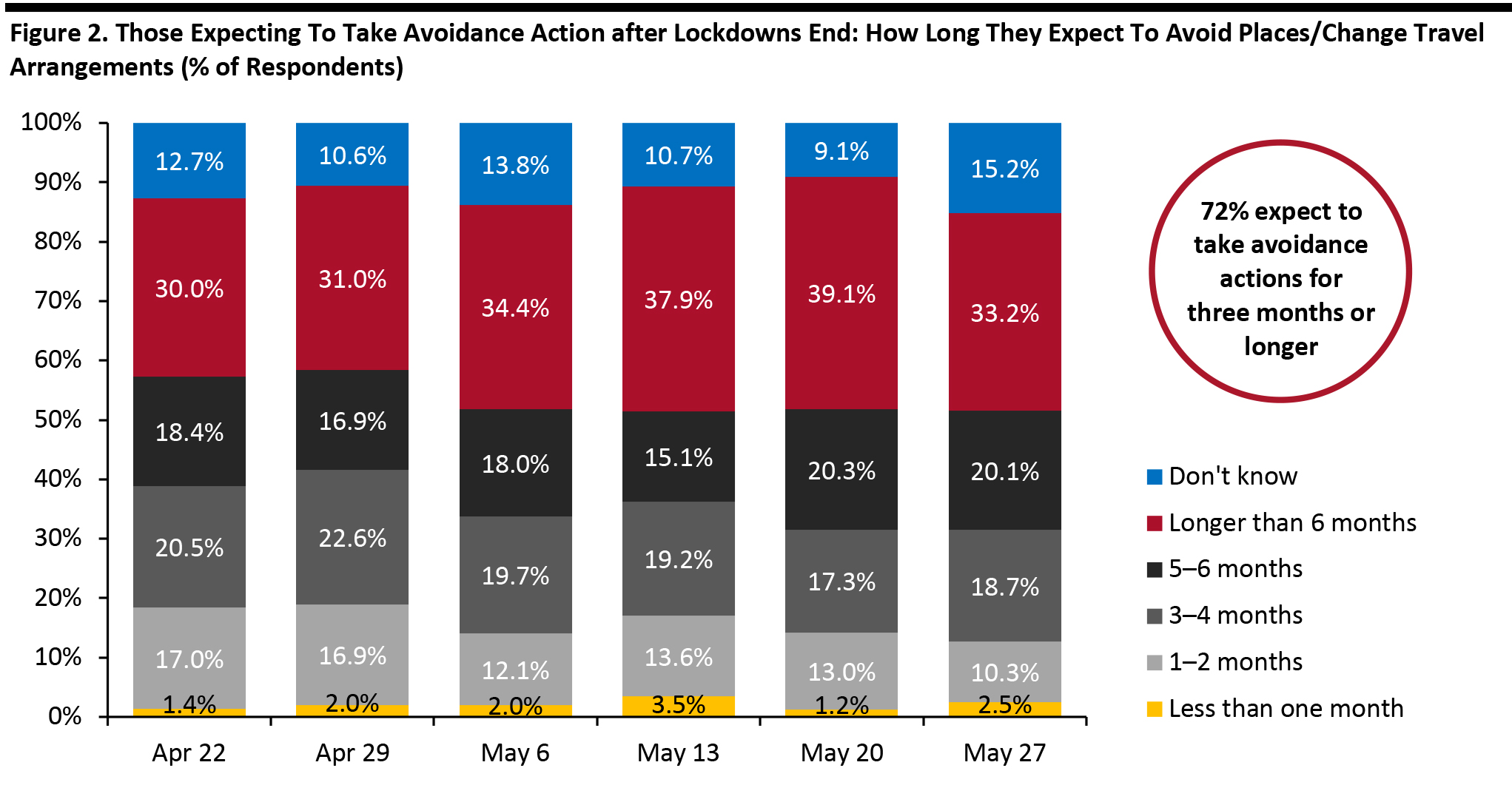

Source: Coresight Research [/caption] Expectation To Avoid Public Places for More Than Six Months Declines Similarly, we saw a positive (for retail) change in how long consumers expect to take avoidance action. Among those expecting to avoid public places or travel after lockdowns end, 33.2% expect to do so for more than six months—representing a decrease from 39.1% last week, after weeks of an upward trend. However, only a fraction of respondents think they will take avoidance action for less than one month, which aligns with the expected low rates of return to regular activities, shown earlier. A total of 72.1% of respondents expect to avoid places for three months or more, down from 76.7% last week. [caption id="attachment_110482" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end

