DIpil Das

In our Coronavirus Briefing series, we outline the possible impact of the coronavirus outbreak on economies, sectors and businesses. In this report, we look at the impact on those retailers in the Coresight 100 in terms of consumer demand and supply chain. We also offer insights into what we’ve been hearing in earnings calls.

US Retailers Take a Hit from Supply Chain Disruptions

Even US retailers that do not do business in China have felt an impact to the supply chain.

Source: Company reports[/caption]

US Retailers Temporarily Close Stores in China

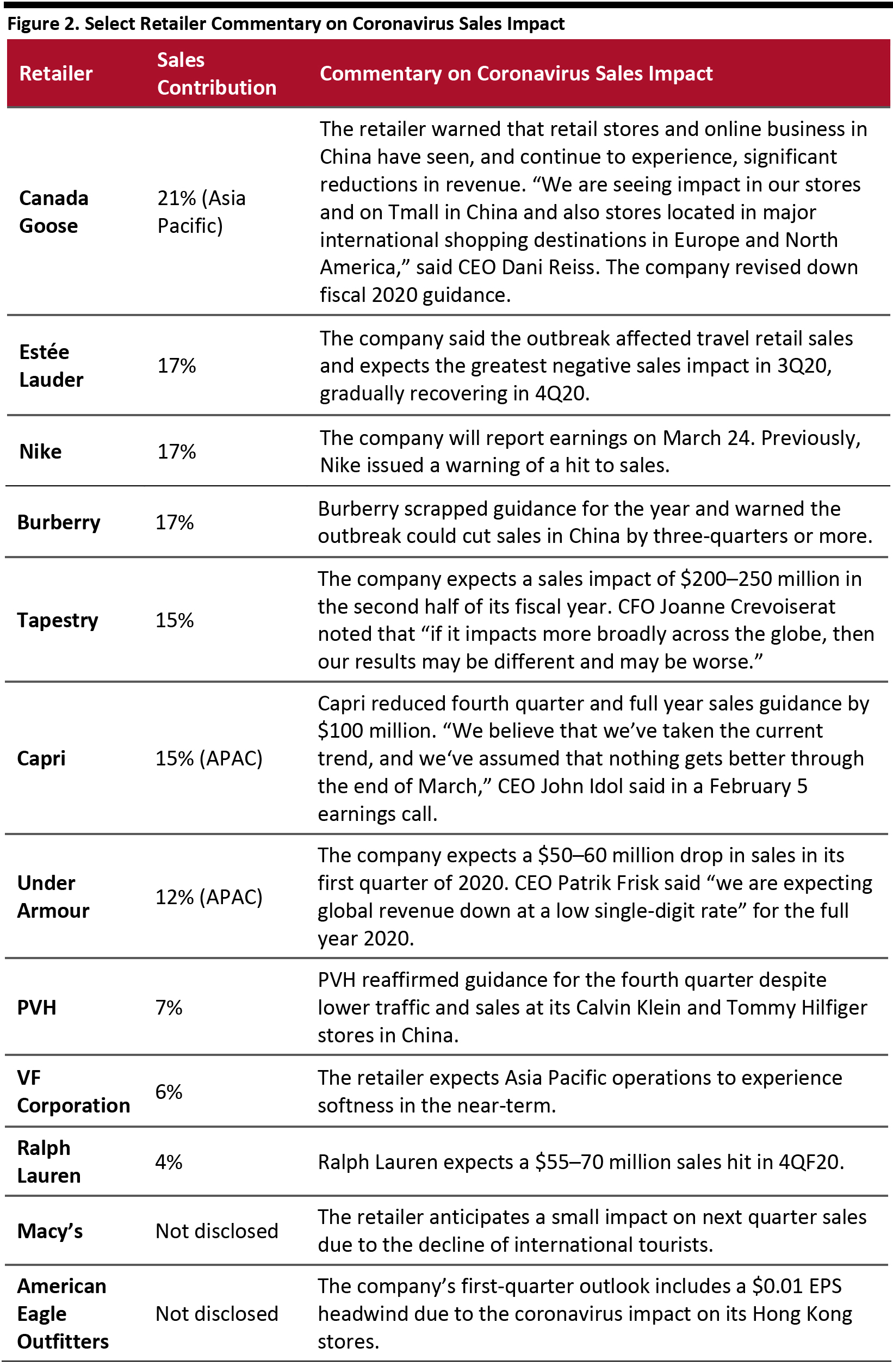

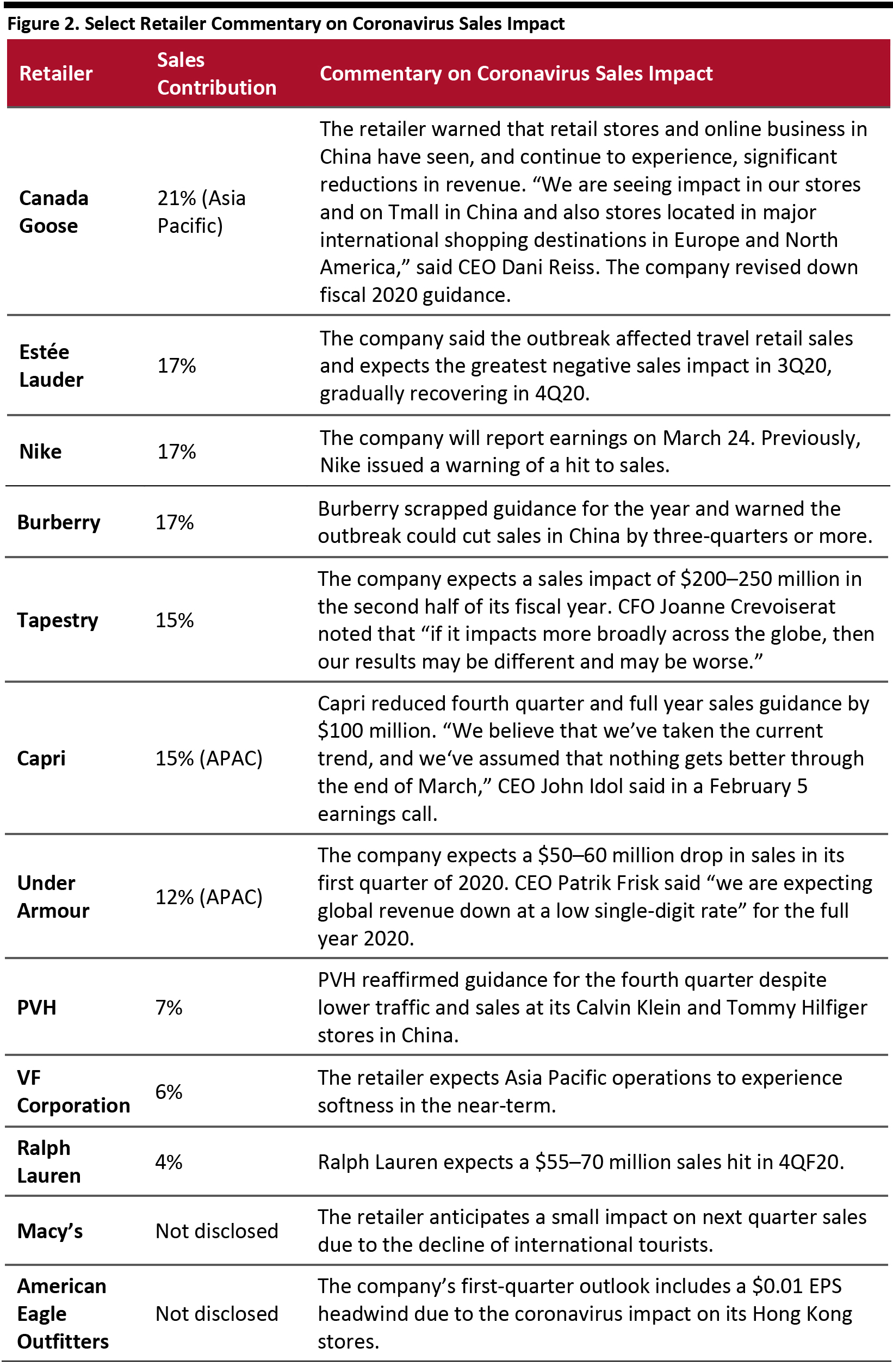

The timing of the coronavirus outbreak—just before the Chinese New Year holiday—significantly affected retailers in China and those outside China that rely on Chinese tourists. As store closed and people cancelled travel, many US retailers have warned of an impact to sales in the coming quarters.

[caption id="attachment_105198" align="aligncenter" width="700"]

Source: Company reports[/caption]

US Retailers Temporarily Close Stores in China

The timing of the coronavirus outbreak—just before the Chinese New Year holiday—significantly affected retailers in China and those outside China that rely on Chinese tourists. As store closed and people cancelled travel, many US retailers have warned of an impact to sales in the coming quarters.

[caption id="attachment_105198" align="aligncenter" width="700"] Source: Company reports[/caption]

