Nitheesh NH

We present our playbook for nonfood retailers in Western markets looking to navigate the coronavirus crisis.

[caption id="attachment_108499" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In the UK, Marks & Spencer has promoted distance-gifting with “thinking-of-you” purchases

In the UK, Marks & Spencer has promoted distance-gifting with “thinking-of-you” purchases

Source: Company email[/caption] More exclusive and exciting products can support demand: Limited-time availability pressures consumers not to defer their purchases. Brand mashups, such as those we have seen in China, can drive interest in discretionary categories, especially apparel. Limited availability translates into shallow inventory commitments from brands and retailers, reducing their risk. To support the retention of sales from closed stores, retailers must make it as easy as possible for consumers to buy from them online. Offering free shipping—or lowering the minimum-purchase requirements for shoppers to earn this benefit—is one means to enhance sales conversion rates. For instance, some retailers are removing the minimum order-value requirement for a limited period, while others are offering free curbside pickup. Retailers can also extend the window during which they accept product returns. Some of the retailers that have recently relaxed their returns policies on account of the current situation include Apple, American Eagle Outfitters, Bed Bath & Beyond, Best Buy, Gap Inc., H&M, Macy’s and Sephora. 3. Offer Rewards for Loyalty—and Build Long-Term Loyalty by Doing Good Retailers can look to reward true loyalty—those shoppers who stick with them during the tough times. Existing loyalty programs can be used to identify and reward those shoppers spending more—whether in absolute terms or relative terms, versus their prior spending. Bonuses and treats can include post-crisis redemption—tying into the deferred gifting theme noted above. However, rewarding preferential behaviour works both ways, and we think shoppers will be attuned to those retailers that behave well in the crisis and those that do not. Retailers must do good wherever possible, including to their store staff. We think shoppers will not be impressed with CEOs taking pay cuts of around 20% or 30% when they have furloughed low-paid staff that are not on salaries. Senior management must be realistic and accept deep cuts where their staff are, too: Shoppers will remember, and short-term benefits may hit longer-term recoveries. 4. Adopt Realism in Operations and Increase Collaboration On the operational side, we suggest that retailers, brand owners and REITs adopt medium-term realism. We think that many retailers went into the coronavirus crisis with unduly optimistic expectations—demonstrated by announcing store closures for only two weeks, for example. The path out of the crisis and the timings around recovery remain uncertain: Some experts have indicated that everyday life can return to a kind of normality only once a vaccine is rolled out or the population develops herd immunity. Even if lockdowns are eased before those conditions are reached, any opening-up of commerce and society is likely to be phased, with restrictions on different activities eased at different times. The retail ecosystem is marked by codependency, with all parties having vested interests in long-term survival over short-term gains. Companies must acknowledge this and share the pain. It is unrealistic for REITs to expect full rents during total shutdowns, just as it is for retailers to abandon orders already placed with suppliers or for CEOs to cut only 20% of their salary but 100% of store-staff pay. Managements across the retail supply chain must accept that they are in this together. Moreover, as we noted above, for retailers, doing the right thing is likely to feed into positive consumer perceptions, post crisis. Firms in the retail space, including brands and REITs, must stand ready to communicate and collaborate with other firms in the ecosystem and must look beyond short-term self-interest. Respondents could select multiple options

Respondents could select multiple options

Base: US Internet users aged 18+

Source: Coresight Research[/caption] 4. Supply-Chain Partners Must Prepare for Inventory Demands To Be Reshaped Even once stores reopen and demand begins to recover, we do not expect this to translate into resurgent demand for product in the supply chain. Nonfood retailers will head toward the fall with a glut of inventory. We expect many to clear the stock in their own stores, to help drive traffic from cautious shoppers, rather than clear it through other channels such as off-price stores. Across discretionary retail, there will be much less need—and much less floor space—for new product. Just as retailers have furloughed staff, some apparel retailers are now “furloughing” product. Gap Inc, for instance, is holding its spring/summer 2020 ranges over for 2021—which means few, if any, orders for spring/summer 2021 product. Assuming an eight-month apparel supply-chain timeline, this suggests that 2021 orders are likely to be canceled just as US and European retail are in the recovery stage. Brands and suppliers selling into retail must adjust their expectations of future demand and cannot work on the assumption of a smooth recovery. Retailers must review their holiday orders in view of an increasingly pessimistic outlook. Our conversations with major US retail firms have yielded a range of perspectives on the likely impact on the end-of-year holiday peak. At their most pessimistic, executives are preparing for US discretionary demand to be as low as 65% of 2019 holiday demand—i.e., down by up to 35% year over year. 5. Adapt Physical Retail Experiences for a “Mask Economy” Before the crisis, brick-and-mortar nonfood retailers were increasingly embracing experiential retail, including through services and events. Post crisis, they must work out how, if at all, they can relaunch these offerings in what is likely to be a social-distancing “mask economy.” Providing safe and reassuring retail environments and experiences will involve sustained work on operational details and is likely to require a permanent or semi-permanent reduction in service offerings. Will beauty treatments and other close-proximity services be feasible even once stores reopen? Will large-gathering events need to be postponed or axed? Will high-traffic flagships need to continue limiting shopper numbers? As we noted earlier, a pre-crisis type of normality may be possible only once a vaccine is rolled out or once the population develops group immunity. Retailers must develop medium-term strategies to restart retail in the hinterland between lockdown and such normality.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

