DIpil Das

While many industries are struggling to survive the crippling impact of the coronavirus crisis, vice industries have experienced a surge in demand. With social distancing and quarantine measures in place across the US, stay-at-home consumers are doubling down on vices such as porn, alcohol, recreational cannabis and tobacco/cigarettes, in order to cope with the mental and emotional stress of the crisis.

*Comparisons were made to an average traffic period in February 2020. As traffic varies depending on the day of the week, each day is compared to the same day of the week during the average period.

*Comparisons were made to an average traffic period in February 2020. As traffic varies depending on the day of the week, each day is compared to the same day of the week during the average period.

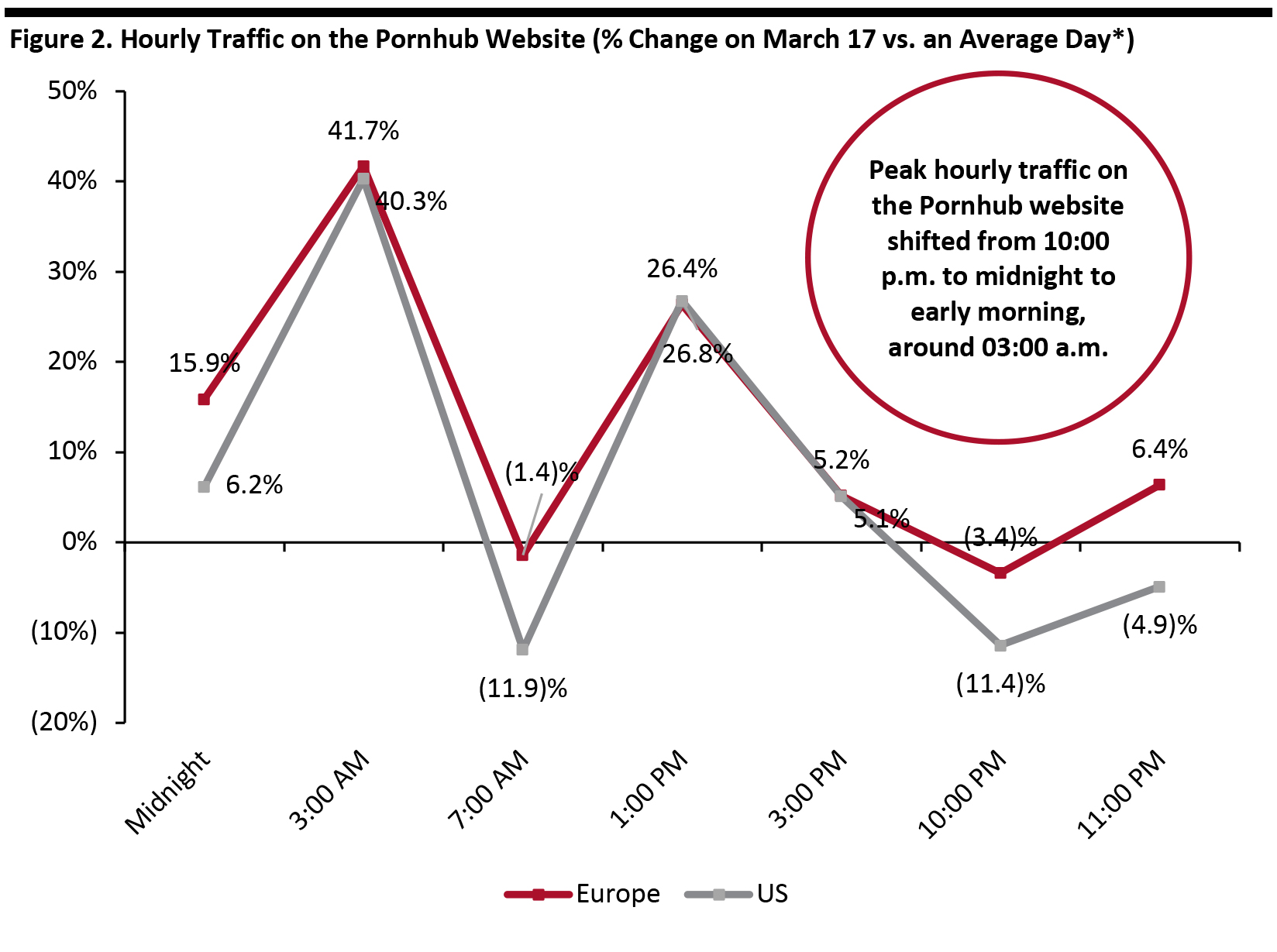

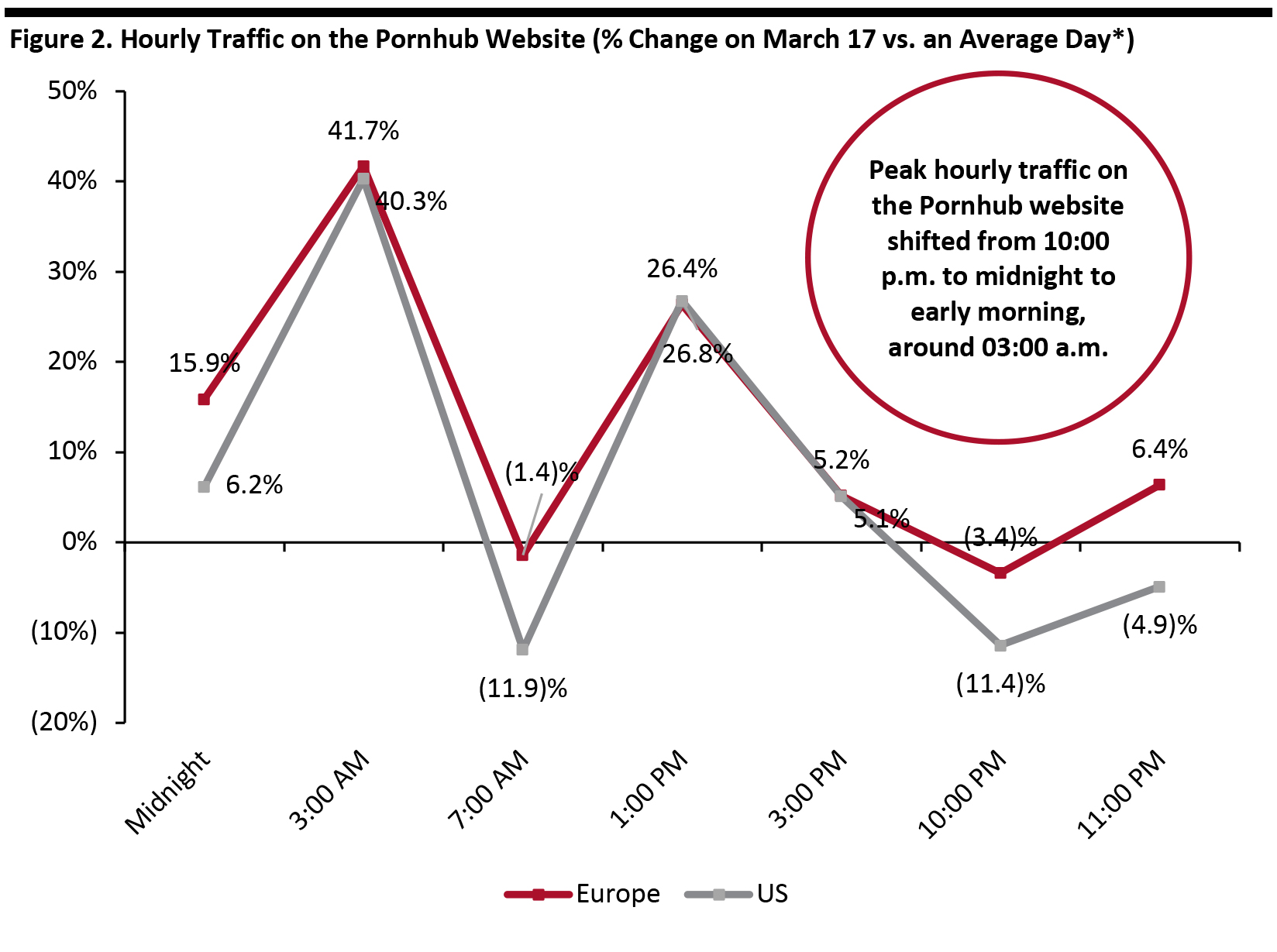

Source: Pornhub Insights [/caption] As the coronavirus spread around the world, the consumption of porn content clearly grew, but more interestingly, people began visiting porn websites at different times. According to Pornhub, on an average day, peak timings of visiting the site are from 10:00 p.m. to midnight, while early morning traffic is lower. However, since the outbreak, hourly traffic on the site has seen significant changes compared to an average day, with peak timings shifting to early morning, around 03:00 a.m. This implies that people stayed up later in the night because they did not need to go to work in the morning, or perhaps they had trouble sleeping. Pornhub also found that traffic in the early afternoon was higher than average, as typically people would have been at work. On March 17, for example, traffic at 01:00 p.m. was 26.8% and 26.4% higher than average in Europe and the US, respectively. [caption id="attachment_108448" align="aligncenter" width="700"] *Pre-coronavirus outbreak

*Pre-coronavirus outbreak

Source: Pornhub Insights [/caption] Source: Statista/Headset [/caption]

However, hoarding of recreational cannabis has so far proved unnecessary, as several recreational cannabis-legal state governments that have put lockdown measures in place have deemed the drug and its associated businesses “essential.” These states are selectively allowing stores, online delivery and curbside pickup to continue to operate. According to Marijuana Business Daily, as of April 2, 2020, eight out of 10 recreational cannabis-legal states under stay-at-home orders had declared the drug “essential.” Massachusetts designated recreational cannabis as “nonessential” and authorized the closure of all associated businesses by March 23. Maine’s recreational cannabis market has not yet launched.

