Nitheesh NH

Introduction

This report presents the results of Coresight Research’s latest weekly survey of US consumers on the coronavirus outbreak, undertaken on May 20. This report explores the trends we are seeing from week to week, following prior surveys on May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.Looking Beyond Lockdown

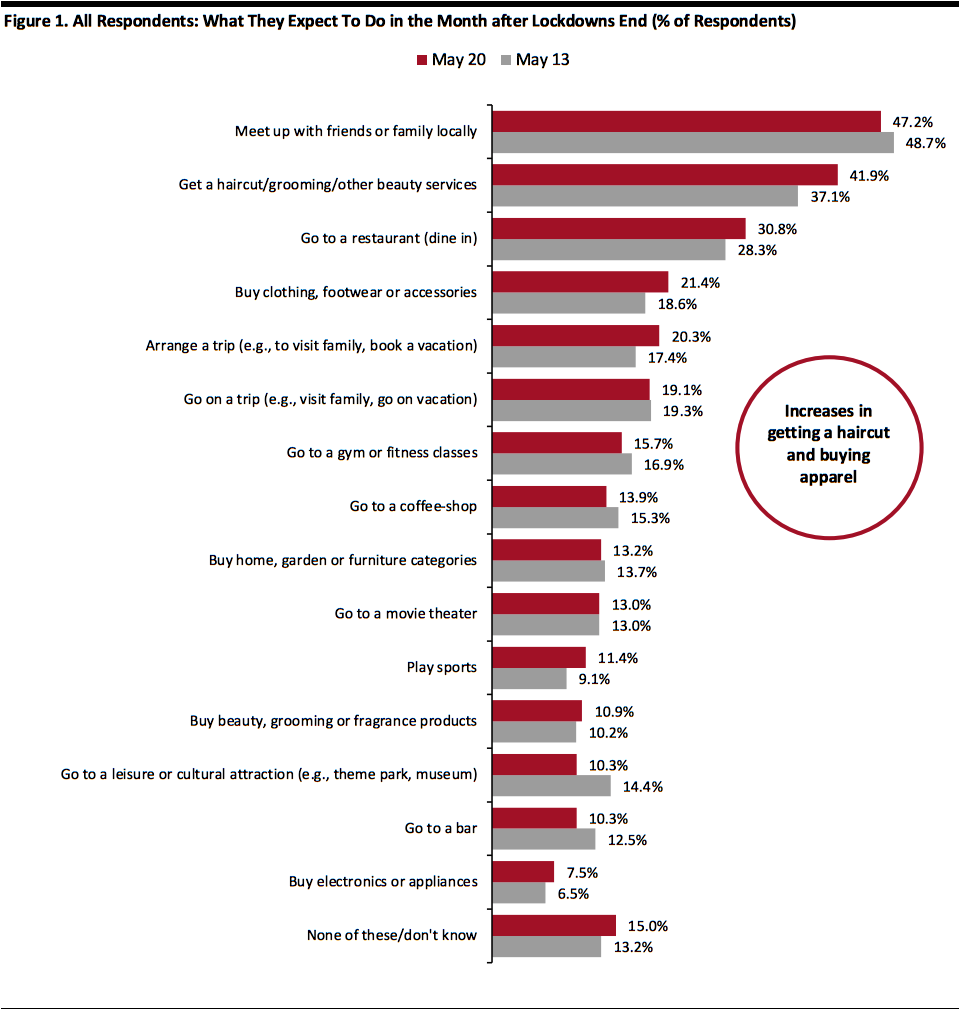

Getting a Haircut Remains at the Top of Consumers’ Wishlists This week, we saw a slight week-over-week increase in the proportion of respondents expecting to take part in activities related to spending in the month after lockdowns end (albeit each within the margin of error). Getting a haircut or other grooming/beauty services remains the top option related specifically to spending, with 41.9% of respondents stating they would do so, versus 37.1% last week. This is followed by dining in a restaurant—almost one-third expect to do this. Expectations to dine in a restaurant rank higher than other options even as we continue to witness an upward trend for expected avoidance of food-service businesses (discussed below; see Figure 3). For discretionary retail purchases, a little over one in five respondents expect to buy apparel, versus 18.6% last week. This places it among the top four activities among the 15 options we provided. The absolute percentages for almost all activities remain low, despite around 85% of respondents overall saying that they would do at least one of these things in the month after lockdowns end. Of the 15 activities options we provided to respondents, almost half saw an uptick from last week, but all under five percentage points. As we have previously noted, the figures suggest that post-lockdown recovery will be gradual and sequential rather than instant, as consumers expect to return to regular activities tentatively and selectively. [caption id="attachment_110114" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

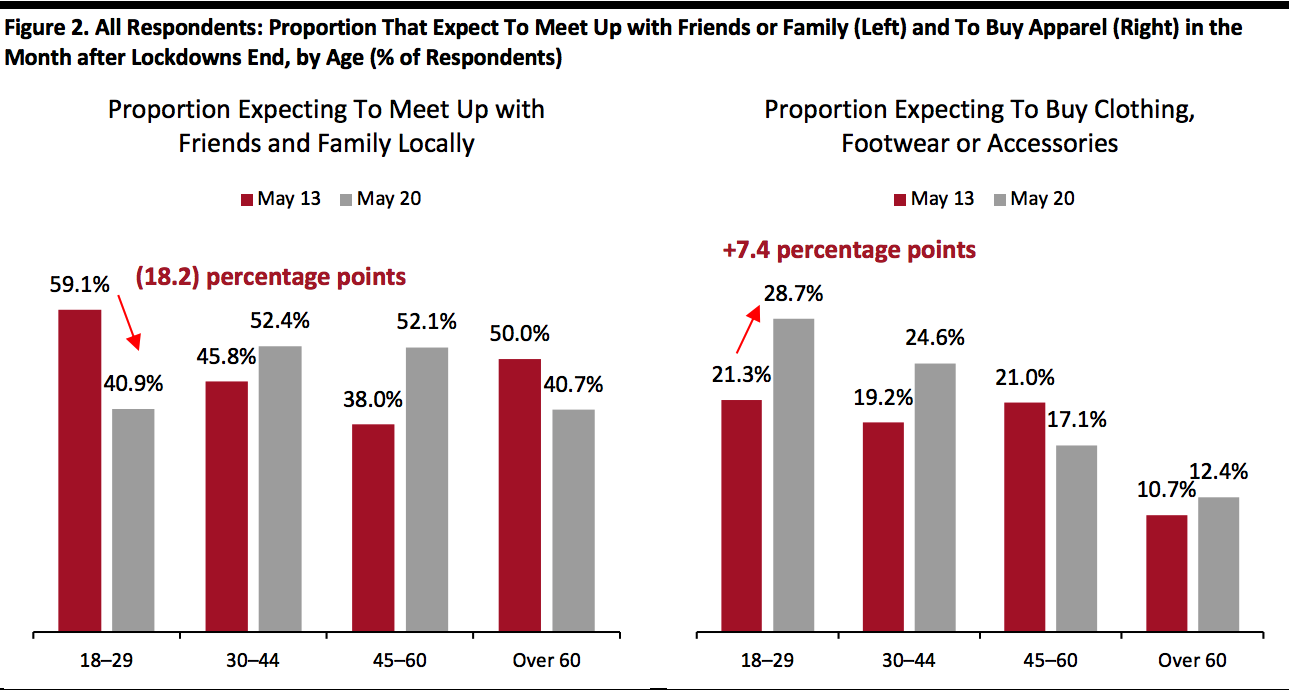

Source: Coresight Research[/caption] While at the total level, the week-over-week change in expectations to meet with friends or family is not significant, we noticed a large shift among the youngest surveyed consumers, with an 18-percentage-point drop in the proportion of this age group expecting to meet with up with others. This week, we saw a higher proportion of younger consumers expecting to buy apparel, up by around seven percentage points from last week—an encouraging sign for apparel retailers. [caption id="attachment_110115" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

