albert Chan

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on July 8, 2020. We explore the trends we are seeing from week to week, following prior surveys on July 1, June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Back-to-School Shopping amid Covid-19

This week, we asked consumers about their expected shopping behaviors for the upcoming back-to-school season. Two-fifths of all respondents said that they will need to buy back-to-school products this year, and we asked this group:

- About their expected back-to-school spending this year compared to last year.

- Whether they agreed with any or all of nine attitudinal and behavioral statements related to back-to-school spending.

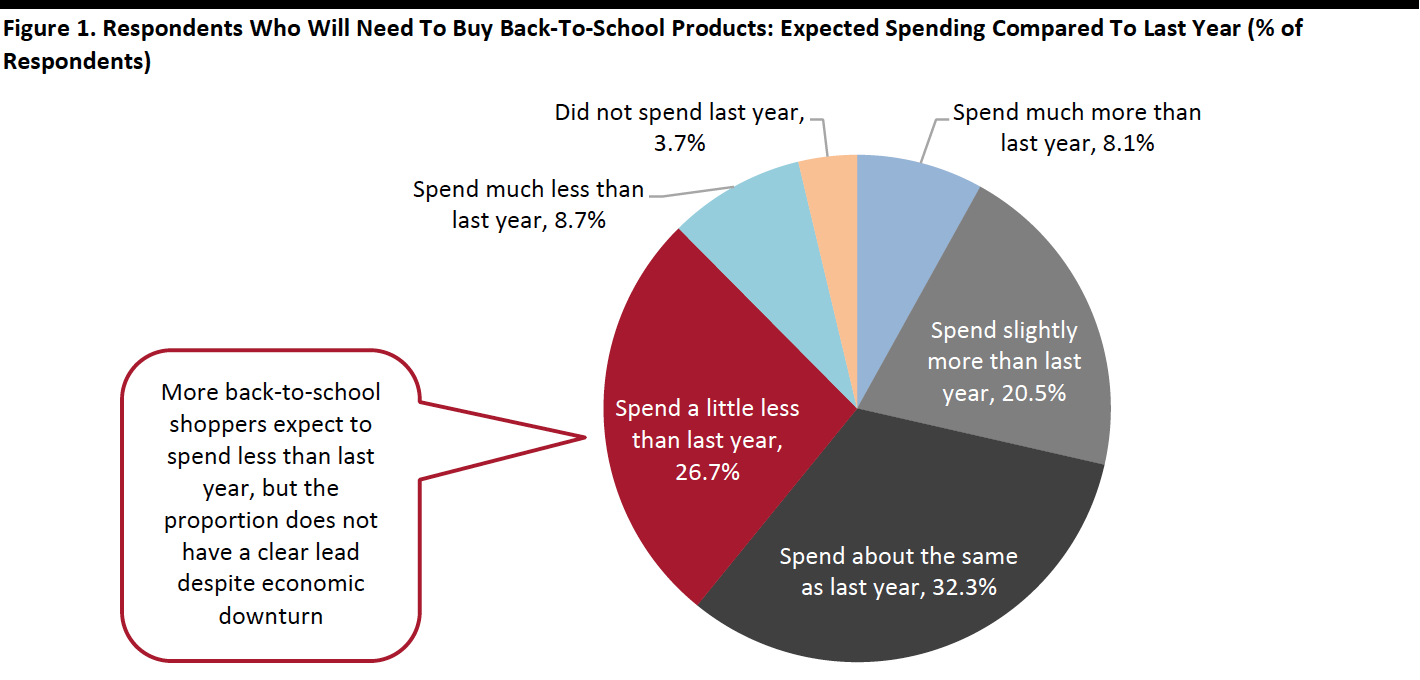

More than One-Third of Back-To-School Shoppers Expect To Spend Less

Among those who expect to buy for back-to-school, 35.4% expect to spend a little, or much, less than last year.

While spending less was the most popular option, its lead was minimal, despite the economic downturn: Some 32.3% stated that they expect their spending to be the same as last year, and 28.6% expect to spend slightly or much more than last year (with an additional 3.7% expecting to spend that did not last year). The relative strength of spending more may be supported by shoppers expecting to spend on non-traditional categories such as masks and hygiene products or products and services to support at-home learning—we explore this in the next section.

[caption id="attachment_112731" align="aligncenter" width="700"] Base: US Internet users aged 18+ who will need to buy back-to-school products this year

Base: US Internet users aged 18+ who will need to buy back-to-school products this yearSource: Coresight Research[/caption]

