DIpil Das

Introduction

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on April 15. This report explores the trends we are seeing from week to week, following prior surveys on April 8, April 1, March 25 and March 17–18. We also compare selected metrics to our late-February consumer survey.Almost Two-Thirds of Consumers Are Now Buying Less

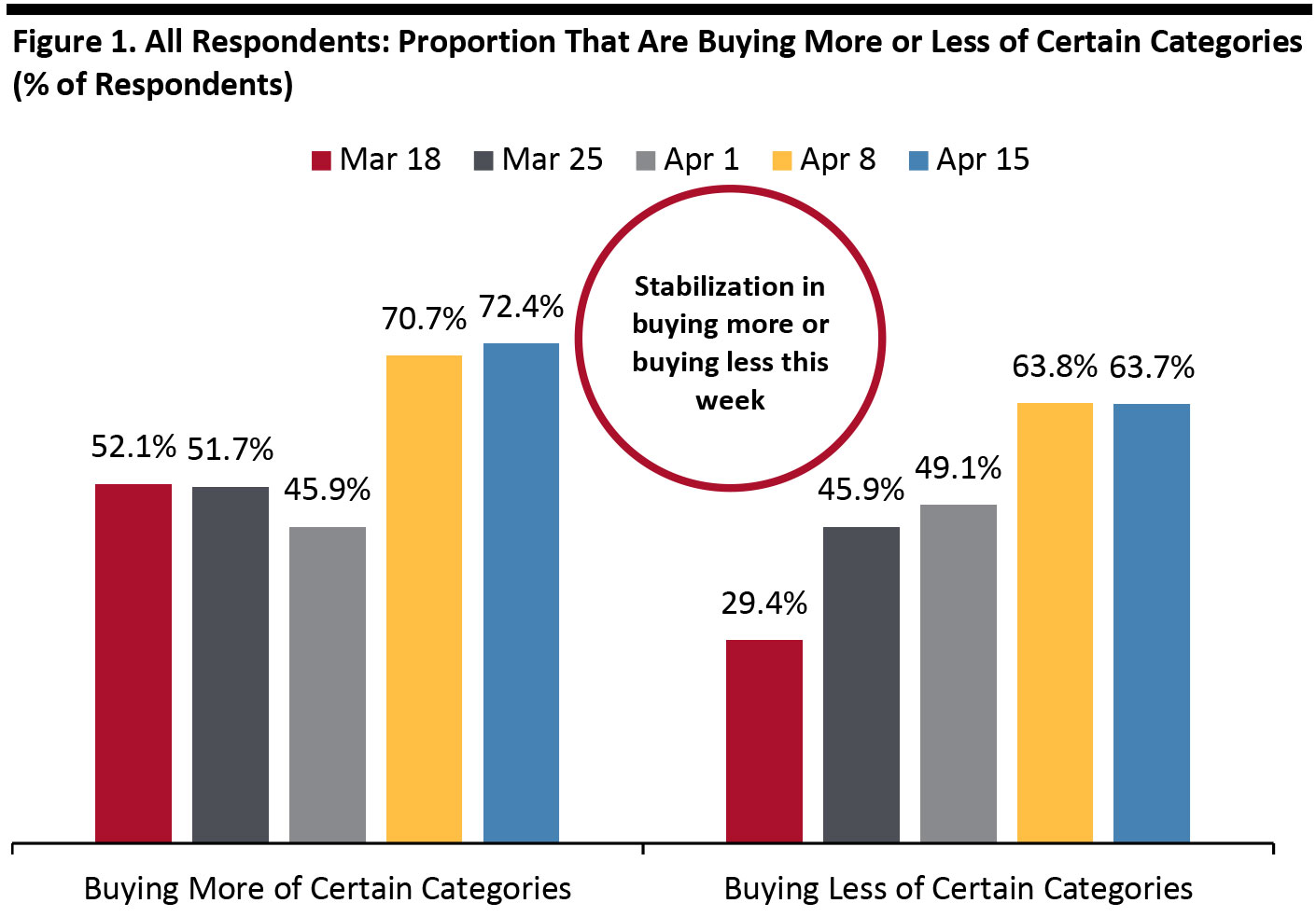

After jumping last week, we saw a leveling-off in the rate of shoppers buying more or less of certain categories this week. Note that buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both. [caption id="attachment_108009" align="aligncenter" width="700"] Not all week-over-week differences charted in this report are statistically significant

Not all week-over-week differences charted in this report are statistically significant Base: US Internet users aged 18+

