DIpil Das

Coresight Research’s latest survey of US consumers on the coronavirus outbreak was undertaken on April 15. In this report, we discuss the latest findings and compare them to those from prior weeks: April 8, April 1, March 25 and March 17–18.

Green Shoots for Fashion?

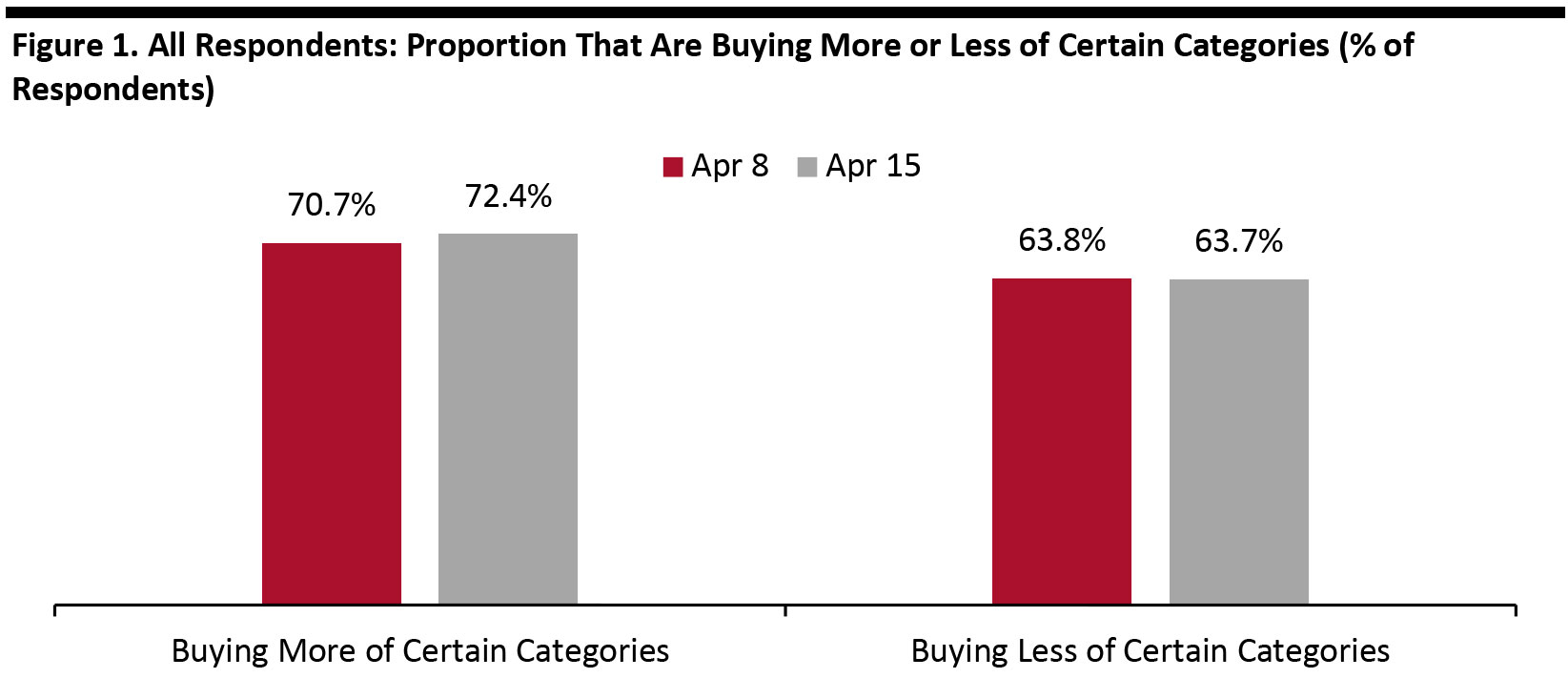

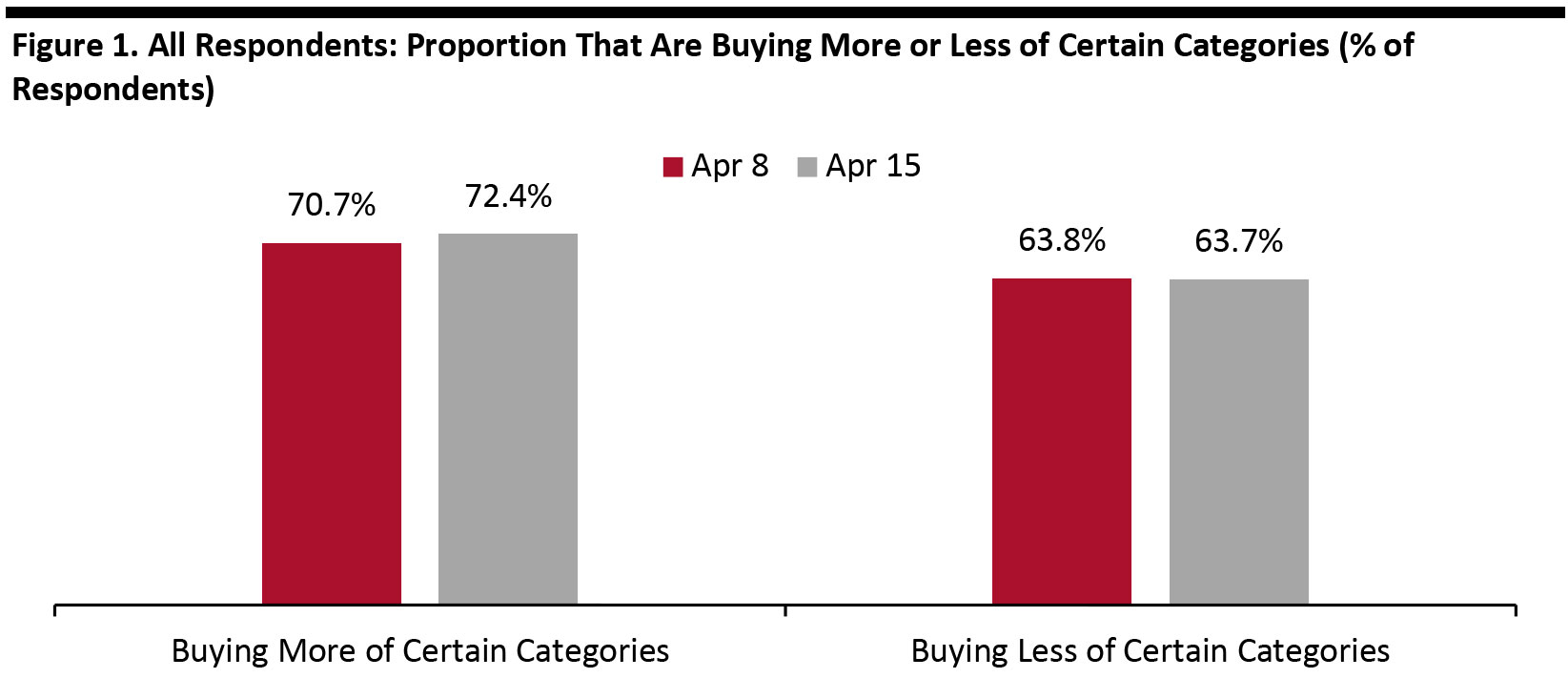

After jumping last week, we saw a leveling-off in the rate of shoppers buying more or less of certain categories this week (see Figure 1). Although these metrics remained stable at the overall level, we saw a number of category movements underlying them—including in clothing and footwear.

The apparel category has been the biggest loser so far in this crisis. However, this week we saw a decline in the number of shoppers making fewer apparel purchases and a further gradual increase in the proportion saying they are making more apparel purchases, although the latter group remains relatively small. These trends have resulted in a decline in the ratio of respondents purchasing less apparel to those purchasing more: That ratio stood at 4.7 shoppers buying less to each shopper buying more this week, versus 5.6 last week and 8.4 two weeks ago. We also recorded an increase in the number of consumers buying apparel online this week—see our full report for details of how many consumers are switching spending to e-commerce and in which categories.

These trends may reflect green shoots for clothing and footwear sales, and that we have passed the nadir. However, any improvement is in the context of deep discounting as retailers seek to recover some lost sales, and the data points do not suggest any return to near-normal levels of spending.