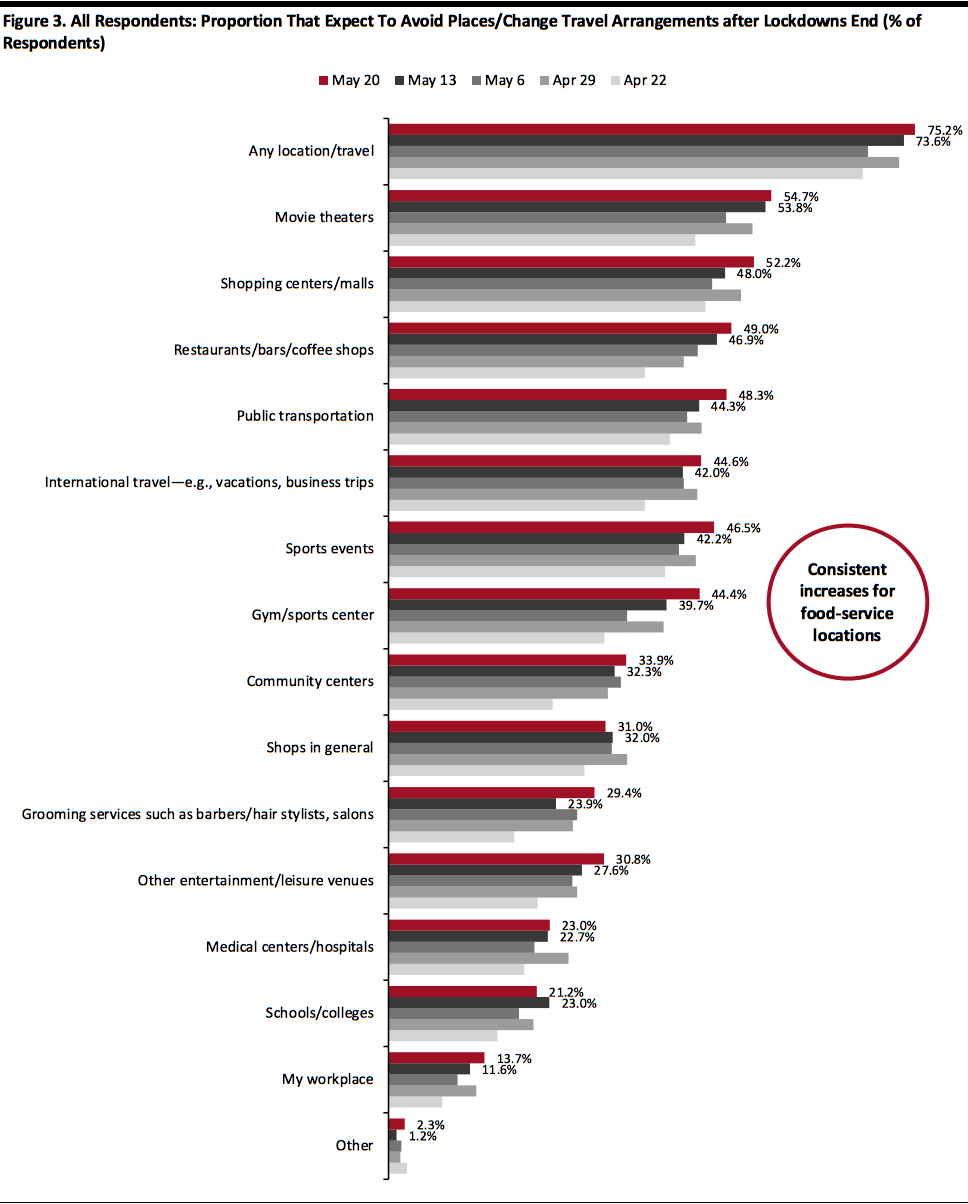

Source: Coresight Research[/caption] Over Half of Consumers Expect To Avoid Shopping Centers Consumers remain concerned about returning to public places as many states ease lockdowns. This week, 75.2% of all respondents anticipated avoiding some kind of public place or travel after lockdowns end, versus 73.6% last week. The notable change this week was in expected avoidance of grooming services, which saw an increase of little over five percentage points. This seems contradictory to our previous finding that getting a haircut is the top priority for consumers, but the prior question asked about a full month after lockdowns end. Shopping centers/malls saw a four-percentage-point increase, week over week, which is within the margin of error; over half of all consumers continue to expect to avoid shopping centers/malls. The one consistent pattern in this data set has been the upward trend for avoidance of food-service businesses—around half of consumers now expect to avoid such locations even as dining in restaurants remains a top post-lockdown option, albeit only for around 31% of consumers (see above). [caption id="attachment_110116" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

