DIpil Das

We live in unique times as a global pandemic keeps shoppers home and compels many stores to close as they work with government to slow the spread. There is no standard roadmap for analysts to assess how retailers will fare amid a disease outbreak that dramatically changes consumer perceptions and behavior—so Coresight Research created one.

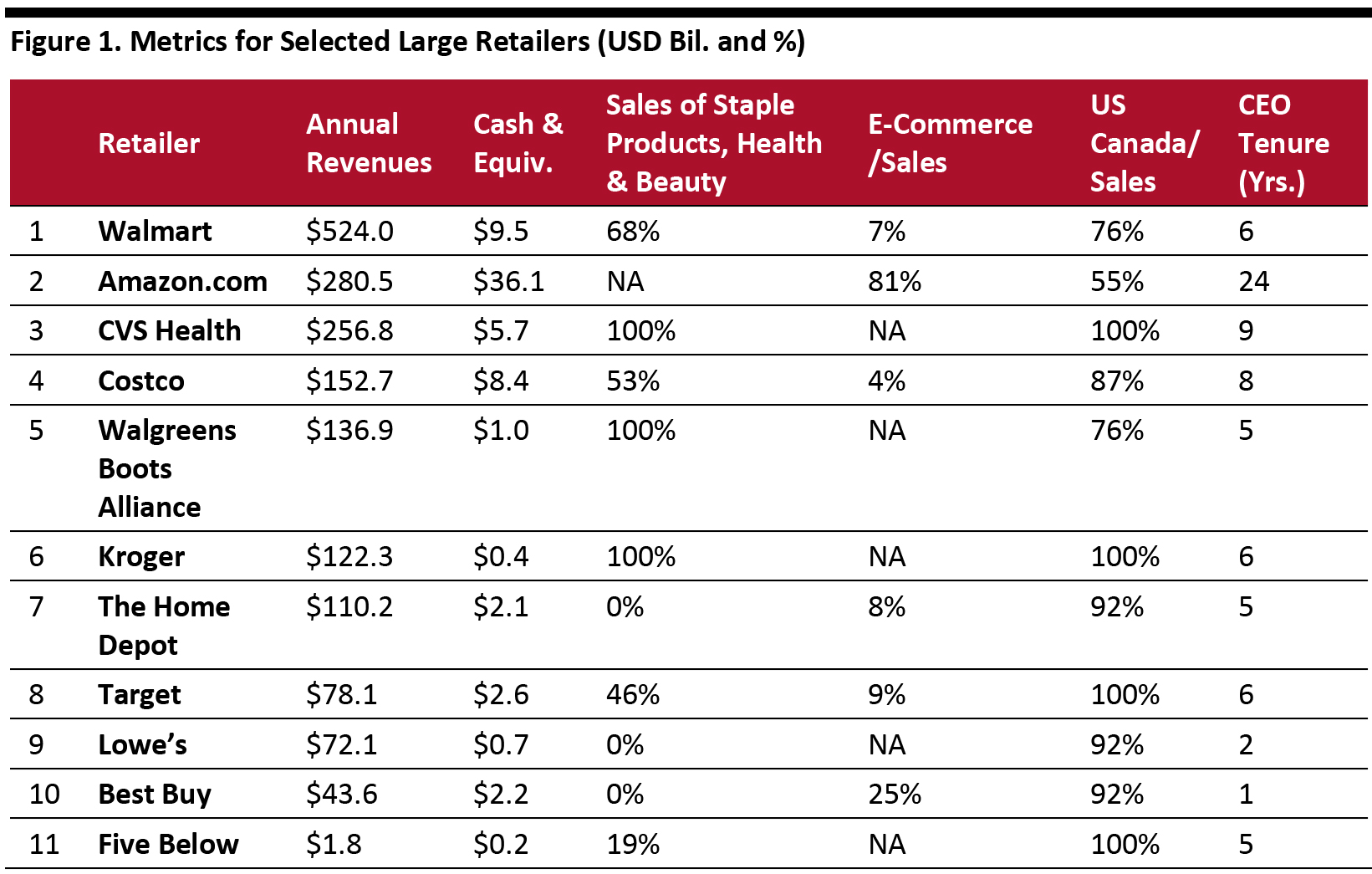

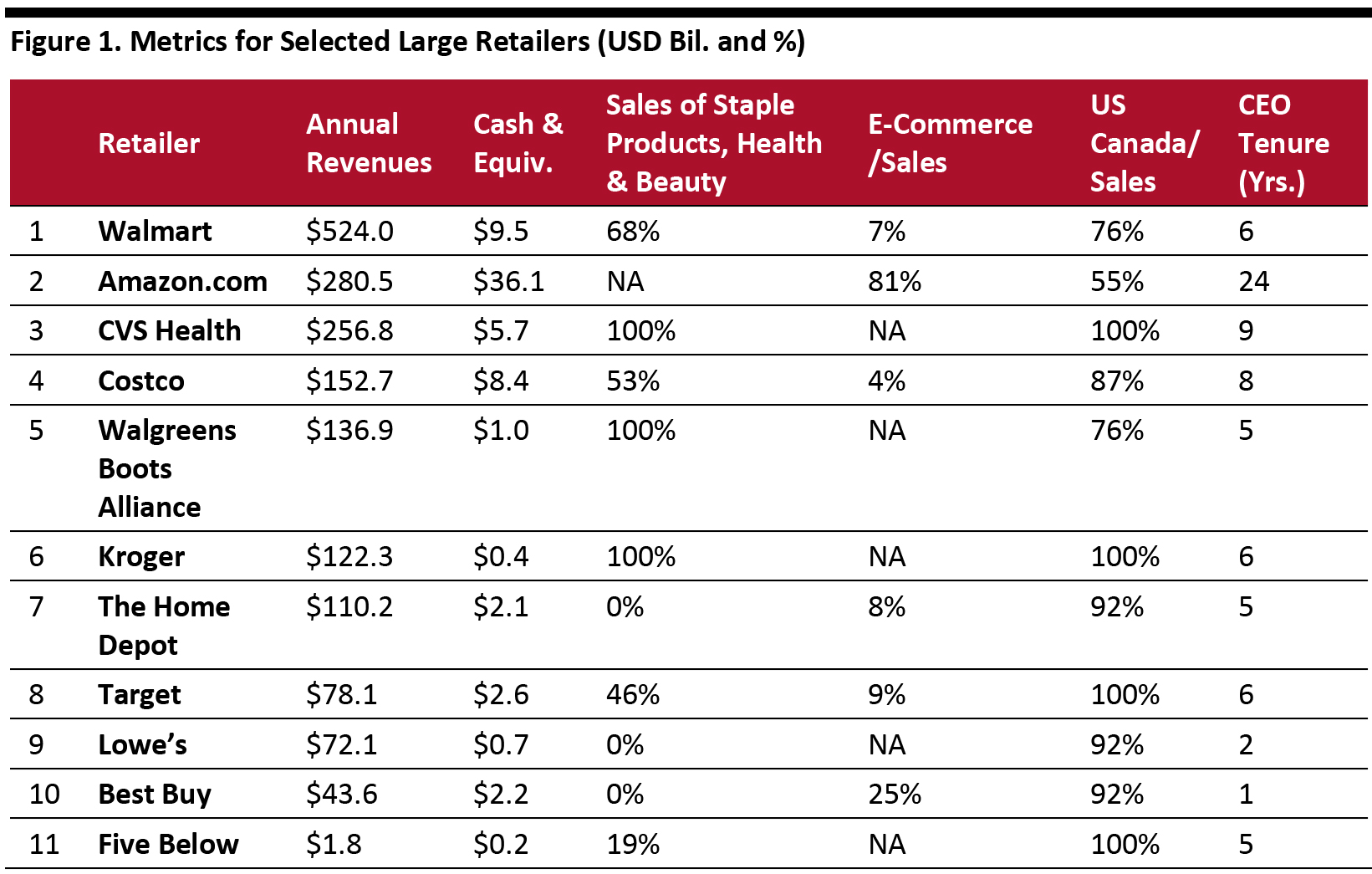

We believe these are the attributes of retailers best positioned to weather the storm: a substantial cash balance; product assortments that favor staples, health and beauty; large e-commerce businesses; high domestic exposure; and, an experienced CEO.

This report evaluates ten of the largest US retailers by revenue, plus one interesting smaller company, Five Below, as a bonus.

Evaluation Metrics

The table below includes select metrics for ten large retailers, ranked by revenue. We believe the following metrics will help retailers weather the coronavirus outbreak.

They are:

Note: Tenure figures are rounded

Note: Tenure figures are rounded

Source: Company reports/Bloomberg/Coresight Research [/caption] Company Analysis Looking at the above companies individually:

- Cash and equivalents: "Cash is king,” as the saying goes, and sizable cash hoards should help retailers cover fixed costs and obligations even as revenues dry up while stores are closed.

- Share of staples, health and beauty revenues: Retailers offering staples (i.e., food) and health and beauty products have kept stores open to supply essential consumer products.

- Share of e-commerce revenues: With many physical stores closed, retailers with a substantial e-commerce presence are well positioned as store-based shopping moves online as consumers shun crowded places. The caveat is those retailers need sufficient infrastructure to handle strong online demand.