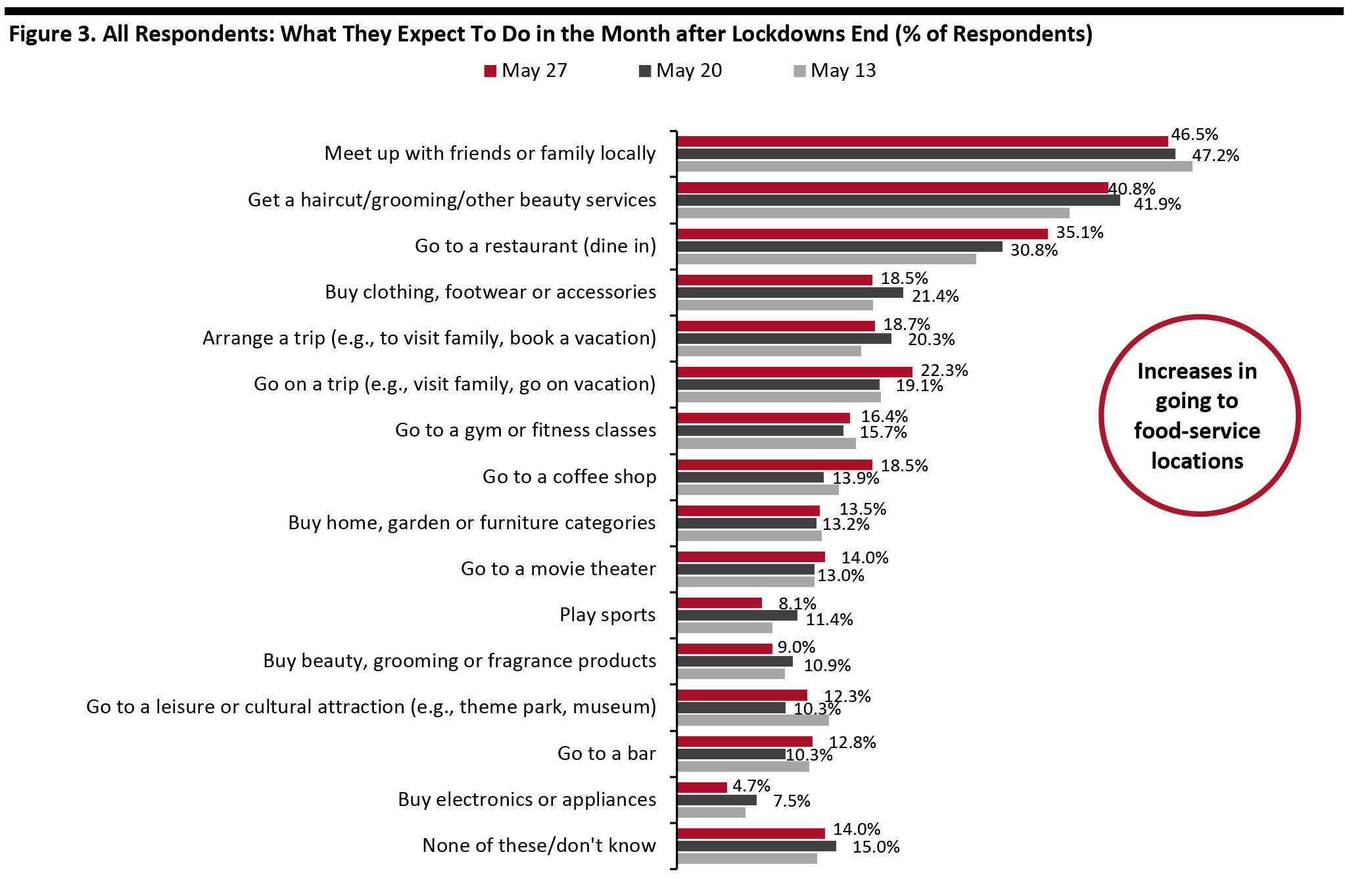

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end Source: Coresight Research [/caption] Expectation To Go to Food-Service Locations Increases This week, we saw mixed results in respondents expecting to take part in spending-related activities in the month after lockdowns end. We saw an uptick in the proportion of respondents expecting to go to food-service locations, albeit still within the margin of error. More than one-third expect to dine in a restaurant, compared to 30.8% last week, and almost one in five expect to go to a coffee shop, versus one in seven last week. The absolute percentages for almost all activities remain relatively low, despite around 86% of respondents overall saying that they would do at least one of these things in the month after lockdowns end. Of the 15 options we provided to respondents, almost half saw an uptick from last week, but all under five percentage points. [caption id="attachment_110441" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

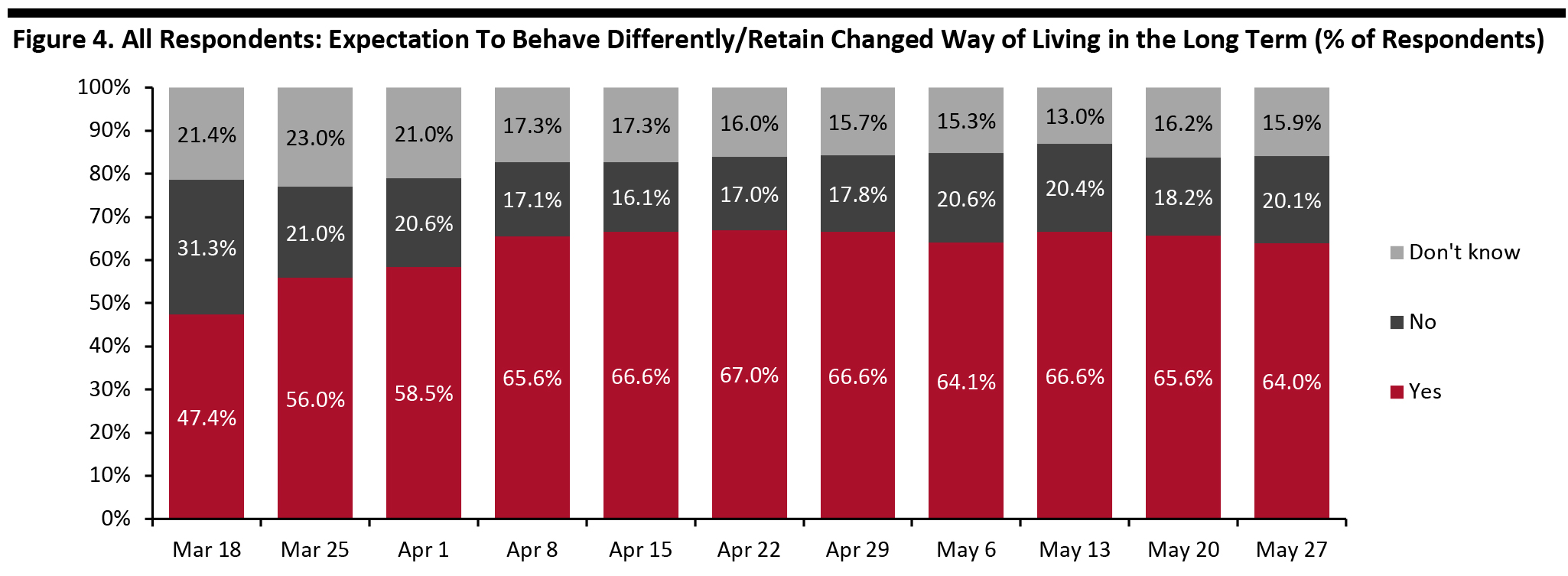

Source: Coresight Research [/caption] Two-Thirds Expect To Retain Changed Behaviors for the Long Term Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. In recent weeks, this metric has leveled off at around two-thirds of all consumers expecting to retain some behaviors over the long term. [caption id="attachment_110442" align="aligncenter" width="700"]