[caption id="attachment_108450" align="aligncenter" width="700"]

Source: Statista/Headset [/caption]

However, hoarding of recreational cannabis has so far proved unnecessary, as several recreational cannabis-legal state governments that have put lockdown measures in place have deemed the drug and its associated businesses “essential.” These states are selectively allowing stores, online delivery and curbside pickup to continue to operate. According to Marijuana Business Daily, as of April 2, 2020, eight out of 10 recreational cannabis-legal states under stay-at-home orders had declared the drug “essential.” Massachusetts designated recreational cannabis as “nonessential” and authorized the closure of all associated businesses by March 23. Maine’s recreational cannabis market has not yet launched.

[caption id="attachment_108450" align="aligncenter" width="700"] Source: Marijuana Business Daily [/caption]

Change in Consumption Habits

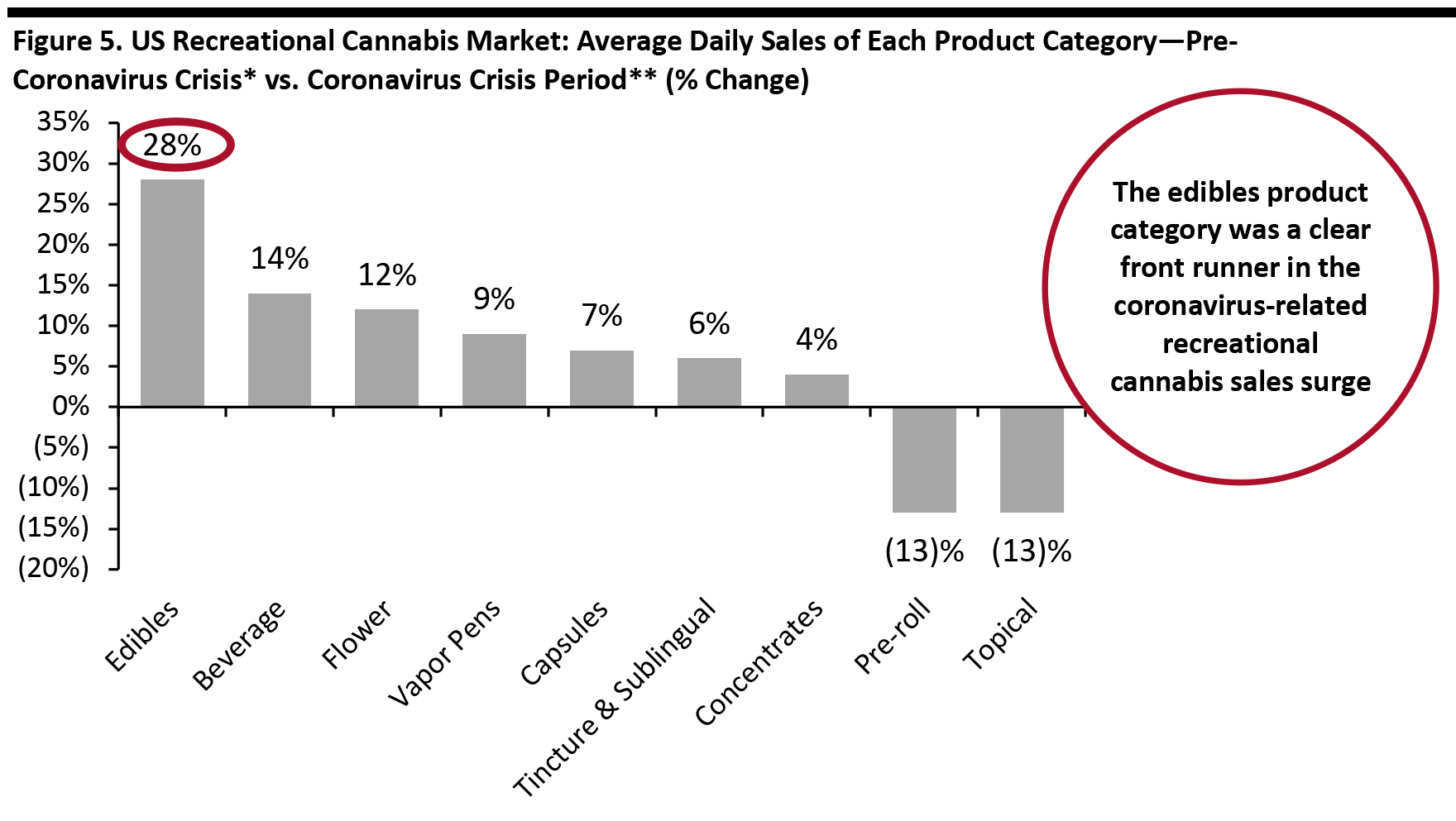

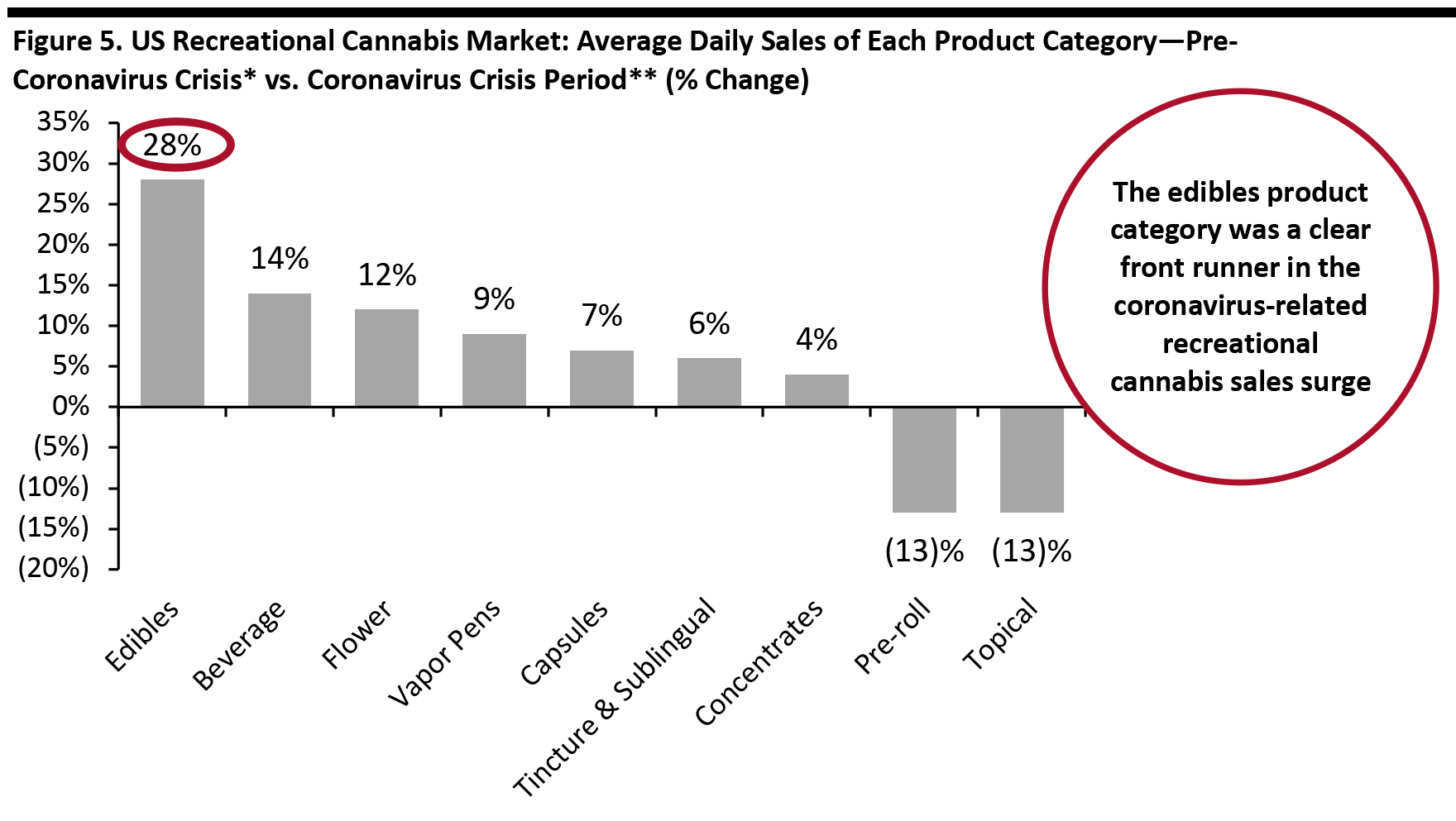

With consumers stocking up the recreational cannabis, their consumption habits may be changing, at least for the short term; sales in product categories responded very differently during the coronavirus crisis. According to a Coresight Research proprietary survey, conducted in December 2019, smoking is the most common method of consuming cannabis among recreational users in the US. However, since the outbreak, edibles have witnessed significantly more growth compared to other product categories, according to Headset. Prerolls, on the other hand, completely missed out on the stock-up sales surge, likely due to concerns of respiratory illness caused by the coronavirus.

[caption id="attachment_108451" align="aligncenter" width="700"]

Source: Marijuana Business Daily [/caption]

Change in Consumption Habits

With consumers stocking up the recreational cannabis, their consumption habits may be changing, at least for the short term; sales in product categories responded very differently during the coronavirus crisis. According to a Coresight Research proprietary survey, conducted in December 2019, smoking is the most common method of consuming cannabis among recreational users in the US. However, since the outbreak, edibles have witnessed significantly more growth compared to other product categories, according to Headset. Prerolls, on the other hand, completely missed out on the stock-up sales surge, likely due to concerns of respiratory illness caused by the coronavirus.

