DIpil Das

Coresight Research surveyed US consumers about the impact of the coronavirus on their behaviors, on March 17–18, 2020.

Worries About the Coronavirus and How Long Consumers Think It Will Last

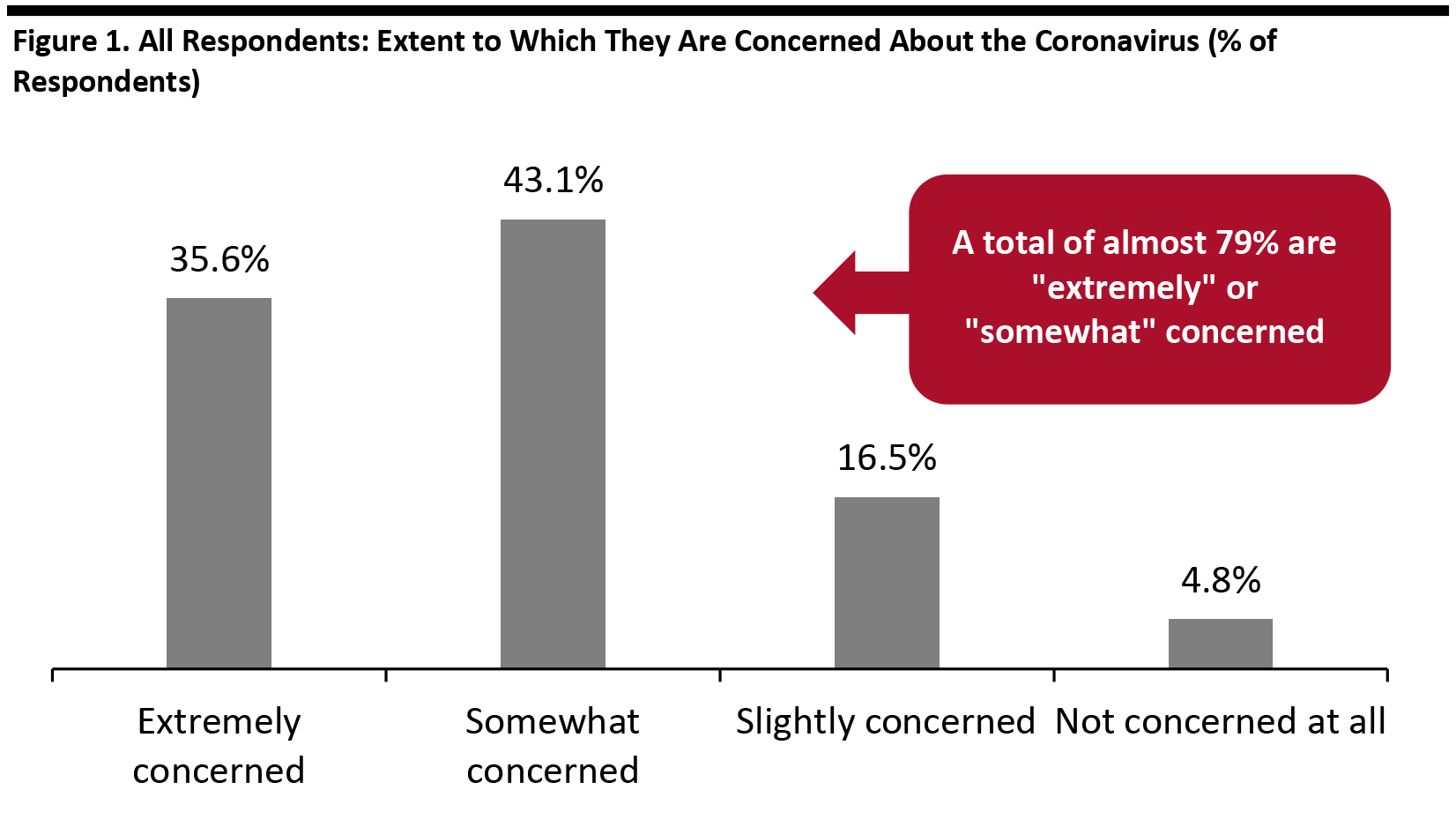

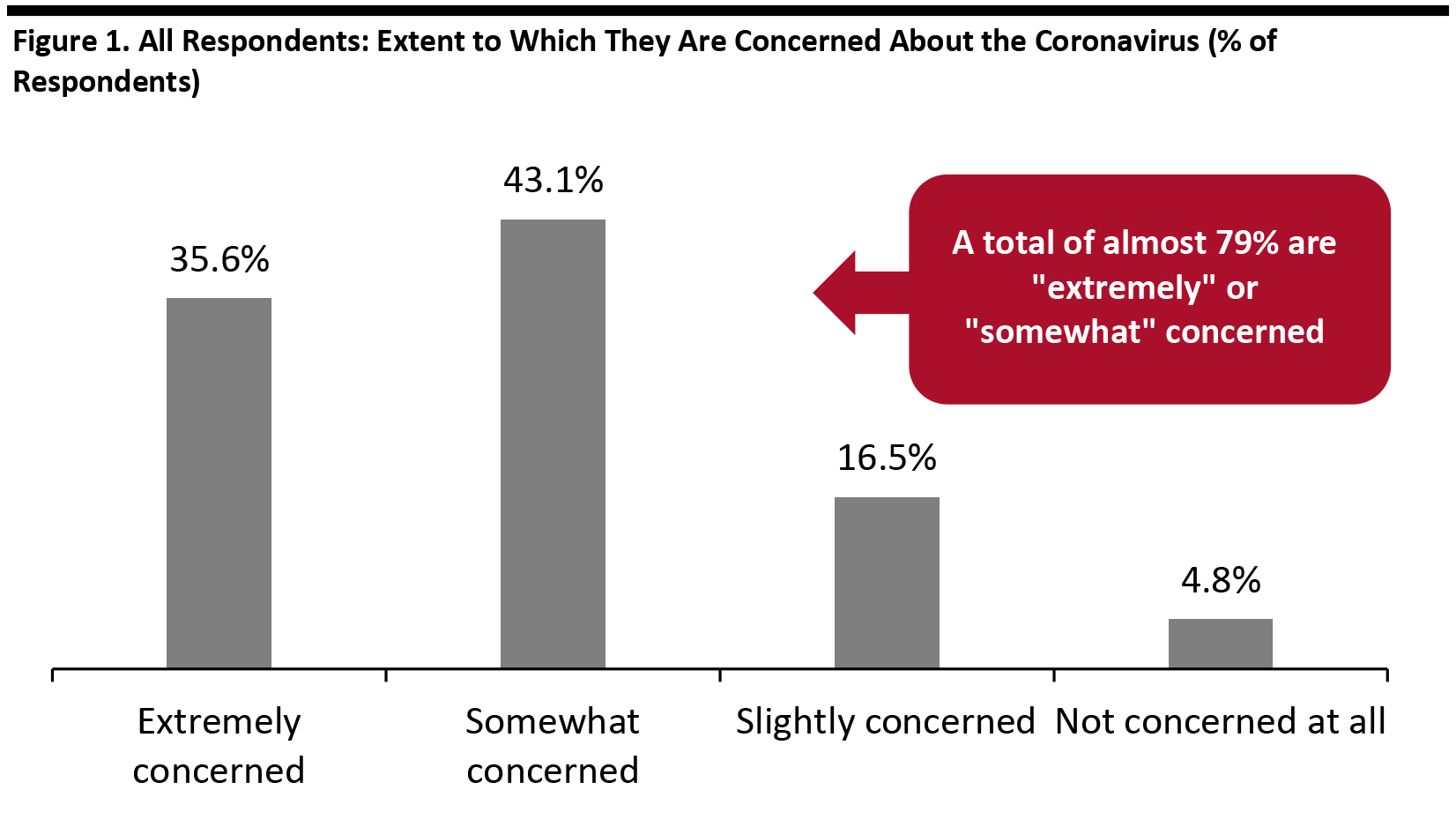

A total of 79% of respondents are somewhat or extremely concerned about the coronavirus, with more than one third saying they are extremely concerned. Just 5% show no concern.

[caption id="attachment_105743" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above