Base: US Internet users aged 18+

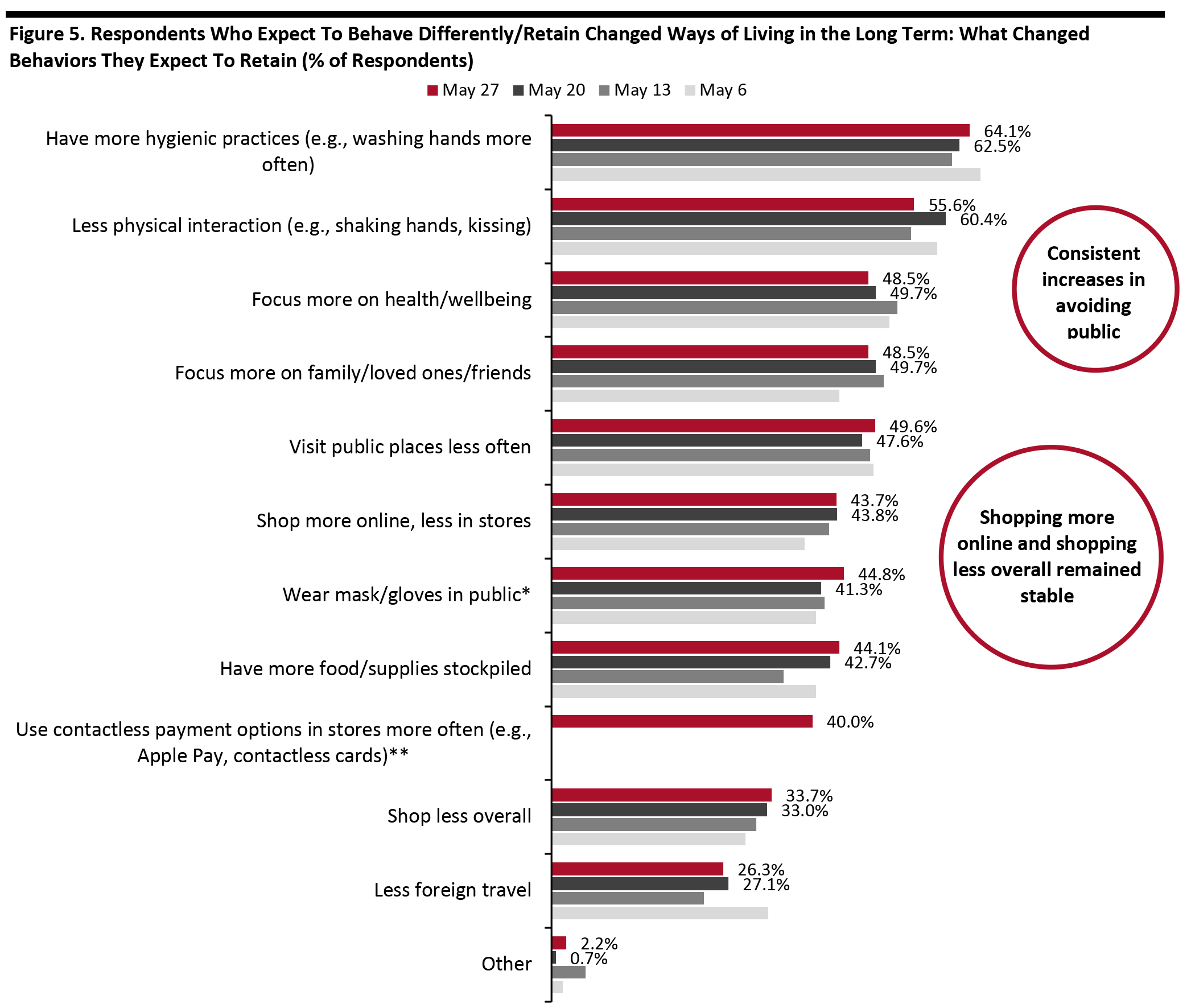

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those expecting to retain changed behaviors, we have seen near-consistent upward trends in the proportion of respondents visiting public places less often, which rose a little after easing last week. This week, we saw an easing in the proportion of respondents expecting to have less physical interaction, which fell to 55.6% versus 60.4% last week. Reflecting shifts to low-contact shopping, four in 10 respondents said that they would use contactless payment options in stores more often (an option newly provided this week). [caption id="attachment_110466" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options *Not provided as an option before May 6

**Not provided as an option before May 27

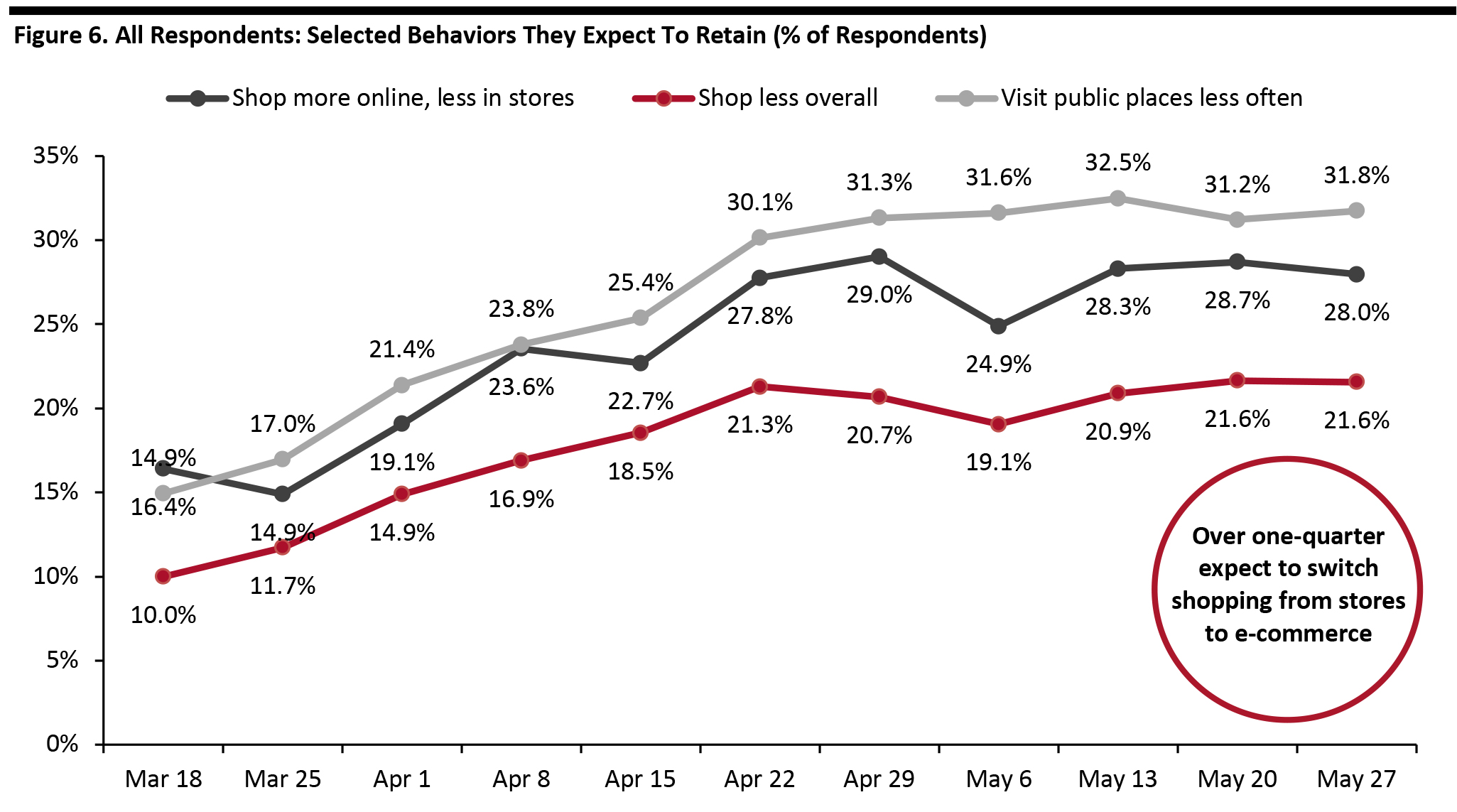

Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak Source: Coresight Research [/caption] In the chart below, we focus on trending data in three of the metrics charted above. We represent these as a proportion of all respondents, to represent consumers overall, rather than as a proportion of those expecting to retain changed behaviors (which is what is charted above). Rebased to all respondents, the overall upward trends are more distinct, though some have tended to level off in the past couple of weeks. This week, all three metrics remained relatively stable. Over one-fifth of respondents expect to shop less overall and almost three in 10 expect to switch shopping to e-commerce. [caption id="attachment_110467" align="aligncenter" width="700"]

