DIpil Das

In our Coronavirus Briefing series, we outline the possible impact of the coronavirus outbreak on economies, sectors and businesses. In this report, we assess how changing consumer behavior in light of the outbreak have positively impacted product sales across various retail sectors.

Grocery and Cooking Products

People in China have been choosing to cook at home rather than visit public places to eat. In fact, most restaurants were closed during the Chinese New Year public holiday. For online group-buying platform Pinduoduo, egg poachers were included in the “Top Ten Best Selling Product List” for the period of January 24 to February 14.

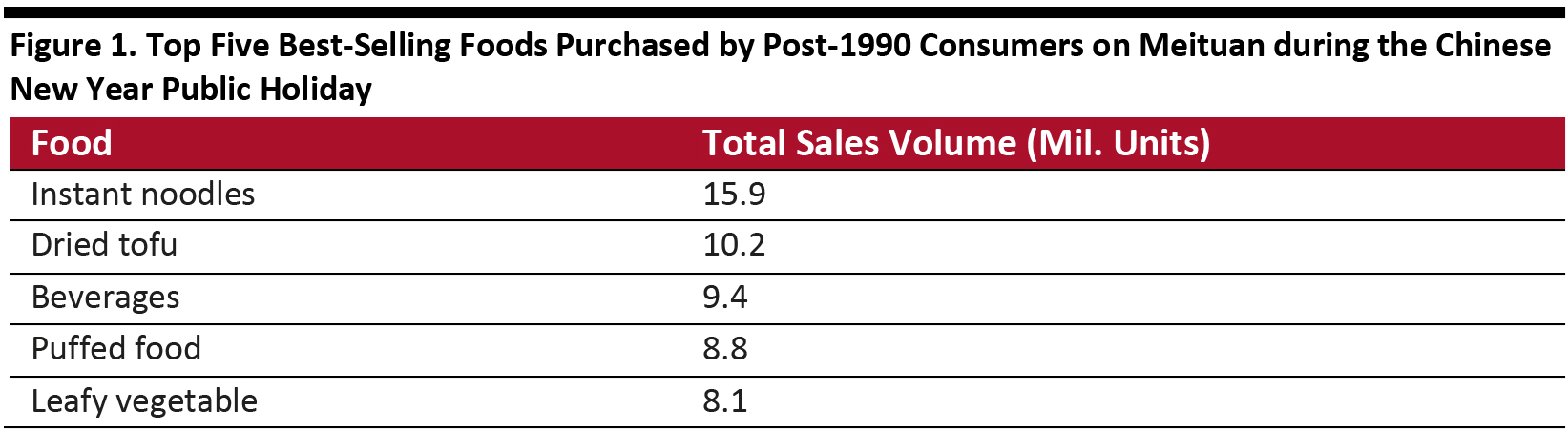

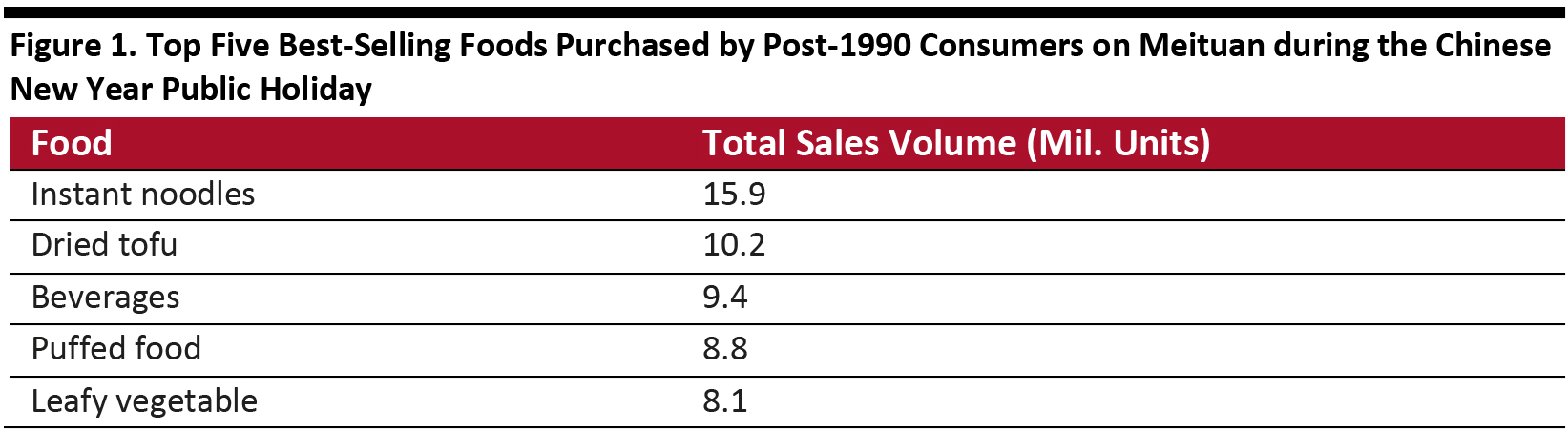

According to Meituan, a Chinese local-services platform, online searches for baking goods jumped 100-fold during the Lunar New Year holiday. Sales of condiments also increased more than eight times during the same period. Instant noodles were the most popular food on Meituan during the Lunar New Year holiday among consumers born after 1990, with a sales volume of 15.9 million (as shown in Figure 1).

[caption id="attachment_104799" align="aligncenter" width="700"] Source: Meituan/Coresight Research [/caption]

Between January 24 and February 2, sales of vegetables on JD.com increased by 215% over the same period a year ago. Data from JD.com also shows that vegetables comprised the category with the highest sales growth during the Chinese New Year holiday, with sales increasing by nearly 450% compared with the same period in 2019.