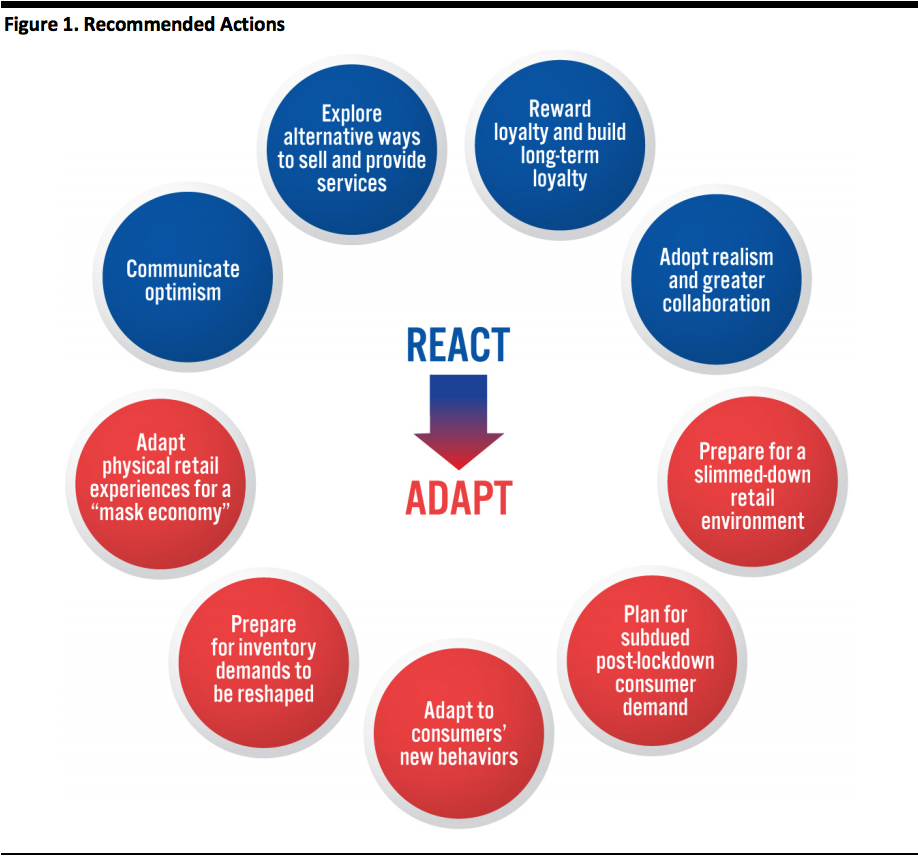

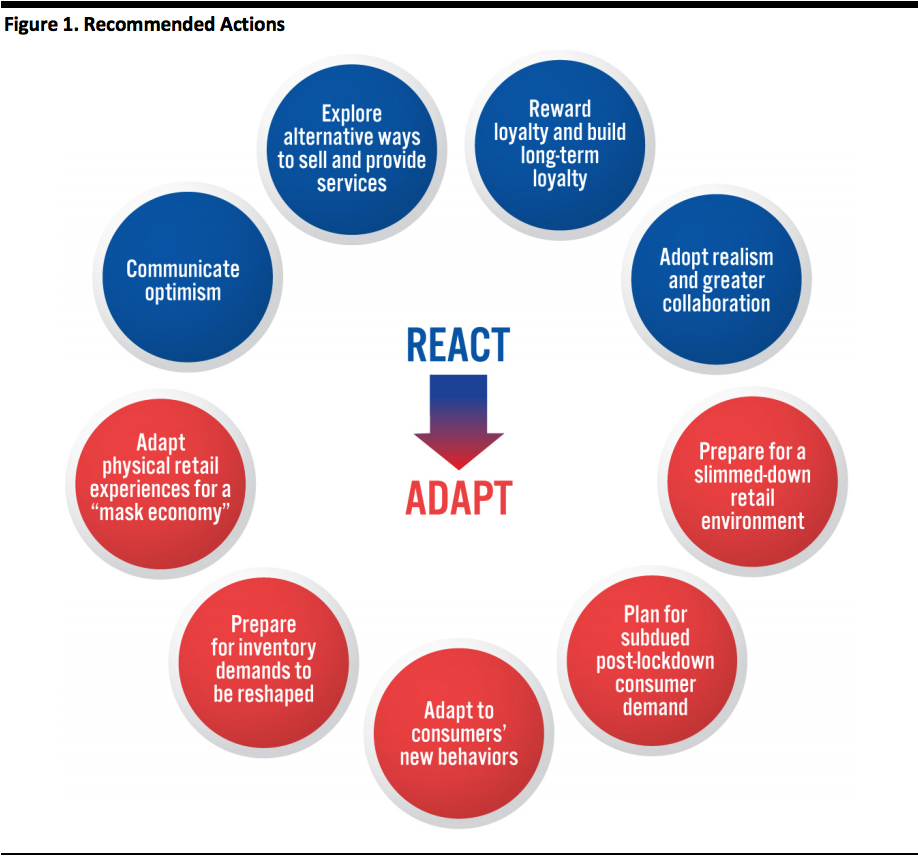

React: Four Actions To Take Now

Nonfood retailers have been furloughing employees and taking a hatchet to costs. On the customer-facing side, retailers must pull every lever to compensate for store closures, build brands and support their share in the recovery—when it arrives. 1. Communicate Optimism Retailers and brands can offer consumers optimism and moments of joy, and turn to quick-response, low-cost marketing channels—notably, social media—to excite consumers, encourage interaction and participation and, ultimately, drive sales. Online games, competitions and interaction further support brand building by engaging with housebound shoppers: Retailers can adapt the booming “Zoom culture” of video calls for shopping, making communication bidirectional rather than broadcasting.- Western brands and retailers can adopt livestreaming from their Asian counterparts, to provide the kind of engagement and experiences that shoppers cannot currently access in brick-and-mortar stores. Beauty brands NYX Cosmetics and Chanel are livestreaming events such as virtual festivals and concerts to engage consumers on Instagram.

- Brands and retailers can use lockdowns as an opportunity to build or strengthen digital communities, as NIKE and Lululemon did in China. The activewear companies engaged with consumers through social media and apps to offer free exercise classes and encourage at-home workouts. NIKE reported that the strong engagement of Chinese consumers with its activity apps translated into 30% digital commerce growth.

In the UK, Marks & Spencer has promoted distance-gifting with “thinking-of-you” purchases

In the UK, Marks & Spencer has promoted distance-gifting with “thinking-of-you” purchasesSource: Company email[/caption] More exclusive and exciting products can support demand: Limited-time availability pressures consumers not to defer their purchases. Brand mashups, such as those we have seen in China, can drive interest in discretionary categories, especially apparel. Limited availability translates into shallow inventory commitments from brands and retailers, reducing their risk. To support the retention of sales from closed stores, retailers must make it as easy as possible for consumers to buy from them online. Offering free shipping—or lowering the minimum-purchase requirements for shoppers to earn this benefit—is one means to enhance sales conversion rates. For instance, some retailers are removing the minimum order-value requirement for a limited period, while others are offering free curbside pickup. Retailers can also extend the window during which they accept product returns. Some of the retailers that have recently relaxed their returns policies on account of the current situation include Apple, American Eagle Outfitters, Bed Bath & Beyond, Best Buy, Gap Inc., H&M, Macy’s and Sephora. 