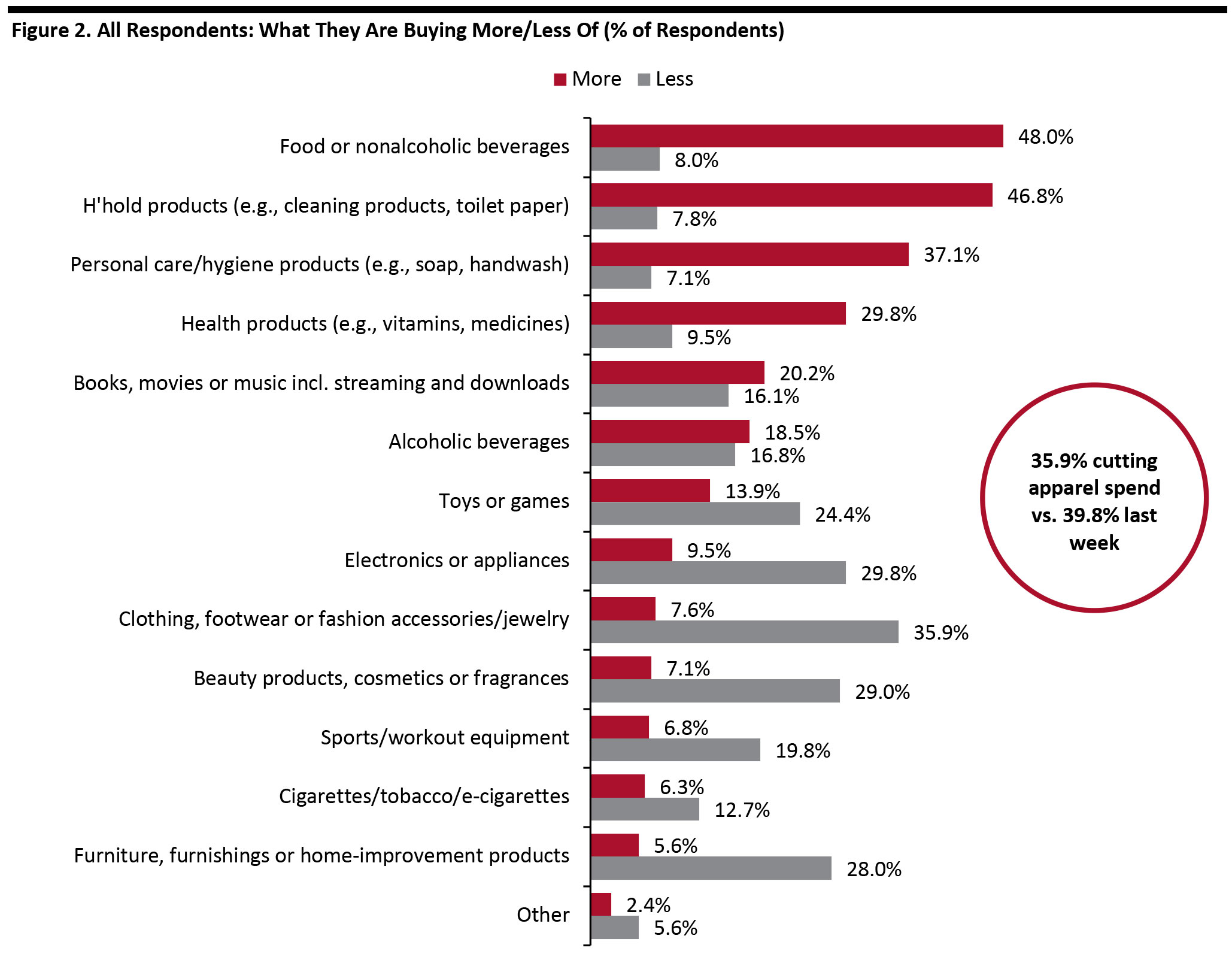

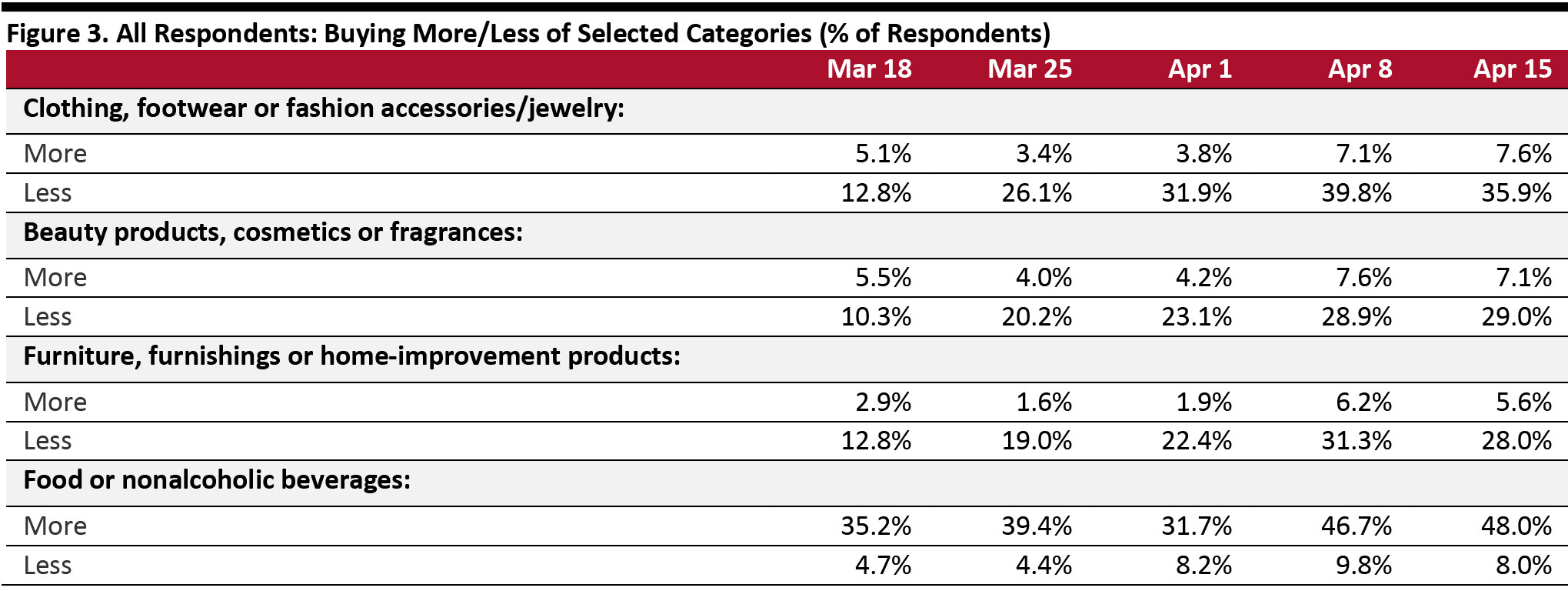

Source: Coresight Research [/caption] What They Are Purchasing More or Less More: Shoppers continue to buy more nondiscretionary or essential categories such as food, everyday household products, personal care and health products. Media products (such as books) and alcoholic beverages also see more consumers buying more than buying less. Less: Apparel has been the biggest loser so far. This week, around 36% of respondents said they were cutting clothing or footwear purchases—but that compares to around 40% last week. We also continued to see a very gradual increase in the proportion of respondents saying they are purchasing more apparel, although the number of consumers spending more is dwarfed by the number spending less. We show week-over-week trends for selected categories in Figure 3. Ratio of less to more: The ratio of respondents purchasing less to those purchasing more eased further in apparel this week, while a consistent trend was less evident in some other discretionary categories.

- The ratio of those purchasing less to those purchasing more for clothing and footwear stood at 4.7 this week versus 5.6 last week and 8.4 two weeks ago.

- Furniture, furnishings and home improvement stood at 5.0 this week, which is level with last week but down from 11.9 two weeks ago.

- Beauty products stood at 4.1 this week, versus 3.8 and 5.5 two weeks ago.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption] Some Shoppers Are Returning to Discretionary Categories—but in Modest Numbers This week, we saw a decline in the proportion of respondents cutting their apparel spend and a further increase in the proportion that are increasing their apparel spend, although the latter group remains small. We saw less consistent trends in home categories, and the proportion cutting beauty spend roughly leveled off week over week. [caption id="attachment_108011" align="aligncenter" width="700"]

