albert Chan

We discuss selected findings and compare them to those from prior weeks: May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Life Beyond Lockdown: Three Learnings

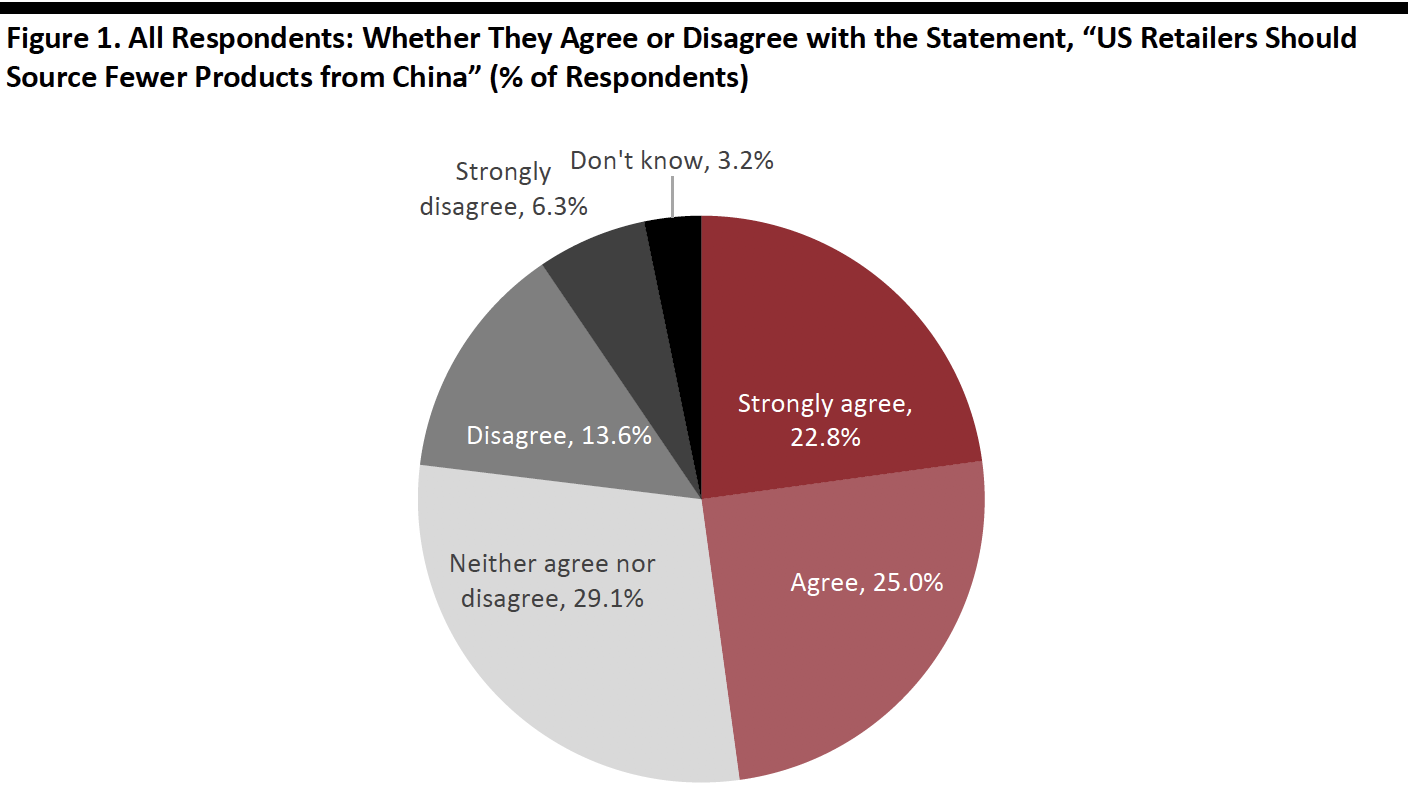

1. Consumers’ Attitude to “Made in China” Products Is Negative Due to the CoronavirusThis week, we asked two questions about consumers’ attitudes toward “Made in China” products in the wake of the coronavirus pandemic.

- We asked respondents if they agreed with the statement, “US retailers should source fewer products from China because of the coronavirus pandemic.”

- We asked respondents if the coronavirus had any effect on their willingness to buy products that are made in China. See our full report for responses to this question, including how attitudes differ by age.

