DIpil Das

The Coronavirus Lockdown in China

The coronavirus broke out in China in right before the Chinese Near Year national holiday in January. As the situation worsened, China imposed a strict lockdown in the origin city of Wuhan and four other cities in Hubei province on January 23, 2020. The nation then implemented a number of unprecedented preventative measures to contain the spread of the virus, such as banning gatherings, suspending flights and trains, blocking roads and closing public areas, stores and restaurants. As a result, the economy was hit hard: China’s retail sales slid some 20.5% in January/February compared to the same period last year as the coronavirus outbreak hammered discretionary demand, according to mid-March 2020 data from China’s National Bureau of Statistics.

However, these measures proved successful, with China’s National Health Commission stating on March 12 that the nation had passed the peak of the outbreak. Furthermore, on March 19, China reported zero new domestic cases for the first time since the outbreak began. We discuss the signs of recovery in China and the emergence of a new normal for Chinese consumers.

Business Operations Resume

After many business operations were temporarily suspended from January 2020 as multiple industries implemented widespread store/office/facility closures, operations in China began to resume at the beginning of March. The average rate of resumption reached 50% on March 5 and continued to rise, according to Baidu Big Data. On that date, the top five industries with the highest rates of employees returning to work were finance, automobile, catering, hospitality and supermarkets/shopping malls (shown in Figure 1).

Figure 1. Top Five Industries with the Highest Return Rates of Employees, as of March 5, 2020

[wpdatachart id=43]

