DIpil Das

Coresight Research’s latest survey of US consumers found a growing proportion expect to adopt changed behaviors after lockdowns end. We discuss selected findings and compare them to those from prior weeks: April 22, April 15, April 8, April 1, March 25 and March 17–18.

Life Beyond Lockdown: Three Learnings

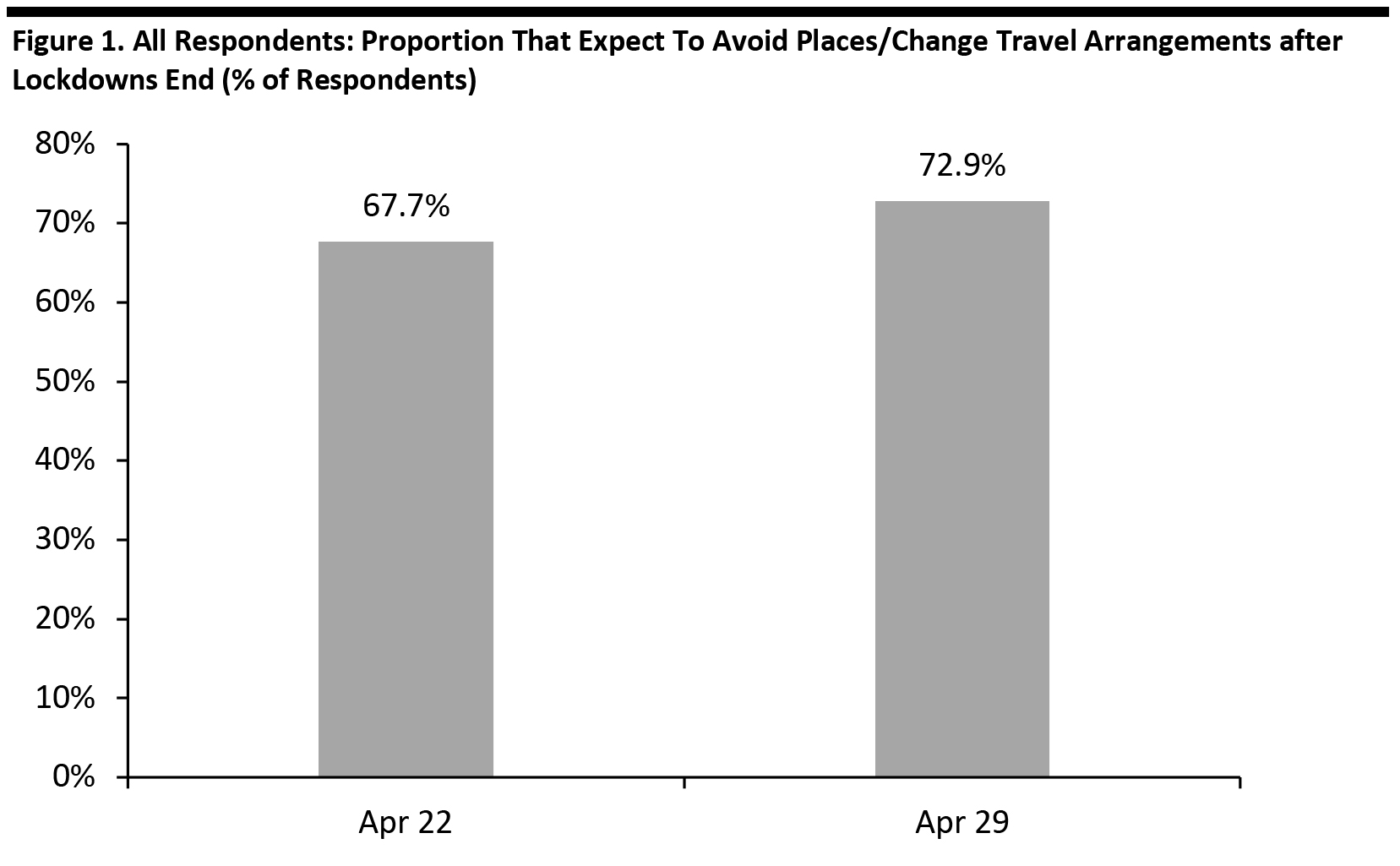

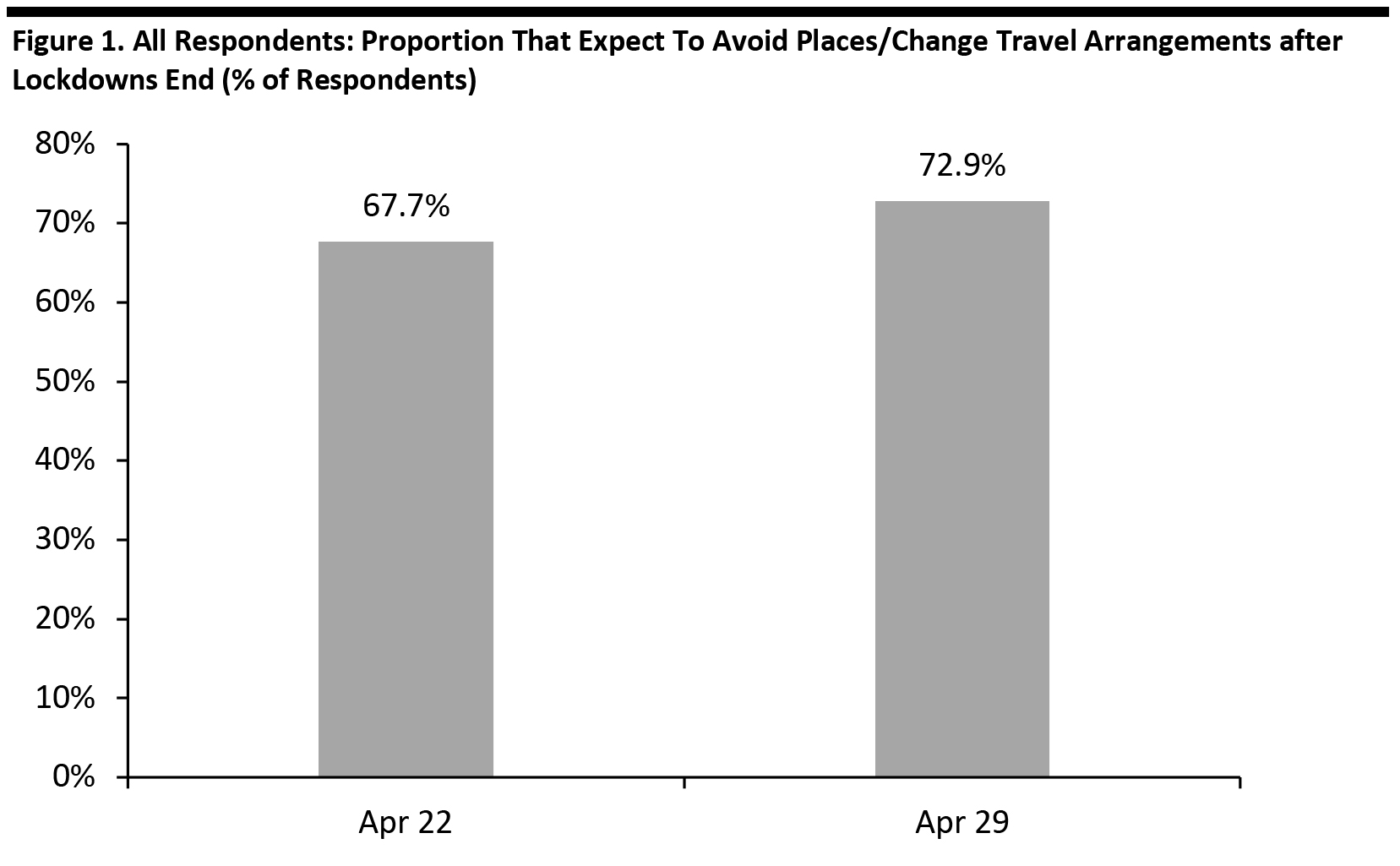

1. Three-quarters of respondents expect to avoid public places after lockdowns end

Almost three-quarters (73%) of respondents expect to avoid public places or change travel arrangements after lockdowns end—up from around two-thirds one week ago.