Home Cleaning Products

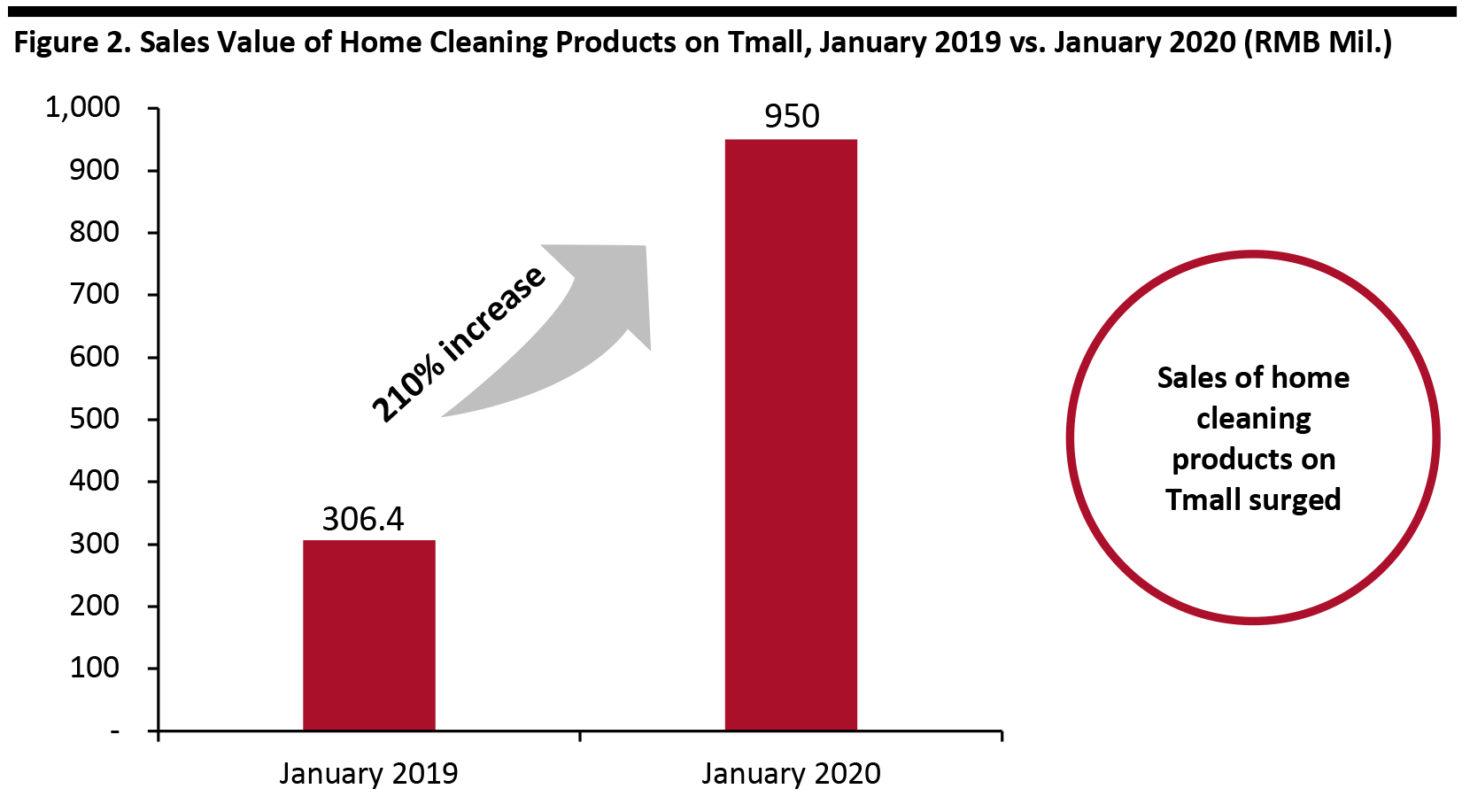

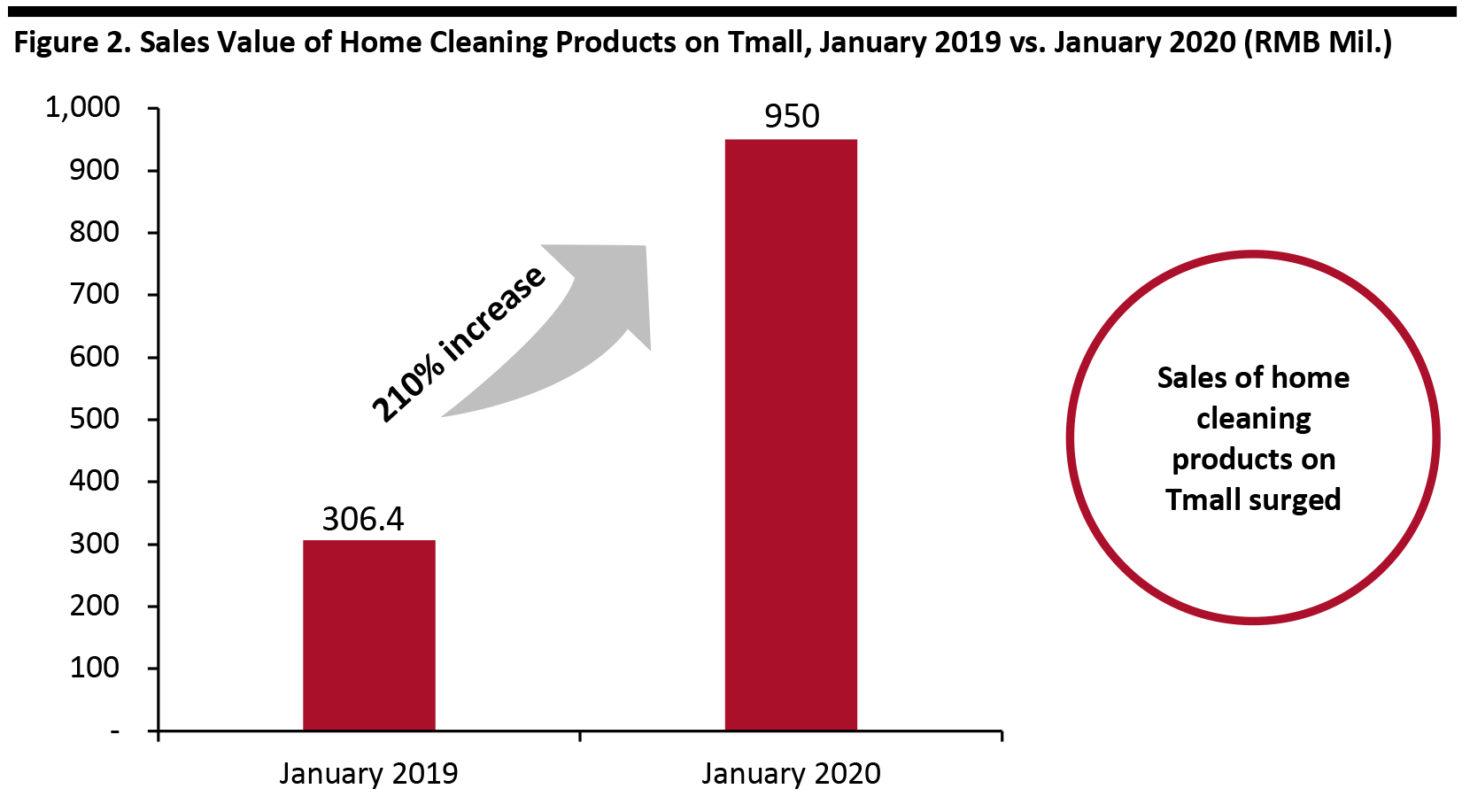

As people in China are being advised by the government to clean frequently touched surfaces and objects regularly to prevent the spread of the coronavirus, demand for home cleaning products has dramatically surged. Data from Sheng Yi Can Mou, a data platform that tracks sales data from Alibaba’s Tmall, shows that sales of home cleaning products on the e-commerce platform surged 210% year over year (as shown in Figure 2).

Between January 25 and February 23 in 2020, the most popular store by sales value on Tmall in the home cleaning category was Weica, a Chinese brand that sells antibacterial sprays. Total sales from the Weica Tmall store reached ¥33.6 million ($4.8 million) during that period.

[caption id="attachment_104800" align="aligncenter" width="700"]

Source: Meituan/Coresight Research [/caption]

Between January 24 and February 2, sales of vegetables on JD.com increased by 215% over the same period a year ago. Data from JD.com also shows that vegetables comprised the category with the highest sales growth during the Chinese New Year holiday, with sales increasing by nearly 450% compared with the same period in 2019.

Home Cleaning Products

As people in China are being advised by the government to clean frequently touched surfaces and objects regularly to prevent the spread of the coronavirus, demand for home cleaning products has dramatically surged. Data from Sheng Yi Can Mou, a data platform that tracks sales data from Alibaba’s Tmall, shows that sales of home cleaning products on the e-commerce platform surged 210% year over year (as shown in Figure 2).

Between January 25 and February 23 in 2020, the most popular store by sales value on Tmall in the home cleaning category was Weica, a Chinese brand that sells antibacterial sprays. Total sales from the Weica Tmall store reached ¥33.6 million ($4.8 million) during that period.

[caption id="attachment_104800" align="aligncenter" width="700"] Source: Sheng Yi Can Mou/Coresight Research [/caption]

