albert Chan

We discuss select findings and compare them to those from prior weeks: July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

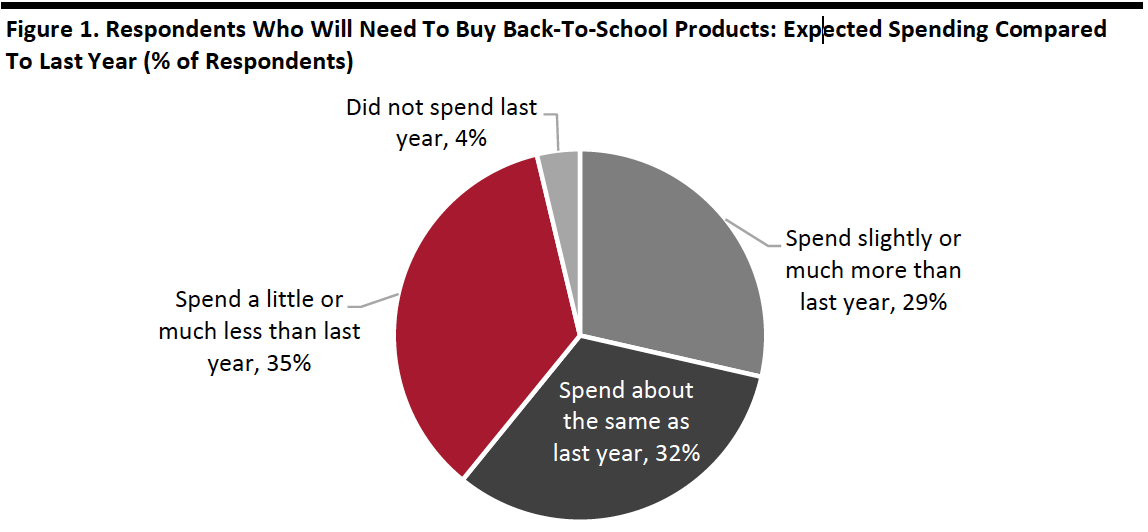

1. Over Two-Fifths Will Buy Protective and Hygiene Products for Back-to-SchoolThis week, we asked consumers questions about their attitude to, and expected behaviors during, the upcoming back-to-school season. Two-fifths of all respondents said that they will need to buy back-to-school products this year. Among those shoppers, more than one-third expect to spend less. However, the proportion did not have a clear lead over those who expect to spend the same or more, despite the economic downturn.

Safety and hygiene are top of mind for back-to-school shoppers. A little over four in ten of them said they will buy face masks and/or other hygiene products/personal protective equipment for their child or children.

Our survey also suggests a shift of back-to-school dollars from products for in-school learning to products for at-home learning: Over one-quarter of back-to-school shoppers expect to spend more on at-home learning products than last year, likely benefiting categories such as electronics and home products; while one in five expect to spend less on in-school products, which we expect to hit apparel, including sportswear.

- See our full report for complete results of how Covid-19 is expected to impact consumers’ back-to-school shopping behaviors.

Base: US Internet users aged 18+ who will need to buy back-to-school products this year

Base: US Internet users aged 18+ who will need to buy back-to-school products this yearSource: Coresight Research[/caption] 2. Online Continues To Overtake In-Store for Apparel Shopping