We saw a noticeable number of respondents have a negative view toward “Made in China” products. Some 47.8% of all respondents agree or strongly agree with the statement, “US retailers should source fewer products from China.” This finding is likely to ring alarm bells for brands and retailers that are heavily reliant on China sourcing. Alongside heightened political tensions, our data hint that US retailers should review their supply chains and consider whether they are overly dependent on China as a manufacturing hub—and whether that is evident to their customers.

One in five respondents disagree or strongly disagree that retailers should switch sourcing away from China.

[caption id="attachment_110950" align="aligncenter" width="700"] Base: US Internet users aged 18+

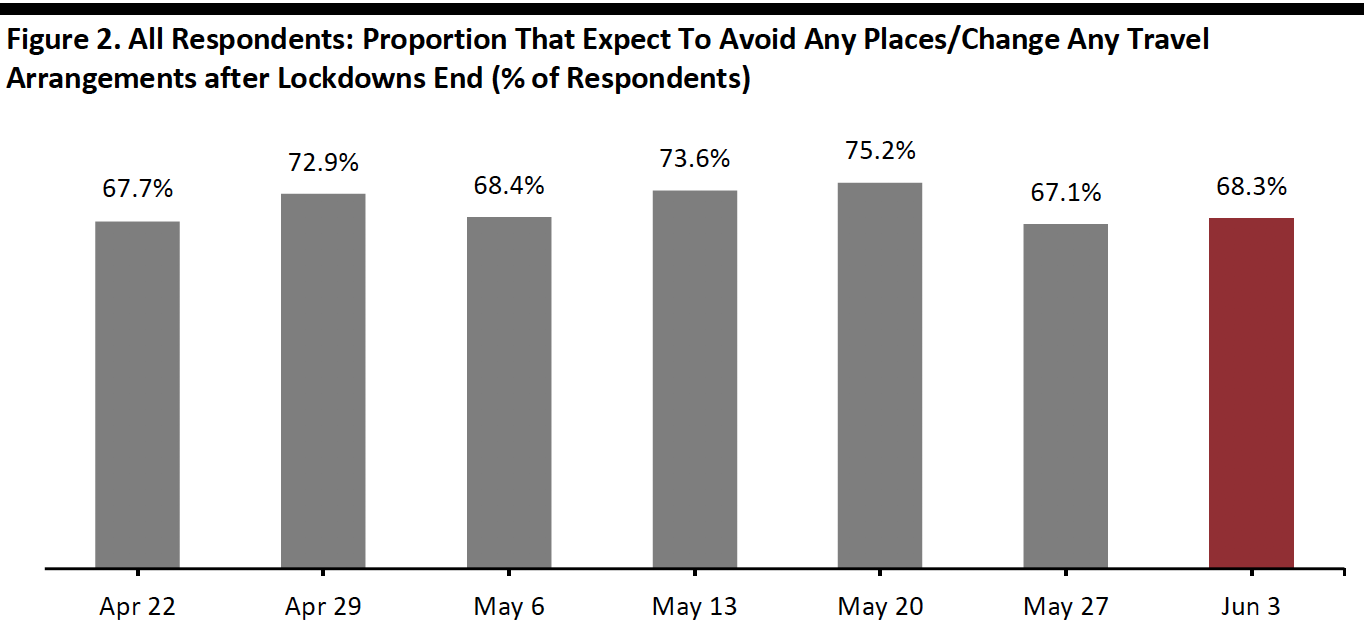

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. Two-Thirds of Respondents Expect To Avoid Public Places after Lockdowns End

Consumers’ concern about returning to public places jumped a little after a significant decline last week (albeit within the margin of error); 68.3% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end, versus 67.1% last week. On the positive side, this week’s figure is still much lower compared to those in the week of May 13 (73.6%) and May 20 (75.6%).

The notable change this week was in expected avoidance of community centers, which saw a decrease of almost six percentage points.

The proportion of respondents expecting to avoid shopping centers/malls moderated this week after the drop last week. Some 45% of consumers now expect to avoid shopping centers/malls, which is remains lowest proportion of respondents since we started asking the question.