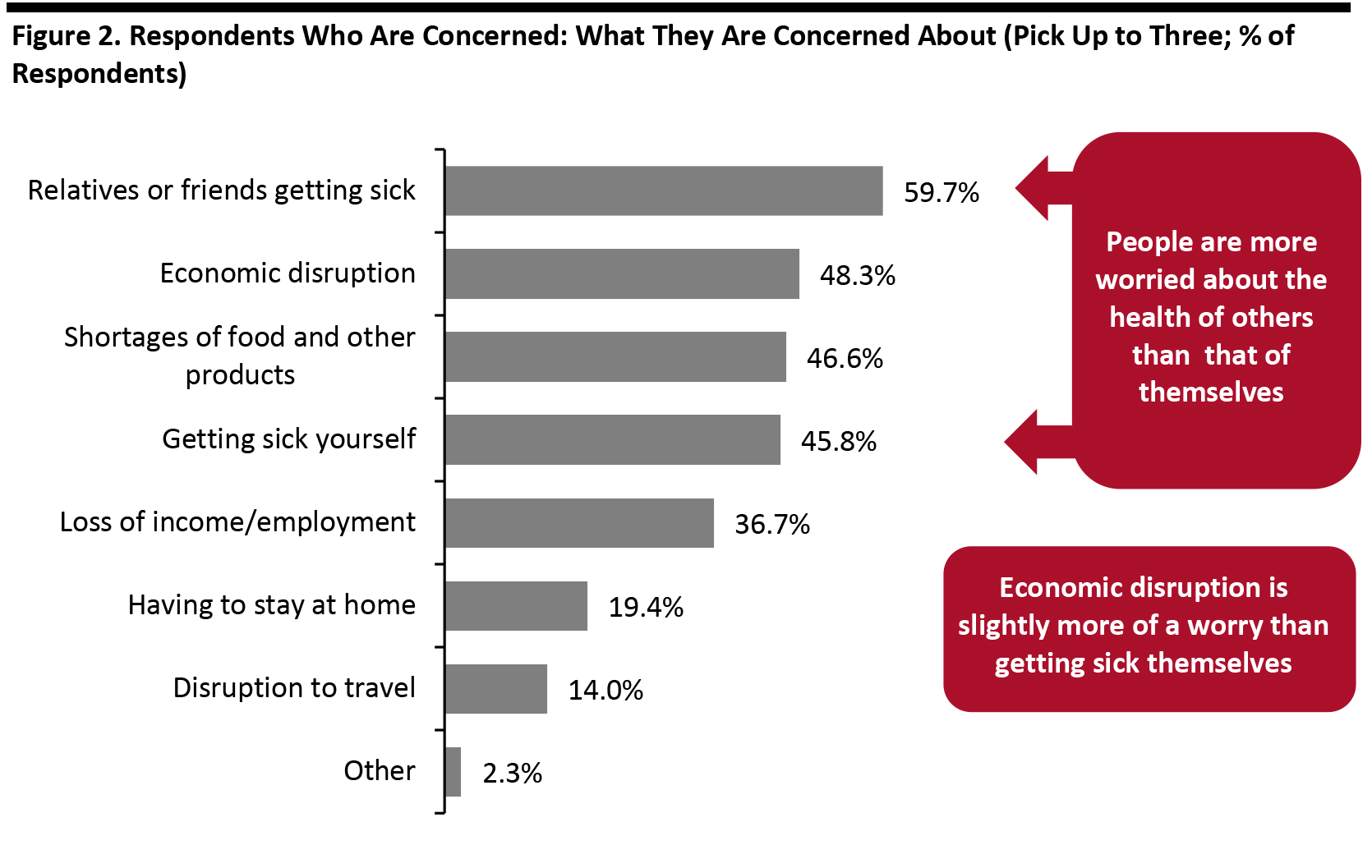

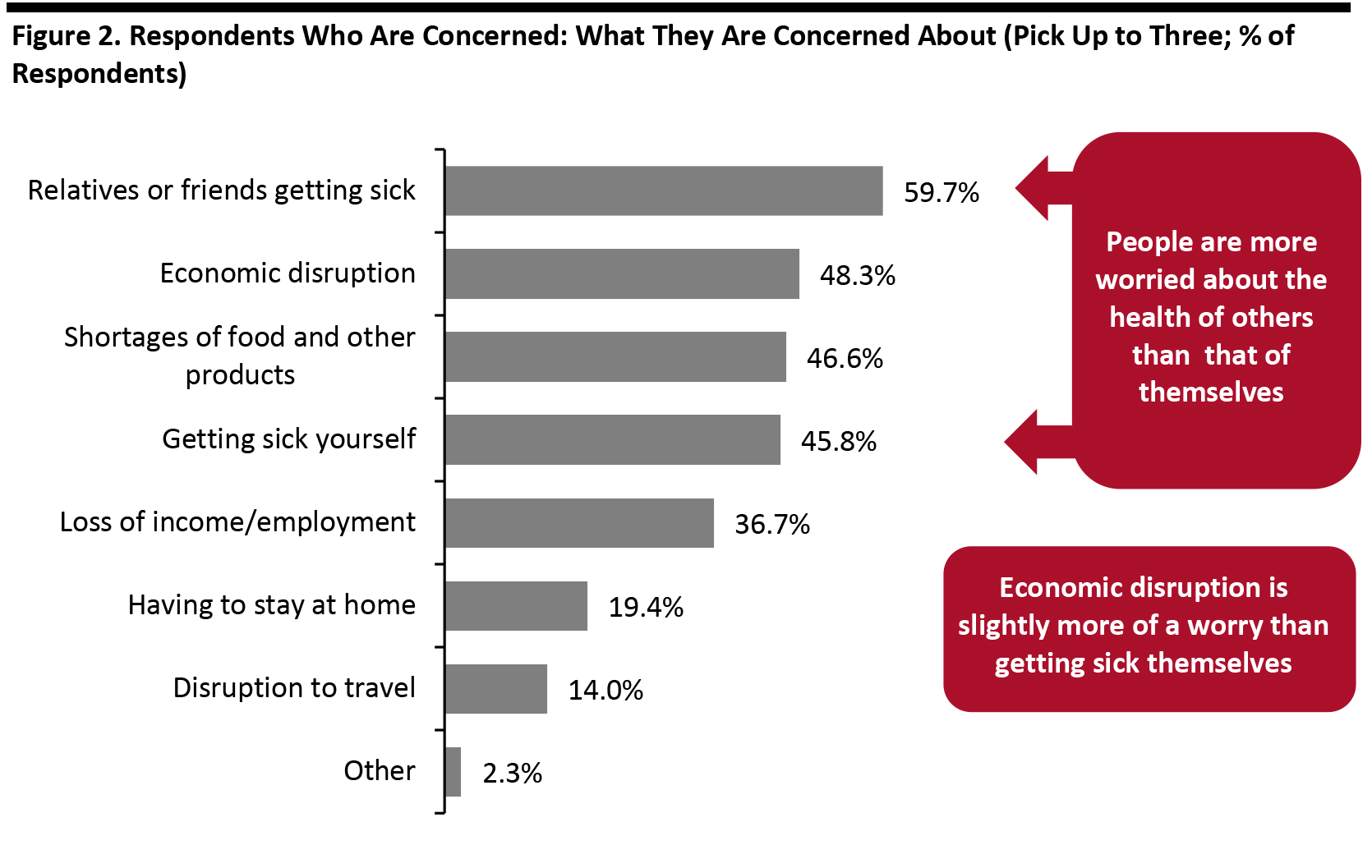

Source: Coresight Research [/caption] Among those expressing concern, we see a mixed collection of worries: relatives or friends getting sick is of greater concern than getting sick themselves. The economic impact also ranked higher than getting sick—not surprising amid growing shutdowns across the country. Shortages of essential products outrank loss of income/employment as a concern. [caption id="attachment_105744" align="aligncenter" width="700"] Respondents could select up to three options Base: 1,097 US Internet users aged 18 and above who are concerned about the coronavirus outbreak

Respondents could select up to three options Base: 1,097 US Internet users aged 18 and above who are concerned about the coronavirus outbreak

