DIpil Das

At the end of March 2020, athletic apparel companies NIKE and Lululemon reported favorable earnings amidst the coronavirus outbreak. On March 24, NIKE reported that 3Q20 saw 7% revenue growth. On March 26, Lululemon reported its 4Q20 earnings results, which included growth by region: North America was up 19%, international was up 25% and China was up 70%. For the full fiscal year 2019, Lululemon delivered over $4 billion in revenue, representing 21% growth over the previous year. The company reported a comparable sales increase of 18% on a constant-currency basis, on top of an 18% increase in 2018, as well as an operating margin of 22.3% (up 80 basis points) and an earnings-per-share increase of 28%.

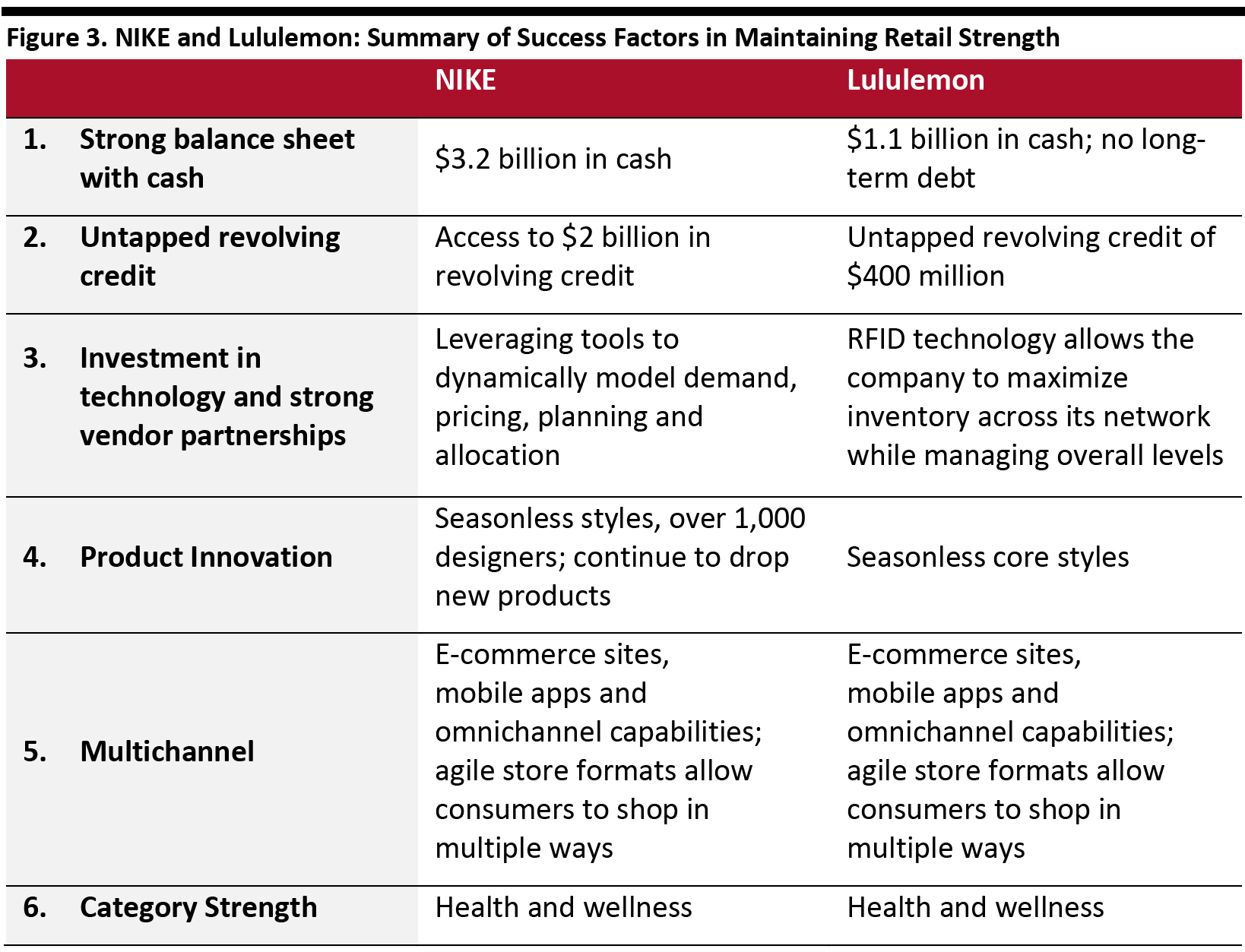

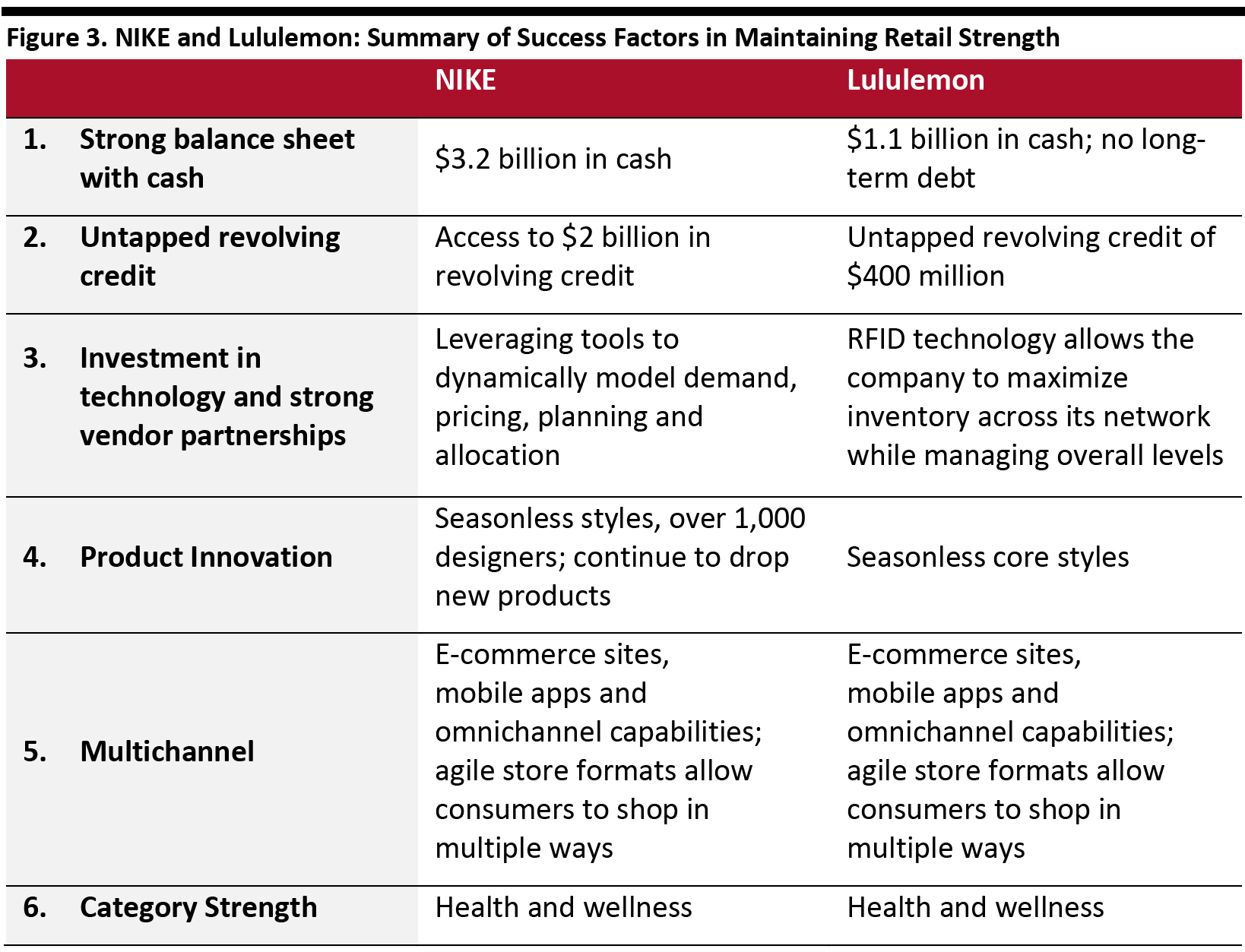

While both companies have been affected by the coronavirus pandemic, each highlighted similar factors that helped to positively position them for success. NIKE and Lululemon also reported the lessons they learned from their experiences during the coronavirus in China and the resulting strategies and tactics that they are therefore applying to their operations in the rest of the world.

Source: Company reports/Coresight Research[/caption]