[caption id="attachment_108451" align="aligncenter" width="700"] *January 1–March 6, 2020

*January 1–March 6, 2020

**March 7–31, 2020

Source: Statista/Headset [/caption] Source: Statista/Nielsen [/caption]

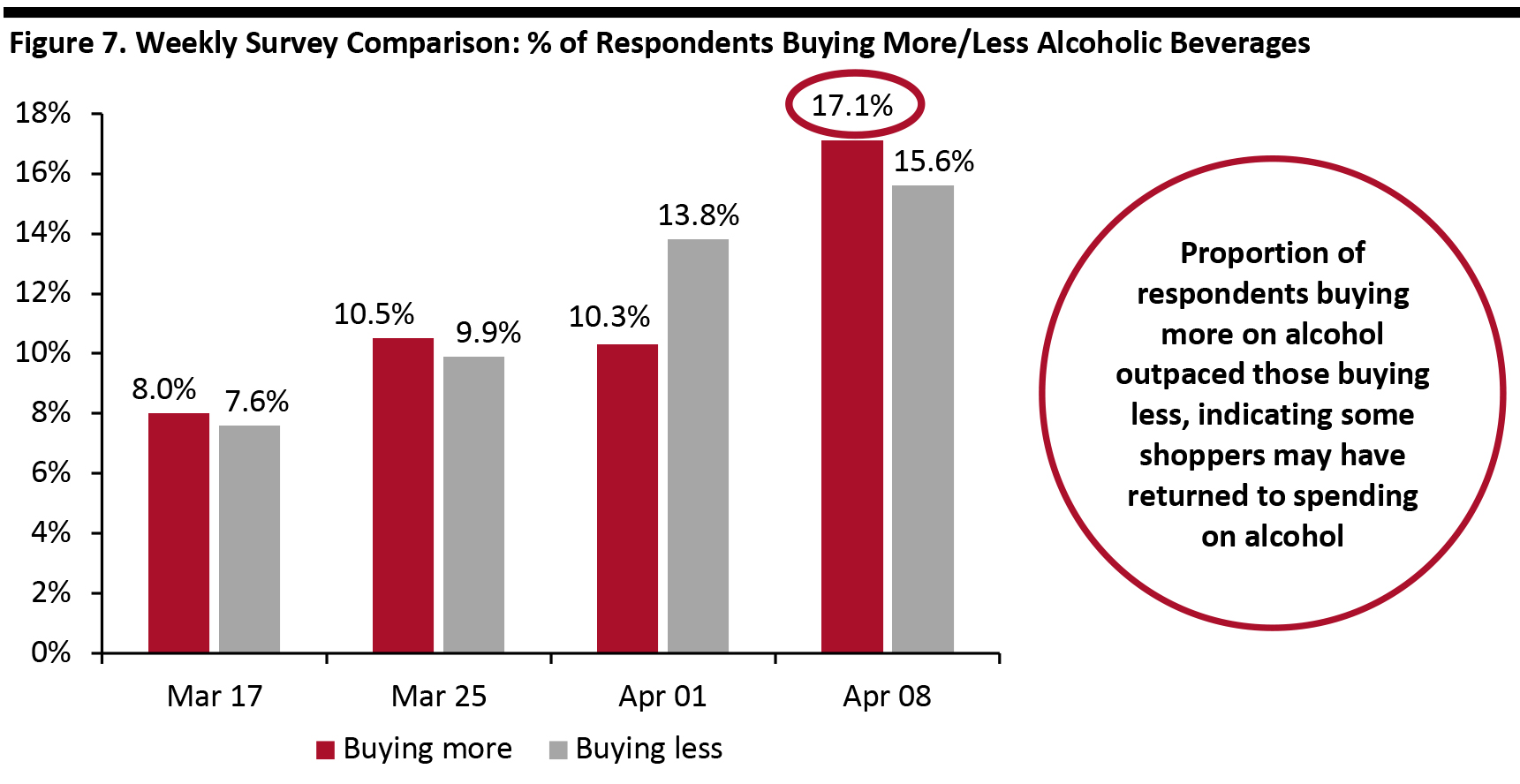

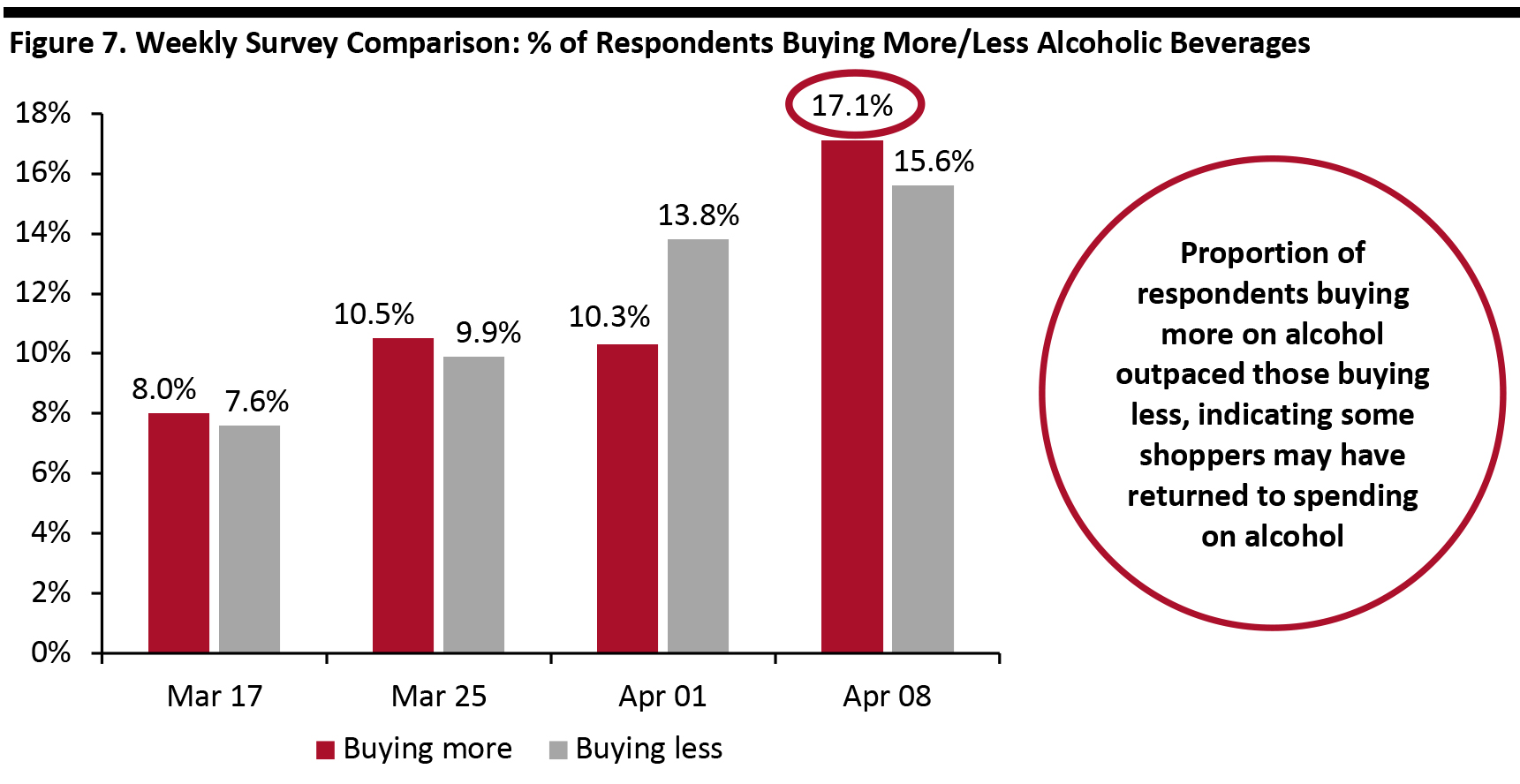

The following chart shows a week-over-week comparison of US consumers who indicated they were spending more/less on alcoholic beverages, based on data from Coresight Research surveys undertaken on April 8, April 1, March 25 and March 17–18. In our weekly survey of March 25, we saw an increase in the number of respondents who indicated they would likely buy more alcohol, but that number dropped in the survey of April 1. However, in the April 8 survey, the proportion of respondents buying more on alcohol jumped by 6.8 percentage points and outpaced those who said they would buy less, indicating that some shoppers have returned to spending on alcohol.

[caption id="attachment_108453" align="aligncenter" width="700"]

Source: Statista/Nielsen [/caption]

The following chart shows a week-over-week comparison of US consumers who indicated they were spending more/less on alcoholic beverages, based on data from Coresight Research surveys undertaken on April 8, April 1, March 25 and March 17–18. In our weekly survey of March 25, we saw an increase in the number of respondents who indicated they would likely buy more alcohol, but that number dropped in the survey of April 1. However, in the April 8 survey, the proportion of respondents buying more on alcohol jumped by 6.8 percentage points and outpaced those who said they would buy less, indicating that some shoppers have returned to spending on alcohol.