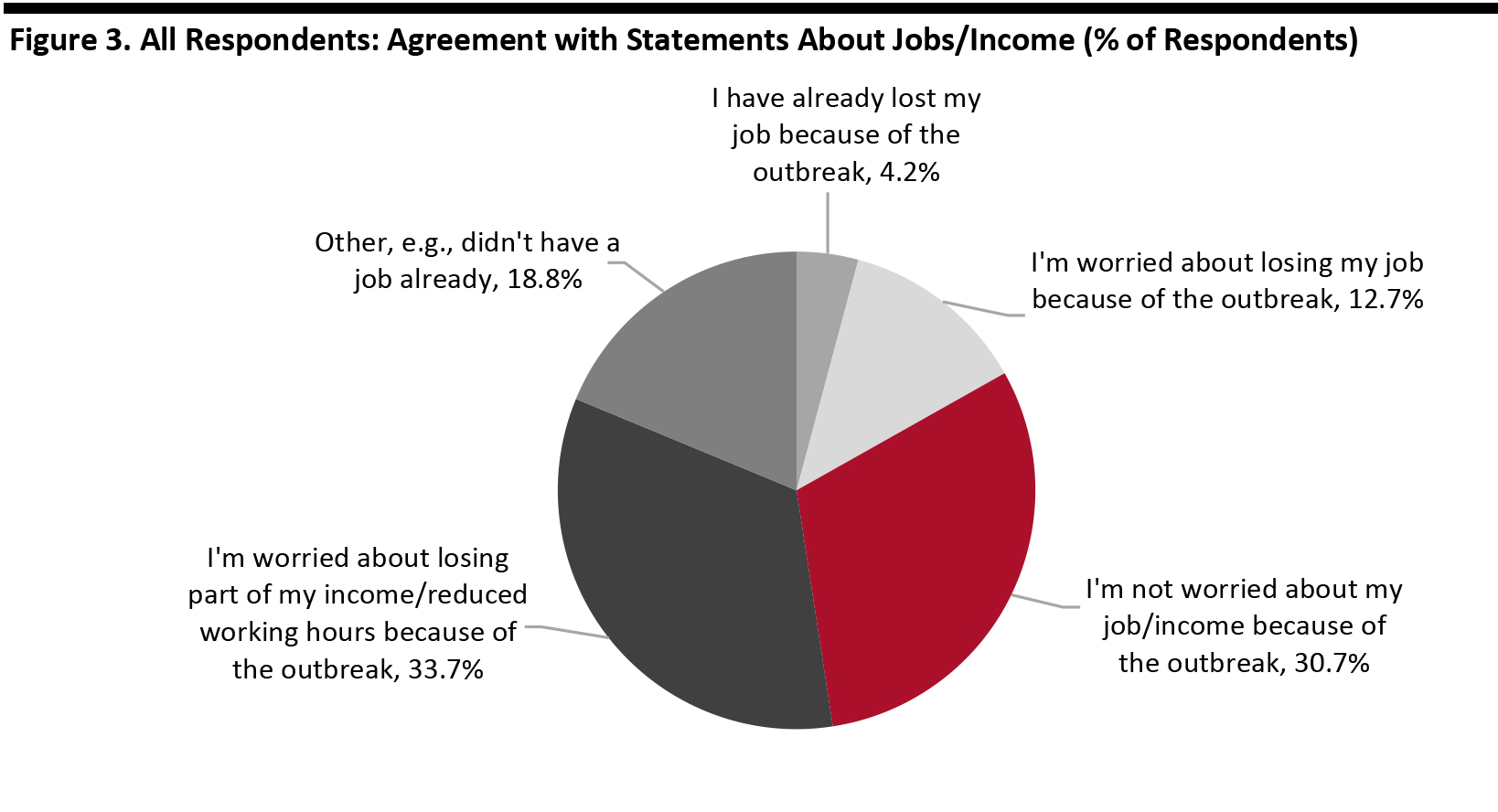

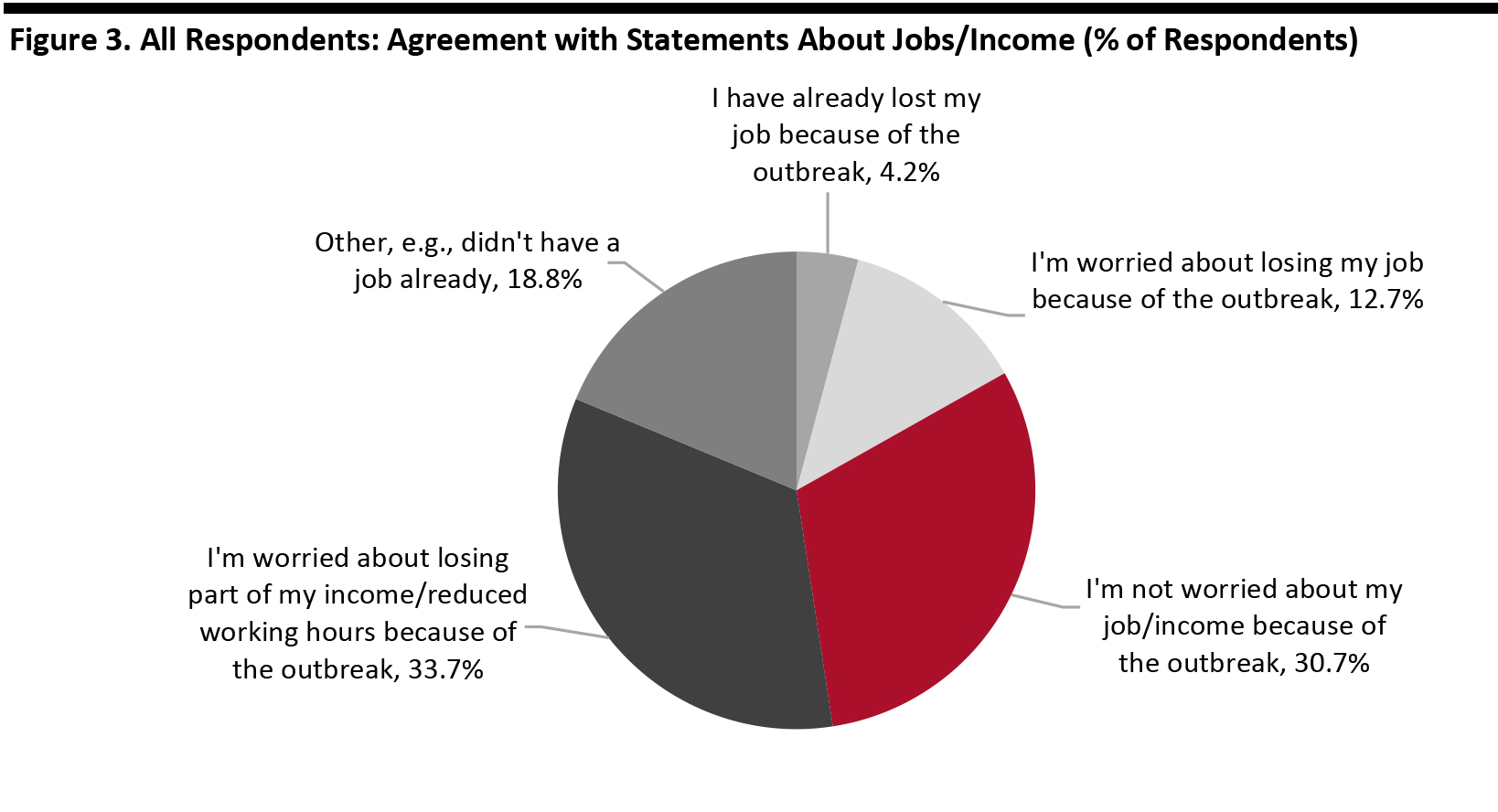

Source: Coresight Research [/caption] We also asked respondents to choose from a selection of statements related to employment and income. Some 4.2% said they had already lost their job because of the coronavirus outbreak, with a further 12.7% worried they would lose their job. However, a much more widespread worry was losing part of their income, such as through reduced hours—with one-third concerned about this. The extent of these worries underscores the economic retrenchment we could see if shoppers stop spending. [caption id="attachment_105745" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above

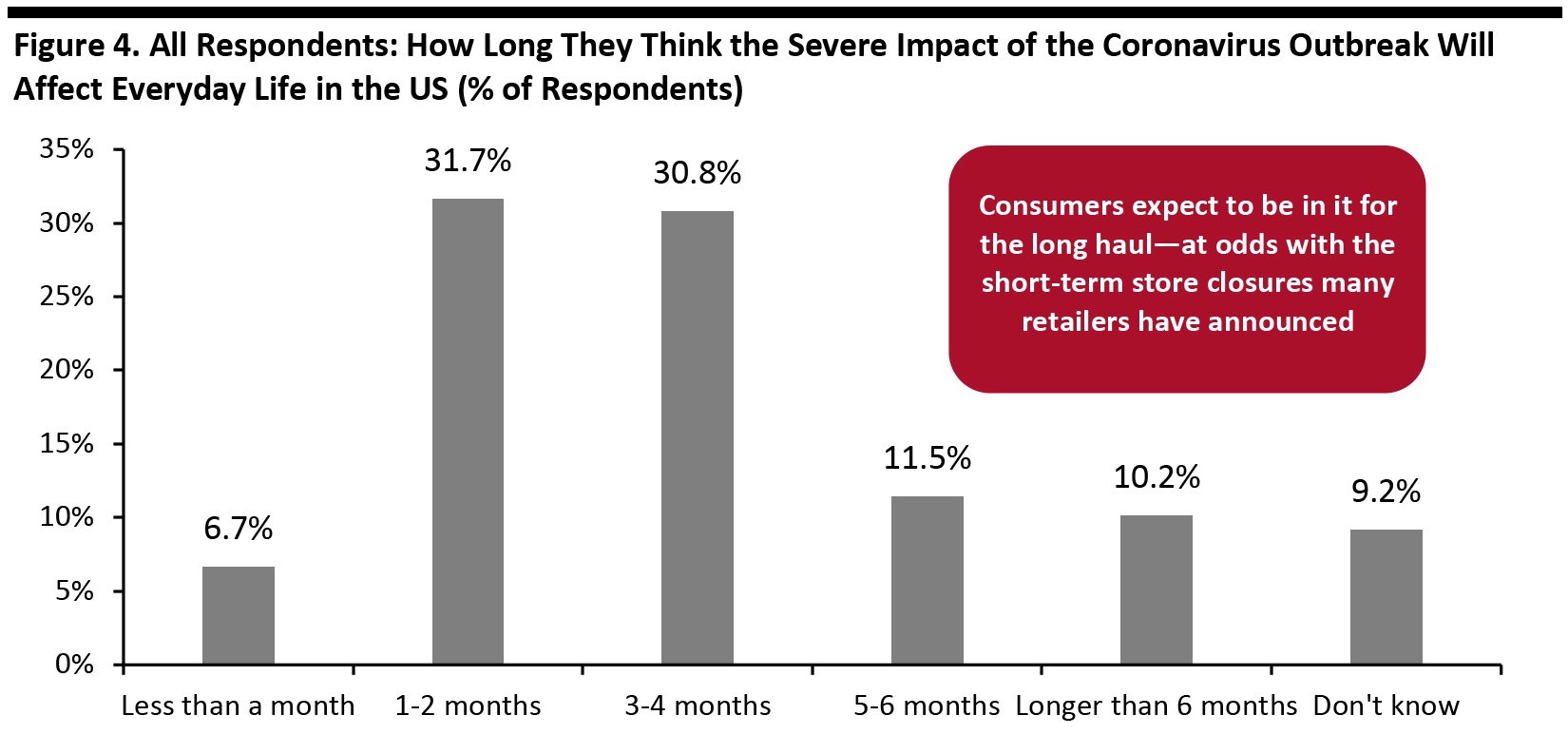

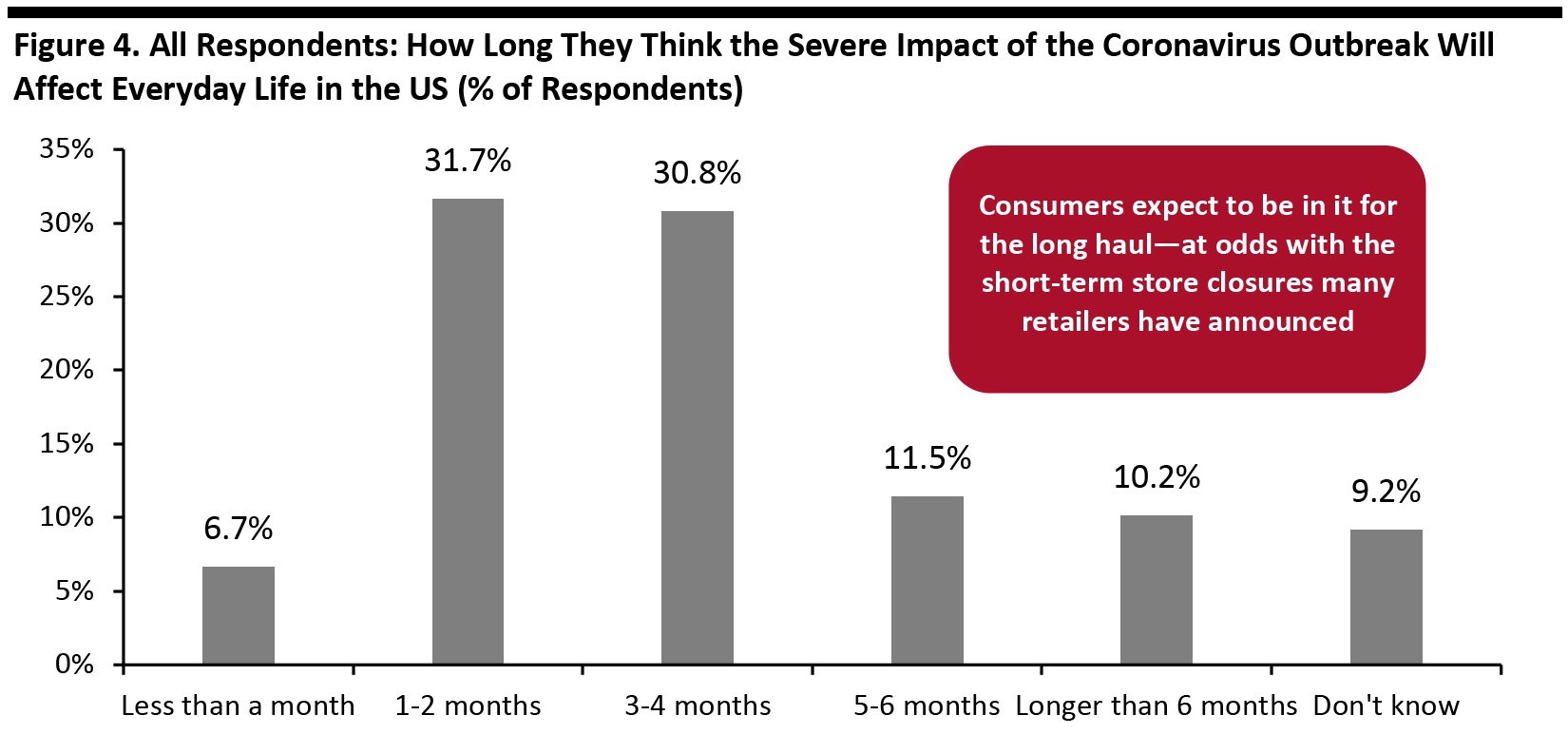

Source: Coresight Research [/caption] Underlying these concerns is a widespread belief that the severe impact of the coronavirus will last several months at least. In fact, less than 7% think the severe impact will last less than a month—interesting given many retailers that have closed stores have done so for only around two weeks starting mid-March. By far the more common perception is that it will last between one and four months, with over one in five thinking the severe disruption will last five months or more. The findings suggest many consumers are likely to batten down the hatches for the long haul. [caption id="attachment_105746" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above