Lululemon Lessons Learned: Two Workstreams

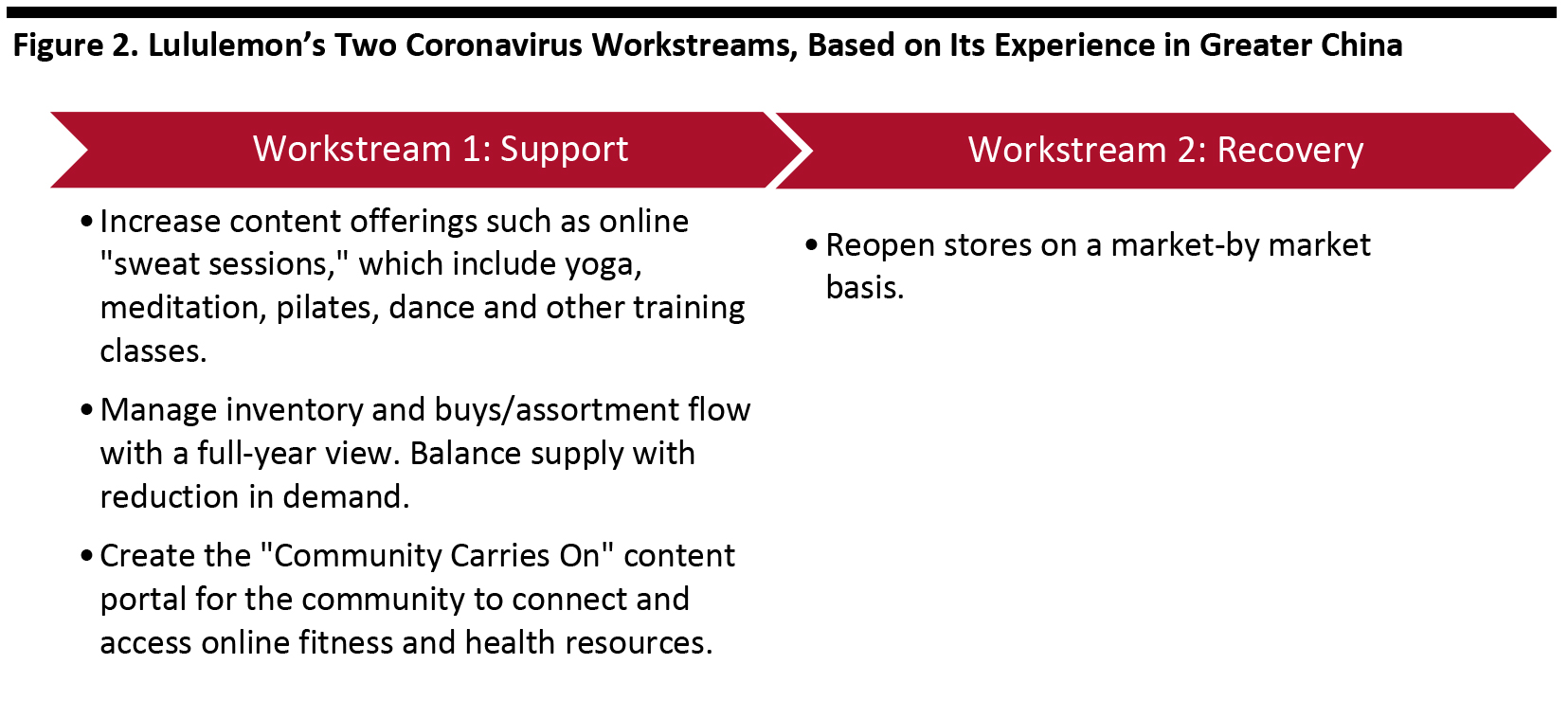

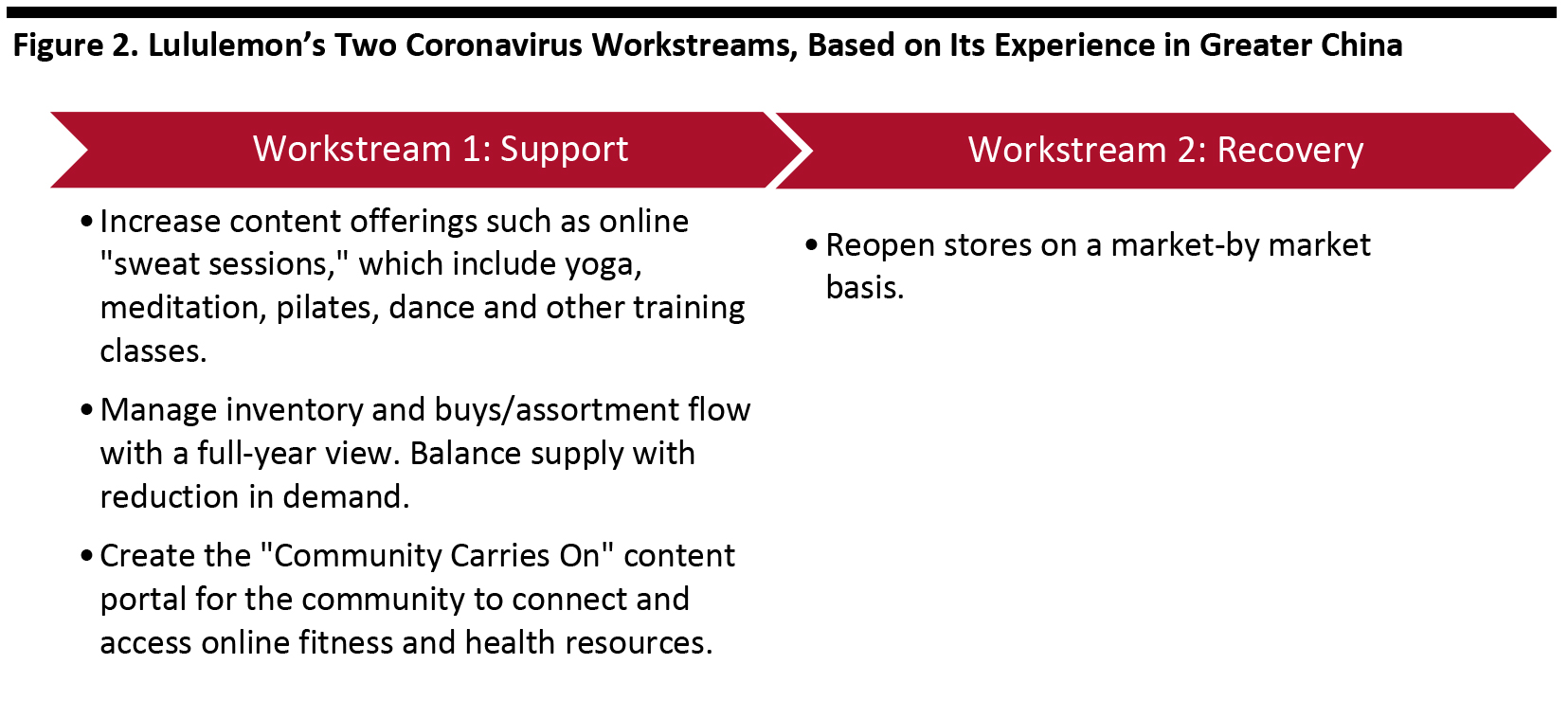

Lululemon summarized its learnings from the coronavirus situation in China into two high-level workstreams—“support” and “recovery.” Management is focusing on support activities, such as inventory management, creating a new content portal for fitness and health and offering online exercise classes to customers. The company plans to reopen stores on a market-by-market basis in the recovery phase.

[caption id="attachment_107177" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Lululemon Lessons Learned: Two Workstreams

Lululemon summarized its learnings from the coronavirus situation in China into two high-level workstreams—“support” and “recovery.” Management is focusing on support activities, such as inventory management, creating a new content portal for fitness and health and offering online exercise classes to customers. The company plans to reopen stores on a market-by-market basis in the recovery phase.

[caption id="attachment_107177" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Nike Training Club Premium app

