Nitheesh NH

We discuss selected findings and compare them to those from prior weeks: May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

Life Beyond Lockdown: Three Learnings

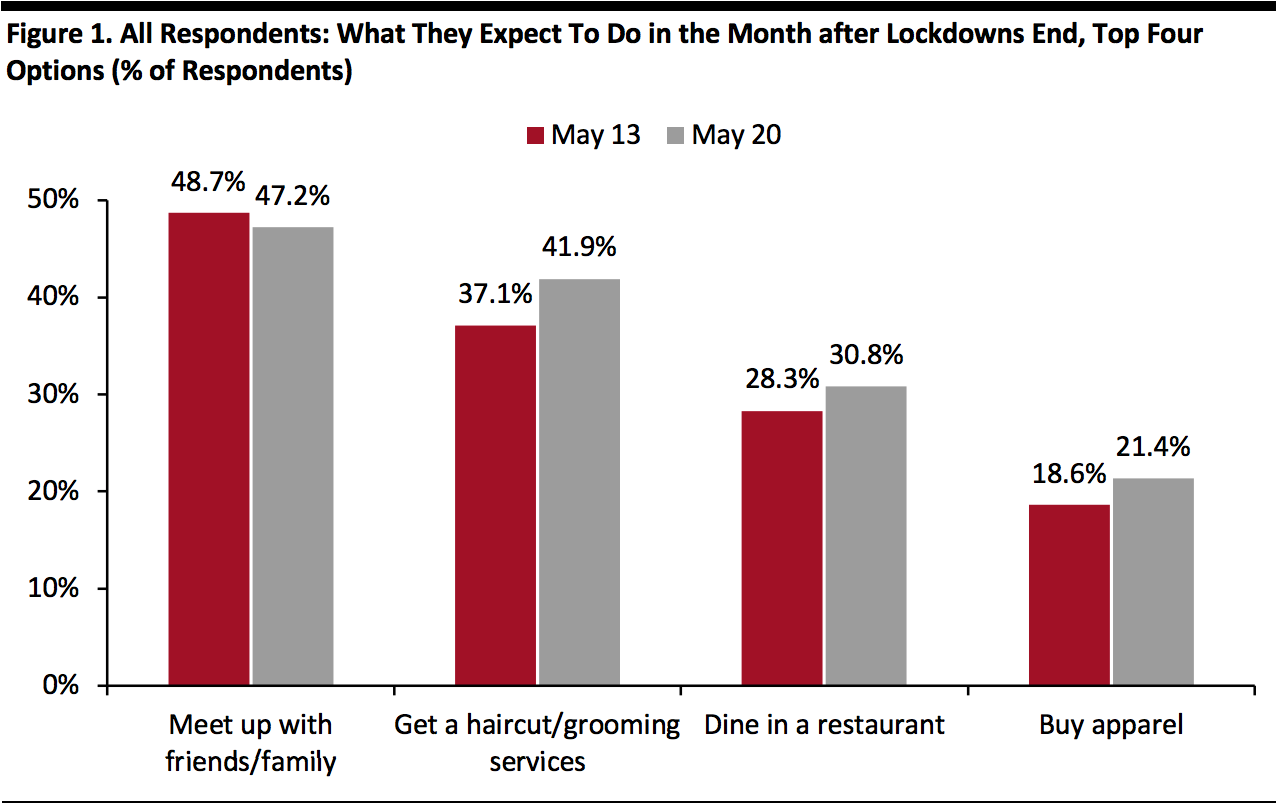

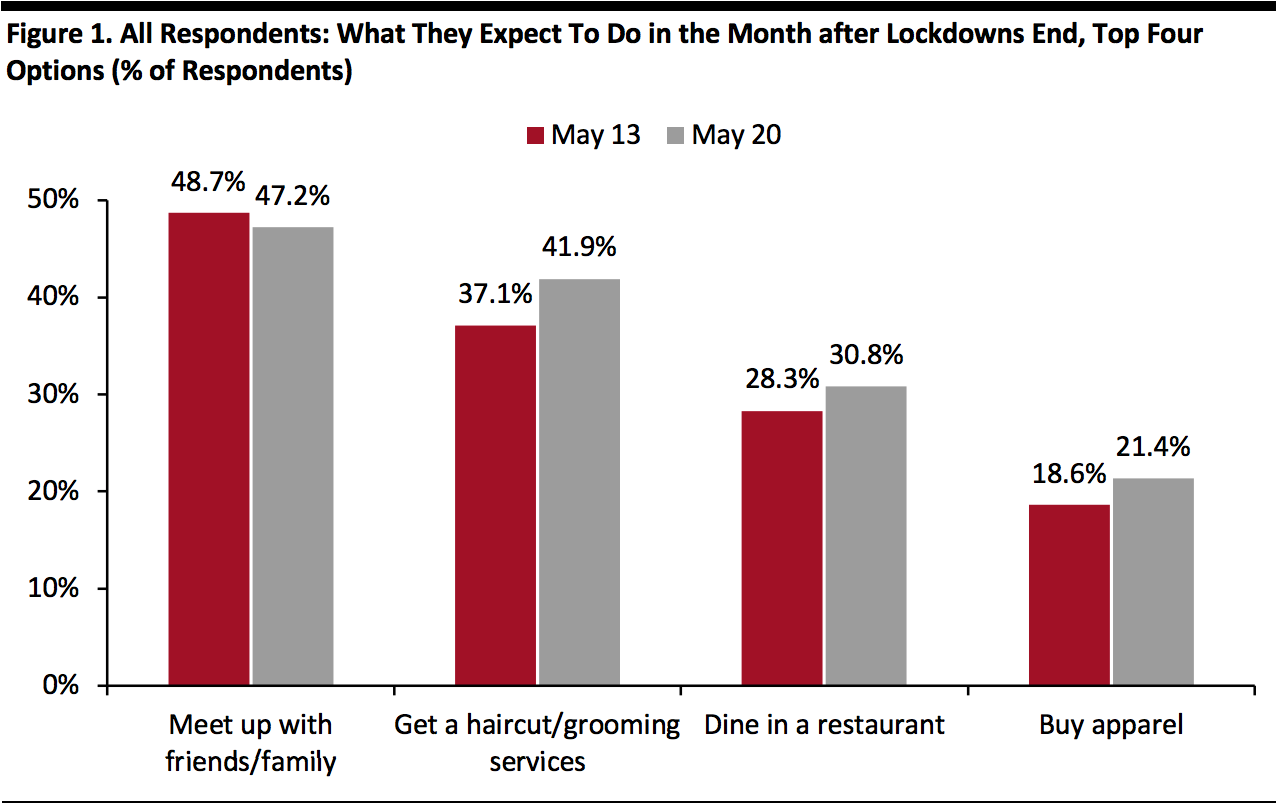

1. Retail Spending on Apparel Jumps into Top Four Post-Lockdown Activities

This week, visiting friends or family remained the number-one option consumers would do in the month after lockdowns end. We saw a slight week-over-week increase in the proportion of respondents expecting to spend on services such as haircuts, dining or going on a trip (albeit each within the margin of error).

The absolute percentages are still relatively low, despite around 85% overall saying that they would do at least one of these things in the month after lockdowns. Of all 15 options provided to respondents, almost half saw an uptick from last week, but all under five percentage points, suggesting that post-lockdown recovery will be gradual and sequential rather than instant, as consumers expect to return to regular activities tentatively and selectively.