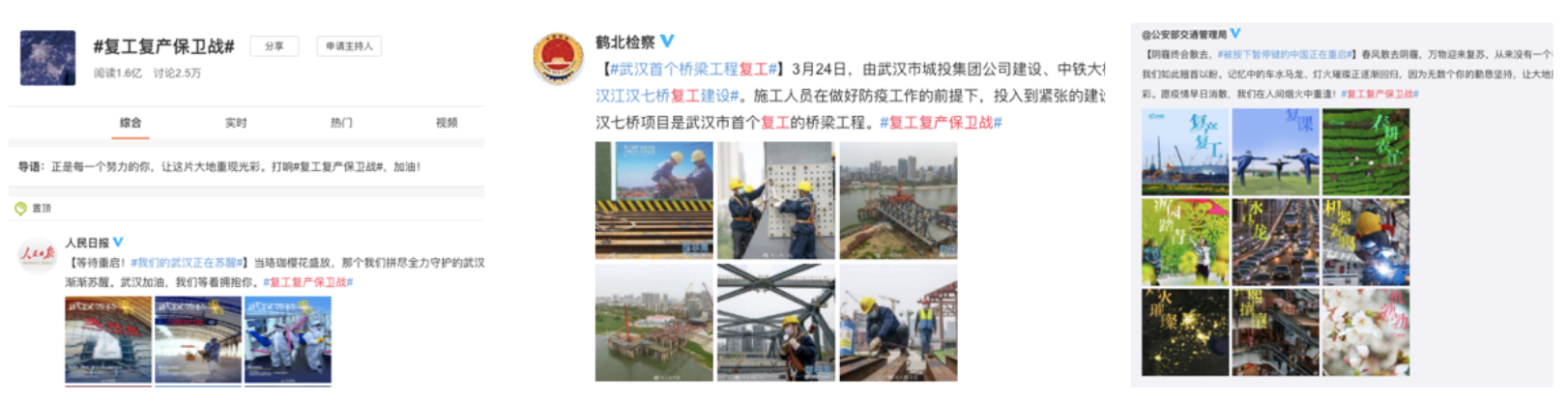

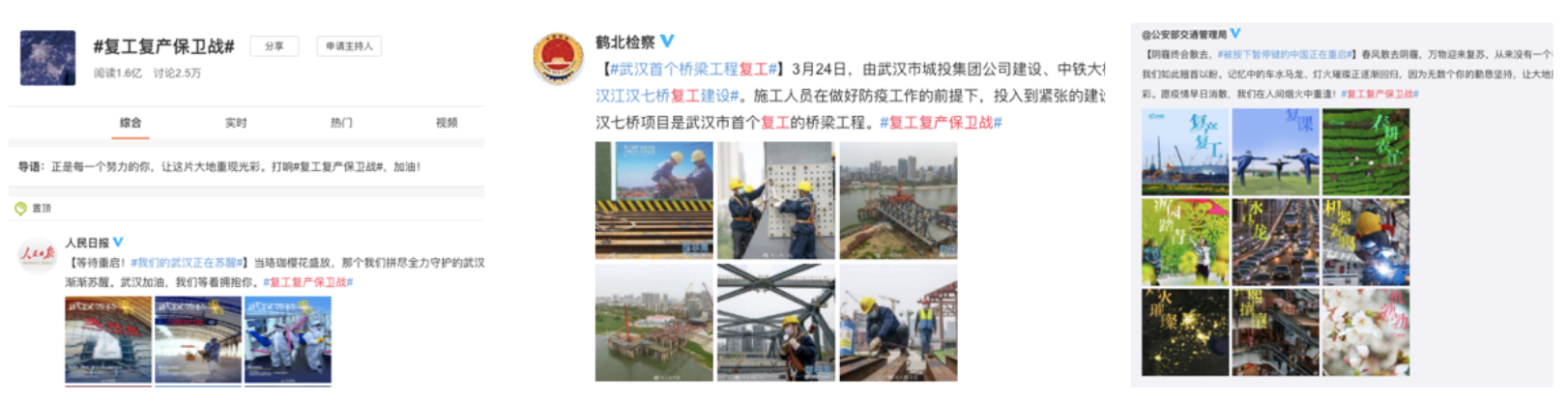

Discussion about “return to work” on Weibo

Discussion about “return to work” on Weibo

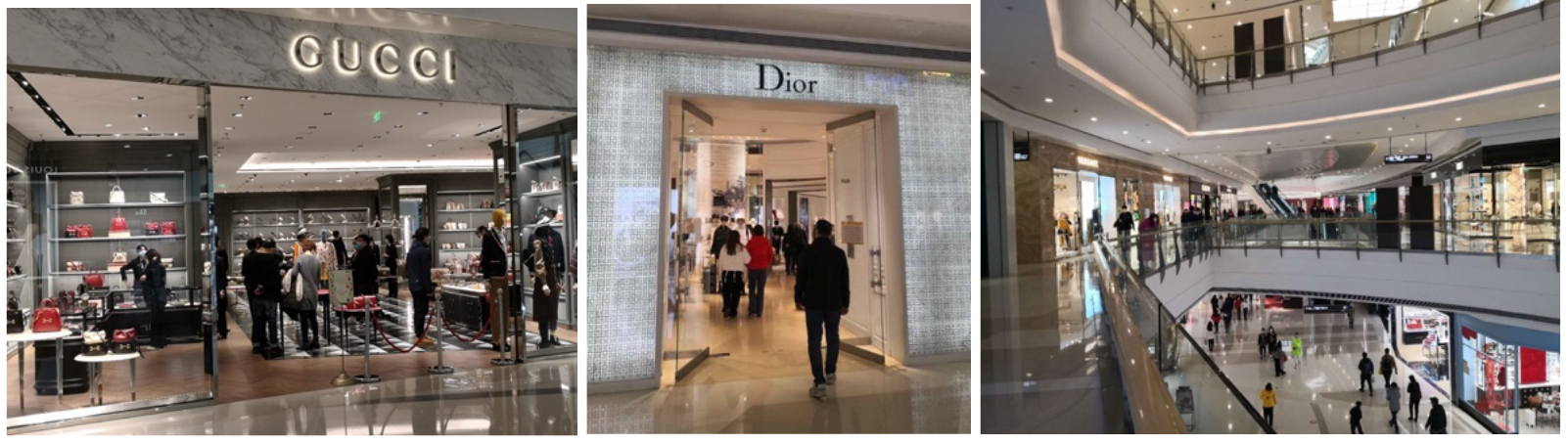

Source: Weibo [/caption] The positive evidence that operations are resuming in China indicates that businesses could recover from the losses experienced in the first quarter of the year. In fact, Joseph Lupton, Senior Global Economist at investment banking company JPMorgan, told CNBC that he expects China’s economy to bounce back from the coronavirus and grow 15% in the second quarter of 2020 on a quarter-on-quarter, annualized basis. However, short-term challenges remain: SMEs face cash-flow difficulties; there are shortages of protective equipment such as masks; and operational capacity across most industries must yet improve to achieve efficiency gains. Multinational Companies Re-Open Stores in Mainland China With lockdowns being lifted as the coronavirus outbreak is gradually brought under control in China, companies have been reopening for business since the beginning of March. A shopping mall in Shengyang on March 23, 2020

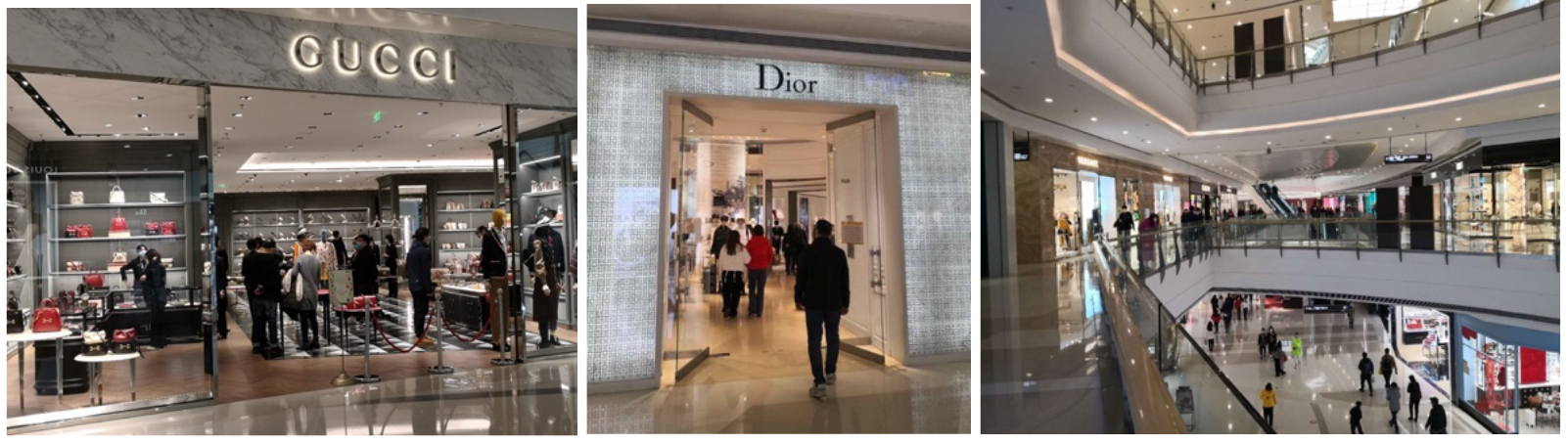

A shopping mall in Shengyang on March 23, 2020

Source: Coresight Research [/caption] Luxury and fashion shopping mall SKP Beijing has been welcoming crowds since the beginning of March, although it limited opening hours to 11:00-18:00 and limited numbers of shoppers permitted inside the stores at any one time. On March 28, it resumed normal opening hours. Consumers have been lining up outside the stores of Chanel, Hermès, Gucci and other luxury brands. [caption id="attachment_107023" align="aligncenter" width="700"] Consumers buying luxury goods in the SKP Beijing shopping center after its reopening