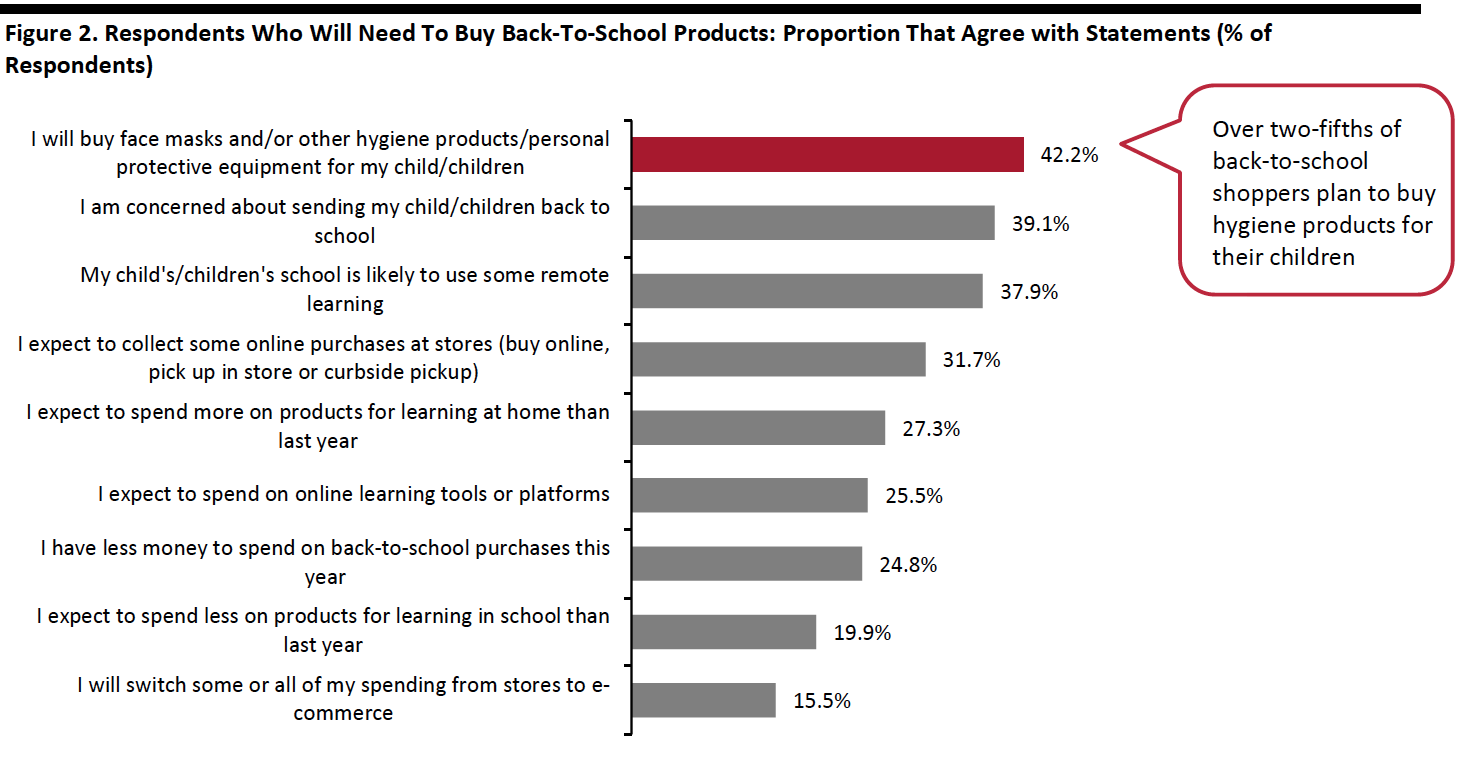

Over Two-Fifths Will Buy Protective and Hygiene Products

Concerns are running high among back-to-school shoppers. When we asked these consumers about their attitudes and expected behaviors, we found the following:

- Some 42.2% of these consumers said they will buy face masks, other hygiene products or personal protective equipment—the highest rate of agreement to any of the options.

- The second-highest level of agreement was related to worries about sending kids to school: Four in 10 are concerned about sending their child or children back to school.

The crisis is shaping what consumers will spend on and how they will shop:

- Our survey suggests a shift of back-to-school dollars from products for in-school learning to products for at-home learning: Over one-quarter (27.3%) expect to spend more on at-home learning products than last year, likely benefiting categories such as electronics and furniture; while one in five expect to spend less on in-school products, which we expect to hit apparel, including sportswear.

- The market for digital learning is growing: One-quarter of back-to-school shoppers expect to spend on online learning tools or platforms.

- Only 15.5% plan to switch some or all of their back-to-school shopping from stores to e-commerce this year—a relatively low proportion given the other indicators of shopper reluctance to visit stores (see later in this report) but perhaps reflecting already-substantial e-commerce penetration.

- Almost one-third expect to use contact-light collection options, such as in-store and curbside pickup for online purchases.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who will need to buy back-to-school products this year

Source: Coresight Research[/caption]

What Shoppers Are Doing and Where They Are Going

Consumers Still Preferred To Shop for Apparel Online in the Past Two Weeks

We saw increases in the proportion of respondents for seven of the 16 options we provided for activities done over the past two weeks, although most are within the margin of error.

- E-commerce continues to overtake the brick-and-mortar format for apparel shopping, although the popularity of the online channel has plateaued. The proportion of respondents that had shopped for apparel online in the past two weeks remained flat at one-third for the third consecutive week. The proportion of all respondents who had bought apparel in a store increased very slightly to 18.3%.

- The proportion of respondents who had bought grocery online has fluctuated in the past couple of weeks. A little below one-third stated that they had done this week, up from 26.6% last week.

- The proportion of respondents who had gone to food-service locations in the past two weeks declined, as restaurants in some states reclosed their dine-in service. Some 24.6% had dined in a restaurant, versus 26.8% last week. One in eight had gone to a coffee shop, compared to 15.3% last week.

- Although remaining at a low level, we saw slight week-over-week increases in the proportions of respondents that visited both types of shopping centers—open-air and enclosed. A little over one in six had gone to an open-air mall in the past two weeks, and one in nine had visited an enclosed shopping center.

[wpdatatable id=312]

Respondents could select multiple options Base: US Internet users aged 18+ Source: Coresight Research