Base: US Internet users aged 18+

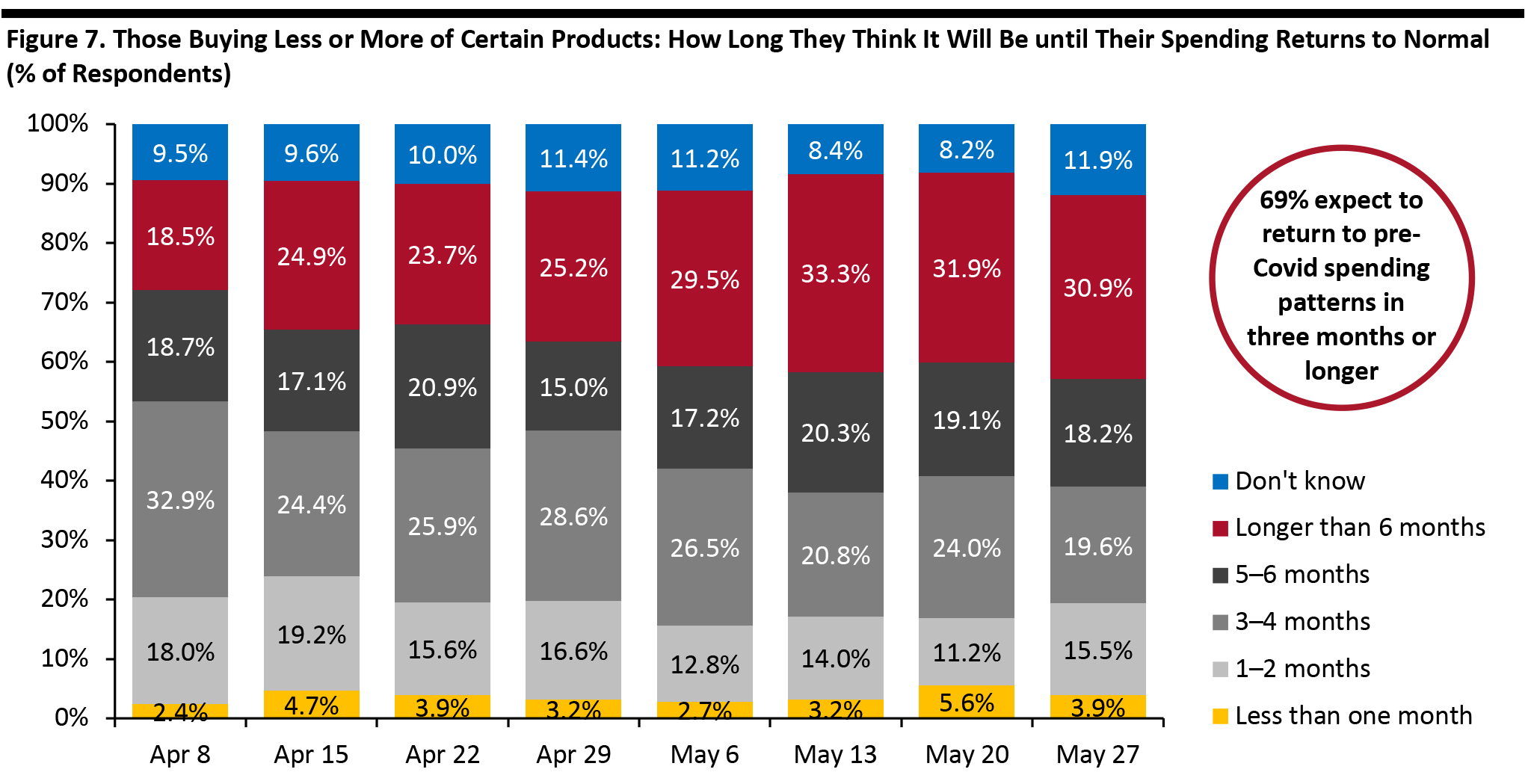

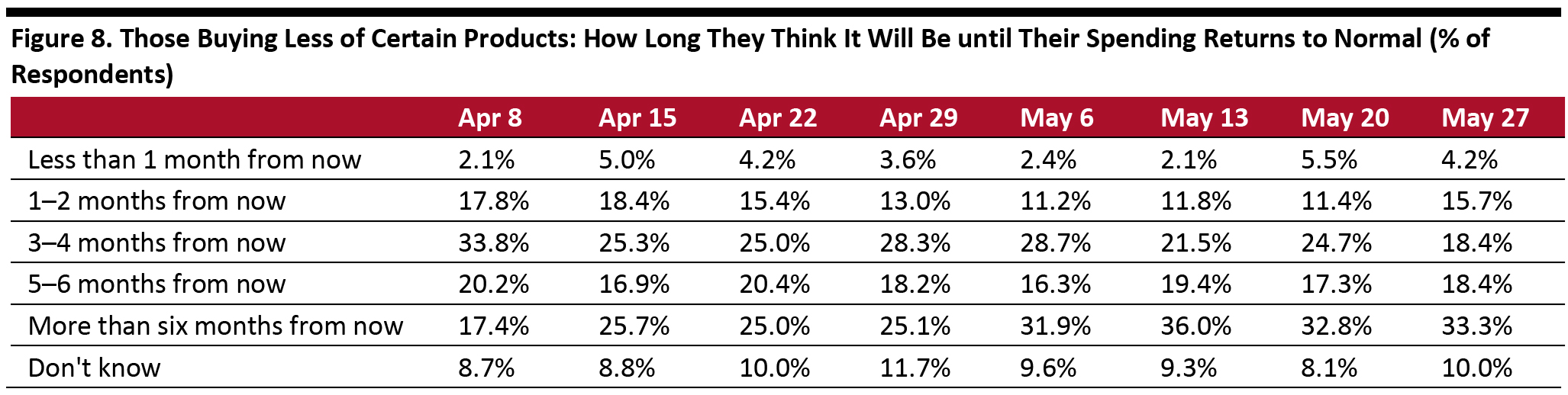

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Less Than One-Third Expect To Retain Changed Spending Patterns for More Than Six Months This week, in another positive sign for retail, we continue to witness a slight moderation in the proportion of respondents anticipating longer-term impacts on their spending. Among consumers who have changed their spending levels—by buying more or less of any categories—30.9% expect it to be more than six months from now before their spending patterns return to normal, versus 31.9% last week and 33.3% the week before that (although this change is within the margin of error). A six-month-plus window takes us up to the end of November at the earliest—into the holiday season. A total of 68.8% of respondents expect to keep their changed purchasing behaviors for three months or more, down from 75% last week. Focusing only on those making fewer purchases, 33.3% expect to return to pre-crisis spending patterns only in more than six months’ time, versus 32.8% last week and 36.0% the week before (Figure 8).

- We show what consumers are buying more of and less of in a separate section later in this report.

