Nitheesh NH

The coronavirus crisis has disrupted the norm of consumer behaviors and lifestyles across the globe over the past few months. China was the first nation to be hit by the coronavirus, but it now appears to be containing the situation and on the road to recovery. We explore how the pandemic has altered China’s consumer behaviors post lockdown and what this means for retailers.

1. Saving Up and Adopting a Rational Spending Mindset

China’s consumers are showing a more cautious mindset as the country comes out of the coronavirus crisis. The economic shock of the pandemic has hit overall consumer sentiment, although the extent of the impact on personal and household incomes will be varied. Furthermore, widescale lockdowns have limited spending and shopping opportunities.

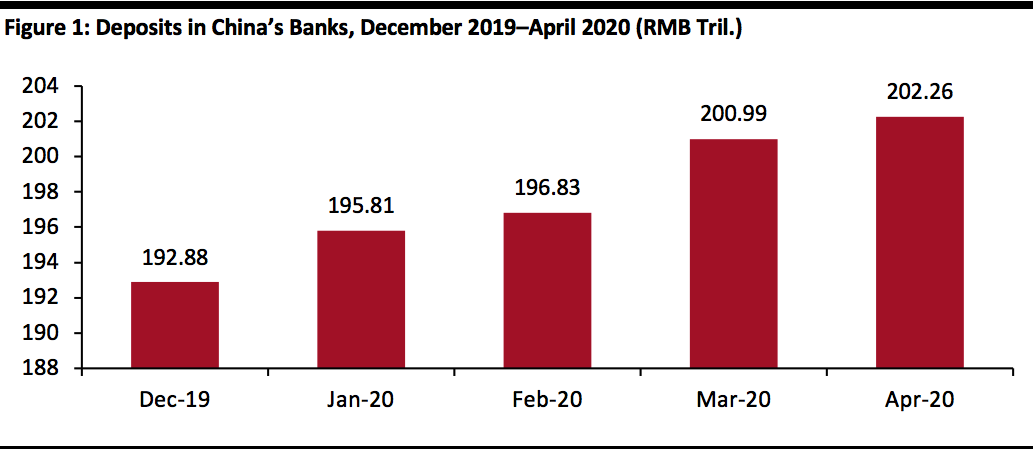

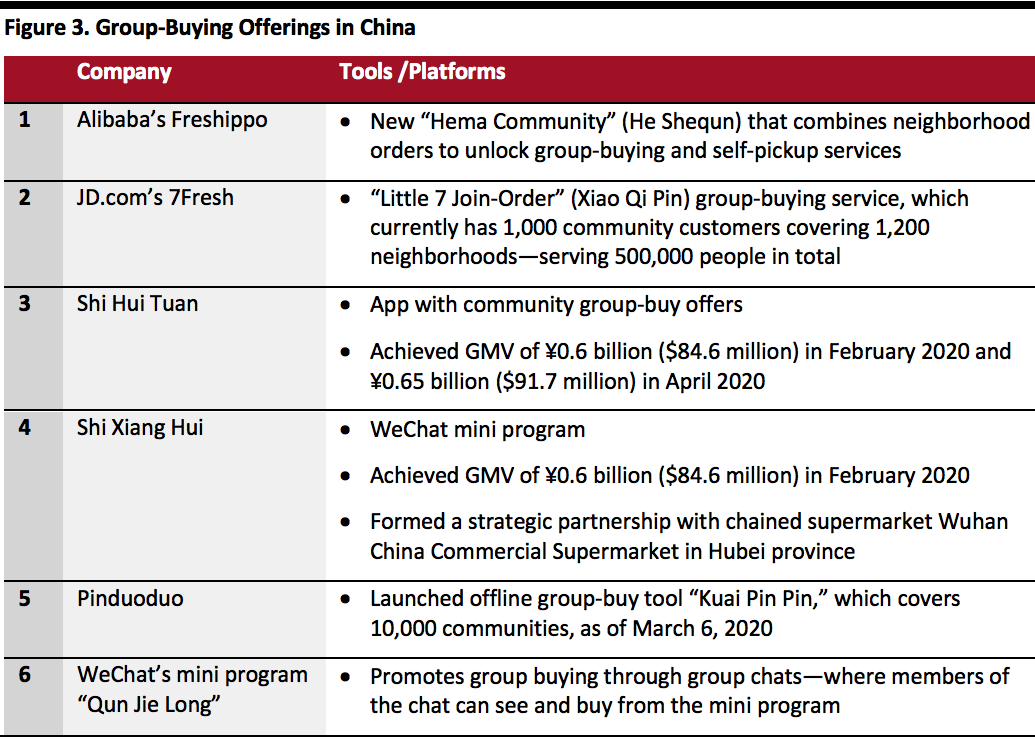

It appears that China’s consumers instead made efforts to save their money: Financial data released by The People's Bank of China (China’s central bank) in a press conference on April 10 showed that by the end of the first quarter 2020, RMB deposits to all major Chinese banks (including Bank of China, Industrial and Commercial Bank of China, Construction Bank, Agricultural Bank of China, Bank of Communications and Postal Savings Bank of China) increased by ¥8.07 trillion (around $1.14 trillion) to ¥200.99 trillion (around $28.39 trillion). This represents a year-over-year increase of ¥1.76 trillion (close to $250 billion)—with household deposits seeing a total ¥6.47 trillion ($915 billion) increase.

[caption id="attachment_109604" align="aligncenter" width="700"] Source: The People’s Bank of China[/caption]

This trend of money saving was a likely reaction to the coronavirus pandemic emphasizing the need for forward planning; many consumers in China were unprepared for the impacts of the crisis. For example, the “moonlight clan” as it is known in China (comprising consumers born mostly after 1985 who live paycheck to paycheck, spending their income by the end of each month) was likely hit hard by the employment uncertainty created by the coronavirus—including job losses, furloughs and temporary workplace closures—meaning that many young consumers would have had to rely on bank loans.

Coronavirus-related financial constrictions also prompted Chinese consumers to prioritize their spending on essential items. According to a survey conducted by Chinese news portal Sina (published on April 28, 2020), 40.2% of Chinese consumers state that they intend to “buy less and buy better” post coronavirus, and 39.6% of respondents agree that they are now more cautious about making purchasing decisions than prior to the pandemic. In addition, 25.5% are concerned about their personal finances, meaning that they will likely implement budgets to limit their future spending.

