DIpil Das

It has been more than six months since the outbreak of Covid-19 in China and over three since the National Health Commission stated on March 12, 2020 that the country had passed the peak of the outbreak. There have been signs of recovery in China following the lifting of the lockdown, and retailers have been making efforts to attract customers back to physical stores. The Coresight Research team observed the current retail environment in Shanghai to assess the success of such initiatives.

Attracting Young Consumers Post Crisis

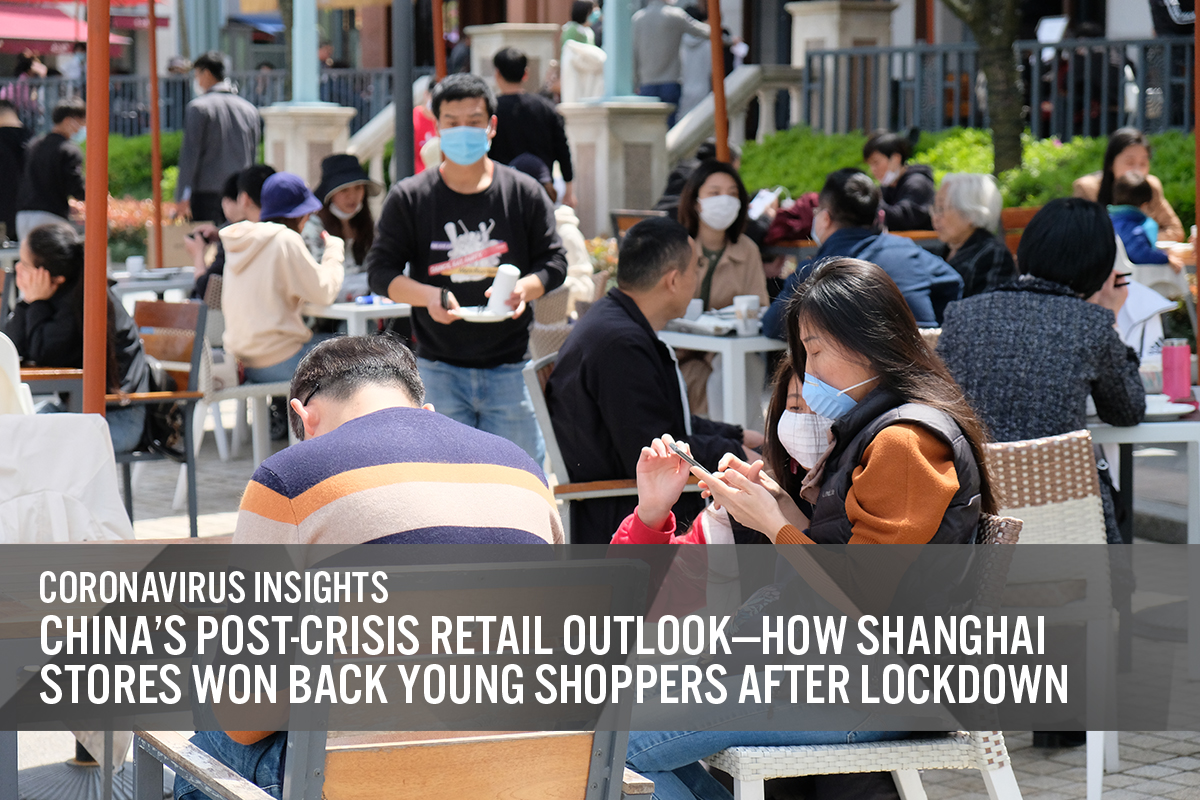

On June 14, 2020, the crossroads of Anfu Road and Wukang Road, Shanghai, were extremely crowded. Young people were gathered together to enjoy brunch or coffee with friends, wearing masks. A few notable retailers capitalized on the high foot traffic to attract this young consumer demographic into their stores—including Harmay (a beauty store) and The Beast Shop (a lifestyle chain store).