[caption id="attachment_108453" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption] Base: US Internet users aged 18+

Base: US Internet users aged 18+

Source: Coresight Research [/caption] Tobacco Companies See No Material Impact Yet from Coronavirus Outbreak British American Tobacco announced on its Capital Markets Day event (held on March 18, 2020) that it had not yet seen the coronavirus cause any change in the consumption pattern of cigarettes globally—other than a sales decline in duty-free shops. The company added that it had not experienced any material impact on group performance and that the “business is performing well” despite global uncertainty. As the impacts are minimal, the company said that it would stick to its previous guidance of a 4% decline in 2020 industry sales of cigarette and tobacco heating products and around a 5% decline in the US. Imperial Brands, owner of ITG, also announced on March 30 that it had not yet experienced any material impact on group performance at a global level due to the coronavirus outbreak, and current trading remains in line with expectations. Tobacco Companies Join Race To Develop Tobacco Plant-Based Coronavirus Vaccine In an unexpected development, British American Tobacco and Phillips Morris have joined pharma companies in the race to develop a coronavirus vaccine. On March 19, 2020, Phillips Morris, through its partially owned Canadian biopharmaceutical company Medicago, announced a significant breakthrough in the development of a tobacco plant-based coronavirus vaccine. Medicago is using a virus-like particle grown in Nicotiana benthamiana, a close relative of the tobacco plant, to develop a potential protein-based vaccine for coronavirus. The company added that it is ready to start pre-clinical testing and will begin human trials of the possible vaccine this summer. Similarly, British American Tobacco, through its biotech subsidiary Kentucky BioProcessing, announced on April 1 that it is developing a potential vaccine for the coronavirus, which is also in pre-clinical testing currently. The company said that the potential vaccine could deliver an effective immune response in a single dose. British American Tobacco said that it has the capability to manufacture 1–3 million doses of vaccine per week and is exploring ways to collaborate with government agencies to bring the vaccine to clinical studies quickly.

Pornography

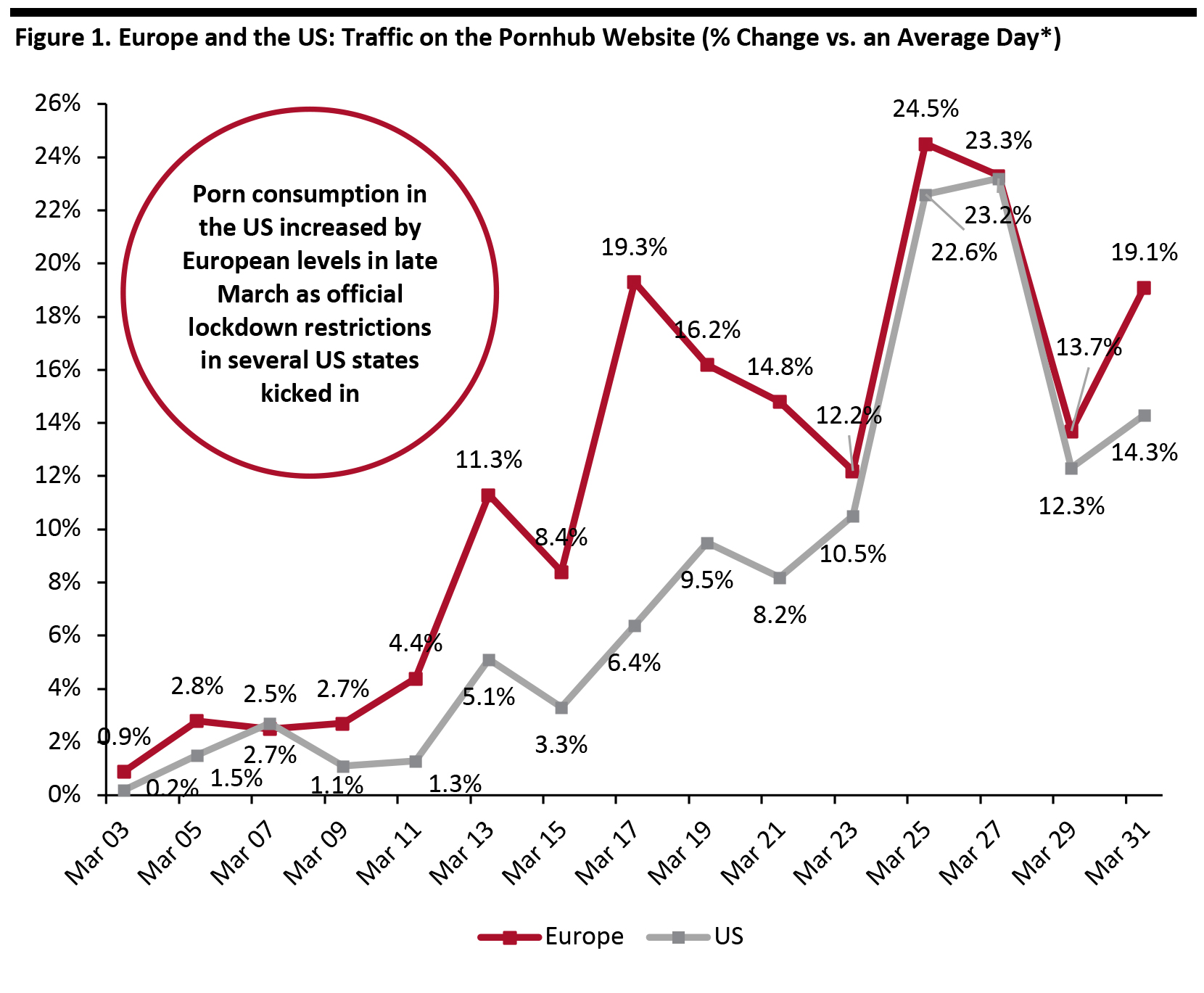

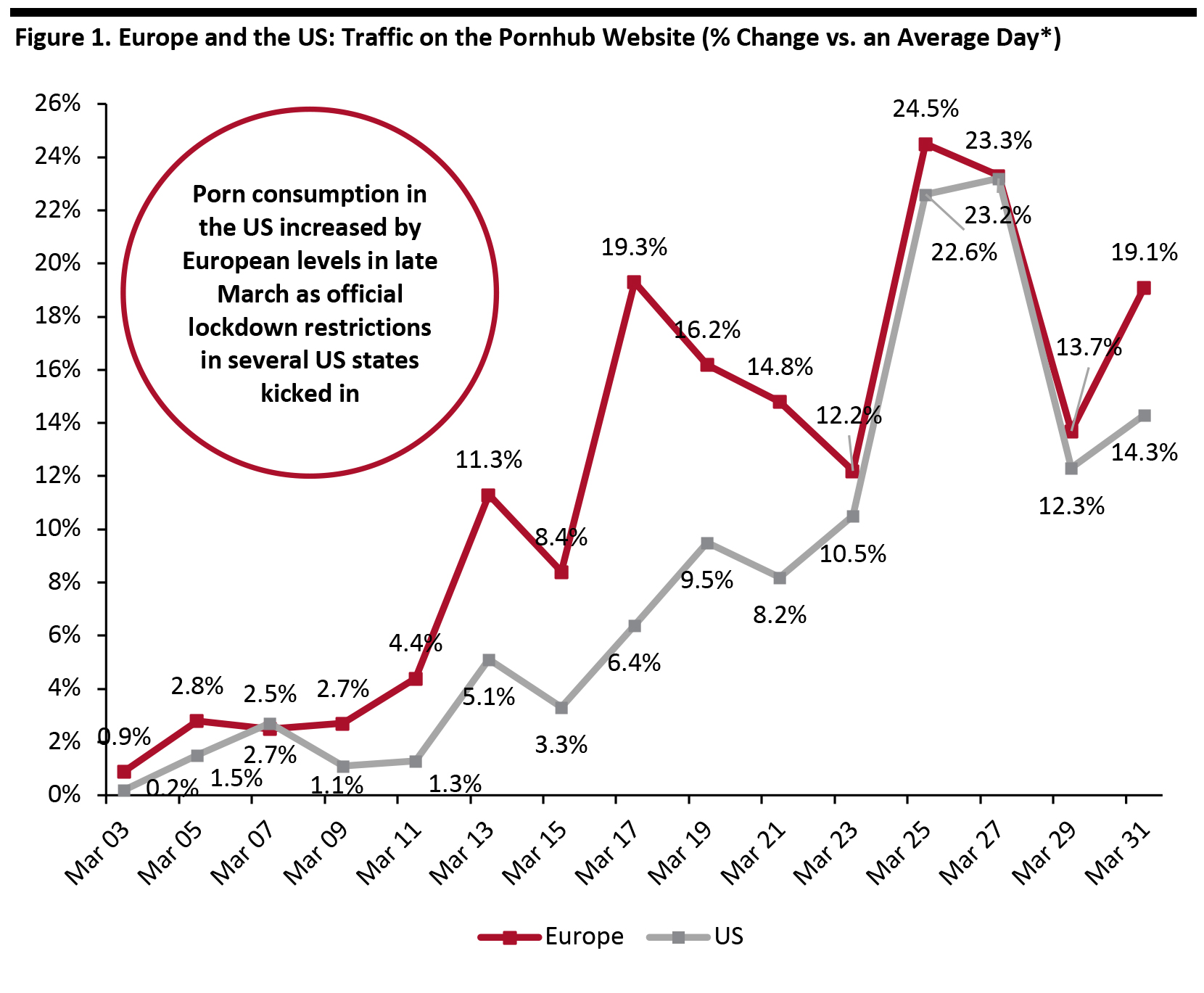

Porn Consumption in the US Witnesses Surge With several state and local governments announcing lockdown restrictions, Americans have been increasingly turning to some form of escapism, such as watching porn to alleviate stress and anxiety. Pornhub, a popular pornographic website, witnessed a surge in its daily traffic levels, as people started to spend more time inside, either self-quarantining or working from home. According to Pornhub, traffic to its website began to increase sooner in Europe than in other parts of the world as the outbreak began to spread. Throughout March, the site saw increasing traffic from Europe, recording the highest jump of 19.3% and 24.5% on March 17 and March 25, respectively. Traffic changes became noticeable much later in the US, when the nation joined Europe by implementing quarantines, social distancing practices, lockdowns and work-at-home efforts across many states. [caption id="attachment_108447" align="aligncenter" width="700"] *Comparisons were made to an average traffic period in February 2020. As traffic varies depending on the day of the week, each day is compared to the same day of the week during the average period.