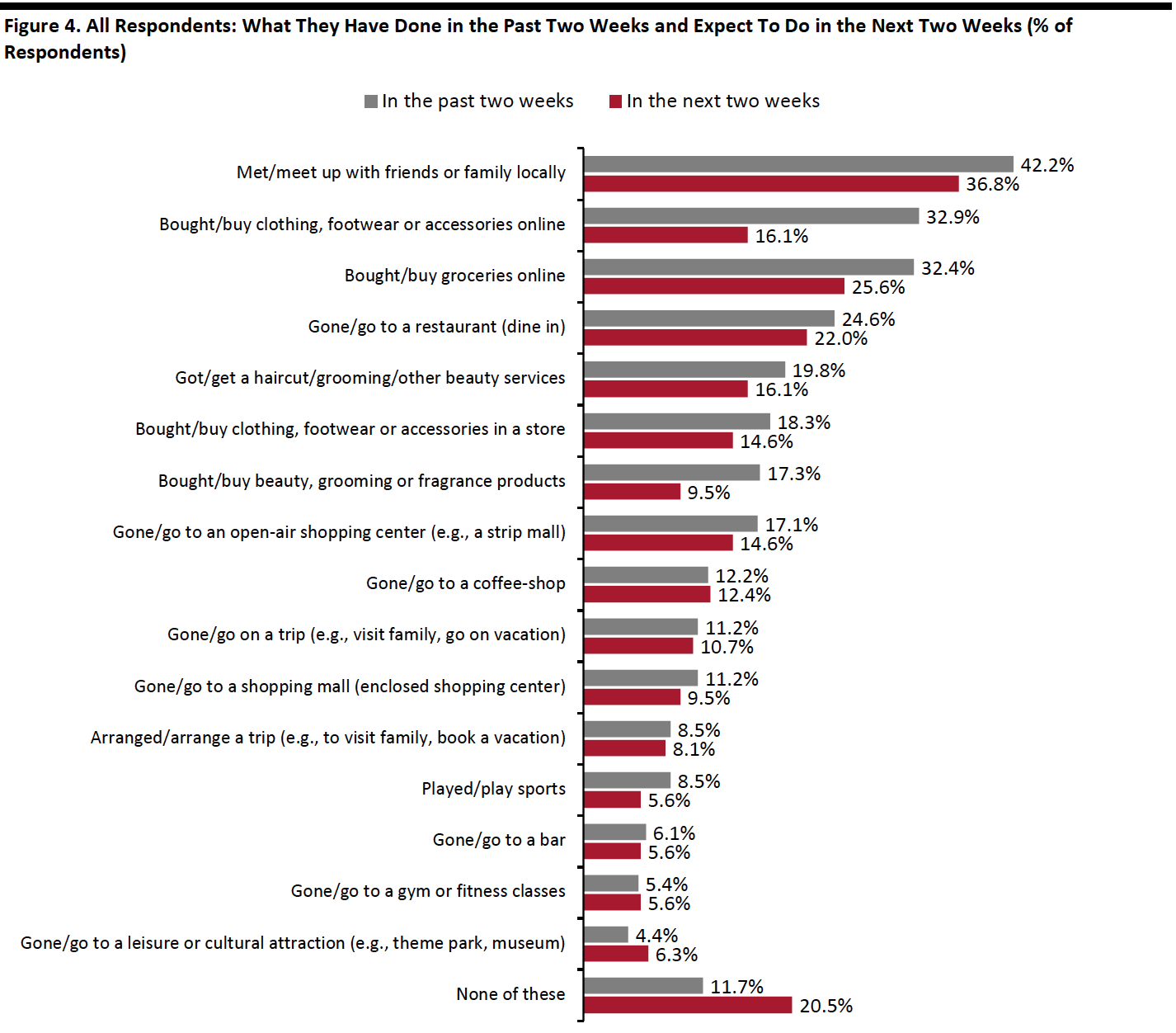

Expectations To Do Shopping-Related Activities in the Next Two Weeks Are Low

Below, we chart what respondents have done in the past two weeks and what they expect to do in the next two weeks. We saw a lower proportion of consumers expecting to do shopping-related activities than actual behavior in the past two weeks, and one-fifth of respondents do not plan to do any of these activities.

The proportion of respondents who expect to buy apparel online in the next two weeks dropped to 16.1%, but we expect actual behavior to be much higher, based on the consistent trend over the past couple of weeks.

Some 14.6% expect to buy clothing or footwear in a store, and only one in 10 expect to buy beauty products, in the next two weeks.

[caption id="attachment_112735" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