3. Offer Rewards for Loyalty—and Build Long-Term Loyalty by Doing Good Retailers can look to reward true loyalty—those shoppers who stick with them during the tough times. Existing loyalty programs can be used to identify and reward those shoppers spending more—whether in absolute terms or relative terms, versus their prior spending. Bonuses and treats can include post-crisis redemption—tying into the deferred gifting theme noted above. However, rewarding preferential behaviour works both ways, and we think shoppers will be attuned to those retailers that behave well in the crisis and those that do not. Retailers must do good wherever possible, including to their store staff. We think shoppers will not be impressed with CEOs taking pay cuts of around 20% or 30% when they have furloughed low-paid staff that are not on salaries. Senior management must be realistic and accept deep cuts where their staff are, too: Shoppers will remember, and short-term benefits may hit longer-term recoveries. 4. Adopt Realism in Operations and Increase Collaboration On the operational side, we suggest that retailers, brand owners and REITs adopt medium-term realism. We think that many retailers went into the coronavirus crisis with unduly optimistic expectations—demonstrated by announcing store closures for only two weeks, for example. The path out of the crisis and the timings around recovery remain uncertain: Some experts have indicated that everyday life can return to a kind of normality only once a vaccine is rolled out or the population develops herd immunity. Even if lockdowns are eased before those conditions are reached, any opening-up of commerce and society is likely to be phased, with restrictions on different activities eased at different times. The retail ecosystem is marked by codependency, with all parties having vested interests in long-term survival over short-term gains. Companies must acknowledge this and share the pain. It is unrealistic for REITs to expect full rents during total shutdowns, just as it is for retailers to abandon orders already placed with suppliers or for CEOs to cut only 20% of their salary but 100% of store-staff pay. Managements across the retail supply chain must accept that they are in this together. Moreover, as we noted above, for retailers, doing the right thing is likely to feed into positive consumer perceptions, post crisis. Firms in the retail space, including brands and REITs, must stand ready to communicate and collaborate with other firms in the ecosystem and must look beyond short-term self-interest.

