albert Chan

We discuss select findings and compare them to those from prior weeks: June 24, June 17, June 10, June 3, May 27, May 20, May 13, May 6, April 29, April 22, April 15, April 8, April 1, March 25 and March 17–18.

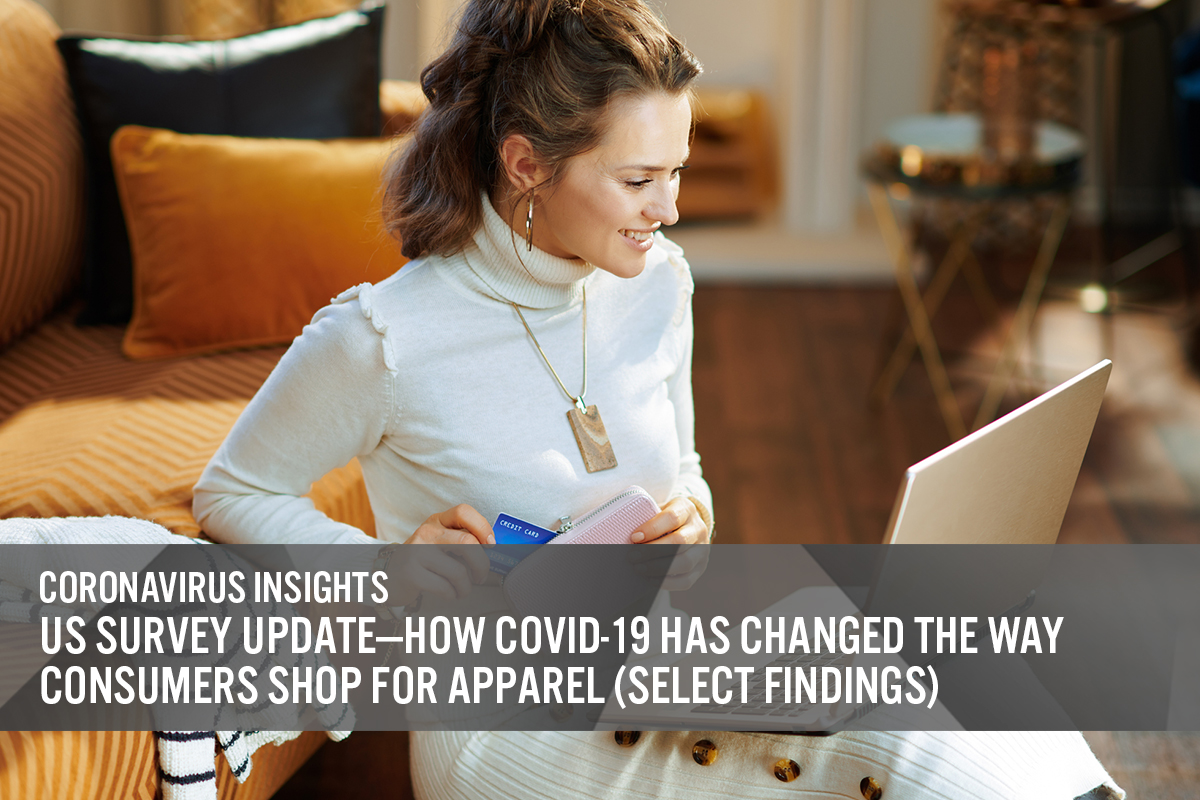

1. Three in 10 Have Switched Apparel Spending to an Online-Only RetailerThis week, we asked consumers about how the coronavirus has changed how they shop for clothing and footwear, giving them 10 options (as well as “none”).

We saw that three in 10 respondents have switched some or all of their spending to an online pure-play retailer such as Amazon.com, reflecting that shoppers have not simply switched to the websites of the brick-and-mortar retailers they previously bought from in store and that e-commerce pure plays have been capturing a growing online market share.