Base: US Internet users aged 18+

Base: US Internet users aged 18+

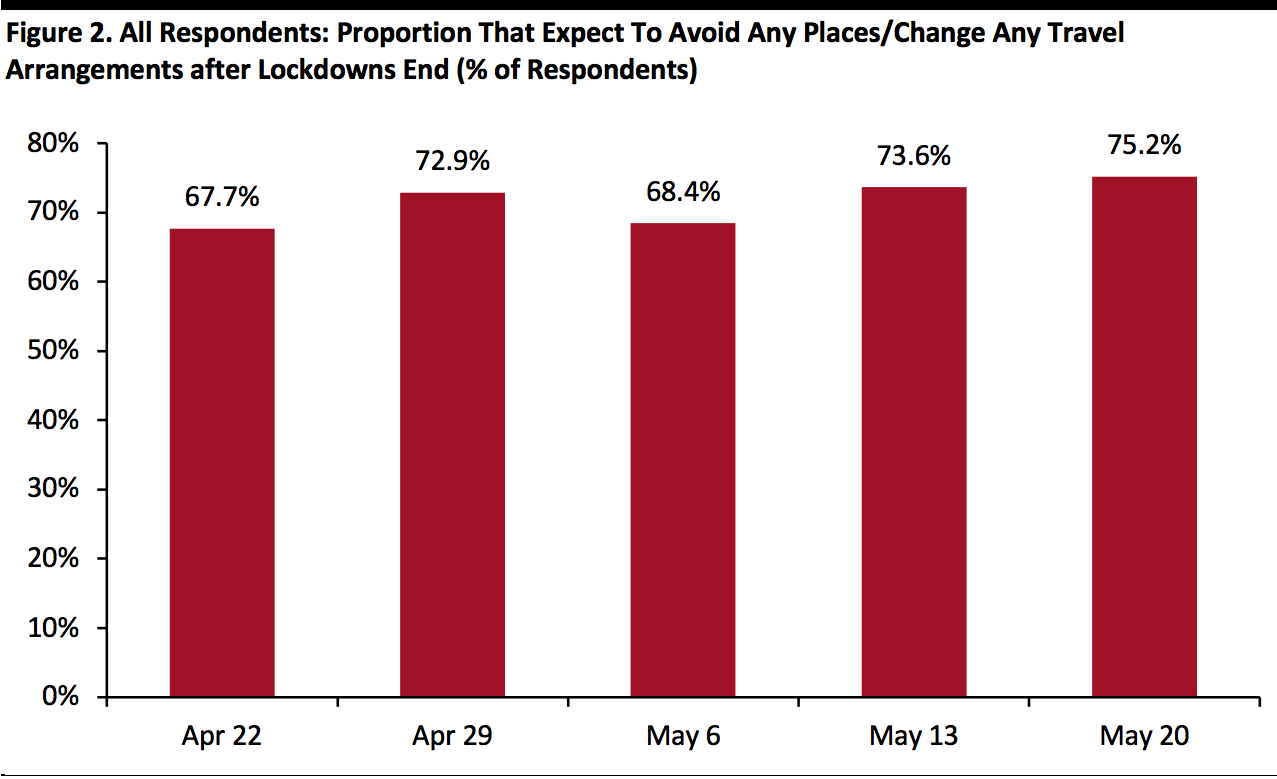

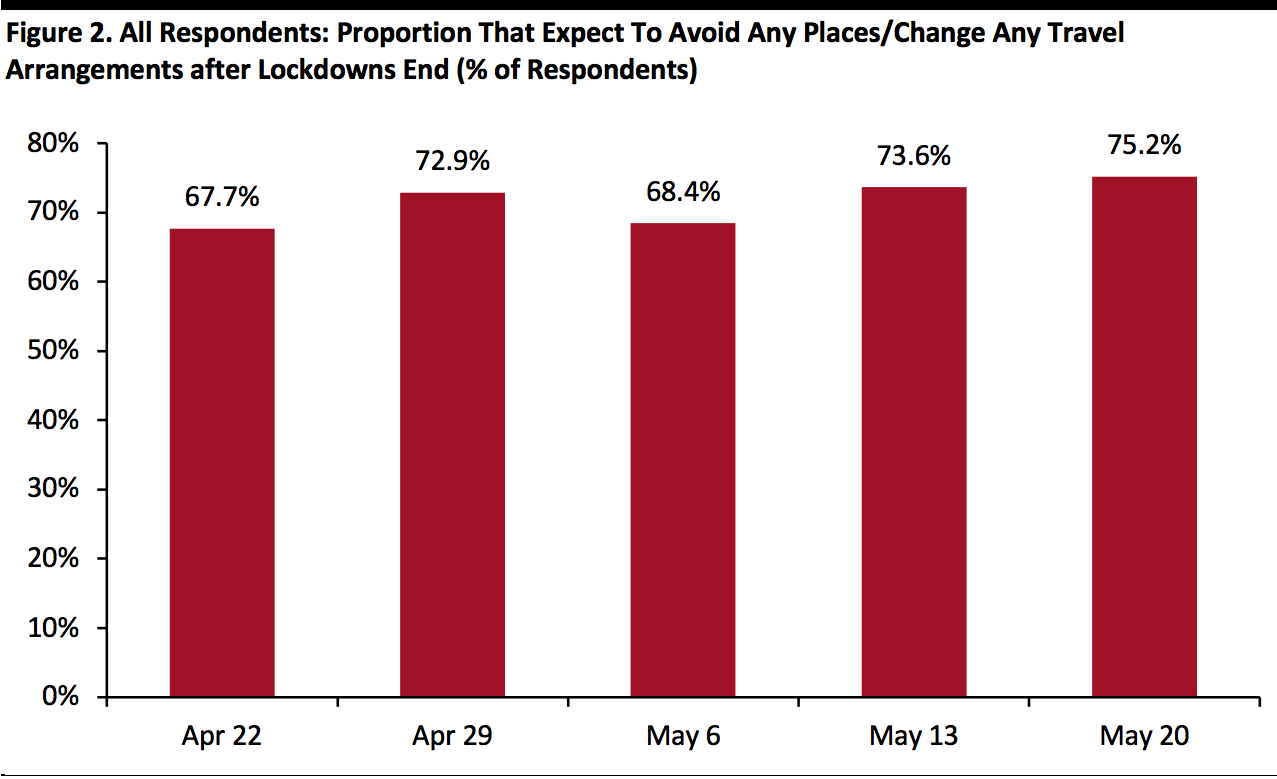

Source: Coresight Research[/caption] 2. Three-Quarters Expect To Avoid Some Public Places This week, 75.2% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end. This compares to 73.6% last week and is the highest proportion of respondents since we started asking the question. We saw significant swings in expected avoidance of grooming services, which may seem contradictory to our previous finding that getting a haircut is the top priority for consumers, but our prior question asked about a full month after lockdowns end. Shopping centers/malls remain among the top locations that consumers expect to avoid. In addition, we saw further week-over-week increases in how long respondents anticipate avoiding public places or changing travel arrangements, with a large majority expecting to do so for three months or longer (not charted). [caption id="attachment_110108" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