Adapt: Five Actions To Prepare for a New Normal

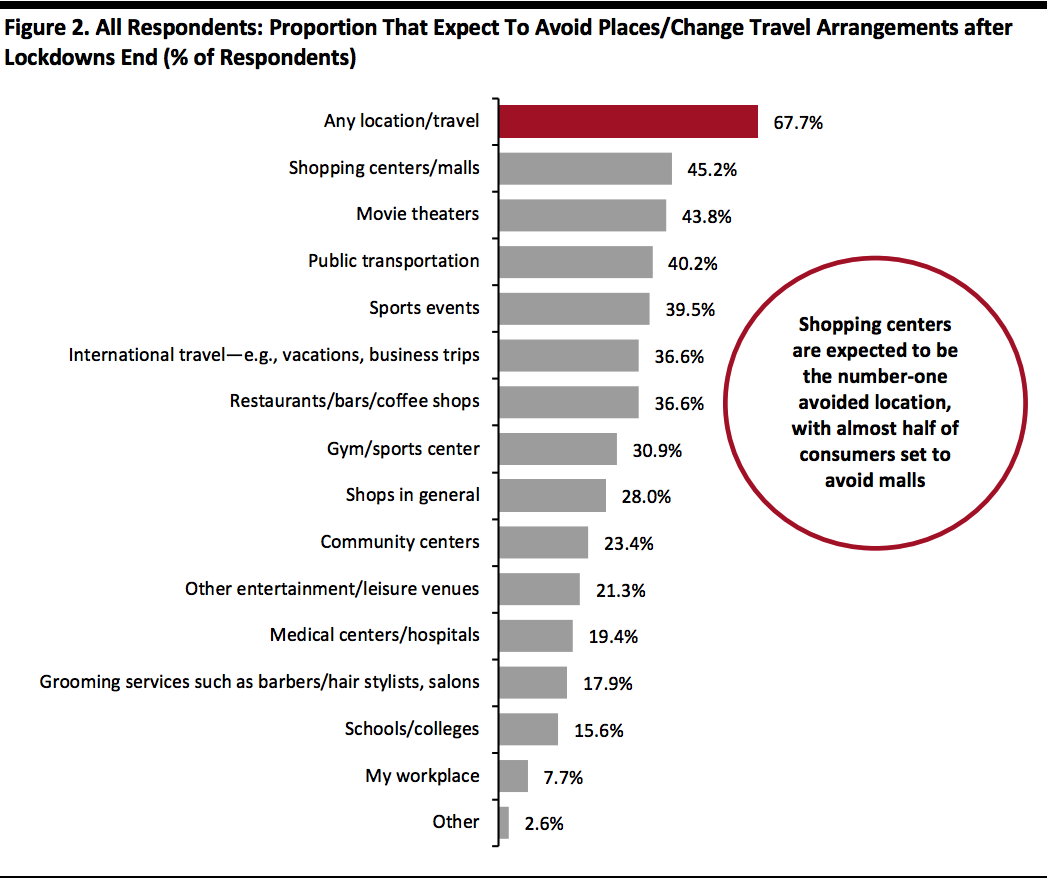

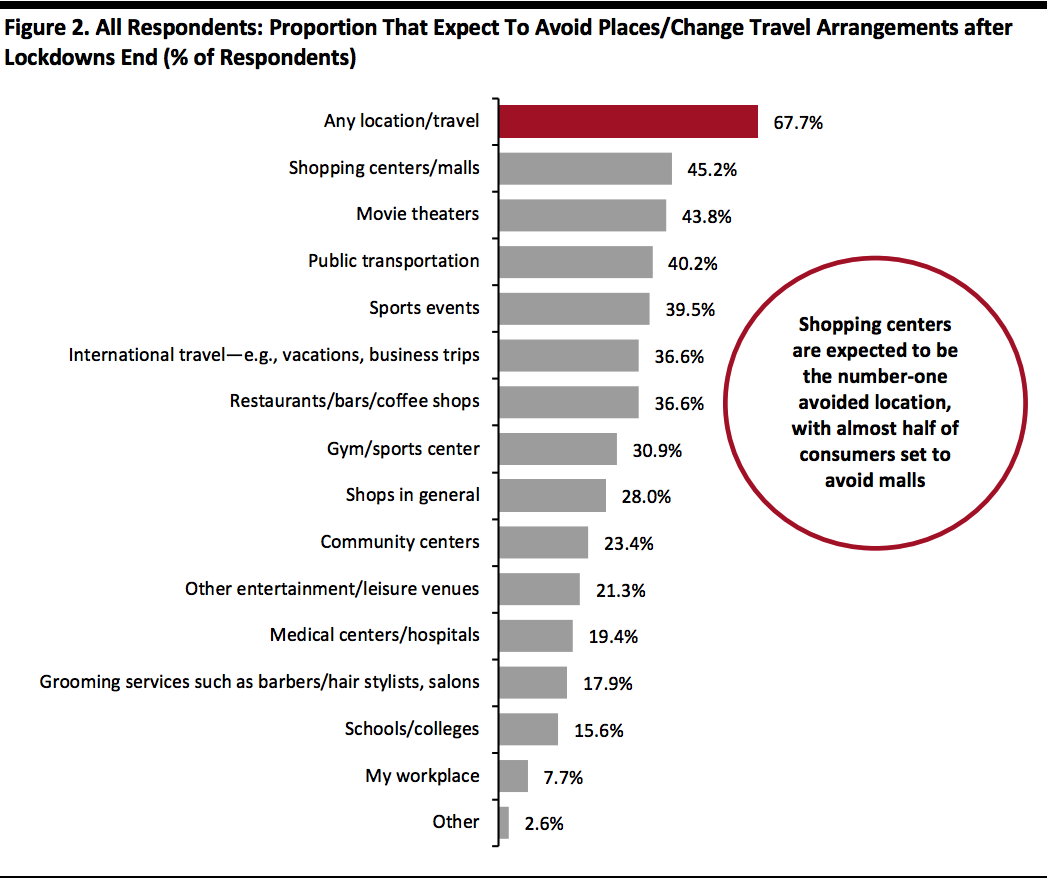

We think that post-crisis normality will not be the same as pre-crisis normality. Physical retail is likely to have been reshaped, and consumers may remain highly cautious and retain changed behaviors for some time. 1. Get Ready for a Diminished Supply Side—Including Seizing Opportunities Retailers, brands and REITs must be prepared for a decimated brick-and-mortar retail environment. Our current base case is that US store closures last for roughly three months from mid-March, implying that physical retail would see reopenings around mid-June. However, we expect that many stores will never reopen and that there will be a wave of bankruptcies and store closures on the back of the crisis. Even retailers that survive in reasonable health may take the opportunity to cut store fleets in the short-term context of rapidly changed consumer demand and the long-term context of structural shifts in retail. Surviving retailers must stand ready to gain market share from bankrupt rivals, including through targeted communications aimed at winning those rivals’ customers—but that is likely to be share of a smaller overall market. 2. Expect the Demand Side To Take a Medium-Term Hit More meaningfully, we expect severe economic and labor-market shocks to continue resonating through the holiday peak. As we write, Americans have registered as unemployed in numbers never seen before. Many of these people will be furloughed, meaning they have jobs to return to—in theory—which assumes 100% business-survival rates. Our recent surveys of US consumers have confirmed that many shoppers are not expecting a swift return to normality. Our April 22 survey found that 62% of respondents are buying less of certain categories (led by apparel, furniture/home categories and beauty products) and 65% are purchasing more of certain categories (largely food and other essentials). Among those who are spending less, one-quarter thought it would take more than six months for their spending to return to normal levels—which takes us up to the holiday season. We think that many retailers went into the coronavirus crisis with unduly optimistic expectations—demonstrated by announcing store closures for only two weeks, for example. The path out of the crisis and the timings around recovery remain uncertain and could take many months. Traditional shopping rhythms could be disrupted, likely impacting consumer planning for major seasons