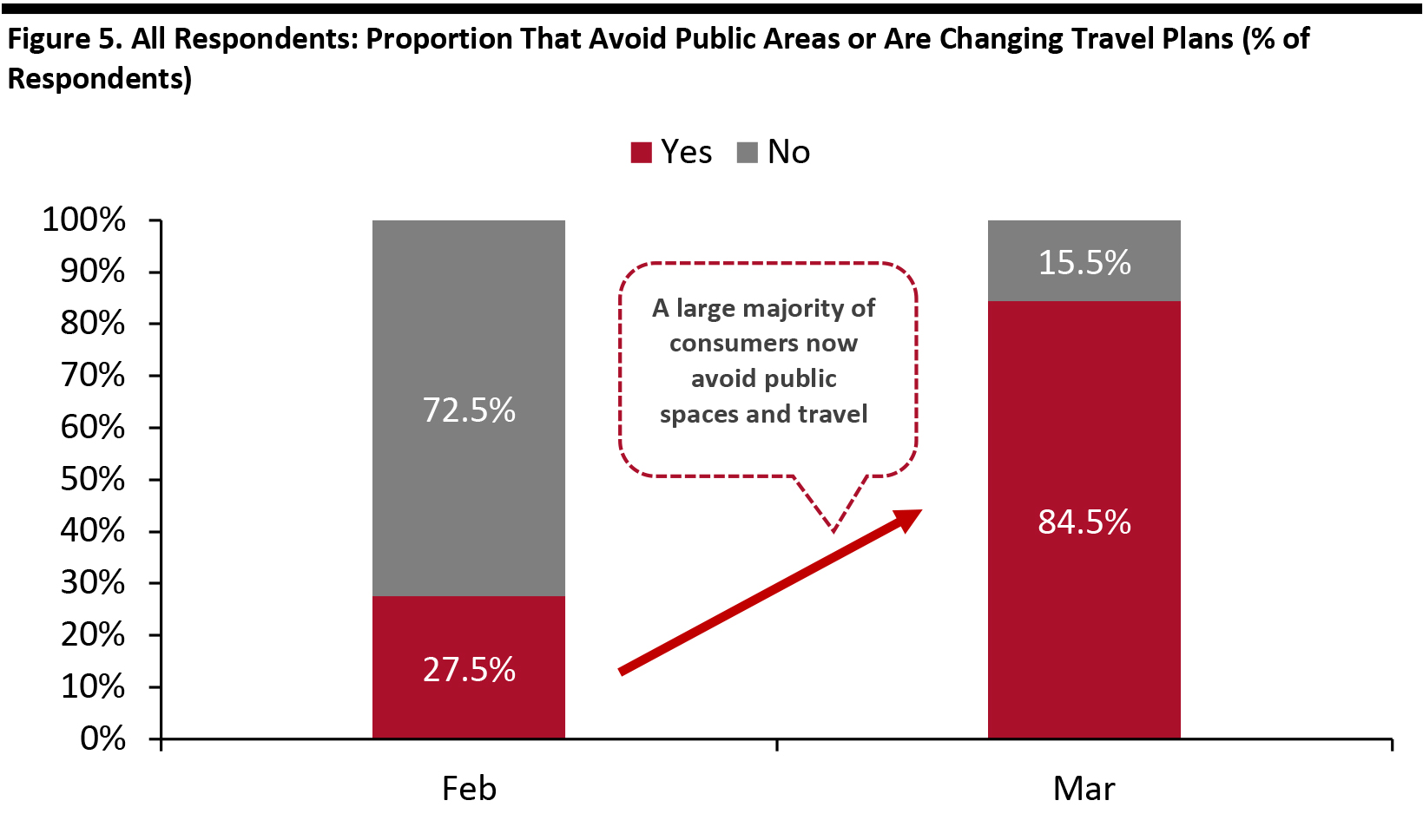

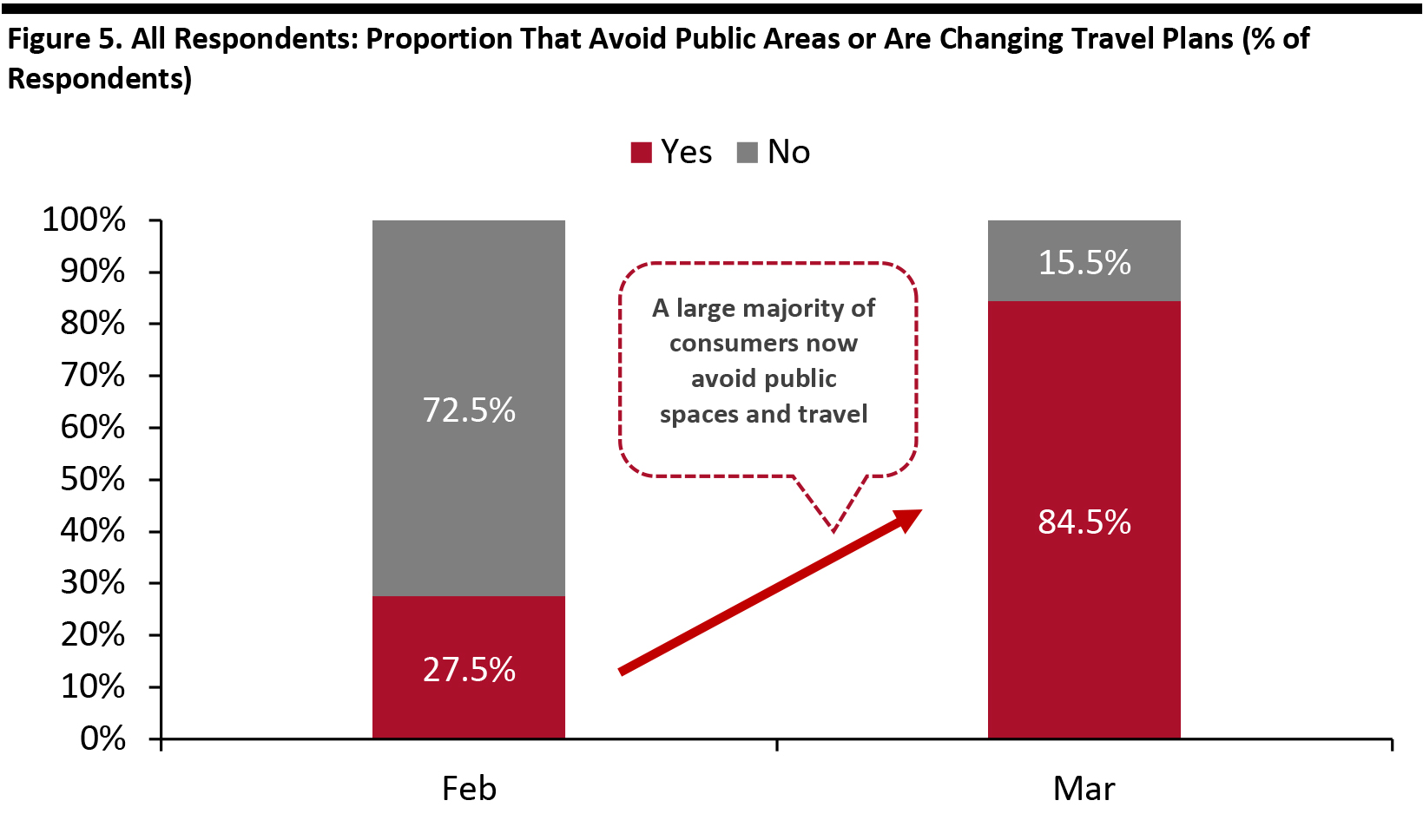

Source: Coresight Research [/caption] Changing Behavior Fully 84.5% of respondents now avoid public areas or travel, up from just 27.5% when we surveyed consumers one month earlier. [caption id="attachment_105747" align="aligncenter" width="700"] Base: Internet users aged 18 and above