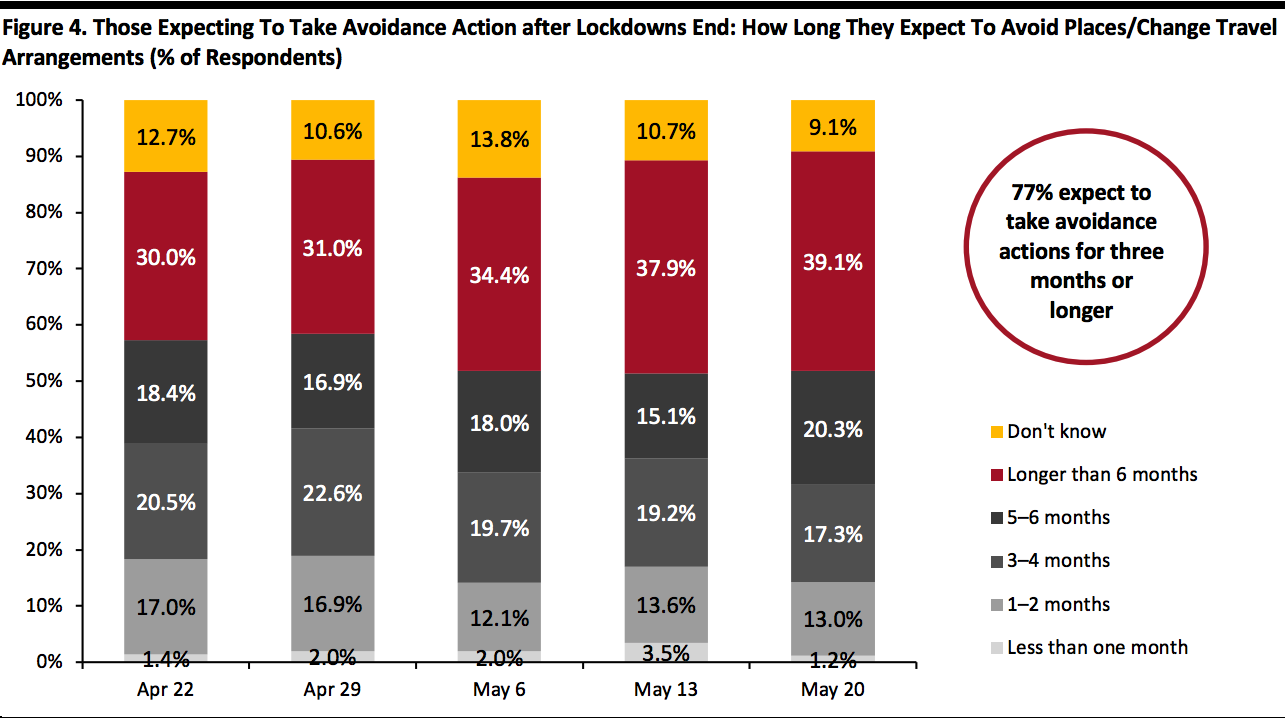

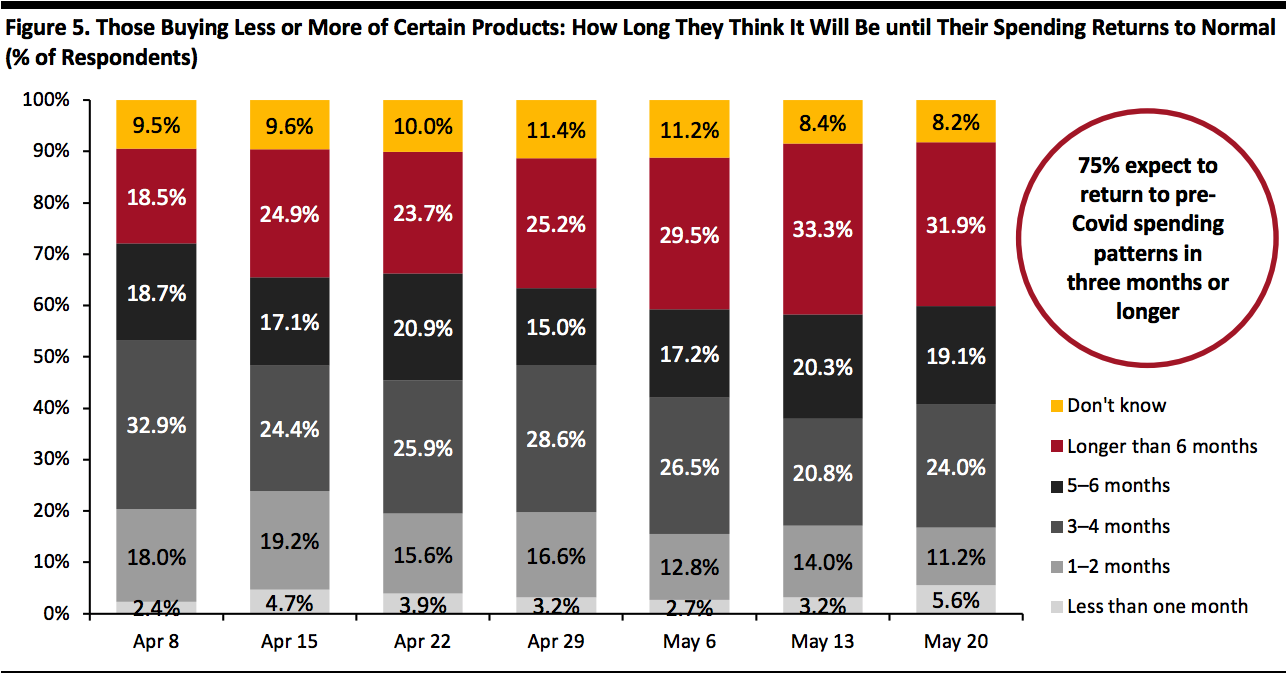

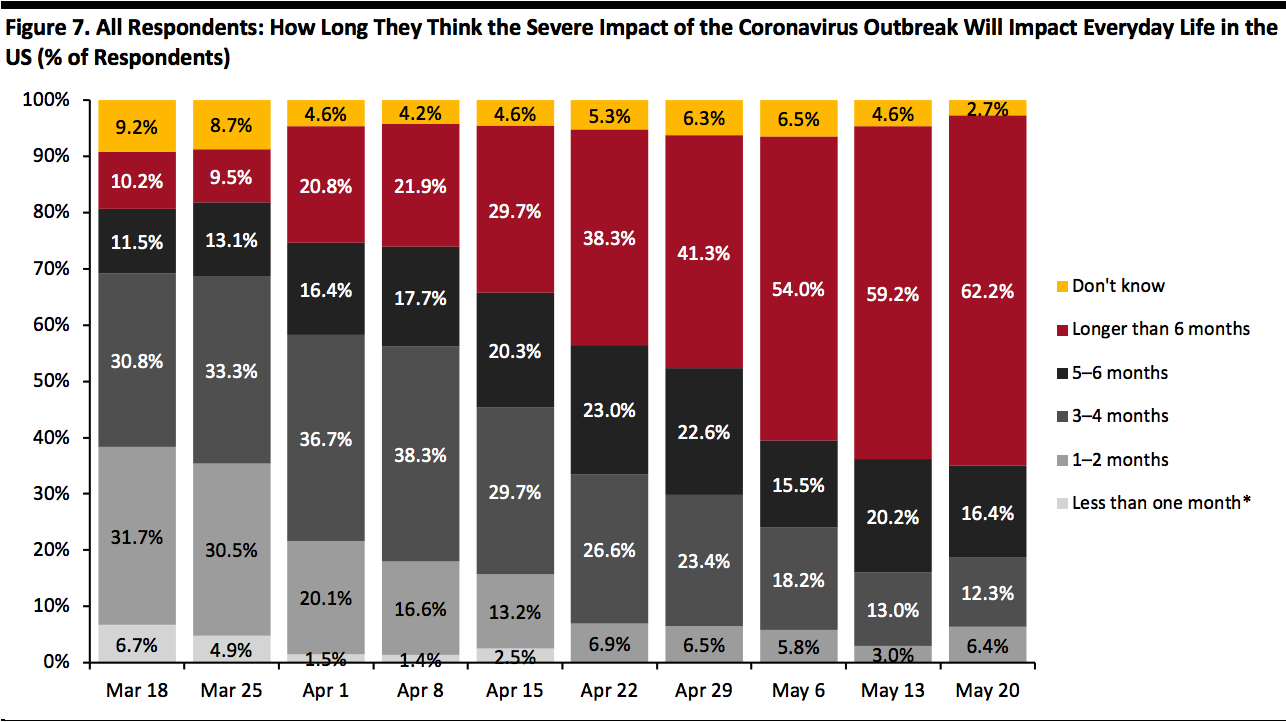

Source: Coresight Research[/caption] More Shoppers Expect Long-Term Impacts We asked three questions in which respondents were required to estimate the timescale of coronavirus impacts.

- We asked those respondents who expect to take avoidance action how long they expect to be doing so for.

- We asked those making fewer or more purchases of any categories how long they expect it will be before their spending bounces back to normal levels.

