Nitheesh NH

As the coronavirus pandemic grips the US, many state and local governments have announced lockdowns, shuttering all non-essential retail businesses and bringing the economy to a temporary standstill. In this report, we look at some of the ways in which the crisis is affecting the cannabis industry. Throughout this report, “cannabis” refers to marijuana

Panic Buying Leads to Sales Surge

Following Donald Trump’s declaration of a national emergency on March 13, 2020, and subsequent announcements of lockdowns and self-quarantine measures in many US states, the cannabis and CBD industries experienced unprecedented demand as consumers rushed to stock up on supplies.

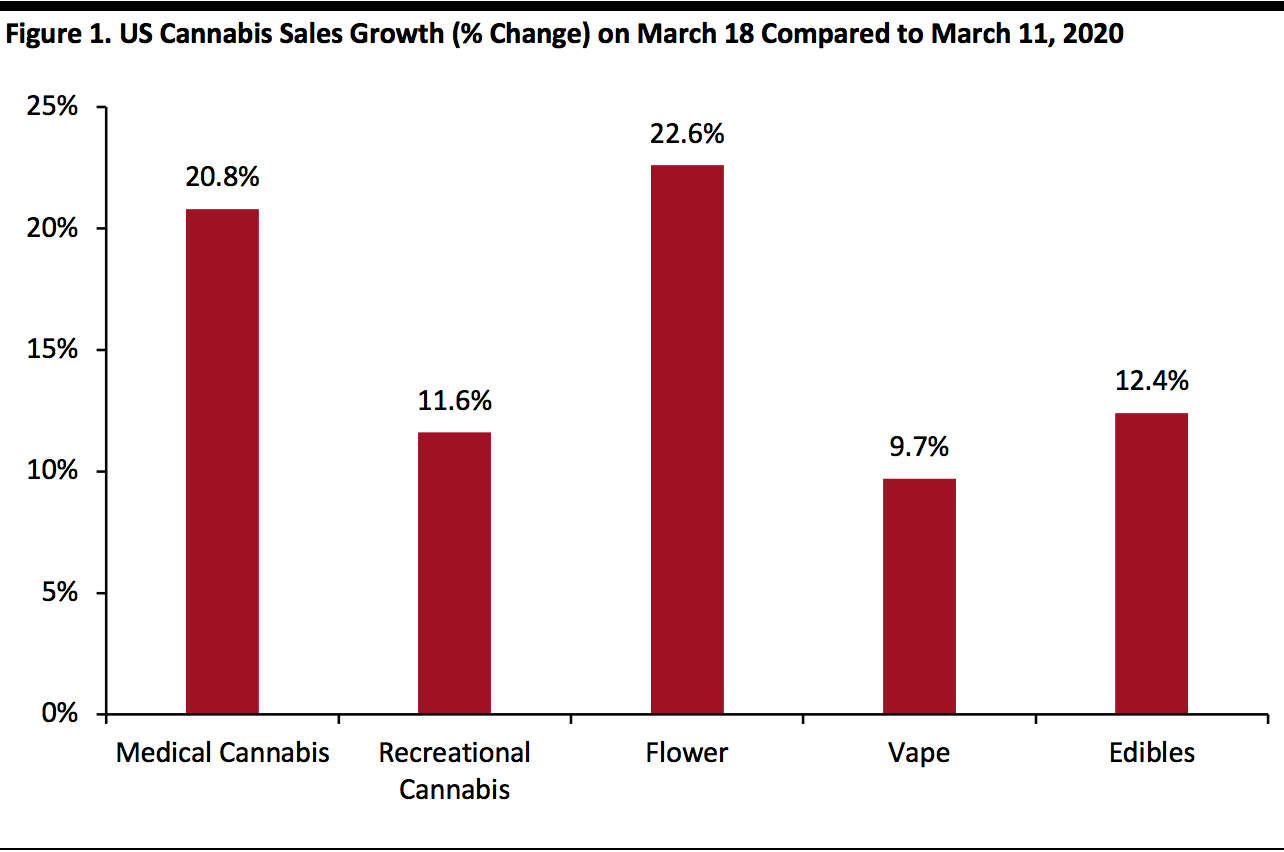

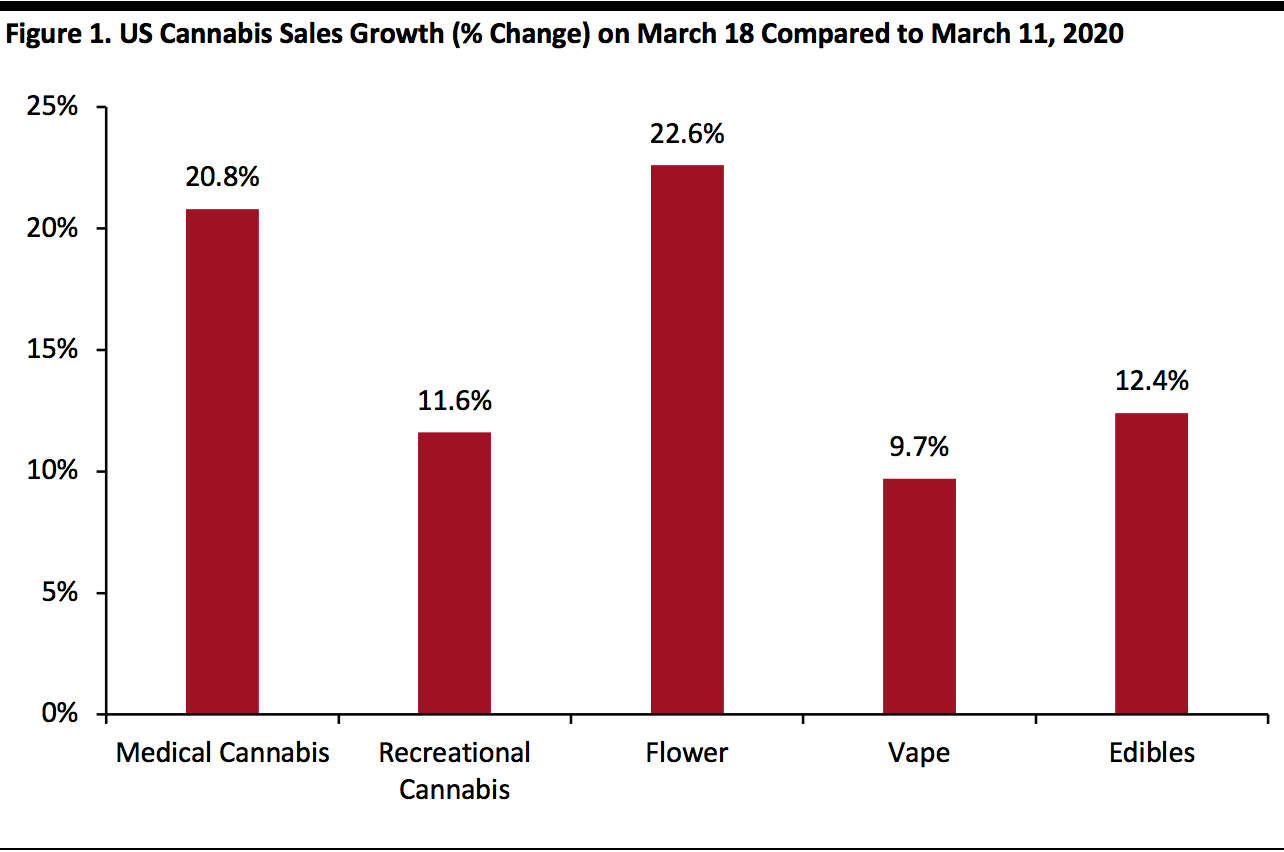

According to the Akerna, a technology and ERP software provider to the cannabis industry, medical cannabis sales in the US were up 20.8% on March 18, compared to a week prior, while recreational cannabis sales were up 11.6% (as shown in Figure 1).

[caption id="attachment_107844" align="aligncenter" width="580"] Source: Akerna[/caption]

Akerna also reported revenue surges in several states that had authorized stay-at-home orders to contain the spread of coronavirus.

For example, Colorado saw the following sales trends on March 23 compared to the previous Monday:

Source: Akerna[/caption]

Akerna also reported revenue surges in several states that had authorized stay-at-home orders to contain the spread of coronavirus.