Consumers buying luxury goods in the SKP Beijing shopping center after its reopening

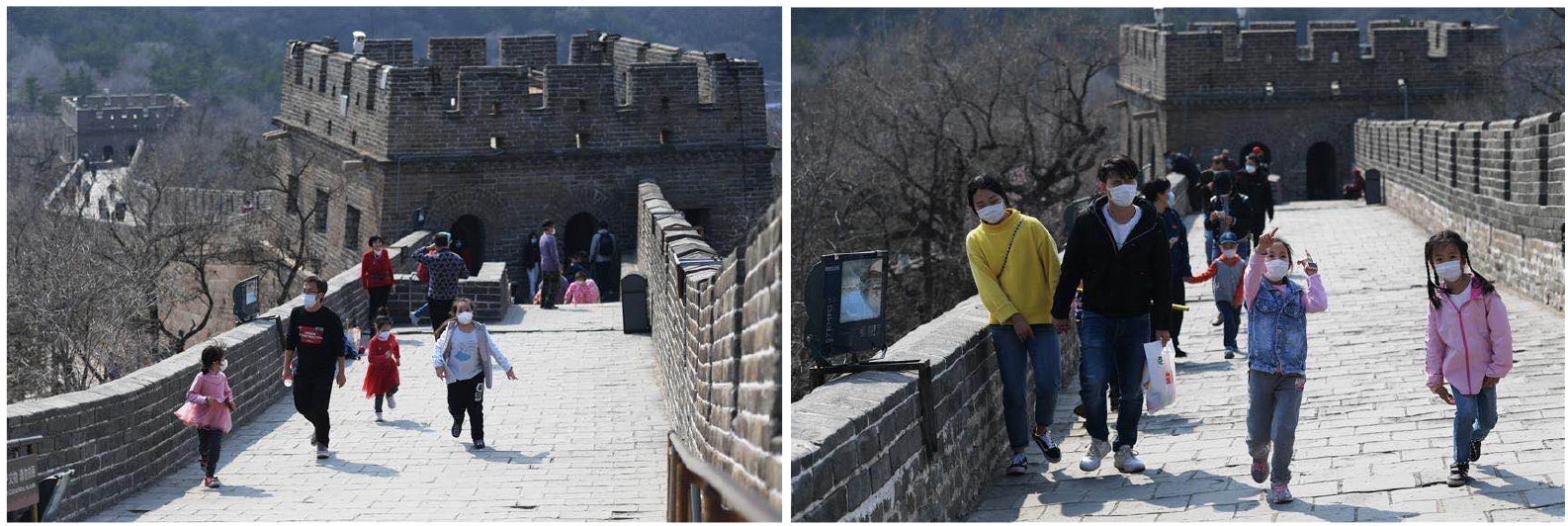

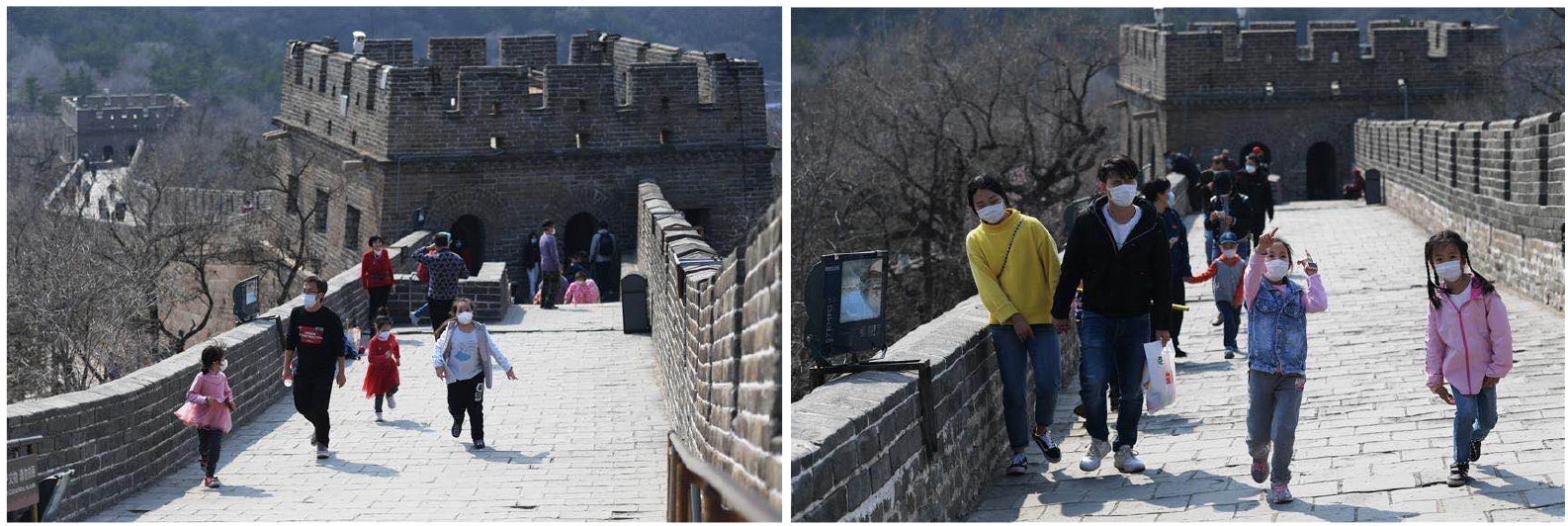

Source: Dianping app [/caption] Demand is also evident in online sales: Alibaba’s data from this year’s “Queen’s Festival” on Tmall—which is centered around International Women’s Day on March 8—showed that overall sales “largely surpassed” sales from last year’s shopping event. For example, US cosmetics brand Elizabeth Arden saw $21.6 million in sales over a two-week period around March 8, which is equivalent to one-fourth of the brand’s total sales in 2019, according to Global Times. The New Normal Involves Precautionary Measures With home quarantines lifted in China, residents are taking the opportunity to get out in public and participate in recreational activities: Public transport, flights, hotels, tourist spots, cinemas and parks are resuming normal operations. Over 20 provinces in China had reopened local tourism operations by March 25, including around 180 museums and more than 3,000 “level A” tourist spots. Shanghai Disney Resort reopened part of its services on March 9, including Disney Town, Starwish Park and shopping and catering areas. In the hospitality industry, over 80% of hotels in China had resumed operations by March 25, according to Chinese travel company Ctrip. Qunar.com, a popular online portal for flights and accommodation, launched a list of “secure hotels” on March 2. The