*Comparisons were made to an average traffic period in February 2020. As traffic varies depending on the day of the week, each day is compared to the same day of the week during the average period. Source: Pornhub Insights [/caption] As the coronavirus spread around the world, the consumption of porn content clearly grew, but more interestingly, people began visiting porn websites at different times. According to Pornhub, on an average day, peak timings of visiting the site are from 10:00 p.m. to midnight, while early morning traffic is lower. However, since the outbreak, hourly traffic on the site has seen significant changes compared to an average day, with peak timings shifting to early morning, around 03:00 a.m. This implies that people stayed up later in the night because they did not need to go to work in the morning, or perhaps they had trouble sleeping. Pornhub also found that traffic in the early afternoon was higher than average, as typically people would have been at work. On March 17, for example, traffic at 01:00 p.m. was 26.8% and 26.4% higher than average in Europe and the US, respectively. [caption id="attachment_108448" align="aligncenter" width="700"]

*Pre-coronavirus outbreak

*Pre-coronavirus outbreak Source: Pornhub Insights [/caption]

Recreational Cannabis

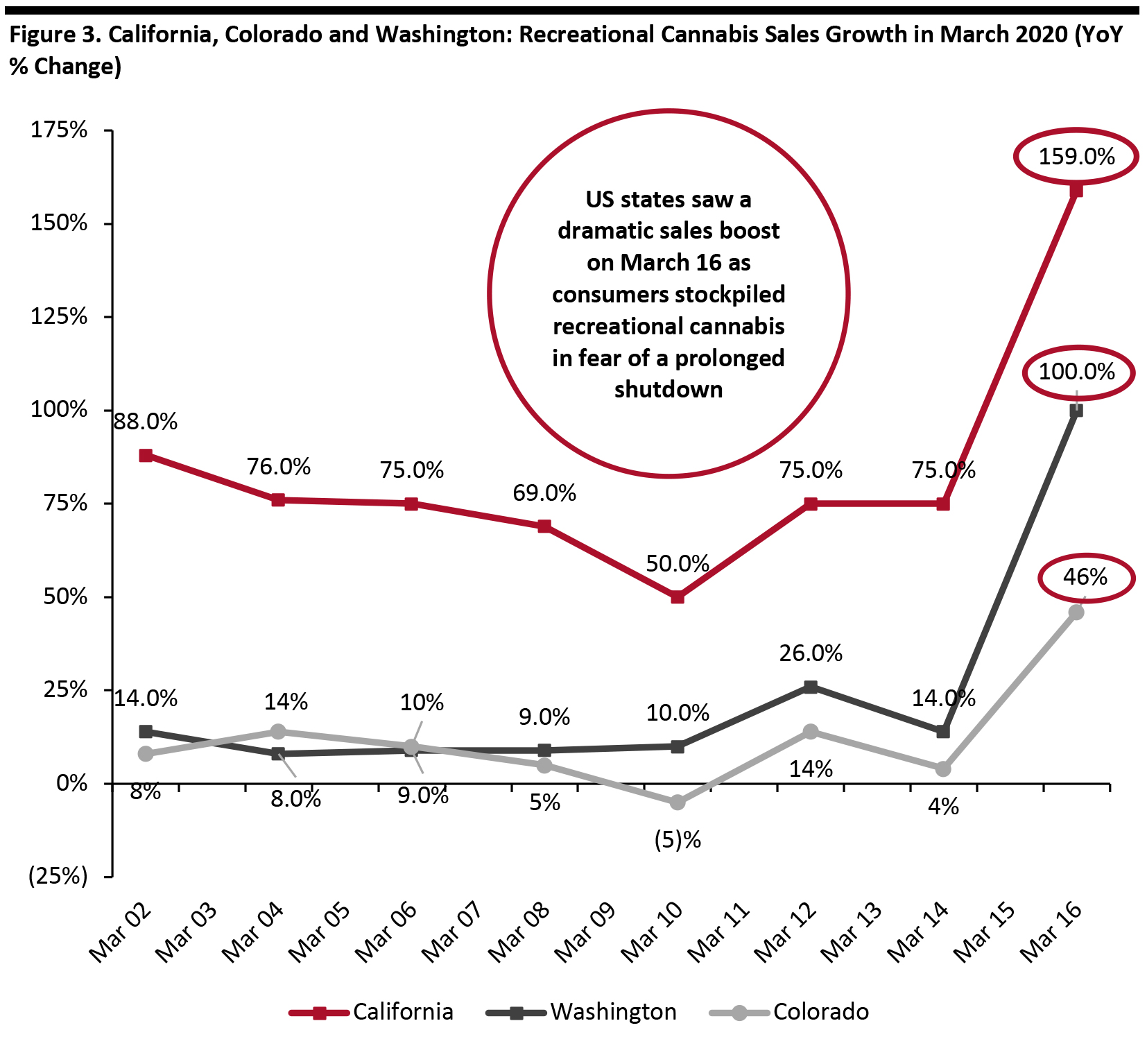

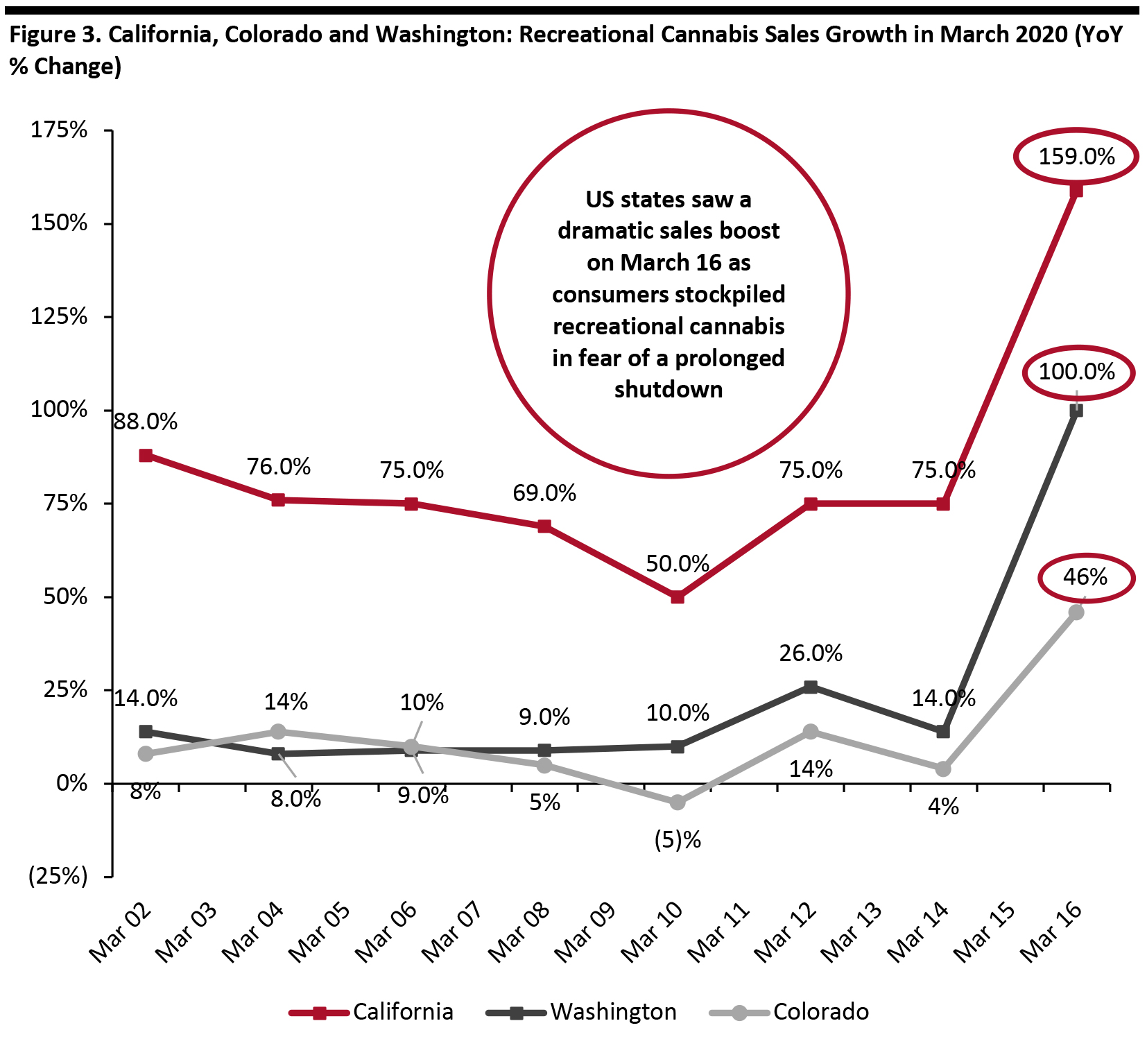

Recreational Cannabis Sales Soar With many US state and local governments imposing lockdowns that limit routine and commercial activities, medical and recreational cannabis experienced a sales spike in several states in mid-March, as consumers rushed to stock up on the drug in fear of a prolonged shutdown. According to cannabis data intelligence firm Headset, sales of recreational cannabis in California grew 159% on March 16, 2020, compared to the same day in 2019. Washington and Colorado also witnessed sales boosts of around 100% and 46%, respectively, on the same day. Stress relief is the top non-medical reason for cannabis consumption. The lockdowns and restrictions are likely to prompt greater frequency of cannabis consumption among existing users, as housebound consumers turn to the drug for relaxation and de-stressing benefits. [caption id="attachment_108449" align="aligncenter" width="700"] Source: Statista/Headset [/caption]