[caption id="attachment_112024" align="aligncenter" width="700"] Crowds of young people in cafes and at the crossroads of Anfu Road and Wukang Road, Shanghai

Crowds of young people in cafes and at the crossroads of Anfu Road and Wukang Road, Shanghai

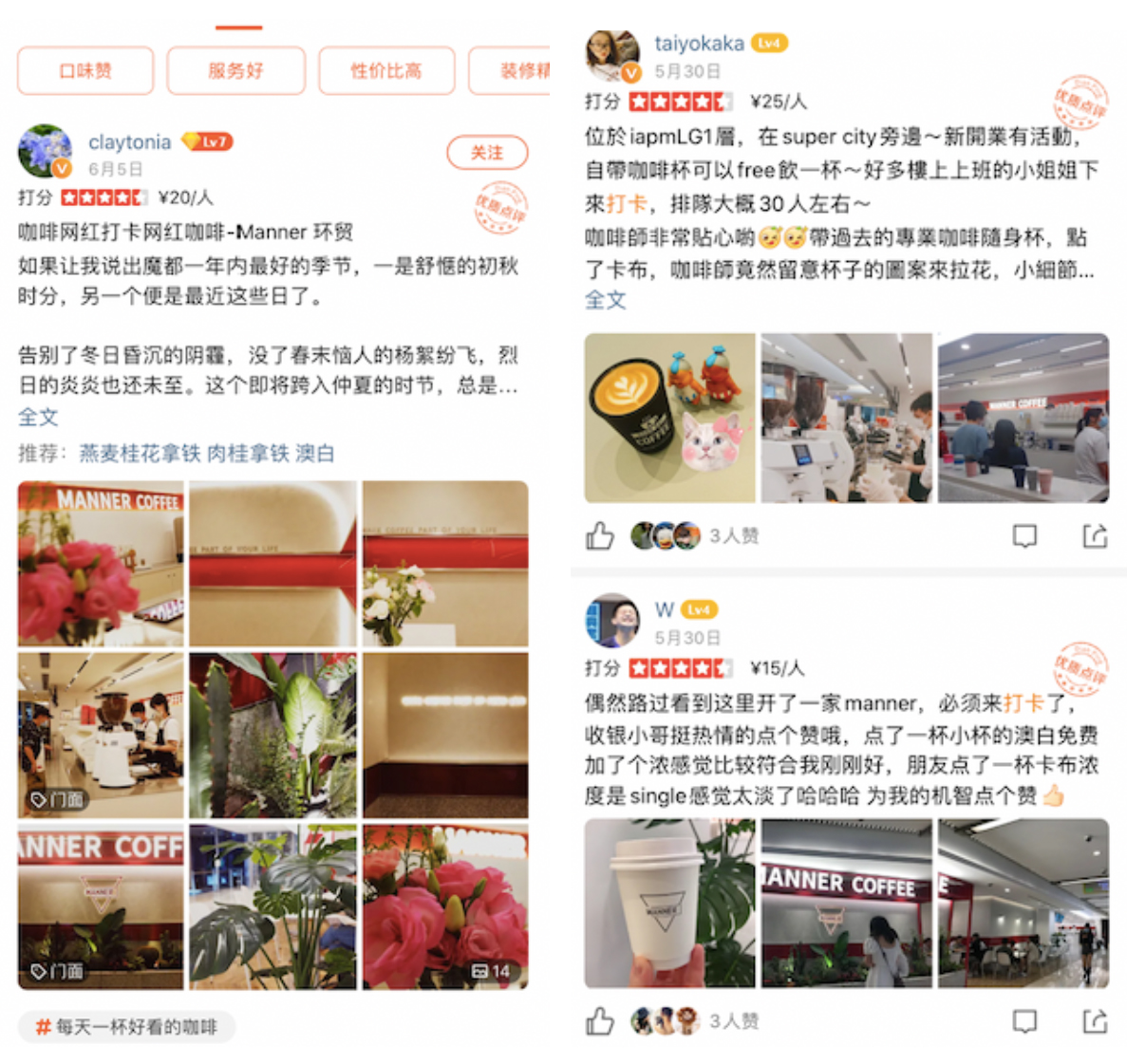

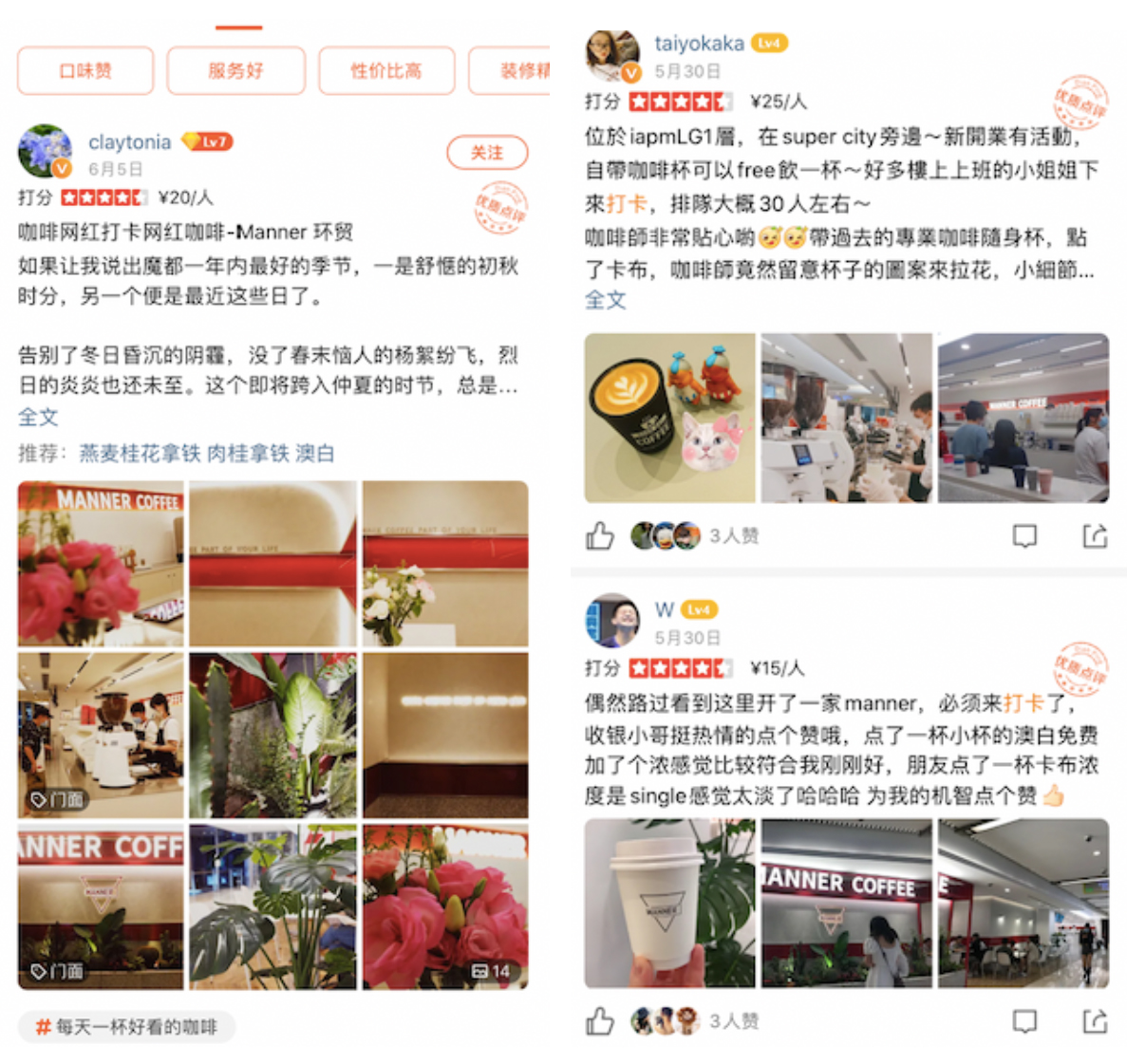

Source: Coresight Research [/caption] One particularly popular destination was the new store of Manner Coffee, a value-price coffee chain, which saw long queues. The new store also achieved high engagement through social media, as young consumers “checked in” and shared photographs and details of their visits; this trend has re-emerged in Shanghai after the coronavirus lockdown was lifted, because consumers are valuing retail and food-service experiences after a long time of staying/working at home. The new Manner Coffee store also offered deals to draw in crowds, such as free coffee within the first three days of opening for consumers who brought their own cup, and discounts thereafter. [caption id="attachment_112025" align="aligncenter" width="700"] The new Manner Coffee store saw high social media engagement

The new Manner Coffee store saw high social media engagement

Source: dianping.com [/caption] [caption id="attachment_112026" align="aligncenter" width="700"] Long queues outside Manner Coffee’s new store

Long queues outside Manner Coffee’s new store

Source: Coresight Research [/caption] Harmay is a beauty retailer that began operating on Alibaba’s Taobao platform in 2008. Currently, the company sells through three channels: Harmay’s Tmall store