For example, Colorado saw the following sales trends on March 23 compared to the previous Monday:

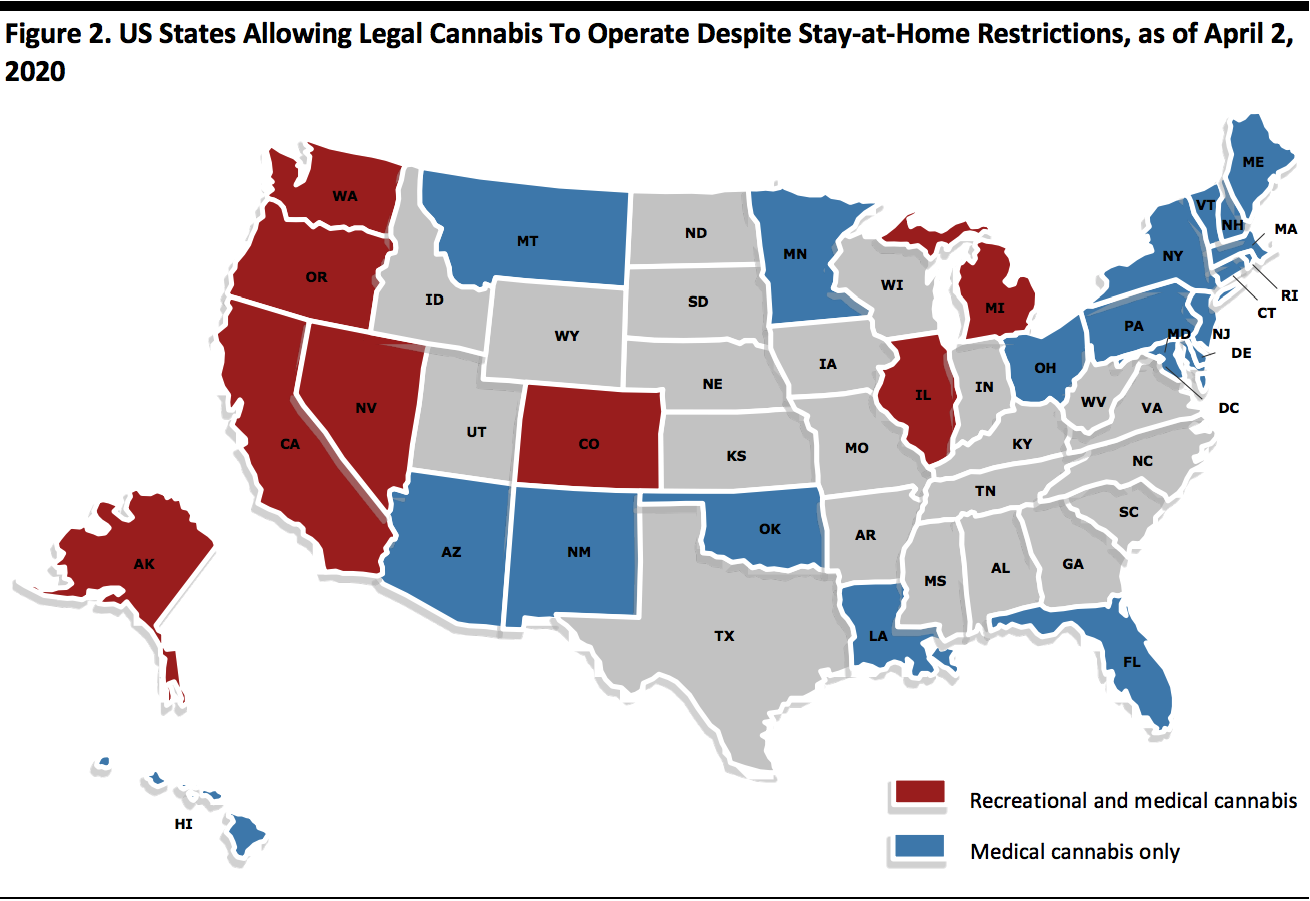

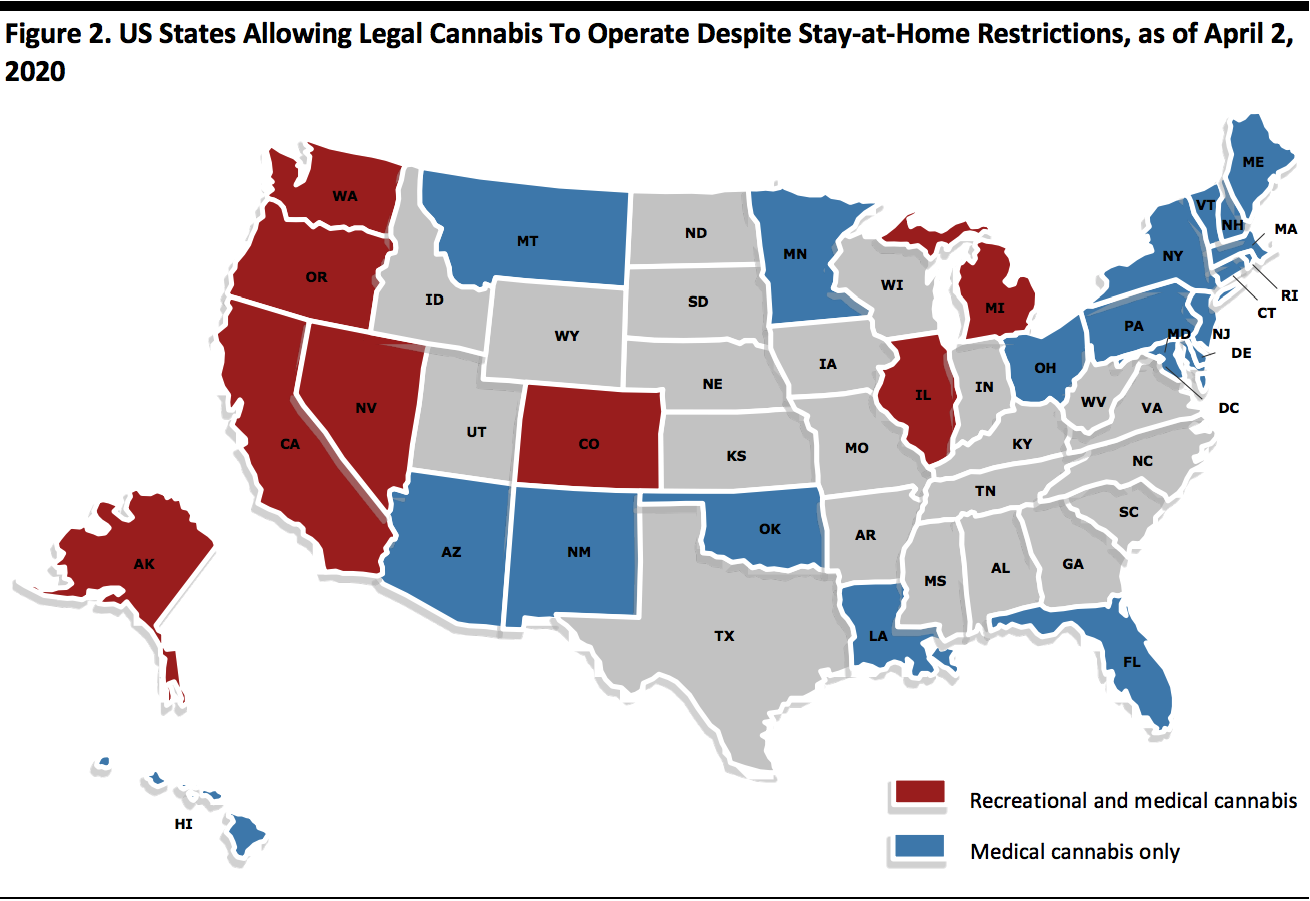

This map applies only to states where governments have ordered statewide stay-at-home orders due to the coronavirus outbreak

This map applies only to states where governments have ordered statewide stay-at-home orders due to the coronavirus outbreak