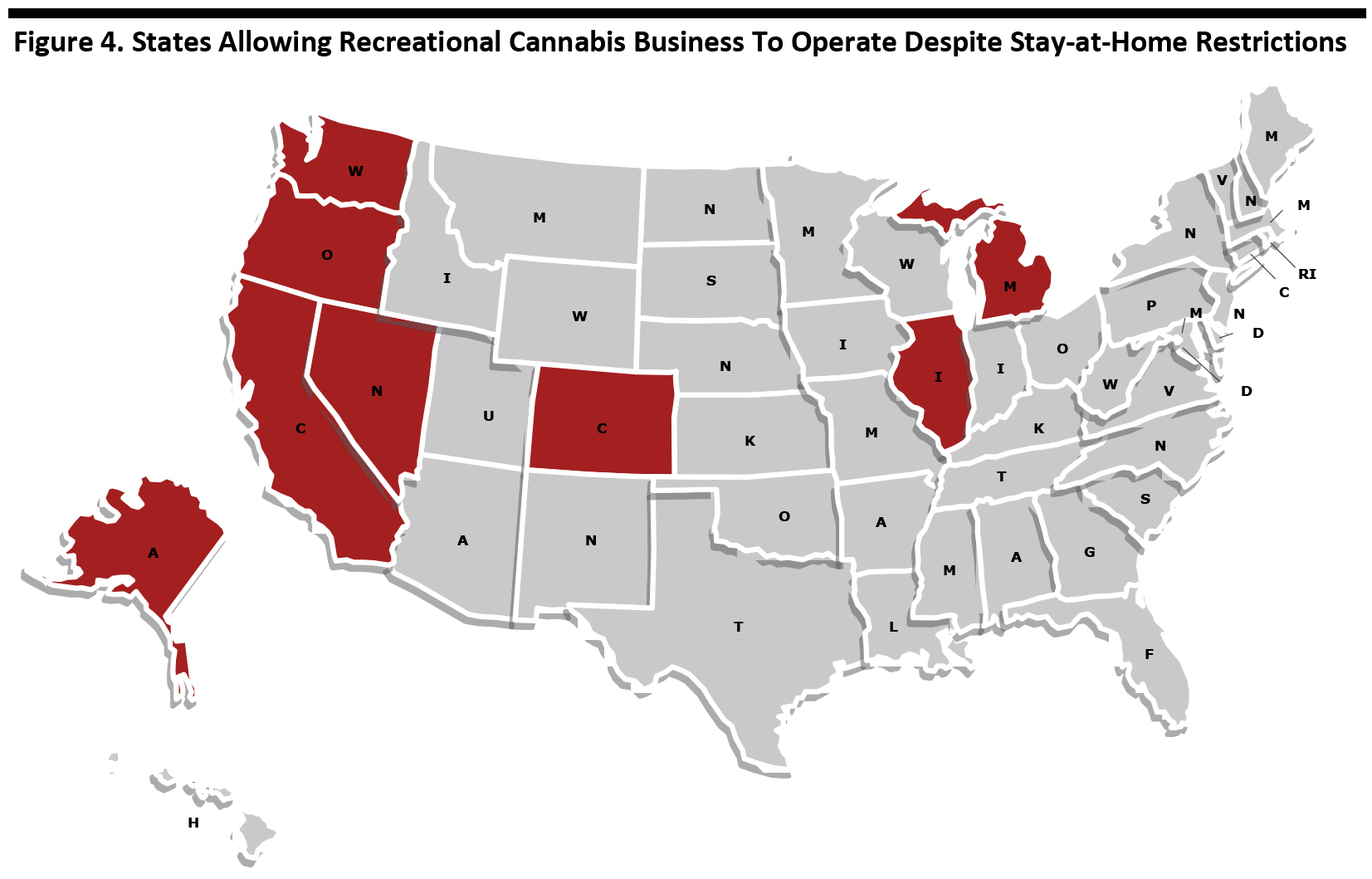

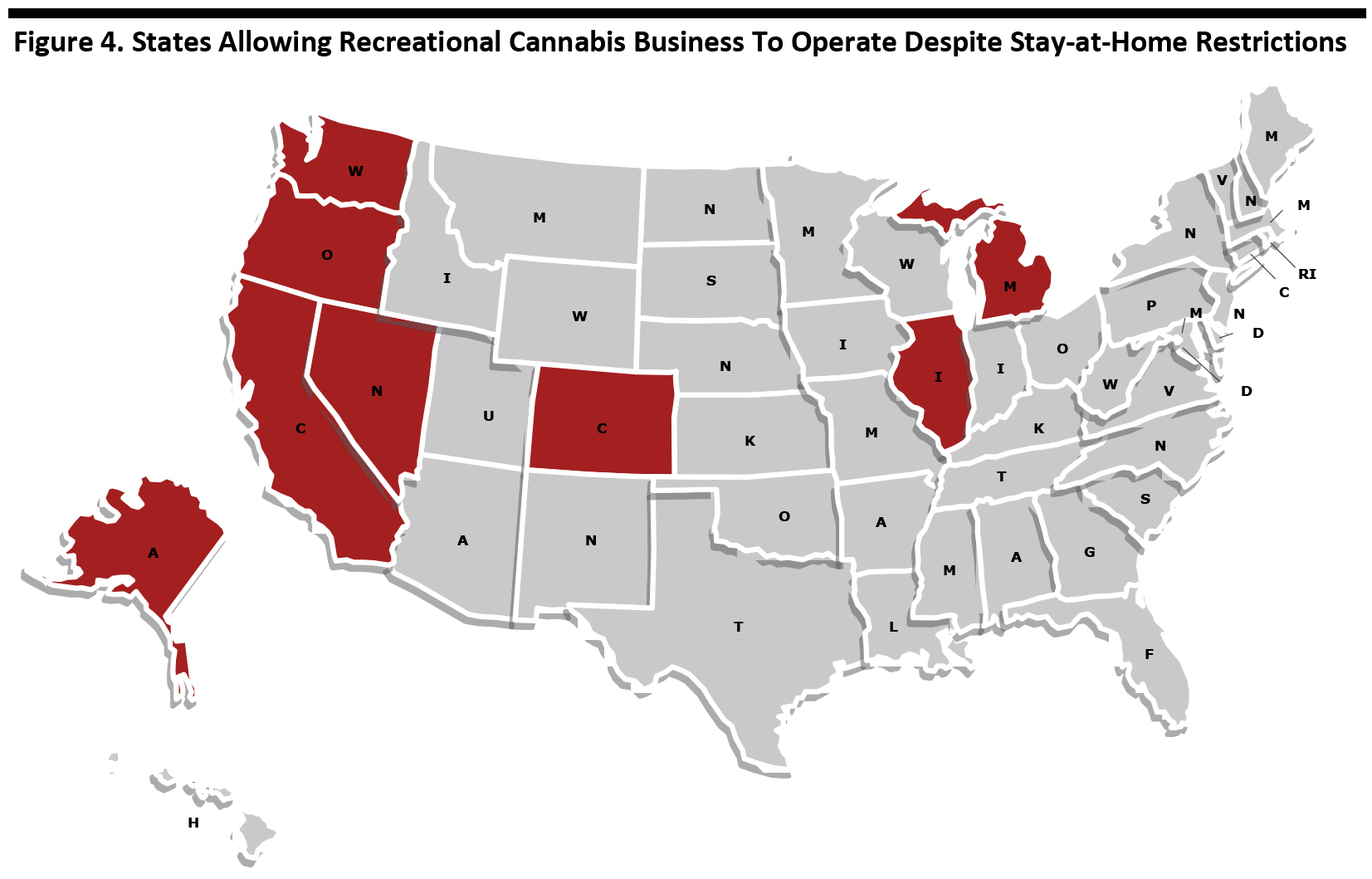

However, hoarding of recreational cannabis has so far proved unnecessary, as several recreational cannabis-legal state governments that have put lockdown measures in place have deemed the drug and its associated businesses “essential.” These states are selectively allowing stores, online delivery and curbside pickup to continue to operate. According to Marijuana Business Daily, as of April 2, 2020, eight out of 10 recreational cannabis-legal states under stay-at-home orders had declared the drug “essential.” Massachusetts designated recreational cannabis as “nonessential” and authorized the closure of all associated businesses by March 23. Maine’s recreational cannabis market has not yet launched.

[caption id="attachment_108450" align="aligncenter" width="700"]

Source: Statista/Headset [/caption]

However, hoarding of recreational cannabis has so far proved unnecessary, as several recreational cannabis-legal state governments that have put lockdown measures in place have deemed the drug and its associated businesses “essential.” These states are selectively allowing stores, online delivery and curbside pickup to continue to operate. According to Marijuana Business Daily, as of April 2, 2020, eight out of 10 recreational cannabis-legal states under stay-at-home orders had declared the drug “essential.” Massachusetts designated recreational cannabis as “nonessential” and authorized the closure of all associated businesses by March 23. Maine’s recreational cannabis market has not yet launched.

[caption id="attachment_108450" align="aligncenter" width="700"] Source: Marijuana Business Daily [/caption]

Change in Consumption Habits

With consumers stocking up the recreational cannabis, their consumption habits may be changing, at least for the short term; sales in product categories responded very differently during the coronavirus crisis. According to a Coresight Research proprietary survey, conducted in December 2019, smoking is the most common method of consuming cannabis among recreational users in the US. However, since the outbreak, edibles have witnessed significantly more growth compared to other product categories, according to Headset. Prerolls, on the other hand, completely missed out on the stock-up sales surge, likely due to concerns of respiratory illness caused by the coronavirus.