Base: US Internet users aged 18+

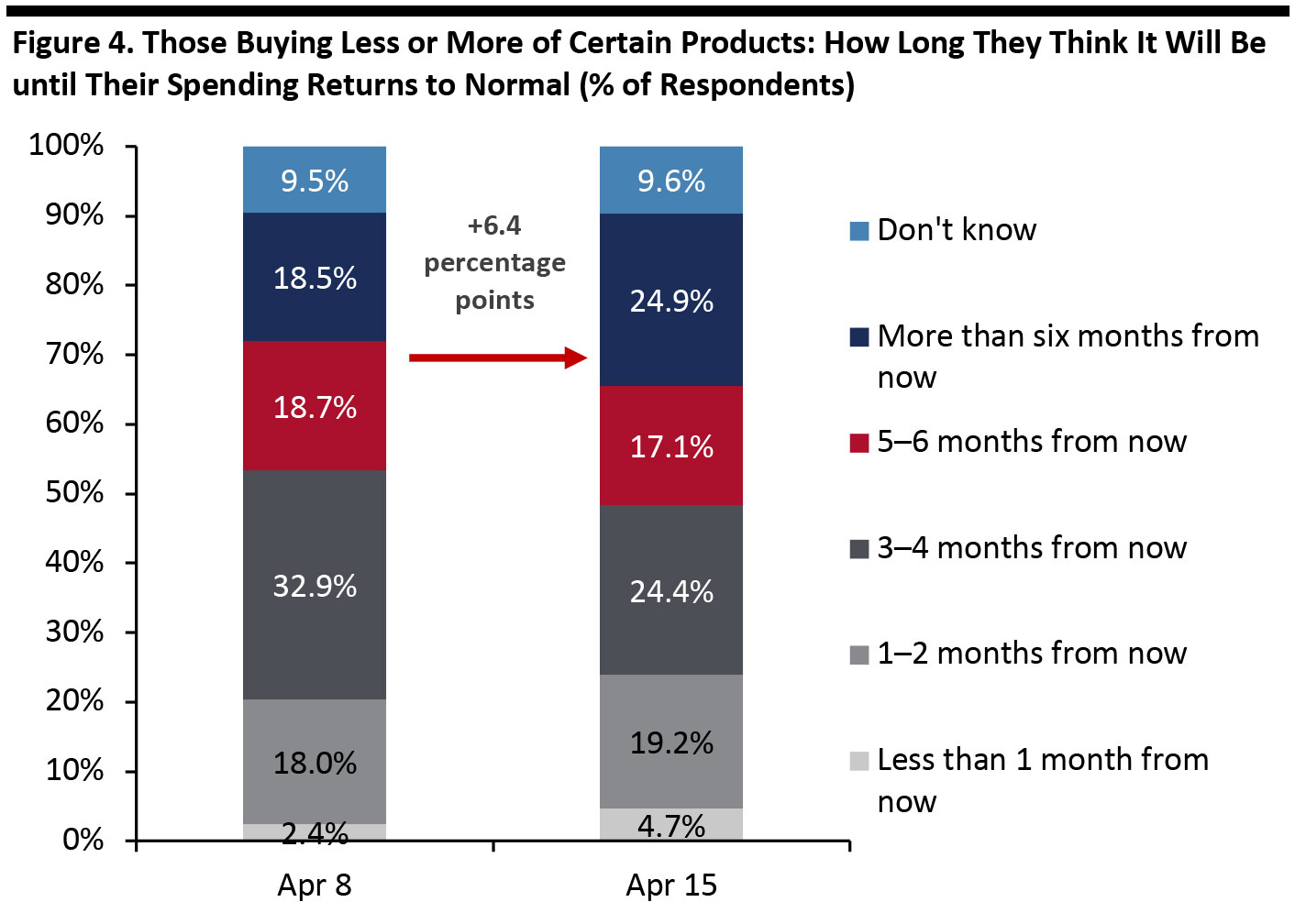

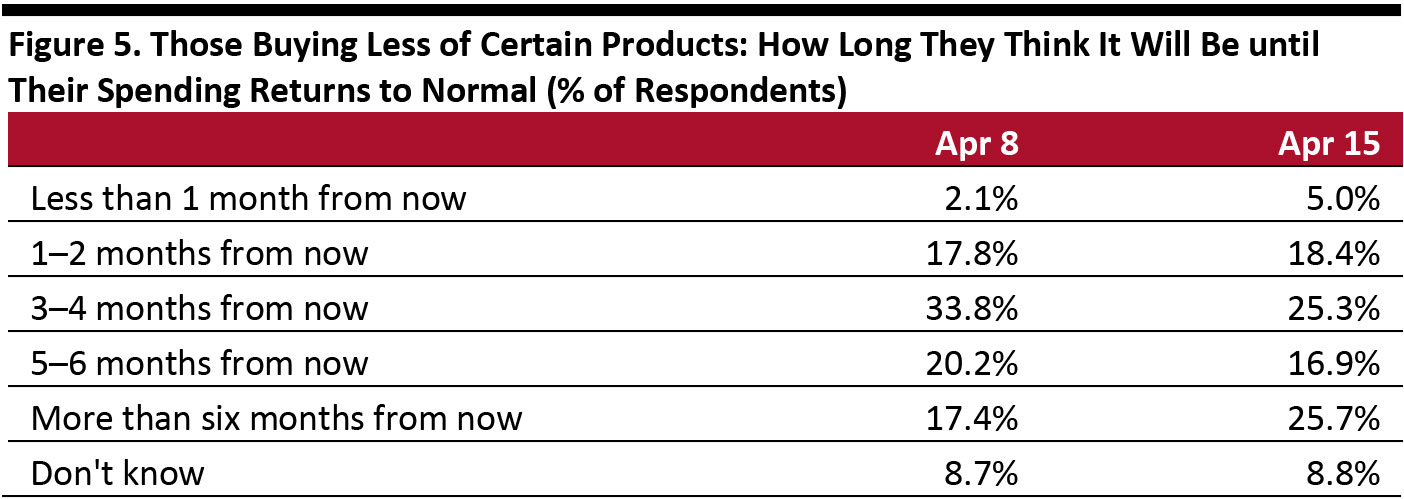

Base: US Internet users aged 18+ Source: Coresight Research [/caption] When They Expect Their Spending To Return to Normal We asked those respondents who are spending more or spending less when they expect their spending to return to normal levels.

- One-quarter now expect a return to normality to be in more than six months’ time, up meaningfully from 18.5% who said this last week.

- A total of two-thirds of this group expect a return to normal spending to be in three months’ time or more, versus around 70% last week.

- We also asked respondents how long they think the severe impacts of the crisis will last; see later for findings.

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak Source: Coresight Research [/caption] The figures below are only for those who currently say they are purchasing some categories less. [caption id="attachment_108013" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak Source: Coresight Research [/caption]

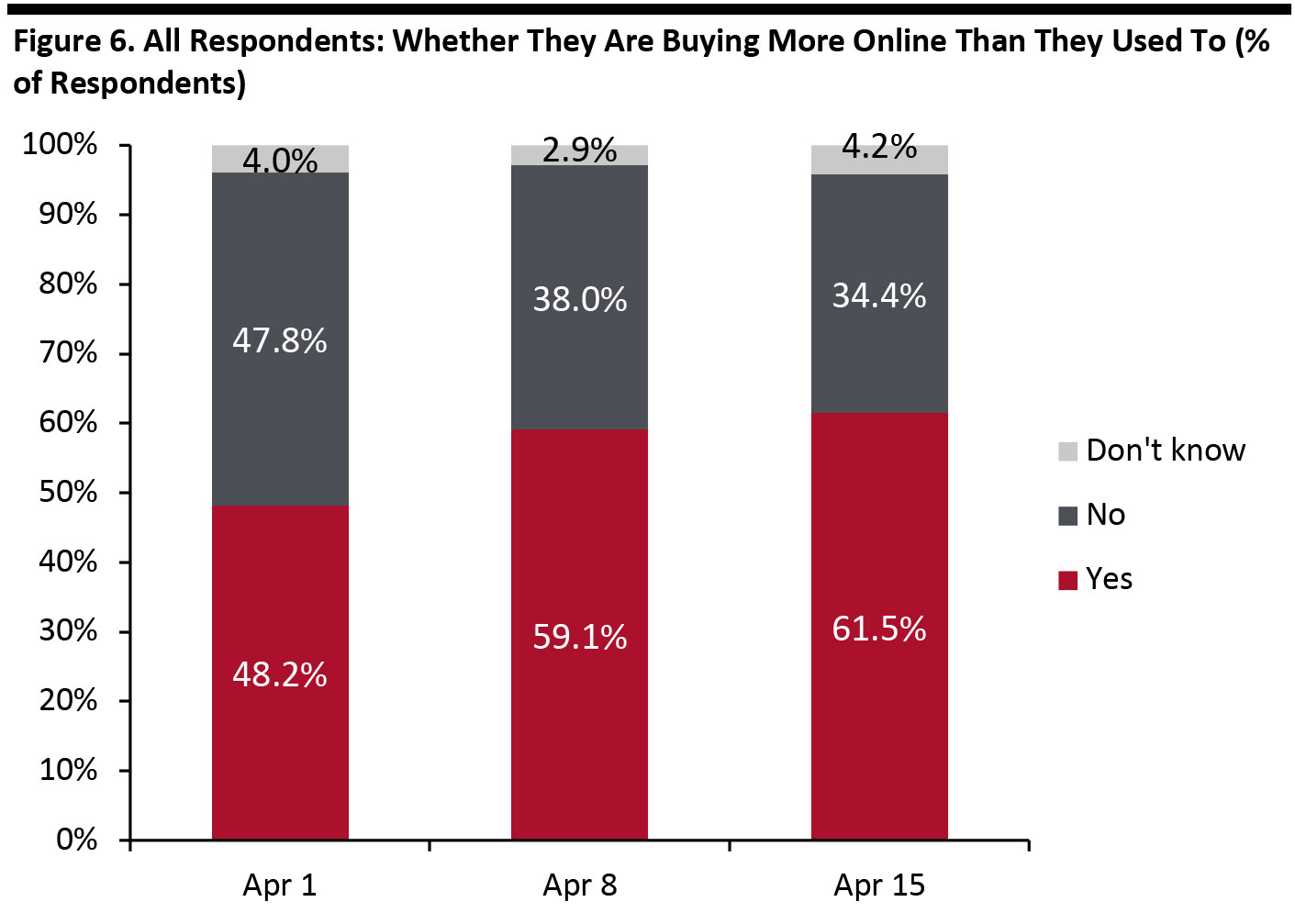

Six in 10 Are Switching Spending Online

More than six in 10 consumers are making more purchases online than before the outbreak—up slightly week over week. [caption id="attachment_108014" align="aligncenter" width="700"] Base: US Internet users aged 18+

