albert Chan

In our Coronavirus Insights series, we outline the impact of the ongoing coronavirus outbreak on economies, sectors and businesses. In this report, we discuss three insights from our channel checks in New York City on the weekend of March 14–15, when stores were still open but starting to adjust hours to reflect the precipitous decline in store traffic at discretionary retailers in the previous week. We include a list of store closing/reduced hours through March 17.

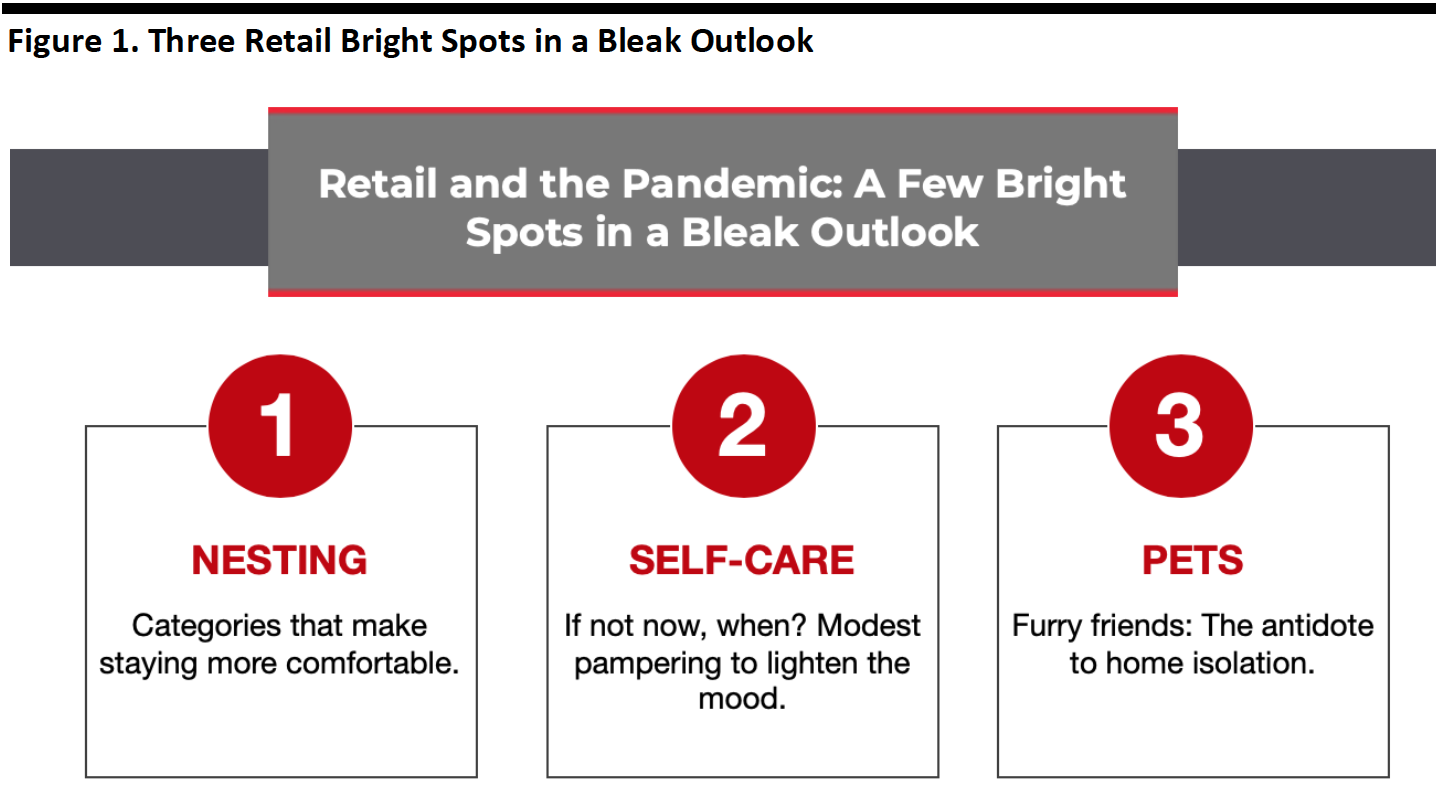

[caption id="attachment_105463" align="aligncenter" width="750"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