German brands Adidas and Puma both warned about sales in China. Adidas said in its earnings call on March 11 that first-quarter sales are expected to fall by as much as €1 billion ($1.14 billion) in China. The company noted that 70% of its stores in China are open, but half are operating at reduced hours and still see low traffic. Puma has withdrawn the full-year guidance it gave on February 19, saying it could not “quantify the negative effect” of the outbreak on sales.

The Spread of the Virus in the US Could Hurt Domestic Retail Sales

Known coronavirus cases had passed 1,000 in the US across at least 35 states as of March 11. Officials have warned about sharp increase of US cases in the next two weeks as testing expands and detects currently undiagnosed infected people who currently are not being counted. The result could be a panic-inducing surge in reported cases, which could hurt retail and services as events are cancelled and people stay home.

Cities are already ordering events that draw large crowds to cancel, universities are moving classes online and companies are encouraging employees to work from home. The cumulative effect could hit retail hard as people stay home and spend less.

The only upside for some retailers is that coronavirus fear has sent US consumers flocking to grocery stores to stock up on food and cleaning products, emptying store shelves of certain products, especially sanitizers, cleaning products, rubbing alcohol, cold remedies and even staples such as rice.

Sales of dried foods such as fruit snacks, dried beans and pretzels jumped in late February, according to data from Nielsen.

Costco reported a surge in sales during the fourth week of February, which the company attributed to coronavirus buying, benefitting February sales by about 3 percentage points. Kroger and Target have not noted a large impact on sales, but have started limiting purchases of cleaning supplies due to high demand.

Despite this short-term fillip to grocers and supermarkets, the surge is not sustainable and will likely show up in subsequent quarters as equivalent declines as people work through the stockpiles they have accumulated. Broader retail is also likely to suffer even more severely as consumer confidence declines and discretionary spending falls.

The National Retail Federation (NRF) in February forecast US retail sales to rise between 3.5–4.1% in 2020. However, it warned that forecast assumes the coronavirus does not become a global pandemic. On March 11, the World Health Organization declared COVID-19 officially a pandemic, so we may see NRF revise down the estimates.

The Bloomberg Consumer Comfort index, which measures consumer confidence weekly, has been declining since late January, falling to a 10-week low in the week ended March 1.

A recent Coresight Research survey also found US consumers will avoid public places including shopping malls, restaurants and movie theaters if the outbreak worsens. If this happens (which is seeming increasingly likely), we expect discretionary spending on categories such as apparel, footwear and luxury to slide. Consumers in China turned to digital channels to shop, and we may see a similar trend play out in the US.