Personal Care Products

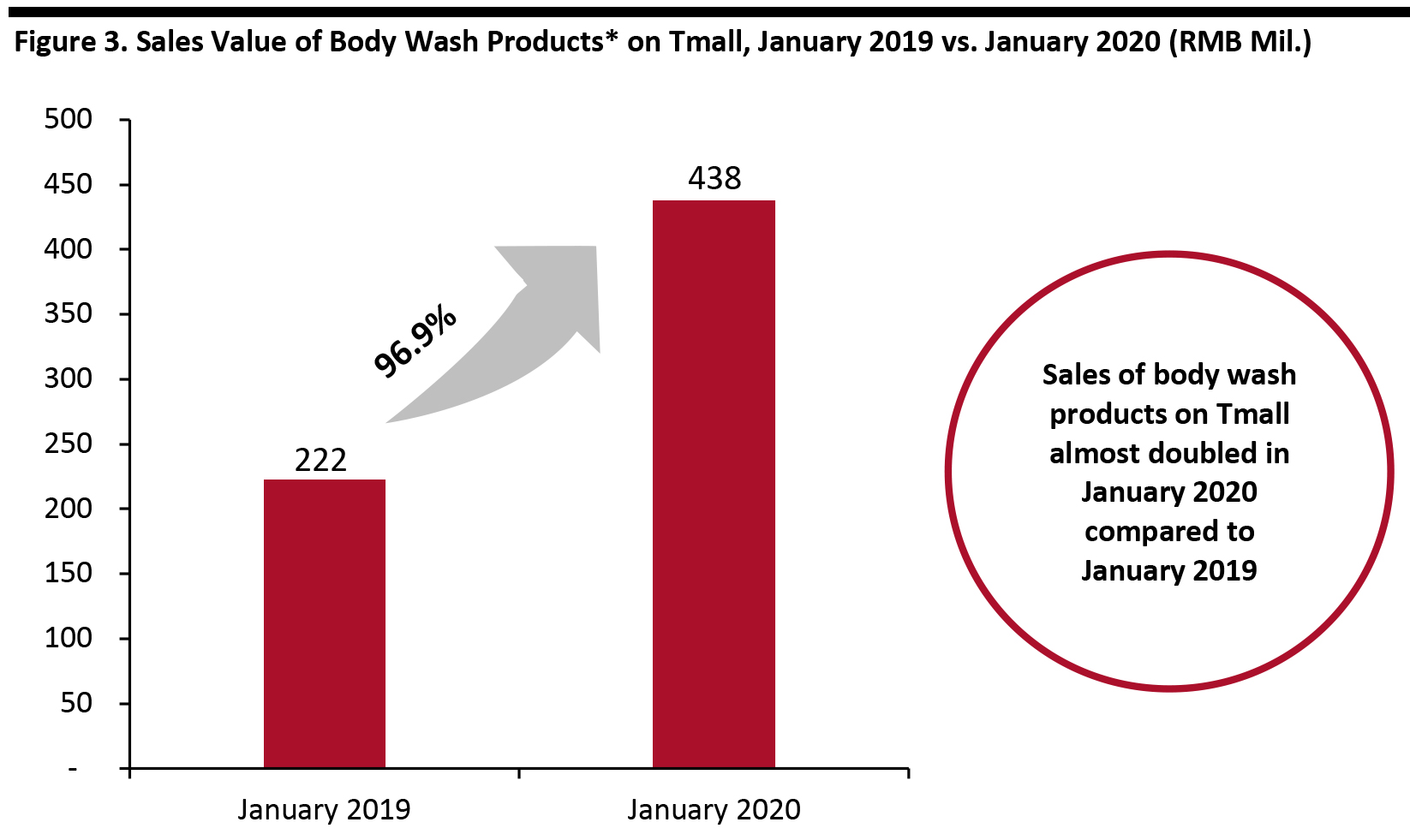

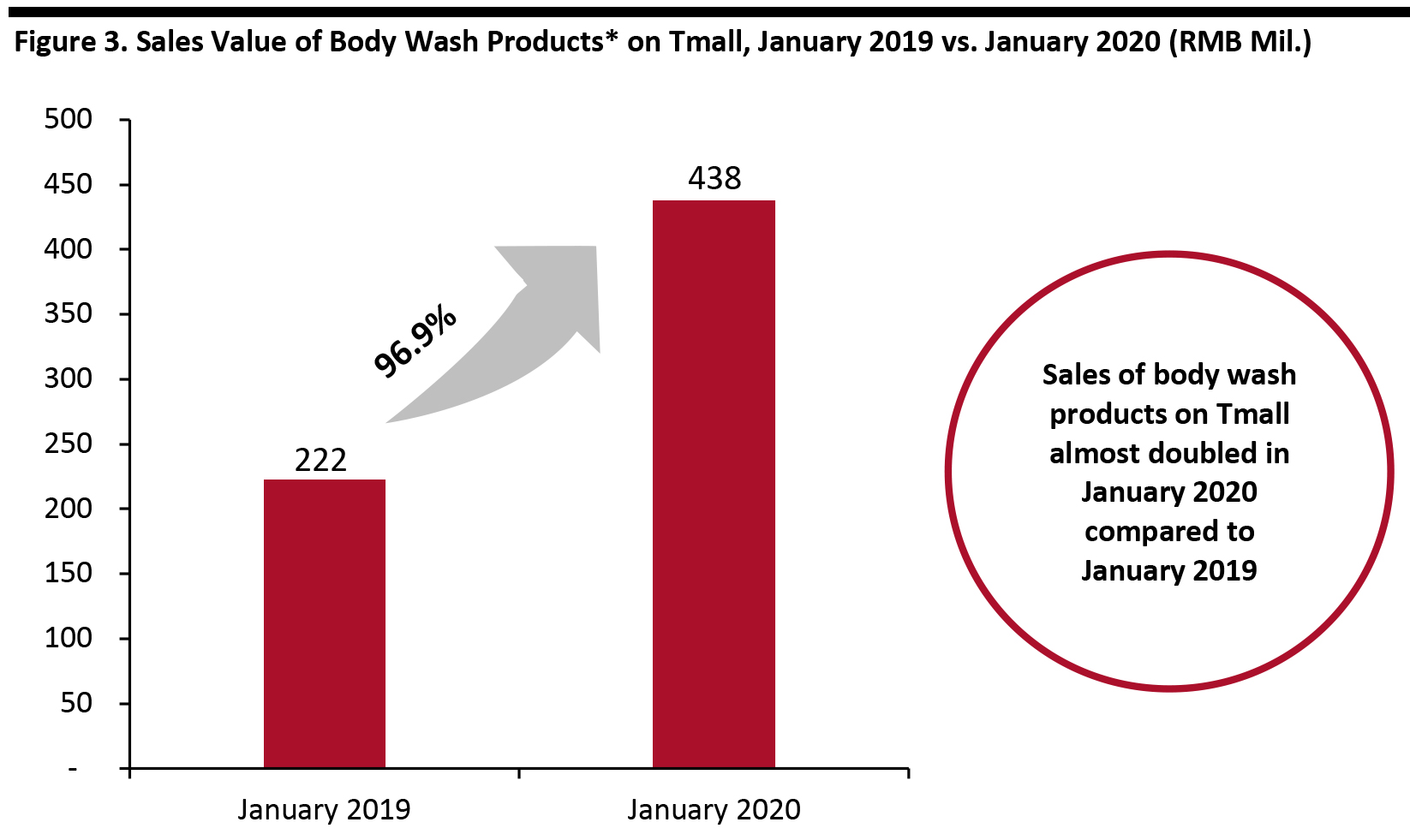

The coronavirus outbreak has boosted sales of personal hygiene products. JD.com saw 1.8 million bottles of disinfectant solution and 3 million bottles of liquid soap sold during the Chinese New Year holiday. According to data from Sheng Yi Can Mou, total sales value of the body wash category on Tmall—which includes bath soap, bath cream, shower gel, handwash, bathing herbs and intimate wash, according to Tmall’s definition—increased by 96.9% to ¥438 million ($62.9 million) in January 2020, compared to January 2019 (see Figure 3). Sheng Yi Can Mou’s data also shows that between January 25 and February 23 in 2020, total sales on antibacterial brand Dettol’s Tmall flagship store reached ¥22.7 million ($3.6 million), making it the number-one store by sales in the body wash product category during that period.

[caption id="attachment_104801" align="aligncenter" width="700"]

Source: Sheng Yi Can Mou/Coresight Research [/caption]

Personal Care Products