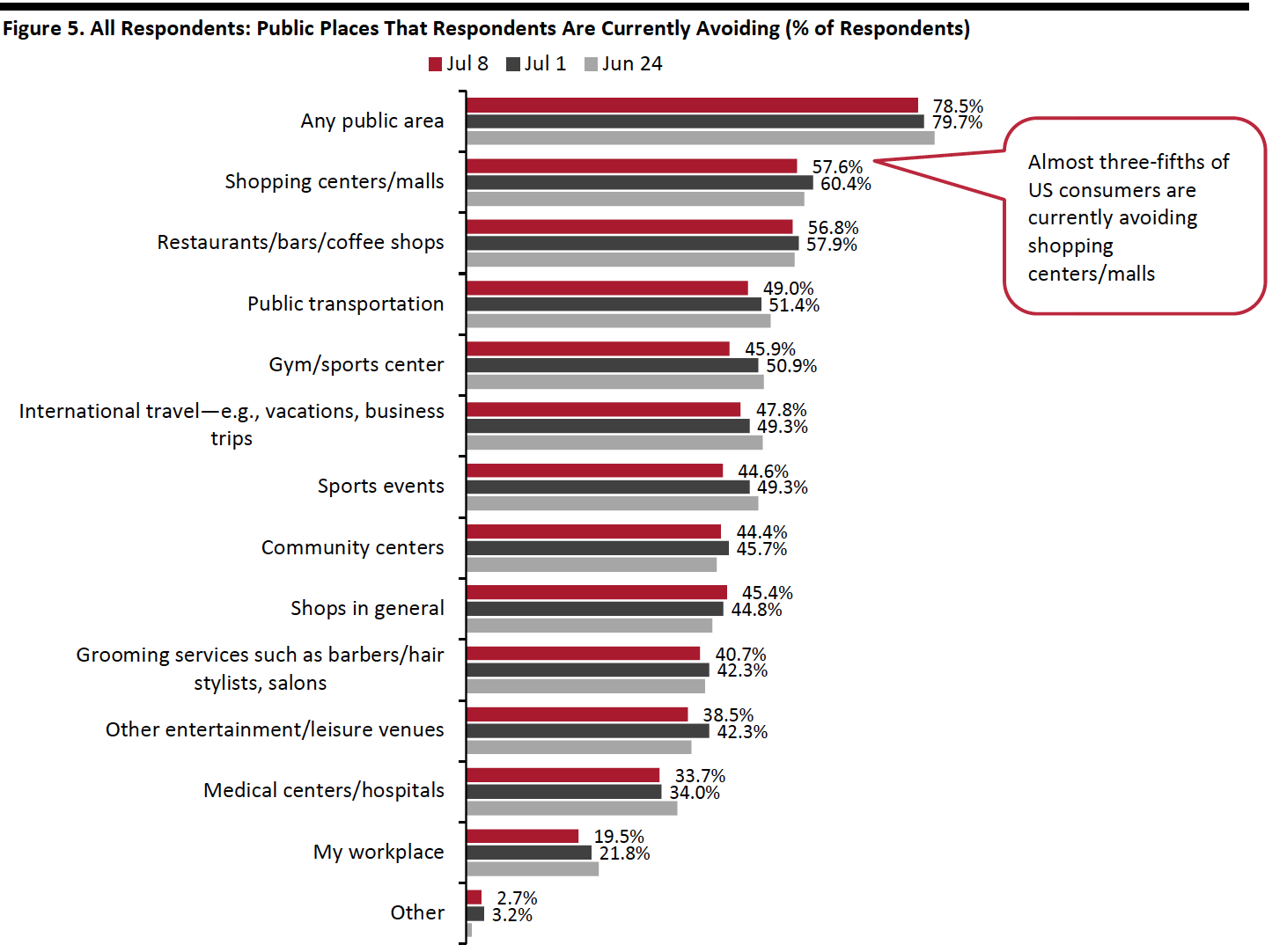

Almost Four-Fifths Are Currently Avoiding Public Places

This week, the proportion of consumers avoiding any kind of public place remains high at 78.5%, broadly in line with last week—reflecting consumers’ response to the recent resurgence of coronavirus cases in some states.

Shopping centers/malls and food-service locations continue to be the most-avoided places. Some 57.6% of respondents reported that they are currently avoiding shopping centers/malls, versus 60.4% last week. Avoidance action of food-service locations came in at 56.8%, compared to 57.9% last week.

In addition, the proportion of respondents that are currently avoiding shops in general is on an upward trend, with 45.4% saying they are doing so.

[caption id="attachment_112736" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

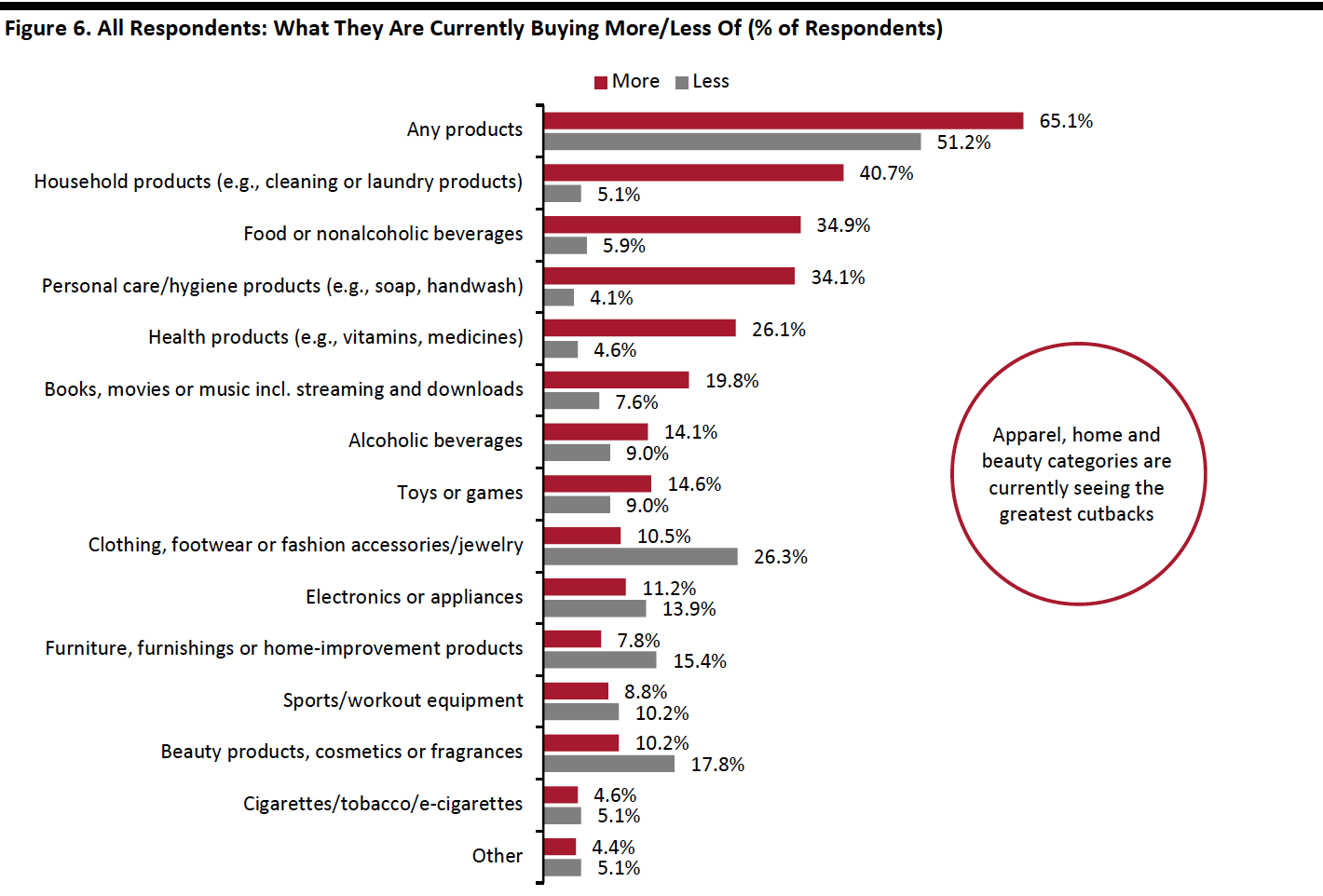

What They Are Currently Buying More Of and Less Of

The proportion of respondents who are buying more of any categories jumped five percentage points this week, to 65.1% from 60.1% last week. We also saw slightly fewer respondents currently buying less, with 51.2% doing so, versus 52.7% last week.

- Buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both.

Buying more: Consumers continue to buy more essentials, including household products, food and personal care products. The proportion of consumers buying these products also jumped slightly after declines last week.

Buying less: Apparel remains the most-cut category, with 26.3% of respondents spending less on such products. This is followed by other discretionary categories, including beauty and furniture products. However, an encouraging sign for retailers is that we saw week-over-week declines in the proportion of shoppers spending less on all discretionary categories (we show trended data in figure 7).

Ratio of less to more: We have seen downward trends in the ratios of the proportion buying less to the proportion buying more in discretionary categories:

- The ratio for apparel was 2.5 this week, versus 2.7 last week and 3.1 two weeks ago.

- The ratio for beauty products stood at 1.7, down from 2.4 last week and 2.9 two weeks before.

- The ratio for electronics fell to 1.2 this week, from 1.5 last week.

- The ratio for home products also dropped to 2.0, from 2.3 last week.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption] Figure 7. All Respondents: Buying More/Less of Selected Categories (% of Respondents)

[wpdatatable id=314]

Base: US Internet users aged 18+ Source: Coresight Research

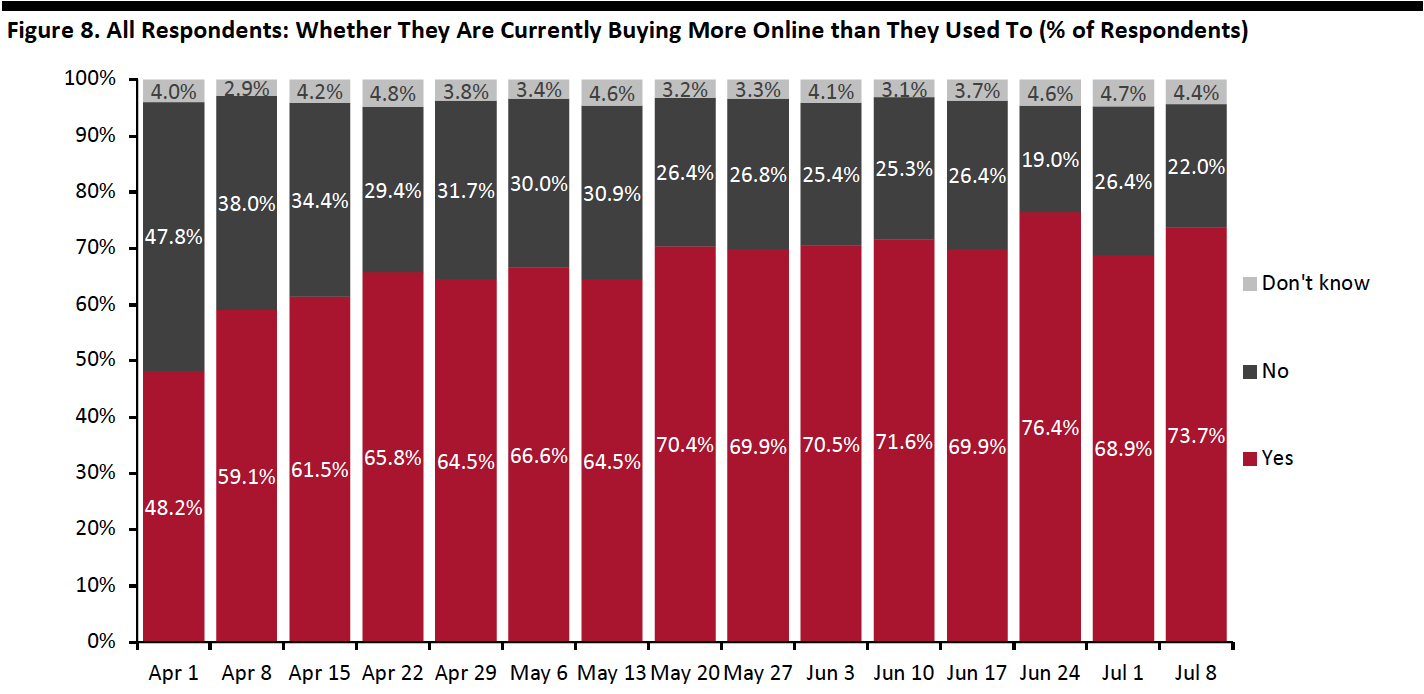

Almost Three-Quarters Are Switching Spending Online

The proportion of consumers switching their spending to e-commerce has been volatile in the past couple of weeks. Some 73.7% of consumers stated that they are buying more online this week, versus 68.9% last week.