Source: Company reports[/caption]

German brands Adidas and Puma both warned about sales in China. Adidas said in its earnings call on March 11 that first-quarter sales are expected to fall by as much as €1 billion ($1.14 billion) in China. The company noted that 70% of its stores in China are open, but half are operating at reduced hours and still see low traffic. Puma has withdrawn the full-year guidance it gave on February 19, saying it could not “quantify the negative effect” of the outbreak on sales.

The Spread of the Virus in the US Could Hurt Domestic Retail Sales

Known coronavirus cases had passed 1,000 in the US across at least 35 states as of March 11. Officials have warned about sharp increase of US cases in the next two weeks as testing expands and detects currently undiagnosed infected people who currently are not being counted. The result could be a panic-inducing surge in reported cases, which could hurt retail and services as events are cancelled and people stay home.

Cities are already ordering events that draw large crowds to cancel, universities are moving classes online and companies are encouraging employees to work from home. The cumulative effect could hit retail hard as people stay home and spend less.

The only upside for some retailers is that coronavirus fear has sent US consumers flocking to grocery stores to stock up on food and cleaning products, emptying store shelves of certain products, especially sanitizers, cleaning products, rubbing alcohol, cold remedies and even staples such as rice.

Sales of dried foods such as fruit snacks, dried beans and pretzels jumped in late February, according to data from Nielsen.

Costco reported a surge in sales during the fourth week of February, which the company attributed to coronavirus buying, benefitting February sales by about 3 percentage points. Kroger and Target have not noted a large impact on sales, but have started limiting purchases of cleaning supplies due to high demand.

Despite this short-term fillip to grocers and supermarkets, the surge is not sustainable and will likely show up in subsequent quarters as equivalent declines as people work through the stockpiles they have accumulated. Broader retail is also likely to suffer even more severely as consumer confidence declines and discretionary spending falls.

The National Retail Federation (NRF) in February forecast US retail sales to rise between 3.5–4.1% in 2020. However, it warned that forecast assumes the coronavirus does not become a global pandemic. On March 11, the World Health Organization declared COVID-19 officially a pandemic, so we may see NRF revise down the estimates.

The Bloomberg Consumer Comfort index, which measures consumer confidence weekly, has been declining since late January, falling to a 10-week low in the week ended March 1.

A recent Coresight Research survey also found US consumers will avoid public places including shopping malls, restaurants and movie theaters if the outbreak worsens. If this happens (which is seeming increasingly likely), we expect discretionary spending on categories such as apparel, footwear and luxury to slide. Consumers in China turned to digital channels to shop, and we may see a similar trend play out in the US.

- Steve Madden said 73% of its products are sourced from China and that around 90% of its factories there had returned to normal operations as of the last week of February. But before then, factories were working at just 30–35% of normal capacity, so the company predicts production delays of about three weeks. “We will be utilizing a lot more air freight,” said by CEO Edward Rosenfeld. “But we certainly can’t put everything on an airplane, so there will be a lot of shipments that will be delayed. We have to assume that there’s going to be a loss of sales associated with that.” The company expects a $0.20 EPS hit related to coronavirus (and tariffs) in the first half of its fiscal year 2020.

- VF Corporation said that China accounts for about 16% of the company’s total cost of goods. The company estimates it can operate with current inventory without disruption until May.

- Best Buy has seen lighter inventory in some areas and expects to experience product shortages in the coming months, which it says will affect its business during the first half the year. “On the lower end of our guidance, we would assume that there’s a material disruption—a supply chain disruption from that, and we can’t make it all up in the year,” Best Buy CFO Matthew Bilunas said in a recent earnings call.