The coronavirus outbreak has boosted sales of personal hygiene products. JD.com saw 1.8 million bottles of disinfectant solution and 3 million bottles of liquid soap sold during the Chinese New Year holiday. According to data from Sheng Yi Can Mou, total sales value of the body wash category on Tmall—which includes bath soap, bath cream, shower gel, handwash, bathing herbs and intimate wash, according to Tmall’s definition—increased by 96.9% to ¥438 million ($62.9 million) in January 2020, compared to January 2019 (see Figure 3). Sheng Yi Can Mou’s data also shows that between January 25 and February 23 in 2020, total sales on antibacterial brand Dettol’s Tmall flagship store reached ¥22.7 million ($3.6 million), making it the number-one store by sales in the body wash product category during that period.

[caption id="attachment_104801" align="aligncenter" width="700"] *According to Tmall, the, body wash category includes bath soap, handwash, bath cream, shower gel, bathing herbs and intimate wash Source: Sheng Yi Can Mou/Coresight Research [/caption]

Medicine

Many people in China have turned to online retailers to buy medicine during the coronavirus outbreak. This is because the outbreak has led to a consumer focus on health and wellbeing, but residents in China are making efforts to reduce direct human contact, thus avoiding shopping in physical pharmacies. Meituan data shows that 200,000 packs of Chinese herbal cold remedies and 200,000 vitamin C supplement products were sold during the Chinese New Year holiday. Many elderly people are also choosing to shop via online medical services in order to have medicine delivered directly to their homes. Sales of prescribed drugs for chronic diseases, such as hypertension and diabetes, rose by 237% on Meituan during the holiday.

Electronics

Due to the coronavirus outbreak, schools were closed for a longer period than usual following the Chinese New Year holiday, so many schools offered online education to their students. Many adults also accessed online education during the prolonged holiday, as well as working remotely rather than going into offices. These changing behaviors drove sales of computer-related products, such as laptops and keyboards. According to e-commerce retailer Fenqile, sales of laptops increased by 50% between February 6 and February 20, compared to the same period last year; sales of earphones, keyboards and PC mice also saw an increase of 30–50% during the same period.