[caption id="attachment_108027" align="aligncenter" width="700"] Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both

Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both

Base: US Internet users aged 18+

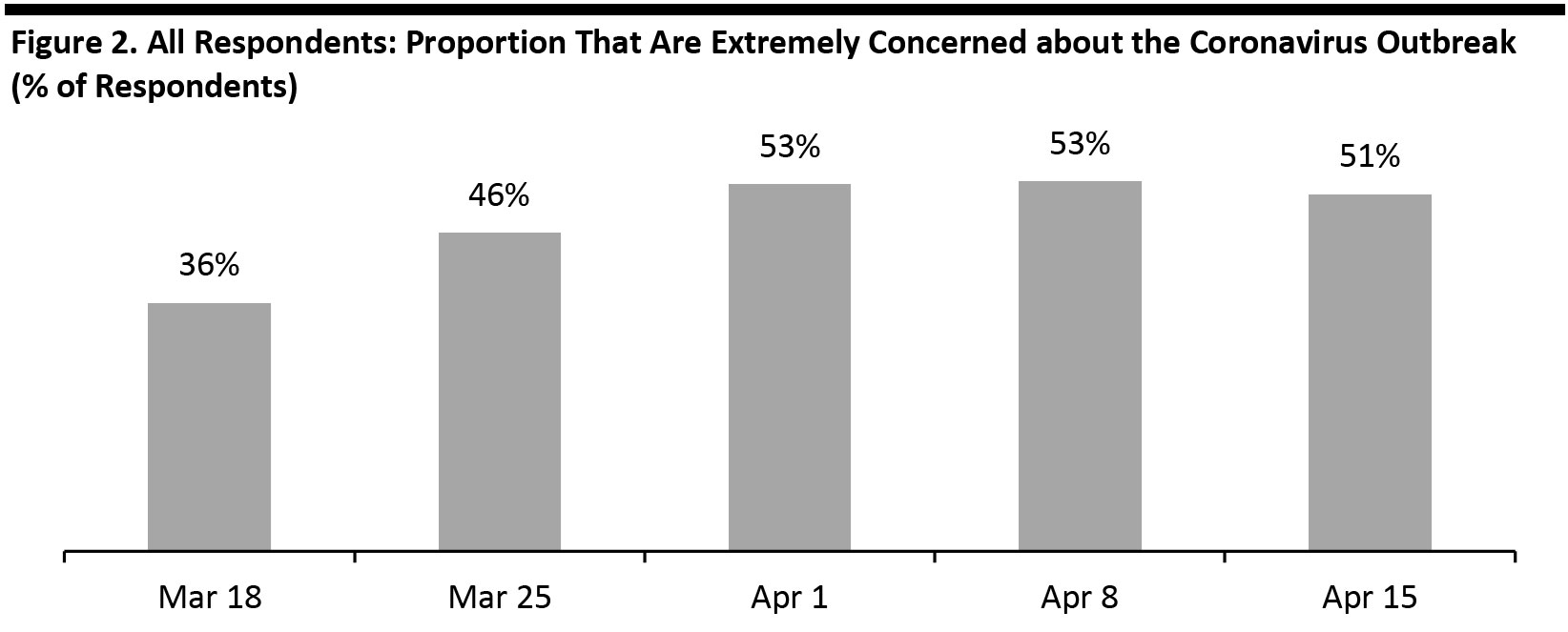

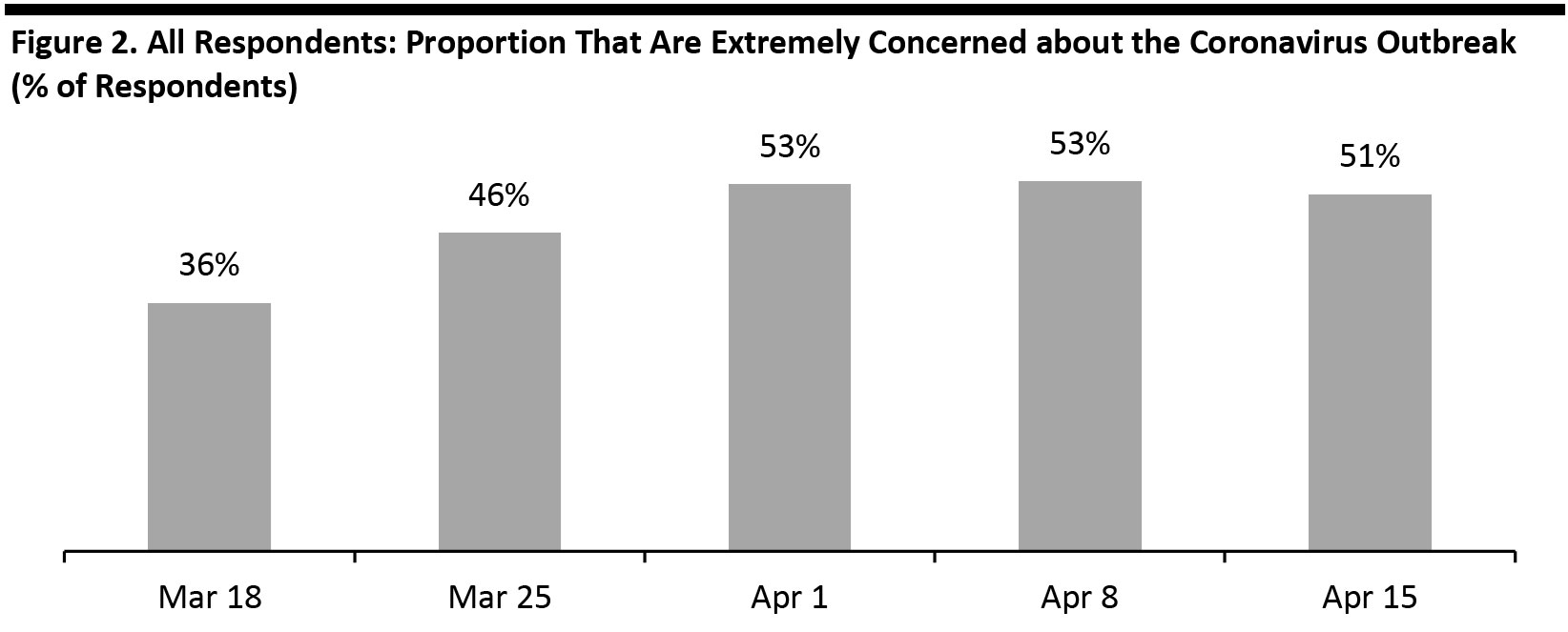

Source: Coresight Research [/caption] Consumers Are Expecting a Long Haul, Although Overall Rates of Concern Have Plateaued We asked those respondents who are spending more or spending less when they expect their spending to return to normal levels. Fully one-quarter of this group now expect their spending to return to normal levels only in more than six months’ time; this was up sharply from 18.5% last week. This timescale implies that the impacts could run up to the holiday season. In total, a majority of respondents expect their spending to return to normal levels only in three months’ time or more. This week, 51% of respondents said they are extremely concerned about the outbreak, broadly level with the rates we recorded in recent weeks and implying a leveling-off of concern. However, we saw a big increase in levels of concern among younger consumers: This week, 48% of those aged 18–29 were extremely concerned, up from 39% last week. [caption id="attachment_108028" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