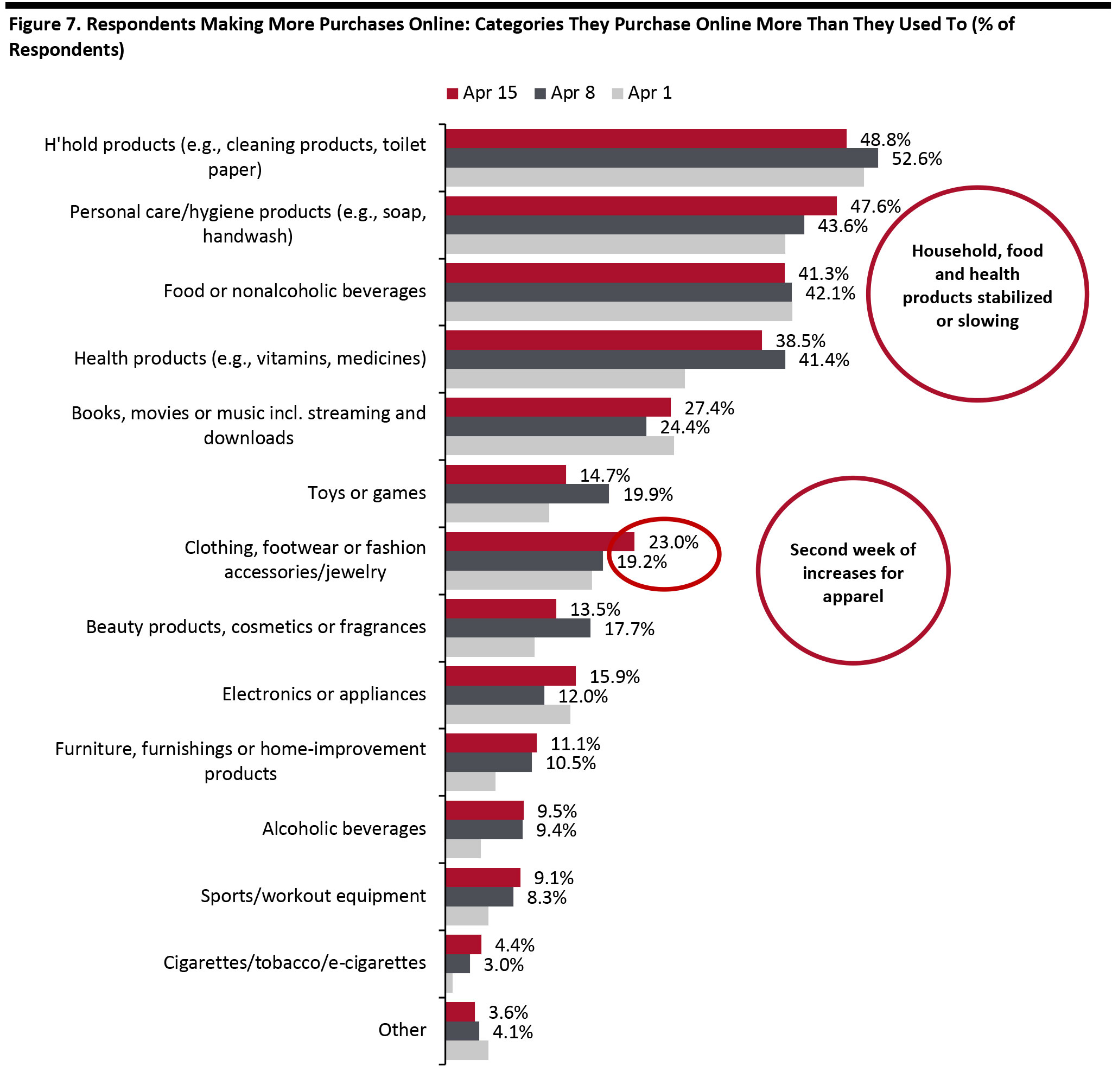

Base: US Internet users aged 18+ Source: Coresight Research [/caption] What They Are Buying More Of Online Among the respondents making more purchases online, we saw a stabilization or decline in the proportion buying more nonfood staples this week, such as household products, food and health products. Personal care/hygiene products bucked this trend, with a continued uptick. Further implying a tentative apparel recovery, we saw the proportion of respondents buying more clothing or footwear online increase for a second week, to 23.0%.

- Note, the percentages below are of those who are buying more online.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research [/caption]