Harmay’s Tmall store

Source: Harmay/Tmall [/caption] Following the coronavirus lockdown, Harmay has issued coupons and free membership points to visitors to its Shanghai store, in order to attract new customers as well as encourage the return of existing members. Furthermore, the retailer has fostered its reputation as among young shoppers: According to social media platforms RED and Weibo, young consumers view Harmay’s Shanghai store as the “largest luxury beauty sample center” and the stylist “beauty warehouse.” There are a number of factors that have contributed to the success of Harmay during and post crisis: Harmay’s Shanghai store

Harmay’s Shanghai store

Source: Coresight Research [/caption] The Beast Shop flagship store, located on Anfu Road, was another frequently visited spot by young people during the weekends after it reopened following the coronavirus lockdown. The Beast Shop is a flower shop that transformed into an artistic lifestyle brand. In addition to its offline flower shops, The Beast Shop has a coffee-shop brand (The Beast Café), furniture-store brand (Beast Home), home brand (T-B-H) and beauty and lifestyle concept store (Little B). The company’s current product line therefore encompasses art, home furnishings, kitchen products, cosmetics, fragrances and jewelry accessories. The Beast Shop operates an omnichannel model, with a shopping portal website and WeChat account—through which it runs a membership program and mini-program. Each of the company’s brick-and-mortar stores has a different style of decoration, but all are tailored to the tastes of the modern, young consumer in Tier 1 cities in China. According to The Beast Shop, it ultimately aims to have a portfolio of “1,000 stores with 1,000 different looks.” The flagship store on Anfu Road offers an immersive shopping environment through its artistic and stylistic design, prompting visitors to share their experiences and photographs on social media. The store has become a destination for consumers to explore artwork and discuss new trends as well as to shop. After the lockdown, The Beast Shop encouraged visitors to its store in Shanghai by offering a free bouquet of flowers to each consumer that registered as a new member by scanning a QR code. [caption id="attachment_112029" align="aligncenter" width="700"] The Beast Shop’s flagship store in Shanghai

The Beast Shop’s flagship store in Shanghai

Source: Coresight Research [/caption] [caption id="attachment_112030" align="aligncenter" width="700"] The Beast Shop’s website

The Beast Shop’s website

Source: Company website [/caption] Key Insights In the wake of the coronavirus crisis, Chinese consumers appear to be enjoying the shopping experience in physical stores, using it as an opportunity to socialize with friends and get outside following the lockdown. In order to further appeal to young shoppers, retailers need to consider how to satisfy their emotional and social needs beyond simply selling products. The omnichannel shopping habits of the young demographic may have been exacerbated by the crisis, as many stores were shut and so consumers turned to e-commerce. Brands and retailers can look to continue engaging with shoppers both online and offline moving forward, providing differentiated offerings and experiences to drive traffic and sales. Furthermore, brands should leverage social media trends to increase awareness by exploring artistic and engaging store décor and formats—which would encourage visitors to share their experiences digitally.

Crowds of young people in cafes and at the crossroads of Anfu Road and Wukang Road, Shanghai

Crowds of young people in cafes and at the crossroads of Anfu Road and Wukang Road, Shanghai Source: Coresight Research [/caption] One particularly popular destination was the new store of Manner Coffee, a value-price coffee chain, which saw long queues. The new store also achieved high engagement through social media, as young consumers “checked in” and shared photographs and details of their visits; this trend has re-emerged in Shanghai after the coronavirus lockdown was lifted, because consumers are valuing retail and food-service experiences after a long time of staying/working at home. The new Manner Coffee store also offered deals to draw in crowds, such as free coffee within the first three days of opening for consumers who brought their own cup, and discounts thereafter. [caption id="attachment_112025" align="aligncenter" width="700"]

The new Manner Coffee store saw high social media engagement

The new Manner Coffee store saw high social media engagement Source: dianping.com [/caption] [caption id="attachment_112026" align="aligncenter" width="700"]

Long queues outside Manner Coffee’s new store

Long queues outside Manner Coffee’s new store Source: Coresight Research [/caption] Harmay is a beauty retailer that began operating on Alibaba’s Taobao platform in 2008. Currently, the company sells through three channels:

- Online—Harmay operates a flagship store Tmall that has a large fan base of 195,000. It also leverages social media, running a WeChat mini-program and gaining exposure on RED, a Chinese lifestyle app.

