DIpil Das

We Expect a Multibillion-Dollar Switch from Food Service to Food Retail

The empty shelves in grocery stores are a testament to the stockpiling and additional purchasing we’re seeing across the US. However, this strong demand is more than just panic buying: Grocery retail sales are being supported by a shift of billions of dollars of spending from food service (restaurants, cafés, canteens, etc.) to retail, as dining establishments close and workers and students stay home.

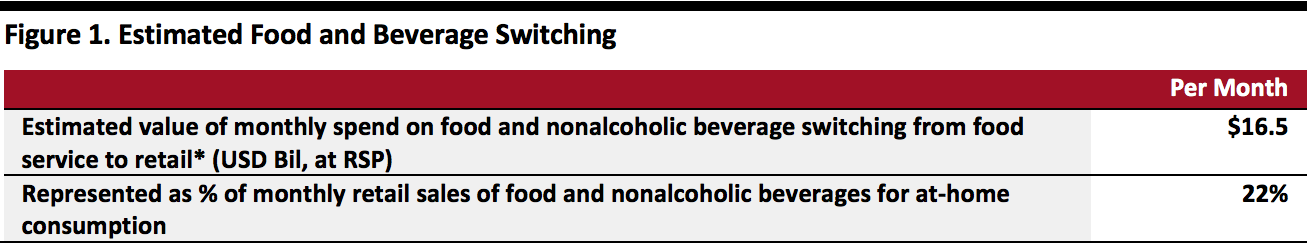

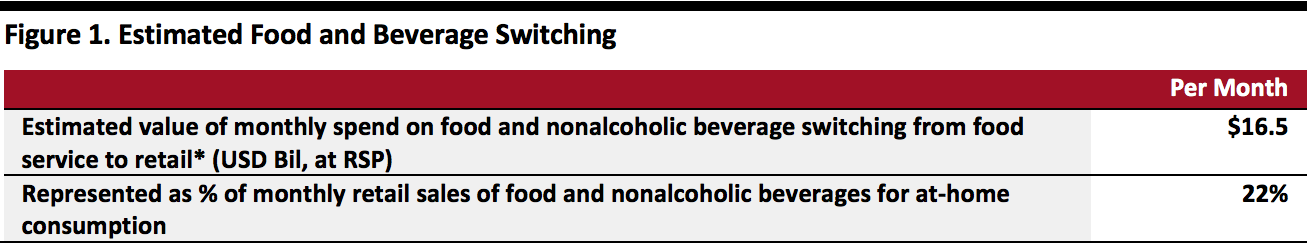

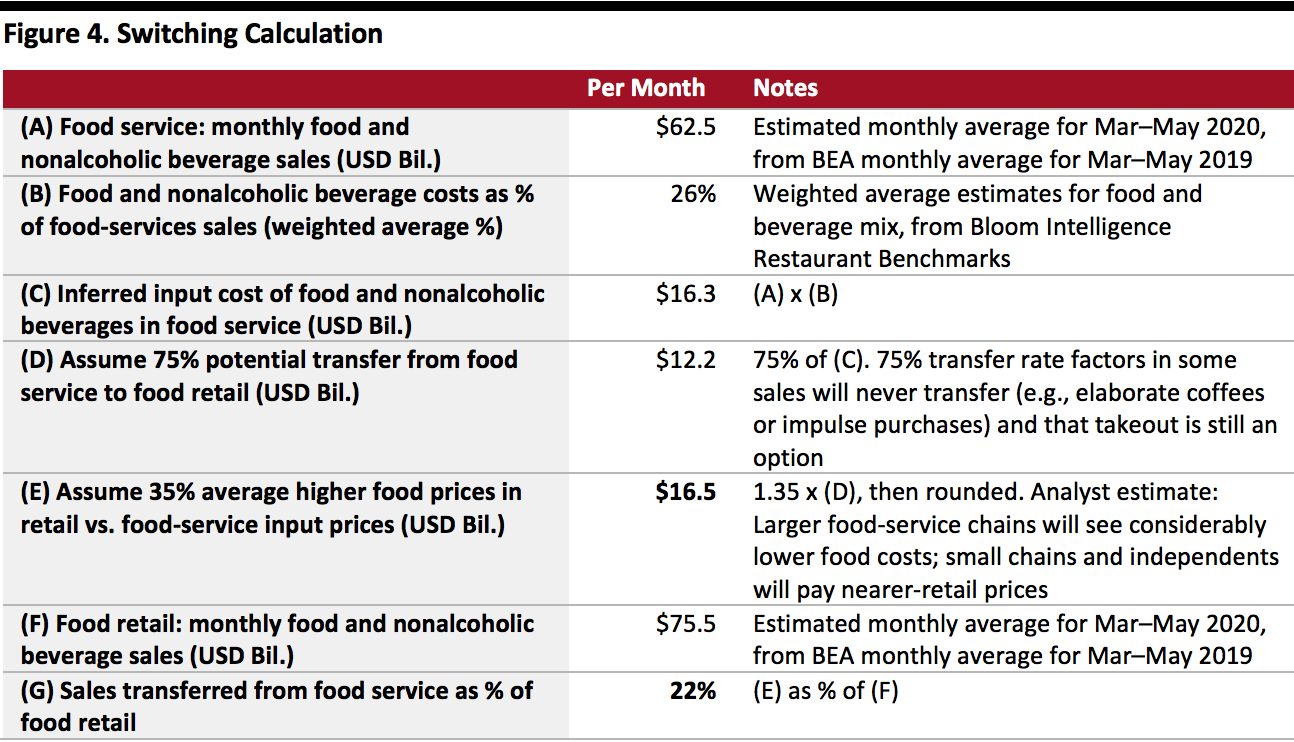

Based on data from the Bureau of Economic Analysis (BEA) and our analysis, we estimate around $16.5 billion of food and nonalcoholic beverage sales could flow to retail for every month that food-service establishments are closed. That’s equivalent to around 22% of regular monthly food-at-home retail spending, we estimate from BEA data.

[caption id="attachment_106507" align="aligncenter" width="700"] Source: BEA/Coresight Research[/caption]

On March 25, Target noted an increase of more than 50% in comparable sales of “essentials” and food and beverage, month-to-date in March.

Our estimates assume:

Source: BEA/Coresight Research[/caption]

On March 25, Target noted an increase of more than 50% in comparable sales of “essentials” and food and beverage, month-to-date in March.

Our estimates assume:

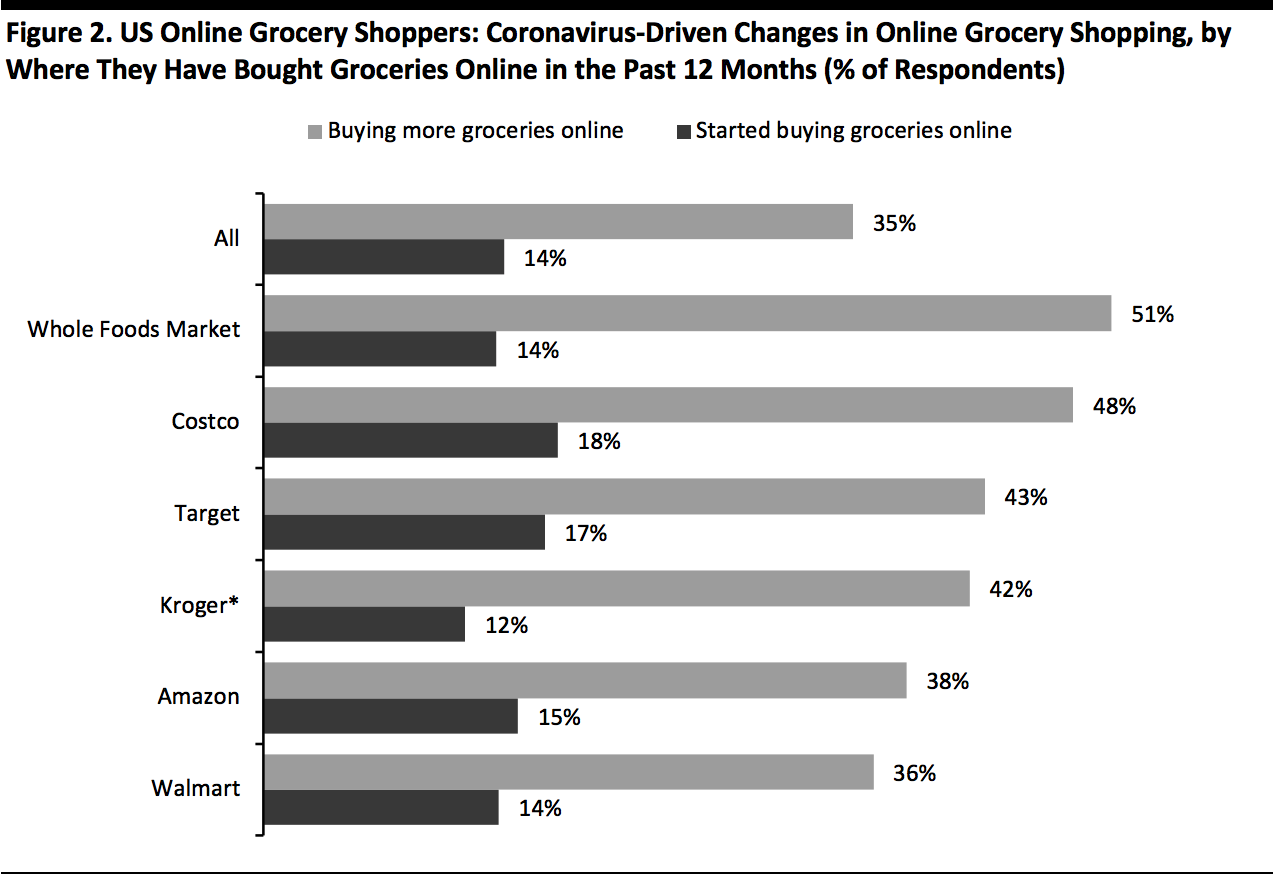

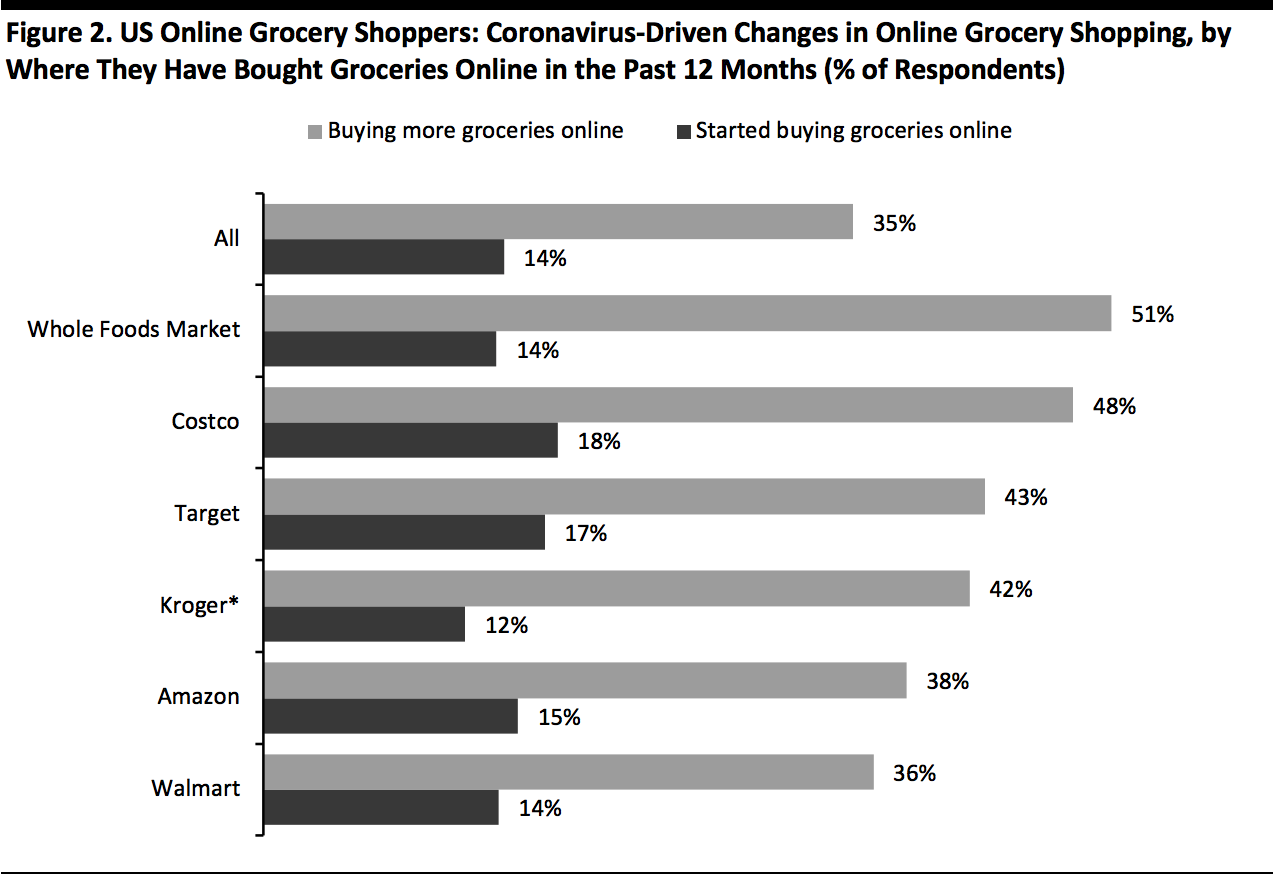

Selected major retailers shown; respondents could choose multiple retailers if they had purchased online from more than one

Selected major retailers shown; respondents could choose multiple retailers if they had purchased online from more than one

Base: 599 US Internet users aged 18+ who bought groceries online in the past 12 Months, surveyed in March 2020

*Includes Harris Teeter, Fred Meyer, Smith’s Food & Drug, King Soopers, City Market and Ralphs