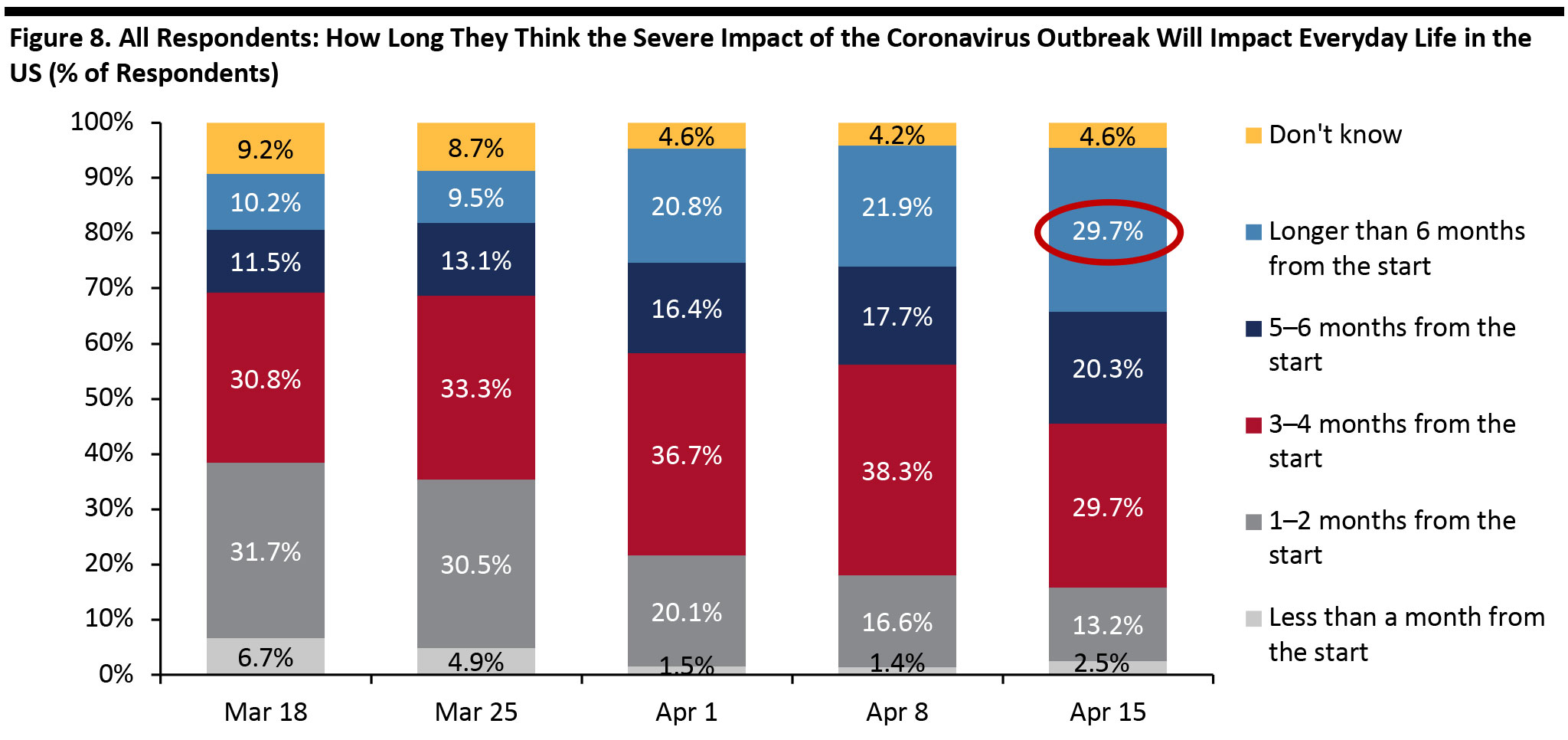

30% of Consumers Expect the Crisis To Last More Than Six Months

Consumers’ expectations of the length of the crisis continue to increase. This week, almost 30% said they expect the severe impact of the outbreak to last more than six months from its start, up from around 22% last week. This timescale implies that the severe impacts will run up to the holiday season. Fully 80% now expect the severe impact to last three months or more, up from 78% last week. [caption id="attachment_108016" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

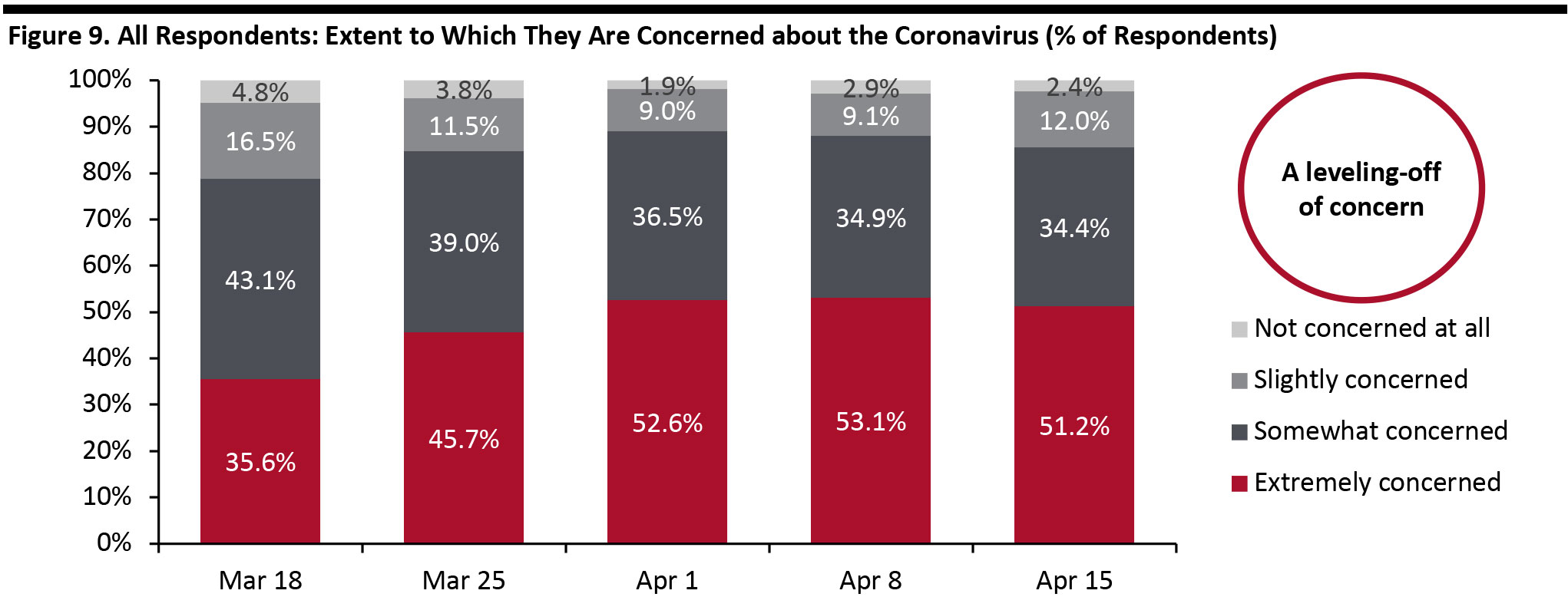

Overall Worries May Have Plateaued

This week, 51.2% of respondents said they are extremely concerned about the outbreak, versus 53.1% last week and 52.6% the week before: The differences are within the margin of error, and the figures imply that concern levels have plateaued. A total of 86% of respondents are now either somewhat or extremely concerned about the coronavirus, versus 88% a week earlier. Older consumers continue to be the most concerned: 60% of those aged over 60 are extremely concerned, versus 55% of respondents aged between 45 and 60, 45% of those aged between 30 and 44 and 48% of those aged between 18 and 29. The latest figure for 18–29 year olds represents a large increase from the 39% that were extremely worried last week. [caption id="attachment_108017" align="aligncenter" width="700"] Base: US Internet users aged 18+