company also reported a 34% week-over-week increase in hotel bookings and an 83% increase in the number of hotel guests on the same date. Airbnb China told Global Times on March 13 that the total number of domestic accommodation searches for 2020 Labor Day (with a check-in time between April 30 and May 5) increased by more than 2.5 times compared to last year. [caption id="attachment_107024" align="aligncenter" width="700"] The Great Wall reopened to visitors, pictured on March 24, 2020

The Great Wall reopened to visitors, pictured on March 24, 2020

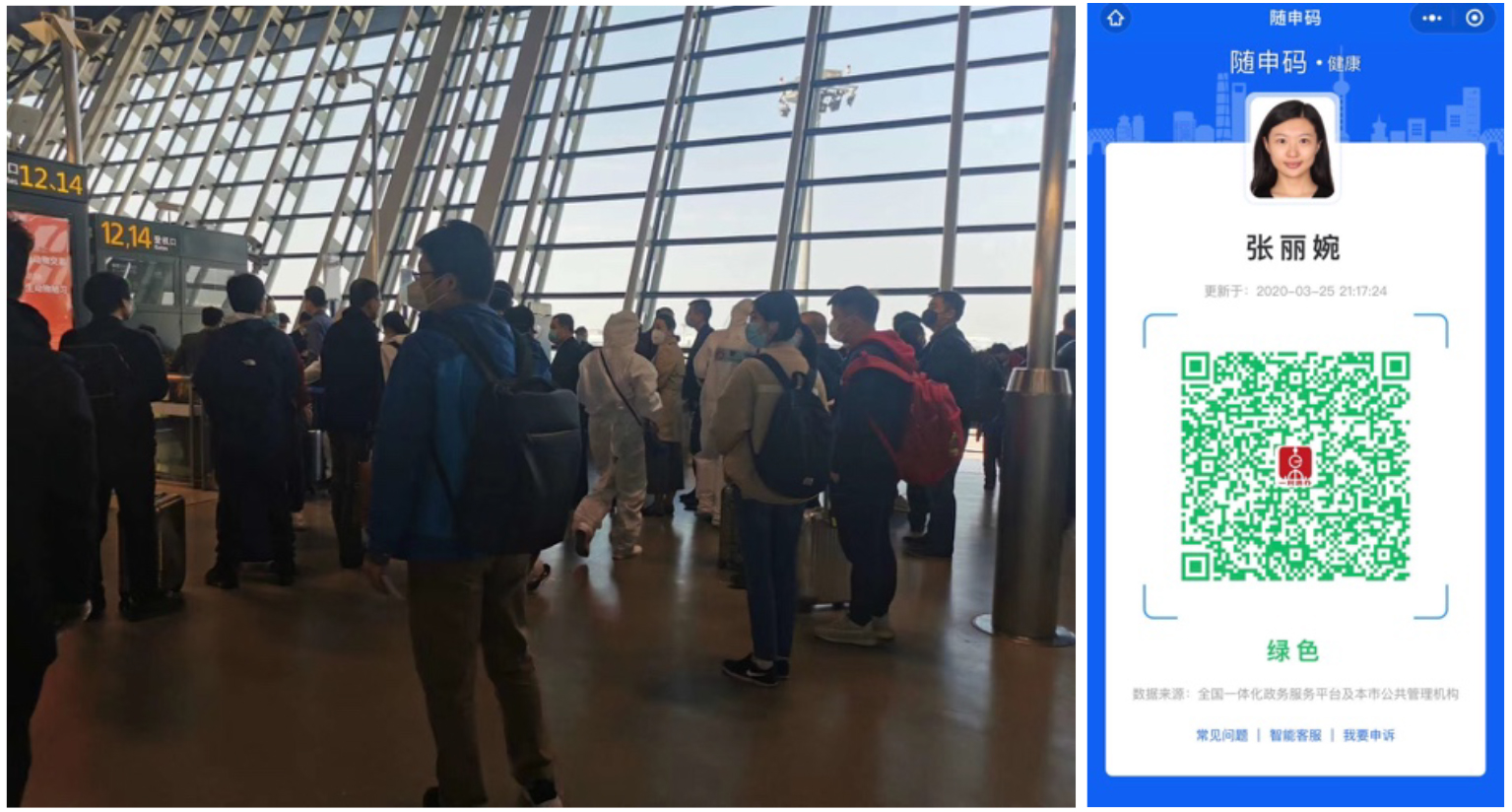

Source: Coresight Research [/caption] Shanghai Pudong Airport built a “mini arrival port” to receive international passengers, which began operations on March 25, after which it has been receiving around 40,000–50,000 passengers per day. In addition, Hubei Airport Group announced that the three major airports in China—Enshi Airport, Shennongjia Airport and Xiangyang Airport—officially resumed operations on March 25. Every airport has implemented a number of precautionary measures to prevent the spread of the coronavirus; for example, passengers need to show a digital “health green code” or “health certificate” before boarding, and they must have their temperature measured to be cleared for flight. [caption id="attachment_107025" align="aligncenter" width="700"] Shanghai Pudong Airport requires passengers to show a digital health certificate before they are cleared to fly