- Big Lots sources a high-teens percentage of products from China, and has noted that factories were still not operating at full capacity as of February 27. It estimates 1.5 points of comp sales impact due to delayed receipts in the first quarter. CFO Jonathan Ramsden said “we haven’t baked in any impact beyond Q1. We think there’s highly likely to be some in 2Q and potentially beyond that.”

- Costco expects minimal impact on items such as laptops and cell phones, but did not specify the overall financial impact. In fact, it saw improved production levels in the factories it sources from to 60–80% in the first week of March, as well as rising port capacity in China. “But again, it is improving and it still has a little way to go,” said CFO Richard Galanti in the latest earnings call.

- American Eagle Outfitters sources 20% of its products from China. “We are working with sourcing partners on migrations and currently do not anticipate any near-term supply chain disruptions,” said CFO Robert Madore in a recent earnings call.

- Dollar Tree directly imports 40–42% of its inventory from China. It has seen increased production and more factory workers return each week and said only a small percentage of product deliveries had been cancelled and delays were limited to a few weeks.

- Foot Locker is closely working with its vendor partners and feels confident about shipments in the first half of the year. “Not saying that there won’t be any disruption, but there’s nothing that I would flag and nothing that is certainly not built into our guidance at this point,” said CEO Richard Johnson in the company’s fourth-quarter earnings call.

- Wayfair relies on China to source 50% of its products. The company expects sales growth to slow in the next quarter, but did not attribute its forecast to the impact of the outbreak. “For any given item, we typically have additional selection coming from various countries of origin, creating options for substitution,” noted CFO Michael Fleisher in its recent earnings call.

- Macy’s and Dick’s Sporting Goods expect a slowdown of products coming from China, but not a significant impact, but Dick’s Sporting Goods did caution that the lower end of its fiscal 2020 guidance factors in possible coronavirus-related supply chain disruption.

- TJX, Kohl’s and Nordstrom have not noticed any material impact to their businesses.

Source: Company reports[/caption]

US Retailers Temporarily Close Stores in China

The timing of the coronavirus outbreak—just before the Chinese New Year holiday—significantly affected retailers in China and those outside China that rely on Chinese tourists. As store closed and people cancelled travel, many US retailers have warned of an impact to sales in the coming quarters.

[caption id="attachment_105198" align="aligncenter" width="700"]

Source: Company reports[/caption]

US Retailers Temporarily Close Stores in China

The timing of the coronavirus outbreak—just before the Chinese New Year holiday—significantly affected retailers in China and those outside China that rely on Chinese tourists. As store closed and people cancelled travel, many US retailers have warned of an impact to sales in the coming quarters.

[caption id="attachment_105198" align="aligncenter" width="700"] Source: Company reports[/caption]

German brands Adidas and Puma both warned about sales in China. Adidas said in its earnings call on March 11 that first-quarter sales are expected to fall by as much as €1 billion ($1.14 billion) in China. The company noted that 70% of its stores in China are open, but half are operating at reduced hours and still see low traffic. Puma has withdrawn the full-year guidance it gave on February 19, saying it could not “quantify the negative effect” of the outbreak on sales.

The Spread of the Virus in the US Could Hurt Domestic Retail Sales

Known coronavirus cases had passed 1,000 in the US across at least 35 states as of March 11. Officials have warned about sharp increase of US cases in the next two weeks as testing expands and detects currently undiagnosed infected people who currently are not being counted. The result could be a panic-inducing surge in reported cases, which could hurt retail and services as events are cancelled and people stay home.

Cities are already ordering events that draw large crowds to cancel, universities are moving classes online and companies are encouraging employees to work from home. The cumulative effect could hit retail hard as people stay home and spend less.

The only upside for some retailers is that coronavirus fear has sent US consumers flocking to grocery stores to stock up on food and cleaning products, emptying store shelves of certain products, especially sanitizers, cleaning products, rubbing alcohol, cold remedies and even staples such as rice.

Sales of dried foods such as fruit snacks, dried beans and pretzels jumped in late February, according to data from Nielsen.