Consumers have also started using pickup options for their online purchases: One in seven respondents have started using in-store pickup; and one in six have begun using curbside pickup, a new service rolled out by several fashion retailers such as Macy’s, Kohl’s and Old Navy.

Some 17% of respondents have avoided trying on clothes when shopping in a store. This fear of trying on apparel in store, coupled an upward trend in online apparel shopping (discussed below), could result in more returns for fashion retailers.

- See our full report for complete results of how coronavirus has changed the way consumers shop for apparel.

Base: US Internet users aged 18+

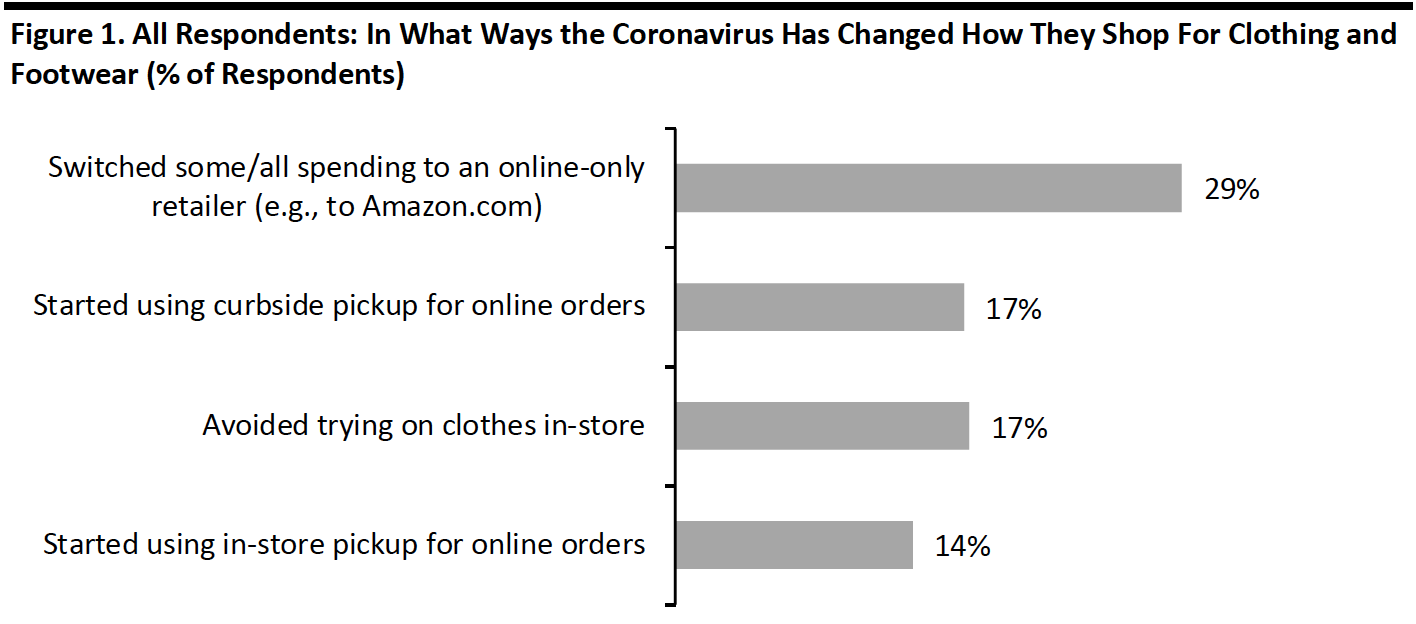

Base: US Internet users aged 18+Source: Coresight Research[/caption] 2. More Consumers Are Still Buying More Apparel Online

This week, the proportion of respondents buying more clothing and footwear online than they used to jumped again to around three in 10. We have seen this general upward trend in online apparel shopping since the week of April 1; the proportion has increased roughly 20 percentage points in three months.

