albert Chan

In our Coronavirus Briefing series, we outline the possible impacts of the coronavirus outbreak on economies, sectors and businesses. In this report, we look at how the outbreak has affected the global supply chain, with a focus on the apparel and smartphone market segments.

Disruptions to Global Supply Chain

The coronavirus outbreak led China’s government to prolong the Chinese New Year public holiday by 10 days, with most cities having resumed work on February 10. However, many factories are still unable to operate at full capacity due to migrant workers being unable to travel from their hometowns. The government has also imposed quarantine regulations for factory workers from regions that belong to coronavirus outbreak clusters; they must isolate themselves for 14 days before they are permitted to return to work.

Factories that have resumed operations are facing component shortages, caused by intercity transportation restrictions: One of many strict rules imposed by the central government to prevent the virus from spreading is that only vehicles transporting essential medical and food supplies are allowed to travel between selected cities. A ripple effect is therefore causing supply chain breakdowns for companies that depend on China for manufacturing and components.

Fashion Sector

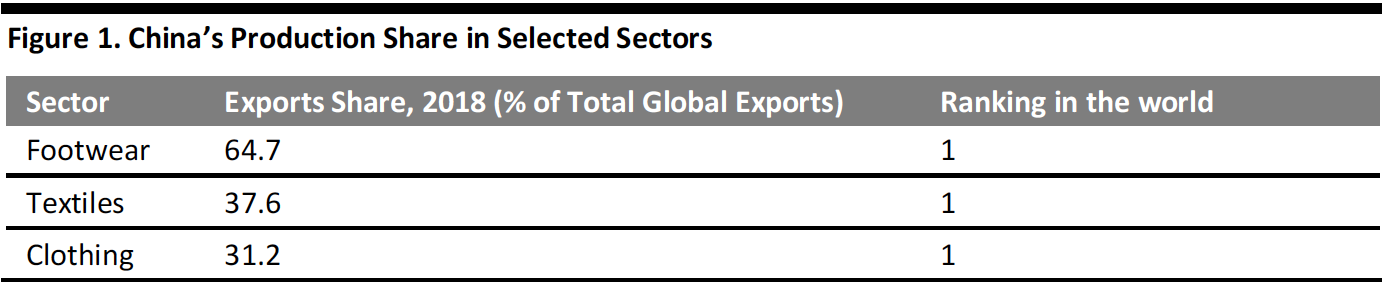

China is the world’s largest exporter of footwear and apparel (as shown in Figure 1). More than two thirds of total global shoe exports are from China. More than one third of clothing is from China. For example, Next, a UK-based apparel retailer, sources 20% of its clothes from China; Nike’s contractor factories in China manufactured 23% of the brand’s footwear; 21% of Gap’s products were produced in factories in China; and 525 factories in China made around half of the clothes for Primark.

[caption id="attachment_103876" align="aligncenter" width="700"] *Counting the European Union as a whole region

*Counting the European Union as a whole regionSource: WTO/World Footwear/Coresight Research[/caption]