such as back to school and even the holiday peak. Retailers should not assume a later-2020 bounce back and must plan for severely reduced holiday-season demand. In addition, many retailers are likely to enter the fall season with a glut of inventory, likely leading to a surfeit of discounting in the preholiday season, which could seep into the holiday peak. 3. Adapt to New Postcrisis Consumer Behaviors Retailers must be ready to recapture share amid a changed landscape with altered behaviors: They cannot assume that their customers will revert to pre-crisis habits. Companies must prepare marketing campaigns, including direct marketing, to rebuild custom. The crisis is likely to amplify challenges for traditional enclosed malls, and brands and retailers must prepare to serve demand where it settles—which is likely to be online more than it was and could slightly favor off-mall locations. The crisis has shaken up consumer routines and habits, and there is a meaningful risk to established retailers that those habits will not resume once the dust settles. Even putting aside consumers’ inability to spend due to the economic shock, we could see behavioral changes prompted by lockdowns. Consumers may reassess whether they need to buy new fashions as often as they did, or whether a new television is as essential as they thought it was. Shoppers may come out of the crisis with new values and priorities, which could feed into preexisting concerns over sustainability—possibly hitting retail volumes over the long term. Around 21% of all respondents in our April 22 US consumer survey said they expected to shop less overall once the crisis ends. Similarly, habits around where they shop have likely been broken and may not resume. We could see gains for e-commerce, as shoppers avoid crowds and retain online shopping habits gained during the crisis:- Our April 22 US consumer survey found that 28% of all respondents expect to shop more online and less in stores once the crisis is over—with that metric creeping up in our weekly surveys.

- Our separate, mid-March US survey on the subject of online grocery shopping found that the outbreak had already encouraged just under half of online grocery shoppers to buy more groceries online or had driven them to start buying online. The US remains a relatively nascent market for online grocery, and we see the crisis pushing up participation rates among consumers.

Respondents could select multiple options

Respondents could select multiple optionsBase: US Internet users aged 18+