Nike Training Club Premium app

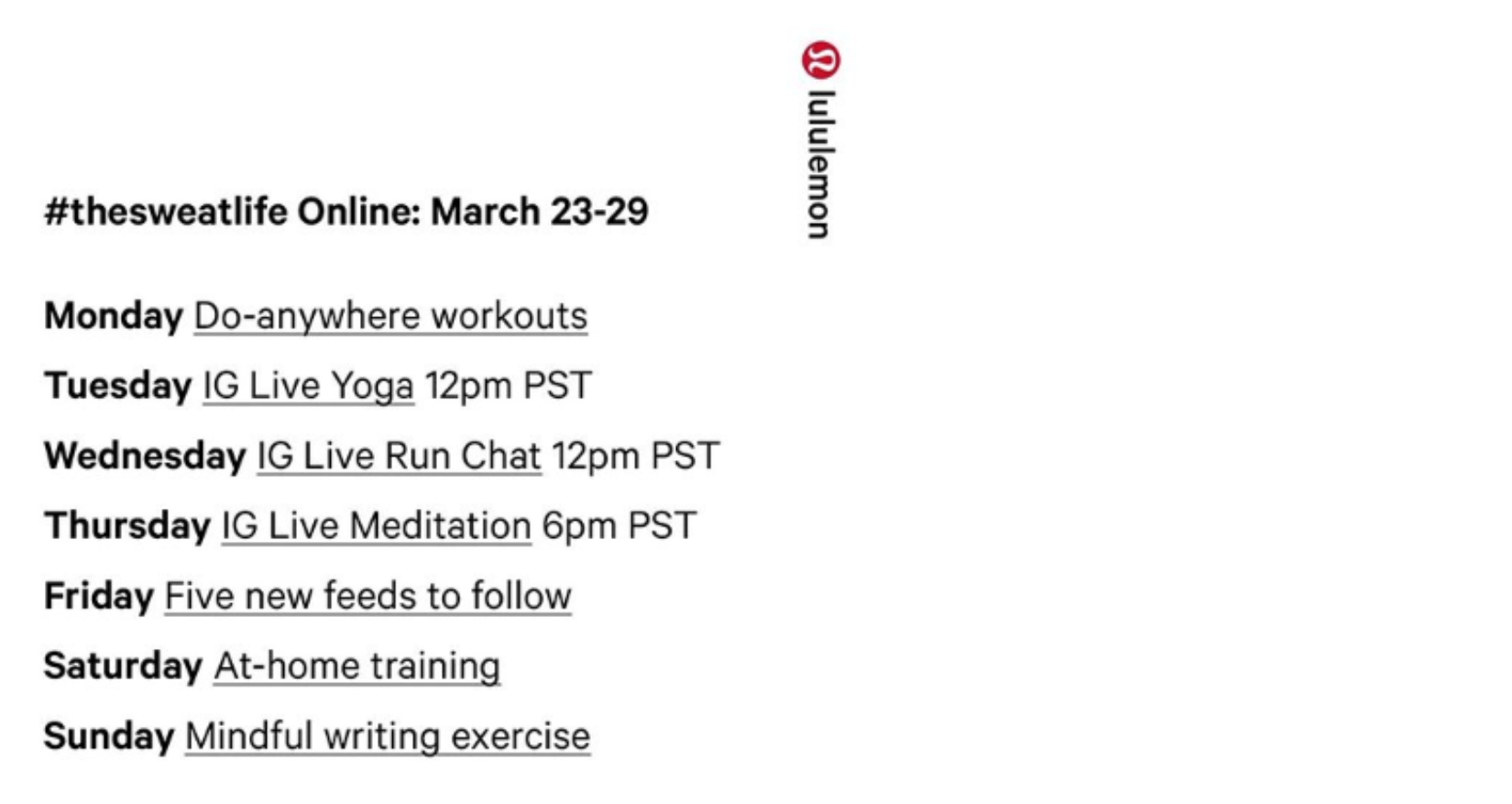

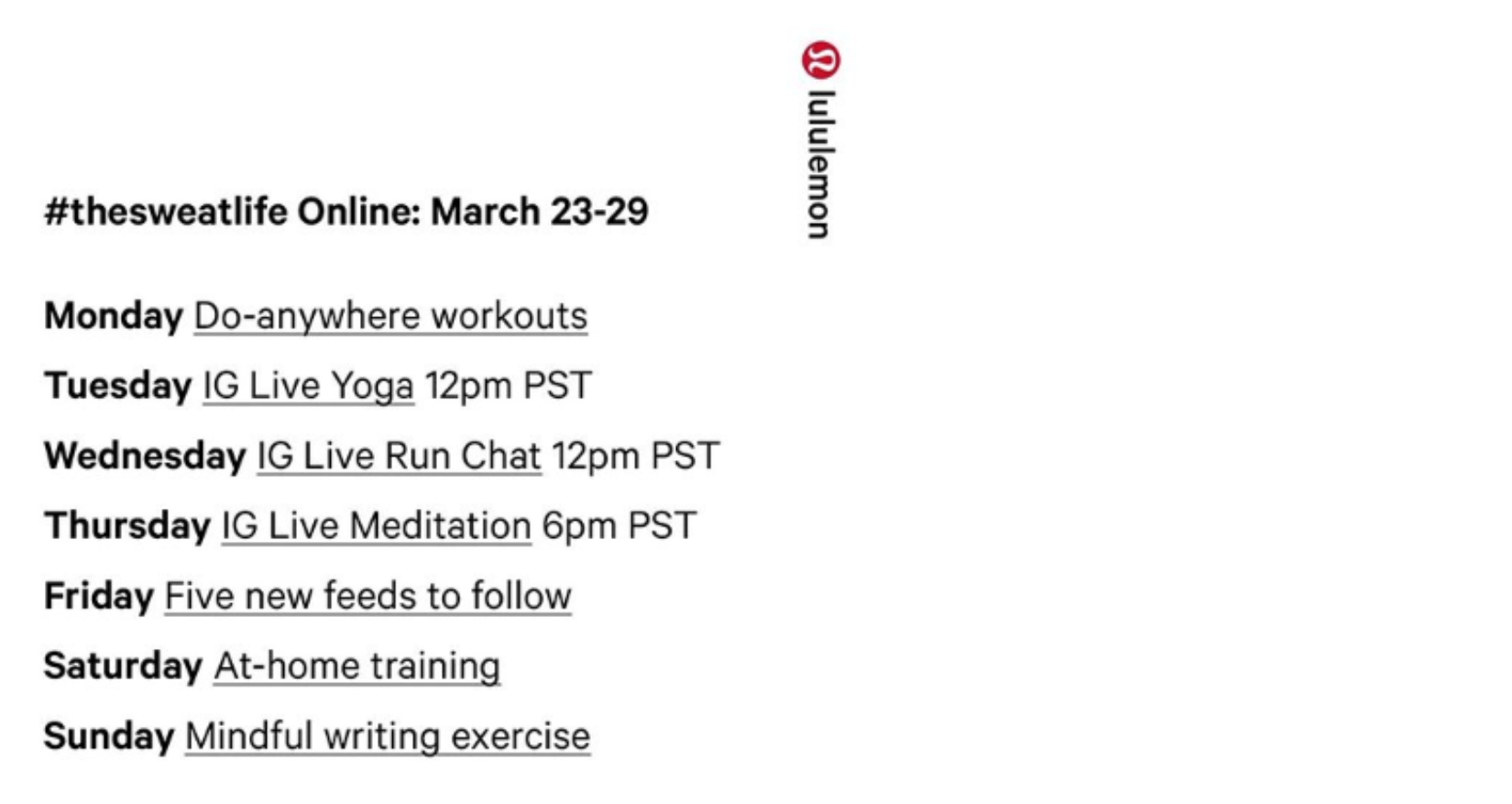

Source: NIKE [/caption] Lululemon’s Live Classes on Instagram In order to stay engaged with consumers during the escalating coronavirus pandemic in the West, Lululemon reported that its North America and Europe businesses followed the lead of China, where the retailer gained thousands of new followers on social media platform WeChat. On Instagram, Lululemon began offering online “sweat sessions” for yoga, meditation, Pilates, dance and other training exercises. During the first week of store closures in the US, 170,000 viewers joined the company’s live classes. [caption id="attachment_107179" align="aligncenter" width="700"] Source: Lululemon/Instagram[/caption]

Lululemon’s “Community Carries On” Content Portal

In addition to reaching out to consumers over social media, Lululemon collected online content from its ambassadors to create a new Community Carries On content portal on its global website. Consumers can access online fitness and health resources through this centralized hub, and the company is also using it as a platform to promote its social media channels to drive further engagement. Lululemon also launched a $2 million global Ambassador Relief Fund to assist its ambassadors—many of whom own studios in their local communities—in sustaining their businesses during the coronavirus.

Source: Lululemon/Instagram[/caption]

Lululemon’s “Community Carries On” Content Portal

In addition to reaching out to consumers over social media, Lululemon collected online content from its ambassadors to create a new Community Carries On content portal on its global website. Consumers can access online fitness and health resources through this centralized hub, and the company is also using it as a platform to promote its social media channels to drive further engagement. Lululemon also launched a $2 million global Ambassador Relief Fund to assist its ambassadors—many of whom own studios in their local communities—in sustaining their businesses during the coronavirus.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