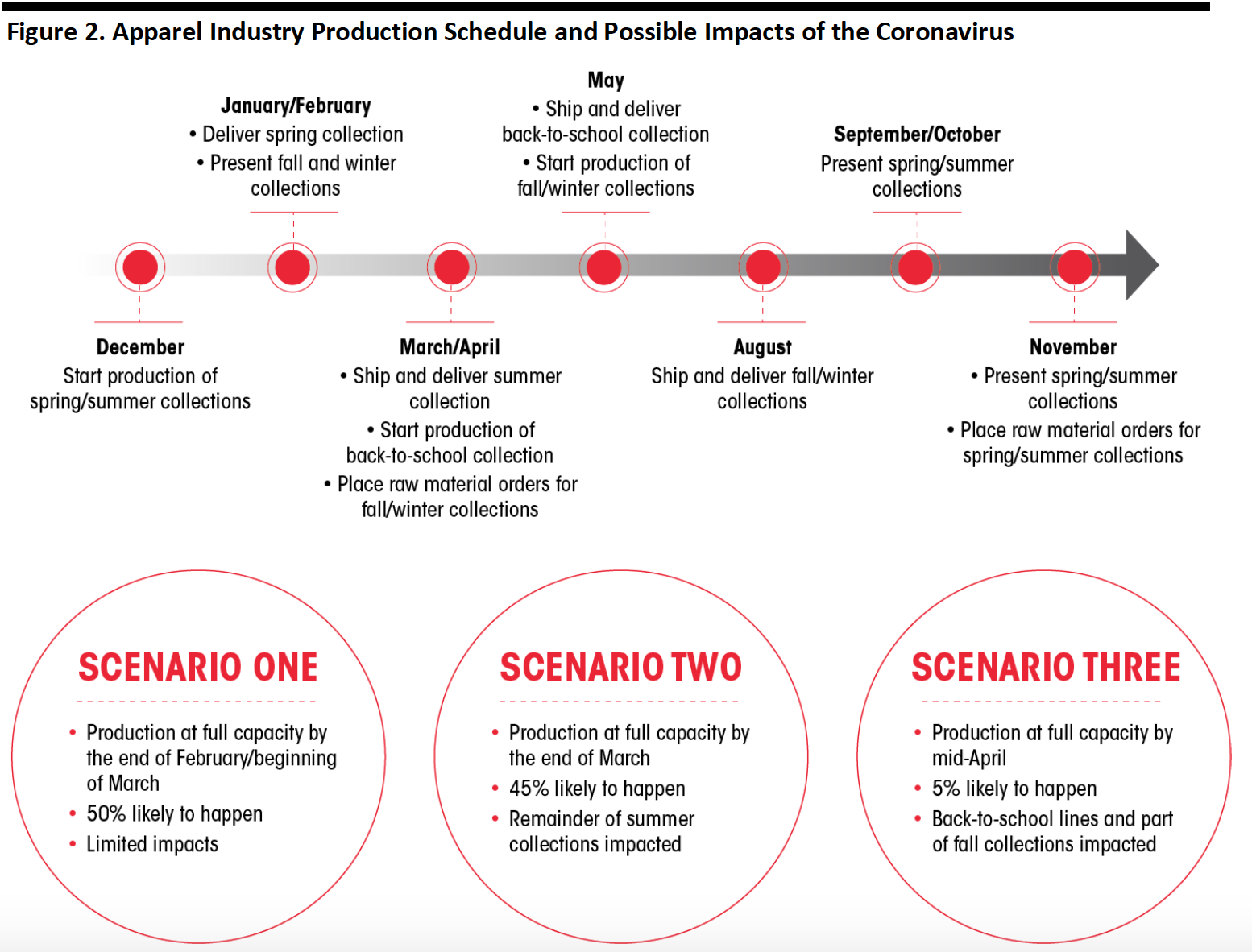

Factories in the fashion industry in China already shipped inventory for all spring—and some of summer—collections before the Chinese New Year. Most apparel and footwear manufacturers were scheduled to produce and ship the remaining summer collection items after the Lunar New Year holiday, the back-to-school collection from April and the fall/winter collections from May (as shown in Figure 2). However, the coronavirus outbreak has caused delays to this schedule as factories are operating at partial capacity. Although retailers and brand owners could diversify their production line from China (to countries such as Cambodia, Vietnam and their home countries) in order to minimize disruption, they would still rely on China for certain raw materials that would not be available due to the strict transportation bans that have been imposed by the government.

The best-case scenario for apparel and footwear manufacturers globally would be if factories in China are able to source the required raw materials and begin to operate at full capacity by the start of March. It would be likely that the supply chain could absorb the holdups—as disruption had only lasted for a few weeks—and thus catch up with the production schedule to deliver inventory on time. However, if the coronavirus situation continues for a prolonged period of time, we would reach a tipping point at which factories would experience significant inventory replenishment issues and so fall behind schedule. We expect the production of summer collections to be impacted if factories are not operating at full capacity by the end of March, with knock-on effects on the timelines of the back-to-school, fall and eventually winter collections should disruption continue in the worst-case scenario. We expect to have a clear picture of the likely scenario to unfold in the coming two to three weeks.

[caption id="attachment_103877" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The coronavirus outbreak has also disrupted fashion and trade shows, which might affect new brand and product launches as well as reduce brands’ exposure within the industry.

- Designers Lena Luo and Ekcee Chan of Luooifstudio were unable to attend the New York Fashion Week—which runs February 3–13—due to the recent travel bans.

- London Fashion Week, which started on February 14, saw a significant absence of Chinese buyers and media. Designers such as Yuhan Wang, a London-based designer born in China, and Asai have had to cut down or cancel their shows due to the closing of factories in China.