- Offline physical stores—Besides the Shanghai Anfu Road flagship store, Harmay has a Beijing Sanlitun store and a Hong Kong store that is currently under renovation.

- Harmay also represents and distributes a wide range of niche beauty brands that consumers cannot find in mainstream channels. At present, it is the representative agent of American skincare brands such as Erno Laszlo and Dermalogica, European brand Stenders and French makeup brand Paul & Joe.

Harmay’s Tmall store

Harmay’s Tmall store Source: Harmay/Tmall [/caption] Following the coronavirus lockdown, Harmay has issued coupons and free membership points to visitors to its Shanghai store, in order to attract new customers as well as encourage the return of existing members. Furthermore, the retailer has fostered its reputation as among young shoppers: According to social media platforms RED and Weibo, young consumers view Harmay’s Shanghai store as the “largest luxury beauty sample center” and the stylist “beauty warehouse.” There are a number of factors that have contributed to the success of Harmay during and post crisis:

- The Shanghai store features Instagram-friendly decor with a warehouse feel, boosting its standing as a hot pop-culture spot for millennials to socialize with their peers.

- The retailer’s omnichannel selling approach suits the shopping behaviors of young people, who may use the online channel for discovering and browsing products, and offline stores for the shopping experience and to take advantage of special offers. This model also enabled the retailer to remain engaged with consumers during the coronavirus lockdown.

- Harmay sells a wide range of small and medium-sized samples from luxury beauty brands such as La Mer, La Prairie and Valmont. This allows young consumers to try out different luxury products at lower prices.

- Harmay features products from niche international brands that Chinese shoppers cannot find elsewhere. The retailer is therefore appealing to young consumers in China, who are typically driven by new and unique offerings.

- The average price point of Harmay’s products is between duty-free shops and brands’ own stores (or Sephora): Smaller sample products are available at less than ¥100 (around $14.30), which is a good entry point for shoppers who want to trial a brand first. Harmay also enables consumers to explore multiple brands in the same location.

Harmay’s Shanghai store

Harmay’s Shanghai store Source: Coresight Research [/caption] The Beast Shop flagship store, located on Anfu Road, was another frequently visited spot by young people during the weekends after it reopened following the coronavirus lockdown. The Beast Shop is a flower shop that transformed into an artistic lifestyle brand. In addition to its offline flower shops, The Beast Shop has a coffee-shop brand (The Beast Café), furniture-store brand (Beast Home), home brand (T-B-H) and beauty and lifestyle concept store (Little B). The company’s current product line therefore encompasses art, home furnishings, kitchen products, cosmetics, fragrances and jewelry accessories. The Beast Shop operates an omnichannel model, with a shopping portal website and WeChat account—through which it runs a membership program and mini-program. Each of the company’s brick-and-mortar stores has a different style of decoration, but all are tailored to the tastes of the modern, young consumer in Tier 1 cities in China. According to The Beast Shop, it ultimately aims to have a portfolio of “1,000 stores with 1,000 different looks.” The flagship store on Anfu Road offers an immersive shopping environment through its artistic and stylistic design, prompting visitors to share their experiences and photographs on social media. The store has become a destination for consumers to explore artwork and discuss new trends as well as to shop. After the lockdown, The Beast Shop encouraged visitors to its store in Shanghai by offering a free bouquet of flowers to each consumer that registered as a new member by scanning a QR code. [caption id="attachment_112029" align="aligncenter" width="700"]

The Beast Shop’s flagship store in Shanghai

The Beast Shop’s flagship store in Shanghai Source: Coresight Research [/caption] [caption id="attachment_112030" align="aligncenter" width="700"]

The Beast Shop’s website

The Beast Shop’s website Source: Company website [/caption] Key Insights In the wake of the coronavirus crisis, Chinese consumers appear to be enjoying the shopping experience in physical stores, using it as an opportunity to socialize with friends and get outside following the lockdown. In order to further appeal to young shoppers, retailers need to consider how to satisfy their emotional and social needs beyond simply selling products. The omnichannel shopping habits of the young demographic may have been exacerbated by the crisis, as many stores were shut and so consumers turned to e-commerce. Brands and retailers can look to continue engaging with shoppers both online and offline moving forward, providing differentiated offerings and experiences to drive traffic and sales. Furthermore, brands should leverage social media trends to increase awareness by exploring artistic and engaging store décor and formats—which would encourage visitors to share their experiences digitally.