Source: Coresight Research[/caption] 4. Supply-Chain Partners Must Prepare for Inventory Demands To Be Reshaped Even once stores reopen and demand begins to recover, we do not expect this to translate into resurgent demand for product in the supply chain. Nonfood retailers will head toward the fall with a glut of inventory. We expect many to clear the stock in their own stores, to help drive traffic from cautious shoppers, rather than clear it through other channels such as off-price stores. Across discretionary retail, there will be much less need—and much less floor space—for new product. Just as retailers have furloughed staff, some apparel retailers are now “furloughing” product. Gap Inc, for instance, is holding its spring/summer 2020 ranges over for 2021—which means few, if any, orders for spring/summer 2021 product. Assuming an eight-month apparel supply-chain timeline, this suggests that 2021 orders are likely to be canceled just as US and European retail are in the recovery stage. Brands and suppliers selling into retail must adjust their expectations of future demand and cannot work on the assumption of a smooth recovery. Retailers must review their holiday orders in view of an increasingly pessimistic outlook. Our conversations with major US retail firms have yielded a range of perspectives on the likely impact on the end-of-year holiday peak. At their most pessimistic, executives are preparing for US discretionary demand to be as low as 65% of 2019 holiday demand—i.e., down by up to 35% year over year. 5. Adapt Physical Retail Experiences for a “Mask Economy” Before the crisis, brick-and-mortar nonfood retailers were increasingly embracing experiential retail, including through services and events. Post crisis, they must work out how, if at all, they can relaunch these offerings in what is likely to be a social-distancing “mask economy.” Providing safe and reassuring retail environments and experiences will involve sustained work on operational details and is likely to require a permanent or semi-permanent reduction in service offerings. Will beauty treatments and other close-proximity services be feasible even once stores reopen? Will large-gathering events need to be postponed or axed? Will high-traffic flagships need to continue limiting shopper numbers? As we noted earlier, a pre-crisis type of normality may be possible only once a vaccine is rolled out or once the population develops group immunity. Retailers must develop medium-term strategies to restart retail in the hinterland between lockdown and such normality.