- We asked all respondents how long they think the severe effects of the outbreak will impact life in the US.

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns end

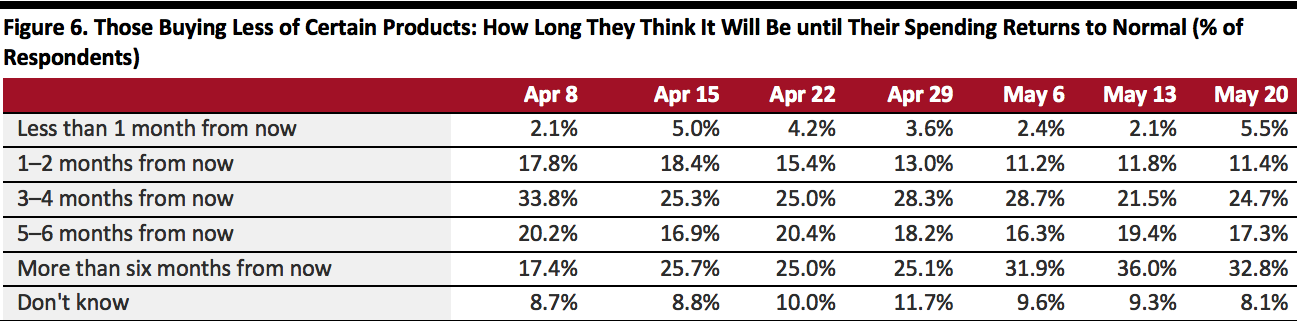

Base: US Internet users aged 18+ who expect to avoid places/change travel arrangements after lockdowns endSource: Coresight Research[/caption] Spending Bounce Back: Less Than One-Third Expect To Retain Changed Spending Patterns for More Than Six Months This week, we saw a slight decline in the proportion of respondents anticipating longer-term impacts on their spending. Among consumers who have changed their spending levels—either buying more or less of any categories—31.9% expect it to be more than six months from now before their spending patterns return to normal, versus one-third last week (although this change is within the margin of error). A six-month-plus window takes us up to the second half of November at the earliest—the start of the holiday season. This provides a further data point suggesting that the weakness in retail demand will persist into the final quarter of 2020. A total of 75% of respondents expect to keep their changed purchasing behaviors for three months or more, versus 74% last week. Focusing only on those making fewer purchases, we also saw a slight shift from the trend in previous weeks for expectations of a long-term impact: 32.8% of this group expect to return to pre-crisis spending patterns only in more than six months’ time versus 36.0% last week (Figure 6).

- We show what consumers are buying more of and less of in a separate section, later in this report.

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products more or less, because of the coronavirus outbreakSource: Coresight Research[/caption] [caption id="attachment_110119" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreak

Base: US Internet users aged 18+ who are purchasing any products less, because of the coronavirus outbreakTotals may not sum due to rounding

Source: Coresight Research[/caption] Impact on Everyday Life: Almost Two-Thirds of Consumers Expect the Crisis To Last More Than Six Months This week, consumers’ expectations of the length of the crisis jumped again, after increasing last week. Fully 62.2% now expect the severe impact of the outbreak to last more than six months from its start, compared to 59.2% last week. Some 90.9% expect the severe impact to last three months or more, slightly lower than 92.3% last week. [caption id="attachment_110120" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+*Not provided as an option after April 15

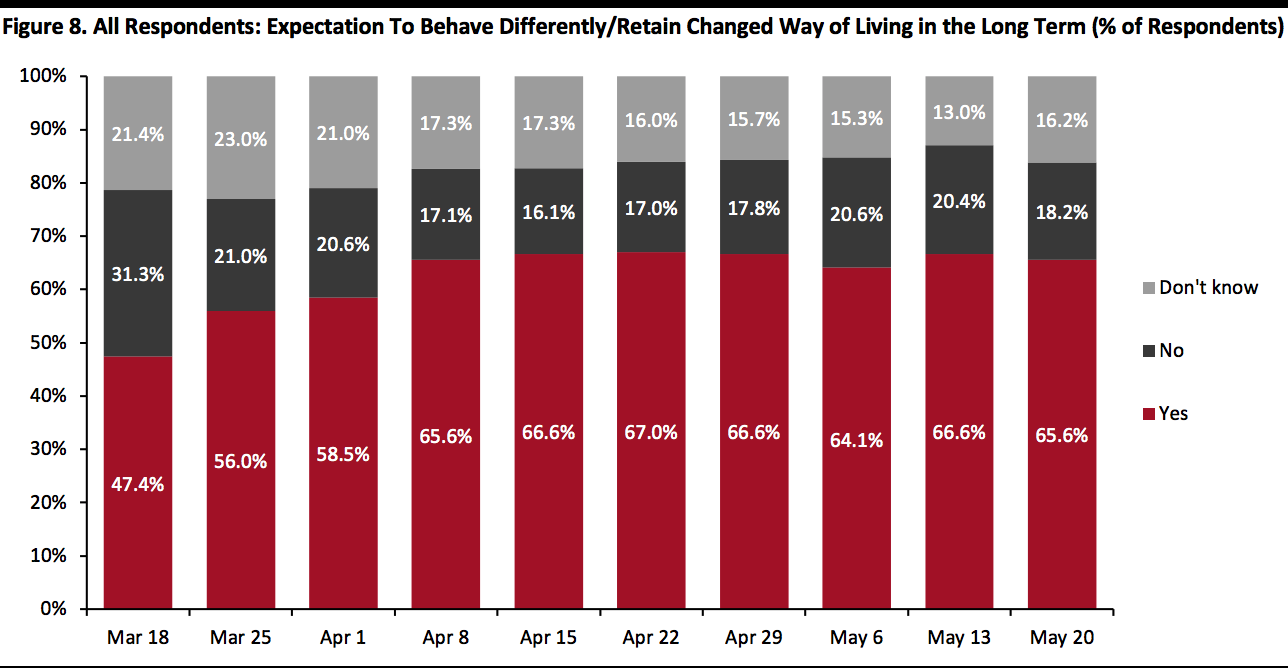

Source: Coresight Research[/caption] Two-Thirds Expect To Retain Changed Behaviors for the Long Term Each week, we ask respondents whether they think they will keep some of the behaviors they have adopted during the coronavirus crisis. In recent weeks, this metric has leveled off at around two-thirds of all consumers expecting to retain some behaviors over the long term. [caption id="attachment_110121" align="aligncenter" width="700"]