Base: Internet users aged 18 and above

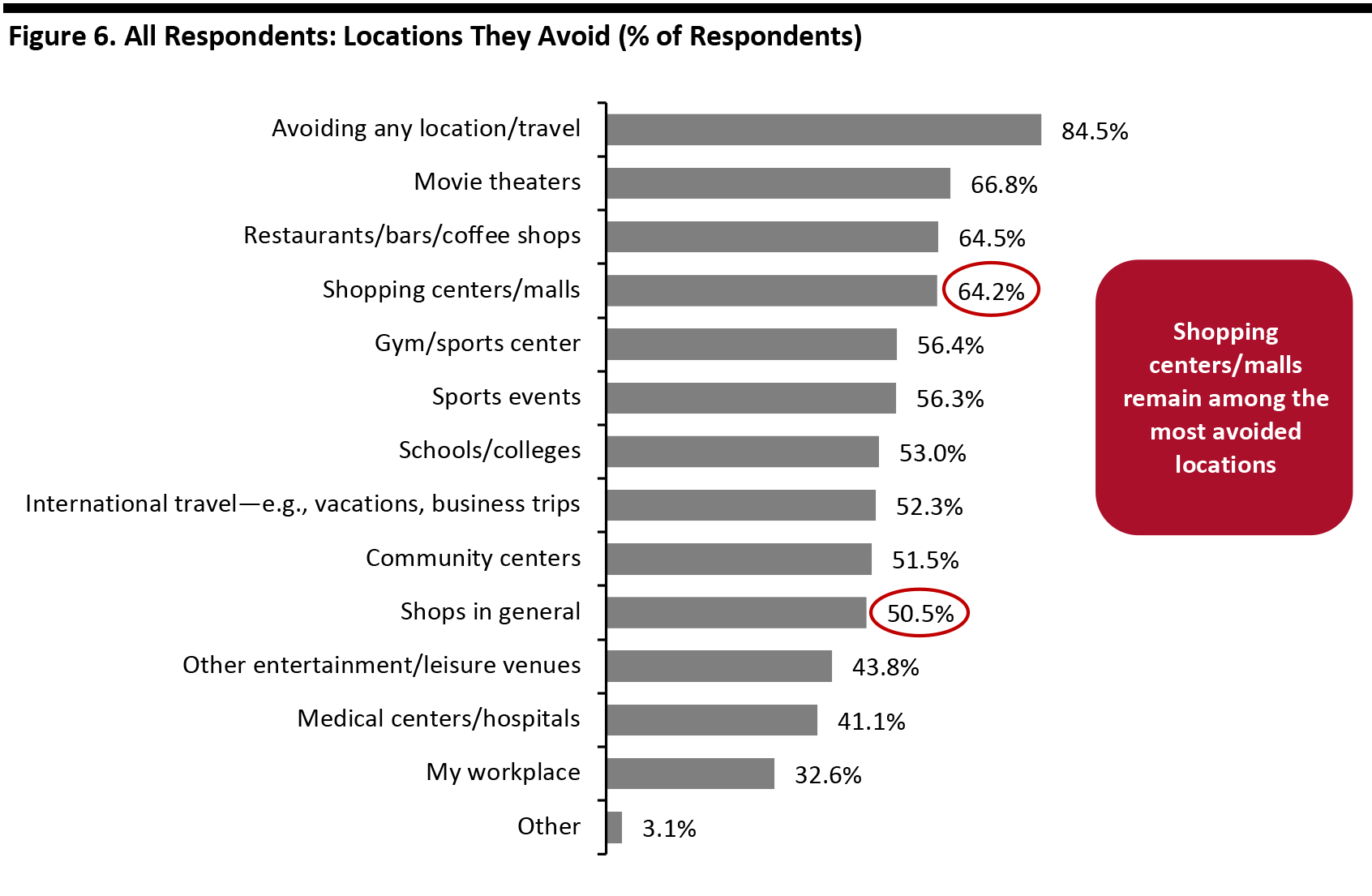

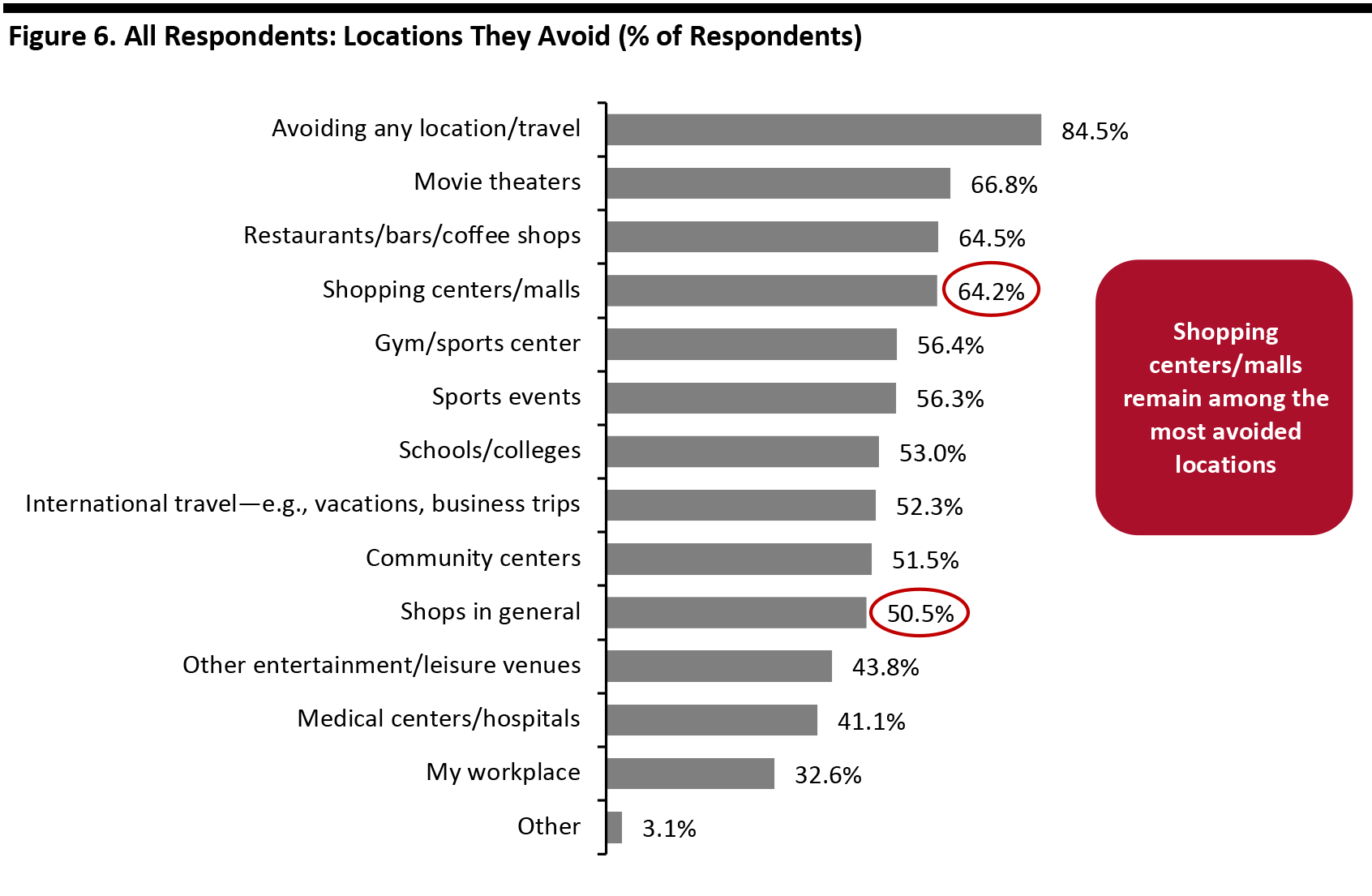

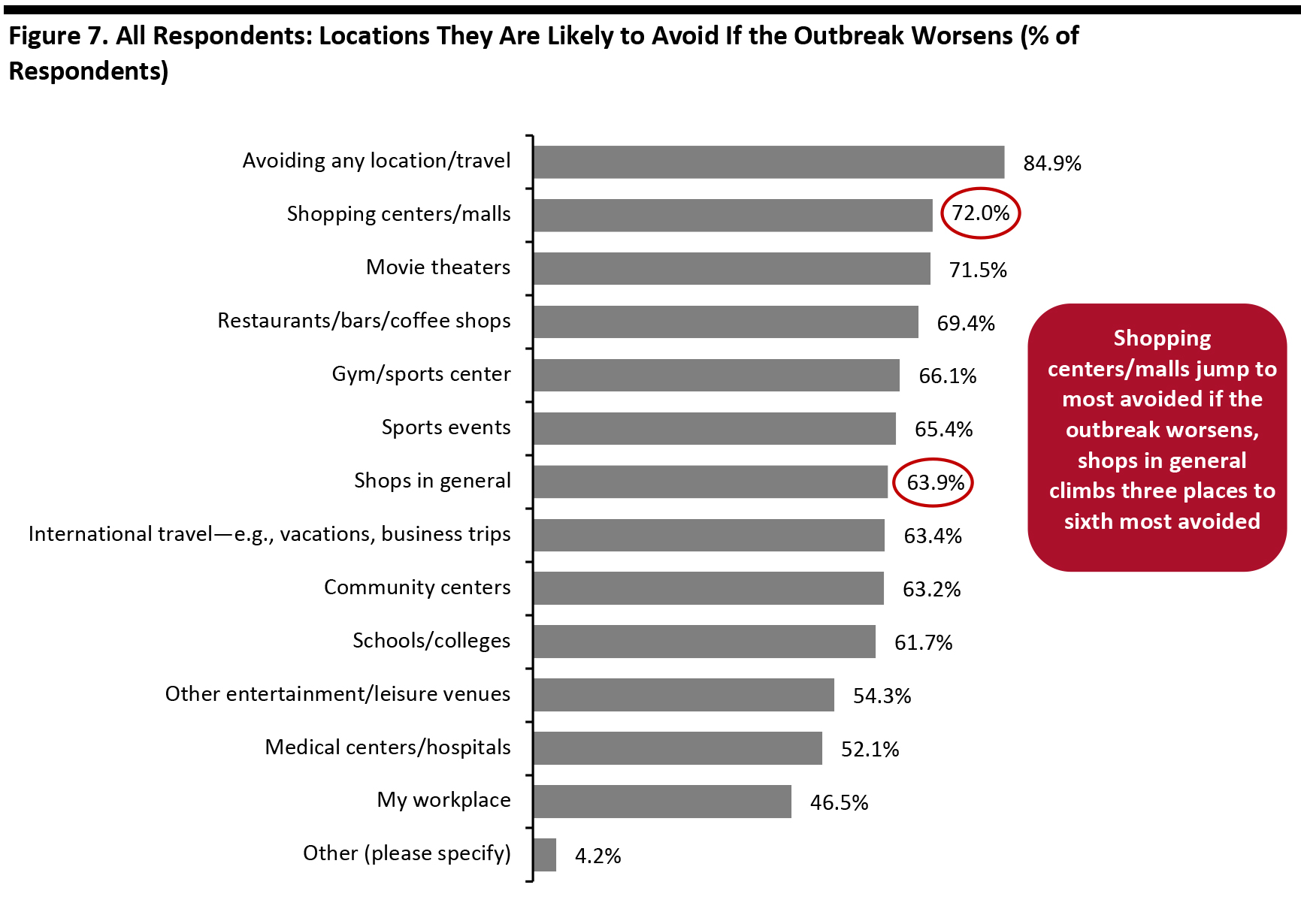

Source: Coresight Research [/caption] Shopping centers/malls are the third most avoided type of location. Shops in general are significantly less avoided—showing that malls are weighted toward discretionary retail while nondiscretionary stores such as grocery stores and drugstores tend to be in off-mall locations. The leisure industry is seeing mass avoidance across spaces such as movie theaters, food service and sports centers. [caption id="attachment_105774" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above