[caption id="attachment_112739" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

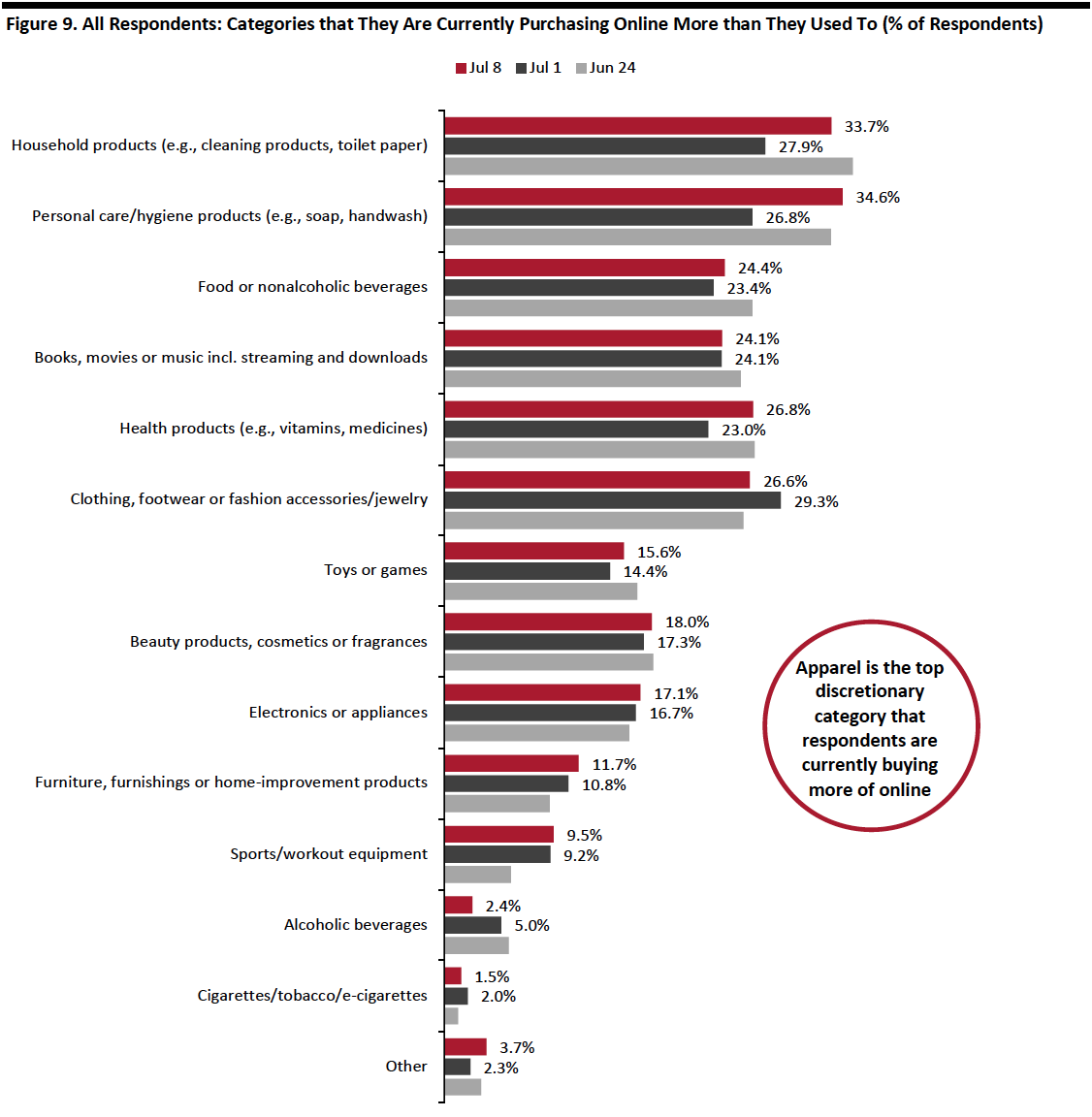

What Consumers Are Currently Buying More Of Online

This week, household and personal care products returned as the top categories that consumers are currently buying more of online after significant declines last week.

Apparel is still the number-one discretionary category that consumers are currently buying more of online, with 26.8% of respondents reporting that they are doing so, slightly down from one in three last week.

We saw online purchases for other discretionary categories, including home and electronics, increase slightly week-over-week. Some 17.1% of respondents are currently buying more electronics products, and 11.7% are buying more furniture.

[caption id="attachment_112740" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption]