Base: US Internet users aged 18+

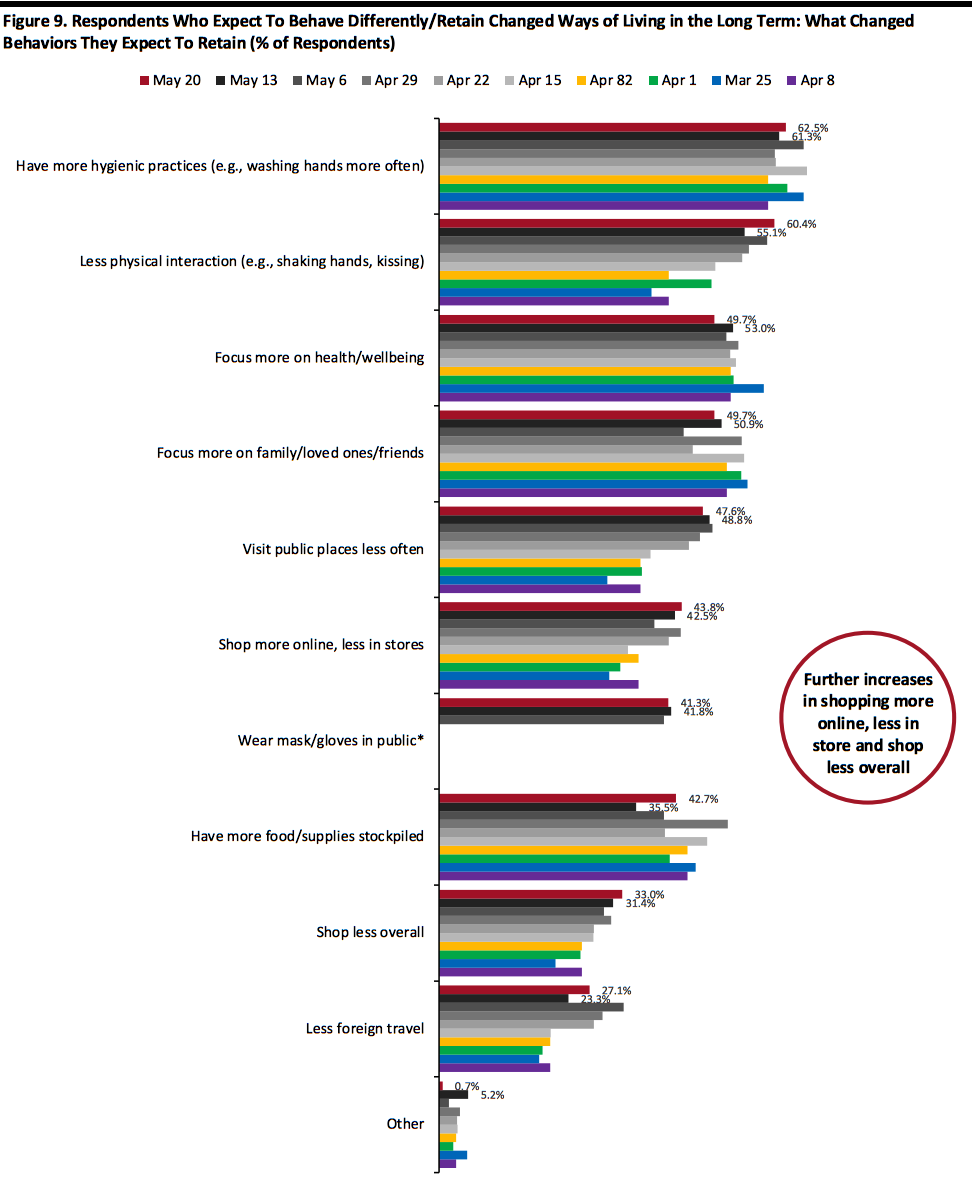

Base: US Internet users aged 18+Source: Coresight Research[/caption] Among those expecting to retain changed behaviors, we have seen consistent or near-consistent upward trends in the following:

- Less physical interaction—which spiked up again after easing last week. The overall upward trend reflects a growing realization that post-lockdown normality involves physical distancing.

- Visiting public places less often—which eased a little this week, but the general trend reflects greater awareness that social distancing will be necessary. Many reopened brick-and-mortar retail stores have enforced social distancing and limited traffic.

Respondents could select multiple options

*Not provided as an option before May 6

Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

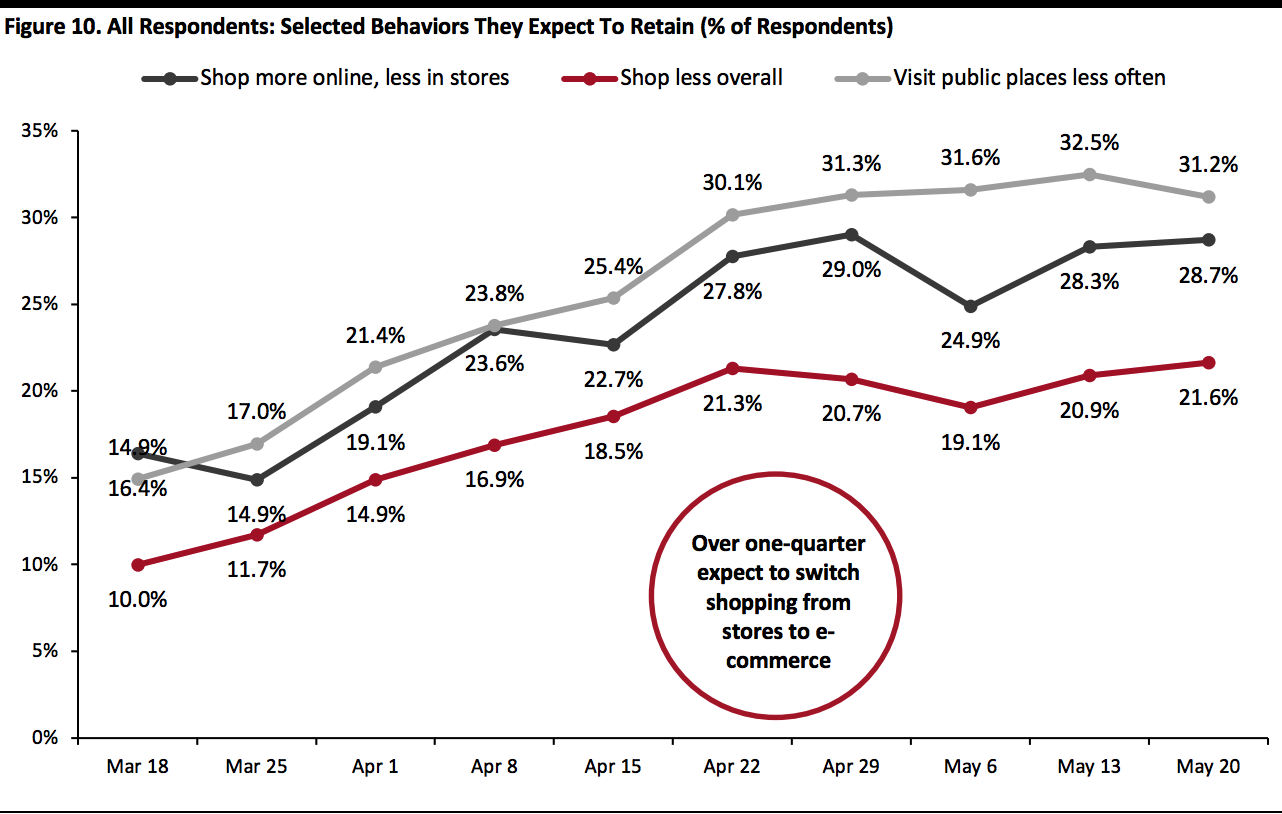

Source: Coresight Research[/caption] In the chart below, we focus on trending data in three of the metrics charted above. We represent these as a proportion of all respondents, to represent consumers overall, rather than as a proportion of those expecting to retain changed behaviors (which is what is charted above). Rebased to all respondents, the overall upward trends are more distinct. This week, we saw a very slight moderation in the proportion of all consumers expecting to visit public places less often (within the margin of error). Alarmingly for retail, over one-fifth of respondents expect to shop less overall. Brick-and-mortar retail could be worse off, as over one-quarter expect to switch shopping from stores to e-commerce. [caption id="attachment_110123" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