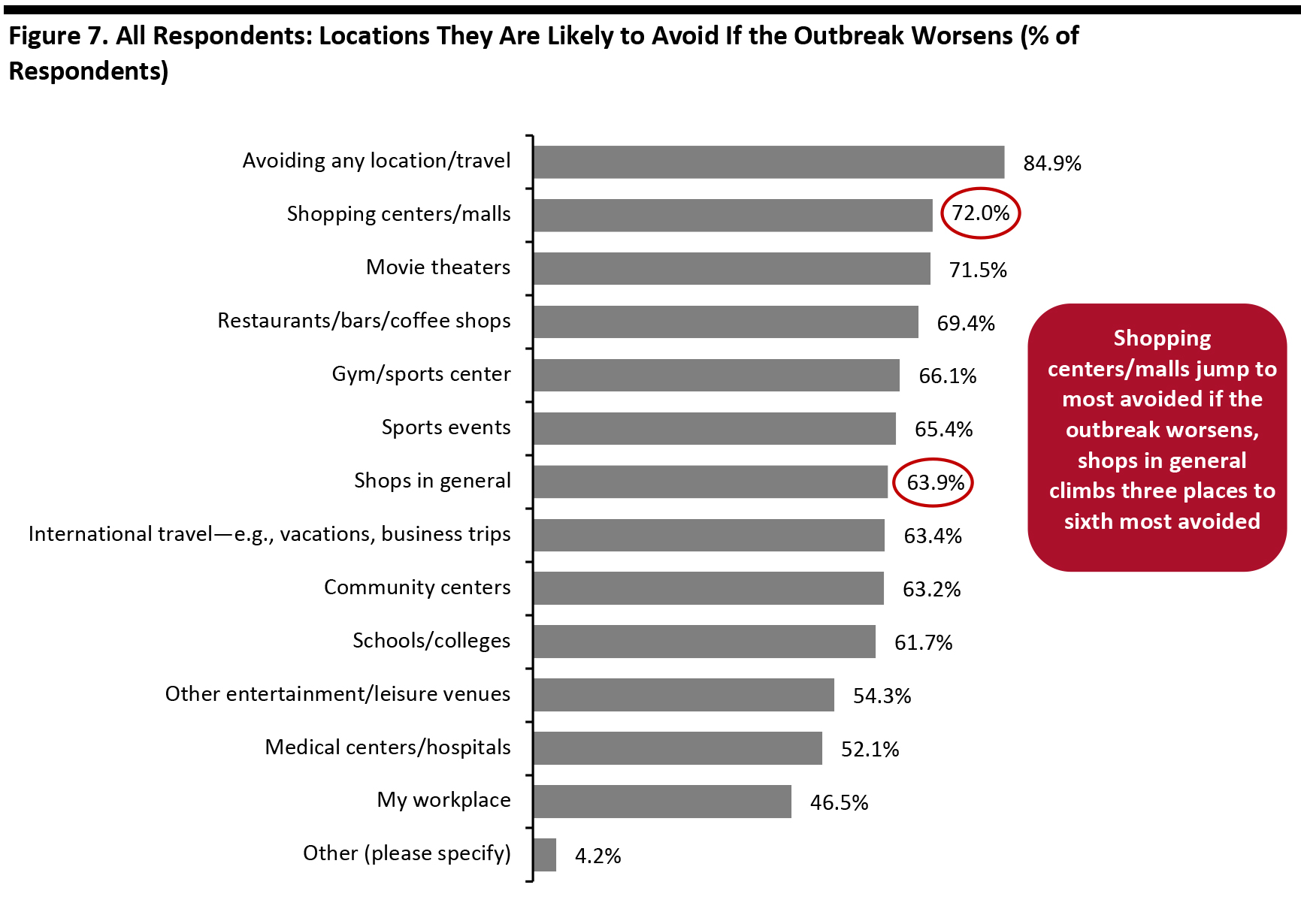

Source: Coresight Research [/caption] We also asked respondents what locations they are likely to avoid if the outbreak worsens and found the overall percentage of people who will avoid any type of place stays roughly the same at 85%. However, shopping centers/malls jump to first place, while more also expect to avoid shops in general. [caption id="attachment_105775" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above

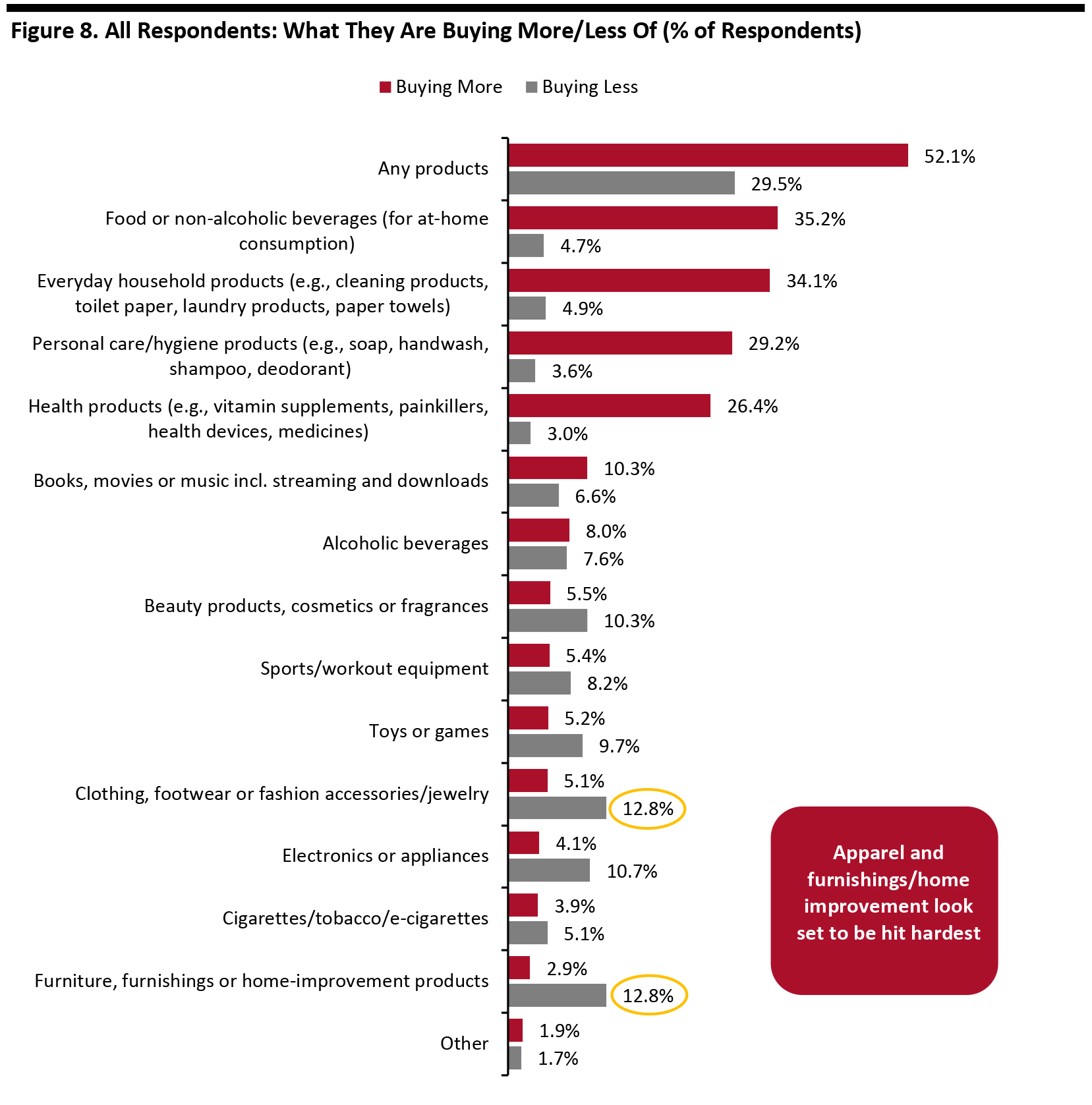

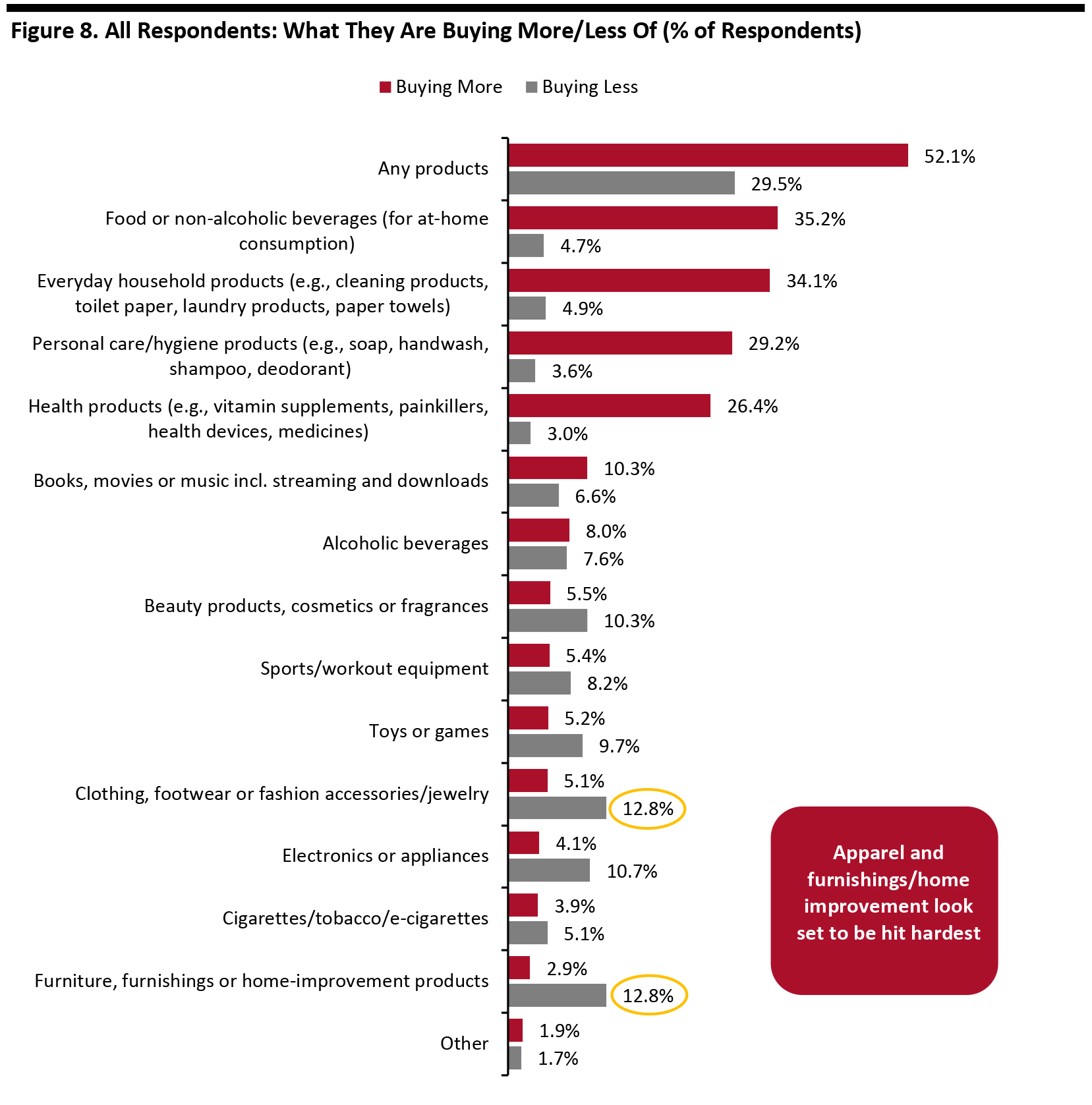

Source: Coresight Research [/caption] Changing Shopping Habits Some 52.1% of all respondents said they are buying more of some categories in response to the outbreak while 29.5% said they were buying less of some categories. More: Unsurprisingly, nondiscretionary or essential categories such as food, household products, personal care and health products saw the biggest jump: more than one-third of all respondents reported buying more food and/or more household products. Less: Apparel, furnishings/home-improvement, electronics/appliances and beauty products saw the greatest number of respondents saying they had reduced their purchases. Ratio of less to more: Furnishings/home improvement saw the greatest proportional disparity between buying less/more, with 4.5 times as many respondents answering “less” as answering “more.” Next was electronics/appliances, with a ratio of 2.6 less to each more, and apparel with 2.5 less to each more. [caption id="attachment_105750" align="aligncenter" width="700"] Respondents could select multiple options