Reiterating the changing financial attitudes of younger consumers (as discussed above regarding the money-saving trend), Sina’s survey found that respondents aged 20–24 have become more rational in making purchase decisions. Previously, studies have shown that the younger generation was more likely to be influenced by celebrities and key opinion leaders (KOLs) on social media when it came to making purchasing decisions. For example, according to McKinsey’s “China Luxury Report 2019,” Chinese celebrities such as Angelababy, Yang Mi and Tiffany Tang, as well as fashion bloggers like Gogoboi, played a major role last year in product awareness and influencing spending decisions, particularly as they command wider followings than brand-owned channels. However, Sina’s findings show that 20–24-year-old consumers are now less responsive to the preferences and recommendations of celebrities, and they also do not intend to “buy everything that everyone else is buying”—suggesting that mass trends may have less impact on the spending behaviors of young shoppers than before the coronavirus crisis.

2. Activities Moved Online To Continue through Omnichannel Models

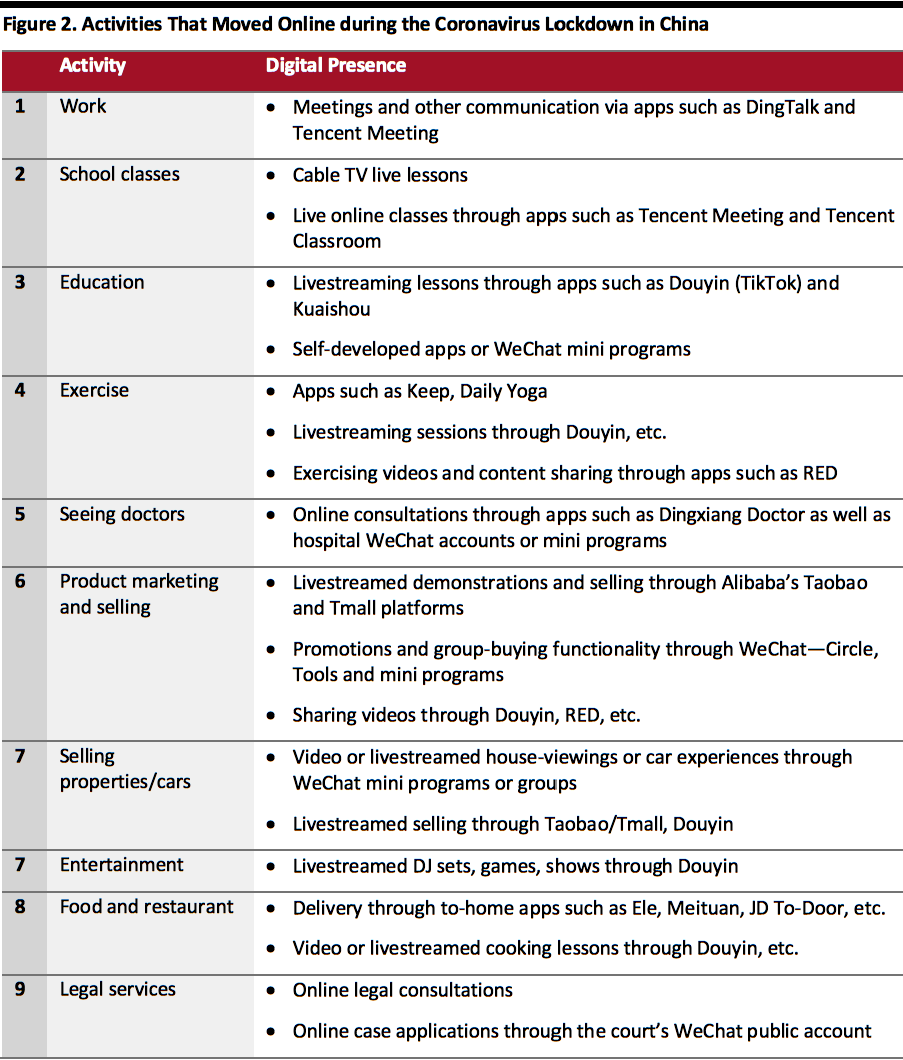

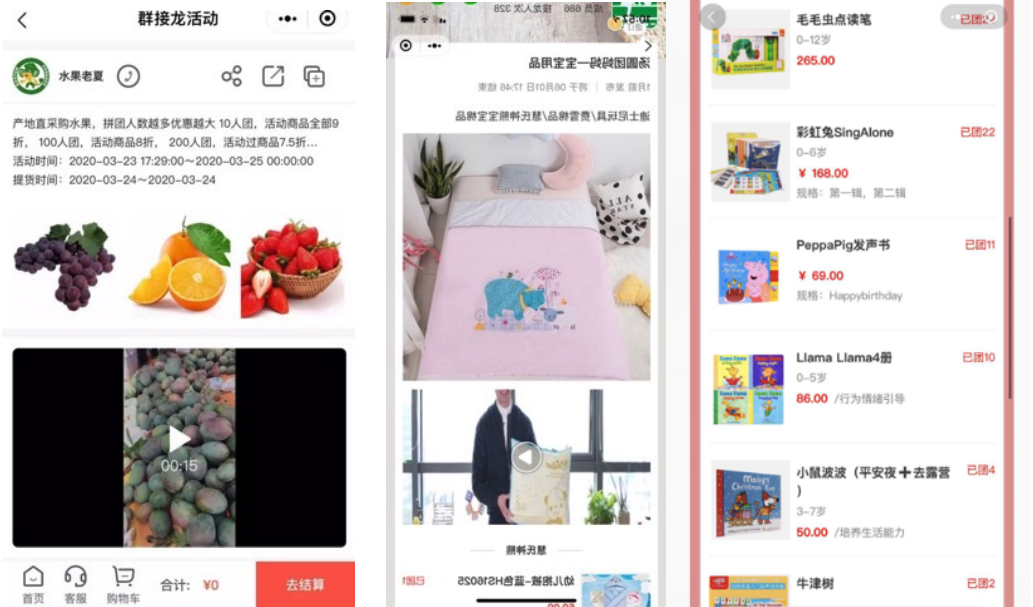

Besides shopping, the coronavirus crisis pushed a number of other activities online, due to the nationwide shutdown of physical places in China and the implementation of social-distancing measures and quarantines.