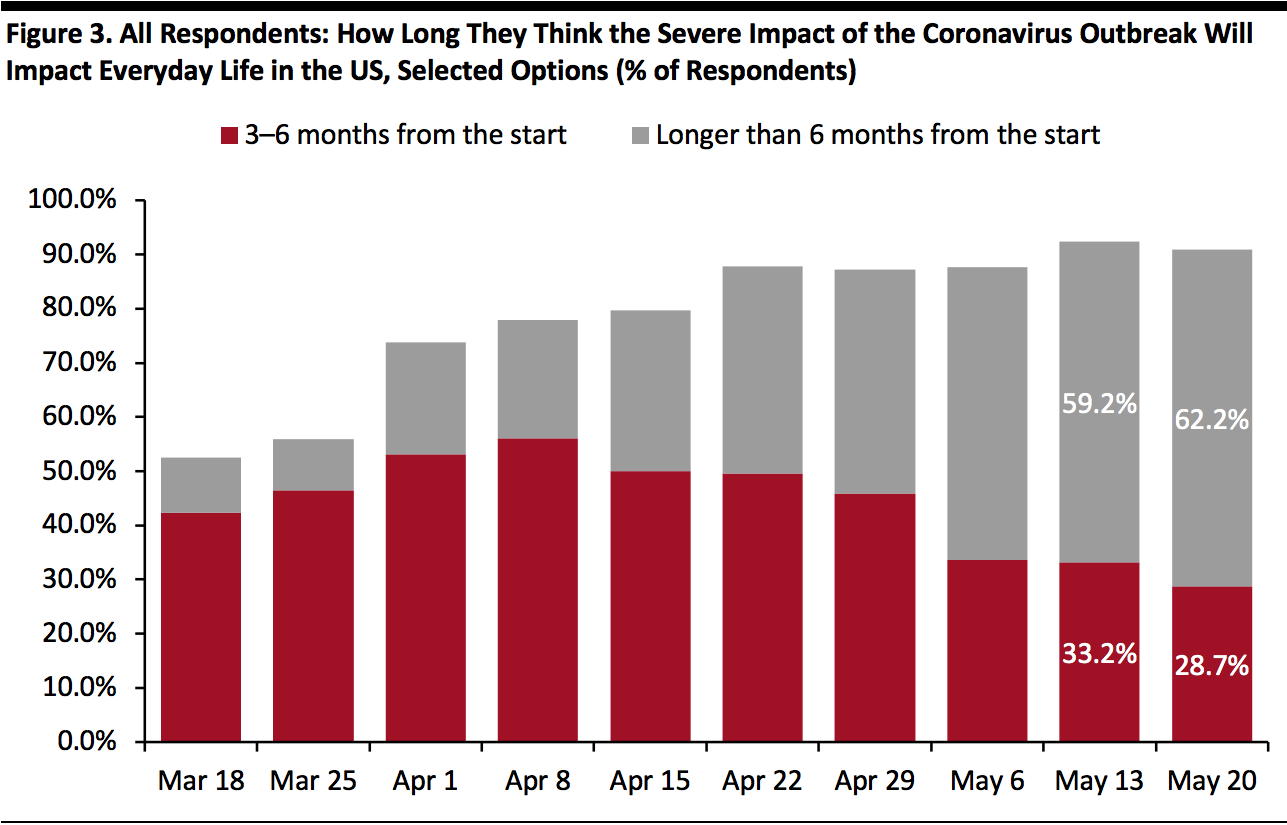

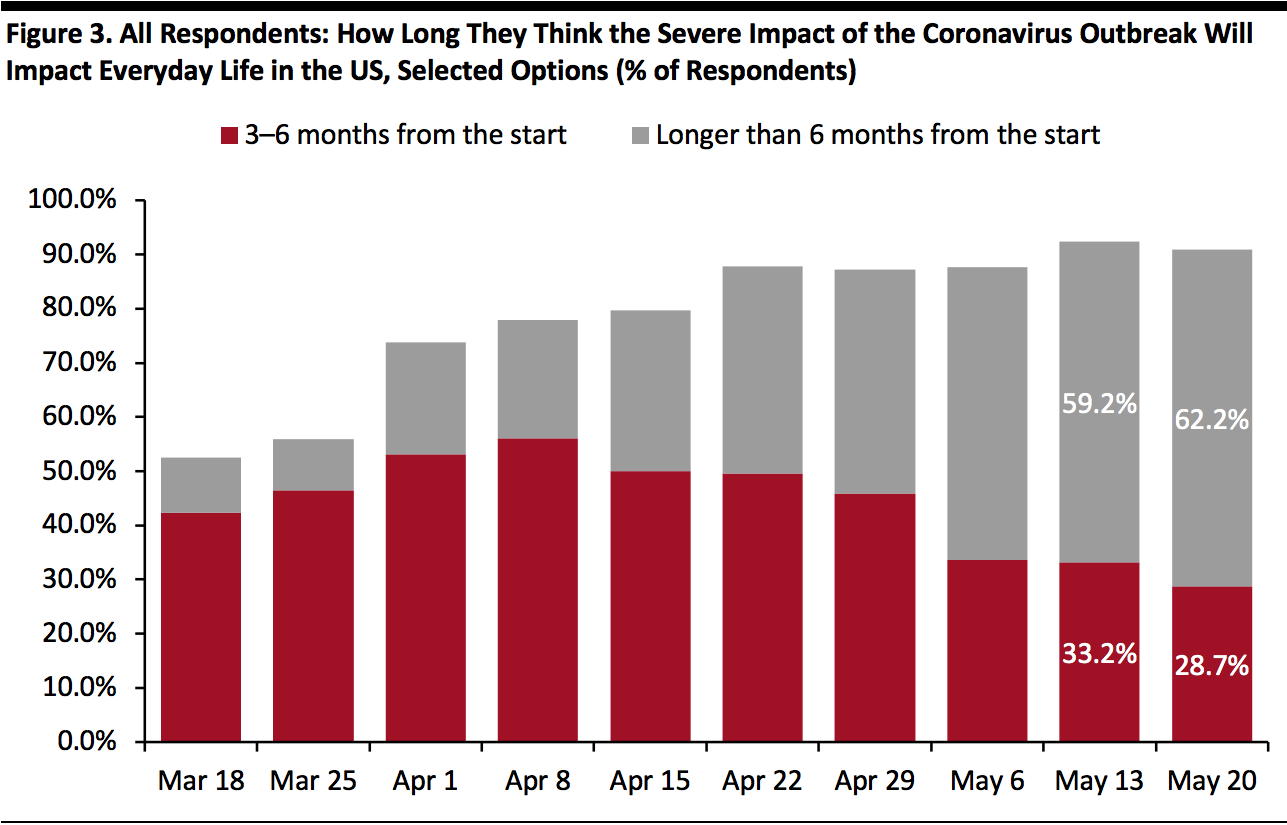

Source: Coresight Research[/caption] 3. More Consumers Expect Long-Term Impacts This week, consumers’ expectations of the length of the crisis increased further, continuing the trend from recent weeks. Fully 62.2% now expect the severe impact of the outbreak to last more than six months from its start, compared to 59.2% last week. Some 90.9% expect the severe impact to last three months or more, versus 92.4% last week. [caption id="attachment_110109" align="aligncenter" width="700"] Selected options shown

Selected options shown

Base: US Internet users aged 18+

Source: Coresight Research[/caption]

- See our full report for a complete ranking of what consumers expect to do and spend on post lockdown.

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. Three-Quarters Expect To Avoid Some Public Places This week, 75.2% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end. This compares to 73.6% last week and is the highest proportion of respondents since we started asking the question. We saw significant swings in expected avoidance of grooming services, which may seem contradictory to our previous finding that getting a haircut is the top priority for consumers, but our prior question asked about a full month after lockdowns end. Shopping centers/malls remain among the top locations that consumers expect to avoid. In addition, we saw further week-over-week increases in how long respondents anticipate avoiding public places or changing travel arrangements, with a large majority expecting to do so for three months or longer (not charted). [caption id="attachment_110108" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. More Consumers Expect Long-Term Impacts This week, consumers’ expectations of the length of the crisis increased further, continuing the trend from recent weeks. Fully 62.2% now expect the severe impact of the outbreak to last more than six months from its start, compared to 59.2% last week. Some 90.9% expect the severe impact to last three months or more, versus 92.4% last week. [caption id="attachment_110109" align="aligncenter" width="700"]

Selected options shown

Selected options shownBase: US Internet users aged 18+

Source: Coresight Research[/caption]