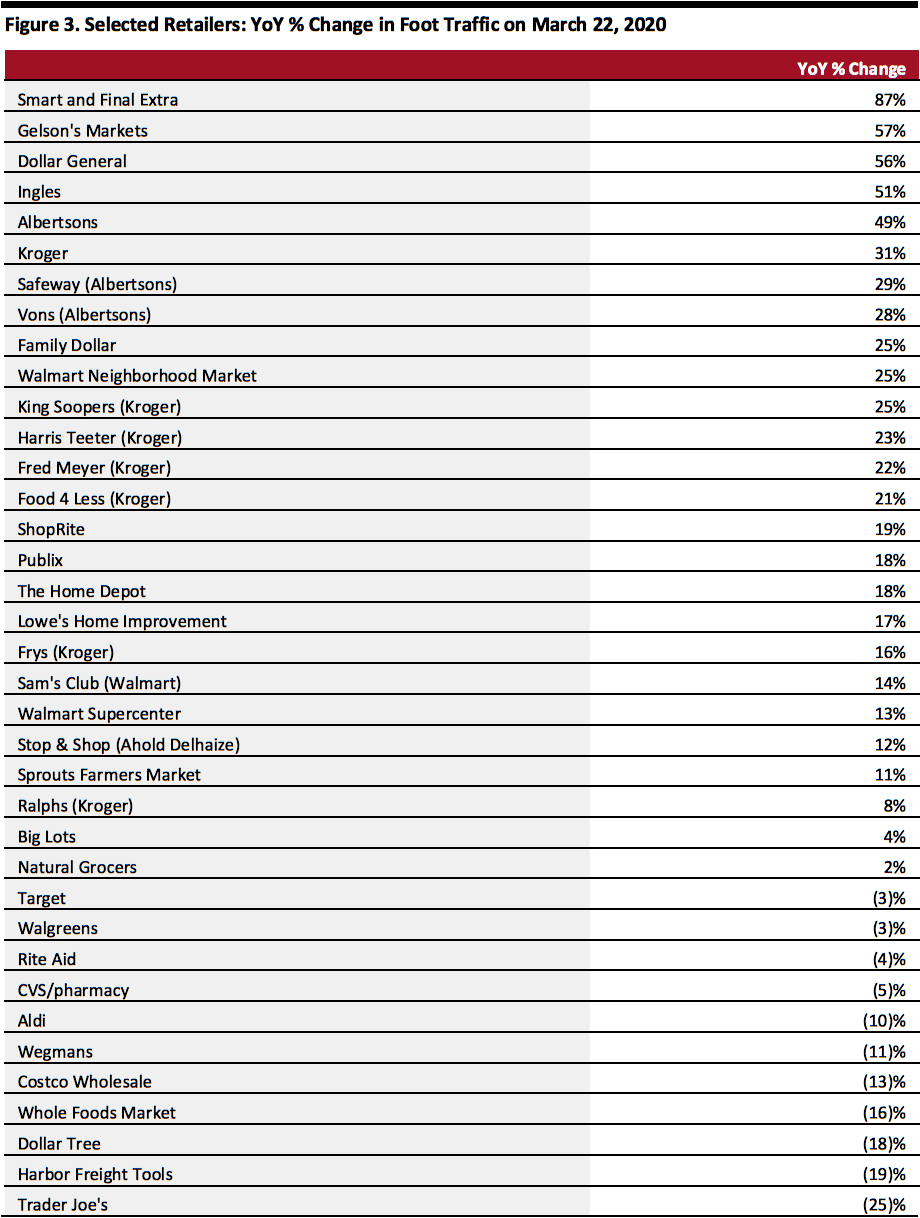

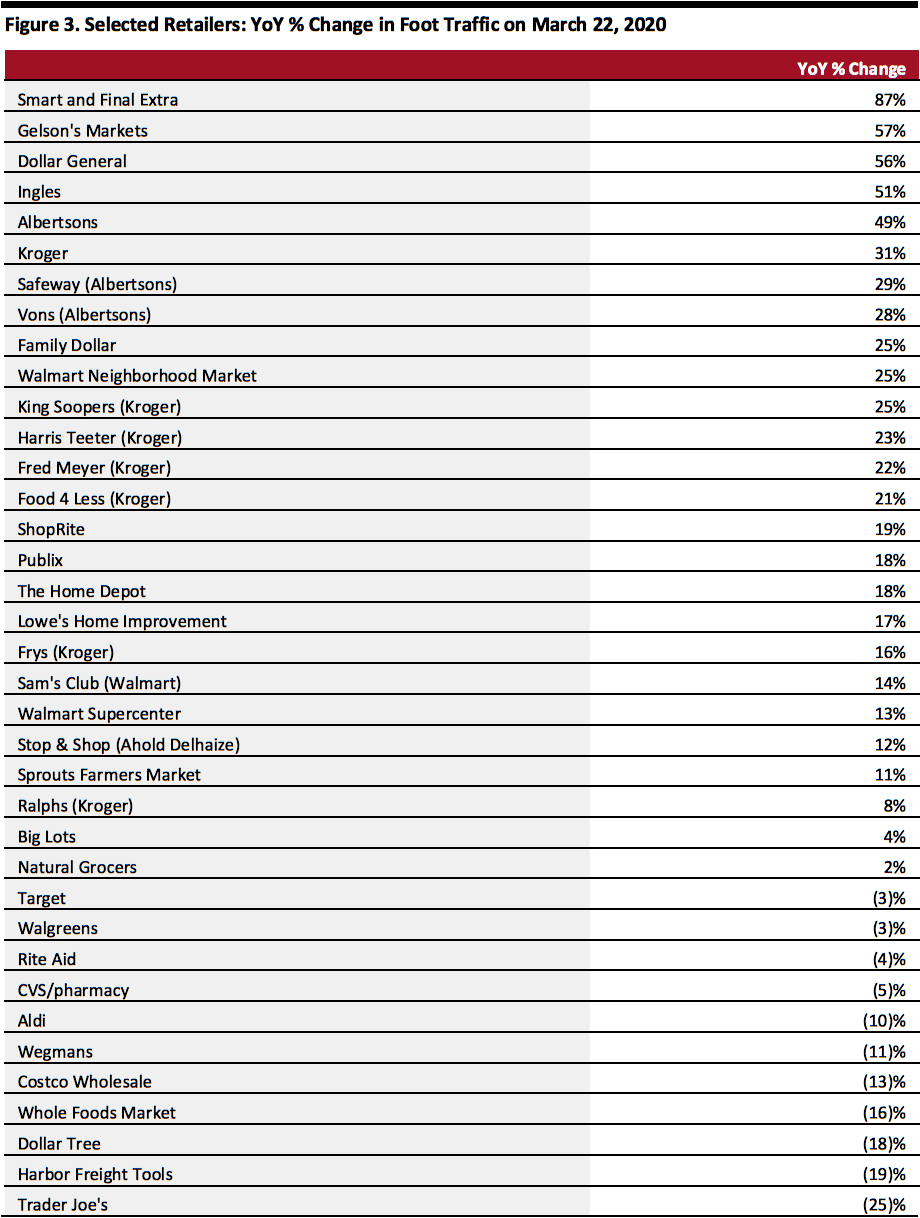

Source: Coresight Research[/caption] These top-line findings complement our recent survey data which found 35% of US respondents are buying more food or nonalcoholic beverages overall (whether online or in stores). We will publish the full findings from our online grocery survey in April. We expect a very strong uplift in US online grocery sales, with capacity rather than demand proving to be the constraint. We believe online grocery sales will approximately double during the crisis period—although the elasticity of capacity in the online grocery market is not readily quantifiable, especially given it is rapidly expanding. On March 23, Instacart reported a 150% uplift in online grocery order volume and a 15% increase in average order size in the prior weeks—although we expect the asset-light model of Instacart to be able to flex capacity more easily than grocery retailers with fleets of trucks or a fixed number of pickup points. Instacart said it was seeking to double its grocery-shopping staff. Grocery Store Traffic Increases Below, we show a snapshot of traffic to physical stores on Sunday, March 22, as recorded by Placer.ai. The data confirm a general trend of strong uplifts in demand at grocery stores, albeit with some exceptions. We note that the data represent one day only—and the decline for Target contradicts the company’s statement this week that it had seen “unusually strong” traffic month-to-date in March. Time-series data from Placer.ai shows a more consistent upswing in traffic at major grocery retailers, that coincided with the entrenchment of the coronavirus outbreak. [caption id="attachment_106510" align="aligncenter" width="700"] Source: Placer.ai[/caption]

Our Recommendations to Retailers

Source: Placer.ai[/caption]