[caption id="attachment_109605" align="aligncenter" width="700"]

Source: The People’s Bank of China[/caption]

This trend of money saving was a likely reaction to the coronavirus pandemic emphasizing the need for forward planning; many consumers in China were unprepared for the impacts of the crisis. For example, the “moonlight clan” as it is known in China (comprising consumers born mostly after 1985 who live paycheck to paycheck, spending their income by the end of each month) was likely hit hard by the employment uncertainty created by the coronavirus—including job losses, furloughs and temporary workplace closures—meaning that many young consumers would have had to rely on bank loans.

Coronavirus-related financial constrictions also prompted Chinese consumers to prioritize their spending on essential items. According to a survey conducted by Chinese news portal Sina (published on April 28, 2020), 40.2% of Chinese consumers state that they intend to “buy less and buy better” post coronavirus, and 39.6% of respondents agree that they are now more cautious about making purchasing decisions than prior to the pandemic. In addition, 25.5% are concerned about their personal finances, meaning that they will likely implement budgets to limit their future spending.

Reiterating the changing financial attitudes of younger consumers (as discussed above regarding the money-saving trend), Sina’s survey found that respondents aged 20–24 have become more rational in making purchase decisions. Previously, studies have shown that the younger generation was more likely to be influenced by celebrities and key opinion leaders (KOLs) on social media when it came to making purchasing decisions. For example, according to McKinsey’s “China Luxury Report 2019,” Chinese celebrities such as Angelababy, Yang Mi and Tiffany Tang, as well as fashion bloggers like Gogoboi, played a major role last year in product awareness and influencing spending decisions, particularly as they command wider followings than brand-owned channels. However, Sina’s findings show that 20–24-year-old consumers are now less responsive to the preferences and recommendations of celebrities, and they also do not intend to “buy everything that everyone else is buying”—suggesting that mass trends may have less impact on the spending behaviors of young shoppers than before the coronavirus crisis.

2. Activities Moved Online To Continue through Omnichannel Models

Besides shopping, the coronavirus crisis pushed a number of other activities online, due to the nationwide shutdown of physical places in China and the implementation of social-distancing measures and quarantines.

[caption id="attachment_109605" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Coming out of the lockdown, these activities have continued through a combination of online and offline channels.

For example, in terms of education, several preschool education brands—such as Gymboree and My Gym Kids—have said that they will operate an online-and-offline class model after the coronavirus. During the shutdown, education providers moved classes online through short-video and livestreaming apps and uploaded teaching resources online by building their own apps, WeChat mini programs and WeChat accounts. Many parents have now become familiar with such teaching modes, and so with schooling reopening nationwide, the education sector can adopt a combined online-and-offline strategy going forward.

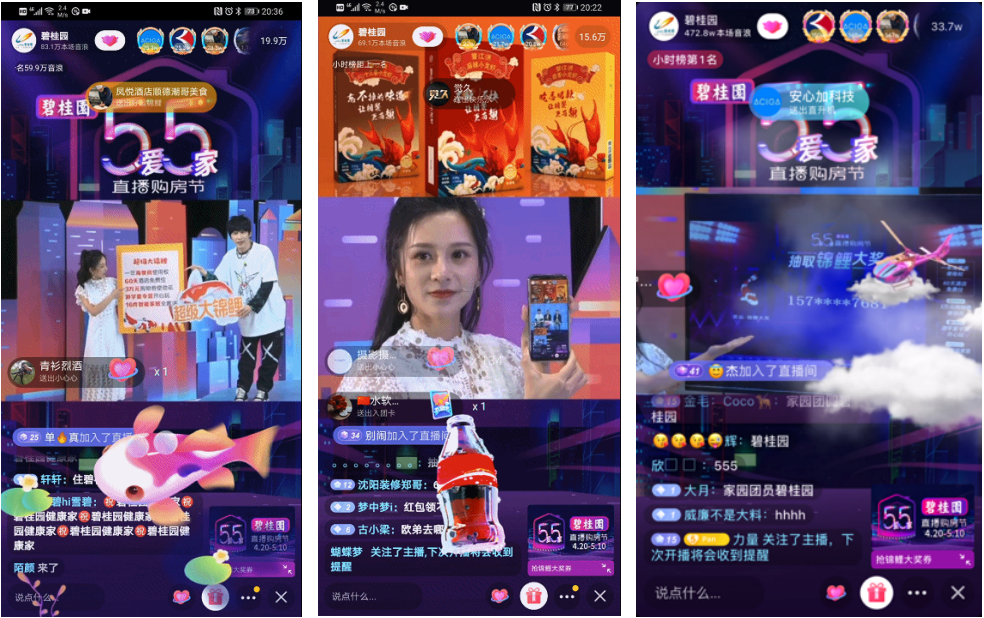

The real-estate sector, which previously relied heavily on the offline experience, saw 500 companies across 100 cities move their businesses online during the coronavirus crisis. The digital channel has enabled estate agents to provide video tours of properties on the market, as well as livestreaming sessions. This type of content—examples of which we outline below—has proved popular among Chinese consumers, so the omnichannel experience may become an expectation in the real-estate market post coronavirus.

Source: Coresight Research[/caption]

Coming out of the lockdown, these activities have continued through a combination of online and offline channels.

For example, in terms of education, several preschool education brands—such as Gymboree and My Gym Kids—have said that they will operate an online-and-offline class model after the coronavirus. During the shutdown, education providers moved classes online through short-video and livestreaming apps and uploaded teaching resources online by building their own apps, WeChat mini programs and WeChat accounts. Many parents have now become familiar with such teaching modes, and so with schooling reopening nationwide, the education sector can adopt a combined online-and-offline strategy going forward.

The real-estate sector, which previously relied heavily on the offline experience, saw 500 companies across 100 cities move their businesses online during the coronavirus crisis. The digital channel has enabled estate agents to provide video tours of properties on the market, as well as livestreaming sessions. This type of content—examples of which we outline below—has proved popular among Chinese consumers, so the omnichannel experience may become an expectation in the real-estate market post coronavirus.