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak Source: Coresight Research [/caption] [caption id="attachment_110446" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak Totals may not sum due to rounding

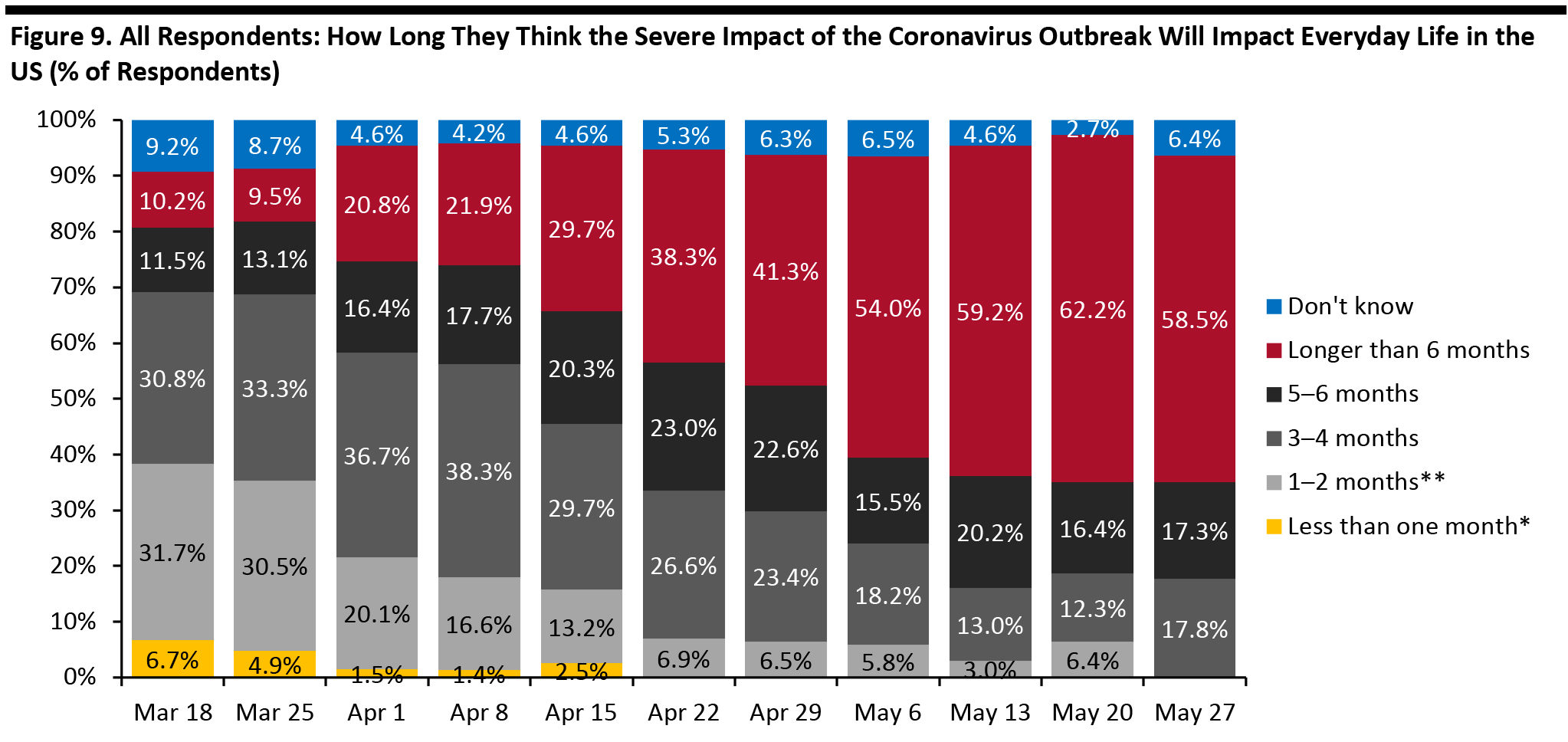

Source: Coresight Research [/caption] Almost Three-Fifths of Consumers Expect the Crisis To Last More Than Six Months Further hinting at a glimmer of optimism, this week, consumers’ expectations of the length of the crisis fell after weeks of continued growth. Some 58.5% now expect the severe impact of the outbreak to last more than six months from its start, compared to 62.2% last week. However, as we are now beyond two months since the crisis began, there was an uptick in the proportion of respondents expecting the severe impact to last three months or more—93.6% versus 90.9% last week. [caption id="attachment_110447" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ *Not provided as an option after April 15

**Not provided as an option after May 20

Source: Coresight Research [/caption]