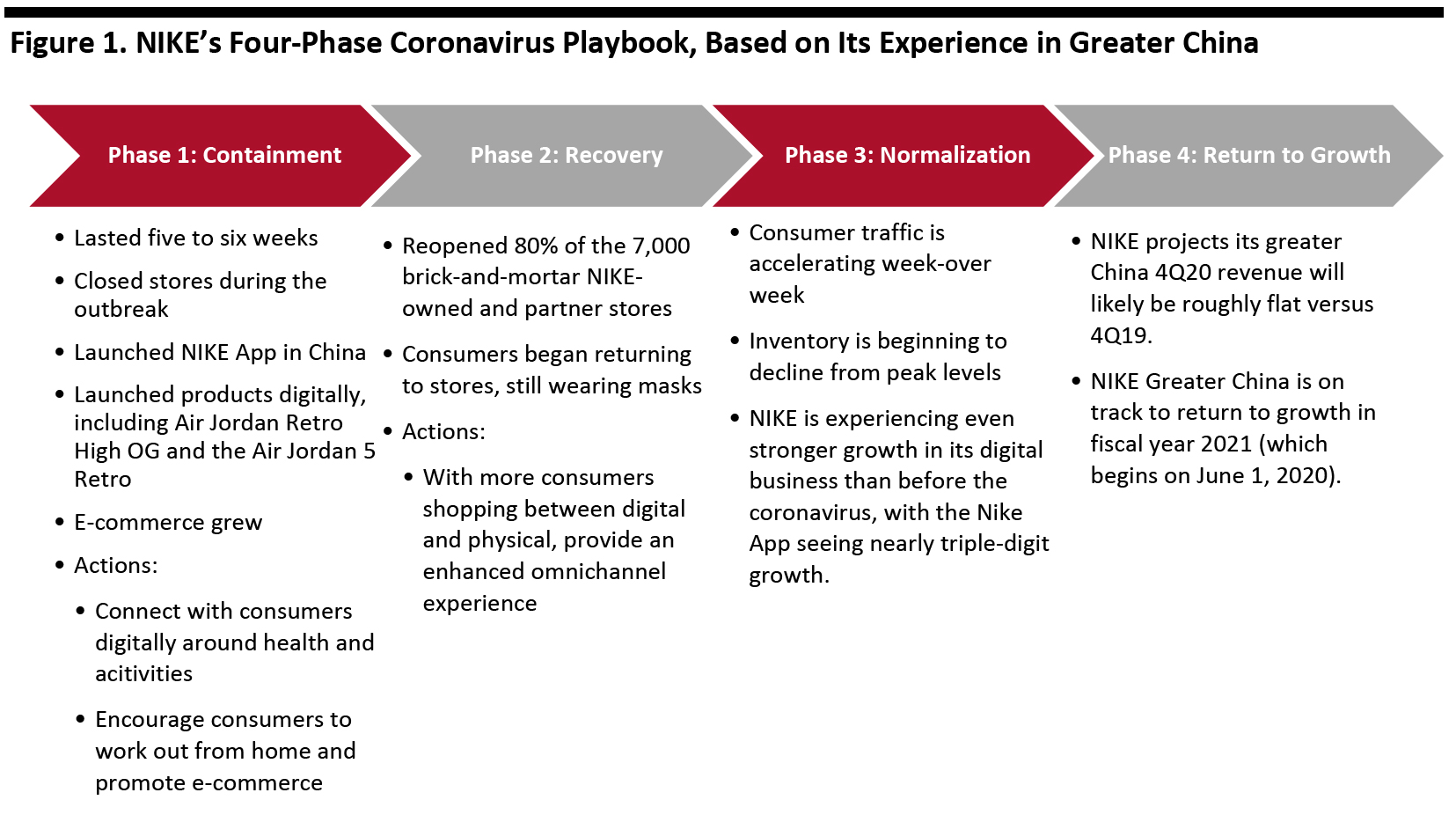

Overview of the Companies’ Learnings from China

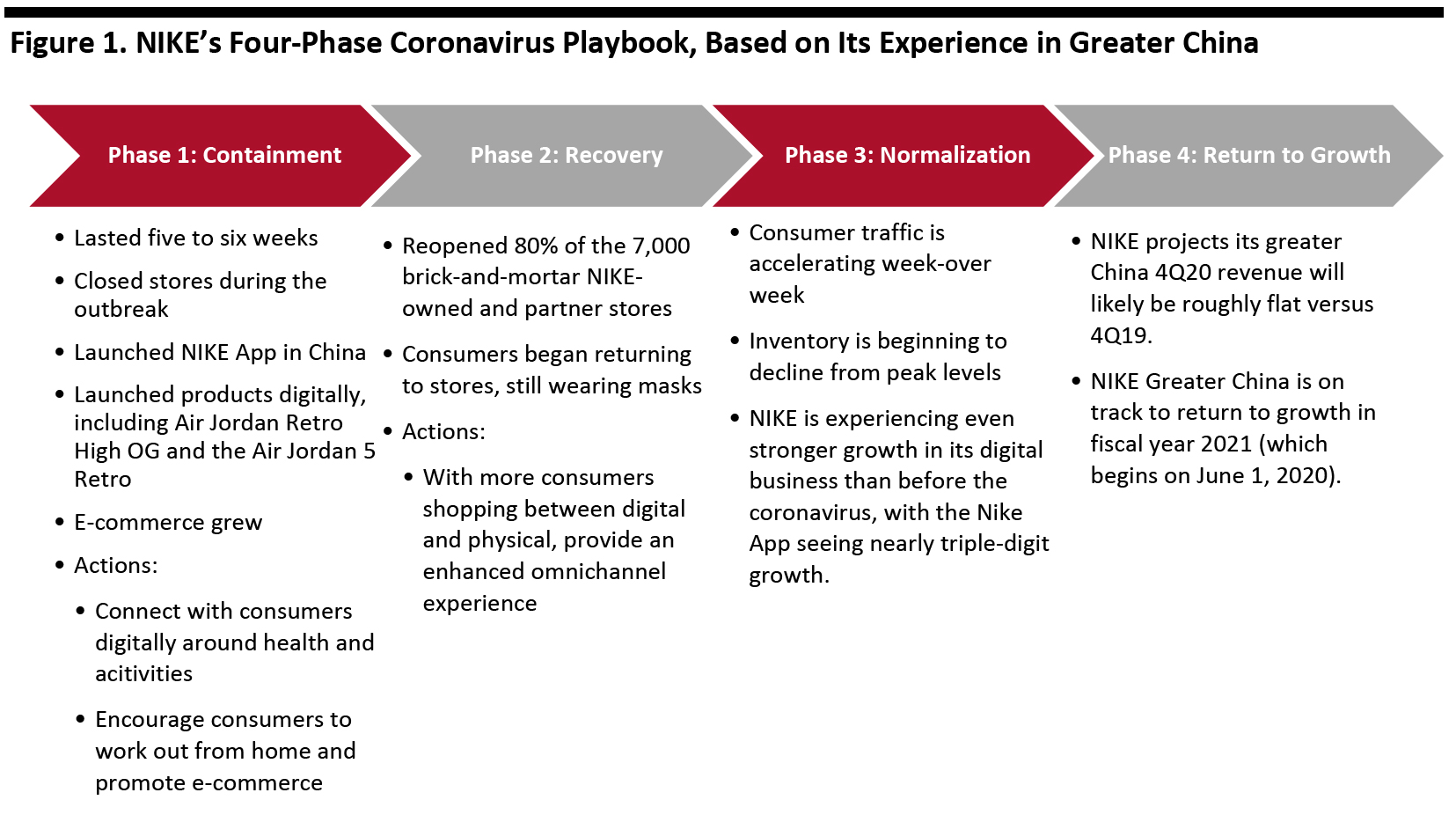

NIKE Playbook: Four Phases NIKE management reported that the company is now “on the other side” of the crisis in China and is able to consolidate its experiences into a “playbook.” The company identified four phases that it predicts each of its markets will progress through over the course of the coronavirus crisis (see Figure 1). NIKE currently considers itself to be in Phase 3 in China and is now seeing early momentum in Japan and South Korea too; the company is in Phase 1 in Europe and North America. [caption id="attachment_107176" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Lululemon Lessons Learned: Two Workstreams

Lululemon summarized its learnings from the coronavirus situation in China into two high-level workstreams—“support” and “recovery.” Management is focusing on support activities, such as inventory management, creating a new content portal for fitness and health and offering online exercise classes to customers. The company plans to reopen stores on a market-by-market basis in the recovery phase.

[caption id="attachment_107177" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Lululemon Lessons Learned: Two Workstreams

Lululemon summarized its learnings from the coronavirus situation in China into two high-level workstreams—“support” and “recovery.” Management is focusing on support activities, such as inventory management, creating a new content portal for fitness and health and offering online exercise classes to customers. The company plans to reopen stores on a market-by-market basis in the recovery phase.