We saw significant week-over-week increases in expected avoidance of almost all types of places. We provided respondents with a list of 14 types of locations or travel options that they may avoid post lockdown; 11 of these saw an uptick of over five percentage points versus last week. See our full report for details of which types of locations shoppers expect to avoid post lockdown and the week-over-week changes in expected avoidance of public places.

Our survey found that shops in general are likely to be much less avoided than shopping centers/malls. This reflects the need for consumers to shop for essentials, more often in off-mall locations. Our survey data imply that the crisis will have more lasting impacts for traditional malls than for other types of retail locations. Shoppers may perceive off-mall centers, such as open-air centers, as safer—and these types of centers are also likely to benefit from the preponderance of nondiscretionary retailers such as supermarkets, versus the discretionary focus of enclosed malls.

[caption id="attachment_108868" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

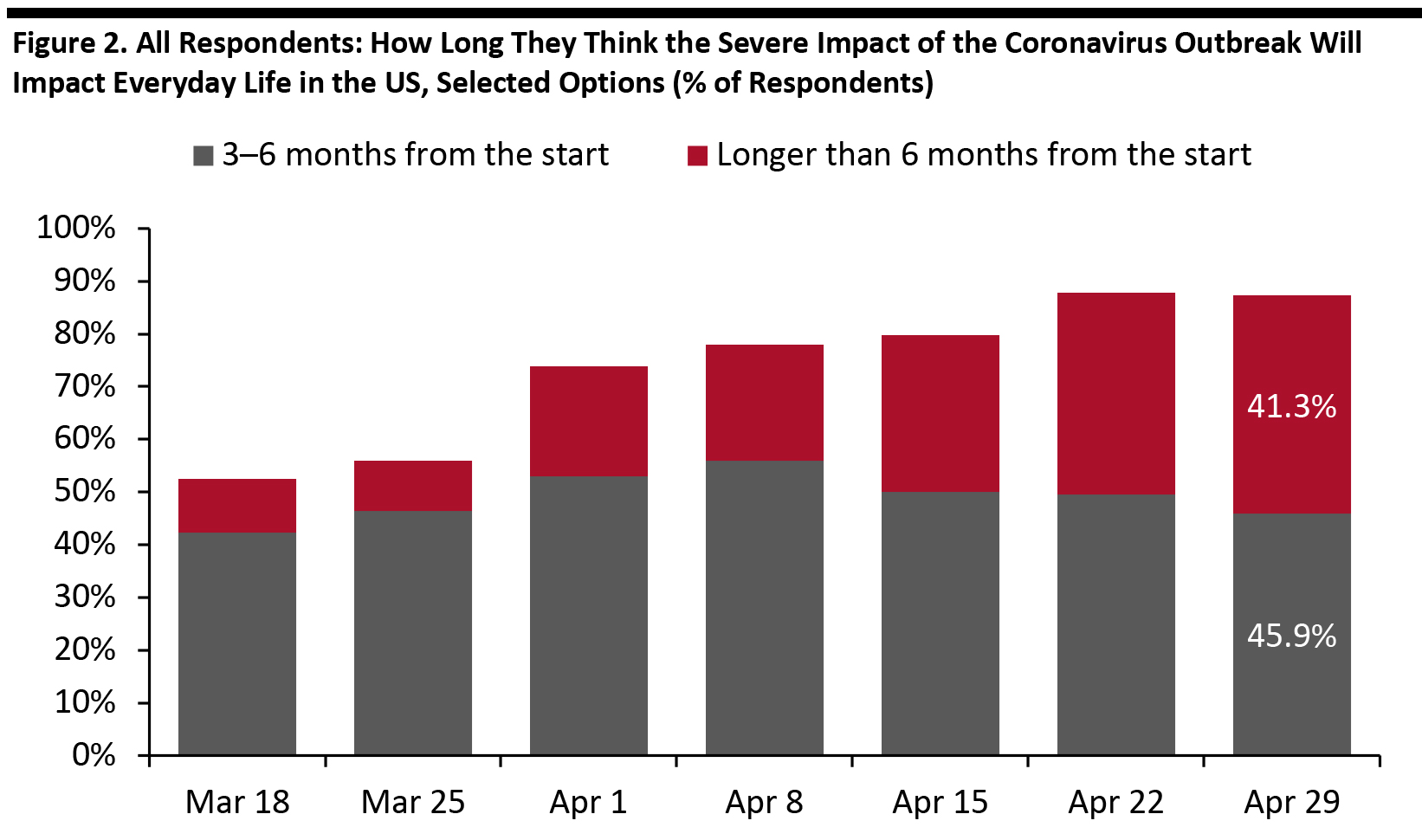

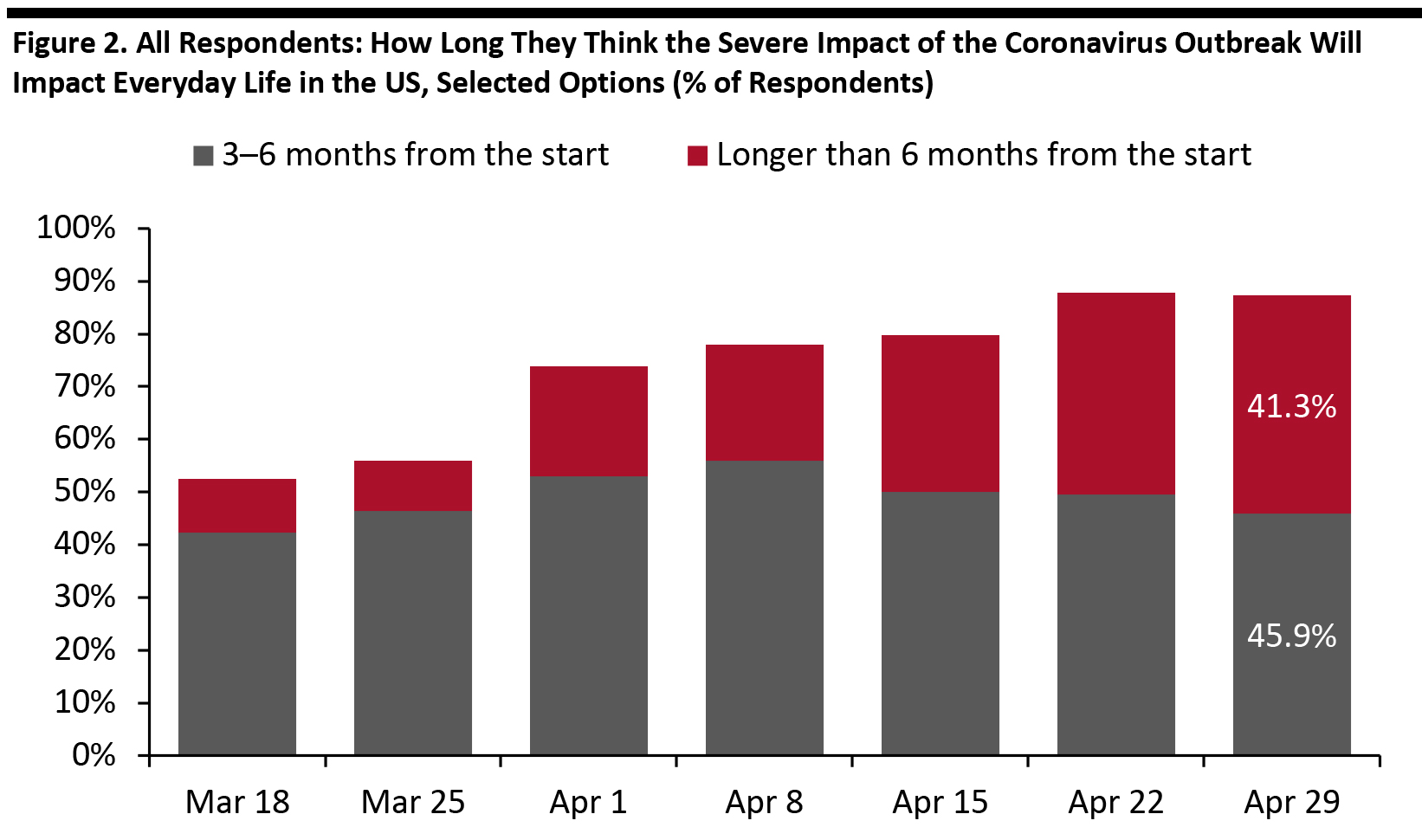

Source: Coresight Research [/caption] 2. Four in 10 expect the severe impact to last over six months This week, consumers’ expectations of the length of the crisis increased yet again. Some 41% now expect the severe impact of the outbreak to last more than six months from its start, up from 38% last week. This timescale implies that the severe impacts will run up to the holiday season. A total of 87.3% expect the severe impact to last three months or more, broadly level with 87.8% last week. [caption id="attachment_108869" align="aligncenter" width="700"] Selected options shown