- Share of US/Canada sales: With consumers staying home and international flights plummeting, retailers that sell products domestically will benefit from domestic consumption (assuming they are able to source product close to home).

- CEO tenure: Retailers with experienced CEOs are likely to have weathered previous downturns and can act more instinctively to adapt to the current environment.

Note: Tenure figures are rounded

Note: Tenure figures are rounded Source: Company reports/Bloomberg/Coresight Research [/caption] Company Analysis Looking at the above companies individually:

- Walmart occupies a favorable cash position of a large cash balance, an assortment benefitting from its large presence in grocery and a highly domestically focused business.

- Amazon has the largest cash position, its revenues are predominantly online and its CEO has the longest tenure.

- CVS Health primarily sells in the health and beauty space and has a longtime CEO.

- Costco has a large cash position and largely domestic revenues, yet its online business trails others on the list.

- Walgreens Boots Alliance primarily sells in the health and beauty space and its sales are largely domestic.

- Kroger generates most of its sales in domestic grocery.

- Home Depot has a minimal presence in staple products and also in health & beauty, and its sales are predominantly domestic.

- Target has a strong presence in staple products and health & beauty and is primarily domestically focused.

- Lowe’s has little presence in staples and health & beauty and its sales a primarily domestic.

- Best Buy has the strongest e-commerce presence and should benefit from demand for devices as more people work from home. It sells primarily domestically.

- Five Below has a cash balance commensurate with its size, a substantial share of revenues from party and snacks, and a purely domestic presence.