DIpil Das

We discuss selected findings and compare them to those from prior weeks: May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Life Beyond Lockdown: Three Learnings

1. Meeting Up and Spending on Services Are Consumers’ Top Priorities

This week we asked what consumers would do in the month after lockdowns end, giving them a choice of 15 options (and none/don’t know). The number-one option was to visit friends or family locally, with around half of consumers expecting to do this. Spending on services such as haircuts, dining or going on a trip rounded off respondents’ top four post-lockdown “must dos.” Spending on retail purchases, including for hard-hit categories such as apparel, are lower-priority and do not make the top four.

Even among some leading options, the absolute percentages are relatively low: Despite weeks of lockdowns and our question asking about a full month after lockdowns, only a little over one in three respondents expect to get a haircut (or other grooming treatment). Our survey also found that relatively few expect to turn to coffee shops or make purchases on discretionary goods such as apparel, home goods or beauty products (not charted below).

The figures add weight to expectations of a very gradual recovery post lockdown, with shoppers taking tentative steps back to leisure activities and discretionary spending.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

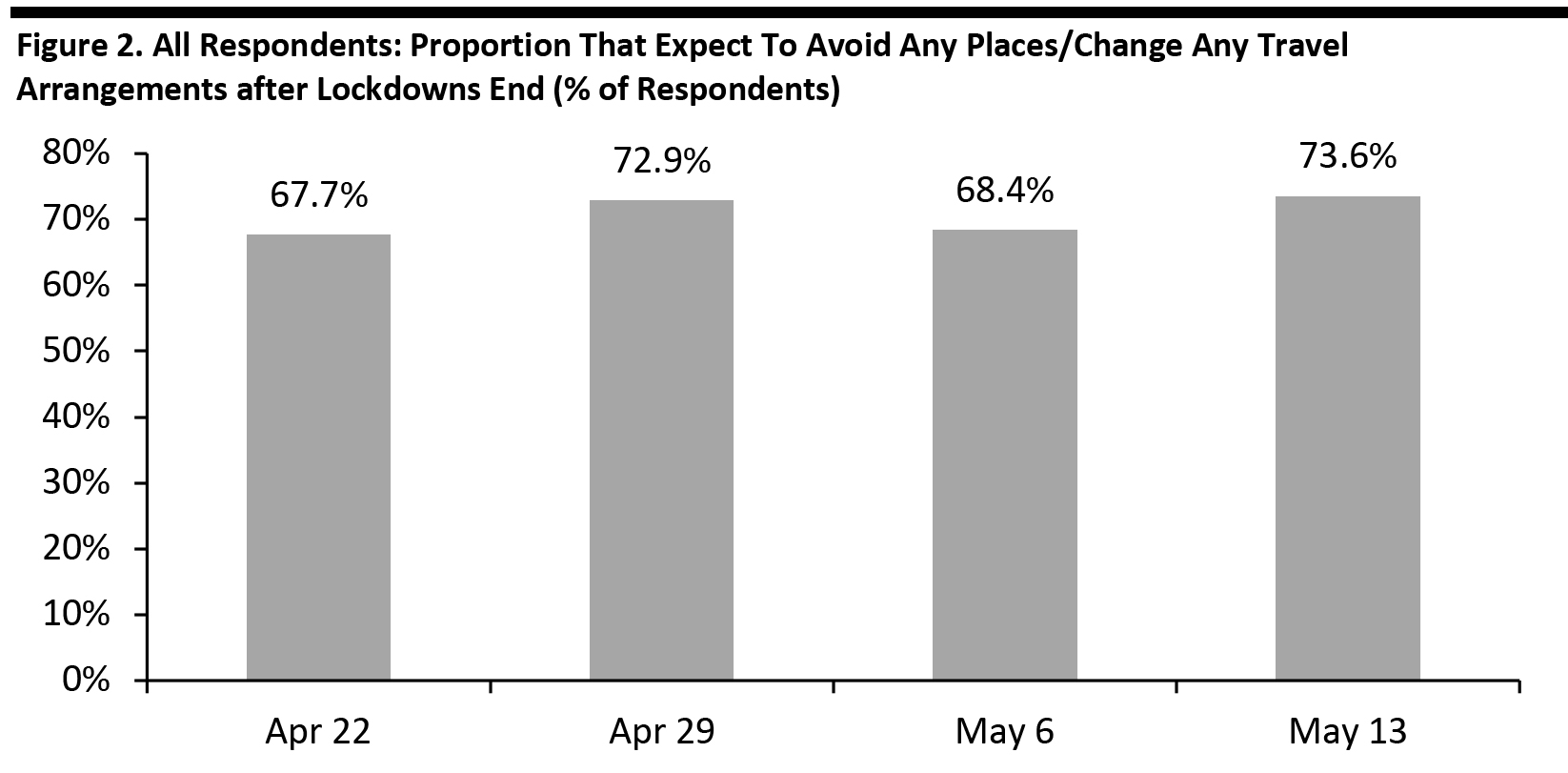

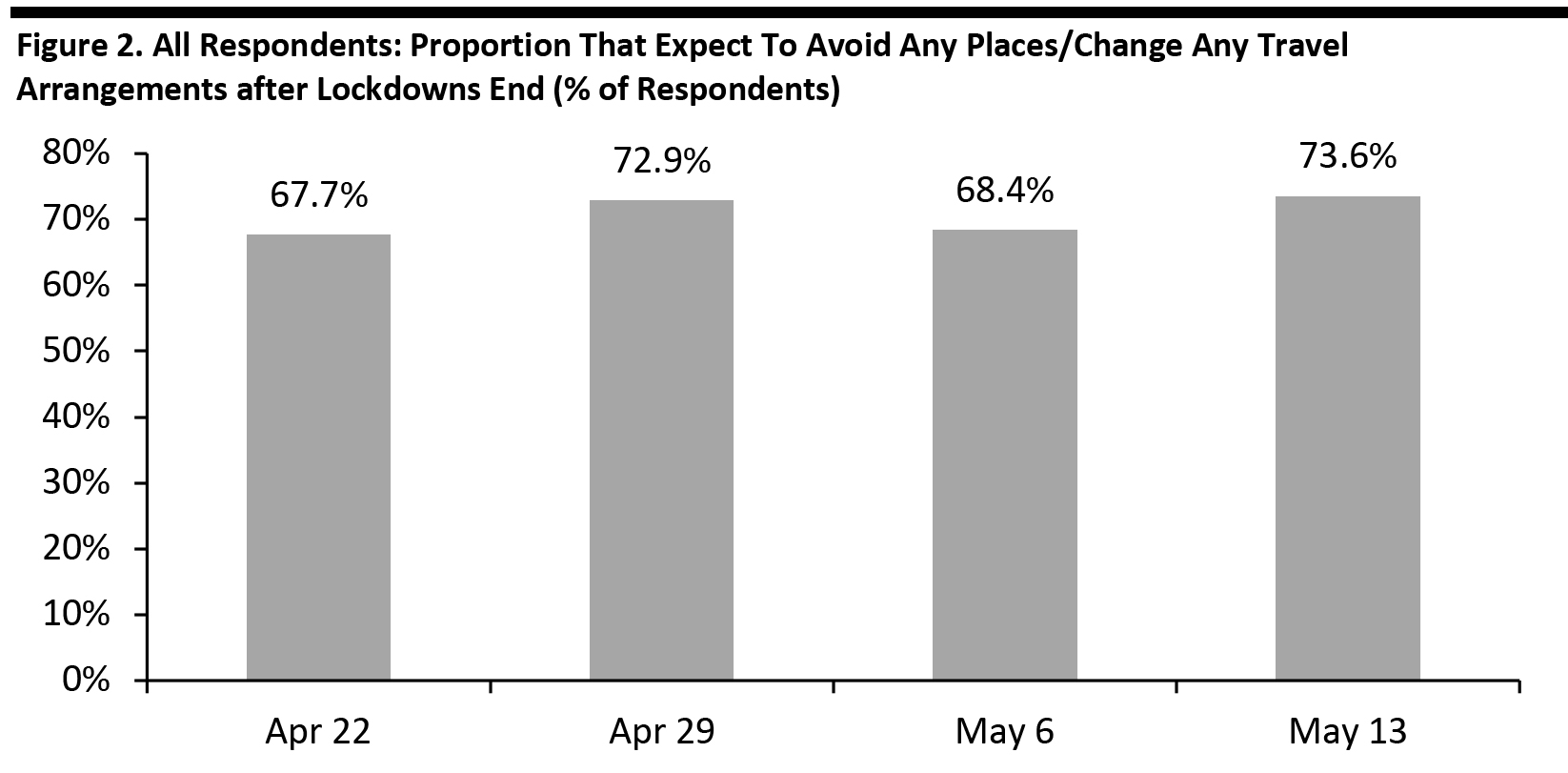

Source: Coresight Research [/caption] 2. Almost Three-Quarters Expect To Avoid Some Public Places This week, 73.6% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end. This compared to 68.4% last week, continuing a yoyoing pattern we have seen week to week. We saw significant swings in expected avoidance of movie theaters or gyms/fitness centers this week. Shopping centers/malls remain among the top locations that consumers expect to avoid. In addition, we saw further week-over-week increases in how long respondents anticipate avoiding public places or changing travel arrangements for, with a large majority expecting to do so for several months (not charted). [caption id="attachment_109787" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