[caption id="attachment_108451" align="aligncenter" width="700"]

Source: Marijuana Business Daily [/caption]

Change in Consumption Habits

With consumers stocking up the recreational cannabis, their consumption habits may be changing, at least for the short term; sales in product categories responded very differently during the coronavirus crisis. According to a Coresight Research proprietary survey, conducted in December 2019, smoking is the most common method of consuming cannabis among recreational users in the US. However, since the outbreak, edibles have witnessed significantly more growth compared to other product categories, according to Headset. Prerolls, on the other hand, completely missed out on the stock-up sales surge, likely due to concerns of respiratory illness caused by the coronavirus.

[caption id="attachment_108451" align="aligncenter" width="700"] *January 1–March 6, 2020

*January 1–March 6, 2020 **March 7–31, 2020

Source: Statista/Headset [/caption]

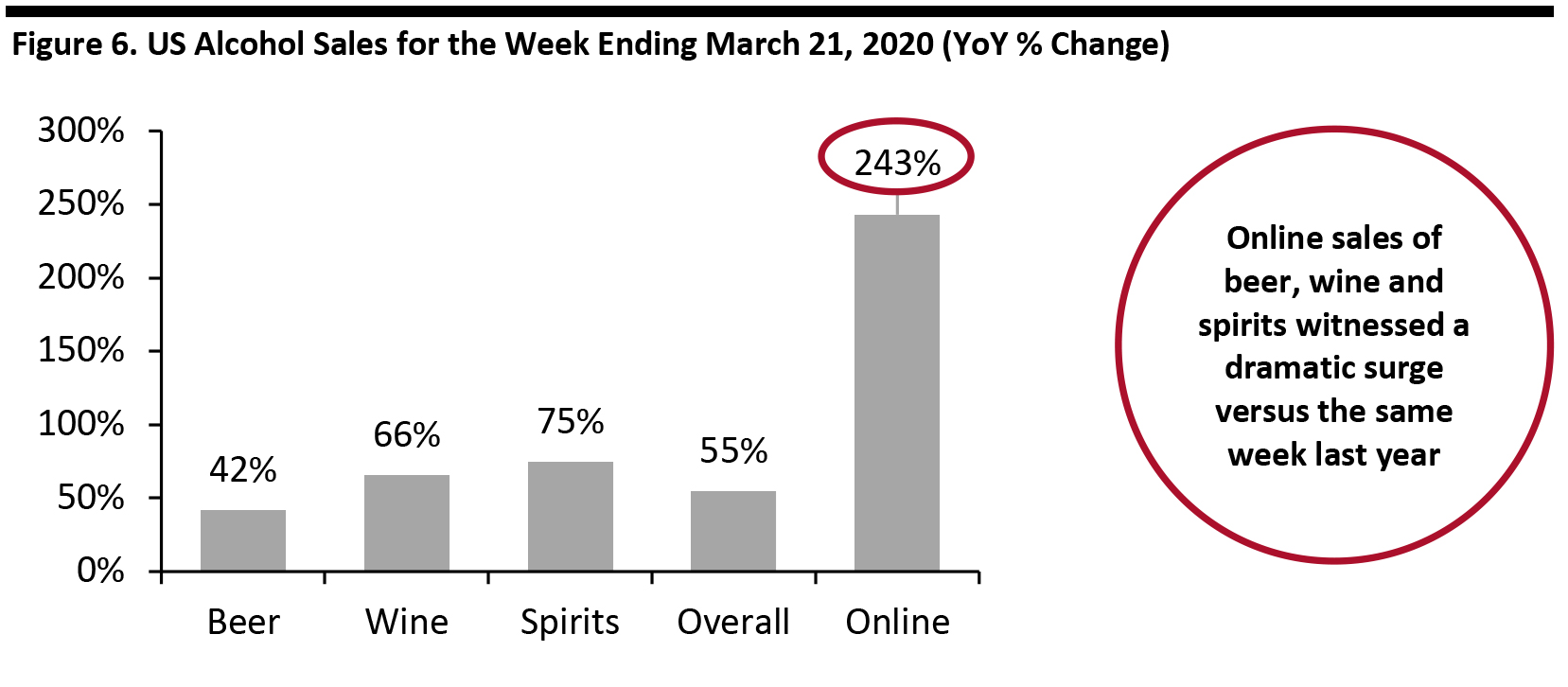

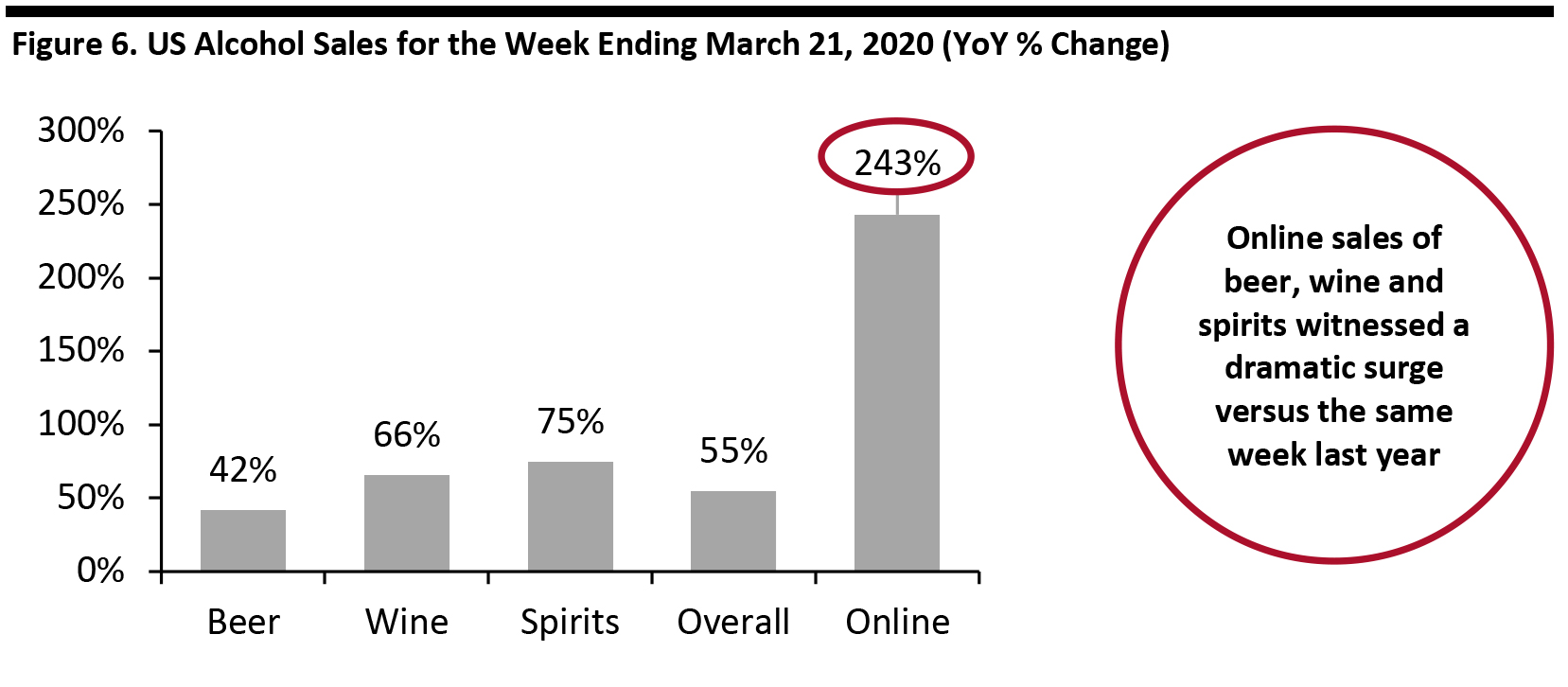

Alcohol

Coronavirus Lockdown Drives Jump in Alcohol Sales Following President Trump’s declaration of a national emergency on March 13, 2020 and subsequent announcements of lockdowns by several state governments—including the closures of bars and restaurants—alcohol sales in stores and online have ramped up sharply. According to research firm Nielsen, total alcohol retail sales (which do not include alcoholic drinks sold in bars and restaurants) increased significantly in the week ending March 21, 2020, over the same period in 2019. Wine sales reported a 66% increase, beer 42% and spirits 75%. Online sales of beer, wine and spirits witnessed a whopping 243% surge versus the same week last year. [caption id="attachment_108452" align="aligncenter" width="700"] Source: Statista/Nielsen [/caption]

The following chart shows a week-over-week comparison of US consumers who indicated they were spending more/less on alcoholic beverages, based on data from Coresight Research surveys undertaken on April 8, April 1, March 25 and March 17–18. In our weekly survey of March 25, we saw an increase in the number of respondents who indicated they would likely buy more alcohol, but that number dropped in the survey of April 1. However, in the April 8 survey, the proportion of respondents buying more on alcohol jumped by 6.8 percentage points and outpaced those who said they would buy less, indicating that some shoppers have returned to spending on alcohol.

[caption id="attachment_108453" align="aligncenter" width="700"]

Source: Statista/Nielsen [/caption]

The following chart shows a week-over-week comparison of US consumers who indicated they were spending more/less on alcoholic beverages, based on data from Coresight Research surveys undertaken on April 8, April 1, March 25 and March 17–18. In our weekly survey of March 25, we saw an increase in the number of respondents who indicated they would likely buy more alcohol, but that number dropped in the survey of April 1. However, in the April 8 survey, the proportion of respondents buying more on alcohol jumped by 6.8 percentage points and outpaced those who said they would buy less, indicating that some shoppers have returned to spending on alcohol.