Source: Douyin/Bi Gui Yuan (Country Garden) account[/caption]

3. Stocking Up Is the New Normal; Group Buying Is the New Trend

In the past, Chinese consumers typically stocked up on products only during holidays—such as Chinese New Year—or during online shopping festivals, prompted by the large discounts on offer during Singles’ Day, for example. This is because most people, particularly residents of tier-1 cities (Beijing, Guangzhou, Shanghai and Shenzhen), instead enjoy the convenience of shopping for daily necessities available through the high penetration of convenience stores and fast delivery services—Alibaba’s Freshippo supermarket chain offers a 30–60-minute free delivery service. However, the coronavirus lockdown caused a psychological shift, whereby consumers believed that it was necessary to buy essential items in bulk, including food, personal care products and baby products.

China’s National Bureau of Statistics reported in March 2020 that total retail sales of consumer goods were down 15.8% year over year, representing an easing of 4.7 percentage points from the decline in the first two months of the year. Supermarket sales increased by 1.9% year over year in March, when lockdowns had begun to be lifted—although only weak growth, this indicates that Chinese consumers continued to buy necessities rather than “destocking” their kitchen cupboards. Retailers and brands in nondiscretionary sectors (such as personal care, food, beverages, etc.) should therefore be prepared for stocking up to become a normal behavior over the longer term, with consumers looking to buy products in large quantities, such as bundles and family and value packs.

[caption id="attachment_109607" align="aligncenter" width="520"]

Source: Douyin/Bi Gui Yuan (Country Garden) account[/caption]

3. Stocking Up Is the New Normal; Group Buying Is the New Trend

In the past, Chinese consumers typically stocked up on products only during holidays—such as Chinese New Year—or during online shopping festivals, prompted by the large discounts on offer during Singles’ Day, for example. This is because most people, particularly residents of tier-1 cities (Beijing, Guangzhou, Shanghai and Shenzhen), instead enjoy the convenience of shopping for daily necessities available through the high penetration of convenience stores and fast delivery services—Alibaba’s Freshippo supermarket chain offers a 30–60-minute free delivery service. However, the coronavirus lockdown caused a psychological shift, whereby consumers believed that it was necessary to buy essential items in bulk, including food, personal care products and baby products.

China’s National Bureau of Statistics reported in March 2020 that total retail sales of consumer goods were down 15.8% year over year, representing an easing of 4.7 percentage points from the decline in the first two months of the year. Supermarket sales increased by 1.9% year over year in March, when lockdowns had begun to be lifted—although only weak growth, this indicates that Chinese consumers continued to buy necessities rather than “destocking” their kitchen cupboards. Retailers and brands in nondiscretionary sectors (such as personal care, food, beverages, etc.) should therefore be prepared for stocking up to become a normal behavior over the longer term, with consumers looking to buy products in large quantities, such as bundles and family and value packs.

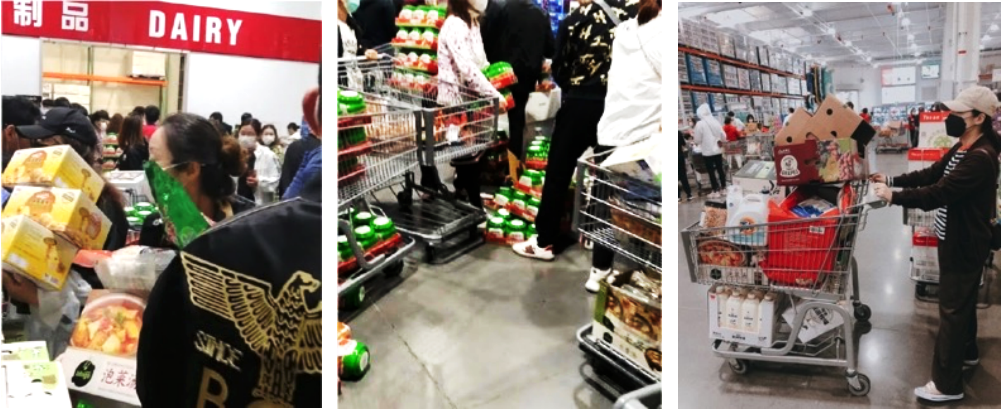

[caption id="attachment_109607" align="aligncenter" width="520"] Consumers showcase on social media how they continue the habit of stocking up even after the shutdown is lifted, dated April 29, 2020

Consumers showcase on social media how they continue the habit of stocking up even after the shutdown is lifted, dated April 29, 2020

Source: weibo.com[/caption] [caption id="attachment_109608" align="aligncenter" width="700"] Costco Shanghai, packed by shoppers who came to stock up on April 29, 2020