Reviewing Trend Data in Purchasing Behavior

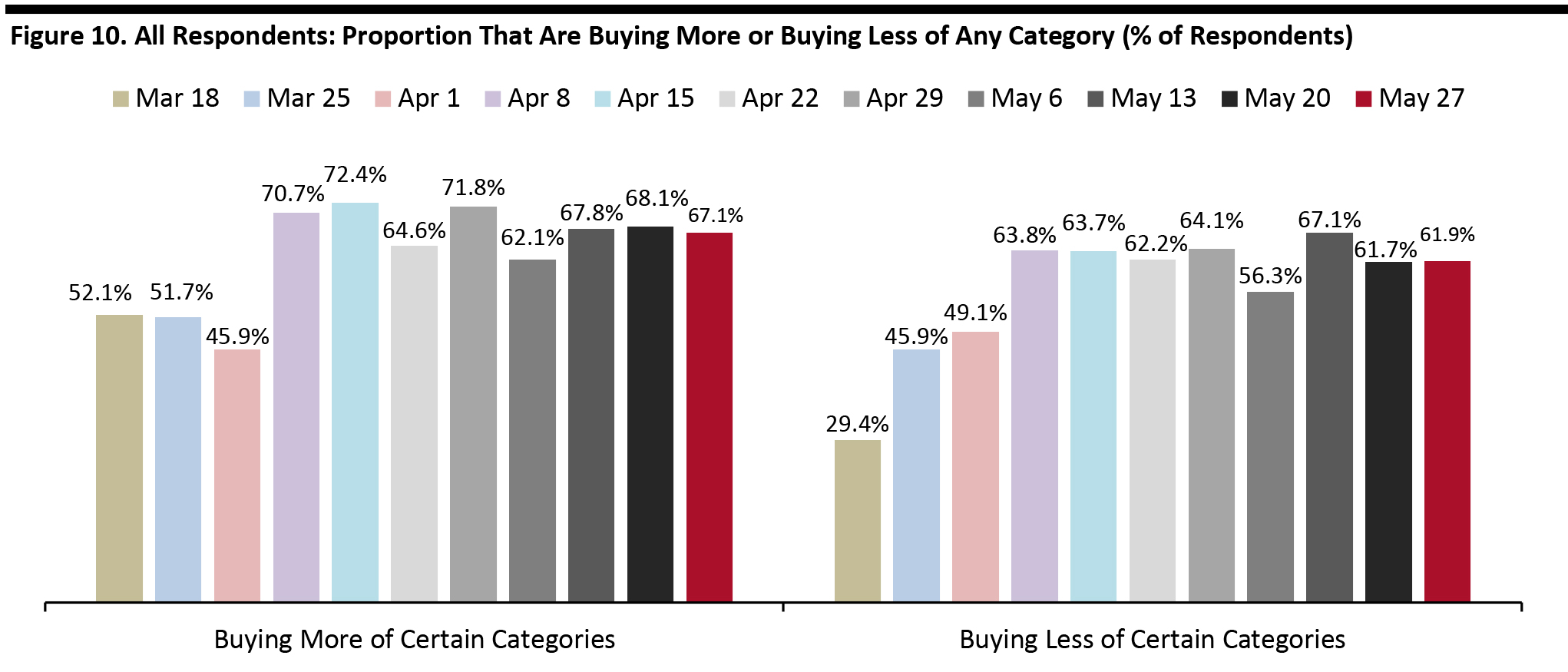

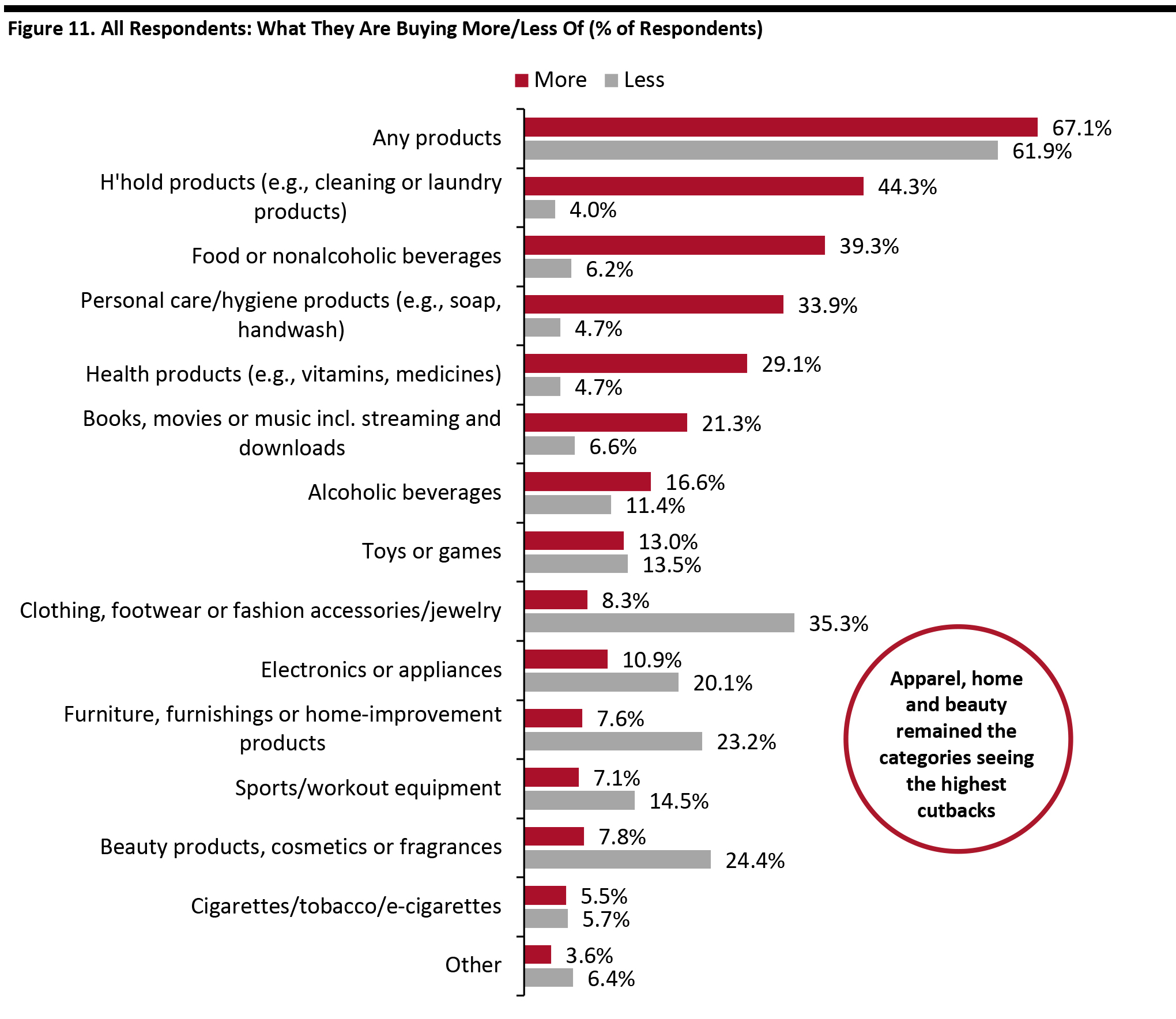

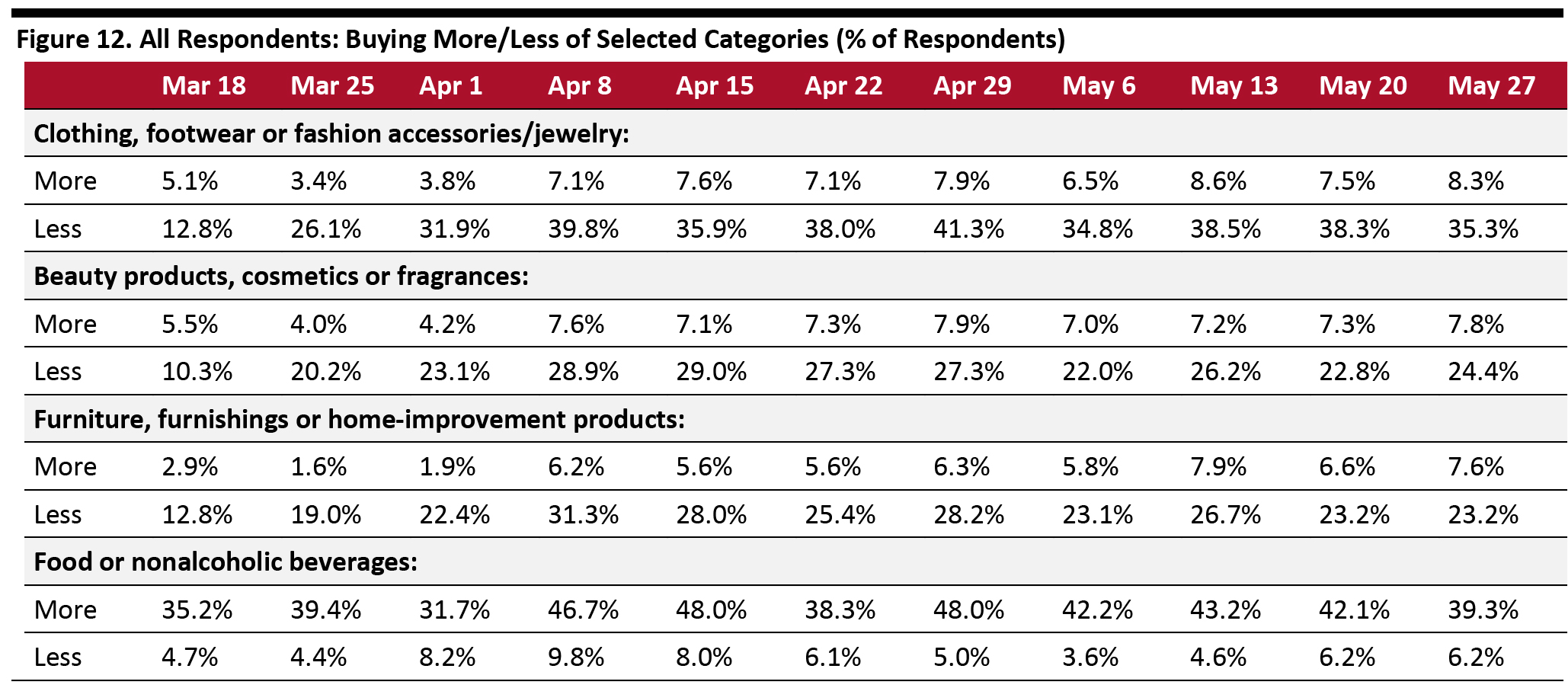

What They Are Buying More Of and Less Of This week, we saw the proportion of respondents both buying less and more remain stable: 67.1% of respondents are buying more, versus 68.1% last week; and 61.9% are buying less, compared to 61.7% last week.- Note, buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Buying more: Although we saw slight week-over-week decreases, essential categories and media products and streaming continue to be net beneficiaries. Buying less: Apparel remains the number-one category for cutbacks, with 35.3% of respondents this week saying they are buying less in this category, slightly down from 38.3% last week (we show trended data in Figure 12). Furniture/home, beauty and electronics remained the next-most-cut categories, but while the proportion of respondents cutting