Appendix: Recent Store Closures and Updates from Retailers Operating in China

*According to Tmall, the, body wash category includes bath soap, handwash, bath cream, shower gel, bathing herbs and intimate wash Source: Sheng Yi Can Mou/Coresight Research [/caption]

Medicine

Many people in China have turned to online retailers to buy medicine during the coronavirus outbreak. This is because the outbreak has led to a consumer focus on health and wellbeing, but residents in China are making efforts to reduce direct human contact, thus avoiding shopping in physical pharmacies. Meituan data shows that 200,000 packs of Chinese herbal cold remedies and 200,000 vitamin C supplement products were sold during the Chinese New Year holiday. Many elderly people are also choosing to shop via online medical services in order to have medicine delivered directly to their homes. Sales of prescribed drugs for chronic diseases, such as hypertension and diabetes, rose by 237% on Meituan during the holiday.

Electronics

Due to the coronavirus outbreak, schools were closed for a longer period than usual following the Chinese New Year holiday, so many schools offered online education to their students. Many adults also accessed online education during the prolonged holiday, as well as working remotely rather than going into offices. These changing behaviors drove sales of computer-related products, such as laptops and keyboards. According to e-commerce retailer Fenqile, sales of laptops increased by 50% between February 6 and February 20, compared to the same period last year; sales of earphones, keyboards and PC mice also saw an increase of 30–50% during the same period.

Appendix: Recent Store Closures and Updates from Retailers Operating in China

Source: Meituan/Coresight Research [/caption]

Between January 24 and February 2, sales of vegetables on JD.com increased by 215% over the same period a year ago. Data from JD.com also shows that vegetables comprised the category with the highest sales growth during the Chinese New Year holiday, with sales increasing by nearly 450% compared with the same period in 2019.

Home Cleaning Products

As people in China are being advised by the government to clean frequently touched surfaces and objects regularly to prevent the spread of the coronavirus, demand for home cleaning products has dramatically surged. Data from Sheng Yi Can Mou, a data platform that tracks sales data from Alibaba’s Tmall, shows that sales of home cleaning products on the e-commerce platform surged 210% year over year (as shown in Figure 2).

Between January 25 and February 23 in 2020, the most popular store by sales value on Tmall in the home cleaning category was Weica, a Chinese brand that sells antibacterial sprays. Total sales from the Weica Tmall store reached ¥33.6 million ($4.8 million) during that period.

[caption id="attachment_104800" align="aligncenter" width="700"]

Source: Meituan/Coresight Research [/caption]

Between January 24 and February 2, sales of vegetables on JD.com increased by 215% over the same period a year ago. Data from JD.com also shows that vegetables comprised the category with the highest sales growth during the Chinese New Year holiday, with sales increasing by nearly 450% compared with the same period in 2019.

Home Cleaning Products

As people in China are being advised by the government to clean frequently touched surfaces and objects regularly to prevent the spread of the coronavirus, demand for home cleaning products has dramatically surged. Data from Sheng Yi Can Mou, a data platform that tracks sales data from Alibaba’s Tmall, shows that sales of home cleaning products on the e-commerce platform surged 210% year over year (as shown in Figure 2).

Between January 25 and February 23 in 2020, the most popular store by sales value on Tmall in the home cleaning category was Weica, a Chinese brand that sells antibacterial sprays. Total sales from the Weica Tmall store reached ¥33.6 million ($4.8 million) during that period.

[caption id="attachment_104800" align="aligncenter" width="700"] Source: Sheng Yi Can Mou/Coresight Research [/caption]

Personal Care Products

The coronavirus outbreak has boosted sales of personal hygiene products. JD.com saw 1.8 million bottles of disinfectant solution and 3 million bottles of liquid soap sold during the Chinese New Year holiday. According to data from Sheng Yi Can Mou, total sales value of the body wash category on Tmall—which includes bath soap, bath cream, shower gel, handwash, bathing herbs and intimate wash, according to Tmall’s definition—increased by 96.9% to ¥438 million ($62.9 million) in January 2020, compared to January 2019 (see Figure 3). Sheng Yi Can Mou’s data also shows that between January 25 and February 23 in 2020, total sales on antibacterial brand Dettol’s Tmall flagship store reached ¥22.7 million ($3.6 million), making it the number-one store by sales in the body wash product category during that period.