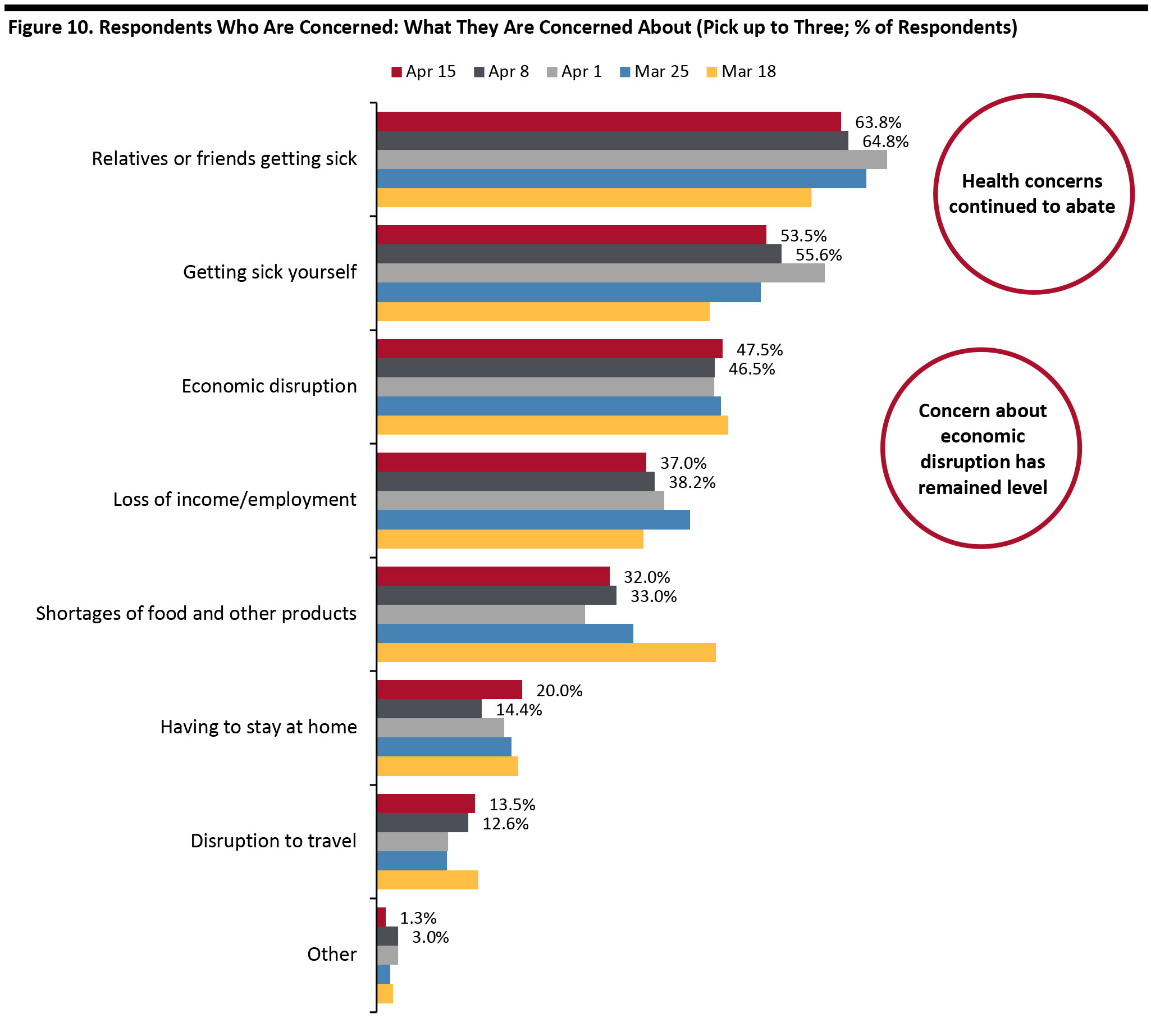

Base: US Internet users aged 18+ Source: Coresight Research [/caption] This week, health concerns continued to abate, although they remained the top worry. Economic concerns have remained the most steady, week to week. We saw a significant uptick in concern at having to stay at home, with one in five respondents appearing to struggle with the lockdown. On average, respondents noted 2.7 concerns this week, level with last week. We discuss specific concerns about jobs and income in a following section. [caption id="attachment_108018" align="aligncenter" width="700"]

Respondents could select up to three options

Respondents could select up to three options Base: US Internet users aged 18+ who are concerned about the coronavirus outbreak

Source: Coresight Research [/caption]

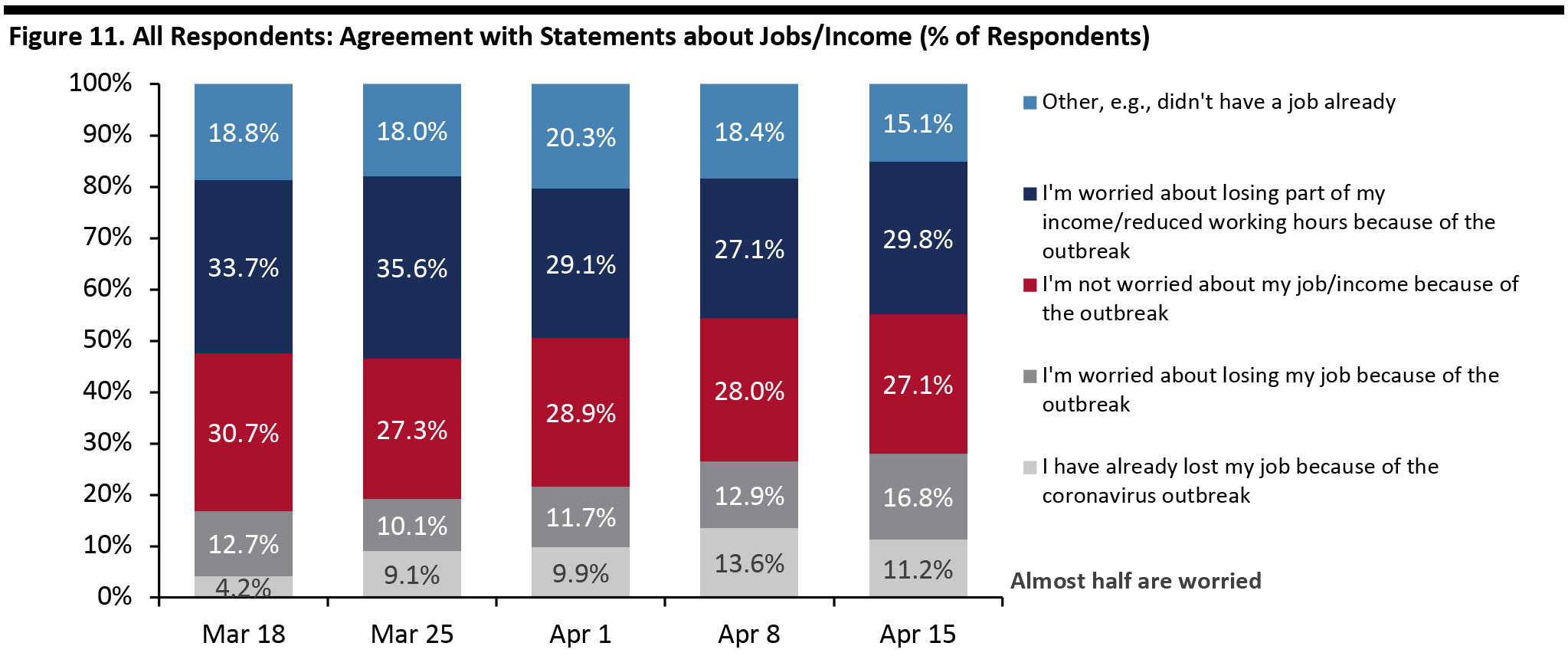

Concerns about Jobs and Income Jump

We asked respondents to choose from a selection of statements related to employment and income. Some 11.2% said they had already lost their job, which is within the margin of error from last week’s figure of 13.6%. By age, around 15% of the 18–29 age group say they have already lost their job, versus around 13% of those aged 30–44 and 11% of those aged 45–60. This week, a total of 46.6% were worried about losing their job or part of their income, up from 40.0% last week. This is the first time that we have seen this figure increase, after peaking at 46.4% on March 18. [caption id="attachment_108019" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