Costco Shanghai, packed by shoppers who came to stock up on April 29, 2020

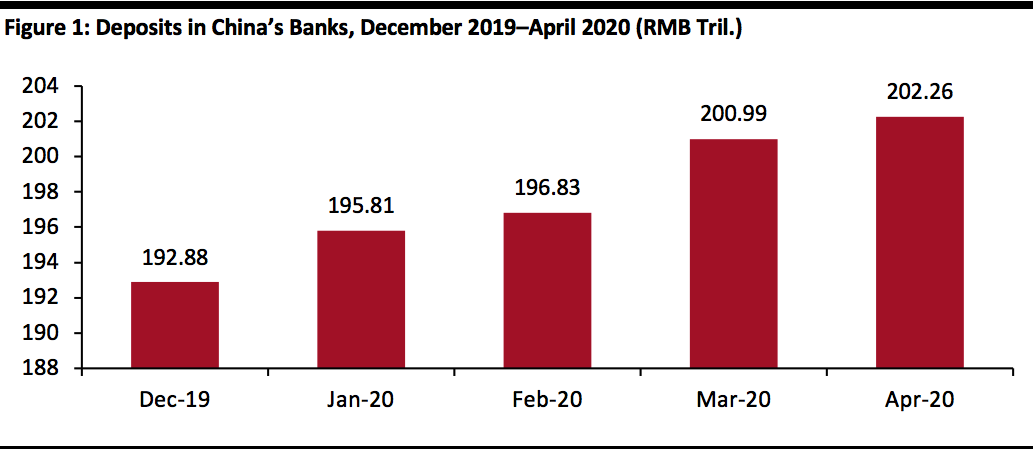

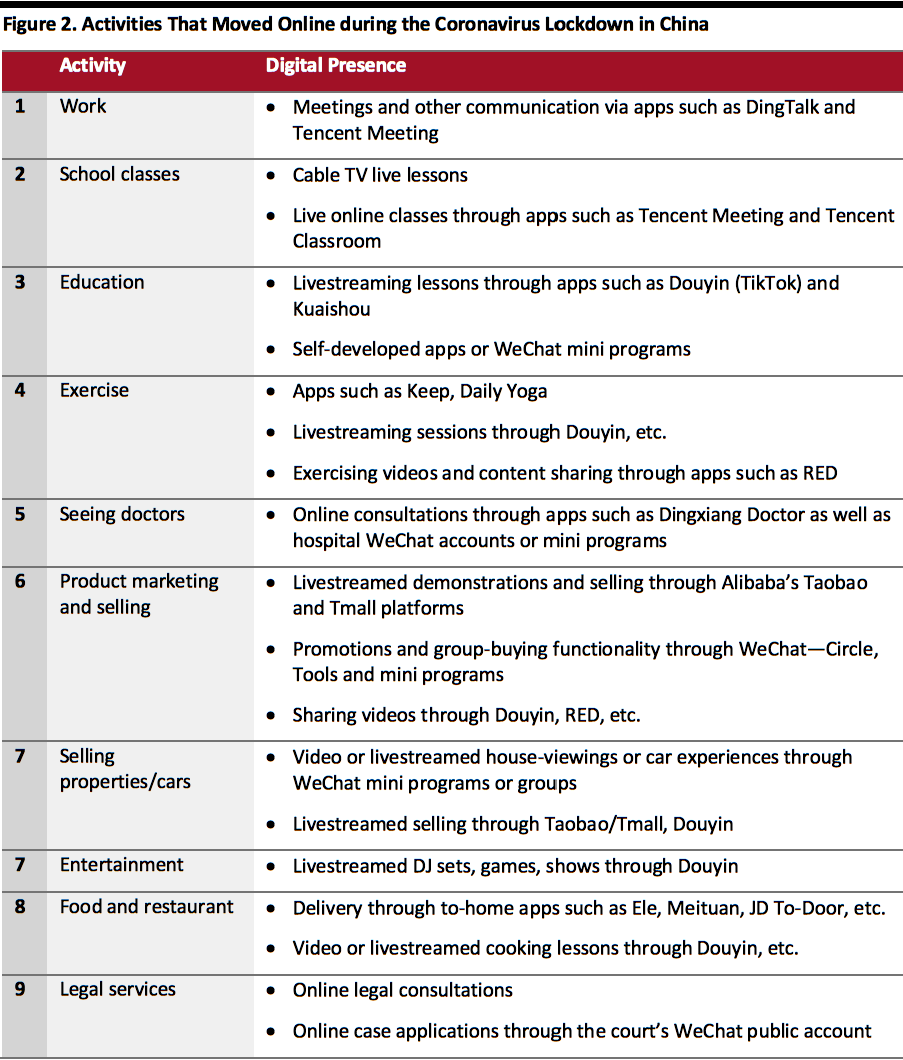

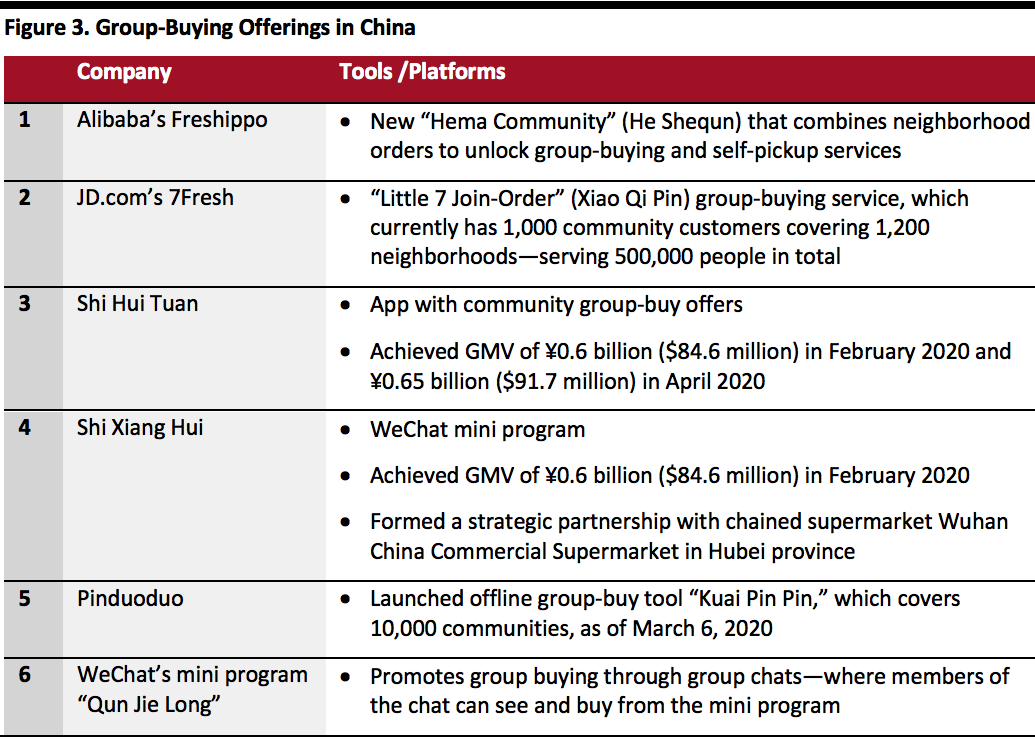

Source: weibo.com[/caption] Another shopping trends during the coronavirus shutdown was group buying. Several grocery retailers launched community group-buying schemes as well as direct-to-consumer group-buying deals—comprising a preselected product bundles—which not only enhance retailers’ turnover efficiency and reduce their logistics costs, but also minimized the risk of the coronavirus spreading as fewer people needed to visit physical stores. Group buying has become a cost-effective and convenient way for consumers to purchase essential goods. Furthermore, technologies and tools have been launched in China that facilitate community group buying, as we outline in Figure 3. [caption id="attachment_109609" align="aligncenter" width="700"] Source: Coresight Research[/caption]

[caption id="attachment_109610" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