[caption id="attachment_107177" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Engaging with Consumers Online; Inspiring At-Home Workouts

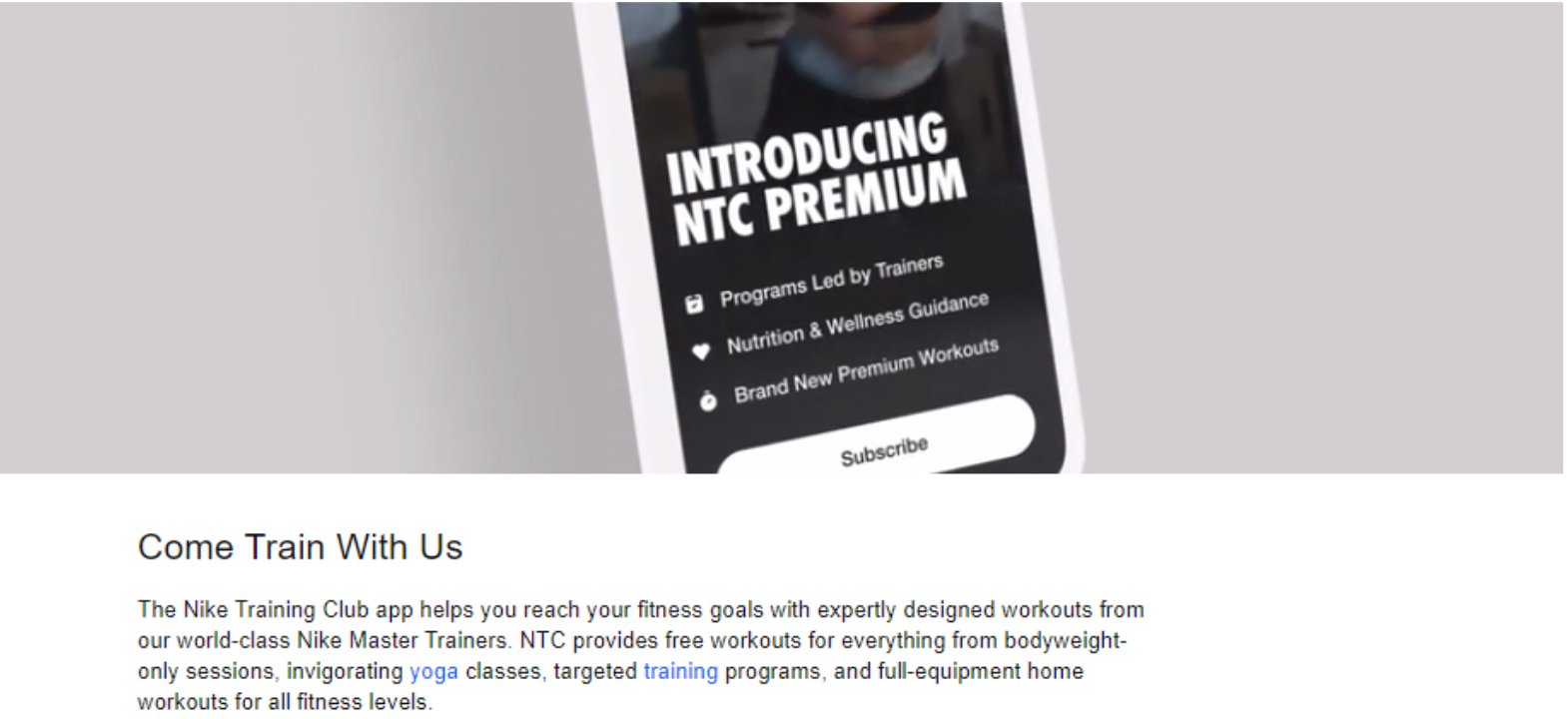

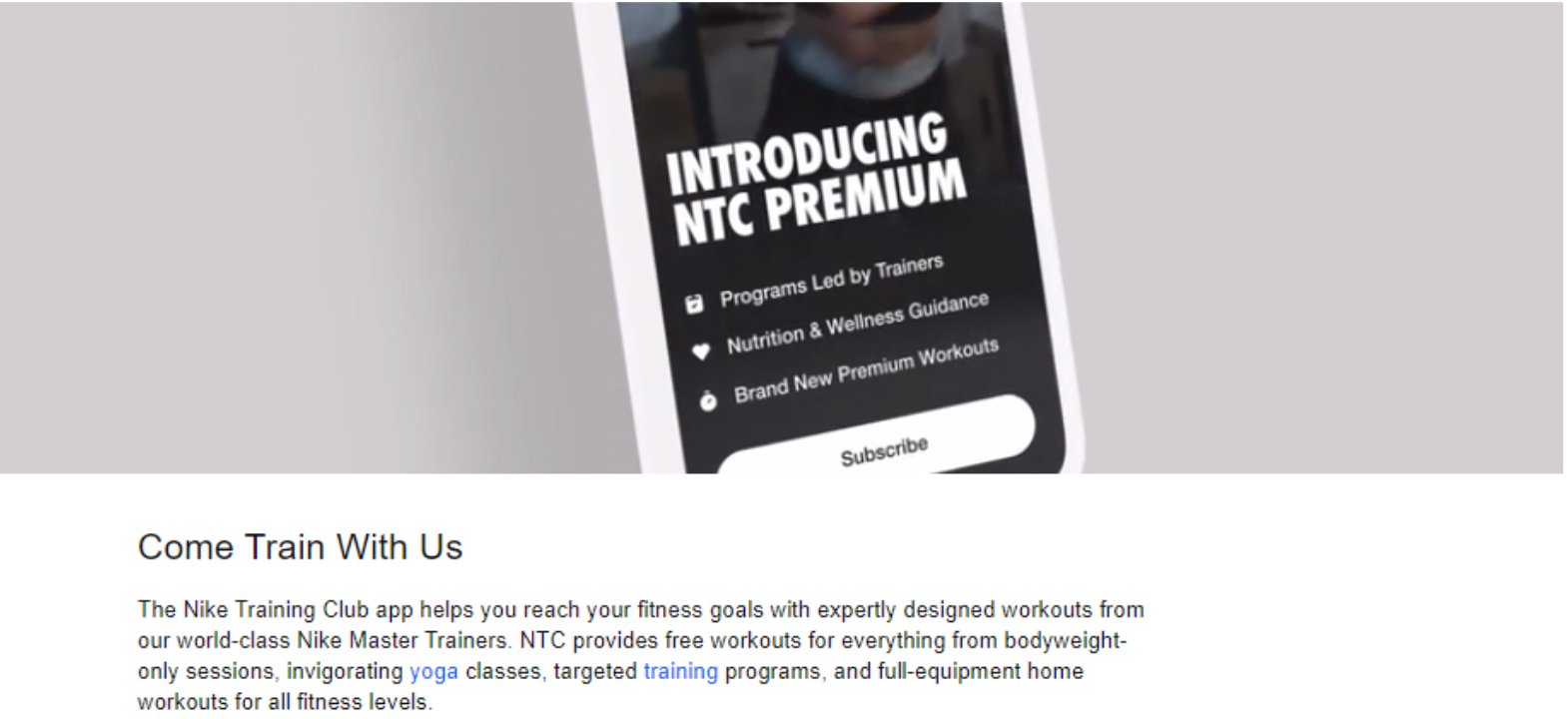

NIKE and Lululemon used digital channels to encourage and inspire Chinese consumers to stay in, stay active, stay healthy and stay connected. This engagement contributed to the success of both companies during the coronavirus, according to company reports. NIKE’s Activity Apps NIKE launched its Nike App in China in the third quarter of fiscal year 2020, and the company reported that there have so far been 5 million Nike App downloads. NIKE has been leveraging its digital app ecosystem and Nike Expert Trainer network to engage with consumers across China since home quarantines were initiated. The company has seen a spike in weekly average users across its activity apps (including Nike Run Club and Nike Training Club) as the company continues to inspire and enable consumers to engage in fitness activities at home—representing an 80% increase by the end of the third quarter versus the beginning of the quarter. Based on this performance, NIKE sought to increase its app penetration in the US by offering its Nike Training Club Premium subscription for free for 90 days—which offers on-demand workouts and expert tips from master trainers, as well as inspiration and support for healthy living. The company reported that digital is NIKE’s fastest-growing channel, up 36% in the third quarter of fiscal year 2020. Owned and partnered digital represents more than 20% of NIKE’s overall business, and apps are a “sharp point” of growth. The company reported that the Nike App saw nearly triple-digit revenue growth in the third quarter. [caption id="attachment_107178" align="aligncenter" width="700"] Nike Training Club Premium app

Nike Training Club Premium app Source: NIKE [/caption] Lululemon’s Live Classes on Instagram In order to stay engaged with consumers during the escalating coronavirus pandemic in the West, Lululemon reported that its North America and Europe businesses followed the lead of China, where the retailer gained thousands of new followers on social media platform WeChat. On Instagram, Lululemon began offering online “sweat sessions” for yoga, meditation, Pilates, dance and other training exercises. During the first week of store closures in the US, 170,000 viewers joined the company’s live classes. [caption id="attachment_107179" align="aligncenter" width="700"]

Source: Lululemon/Instagram[/caption]

Lululemon’s “Community Carries On” Content Portal

In addition to reaching out to consumers over social media, Lululemon collected online content from its ambassadors to create a new Community Carries On content portal on its global website. Consumers can access online fitness and health resources through this centralized hub, and the company is also using it as a platform to promote its social media channels to drive further engagement. Lululemon also launched a $2 million global Ambassador Relief Fund to assist its ambassadors—many of whom own studios in their local communities—in sustaining their businesses during the coronavirus.