Reviewing Trend Data in Purchasing Behavior

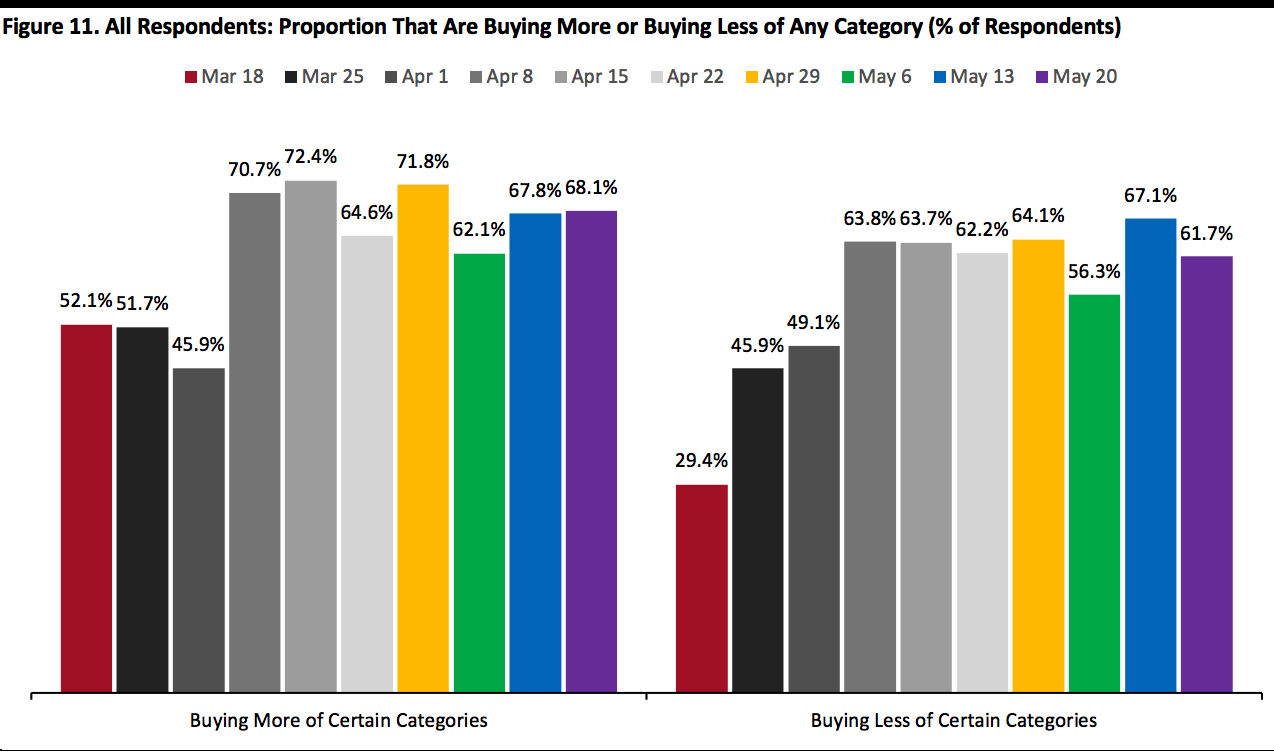

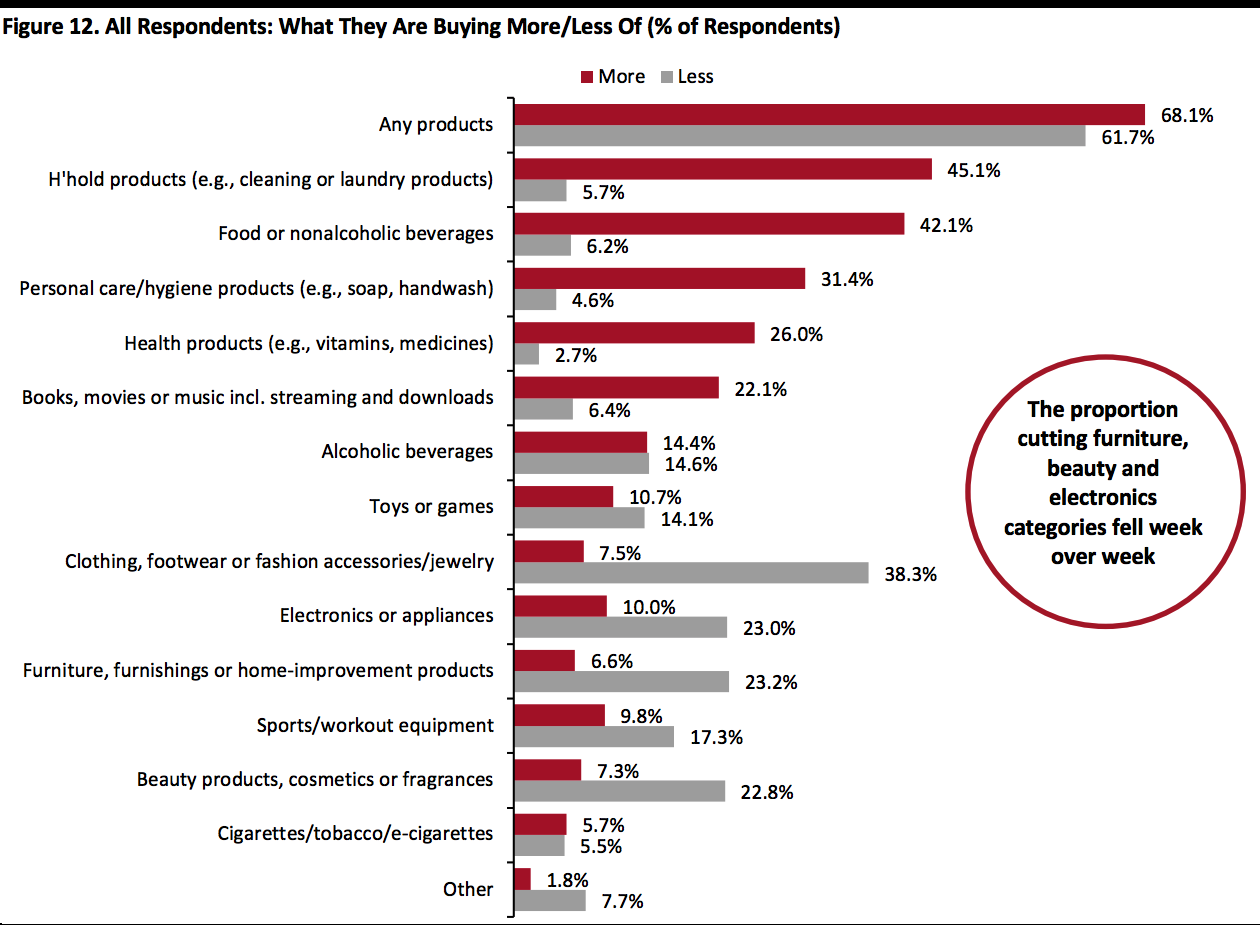

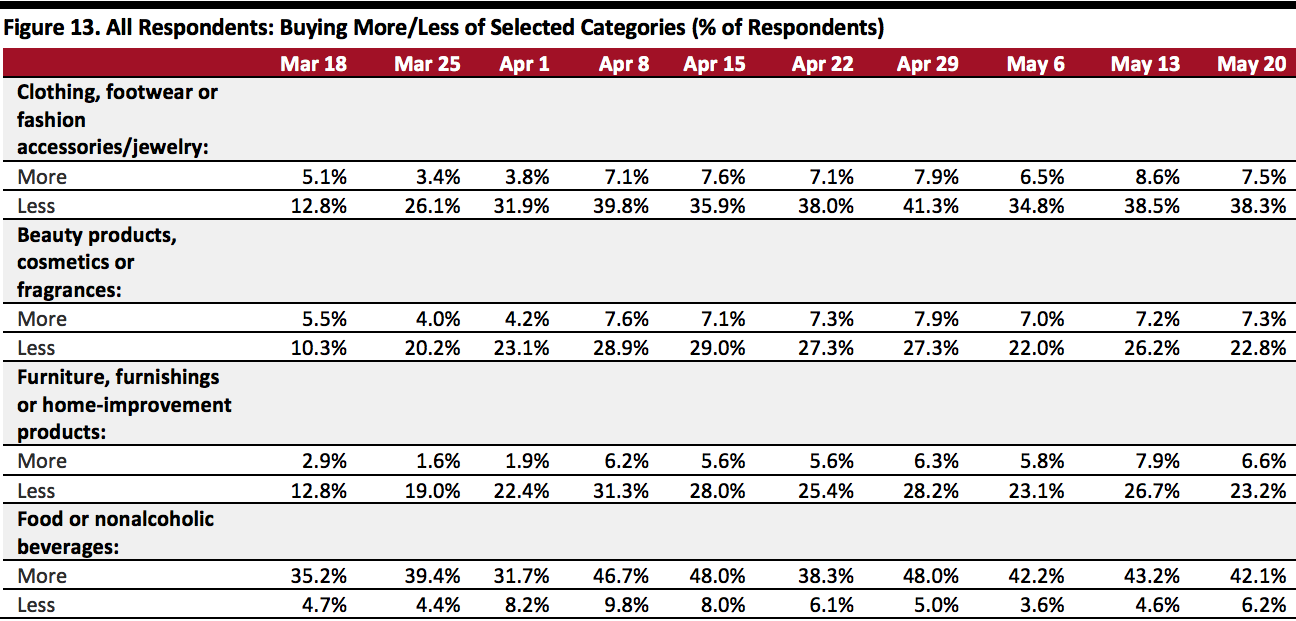

What They Are Buying More Of and Less Of This week, we noticed a moderation in those buying less of any category, to 61.7% from 67.1% last week. The proportion of respondents buying more remained relatively stable at 68.1% this week versus 67.8% last week. Note, buying more of certain categories and buying less of certain categories were not mutually exclusive options, so respondents could answer yes to both. [caption id="attachment_110124" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption] Buying more: Alongside food and other essentials, media products and streaming continue to be net beneficiaries of the crisis. Buying less: Apparel remains the number-one category for cutbacks, with 38.3% of respondents this week saying they are buying less, flat from last week (we show trended data in Figure 13). Furniture/home, beauty and electronics