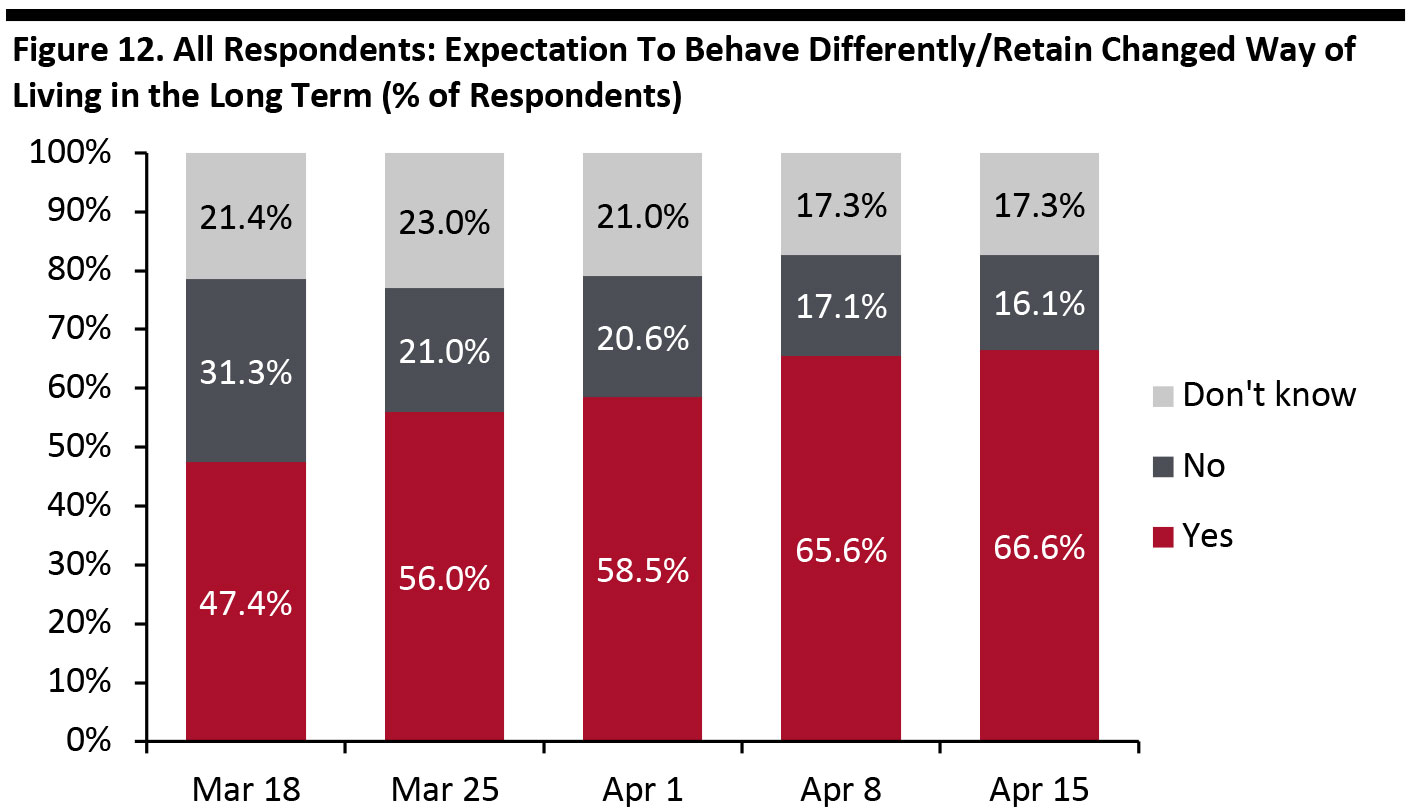

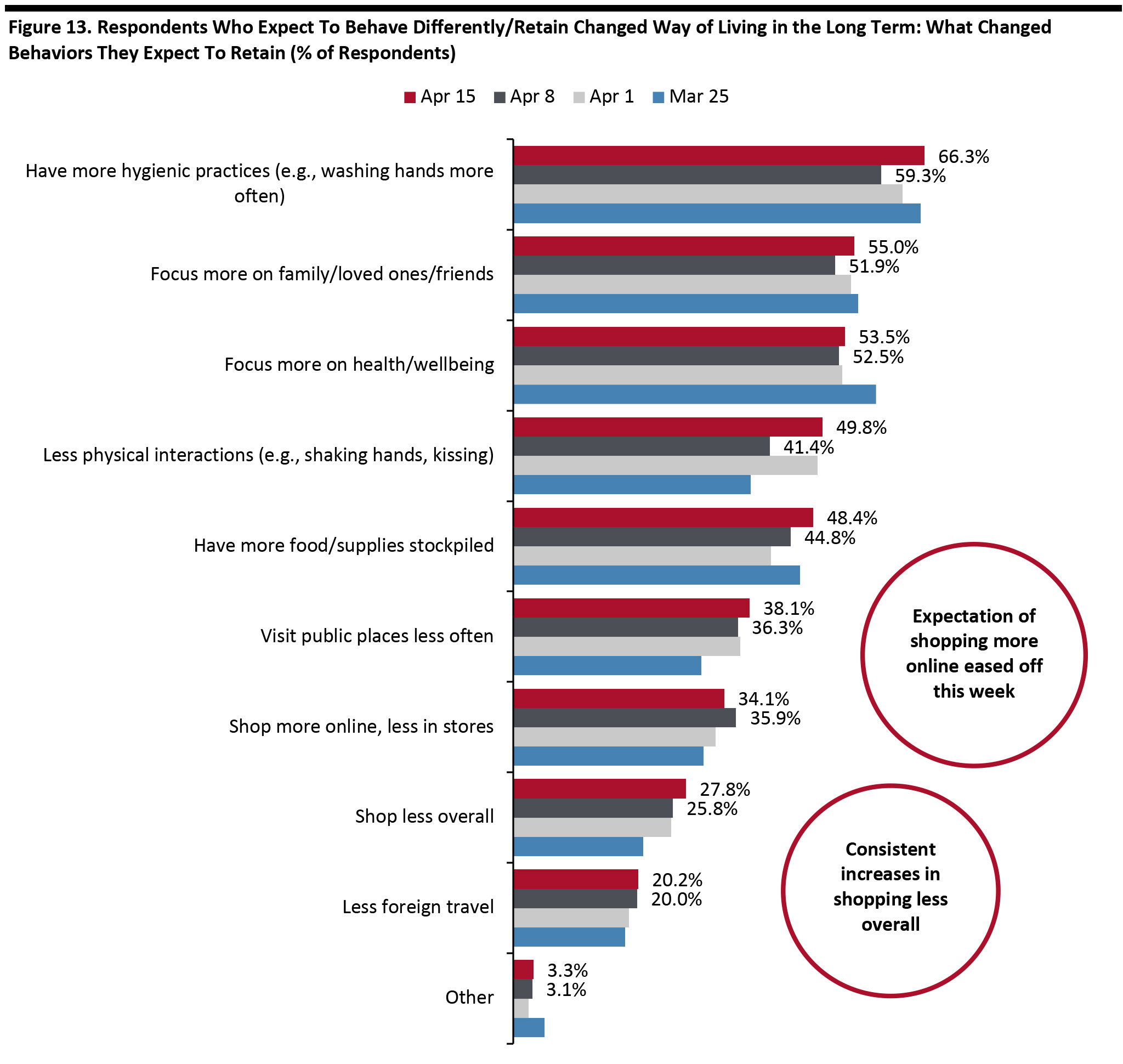

Two-Thirds Expect To Retain Changes in Behavior

Each week, we ask respondents if they will retain changed behaviors after the crisis ends. This week, we saw an approximate leveling-off in the proportion expecting to do so, at around two-thirds. [caption id="attachment_108020" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Among those who expect to keep outbreak-driven behavior, prevention through better hygiene was the top behavior, consistent with prior weeks. After previous increases in the proportion of respondents expecting to switch retail purchases from stores to e-commerce, we saw this option moderate a little this week: Around 34% of those expecting to retain changed behaviors now expect to permanently switch some spending to e-commerce, which equates to just under 23% of all respondents. We saw a further increase in the proportion expecting to shop less overall—to 27.8% of those expecting to retain changed behaviors, which equates to 18.5% of allrespondents.

- Note, the percentages below are of those people who expect to retain changed behaviors.