Source: Lululemon/Instagram[/caption]

Lululemon’s “Community Carries On” Content Portal

In addition to reaching out to consumers over social media, Lululemon collected online content from its ambassadors to create a new Community Carries On content portal on its global website. Consumers can access online fitness and health resources through this centralized hub, and the company is also using it as a platform to promote its social media channels to drive further engagement. Lululemon also launched a $2 million global Ambassador Relief Fund to assist its ambassadors—many of whom own studios in their local communities—in sustaining their businesses during the coronavirus.

Growing Digital Commerce through Digital Marketing

NIKE reported that its digital marketing campaigns have successfully engaged customers and thus helped to accelerate the company’s digital commerce growth beyond pre-coronavirus levels. NIKE said that while its third-quarter 2020 results in Greater China were significantly impacted by the coronavirus, it is now through the recovery phase and into the normalization phase. The strong engagement of Chinese consumers with the company’s activity apps contributed to 30% growth in NIKE’s digital business in China over the quarter. NIKE reported that its digital commerce growth continues to accelerate as the majority of its stores and partner stores open, with retail traffic accelerating week over week. Inventory is starting to decrease. NIKE reported that it has applied this same digital strategy in North America, focusing on the shipment of digital orders while maintaining operations in its distribution centers and implementing social distancing and reduced staffing. On the company’s earnings call on March 24, 2020, management highlighted that digital commerce sales “over just the past few days” have approached holiday peak levels, growing “triple digits over just the past week.”Product Innovation

Innovation is at the heart of both companies: NIKE has over 1,000 product designers across footwear and apparel; and “product innovation” is one of the three pillars in Lululemon’s five-year growth plan. NIKE management said that it got creative with a few product launches that were scheduled to be released in February 2020, making them digital-only in China. For example, the Air Jordan Retro High OG and the Air Jordan 5 Retro were launched digitally as stores were temporarily closed. NIKE reported that it is going to proceed with the product pipeline due to the strong digital demand it has seen. Furthermore, NIKE reported that it still plans to launch some of its product innovations that center around sustainability “when the time is right.” Such products include the VaporMax 2020, which utilizes 75% recycled manufacturing waste, and the Space Hippie line of “low-carbon-footprint footwear.”Maintaining Positions of Strength

NIKE and Lululemon highlighted similar factors that helped them to maintain a position of strength through the coronavirus crisis in China—and which may see them through the global pandemic. [caption id="attachment_107180" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]