furniture/home and electronics purchases was stable week over week, the proportion cutting beauty purchases increased versus last week. Ratio of less to more: The ratio of those purchasing less to those purchasing more for clothing and footwear stood at 4.3 this week versus 5.1 last week. The ratio for furniture, furnishings and home improvement was 3.1 this week versus 3.5 last week. Beauty products stood the same at 3.1 this week from last week. [caption id="attachment_110449" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] [caption id="attachment_110468" align="aligncenter" width="700"]

Base: US Internet users aged 18+

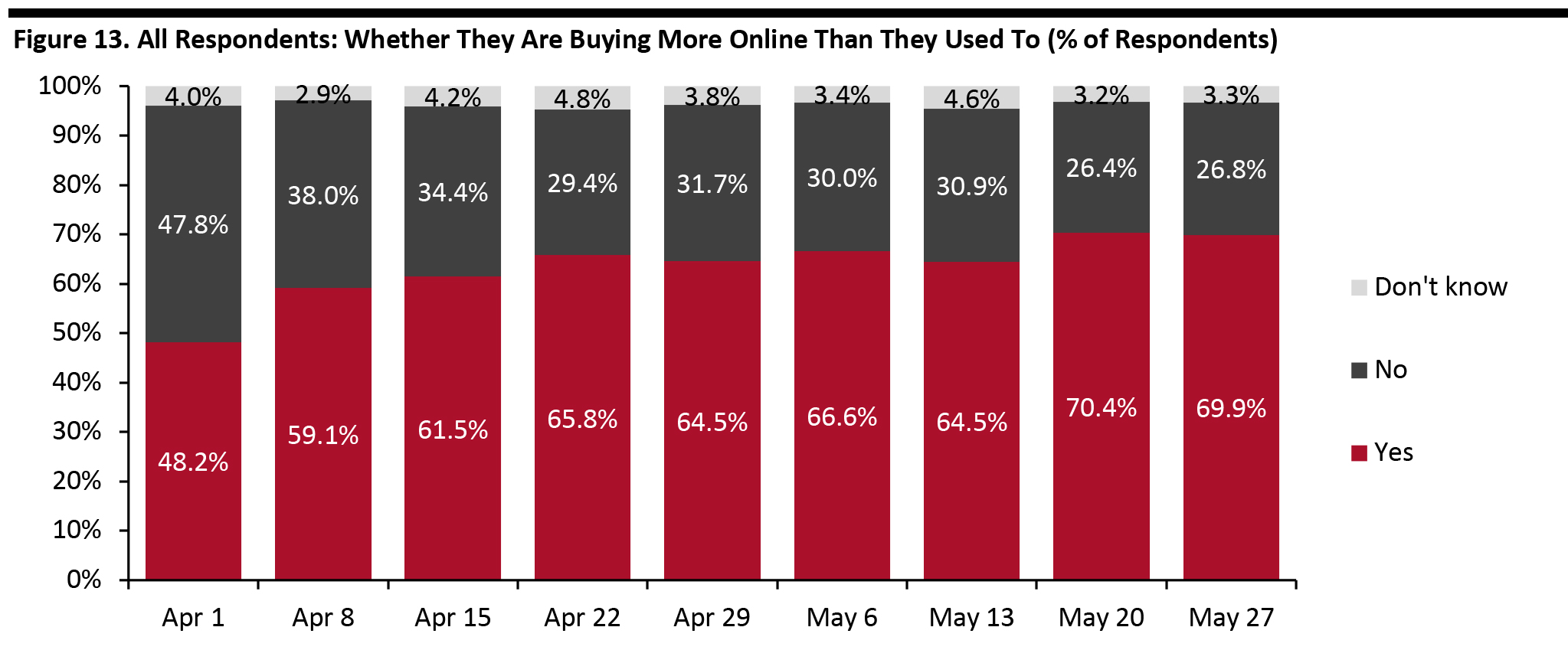

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Seven in 10 Are Switching Spending Online The proportion of consumers switching spending to e-commerce remained stable this week—seven in 10 reported to have done so this week. [caption id="attachment_110451" align="aligncenter" width="700"]