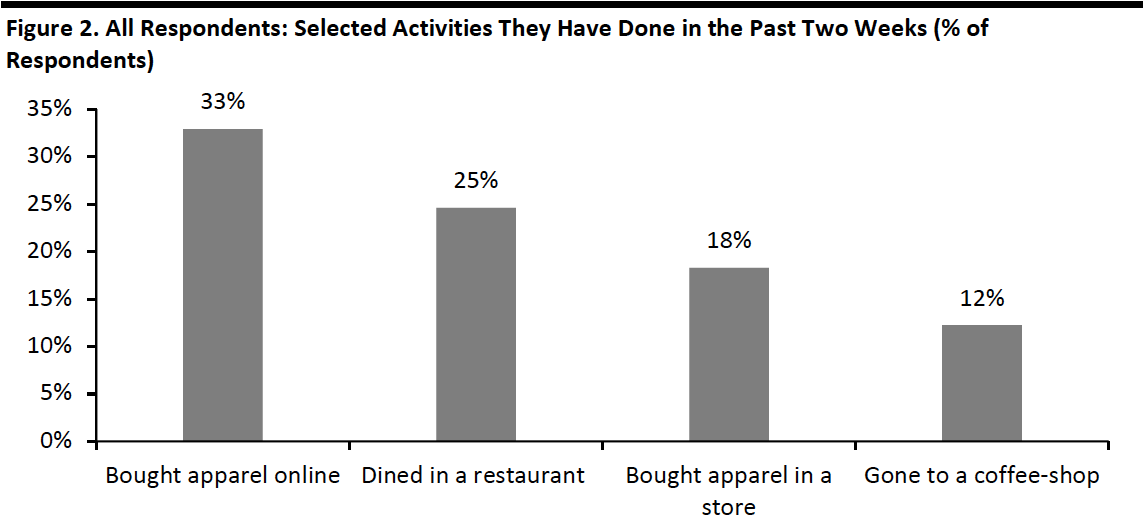

When we asked consumers what they had done over the past two weeks, e-commerce was again the preferred shopping channel for apparel, although the popularity of the online channel has plateaued. We saw a stable proportion of around one-third of respondents stating that they had made apparel purchases online in the past two weeks. This compares to a little over one in six respondents who had bought apparel in a store over the same period.

Looking at other activities that consumers had done in the past two weeks, the proportion of respondents who had gone to food-service locations declined, as restaurants in some states reclosed their dine-in service. Around one-quarter had dined in a restaurant in the past two weeks, and one in eight had gone to a coffee shop.

[caption id="attachment_112750" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Rebound of Discretionary Spending

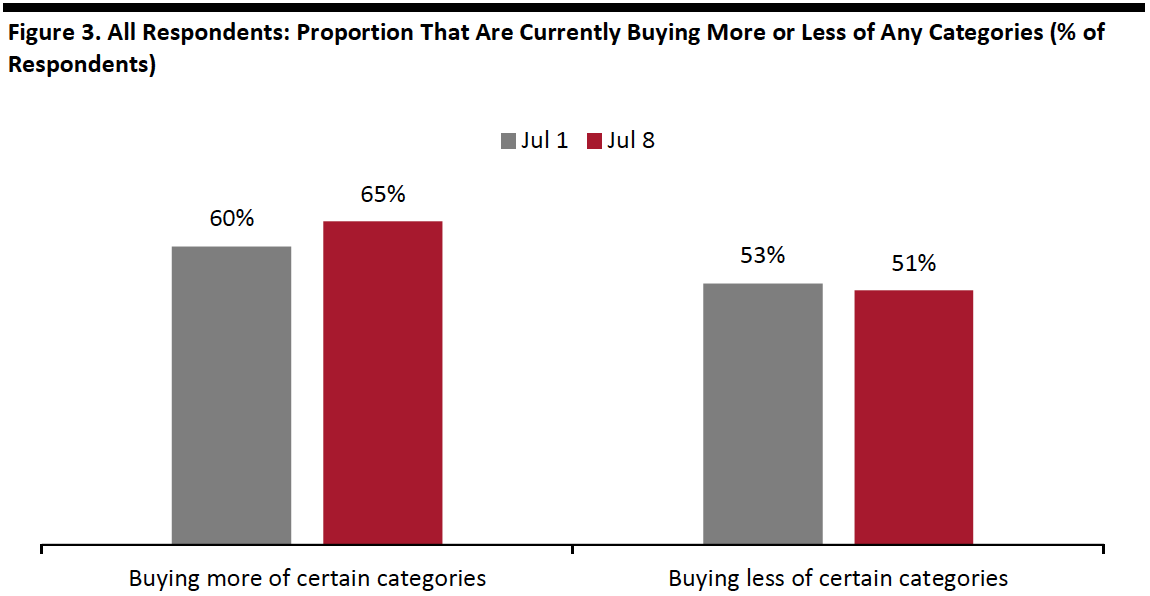

We saw a jump in the rate of consumers buying more in any categories and decline in buying less in any categories this week. Consumers continue to buy more essentials, including household products, food and personal care products, and reduce spending on discretionary categories.

However, a positive sign for retailers is that we have seen downward trends in the ratios of the proportion of respondents purchasing less to those purchasing more in discretionary categories:

- The ratio for apparel was 2.5 this week, versus 2.7 last week and 3.1 two weeks ago.

- The ratio for beauty products stood at 1.7, down from 2.4 last week and 2.9 two weeks before.

- The ratio for electronics fell to 1.2, from 1.5 last week and 1.6 two weeks ago.

Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to both

Buying more of certain categories and buying less of certain categories were not mutually exclusive options and respondents could answer yes to bothBase: US Internet users aged 18+

Source: Coresight Research[/caption]