Shanghai Pudong Airport requires passengers to show a digital health certificate before they are cleared to fly

Source: Coresight Research [/caption] Cinemas, parks and recreational activities have all resumed in China: On March 24, 528 cinemas resumed operations, contributing to an average national box office of ¥26,400 (roughly $3,700) per day between March 20 and 24, and this number is rising. However, wearing medical masks while shopping and enjoying other activities in public has become the new normal for China’s residents. [caption id="attachment_107026" align="aligncenter" width="700"] People form an orderly line nearly 300 meters long outside Costco Shanghai, and the store is busy inside

People form an orderly line nearly 300 meters long outside Costco Shanghai, and the store is busy inside

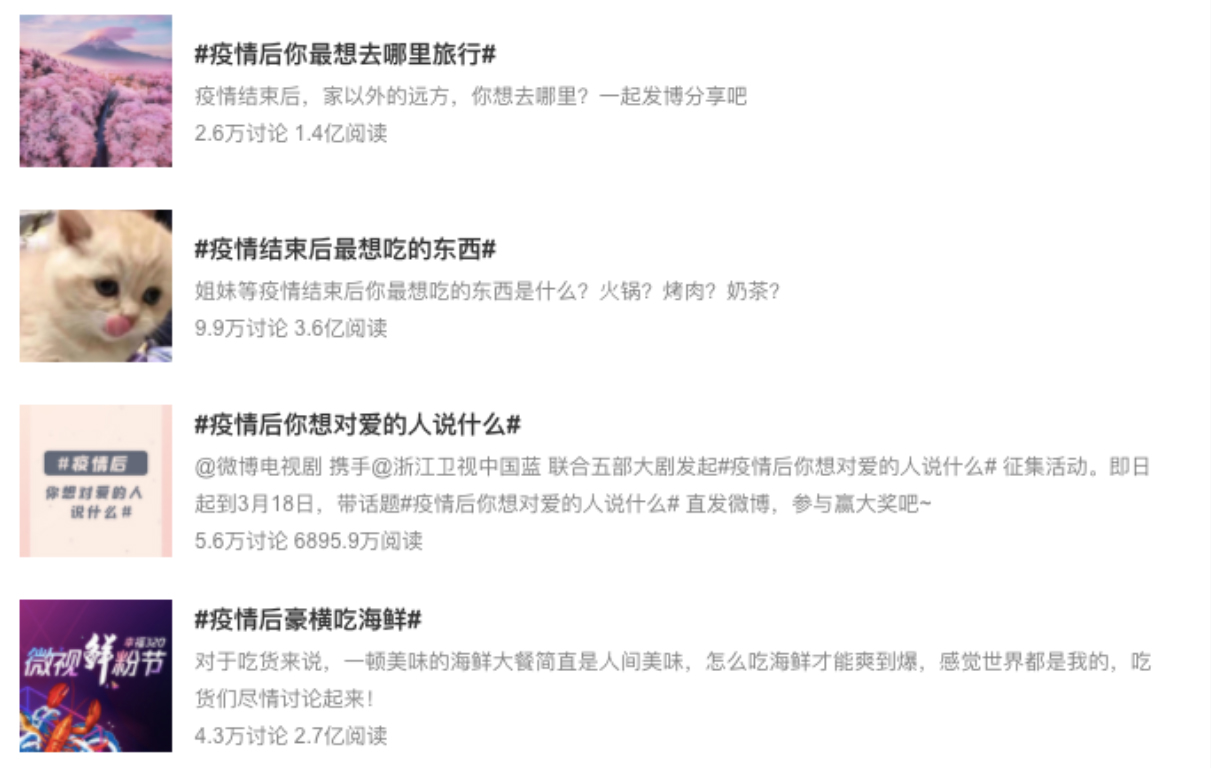

Source: Coresight Research [/caption] Positive consumer sentiment can also be observed. A number of topics on Weibo about “what do you want to do post coronavirus”—covering travel and dining preferences, for instance—have received over 100 million reads and hundreds of thousands of discussions. [caption id="attachment_107027" align="aligncenter" width="700"] Topics on post-coronavirus consumer behavior have seen high engagement on Weibo

Topics on post-coronavirus consumer behavior have seen high engagement on Weibo

Source: Weibo [/caption] Implications for Brands With the coronavirus crisis having been gradually brought under control in China—and assuming there will not be another major outbreak in the near future—we can expect a new wave of consumption to take hold in April/May. Categories such as beauty/skincare will likely see consumer demand rebound quickly as people return to the workplace and resume social activities. Catering and hospitality are also likely to bounce back from the pandemic as consumers look to spend time away from home following the lifting of quarantines—particularly with China announcing a five-day Labor Day holiday this year, compared to four days in 2019 and three in 2018. With many brick-and-mortar retail stores and shopping malls reopening in China, pent-up demand has started to be unleashed, most notably in luxury. This will play a key role in picking up the economy in the short term, as well as boosting sales for brands that have struggled during the coronavirus crisis. However, the question remains whether a recovery to near-normal everyday life will simply prompt a resurgence of the coronavirus. Academics and scientists in other countries have pointed to the need for a total or near-total shutdown until a vaccine is produced (which may yet be 12–18 months away), and suggest that any return to regular life before that point will cause a second wave of infections. Should that prove to be the case, we will see another retrenchment in economic activity, including retail. [caption id="attachment_107028" align="aligncenter" width="700"] An Apple store is crowded with people in a Shanghai shopping mall on March 29

An Apple store is crowded with people in a Shanghai shopping mall on March 29

Source: Coresight Research [/caption]