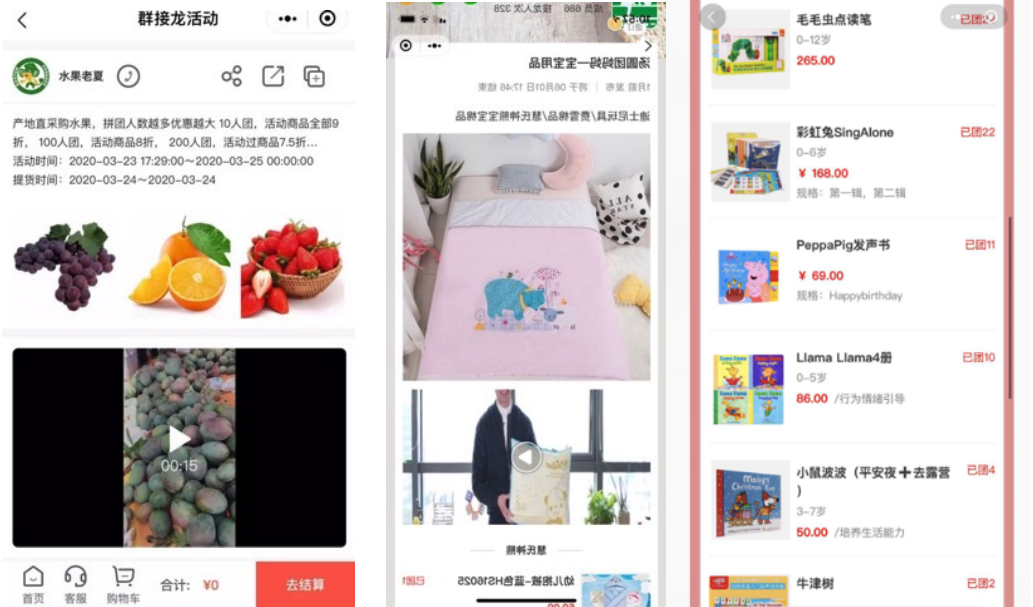

[caption id="attachment_109610" align="aligncenter" width="700"] WeChat group buying—fruits, books, baby products, etc. are offered with significant discounts

WeChat group buying—fruits, books, baby products, etc. are offered with significant discounts

Source: WeChat[/caption] What This Means for Retailers It seems that China’s consumers have a cautious mindset when it comes to spending, as the nation emerges from the coronavirus crisis. Data shows that people have been saving their money, and they may be more rational in their purchasing decisions going forward. Brands and retailers should be mindful of a potential personal-budgeting trend—for instance, pushing for impulse purchases may not be effective in short-term marketing strategies. Brands and retailers should also look to maintain the digital presence that they built up during the coronavirus lockdown. Consumers seem to have accepted an omnichannel shopping experience and may not go back to their previous shopping patterns in physical retail, even for products like houses and cars. After the lockdown is fully lifted, China’s consumers may keep in the habit of stocking up on essential products, rather than shopping incrementally. Retailers should prepare their inventory and product portfolio to accommodate this trend, by selling family packs, bundles and products in multiple quantity options. Group buying was a booming trend during the coronavirus lockdown in China, with consumers looking to minimize physical contact while shopping. Brands and retailers can work with group-buying platforms and tools to promote their products to communities, which would largely enhance efficiency and reduce logistics costs, as well as boosting sales: The group-buying channel offers cost-savings and convenience for customers that may ensure the popularity of the channel going forward.

Source: The People’s Bank of China[/caption]

This trend of money saving was a likely reaction to the coronavirus pandemic emphasizing the need for forward planning; many consumers in China were unprepared for the impacts of the crisis. For example, the “moonlight clan” as it is known in China (comprising consumers born mostly after 1985 who live paycheck to paycheck, spending their income by the end of each month) was likely hit hard by the employment uncertainty created by the coronavirus—including job losses, furloughs and temporary workplace closures—meaning that many young consumers would have had to rely on bank loans.

Coronavirus-related financial constrictions also prompted Chinese consumers to prioritize their spending on essential items. According to a survey conducted by Chinese news portal Sina (published on April 28, 2020), 40.2% of Chinese consumers state that they intend to “buy less and buy better” post coronavirus, and 39.6% of respondents agree that they are now more cautious about making purchasing decisions than prior to the pandemic. In addition, 25.5% are concerned about their personal finances, meaning that they will likely implement budgets to limit their future spending.

Reiterating the changing financial attitudes of younger consumers (as discussed above regarding the money-saving trend), Sina’s survey found that respondents aged 20–24 have become more rational in making purchase decisions. Previously, studies have shown that the younger generation was more likely to be influenced by celebrities and key opinion leaders (KOLs) on social media when it came to making purchasing decisions. For example, according to McKinsey’s “China Luxury Report 2019,” Chinese celebrities such as Angelababy, Yang Mi and Tiffany Tang, as well as fashion bloggers like Gogoboi, played a major role last year in product awareness and influencing spending decisions, particularly as they command wider followings than brand-owned channels. However, Sina’s findings show that 20–24-year-old consumers are now less responsive to the preferences and recommendations of celebrities, and they also do not intend to “buy everything that everyone else is buying”—suggesting that mass trends may have less impact on the spending behaviors of young shoppers than before the coronavirus crisis.

2. Activities Moved Online To Continue through Omnichannel Models

Besides shopping, the coronavirus crisis pushed a number of other activities online, due to the nationwide shutdown of physical places in China and the implementation of social-distancing measures and quarantines.

[caption id="attachment_109605" align="aligncenter" width="700"]

Source: The People’s Bank of China[/caption]

This trend of money saving was a likely reaction to the coronavirus pandemic emphasizing the need for forward planning; many consumers in China were unprepared for the impacts of the crisis. For example, the “moonlight clan” as it is known in China (comprising consumers born mostly after 1985 who live paycheck to paycheck, spending their income by the end of each month) was likely hit hard by the employment uncertainty created by the coronavirus—including job losses, furloughs and temporary workplace closures—meaning that many young consumers would have had to rely on bank loans.