Our Recommendations to Retailers

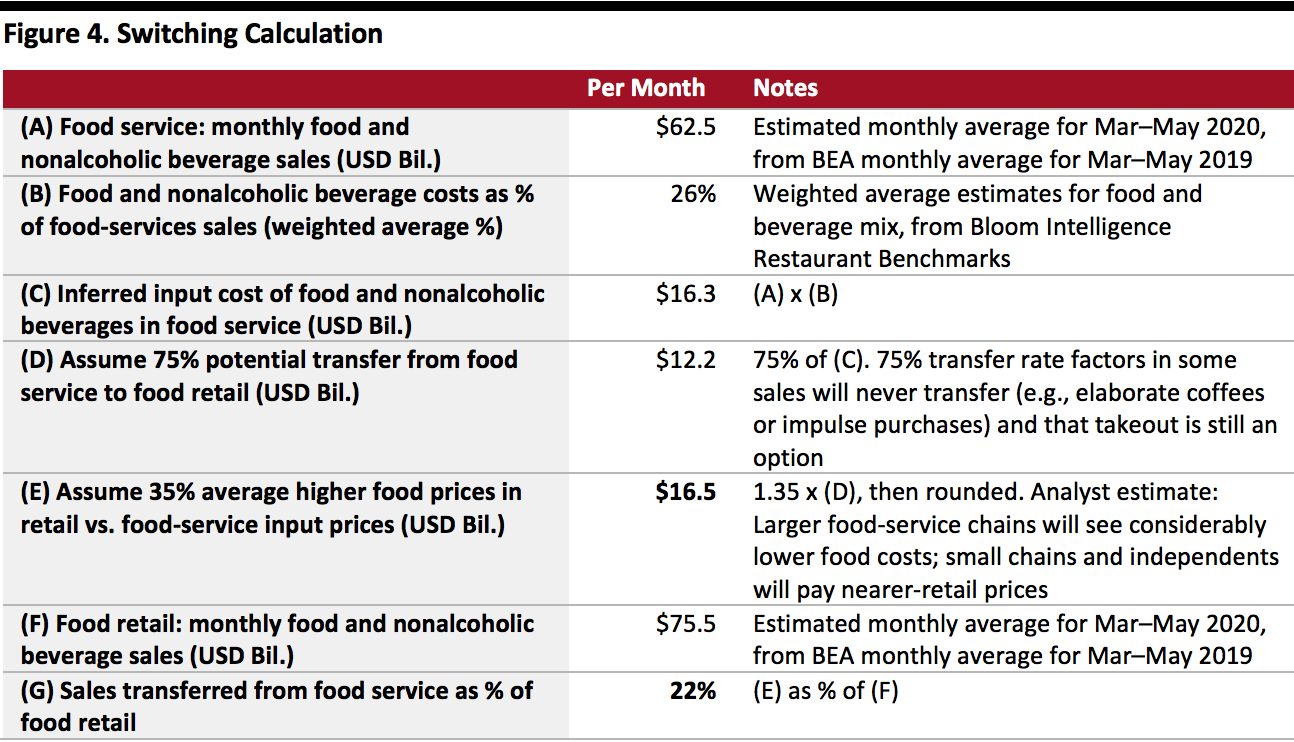

Source: BEA/Bloom Intelligence/Coresight Research[/caption]

Source: BEA/Bloom Intelligence/Coresight Research[/caption]

Source: BEA/Coresight Research[/caption]

On March 25, Target noted an increase of more than 50% in comparable sales of “essentials” and food and beverage, month-to-date in March.

Our estimates assume:

Source: BEA/Coresight Research[/caption]

On March 25, Target noted an increase of more than 50% in comparable sales of “essentials” and food and beverage, month-to-date in March.

Our estimates assume:

- That the retail price of food and nonalcoholic beverages costs are equivalent to approximately 26% of the equivalent of the final selling price in food-service establishments—based on our analysts’ weighting of data points from Bloom Intelligence Restaurant Benchmarks.

- That around 75% of food-service sales have the potential to switch to retail. This ratio assumes dine-in options are closed but takeaway/delivery options and some workplace canteens remain; it includes an adjustment for impulse purchases and selected food-service spend that we expect will not transition to retail, such as elaborate coffees normally bought from a coffee shop and that people typically would not make at home.

- However, our calculations don’t include alcoholic beverages, which we expect will provide a further boost for retail sales.

Selected major retailers shown; respondents could choose multiple retailers if they had purchased online from more than one

Selected major retailers shown; respondents could choose multiple retailers if they had purchased online from more than oneBase: 599 US Internet users aged 18+ who bought groceries online in the past 12 Months, surveyed in March 2020

*Includes Harris Teeter, Fred Meyer, Smith’s Food & Drug, King Soopers, City Market and Ralphs