Source: Baidu Big Data

Catering ranked highly in terms of employee return rates, and over 90% of restaurants and other businesses in the catering sector in Beijing have now resumed business, and many major tier-1 and tier-2 cities such as Shanghai, Guangzhou and Shenyang have operation rates of over 80% (shown in Figure 2). Figure 2. Top Five Chinese Cities with the Highest Operation Rates of Catering Businesses, as of March 5, 2020 [wpdatachart id=44]Source: Baidu Big Data

In a press conference, Xin Guofu, Deputy Minister of the Ministry of Industry and Information Technology of China (MIIT), said that the average operating rate of large industrial and manufacturing enterprises (except for operations in Hubei province), had reached 98.65% by March 28. In addition, the average return rate of employees in the manufacturing industry was around 89.9% on the same date; the operating rate of small and medium-sized enterprises (SMEs) was 76% and seeing growth every day. On March 21, Ou Hong, Director of the Investment Department of the National Development and Reform Commission, said that the overall resumption rate of key construction projects has reached 89.1%. In line with the nationwide trend of high return-to-work rates, the search term “return to work” on Baidu climbed by 678% on March 5, compared with that of last month (February 5). On Chinese social media platform Weibo, the topic of returning to work garnered 160 million views/engagements and prompted 250,000 discussions on the social media platform, as of March 25. [caption id="attachment_107021" align="aligncenter" width="700"] Discussion about “return to work” on Weibo

Discussion about “return to work” on Weibo Source: Weibo [/caption] The positive evidence that operations are resuming in China indicates that businesses could recover from the losses experienced in the first quarter of the year. In fact, Joseph Lupton, Senior Global Economist at investment banking company JPMorgan, told CNBC that he expects China’s economy to bounce back from the coronavirus and grow 15% in the second quarter of 2020 on a quarter-on-quarter, annualized basis. However, short-term challenges remain: SMEs face cash-flow difficulties; there are shortages of protective equipment such as masks; and operational capacity across most industries must yet improve to achieve efficiency gains. Multinational Companies Re-Open Stores in Mainland China With lockdowns being lifted as the coronavirus outbreak is gradually brought under control in China, companies have been reopening for business since the beginning of March.

- Apple: Apple has reopened all 42 of its retail stores in Greater China, albeit with extensive safety measures implemented, such as temperature checks for shoppers entering the store, controlled entrances and reduced capacity. Although China is recovering from the pandemic, the global outlook is not yet as positive, and Apple announced on March 14 that it would temporarily close all of its stores outside China as a result of the coronavirus.

- Chow Tai Fook: The Hong Kong brand, which is the world’s biggest jeweler by sales, stated that about 85% of its 3,600+ stores in China resumed operations in the week of March 9.

- IKEA: The retailer had reopened all of its offline stores in mainland China by March 17 (excluding in Wuhan). However, IKEA’s restaurants, children’s play centers and maternity centers remain temporarily closed.

- McDonald's: The food chain has reopened 90% of its 3,300+ restaurants in mainland China, following the rollout of its group delivery services to enterprises that have resumed work since February 10, according to China Daily.

- NIKE: According to the company, at the peak of the coronavirus pandemic in China in February, roughly 75% of NIKE-owned and partner stores in Greater China were temporarily closed, and others were operating on reduced hours. By March 15, 2020, nearly 80% of these stores had reopened, mostly in key cities.

- Starbucks: The international chain had re-opened over 90% of its roughly 4,200 coffeehouses in China by March 9, although most are operating on a reduced schedule and with safety measures implemented. Starbucks expects to have opened 95% of its China locations by the end of second quarter of fiscal year 2020, according to Kevin Johnson, President and CEO of the company. In a letter to stakeholders, Johnson reported that comparable store sales during February were down 78% in China versus the prior year, but that by the beginning of March, Starbucks saw average daily transactions per store improve by 6% and total weekly gross sales grow by 80%. Mobile orders accounted for approximately 80% of sales. Starbucks also announced on March 12 that it would invest approximately $130 million to open a coffee roasting facility in China in 2022, as part of its new Coffee Innovation Park.

- Uniqlo: On March 16, the Fast Retailing-owned brand reported that only 30 of its 750 Uniqlo stores in China were still closed—including those located in Hubei province. According to a spokesperson, “China and Southeast Asia will continue to serve as the key pillars of [Uniqlo’s] business growth.”

- Burberry: On March 19, Burberry released an update on the impact of the coronavirus, which reported that most of the brand’s stores in mainland China had reopened and that trading had started to improve. The company stated that it expects a drop of 70–80% in comparable store sales in the final weeks of fiscal year 2020, ended March 28.

- Hermès: On February 25, Hermès stated that it had reopened all but two of its stores in mainland China, after temporarily closing 11 locations due to quarantine measures in the peak of the coronavirus outbreak.

A shopping mall in Shengyang on March 23, 2020

A shopping mall in Shengyang on March 23, 2020 Source: Coresight Research [/caption] Luxury and fashion shopping mall SKP Beijing has been welcoming crowds since the beginning of March, although it limited opening hours to 11:00-18:00 and limited numbers of shoppers permitted inside the stores at any one time. On March 28, it resumed normal opening hours. Consumers have been lining up outside the stores of Chanel, Hermès, Gucci and other luxury brands. [caption id="attachment_107023" align="aligncenter" width="700"]

Consumers buying luxury goods in the SKP Beijing shopping center after its reopening