New York has the most coronavirus cases of any US state, surpassing 1,300 cases as of March 17, 2020, with many of those in New York City. New York City closed all public schools from March 16, 2020, and limited restaurants, bars and cafes to takeout and delivery only starting March 17, 2020. Overall, we estimate store traffic was down 50–60% in New York City. People were already avoiding crowded places such as stores anyway, then retail stores started announcing temporary closures or reduced hours to slow the outbreak. Total US retail traffic fell 9.1% in the first week of March, according to Morgan Stanley. We noticed even steeper declines in specialty retail stores in New York City channel checks.

- Traffic at Bloomingdale’s was only about 10% of usual traffic on most Saturdays or Sundays, even though the store was holding a promotional gift card event. We noticed sales associates were more engaged with consumers. The store closed early, at 7 pm.

- Specialty apparel stores such as Gap, Aerie and Zara, and cosmetics store Sephora, were almost empty. In its recent earnings call Gap said it had started to see traffic impact in the Northwest and Northeast, particularly in the New York area.

US Consumers Are Buying Nesting Items

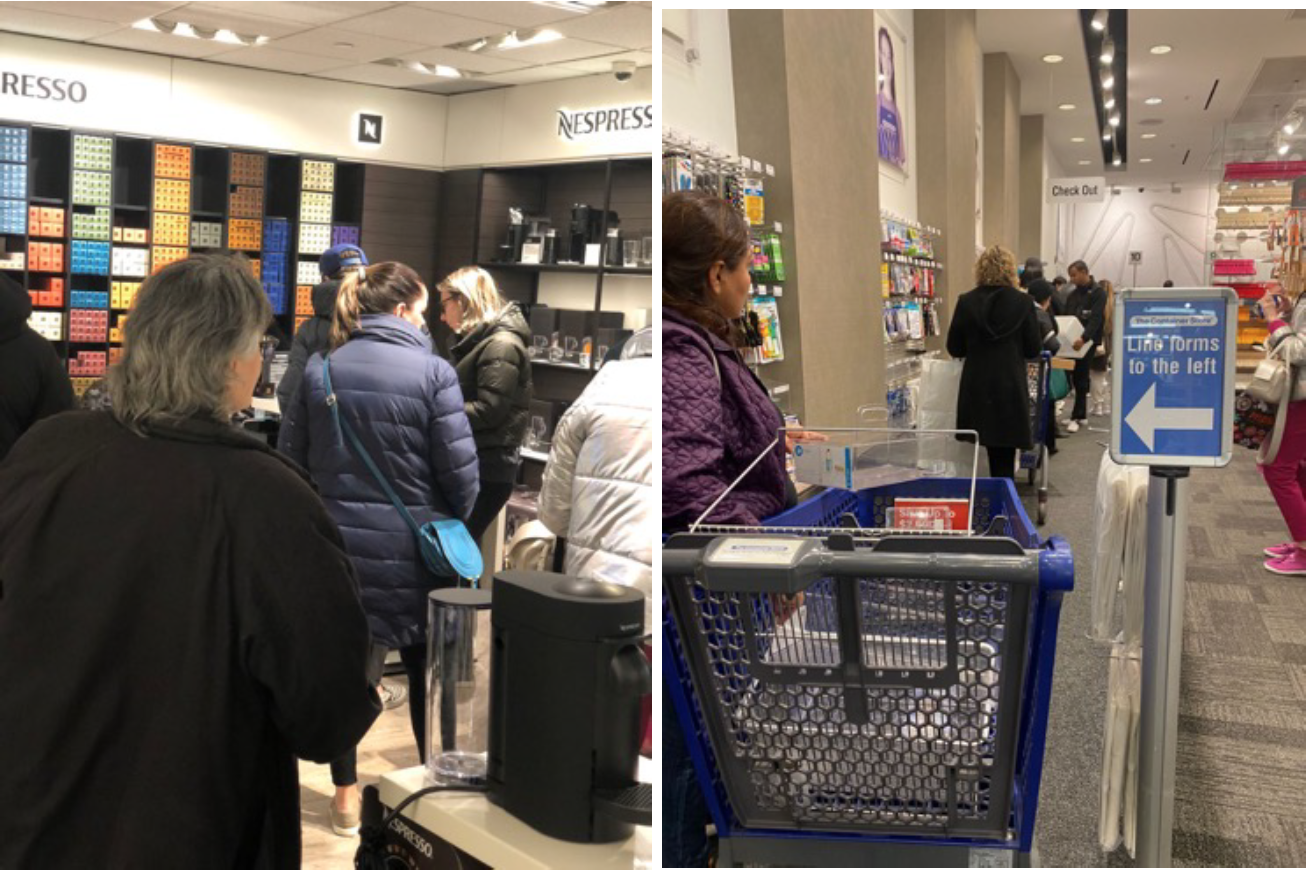

In a previous report in this series, we outlined how US consumers were flocking to grocery stores to stockpile food and cleaning products—but we also found consumers snapping up items to make a prolonged at-home quarantine more manageable. In New York City’s Bloomingdale’s, the few busy areas were the Nespresso shop-in-shop and the home section that sells tabletop or kitchenware, home fragrances and candles. A sales associate at Nespresso told Coresight Research that the shop was busy all day long as consumers bought new machines and stocked up on pods.

We also discovered a line at the Container Store, where consumers were buying various organizational products—likely for use as they work from home for the next few weeks or months with children at home thanks to school closures. We expect the nesting trend to drive sales of comfy attire, such as sweatshirts, loungewear and pajamas, which could benefit brands such as Kim Kardashian’s Cozy and Aerie.