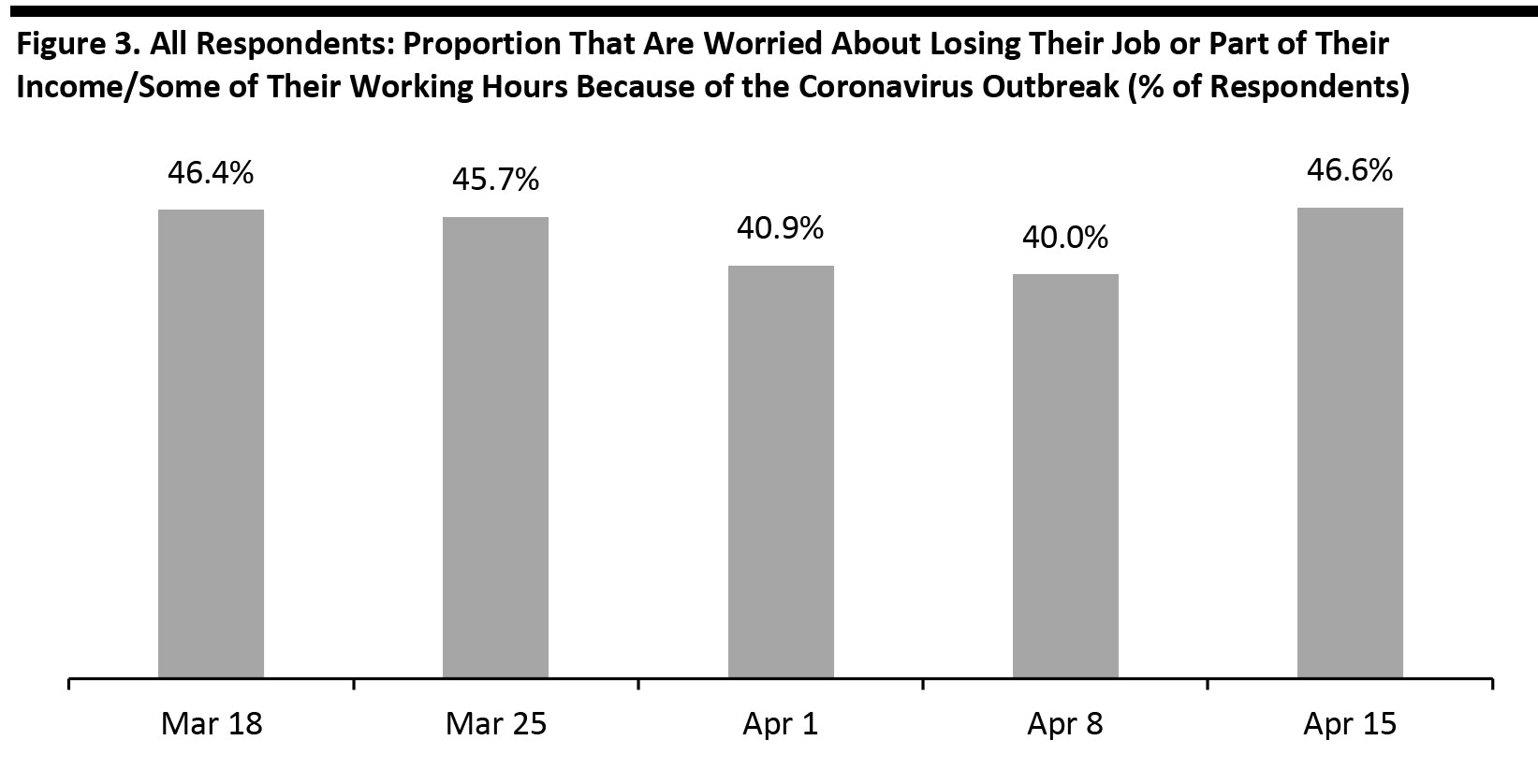

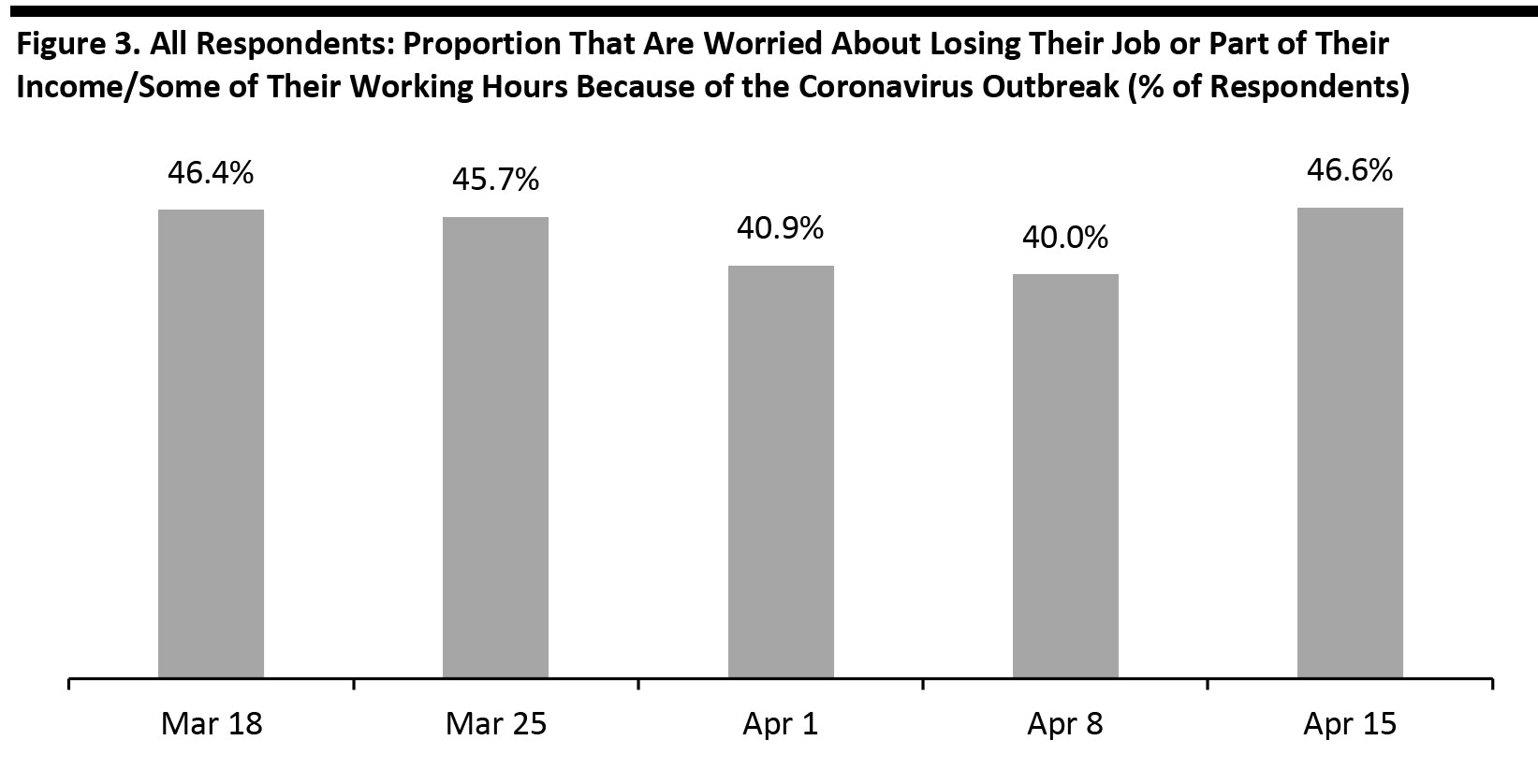

Source: Coresight Research [/caption] Job Fears Increase, Week over Week Despite the overall plateau in levels of concern, this week saw job and income worries increase. A total of 46.6% were worried about losing their job or part of their income, up from 40.0% last week. This is the first time that we have seen this figure increase since it peaked at 46.4% on March 18. Base: US Internet users aged 18+ Source: Coresight Research [/caption]

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both

Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both Base: US Internet users aged 18+

Source: Coresight Research [/caption] Consumers Are Expecting a Long Haul, Although Overall Rates of Concern Have Plateaued We asked those respondents who are spending more or spending less when they expect their spending to return to normal levels. Fully one-quarter of this group now expect their spending to return to normal levels only in more than six months’ time; this was up sharply from 18.5% last week. This timescale implies that the impacts could run up to the holiday season. In total, a majority of respondents expect their spending to return to normal levels only in three months’ time or more. This week, 51% of respondents said they are extremely concerned about the outbreak, broadly level with the rates we recorded in recent weeks and implying a leveling-off of concern. However, we saw a big increase in levels of concern among younger consumers: This week, 48% of those aged 18–29 were extremely concerned, up from 39% last week. [caption id="attachment_108028" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Job Fears Increase, Week over Week Despite the overall plateau in levels of concern, this week saw job and income worries increase. A total of 46.6% were worried about losing their job or part of their income, up from 40.0% last week. This is the first time that we have seen this figure increase since it peaked at 46.4% on March 18.

- Our full report includes more detailed findings on the impact of the outbreak on respondents’ employment and on what respondents are most concerned about during the coronavirus outbreak.

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

Base: US Internet users aged 18+ Source: Coresight Research [/caption]