Source: Marijuana Business Daily[/caption] Supply Chain Disruptions for Vape Hardware Products Like many other industries, the cannabis industry has manufacturing operations in China, particularly for vape hardware products including vaporizers, vape cartridges and batteries. According to Marijuana Business Daily, 90–95% of all components that comprise a cannabis vaporizer are manufactured in Shenzhen, China, while only 5–10% are sourced from the US. The halt in manufacturing activities in China due to the coronavirus outbreak has therefore impacted the US cannabis companies that depended on these factories for their vape products. Vape hardware provider KushCo Holdings, which depends on third-party suppliers in China for product components, noted on March 13 that its operations were briefly impacted by temporary factory shutdowns, production delays and product shortages due to the coronavirus situation. However, the company added that its current inventory level is strong enough to fulfill its commitments to clients for the next several months and will periodically place additional orders to replenish its inventory going forward. Vertically integrated cannabis company Cronos Group, which imports all the batteries and cartridges for its vaporizers from China, noted in its annual report released on March 30 that it had faced a significant delay of deliveries due to the coronavirus. The company stated that though it has sufficient supply to meet its commitments for the next thirty days, but if the outbreak persists, it will have to find alternative suppliers, which may lead to higher costs and further delays. Feather Company, a cannabis hardware provider that sources nearly all of its products from China, also experienced supply chain interruptions caused by shipment delays due to coronavirus-related factory shutdowns. On a positive note for the US cannabis industry, China has gradually brought the outbreak under control, and manufacturing operations began to resume at the beginning of March. In a press conference, Xin Guofu, Deputy Minister of the Ministry of Industry and Information Technology of China, said that the average operating rate of large industrial and manufacturing enterprises (except for operations in Hubei province), had reached 98.65% by March 28. In addition, the average return rate of employees in the manufacturing industry was around 89.9% on the same date. However, cannabis companies are likely to face some delay in the procurement of vaporizers and vaping equipment, as Chinese factories will be swamped with backlogged orders, coupled with longer lead times for manufacturing vaporizers. CBD Companies Launches CBD-Infused Hand Sanitizer Sales of hand sanitizer and personal hygiene products have surged across the US since the coronavirus outbreak. With a large amount of ethanol already at their disposal, several CBD companies have started to produce CBD-infused hand sanitizer to fill supply gaps in the market. Our late-2019 survey of CBD users found that beauty/personal care remained a niche category. More traditional CBD categories, such as tinctures and oils, were found to be much more widely used. New hand-sanitizer product launches may provide a small boost to the CBD personal care market in terms of awareness and purchase levels. However, we think that companies should tread carefully to avoid perceptions of capitalizing on a crisis. Source: Pure Bloom CBD[/caption]

Coronavirus Scare Prompts Cancellation and Postponement of Cannabis and CBD-related Events.

Several cannabis and cannabis-related events that were scheduled to take place in March and April 2020 are being postponed, canceled or moved online. Some of the high-profile events that bore the brunt of the coronavirus outbreak include the following:

Source: Pure Bloom CBD[/caption]

Coronavirus Scare Prompts Cancellation and Postponement of Cannabis and CBD-related Events.

Several cannabis and cannabis-related events that were scheduled to take place in March and April 2020 are being postponed, canceled or moved online. Some of the high-profile events that bore the brunt of the coronavirus outbreak include the following:

Source: Akerna[/caption]

Akerna also reported revenue surges in several states that had authorized stay-at-home orders to contain the spread of coronavirus.

For example, Colorado saw the following sales trends on March 23 compared to the previous Monday:

Source: Akerna[/caption]

Akerna also reported revenue surges in several states that had authorized stay-at-home orders to contain the spread of coronavirus.

For example, Colorado saw the following sales trends on March 23 compared to the previous Monday:

- Dispensary orders were up 54%.

- The number of products ordered was up 101%.

- Total sales increased by 140%.

- New York’s Department of Health stated that all licensed medical marijuana companies are classified as “essential” and are allowed to remain open.

- Colorado’s Department of Public Health and Environment designated cannabis businesses as “critical” services. However, recreational cannabis shops are limited to curbside pickup only.

- In Massachusetts, all cannabis dispensaries supplying recreational product have been ordered to close, and dispensaries that serve both adult-use and medical product may only serve medical patients.

This map applies only to states where governments have ordered statewide stay-at-home orders due to the coronavirus outbreak