Another unusual thing we found was the pet shop: Specialist pet store the Puptown was busy on multiple visits. We expect pets to be pampered in the coming weeks as owners spend more time at home with them—or even buy, adopt or foster a new furry friend.

[caption id="attachment_105464" align="aligncenter" width="500"] Nespresso shop-in-shop (left) in New York City’s Bloomingdale’s (L); The container store in New York City (right)

Nespresso shop-in-shop (left) in New York City’s Bloomingdale’s (L); The container store in New York City (right)Source: Coresight Research[/caption]

Consumers Adopt Small Luxury Indulgences

While we believe consumers are less likely to spend on big-ticket luxury items amid an ongoing pandemic, we do see continued demand for small luxuries. Coresight Research spoke to store associates at Bloomingdale’s who told us the recently launched Hermès lipstick line, which costs $67, was sold out. In a recent interview with Forbes, Jorge Barraza, a professor of consumer psychology at the University of Southern California, explained his view that consumers engage in more comfort-seeking behaviors during times of uncertainty. For example, consumers may prefer an ornate or more luxurious item over a strictly utilitarian one as it gives them a sense of control during uncontrollable times. This could drive demand for reasonably priced luxury items, such as high-end scented products, candles, diffusers and other high-end home products.

The Bidet Makes a Comeback as Toilet Paper Sells Out

With panic buying depleting store shelf inventory of toilet paper, some US consumers are switching to bidets, a common fixture in Asian and Southern European bathrooms but relatively rare here. Bidet manufacturer TUSHY, a member of Coresight Research’s Innovator Intelligence program, said sales have grown tenfold in the past few weeks as word spread about toilet paper shortages. According to Jason Ojalvo, CEO of TUSHY, Americans use 36 billion rolls of toilet paper per year, at a cost of 15 million trees, 437 billion gallons of water and 235,000 tons of bleach. We could see bidets go mainstream in the US.

[wpdatatable id=75 table_view=regular]