Consumers buying luxury goods in the SKP Beijing shopping center after its reopening Source: Dianping app [/caption] Demand is also evident in online sales: Alibaba’s data from this year’s “Queen’s Festival” on Tmall—which is centered around International Women’s Day on March 8—showed that overall sales “largely surpassed” sales from last year’s shopping event. For example, US cosmetics brand Elizabeth Arden saw $21.6 million in sales over a two-week period around March 8, which is equivalent to one-fourth of the brand’s total sales in 2019, according to Global Times. The New Normal Involves Precautionary Measures With home quarantines lifted in China, residents are taking the opportunity to get out in public and participate in recreational activities: Public transport, flights, hotels, tourist spots, cinemas and parks are resuming normal operations. Over 20 provinces in China had reopened local tourism operations by March 25, including around 180 museums and more than 3,000 “level A” tourist spots. Shanghai Disney Resort reopened part of its services on March 9, including Disney Town, Starwish Park and shopping and catering areas. In the hospitality industry, over 80% of hotels in China had resumed operations by March 25, according to Chinese travel company Ctrip. Qunar.com, a popular online portal for flights and accommodation, launched a list of “secure hotels” on March 2. The company also reported a 34% week-over-week increase in hotel bookings and an 83% increase in the number of hotel guests on the same date. Airbnb China told Global Times on March 13 that the total number of domestic accommodation searches for 2020 Labor Day (with a check-in time between April 30 and May 5) increased by more than 2.5 times compared to last year. [caption id="attachment_107024" align="aligncenter" width="700"]

The Great Wall reopened to visitors, pictured on March 24, 2020

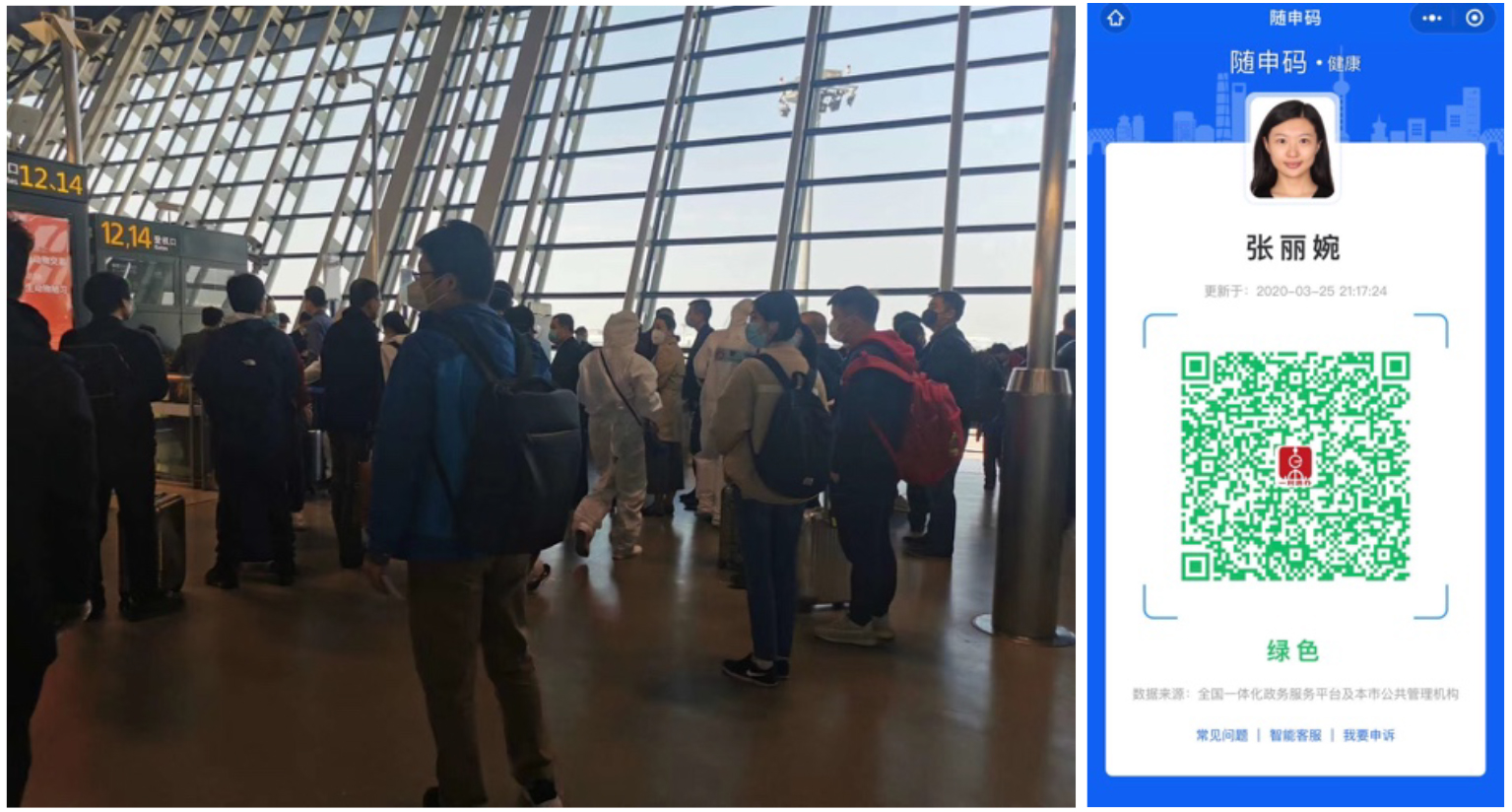

The Great Wall reopened to visitors, pictured on March 24, 2020 Source: Coresight Research [/caption] Shanghai Pudong Airport built a “mini arrival port” to receive international passengers, which began operations on March 25, after which it has been receiving around 40,000–50,000 passengers per day. In addition, Hubei Airport Group announced that the three major airports in China—Enshi Airport, Shennongjia Airport and Xiangyang Airport—officially resumed operations on March 25. Every airport has implemented a number of precautionary measures to prevent the spread of the coronavirus; for example, passengers need to show a digital “health green code” or “health certificate” before boarding, and they must have their temperature measured to be cleared for flight. [caption id="attachment_107025" align="aligncenter" width="700"]