remained the next-most-cut categories, and they saw week-over-week reductions in the proportion of respondents cutting their purchases as well. Ratio of less to more: The ratio of those purchasing less to those purchasing more for clothing and footwear stood at 5.1 this week versus 4.5 last week. The ratio for furniture, furnishings and home improvement was 3.5 this week versus 3.4 last week. Beauty products stood at 3.1 this week versus 3.6 last week. [caption id="attachment_110125" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption] [caption id="attachment_110126" align="aligncenter" width="700"]

Base: US Internet users aged 18+

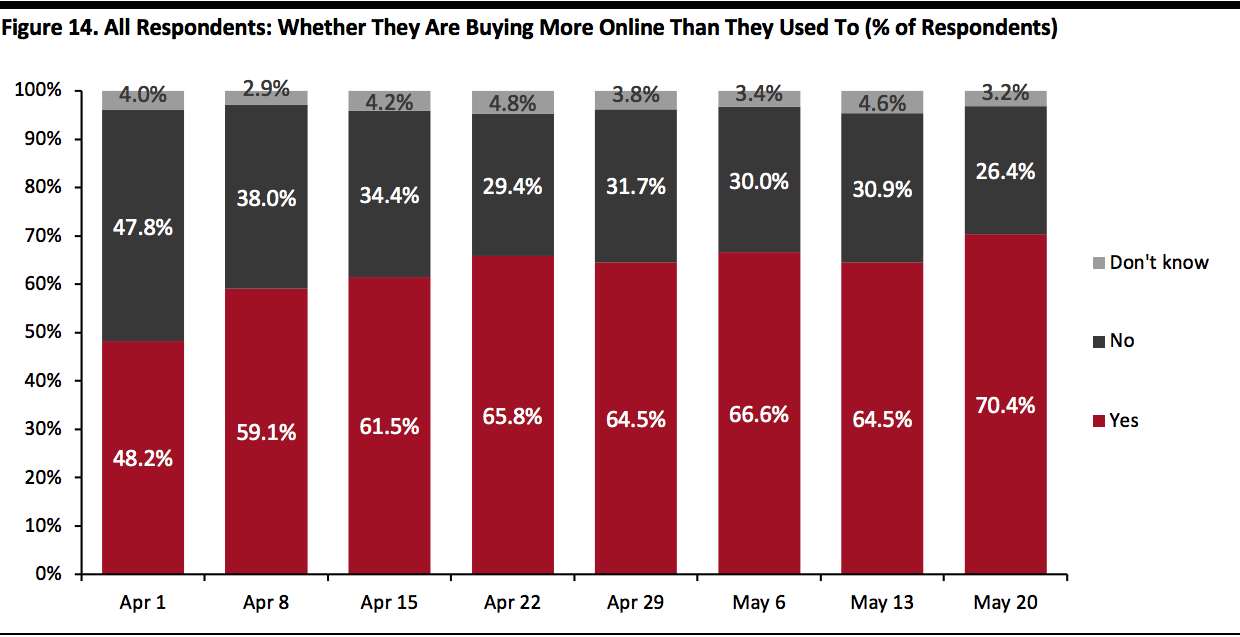

Base: US Internet users aged 18+Source: Coresight Research[/caption] Seven in 10 Are Switching Spending Online The proportion of consumers switching spending to e-commerce jumped this week—seven in 10 reported to have done so this week, from around two-thirds in previous weeks. [caption id="attachment_110127" align="aligncenter" width="700"]