[caption id="attachment_110951" align="aligncenter" width="700"] Base: US Internet users aged 18+

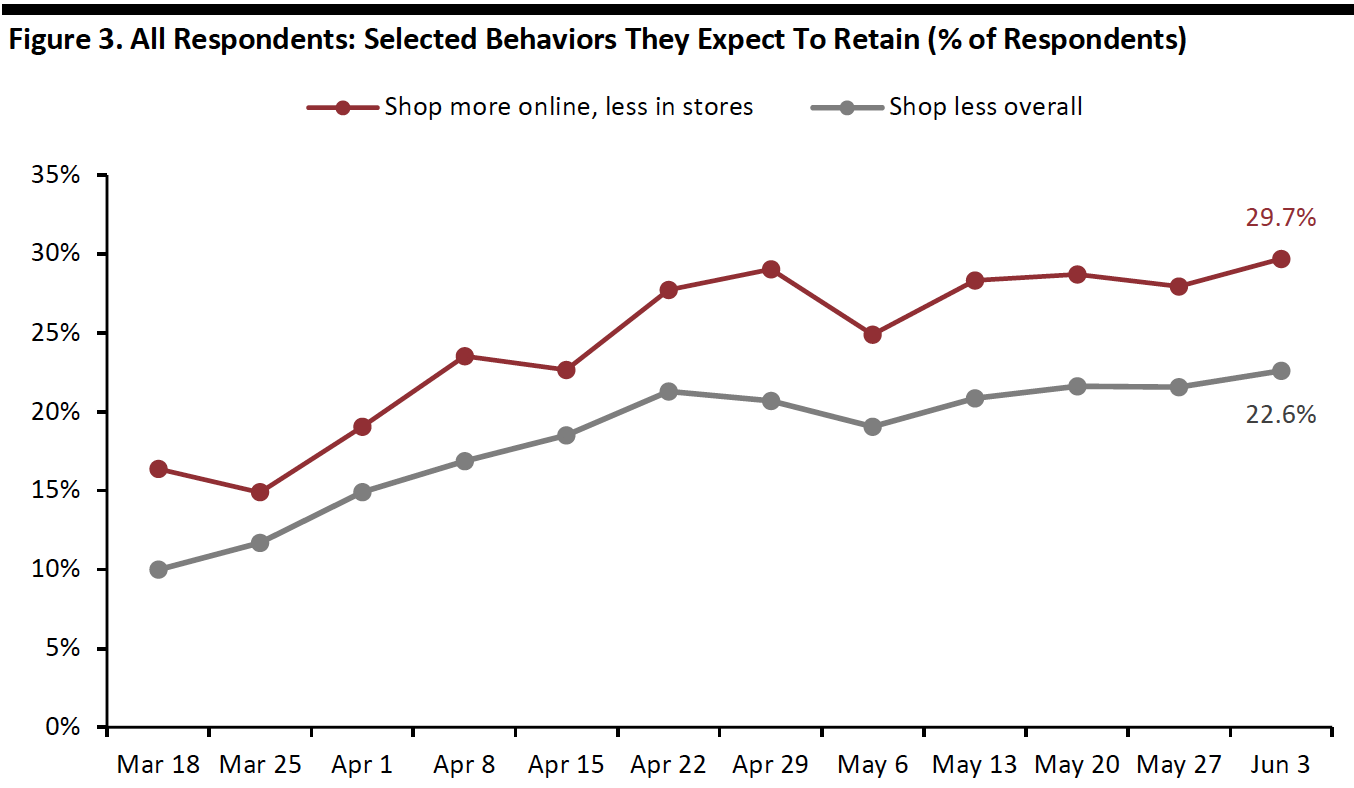

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Changed Consumers Behaviors Are Here To Stay Post Crisis

Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Consistently, two-thirds of respondents expect to keep some behaviors over the long term.

Since we added the option on May 6 about wearing masks/gloves in public, there has been a near-consistent upward trend in the proportion of respondents expecting to do so. This week, almost one-third of all respondents expect to wear masks/gloves in public.

In addition, we have seen an overall upward trend in expectations of retaining changed shopping habits, after tending to level off in the past couple of weeks:

- Almost 30% of all respondents now expect to switch shopping from stores to e-commerce. This figure is almost double that of when we first asked the question in mid-March.

- Over one-fifth of all respondents expect to shop less overall once the outbreak ends.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]