[caption id="attachment_104801" align="aligncenter" width="700"]

Source: Sheng Yi Can Mou/Coresight Research [/caption]

Personal Care Products

The coronavirus outbreak has boosted sales of personal hygiene products. JD.com saw 1.8 million bottles of disinfectant solution and 3 million bottles of liquid soap sold during the Chinese New Year holiday. According to data from Sheng Yi Can Mou, total sales value of the body wash category on Tmall—which includes bath soap, bath cream, shower gel, handwash, bathing herbs and intimate wash, according to Tmall’s definition—increased by 96.9% to ¥438 million ($62.9 million) in January 2020, compared to January 2019 (see Figure 3). Sheng Yi Can Mou’s data also shows that between January 25 and February 23 in 2020, total sales on antibacterial brand Dettol’s Tmall flagship store reached ¥22.7 million ($3.6 million), making it the number-one store by sales in the body wash product category during that period.

[caption id="attachment_104801" align="aligncenter" width="700"] *According to Tmall, the, body wash category includes bath soap, handwash, bath cream, shower gel, bathing herbs and intimate wash Source: Sheng Yi Can Mou/Coresight Research [/caption]

Medicine

Many people in China have turned to online retailers to buy medicine during the coronavirus outbreak. This is because the outbreak has led to a consumer focus on health and wellbeing, but residents in China are making efforts to reduce direct human contact, thus avoiding shopping in physical pharmacies. Meituan data shows that 200,000 packs of Chinese herbal cold remedies and 200,000 vitamin C supplement products were sold during the Chinese New Year holiday. Many elderly people are also choosing to shop via online medical services in order to have medicine delivered directly to their homes. Sales of prescribed drugs for chronic diseases, such as hypertension and diabetes, rose by 237% on Meituan during the holiday.

Electronics

Due to the coronavirus outbreak, schools were closed for a longer period than usual following the Chinese New Year holiday, so many schools offered online education to their students. Many adults also accessed online education during the prolonged holiday, as well as working remotely rather than going into offices. These changing behaviors drove sales of computer-related products, such as laptops and keyboards. According to e-commerce retailer Fenqile, sales of laptops increased by 50% between February 6 and February 20, compared to the same period last year; sales of earphones, keyboards and PC mice also saw an increase of 30–50% during the same period.

Appendix: Recent Store Closures and Updates from Retailers Operating in China

*According to Tmall, the, body wash category includes bath soap, handwash, bath cream, shower gel, bathing herbs and intimate wash Source: Sheng Yi Can Mou/Coresight Research [/caption]

Medicine

Many people in China have turned to online retailers to buy medicine during the coronavirus outbreak. This is because the outbreak has led to a consumer focus on health and wellbeing, but residents in China are making efforts to reduce direct human contact, thus avoiding shopping in physical pharmacies. Meituan data shows that 200,000 packs of Chinese herbal cold remedies and 200,000 vitamin C supplement products were sold during the Chinese New Year holiday. Many elderly people are also choosing to shop via online medical services in order to have medicine delivered directly to their homes. Sales of prescribed drugs for chronic diseases, such as hypertension and diabetes, rose by 237% on Meituan during the holiday.

Electronics

Due to the coronavirus outbreak, schools were closed for a longer period than usual following the Chinese New Year holiday, so many schools offered online education to their students. Many adults also accessed online education during the prolonged holiday, as well as working remotely rather than going into offices. These changing behaviors drove sales of computer-related products, such as laptops and keyboards. According to e-commerce retailer Fenqile, sales of laptops increased by 50% between February 6 and February 20, compared to the same period last year; sales of earphones, keyboards and PC mice also saw an increase of 30–50% during the same period.

Appendix: Recent Store Closures and Updates from Retailers Operating in China

- Coca-Cola: The retailer has not changed its full-year guidance but did warn of an earnings-per-share hit of $0.01 to $0.02 cents in the first quarter of 2020.

- IKEA: The retailer stated that it is too early to quantify the total impact of the coronavirus outbreak on its business in China and globally but that it is prepared and planning for multiple scenarios.

- Microsoft: The technology company expects that sales in the first quarter of 2020 will be lower than initially expected due to coronavirus-related supply chain issues.

- Starbucks: According to a company announcement, financial guidance for fiscal year 2020 hadn't changed for Starbucks amid the coronavirus. However, the company is monitoring factors such as declining foot traffic and "business disruption."

- Walmart: The supermarket operator is continuing to monitor the coronavirus outbreak in China and around the world. According to a Walmart announcement on February 18, it is not lowering its sales forecast for 2020. However, the company’s CEO said that it is possible that the fallout from the coronavirus outbreak could have a “couple of cents’ negative impact” on earnings per share in the coming quarters.