Base: US Internet users aged 18+

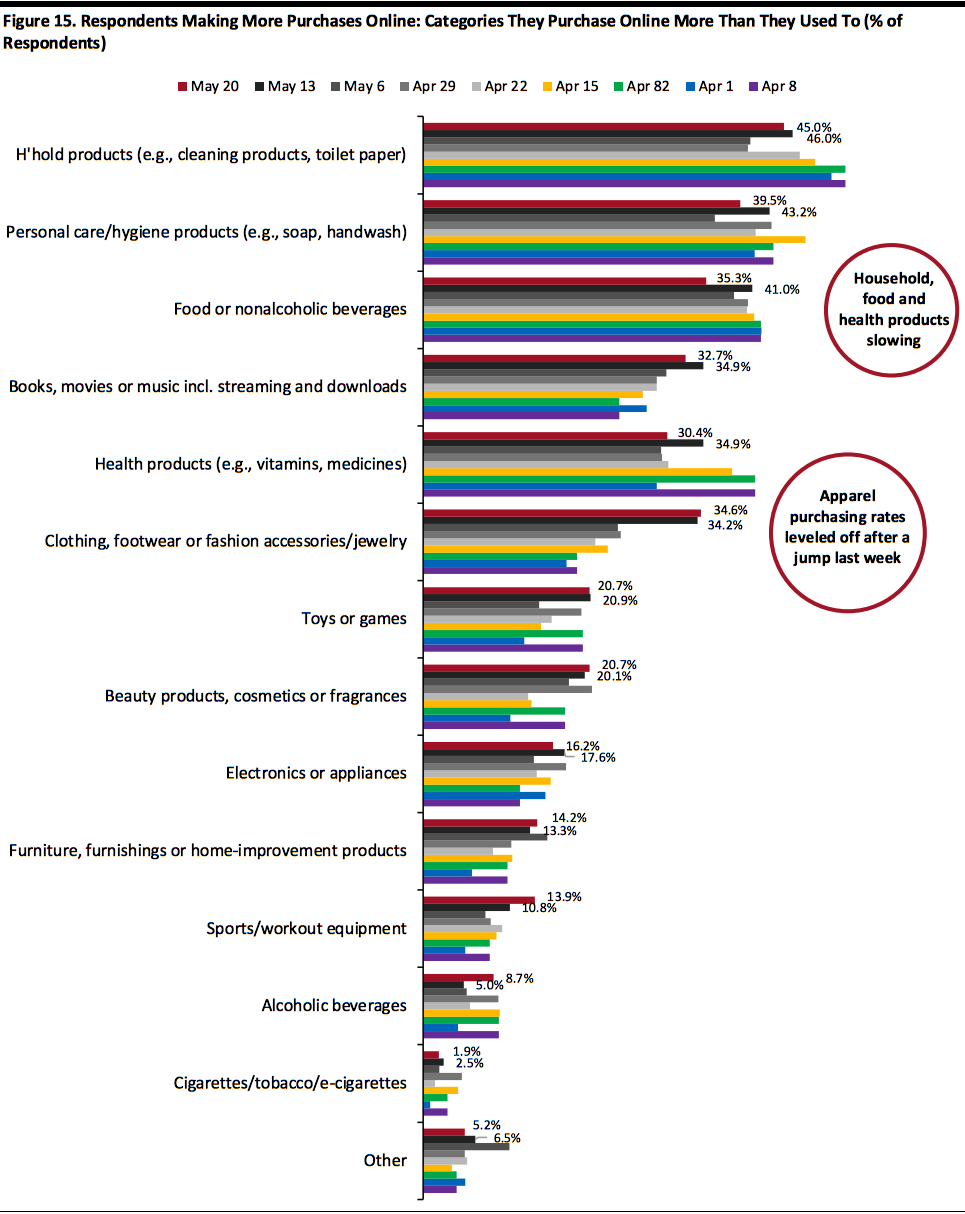

Base: US Internet users aged 18+Source: Coresight Research[/caption] What They Are Buying More Of Online Among the respondents making more purchases online, we saw everyday household products and health products fall back after a spike last week, reflecting that consumers are turning to their stockpiled supplies. After a sizeable upswing for apparel last week, we saw stabilization in the proportion of consumers buying more apparel online this week. We did not see a leap for other discretionary categories this week, including furniture/home and beauty. The proportion of consumers who are buying these online remained broadly stable week over week. The figures below are a proportion of those who are buying more online in general. Considered as a proportion of all respondents (representing consumers in general), buying more apparel online stood at 24.4% this week, versus 22.0% last week. [caption id="attachment_110128" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+ who make more purchases online than they did before the coronavirus outbreak

Source: Coresight Research[/caption]

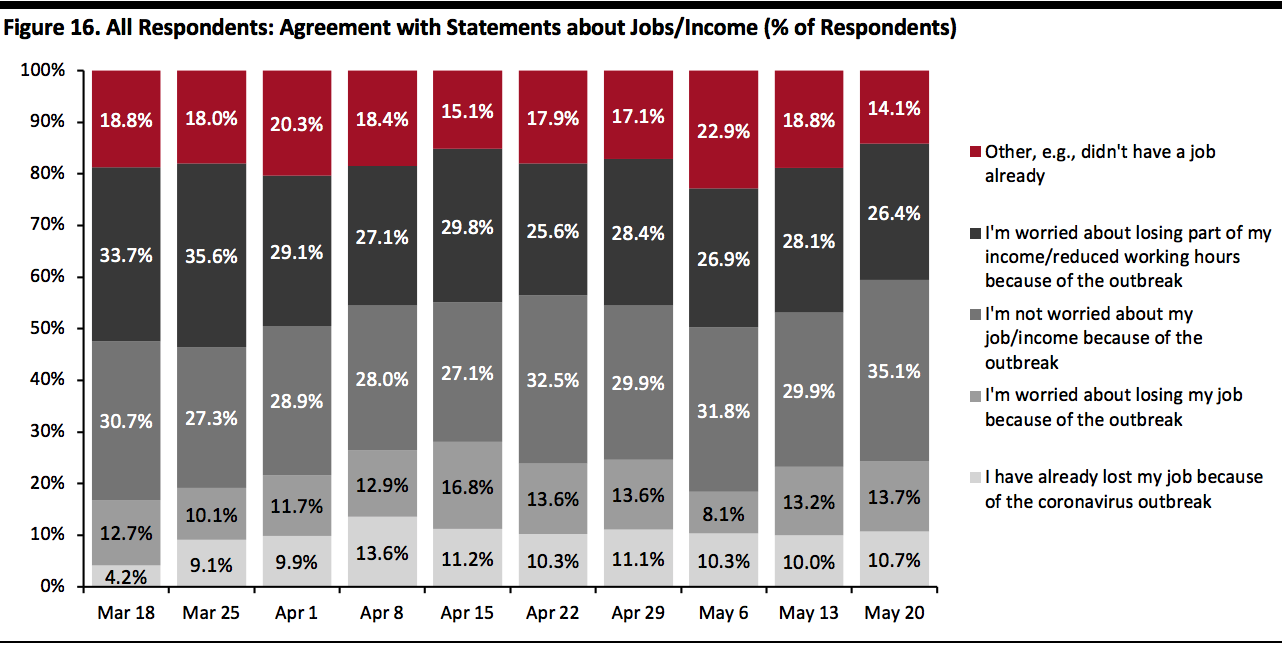

Employment and Income Concerns

Each week, we ask respondents to choose from a selection of statements related to employment and income. We have seen some fluctuation in the proportion of respondents worried about what may happen. This week, a total of 40.1% were worried about losing their job or part of their income, versus 41.3% last week. [caption id="attachment_110129" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]