Coronavirus-related financial constrictions also prompted Chinese consumers to prioritize their spending on essential items. According to a survey conducted by Chinese news portal Sina (published on April 28, 2020), 40.2% of Chinese consumers state that they intend to “buy less and buy better” post coronavirus, and 39.6% of respondents agree that they are now more cautious about making purchasing decisions than prior to the pandemic. In addition, 25.5% are concerned about their personal finances, meaning that they will likely implement budgets to limit their future spending.

Reiterating the changing financial attitudes of younger consumers (as discussed above regarding the money-saving trend), Sina’s survey found that respondents aged 20–24 have become more rational in making purchase decisions. Previously, studies have shown that the younger generation was more likely to be influenced by celebrities and key opinion leaders (KOLs) on social media when it came to making purchasing decisions. For example, according to McKinsey’s “China Luxury Report 2019,” Chinese celebrities such as Angelababy, Yang Mi and Tiffany Tang, as well as fashion bloggers like Gogoboi, played a major role last year in product awareness and influencing spending decisions, particularly as they command wider followings than brand-owned channels. However, Sina’s findings show that 20–24-year-old consumers are now less responsive to the preferences and recommendations of celebrities, and they also do not intend to “buy everything that everyone else is buying”—suggesting that mass trends may have less impact on the spending behaviors of young shoppers than before the coronavirus crisis.

2. Activities Moved Online To Continue through Omnichannel Models

Besides shopping, the coronavirus crisis pushed a number of other activities online, due to the nationwide shutdown of physical places in China and the implementation of social-distancing measures and quarantines.

[caption id="attachment_109605" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Coming out of the lockdown, these activities have continued through a combination of online and offline channels.

For example, in terms of education, several preschool education brands—such as Gymboree and My Gym Kids—have said that they will operate an online-and-offline class model after the coronavirus. During the shutdown, education providers moved classes online through short-video and livestreaming apps and uploaded teaching resources online by building their own apps, WeChat mini programs and WeChat accounts. Many parents have now become familiar with such teaching modes, and so with schooling reopening nationwide, the education sector can adopt a combined online-and-offline strategy going forward.

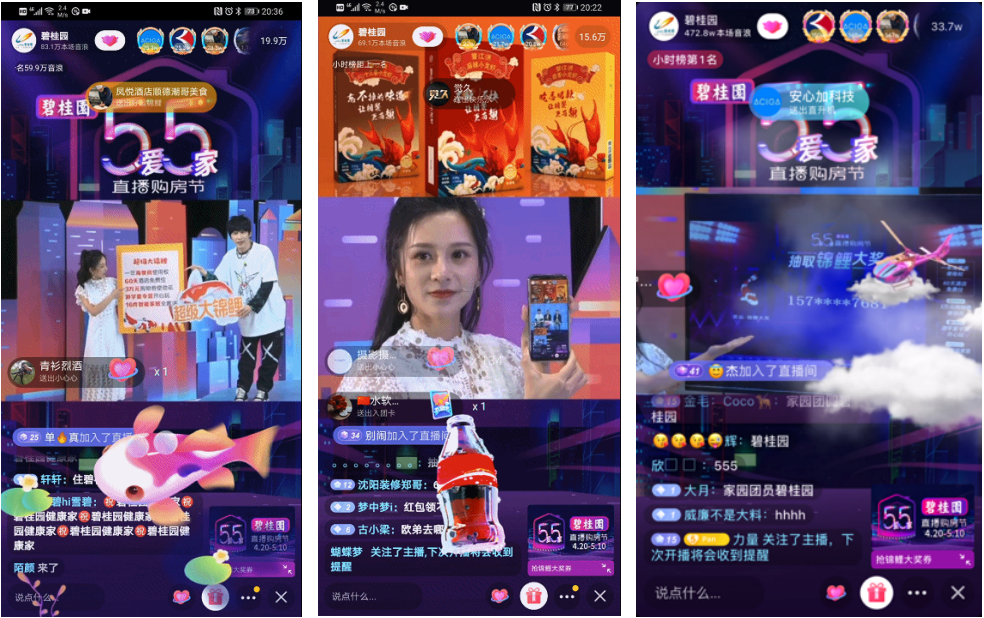

The real-estate sector, which previously relied heavily on the offline experience, saw 500 companies across 100 cities move their businesses online during the coronavirus crisis. The digital channel has enabled estate agents to provide video tours of properties on the market, as well as livestreaming sessions. This type of content—examples of which we outline below—has proved popular among Chinese consumers, so the omnichannel experience may become an expectation in the real-estate market post coronavirus.

Source: Coresight Research[/caption]

Coming out of the lockdown, these activities have continued through a combination of online and offline channels.

For example, in terms of education, several preschool education brands—such as Gymboree and My Gym Kids—have said that they will operate an online-and-offline class model after the coronavirus. During the shutdown, education providers moved classes online through short-video and livestreaming apps and uploaded teaching resources online by building their own apps, WeChat mini programs and WeChat accounts. Many parents have now become familiar with such teaching modes, and so with schooling reopening nationwide, the education sector can adopt a combined online-and-offline strategy going forward.

The real-estate sector, which previously relied heavily on the offline experience, saw 500 companies across 100 cities move their businesses online during the coronavirus crisis. The digital channel has enabled estate agents to provide video tours of properties on the market, as well as livestreaming sessions. This type of content—examples of which we outline below—has proved popular among Chinese consumers, so the omnichannel experience may become an expectation in the real-estate market post coronavirus.

- On April 2, 2020, Viya, a livestreaming KOL on Taobao, hosted a house-selling session that attracted 14 million consumers to watch and participate online.

- On May 5, 2020, Bi Gui Yuan (Country Garden) held a livestreaming house-selling “festival” on Douyin. A total of 17,000 properties across 76 cities were advertised with discounts: Within the two-hour live broadcast, the main live room and 29 sub-venues together attracted nearly 8 million viewers. According to the company, it achieved ¥2.5 billion (over $350 million) in sales during the live broadcast.