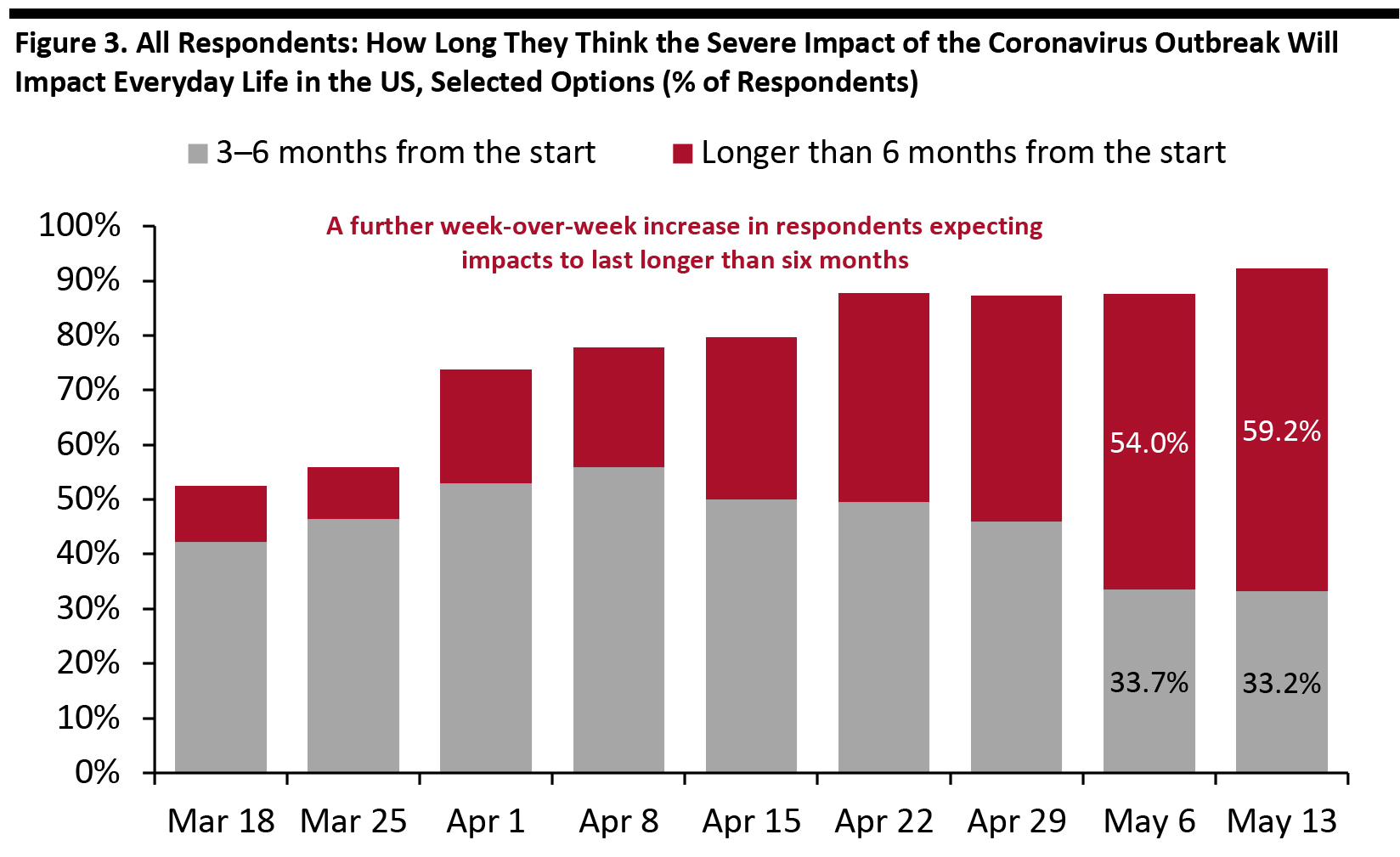

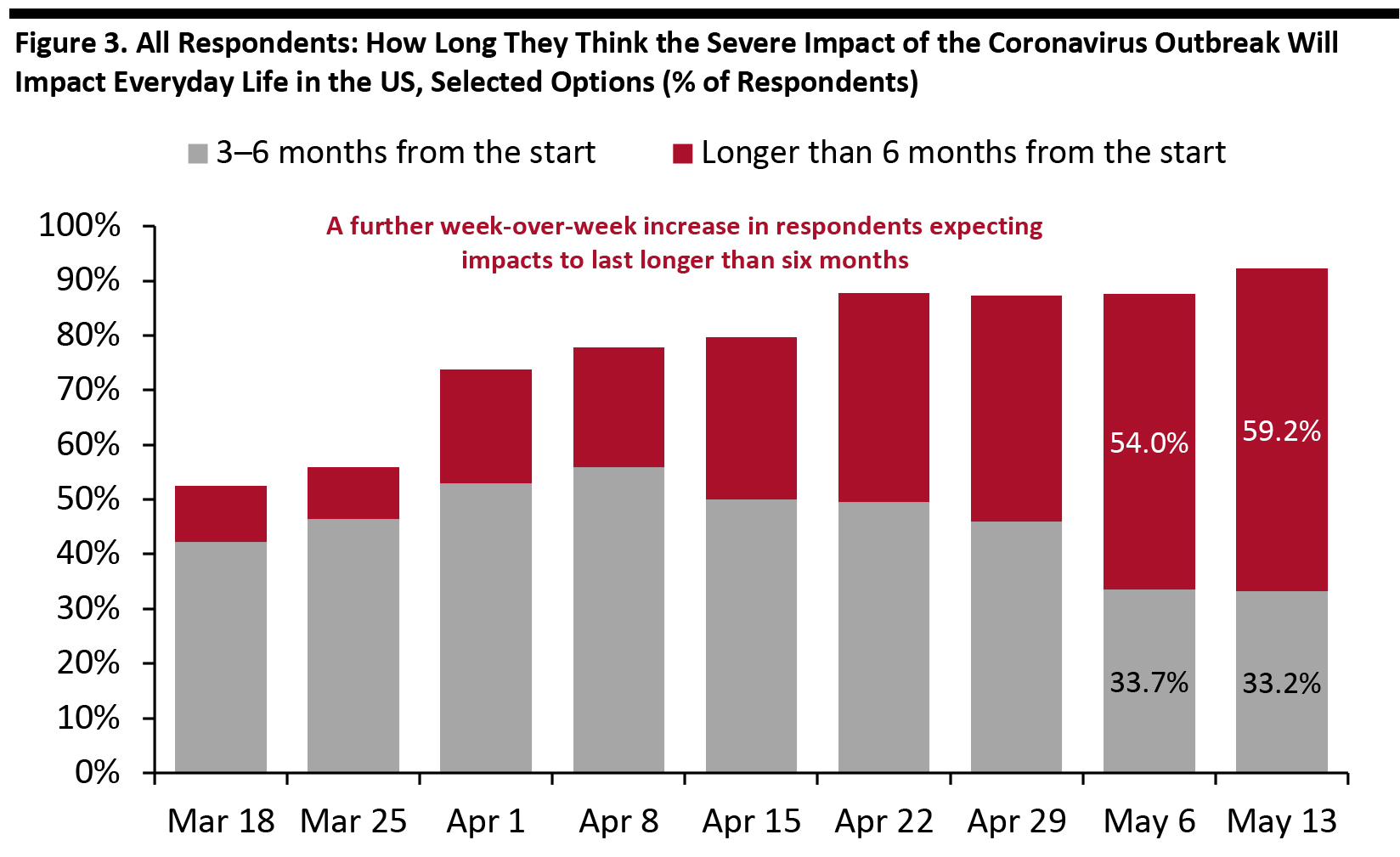

Source: Coresight Research [/caption] 3. Even More Consumers Expect Long-Term Impacts Consumers’ expectations of the length of the crisis increased again this week, after jumping last week. Fully 59.2% now expect the severe impact of the outbreak to last more than six months from its start, up from 54.0% last week. Some 92.4% expect the severe impact to last three months or more, up from 87.7% last week. Echoing these expectations, we also saw further week-over-week increases in how long respondents expect to retain changed purchasing behaviors for (not charted). [caption id="attachment_109798" align="aligncenter" width="700"] Selected options shown

Selected options shown

Base: US Internet users aged 18+

Source: Coresight Research [/caption]

- See our full report for a complete ranking of what consumers expect to do and spend on post lockdown, including by age group.

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Almost Three-Quarters Expect To Avoid Some Public Places This week, 73.6% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end. This compared to 68.4% last week, continuing a yoyoing pattern we have seen week to week. We saw significant swings in expected avoidance of movie theaters or gyms/fitness centers this week. Shopping centers/malls remain among the top locations that consumers expect to avoid. In addition, we saw further week-over-week increases in how long respondents anticipate avoiding public places or changing travel arrangements for, with a large majority expecting to do so for several months (not charted). [caption id="attachment_109787" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 3. Even More Consumers Expect Long-Term Impacts Consumers’ expectations of the length of the crisis increased again this week, after jumping last week. Fully 59.2% now expect the severe impact of the outbreak to last more than six months from its start, up from 54.0% last week. Some 92.4% expect the severe impact to last three months or more, up from 87.7% last week. Echoing these expectations, we also saw further week-over-week increases in how long respondents expect to retain changed purchasing behaviors for (not charted). [caption id="attachment_109798" align="aligncenter" width="700"]

Selected options shown

Selected options shown Base: US Internet users aged 18+

Source: Coresight Research [/caption]