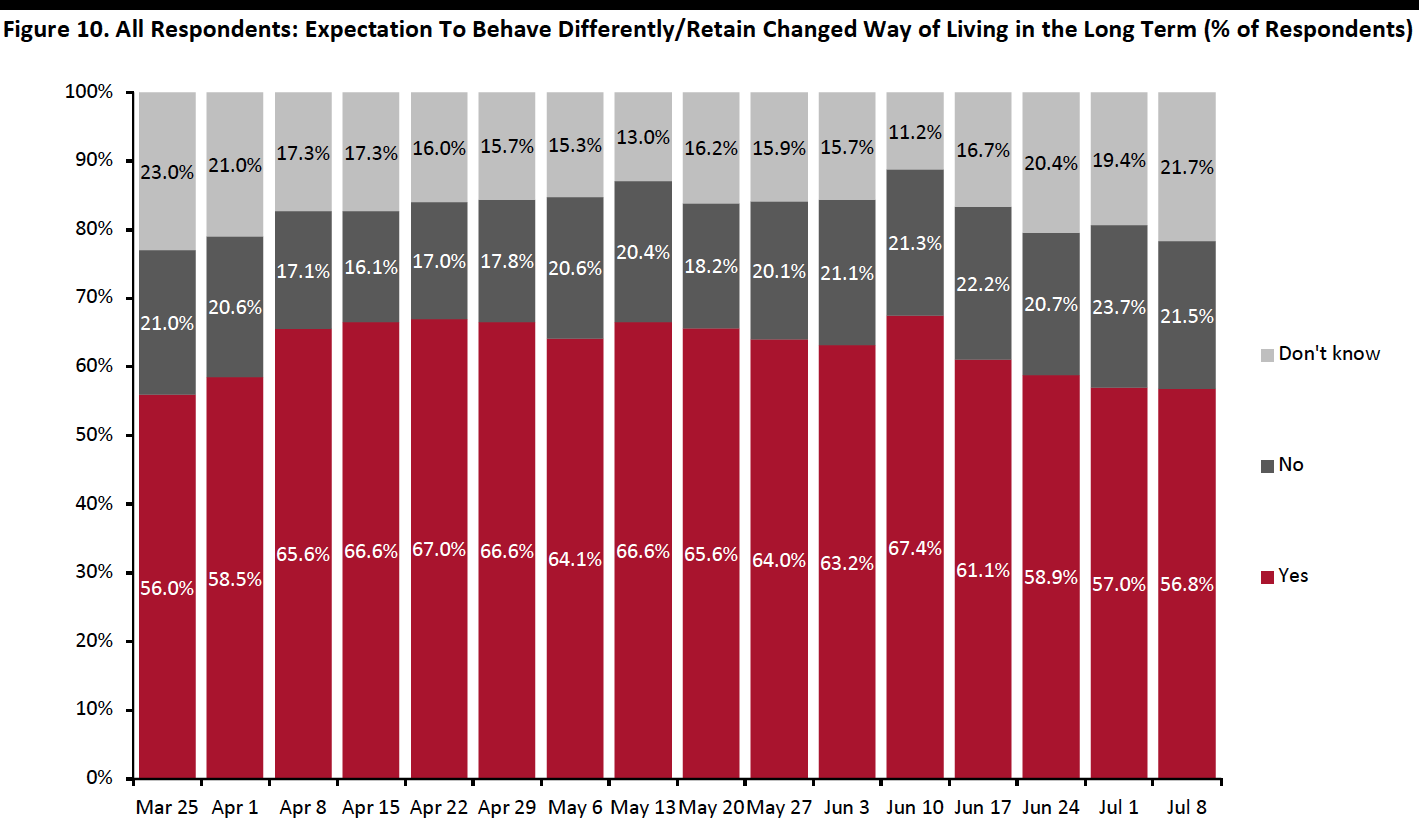

Reviewing Trend Data in Purchasing Behavior

Fewer than Six in 10 Expect To Retain Changed Behaviors over the Long Term

Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. This week, the proportion of respondents expecting to retain some changed behaviors leveled off, with 56.8% expecting to do so for the long-term.

[caption id="attachment_112741" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

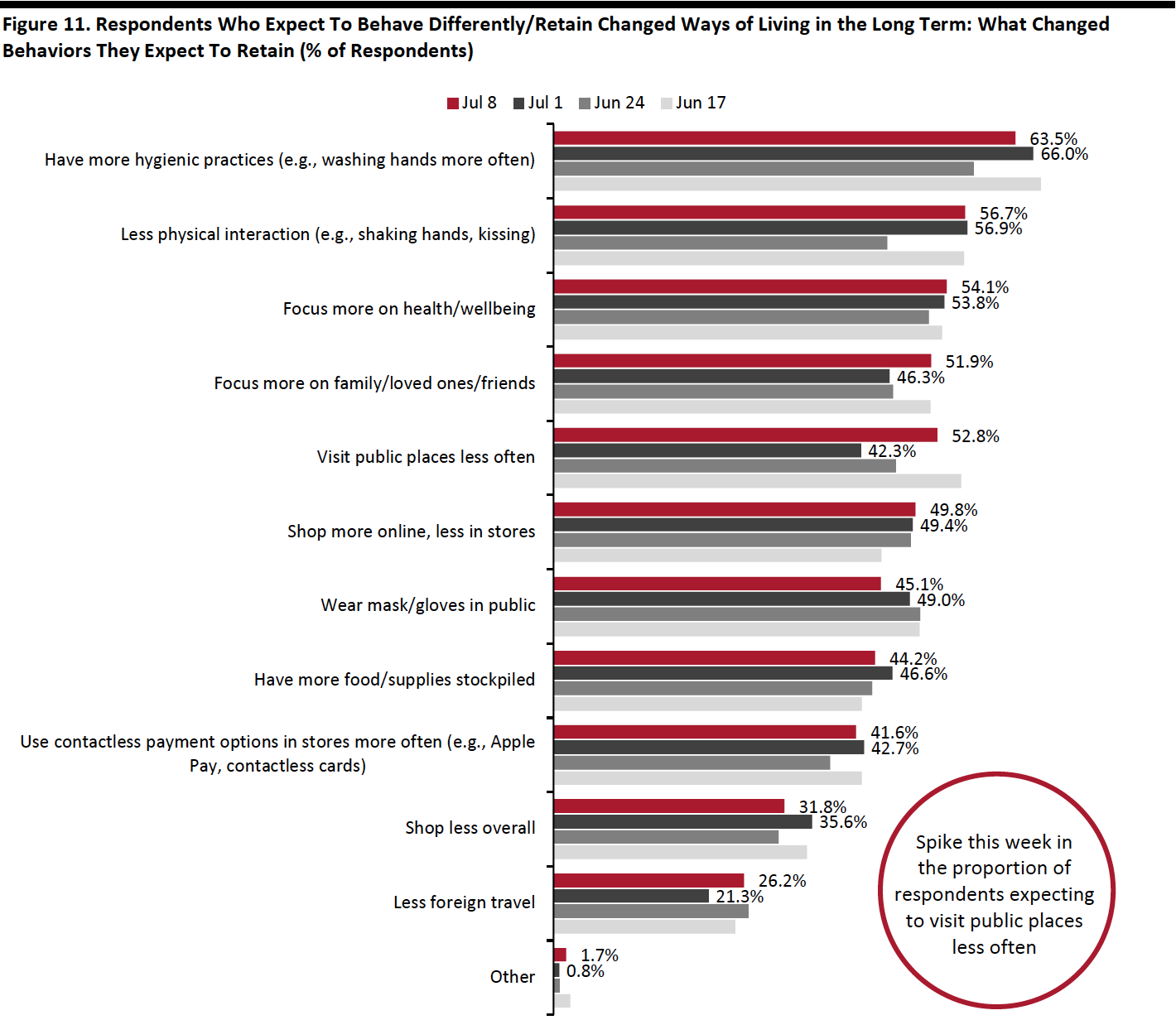

Among those expecting to retain changed behaviors, the proportion of respondents expecting to have more hygienic practices and less physical interaction stayed at a high level this week.