Base: US Internet users aged 18+

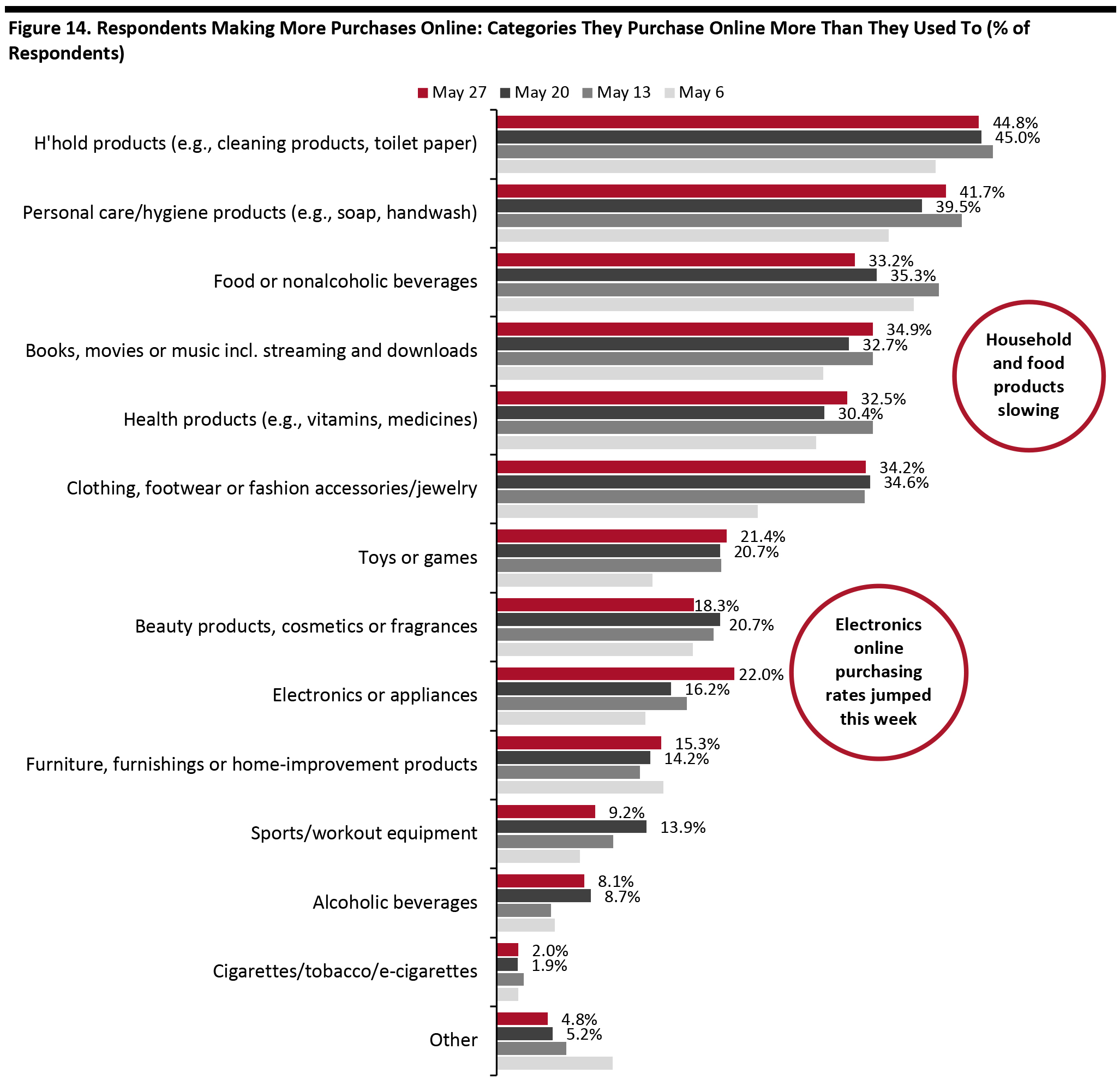

Base: US Internet users aged 18+ Source: Coresight Research [/caption] What Consumers Are Buying More Of Online Among the respondents making more purchases online, we saw everyday household products and health products continue to fall back, reflecting that consumers are turning to their stockpiled supplies. We saw an upswing for electronics, with a six-percentage-point increase in the proportion of respondents buying electronics online, to 22.0%. After a sizeable upswing for apparel last week, we saw stabilization in the proportion of consumers buying more apparel online this week. We did not see a leap for other discretionary categories. The proportion of consumers who are buying furniture/home, beauty and apparel online remained broadly stable week over week. The figures below are a proportion of those who are buying more online in general. Considered as a proportion of all respondents (representing consumers in general), buying more apparel online stood at 24.4% this week, versus 22.0% last week. [caption id="attachment_110452" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research [/caption]

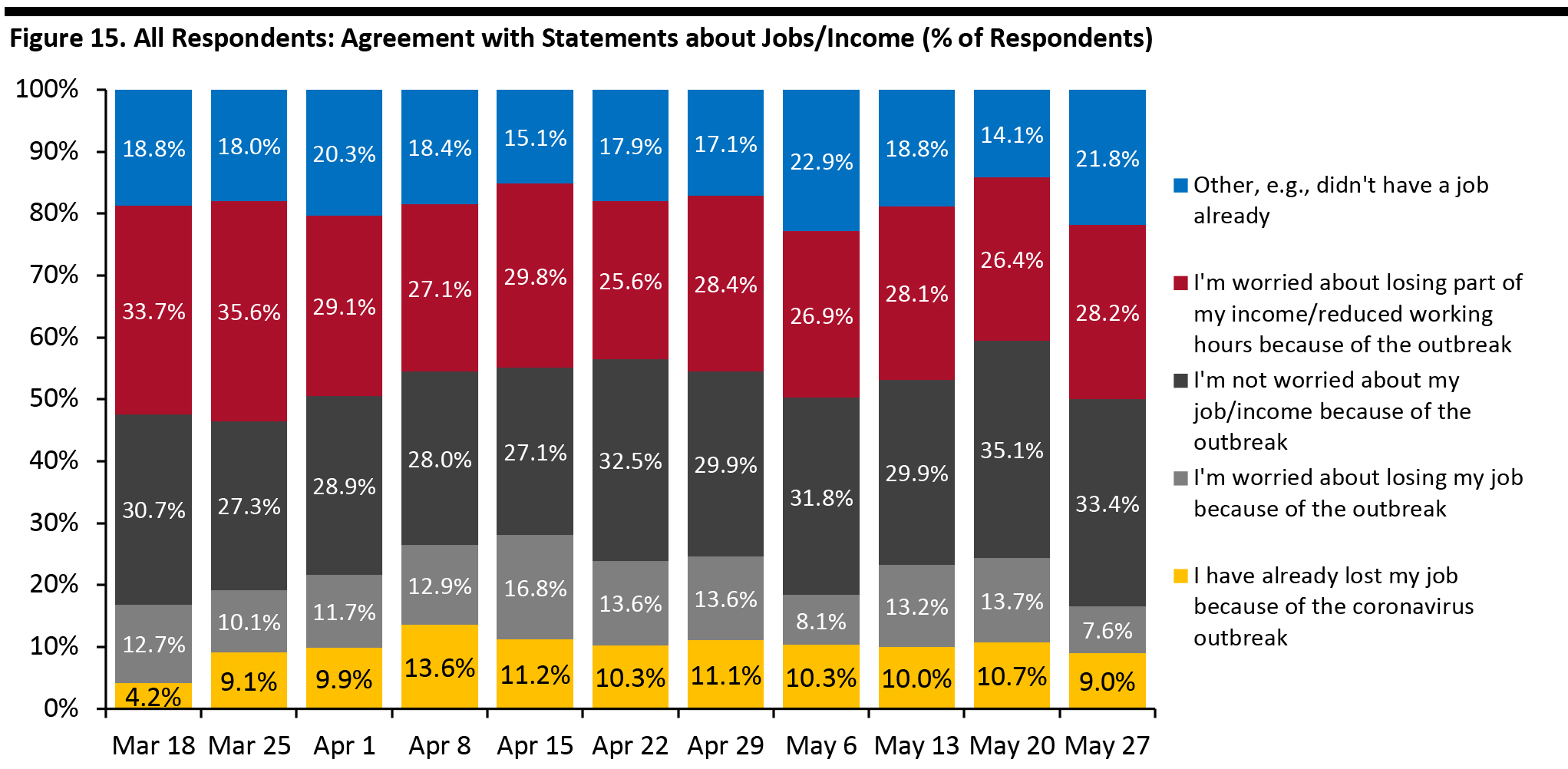

Employment and Income Concerns

Each week, we ask respondents to choose from a selection of statements related to employment and income. We have seen some fluctuation in the proportion of respondents worried about what may happen. This week, a total of 35.8% were worried about losing their job or part of their income, versus 40.1% last week. [caption id="attachment_110453" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]