Shanghai Pudong Airport requires passengers to show a digital health certificate before they are cleared to fly

Shanghai Pudong Airport requires passengers to show a digital health certificate before they are cleared to fly Source: Coresight Research [/caption] Cinemas, parks and recreational activities have all resumed in China: On March 24, 528 cinemas resumed operations, contributing to an average national box office of ¥26,400 (roughly $3,700) per day between March 20 and 24, and this number is rising. However, wearing medical masks while shopping and enjoying other activities in public has become the new normal for China’s residents. [caption id="attachment_107026" align="aligncenter" width="700"]

People form an orderly line nearly 300 meters long outside Costco Shanghai, and the store is busy inside

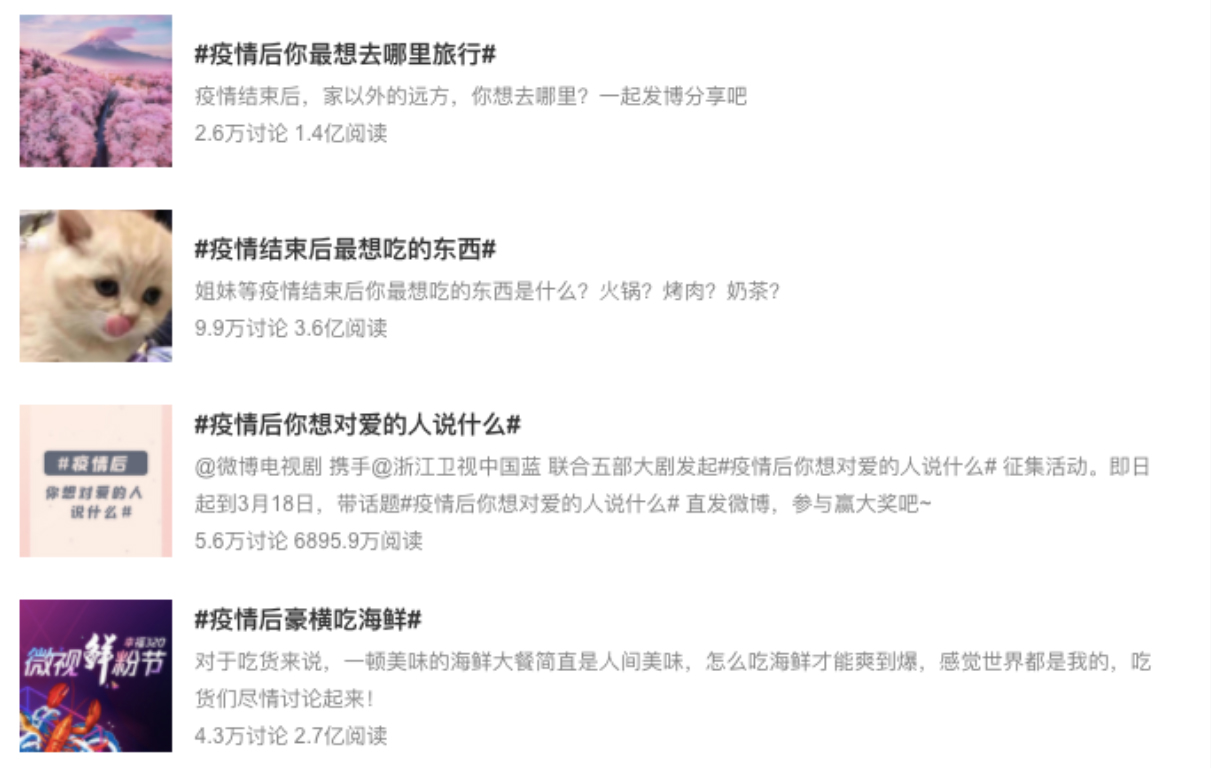

People form an orderly line nearly 300 meters long outside Costco Shanghai, and the store is busy inside Source: Coresight Research [/caption] Positive consumer sentiment can also be observed. A number of topics on Weibo about “what do you want to do post coronavirus”—covering travel and dining preferences, for instance—have received over 100 million reads and hundreds of thousands of discussions. [caption id="attachment_107027" align="aligncenter" width="700"]

Topics on post-coronavirus consumer behavior have seen high engagement on Weibo

Topics on post-coronavirus consumer behavior have seen high engagement on Weibo Source: Weibo [/caption] Implications for Brands With the coronavirus crisis having been gradually brought under control in China—and assuming there will not be another major outbreak in the near future—we can expect a new wave of consumption to take hold in April/May. Categories such as beauty/skincare will likely see consumer demand rebound quickly as people return to the workplace and resume social activities. Catering and hospitality are also likely to bounce back from the pandemic as consumers look to spend time away from home following the lifting of quarantines—particularly with China announcing a five-day Labor Day holiday this year, compared to four days in 2019 and three in 2018. With many brick-and-mortar retail stores and shopping malls reopening in China, pent-up demand has started to be unleashed, most notably in luxury. This will play a key role in picking up the economy in the short term, as well as boosting sales for brands that have struggled during the coronavirus crisis. However, the question remains whether a recovery to near-normal everyday life will simply prompt a resurgence of the coronavirus. Academics and scientists in other countries have pointed to the need for a total or near-total shutdown until a vaccine is produced (which may yet be 12–18 months away), and suggest that any return to regular life before that point will cause a second wave of infections. Should that prove to be the case, we will see another retrenchment in economic activity, including retail. [caption id="attachment_107028" align="aligncenter" width="700"]

An Apple store is crowded with people in a Shanghai shopping mall on March 29

An Apple store is crowded with people in a Shanghai shopping mall on March 29 Source: Coresight Research [/caption]