Source: Coresight Research[/caption] These top-line findings complement our recent survey data which found 35% of US respondents are buying more food or nonalcoholic beverages overall (whether online or in stores). We will publish the full findings from our online grocery survey in April. We expect a very strong uplift in US online grocery sales, with capacity rather than demand proving to be the constraint. We believe online grocery sales will approximately double during the crisis period—although the elasticity of capacity in the online grocery market is not readily quantifiable, especially given it is rapidly expanding. On March 23, Instacart reported a 150% uplift in online grocery order volume and a 15% increase in average order size in the prior weeks—although we expect the asset-light model of Instacart to be able to flex capacity more easily than grocery retailers with fleets of trucks or a fixed number of pickup points. Instacart said it was seeking to double its grocery-shopping staff. Grocery Store Traffic Increases Below, we show a snapshot of traffic to physical stores on Sunday, March 22, as recorded by Placer.ai. The data confirm a general trend of strong uplifts in demand at grocery stores, albeit with some exceptions. We note that the data represent one day only—and the decline for Target contradicts the company’s statement this week that it had seen “unusually strong” traffic month-to-date in March. Time-series data from Placer.ai shows a more consistent upswing in traffic at major grocery retailers, that coincided with the entrenchment of the coronavirus outbreak. [caption id="attachment_106510" align="aligncenter" width="700"]

Source: Placer.ai[/caption]

Our Recommendations to Retailers

Source: Placer.ai[/caption]

Our Recommendations to Retailers

- Rationalize ranges to optimize shelf-space and replenishment capacity, and in so doing, maximize availability—shoppers are looking for essentials, not endless choice.

- Assume the increase in demand for core grocery lines will be roughly equivalent to the holiday peak—albeit without the months-long preparation.

- Pull all levers to increase capacity online, including working with third-party service providers and ramping up at-store pickup services.

Source: BEA/Bloom Intelligence/Coresight Research[/caption]

Source: BEA/Bloom Intelligence/Coresight Research[/caption]