Respondents could select multiple options

Base: 1,152 US Internet users aged 18 and above

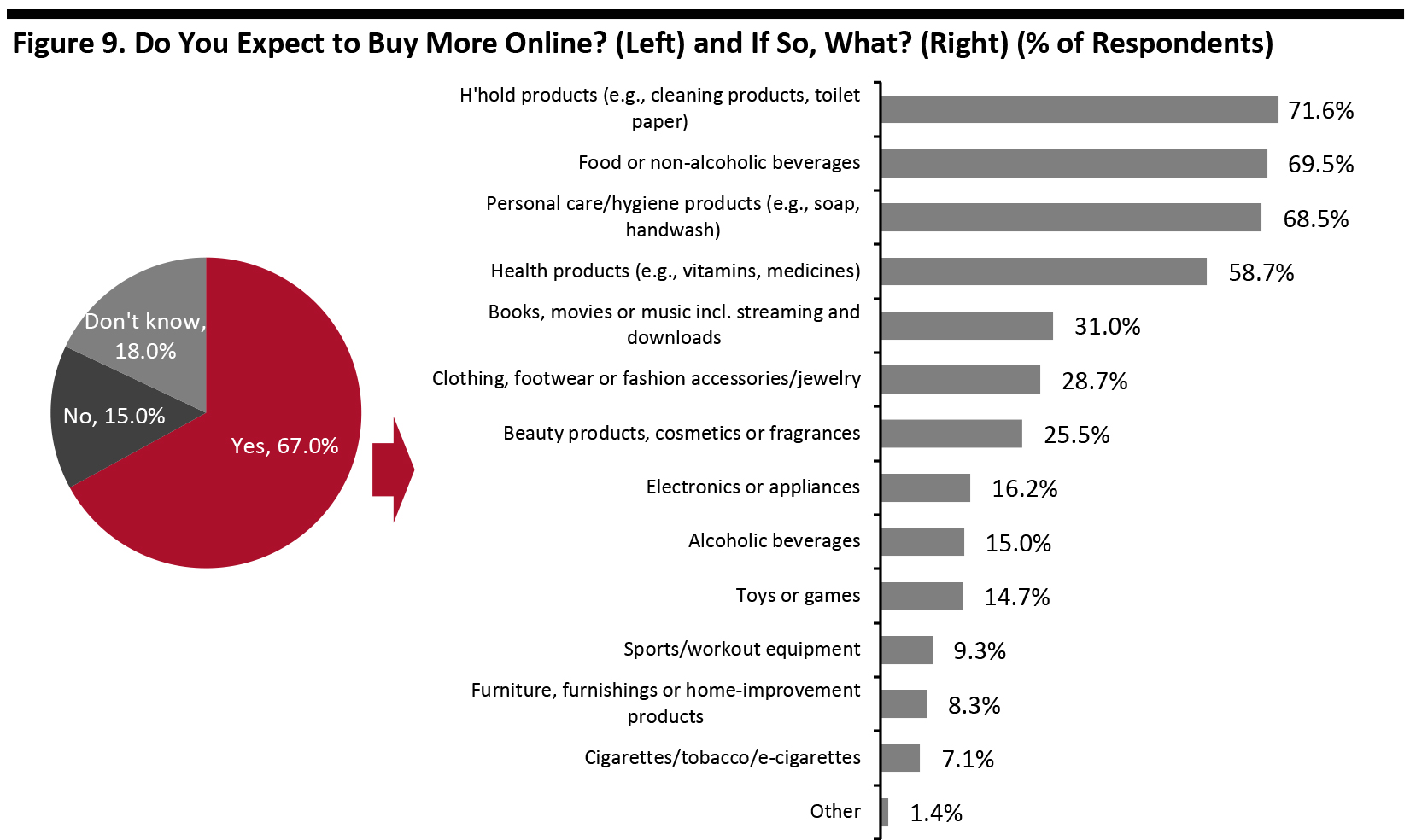

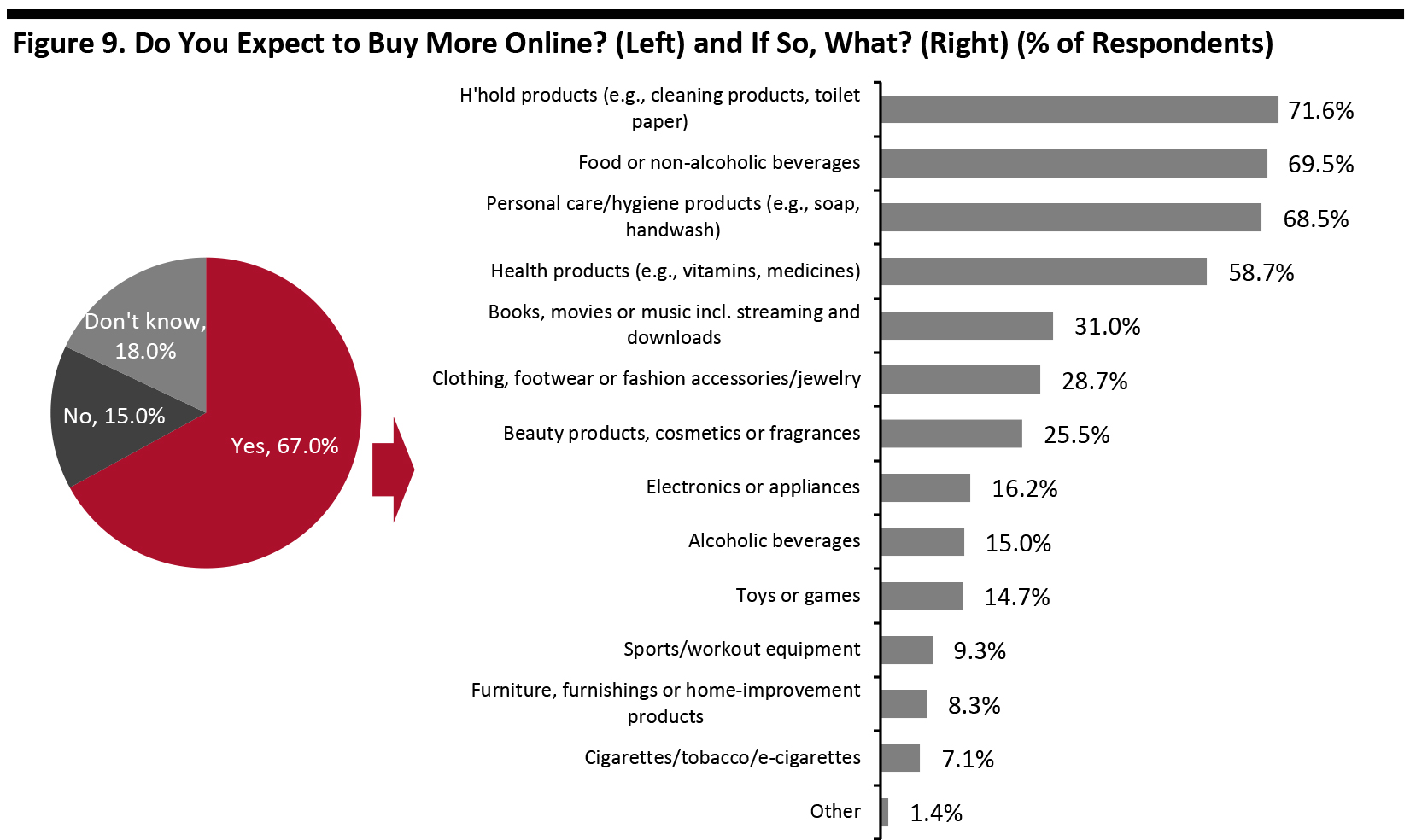

Source: Coresight Research [/caption] Fully two-thirds expect to buy more online if the outbreak continues. Of those expecting to buy more, we again saw essentials such as household products and food take a strong lead. However, discretionary categories also figured relatively strongly, with almost one-third expecting to buy media products (or stream/download them) more—reflecting demand for entertainment and distractions among consumers stuck at home. Almost one in three of those expecting to make more purchases online anticipate buying more apparel online than they currently do. [caption id="attachment_105753" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above (left) including 772 who expect to buy more online (right)

Base: 1,152 US Internet users aged 18 and above (left) including 772 who expect to buy more online (right)