Source: Douyin/Bi Gui Yuan (Country Garden) account[/caption]

3. Stocking Up Is the New Normal; Group Buying Is the New Trend

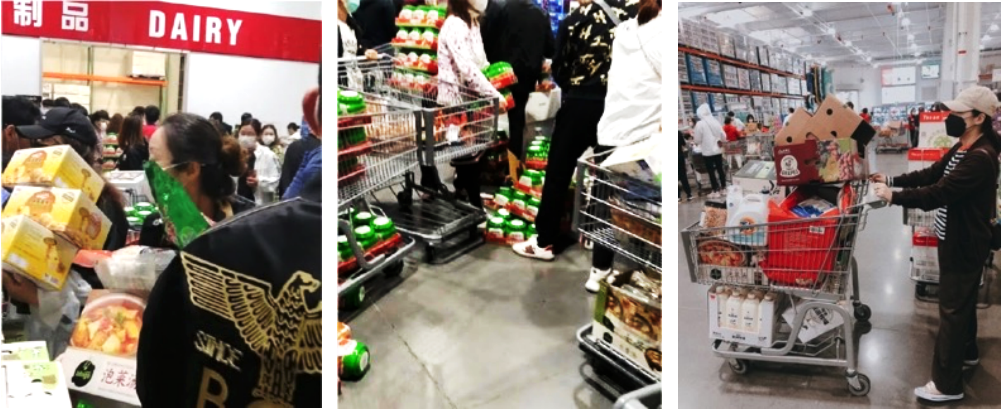

In the past, Chinese consumers typically stocked up on products only during holidays—such as Chinese New Year—or during online shopping festivals, prompted by the large discounts on offer during Singles’ Day, for example. This is because most people, particularly residents of tier-1 cities (Beijing, Guangzhou, Shanghai and Shenzhen), instead enjoy the convenience of shopping for daily necessities available through the high penetration of convenience stores and fast delivery services—Alibaba’s Freshippo supermarket chain offers a 30–60-minute free delivery service. However, the coronavirus lockdown caused a psychological shift, whereby consumers believed that it was necessary to buy essential items in bulk, including food, personal care products and baby products.

China’s National Bureau of Statistics reported in March 2020 that total retail sales of consumer goods were down 15.8% year over year, representing an easing of 4.7 percentage points from the decline in the first two months of the year. Supermarket sales increased by 1.9% year over year in March, when lockdowns had begun to be lifted—although only weak growth, this indicates that Chinese consumers continued to buy necessities rather than “destocking” their kitchen cupboards. Retailers and brands in nondiscretionary sectors (such as personal care, food, beverages, etc.) should therefore be prepared for stocking up to become a normal behavior over the longer term, with consumers looking to buy products in large quantities, such as bundles and family and value packs.

[caption id="attachment_109607" align="aligncenter" width="520"]

Source: Douyin/Bi Gui Yuan (Country Garden) account[/caption]

3. Stocking Up Is the New Normal; Group Buying Is the New Trend

In the past, Chinese consumers typically stocked up on products only during holidays—such as Chinese New Year—or during online shopping festivals, prompted by the large discounts on offer during Singles’ Day, for example. This is because most people, particularly residents of tier-1 cities (Beijing, Guangzhou, Shanghai and Shenzhen), instead enjoy the convenience of shopping for daily necessities available through the high penetration of convenience stores and fast delivery services—Alibaba’s Freshippo supermarket chain offers a 30–60-minute free delivery service. However, the coronavirus lockdown caused a psychological shift, whereby consumers believed that it was necessary to buy essential items in bulk, including food, personal care products and baby products.

China’s National Bureau of Statistics reported in March 2020 that total retail sales of consumer goods were down 15.8% year over year, representing an easing of 4.7 percentage points from the decline in the first two months of the year. Supermarket sales increased by 1.9% year over year in March, when lockdowns had begun to be lifted—although only weak growth, this indicates that Chinese consumers continued to buy necessities rather than “destocking” their kitchen cupboards. Retailers and brands in nondiscretionary sectors (such as personal care, food, beverages, etc.) should therefore be prepared for stocking up to become a normal behavior over the longer term, with consumers looking to buy products in large quantities, such as bundles and family and value packs.

[caption id="attachment_109607" align="aligncenter" width="520"] Consumers showcase on social media how they continue the habit of stocking up even after the shutdown is lifted, dated April 29, 2020

Consumers showcase on social media how they continue the habit of stocking up even after the shutdown is lifted, dated April 29, 2020Source: weibo.com[/caption] [caption id="attachment_109608" align="aligncenter" width="700"]

Costco Shanghai, packed by shoppers who came to stock up on April 29, 2020

Costco Shanghai, packed by shoppers who came to stock up on April 29, 2020Source: weibo.com[/caption] Another shopping trends during the coronavirus shutdown was group buying. Several grocery retailers launched community group-buying schemes as well as direct-to-consumer group-buying deals—comprising a preselected product bundles—which not only enhance retailers’ turnover efficiency and reduce their logistics costs, but also minimized the risk of the coronavirus spreading as fewer people needed to visit physical stores. Group buying has become a cost-effective and convenient way for consumers to purchase essential goods. Furthermore, technologies and tools have been launched in China that facilitate community group buying, as we outline in Figure 3. [caption id="attachment_109609" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

[caption id="attachment_109610" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

[caption id="attachment_109610" align="aligncenter" width="700"] WeChat group buying—fruits, books, baby products, etc. are offered with significant discounts

WeChat group buying—fruits, books, baby products, etc. are offered with significant discountsSource: WeChat[/caption] What This Means for Retailers It seems that China’s consumers have a cautious mindset when it comes to spending, as the nation emerges from the coronavirus crisis. Data shows that people have been saving their money, and they may be more rational in their purchasing decisions going forward. Brands and retailers should be mindful of a potential personal-budgeting trend—for instance, pushing for impulse purchases may not be effective in short-term marketing strategies. Brands and retailers should also look to maintain the digital presence that they built up during the coronavirus lockdown. Consumers seem to have accepted an omnichannel shopping experience and may not go back to their previous shopping patterns in physical retail, even for products like houses and cars. After the lockdown is fully lifted, China’s consumers may keep in the habit of stocking up on essential products, rather than shopping incrementally. Retailers should prepare their inventory and product portfolio to accommodate this trend, by selling family packs, bundles and products in multiple quantity options. Group buying was a booming trend during the coronavirus lockdown in China, with consumers looking to minimize physical contact while shopping. Brands and retailers can work with group-buying platforms and tools to promote their products to communities, which would largely enhance efficiency and reduce logistics costs, as well as boosting sales: The group-buying channel offers cost-savings and convenience for customers that may ensure the popularity of the channel going forward.