Costco reported a surge in sales during the fourth week of February, which the company attributed to coronavirus buying, benefitting February sales by about 3 percentage points. Kroger and Target have not noted a large impact on sales, but have started limiting purchases of cleaning supplies due to high demand.

Despite this short-term fillip to grocers and supermarkets, the surge is not sustainable and will likely show up in subsequent quarters as equivalent declines as people work through the stockpiles they have accumulated. Broader retail is also likely to suffer even more severely as consumer confidence declines and discretionary spending falls.

The National Retail Federation (NRF) in February forecast US retail sales to rise between 3.5–4.1% in 2020. However, it warned that forecast assumes the coronavirus does not become a global pandemic. On March 11, the World Health Organization declared COVID-19 officially a pandemic, so we may see NRF revise down the estimates.

The Bloomberg Consumer Comfort index, which measures consumer confidence weekly, has been declining since late January, falling to a 10-week low in the week ended March 1.

A recent Coresight Research survey also found US consumers will avoid public places including shopping malls, restaurants and movie theaters if the outbreak worsens. If this happens (which is seeming increasingly likely), we expect discretionary spending on categories such as apparel, footwear and luxury to slide. Consumers in China turned to digital channels to shop, and we may see a similar trend play out in the US.

Source: Company reports[/caption]

German brands Adidas and Puma both warned about sales in China. Adidas said in its earnings call on March 11 that first-quarter sales are expected to fall by as much as €1 billion ($1.14 billion) in China. The company noted that 70% of its stores in China are open, but half are operating at reduced hours and still see low traffic. Puma has withdrawn the full-year guidance it gave on February 19, saying it could not “quantify the negative effect” of the outbreak on sales.

The Spread of the Virus in the US Could Hurt Domestic Retail Sales

Known coronavirus cases had passed 1,000 in the US across at least 35 states as of March 11. Officials have warned about sharp increase of US cases in the next two weeks as testing expands and detects currently undiagnosed infected people who currently are not being counted. The result could be a panic-inducing surge in reported cases, which could hurt retail and services as events are cancelled and people stay home.

Cities are already ordering events that draw large crowds to cancel, universities are moving classes online and companies are encouraging employees to work from home. The cumulative effect could hit retail hard as people stay home and spend less.

The only upside for some retailers is that coronavirus fear has sent US consumers flocking to grocery stores to stock up on food and cleaning products, emptying store shelves of certain products, especially sanitizers, cleaning products, rubbing alcohol, cold remedies and even staples such as rice.

Sales of dried foods such as fruit snacks, dried beans and pretzels jumped in late February, according to data from Nielsen.

Costco reported a surge in sales during the fourth week of February, which the company attributed to coronavirus buying, benefitting February sales by about 3 percentage points. Kroger and Target have not noted a large impact on sales, but have started limiting purchases of cleaning supplies due to high demand.

Despite this short-term fillip to grocers and supermarkets, the surge is not sustainable and will likely show up in subsequent quarters as equivalent declines as people work through the stockpiles they have accumulated. Broader retail is also likely to suffer even more severely as consumer confidence declines and discretionary spending falls.

The National Retail Federation (NRF) in February forecast US retail sales to rise between 3.5–4.1% in 2020. However, it warned that forecast assumes the coronavirus does not become a global pandemic. On March 11, the World Health Organization declared COVID-19 officially a pandemic, so we may see NRF revise down the estimates.

The Bloomberg Consumer Comfort index, which measures consumer confidence weekly, has been declining since late January, falling to a 10-week low in the week ended March 1.

A recent Coresight Research survey also found US consumers will avoid public places including shopping malls, restaurants and movie theaters if the outbreak worsens. If this happens (which is seeming increasingly likely), we expect discretionary spending on categories such as apparel, footwear and luxury to slide. Consumers in China turned to digital channels to shop, and we may see a similar trend play out in the US.