From our questions asking what consumers had done over the past two weeks, online shopping for apparel continues to top the list of spending-related activities: We saw a stable proportion of around one-third of respondents saying they had done so in the past two weeks. This compares to only one in six respondents who had bought apparel in a store over the same period.

[caption id="attachment_112418" align="aligncenter" width="700"] Base: US Internet users aged 18+

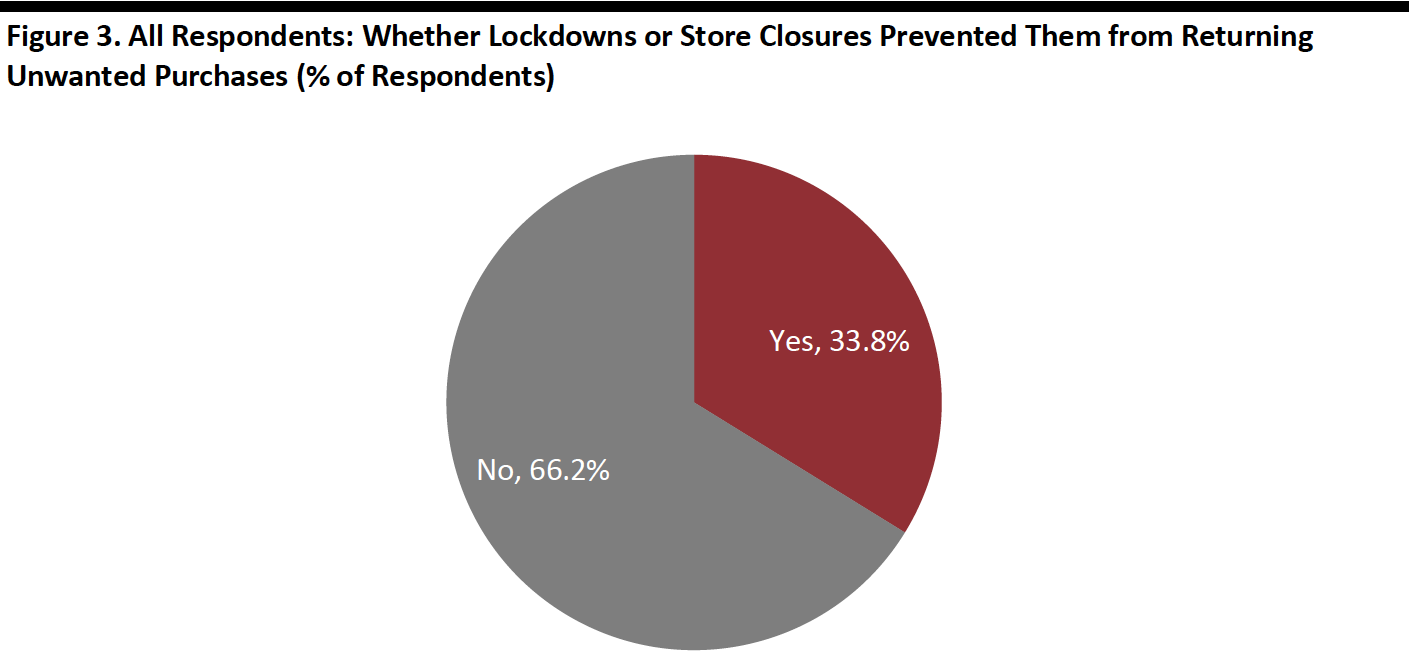

Base: US Internet users aged 18+Source: Coresight Research[/caption] 3. Covid-19 Has Impacted Consumers’ Returns of Unwanted Purchases We asked respondents if lockdowns or store closures had prevented them from returning any unwanted purchases, and if so, what they have done with their unwanted purchases. One-third of all respondents said that lockdowns or store closures prevented them from returning their unwanted purchases. Among those respondents, we saw more consumers who have yet to return some unwanted items from the lockdown period expect to return them in store than by mail. [caption id="attachment_112419" align="aligncenter" width="700"]

Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]