Selected options shown

Base: US Internet users aged 18+

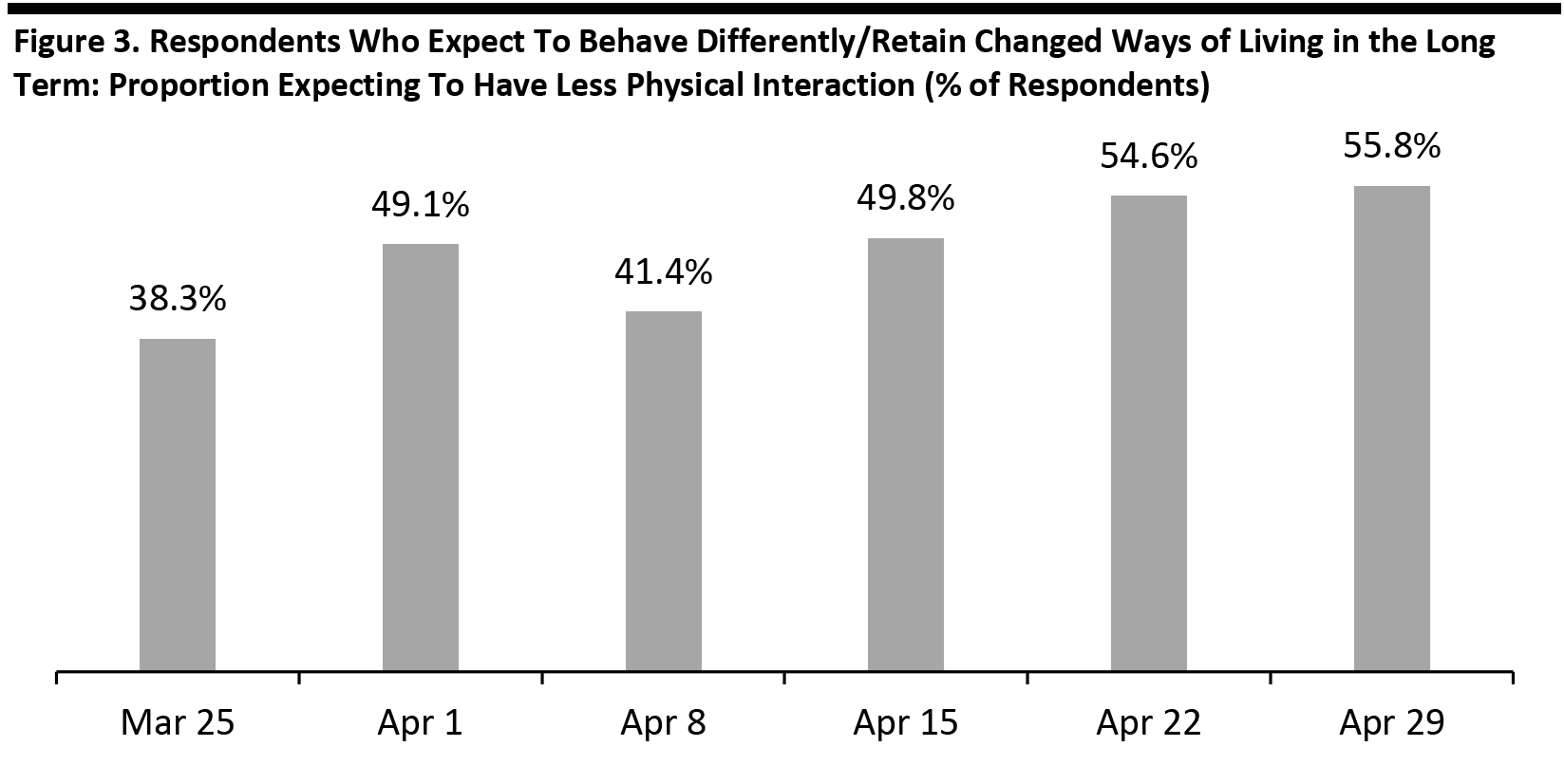

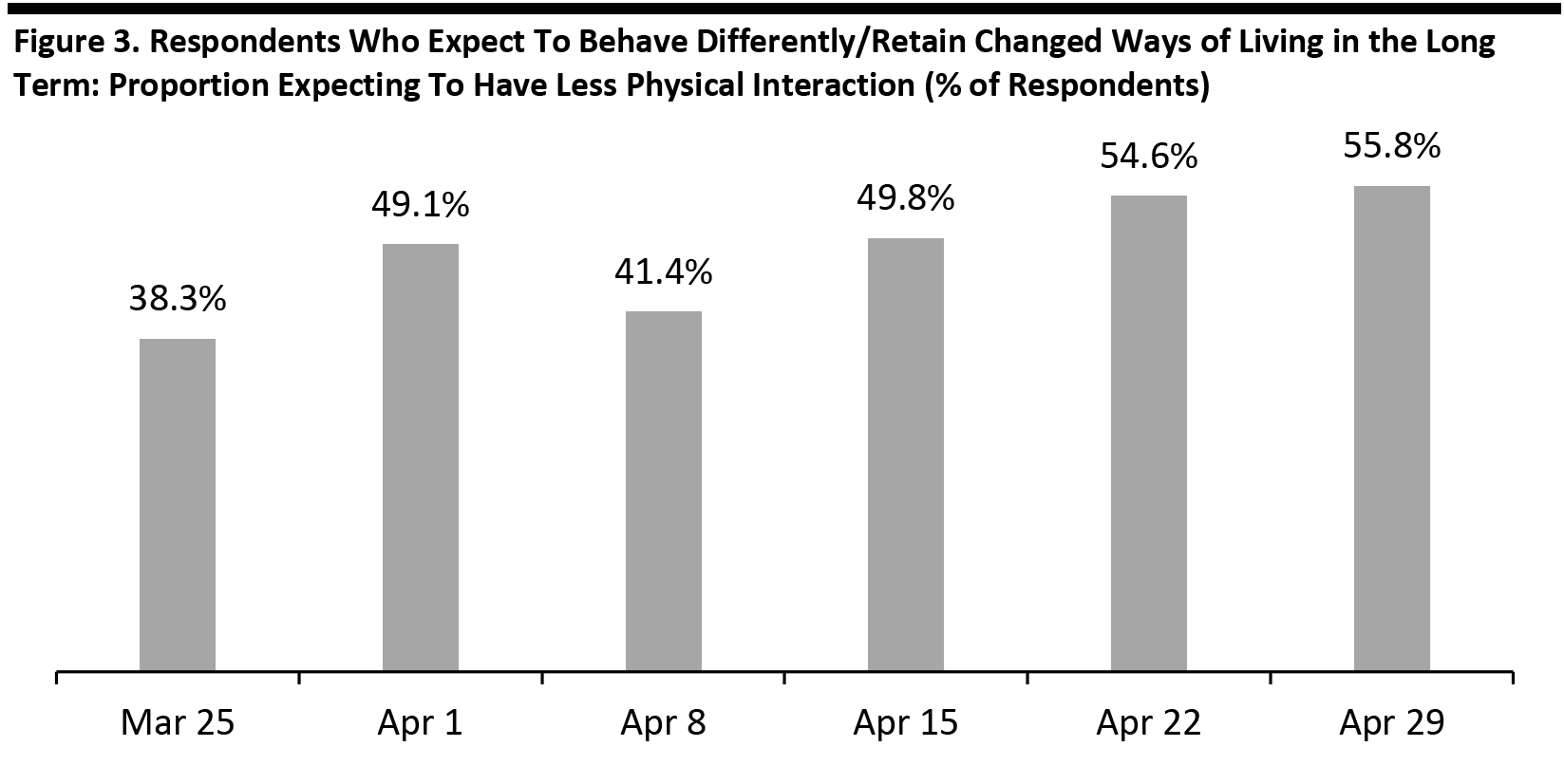

Source: Coresight Research [/caption] 3. Shoppers Are Realizing Post-Crisis Behavior Will Be Different Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Among those respondents expecting to retain changed behaviors after the outbreak ends, around 56% expect to have less physical interaction; this metric has increased in recent weeks, reflecting a growing realization that post-lockdown normality will involve physical distancing. In retail, this will be reflected in the regulation of shopper numbers and social distancing in physical stores. We have also seen upward trends in expectations of changed shopping habits: Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Source: Coresight Research [/caption]

Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] 2. Four in 10 expect the severe impact to last over six months This week, consumers’ expectations of the length of the crisis increased yet again. Some 41% now expect the severe impact of the outbreak to last more than six months from its start, up from 38% last week. This timescale implies that the severe impacts will run up to the holiday season. A total of 87.3% expect the severe impact to last three months or more, broadly level with 87.8% last week. [caption id="attachment_108869" align="aligncenter" width="700"]

Selected options shown

Selected options shown Base: US Internet users aged 18+

Source: Coresight Research [/caption] 3. Shoppers Are Realizing Post-Crisis Behavior Will Be Different Each week, we ask respondents which, if any, behaviors they will retain from the crisis period. Among those respondents expecting to retain changed behaviors after the outbreak ends, around 56% expect to have less physical interaction; this metric has increased in recent weeks, reflecting a growing realization that post-lockdown normality will involve physical distancing. In retail, this will be reflected in the regulation of shopper numbers and social distancing in physical stores. We have also seen upward trends in expectations of changed shopping habits:

- Among respondents expecting to retain changed behaviors, around four in 10 now expect to switch retail purchases from stores to e-commerce.

- Almost three in 10 of this group expect to shop less overall once the outbreak ends.

Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak

Base: US Internet users aged 18+ who expect to behave differently in the long term/retain changed ways of living from the outbreak Source: Coresight Research [/caption]