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research [/caption]

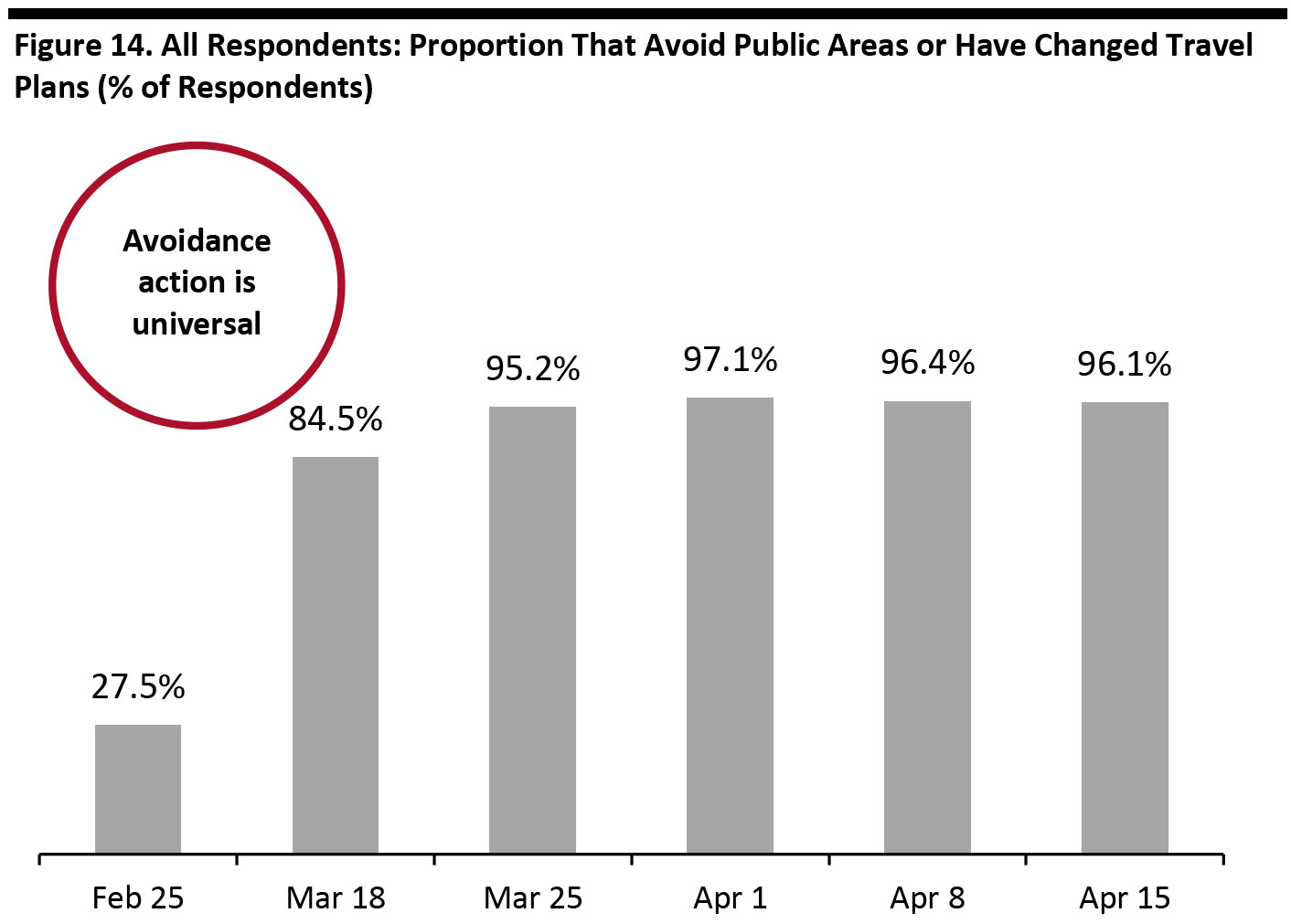

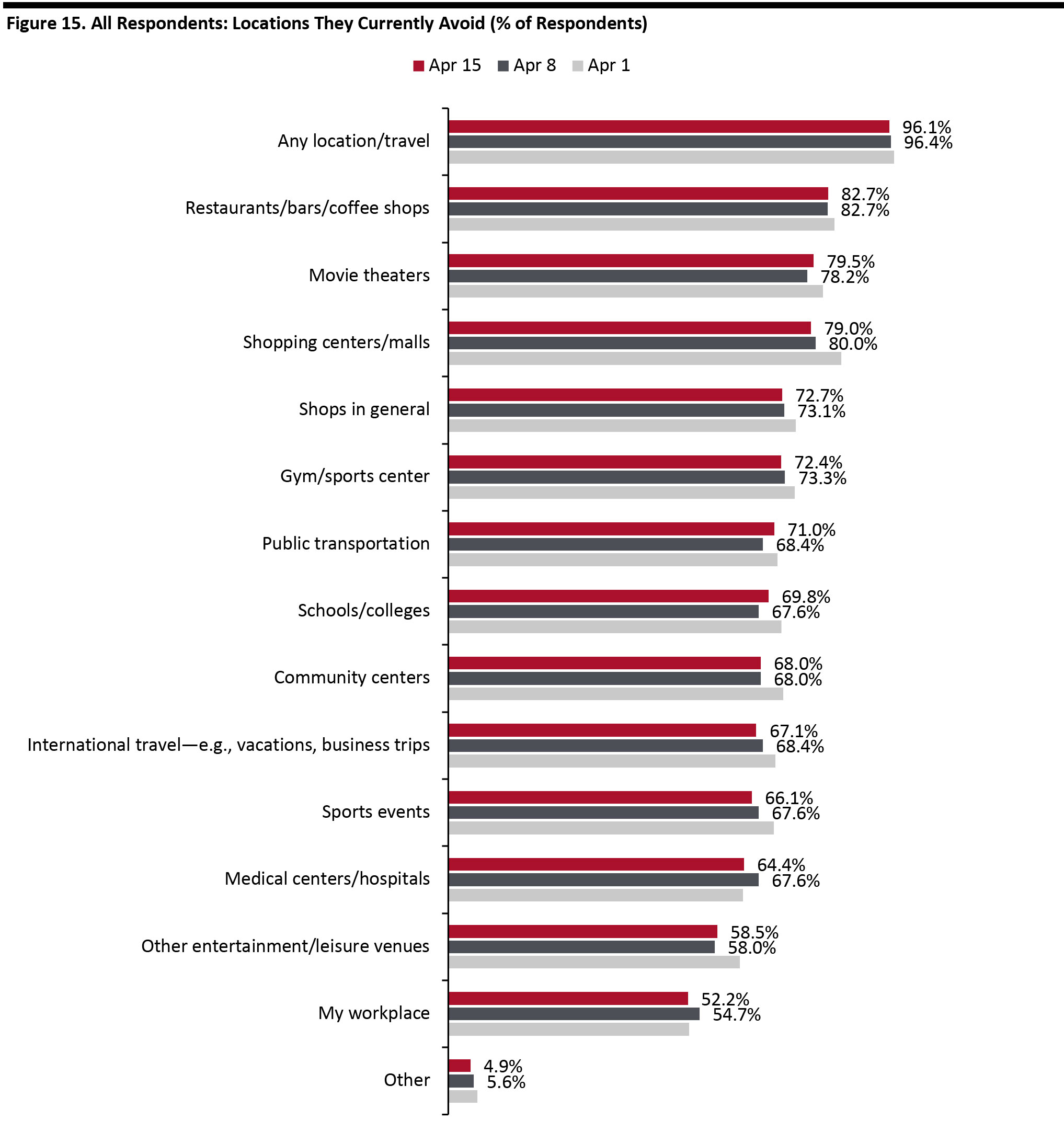

Almost All Consumers Now Taking Avoidance Actions

Given the lockdowns, avoidance action is now virtually universal. [caption id="attachment_108022" align="aligncenter" width="700"] Base: Internet users aged 18+

Base: Internet users aged 18+ Source: Coresight Research [/caption] This week, around 83% of respondents said they avoided food-service businesses, and 79% avoided shopping centers. [caption id="attachment_108023" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: US Internet users aged 18+

Source: Coresight Research [/caption]