Some 45.1% expect to wear masks/gloves in the long term, slightly down from about half last week.

The proportion of respondents expecting to use contactless payment options in stores more often than they did previously broadly leveled off this week, with 41.6% expecting to do so, after reaching the highest level last week.

[caption id="attachment_112742" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research[/caption]

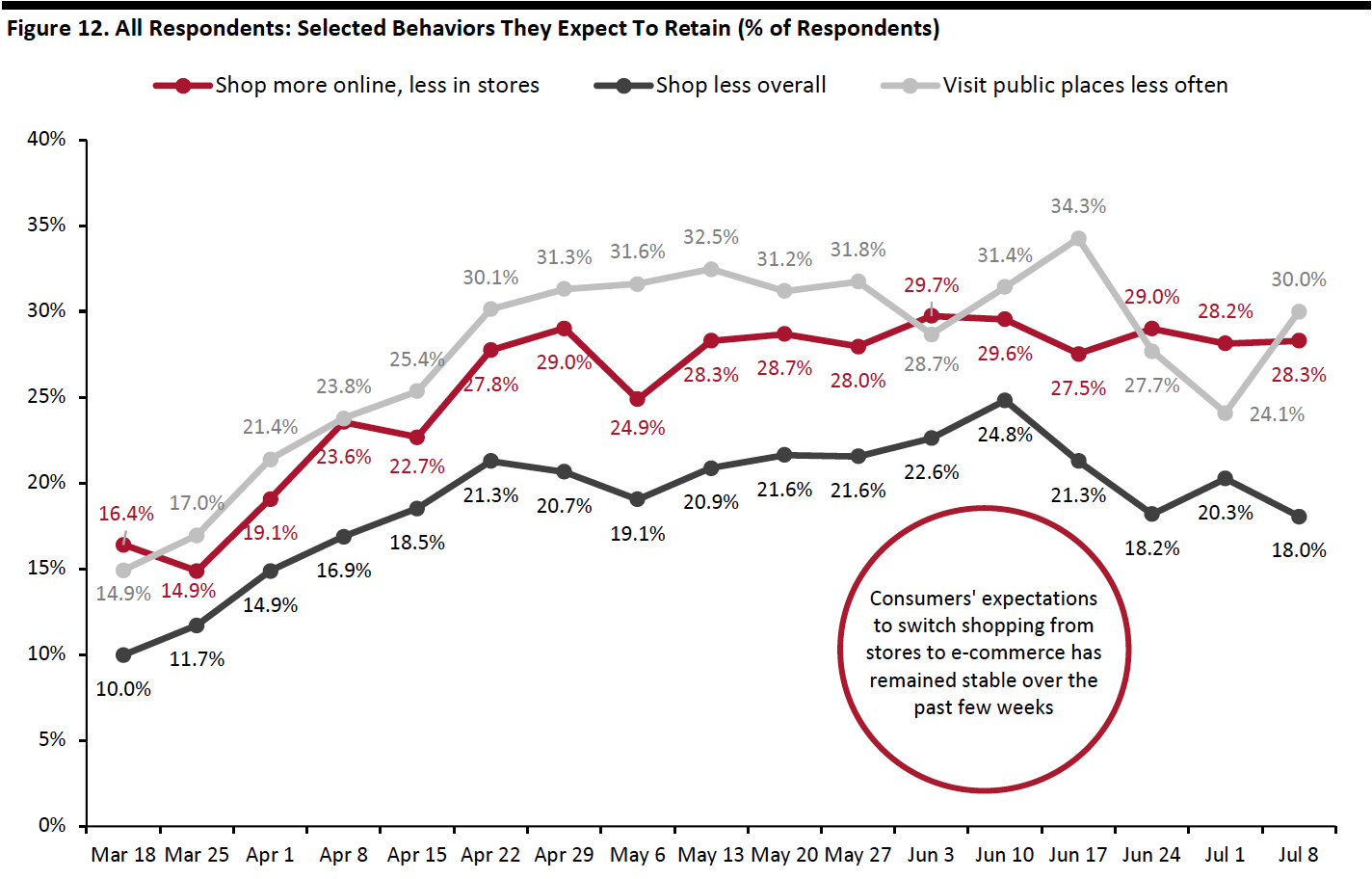

In the chart below, we show trending data in three of the metrics charted above. We represent these as a proportion of all respondents, to represent consumers overall, rather than as a proportion of those expecting to retain changed behaviors (which is what charted above).

Rebased to all respondents, we have seen oscillation over the past few weeks in the proportion of respondents who expect to visit public places less often. Three in 10 expect to do so this week, jumping six percentage points from 24.1% last week.

The proportion of respondents who expect to shop less overall decreased slightly this week, to 18.0% from one-fifth last week. The near-consistent downward trend since the week of June 10 suggests that this trend is past its peak.

The proportion of consumers expecting to shop more online in the long term leveled off in recent weeks, at around 28%.

[caption id="attachment_112743" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

Methodology

We surveyed respondents online on July 8 (410 respondents), July 1 (444 respondents), June 24 (411 respondents), June 17 (432 respondents), June 10 (423 respondents), June 3 (464 respondents), May 27 (422 respondents), May 20 (439 respondents), May 13 (431 respondents), May 6 (446 respondents), April 29 (479 respondents), April 22 (418 respondents), April 15 (410 respondents), April 8 (450 respondents), April 1 (477 respondents), March 25 (495 respondents) and March 17–18 (1,152 respondents). The most recent results have a margin of error of +/- 5%, with a 95% confidence interval. Not all charted week-over-week differences may be statistically significant.