[caption id="attachment_108453" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption]

Tobacco/Cigarettes

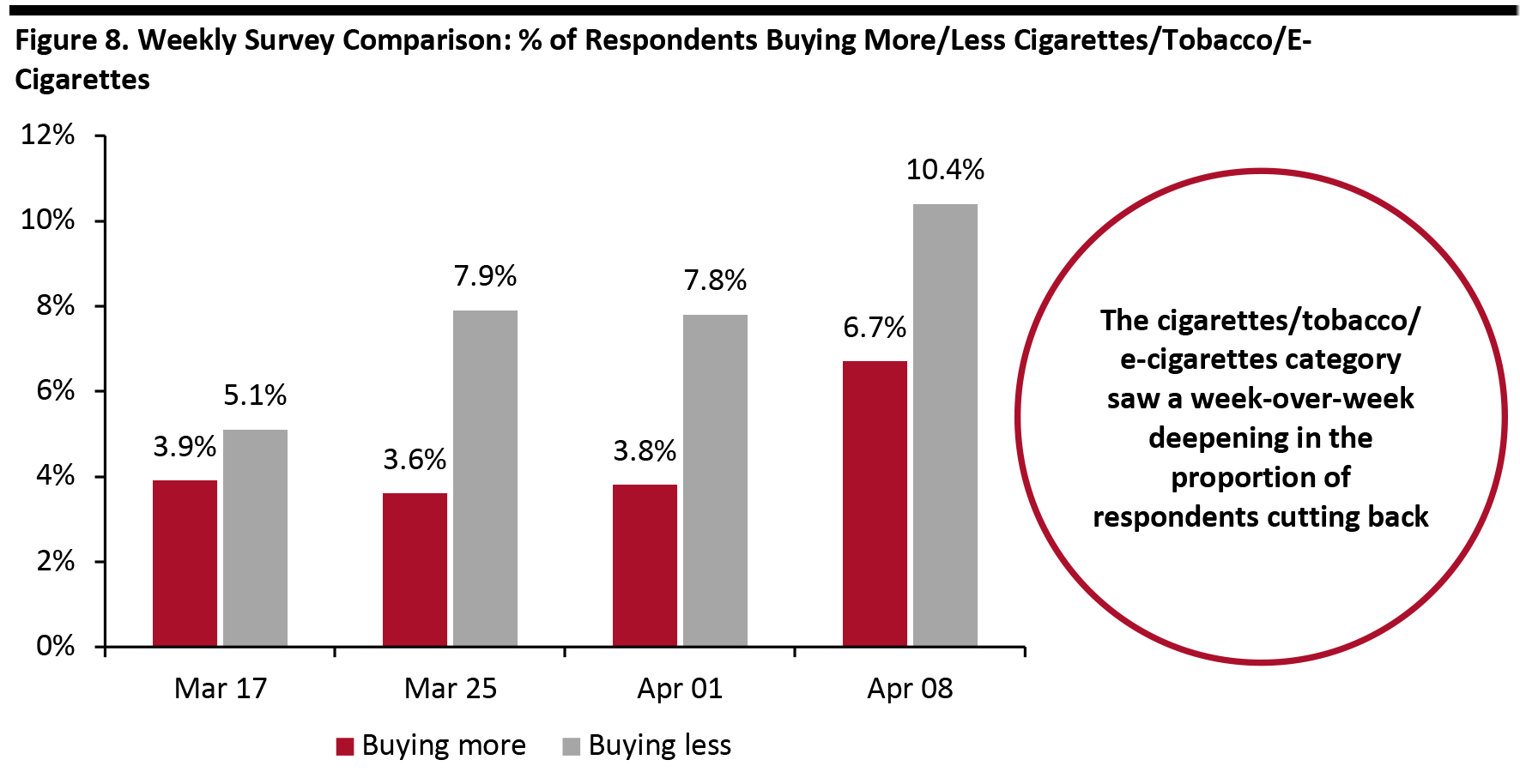

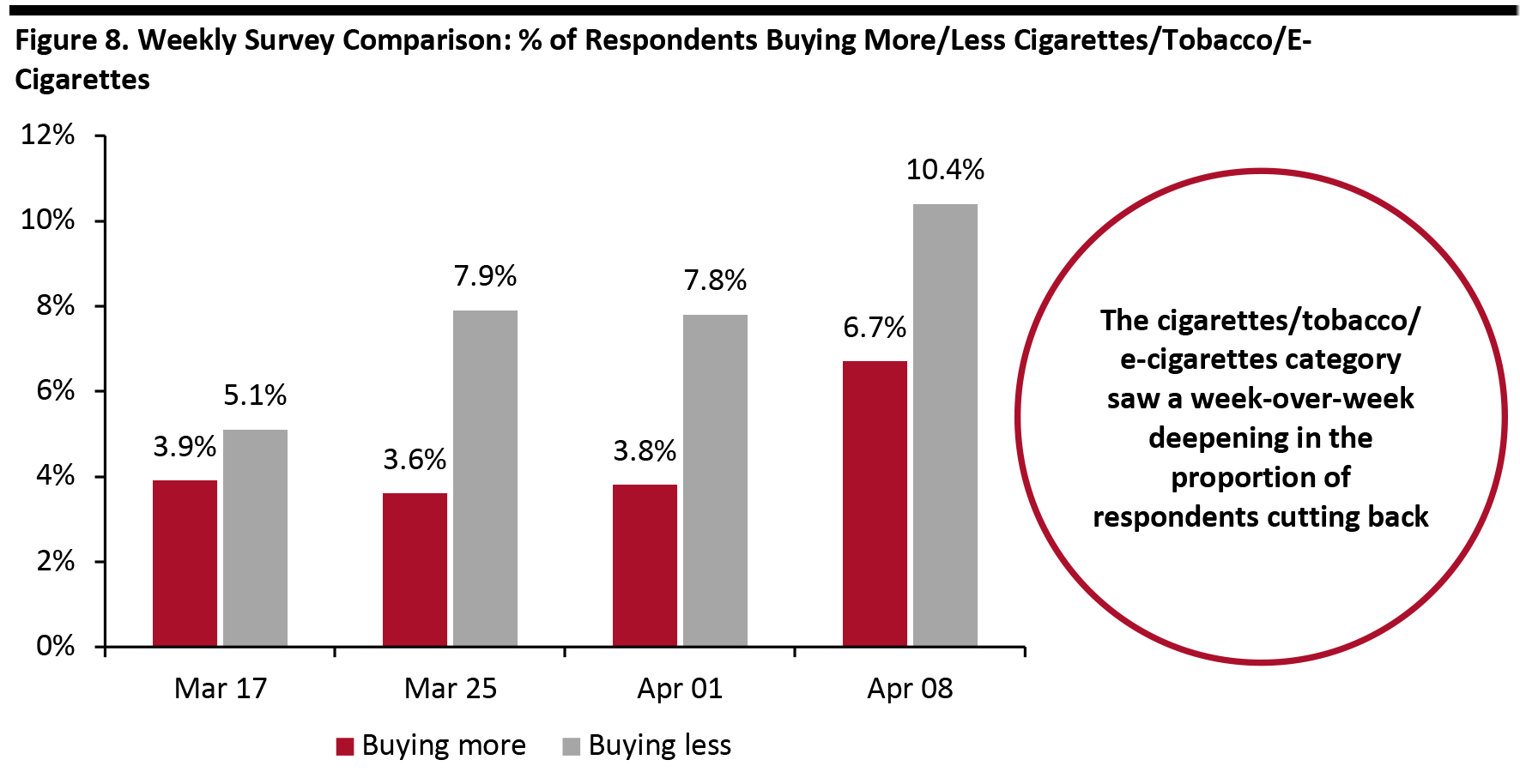

Tobacco/Cigarettes Sales Pick Up, but Not Much Sales of traditional cigarettes grew marginally with the issuing of stay-at-home orders. According to the investment banking firm Piper Sandler, traditional cigarette sales volume grew 1.1% for the week ended March 22, which indicates that tobacco/cigarettes did not witness any dramatic shift in sales as seen in other vice categories. According to the Coresight Research weekly survey, cigarettes/tobacco/e-cigarettes continue to see a week-over-week deepening in the proportion of respondents who indicated they are cutting their spending on these products. [caption id="attachment_108458" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Tobacco Companies See No Material Impact Yet from Coronavirus Outbreak British American Tobacco announced on its Capital Markets Day event (held on March 18, 2020) that it had not yet seen the coronavirus cause any change in the consumption pattern of cigarettes globally—other than a sales decline in duty-free shops. The company added that it had not experienced any material impact on group performance and that the “business is performing well” despite global uncertainty. As the impacts are minimal, the company said that it would stick to its previous guidance of a 4% decline in 2020 industry sales of cigarette and tobacco heating products and around a 5% decline in the US. Imperial Brands, owner of ITG, also announced on March 30 that it had not yet experienced any material impact on group performance at a global level due to the coronavirus outbreak, and current trading remains in line with expectations. Tobacco Companies Join Race To Develop Tobacco Plant-Based Coronavirus Vaccine In an unexpected development, British American Tobacco and Phillips Morris have joined pharma companies in the race to develop a coronavirus vaccine. On March 19, 2020, Phillips Morris, through its partially owned Canadian biopharmaceutical company Medicago, announced a significant breakthrough in the development of a tobacco plant-based coronavirus vaccine. Medicago is using a virus-like particle grown in Nicotiana benthamiana, a close relative of the tobacco plant, to develop a potential protein-based vaccine for coronavirus. The company added that it is ready to start pre-clinical testing and will begin human trials of the possible vaccine this summer. Similarly, British American Tobacco, through its biotech subsidiary Kentucky BioProcessing, announced on April 1 that it is developing a potential vaccine for the coronavirus, which is also in pre-clinical testing currently. The company said that the potential vaccine could deliver an effective immune response in a single dose. British American Tobacco said that it has the capability to manufacture 1–3 million doses of vaccine per week and is exploring ways to collaborate with government agencies to bring the vaccine to clinical studies quickly.