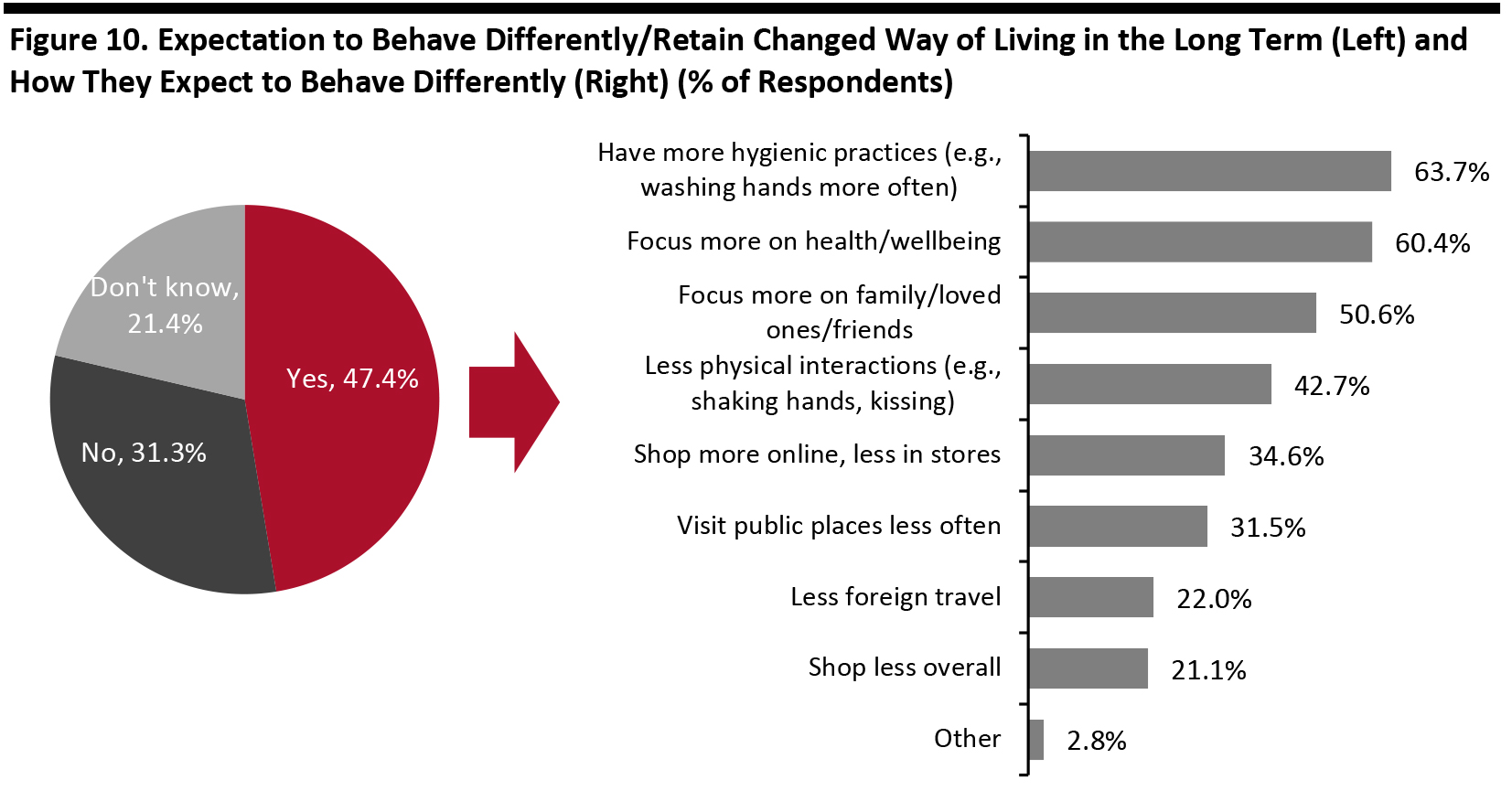

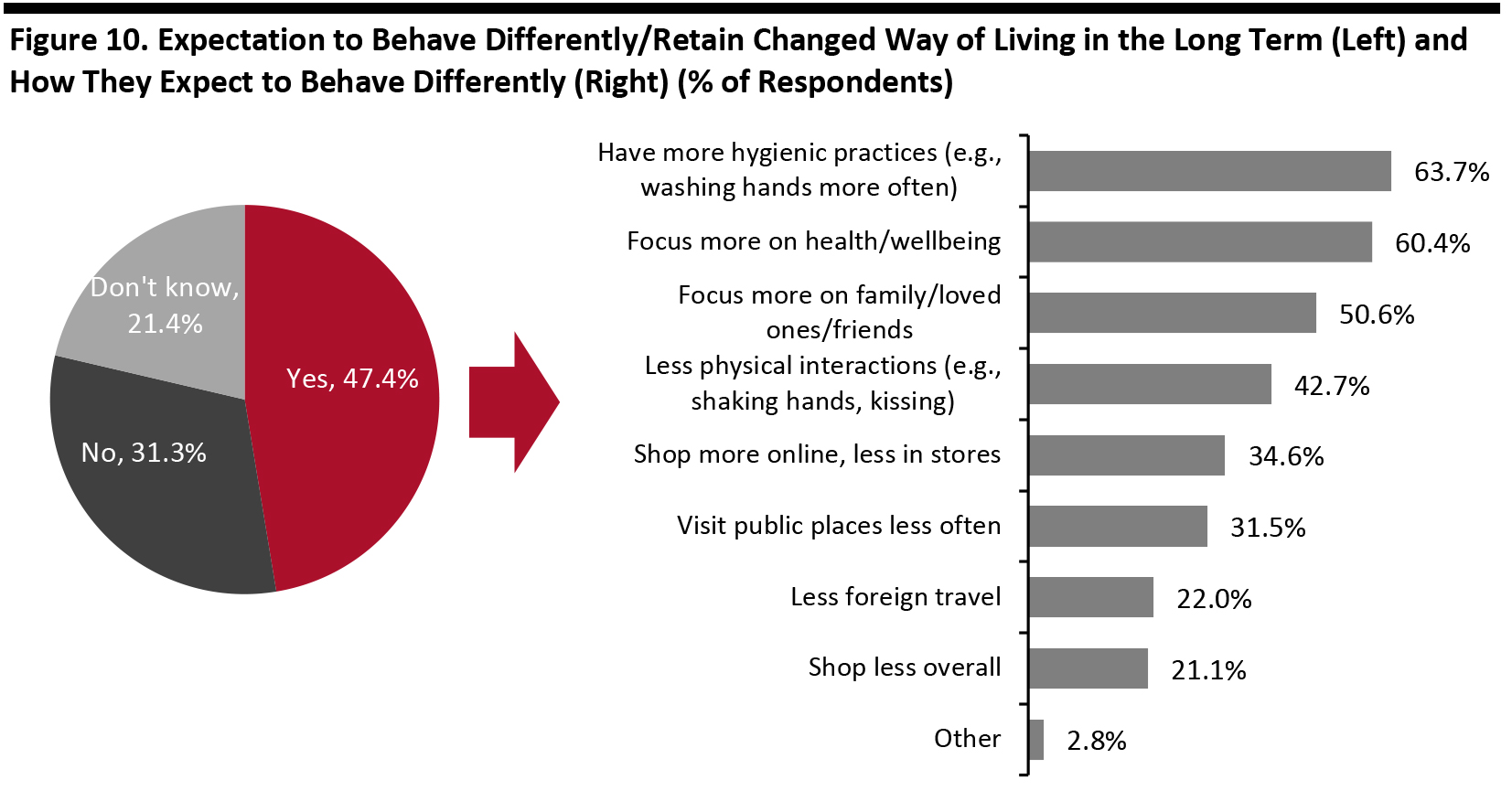

Source: Coresight Research [/caption] Long-Term Changes in Behavior Nobody yet knows if the changes wrought by the coronavirus will lead to long-term shifts in the way consumers behave. So, we asked them—and close to half of respondents expect to retain changed behaviors after the outbreak ends. Among those expecting to retain behaviors from the outbreak, prevention through better hygiene and a focus on wellness were top responses, but around half also expect to focus more on people who mean a lot to them. For retailers looking to see if the outbreak will prompt a jump in e-commerce, there are mixed messages. Just over one-third of those expecting to make changes think they will shop more online, long term—but this option ranks below several other changes, and is equivalent to a relatively minor 16% of all respondents (i.e., including those not expecting to make changes). [caption id="attachment_105752" align="aligncenter" width="700"] Base: 1,152 US Internet users aged 18 and above (left) including 546 who expect to behave differently/retain changed way of living in the long term (right)

Base: 1,152 US Internet users aged 18 and above (left) including 546 who expect to behave differently/retain changed way of living in the long term (right)

Source: Coresight Research [/caption]

Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above Source: Coresight Research [/caption] Among those expressing concern, we see a mixed collection of worries: relatives or friends getting sick is of greater concern than getting sick themselves. The economic impact also ranked higher than getting sick—not surprising amid growing shutdowns across the country. Shortages of essential products outrank loss of income/employment as a concern. [caption id="attachment_105744" align="aligncenter" width="700"]

Respondents could select up to three options Base: 1,097 US Internet users aged 18 and above who are concerned about the coronavirus outbreak

Respondents could select up to three options Base: 1,097 US Internet users aged 18 and above who are concerned about the coronavirus outbreak Source: Coresight Research [/caption] We also asked respondents to choose from a selection of statements related to employment and income. Some 4.2% said they had already lost their job because of the coronavirus outbreak, with a further 12.7% worried they would lose their job. However, a much more widespread worry was losing part of their income, such as through reduced hours—with one-third concerned about this. The extent of these worries underscores the economic retrenchment we could see if shoppers stop spending. [caption id="attachment_105745" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above Source: Coresight Research [/caption] Underlying these concerns is a widespread belief that the severe impact of the coronavirus will last several months at least. In fact, less than 7% think the severe impact will last less than a month—interesting given many retailers that have closed stores have done so for only around two weeks starting mid-March. By far the more common perception is that it will last between one and four months, with over one in five thinking the severe disruption will last five months or more. The findings suggest many consumers are likely to batten down the hatches for the long haul. [caption id="attachment_105746" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above Source: Coresight Research [/caption] Changing Behavior Fully 84.5% of respondents now avoid public areas or travel, up from just 27.5% when we surveyed consumers one month earlier. [caption id="attachment_105747" align="aligncenter" width="700"]

Base: Internet users aged 18 and above

Base: Internet users aged 18 and above Source: Coresight Research [/caption] Shopping centers/malls are the third most avoided type of location. Shops in general are significantly less avoided—showing that malls are weighted toward discretionary retail while nondiscretionary stores such as grocery stores and drugstores tend to be in off-mall locations. The leisure industry is seeing mass avoidance across spaces such as movie theaters, food service and sports centers. [caption id="attachment_105774" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above Source: Coresight Research [/caption] We also asked respondents what locations they are likely to avoid if the outbreak worsens and found the overall percentage of people who will avoid any type of place stays roughly the same at 85%. However, shopping centers/malls jump to first place, while more also expect to avoid shops in general. [caption id="attachment_105775" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above

Base: 1,152 US Internet users aged 18 and above Source: Coresight Research [/caption] Changing Shopping Habits Some 52.1% of all respondents said they are buying more of some categories in response to the outbreak while 29.5% said they were buying less of some categories. More: Unsurprisingly, nondiscretionary or essential categories such as food, household products, personal care and health products saw the biggest jump: more than one-third of all respondents reported buying more food and/or more household products. Less: Apparel, furnishings/home-improvement, electronics/appliances and beauty products saw the greatest number of respondents saying they had reduced their purchases. Ratio of less to more: Furnishings/home improvement saw the greatest proportional disparity between buying less/more, with 4.5 times as many respondents answering “less” as answering “more.” Next was electronics/appliances, with a ratio of 2.6 less to each more, and apparel with 2.5 less to each more. [caption id="attachment_105750" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple options Base: 1,152 US Internet users aged 18 and above

Source: Coresight Research [/caption] Fully two-thirds expect to buy more online if the outbreak continues. Of those expecting to buy more, we again saw essentials such as household products and food take a strong lead. However, discretionary categories also figured relatively strongly, with almost one-third expecting to buy media products (or stream/download them) more—reflecting demand for entertainment and distractions among consumers stuck at home. Almost one in three of those expecting to make more purchases online anticipate buying more apparel online than they currently do. [caption id="attachment_105753" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above (left) including 772 who expect to buy more online (right)

Base: 1,152 US Internet users aged 18 and above (left) including 772 who expect to buy more online (right) Source: Coresight Research [/caption] Long-Term Changes in Behavior Nobody yet knows if the changes wrought by the coronavirus will lead to long-term shifts in the way consumers behave. So, we asked them—and close to half of respondents expect to retain changed behaviors after the outbreak ends. Among those expecting to retain behaviors from the outbreak, prevention through better hygiene and a focus on wellness were top responses, but around half also expect to focus more on people who mean a lot to them. For retailers looking to see if the outbreak will prompt a jump in e-commerce, there are mixed messages. Just over one-third of those expecting to make changes think they will shop more online, long term—but this option ranks below several other changes, and is equivalent to a relatively minor 16% of all respondents (i.e., including those not expecting to make changes). [caption id="attachment_105752" align="aligncenter" width="700"]

Base: 1,152 US Internet users aged 18 and above (left) including 546 who expect to behave differently/retain changed way of living in the long term (right)

Base: 1,152 US Internet users aged 18 and above (left) including 546 who expect to behave differently/retain changed way of living in the long term (right) Source: Coresight Research [/caption]