This map applies only to states where governments have ordered statewide stay-at-home orders due to the coronavirus outbreakSource: Marijuana Business Daily[/caption] Supply Chain Disruptions for Vape Hardware Products Like many other industries, the cannabis industry has manufacturing operations in China, particularly for vape hardware products including vaporizers, vape cartridges and batteries. According to Marijuana Business Daily, 90–95% of all components that comprise a cannabis vaporizer are manufactured in Shenzhen, China, while only 5–10% are sourced from the US. The halt in manufacturing activities in China due to the coronavirus outbreak has therefore impacted the US cannabis companies that depended on these factories for their vape products. Vape hardware provider KushCo Holdings, which depends on third-party suppliers in China for product components, noted on March 13 that its operations were briefly impacted by temporary factory shutdowns, production delays and product shortages due to the coronavirus situation. However, the company added that its current inventory level is strong enough to fulfill its commitments to clients for the next several months and will periodically place additional orders to replenish its inventory going forward. Vertically integrated cannabis company Cronos Group, which imports all the batteries and cartridges for its vaporizers from China, noted in its annual report released on March 30 that it had faced a significant delay of deliveries due to the coronavirus. The company stated that though it has sufficient supply to meet its commitments for the next thirty days, but if the outbreak persists, it will have to find alternative suppliers, which may lead to higher costs and further delays. Feather Company, a cannabis hardware provider that sources nearly all of its products from China, also experienced supply chain interruptions caused by shipment delays due to coronavirus-related factory shutdowns. On a positive note for the US cannabis industry, China has gradually brought the outbreak under control, and manufacturing operations began to resume at the beginning of March. In a press conference, Xin Guofu, Deputy Minister of the Ministry of Industry and Information Technology of China, said that the average operating rate of large industrial and manufacturing enterprises (except for operations in Hubei province), had reached 98.65% by March 28. In addition, the average return rate of employees in the manufacturing industry was around 89.9% on the same date. However, cannabis companies are likely to face some delay in the procurement of vaporizers and vaping equipment, as Chinese factories will be swamped with backlogged orders, coupled with longer lead times for manufacturing vaporizers. CBD Companies Launches CBD-Infused Hand Sanitizer Sales of hand sanitizer and personal hygiene products have surged across the US since the coronavirus outbreak. With a large amount of ethanol already at their disposal, several CBD companies have started to produce CBD-infused hand sanitizer to fill supply gaps in the market. Our late-2019 survey of CBD users found that beauty/personal care remained a niche category. More traditional CBD categories, such as tinctures and oils, were found to be much more widely used. New hand-sanitizer product launches may provide a small boost to the CBD personal care market in terms of awareness and purchase levels. However, we think that companies should tread carefully to avoid perceptions of capitalizing on a crisis.

- On March 12, 2020, Global Cannabinoids, a business-to-business wholesale CBD supplier, announced the launch of its white-label CBD-infused hand sanitizer, which retailers can include in their store-brand products to meet the high demands for sanitizer during the coronavirus outbreak. On April 1, the company announced that it secured $15 million in hand-sanitizer orders over the previous seven days. Global Cannabinoids said that it had diverted the supply chain of ethanol used in the extraction of hemp towards the production of hand sanitizer. The company added that it has introduced its own line of hand sanitizers under the “Medically Minded” brand and will ship millions of units to brick-and-mortar retailers across the US.

- Green Cure & Botanical Distribution, a manufacturer of CBD and hemp-infused products, announced plans on March 26 to launch new hemp-based hand sanitizer in April 2020. The company will also offer private-label services for other companies looking to enter the hemp-infused sanitizer market. Green Cure & Botanical Distribution believes that the niche hand-sanitizer market will continue to expand over the next few months and will remain strong even when the coronavirus outbreak subsides.

- On March 27, 2020, Pure Bloom CBD launched a CBD-infused hand sanitizer, which is available in two scents. The company believes that the demand for CBD hand sanitizer and related hygiene products will remain high in the US following recovery from the pandemic.

Source: Pure Bloom CBD[/caption]

Coronavirus Scare Prompts Cancellation and Postponement of Cannabis and CBD-related Events.

Several cannabis and cannabis-related events that were scheduled to take place in March and April 2020 are being postponed, canceled or moved online. Some of the high-profile events that bore the brunt of the coronavirus outbreak include the following:

Source: Pure Bloom CBD[/caption]

Coronavirus Scare Prompts Cancellation and Postponement of Cannabis and CBD-related Events.

Several cannabis and cannabis-related events that were scheduled to take place in March and April 2020 are being postponed, canceled or moved online. Some of the high-profile events that bore the brunt of the coronavirus outbreak include the following:

- South by Southwest (SXSW) was slated for March 13–22 in Austin, Texas, but has been temporarily cancelled. The SXSW had a business track that included speakers from Marijuana Business Daily. According to the event website, organizers are exploring options to reschedule SXSW and are planning to offer a virtual online experience for 2020 participants.

- New England Cannabis Convention was scheduled to be held over March 20–22 but has been postponed to June 27–29 due to coronavirus disruption.

- The California Cannabis Industry Association’s 5th Annual Policy Conference was set to take place on March 18 in Sacramento but has been postponed.

- The National Cannabis Risk Management Association has postponed its NCRMA 2020 convention, which was scheduled to be held on March 22–24 in Las Vegas.

- NoCo Hemp Expo, originally slated for March 26–28 in Denver, Colorado, has been rescheduled for August 6–8 at the same location.