- Multi-segment sports trade show ISPO Beijing, which was scheduled to take place on February 12–15, was cancelled.

- Shanghai Fashion Week, originally scheduled between March 26 and April 2, has been postponed.

- Kingpins Hong Kong, a denim-sourcing trade show which runs between May 13 and May 14, has been cancelled.

Smartphone Industry

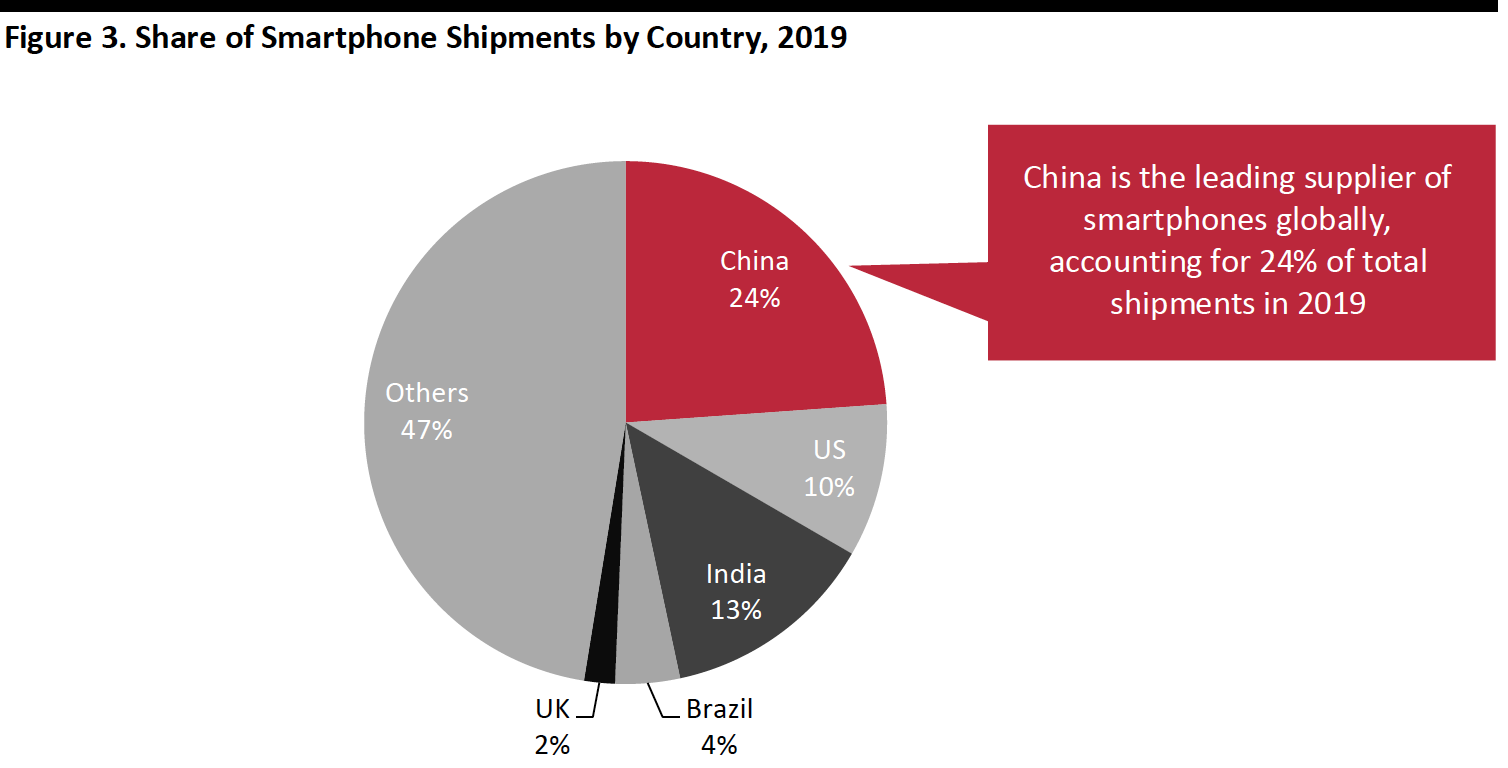

China is the leading supplier of smartphones globally, accounting for 24% of total shipments in 2019 (as shown in Figure 3). Vendors in China manufacture components for leading brands such as Apple, Huawei and Xiaomi.

[caption id="attachment_103878" align="aligncenter" width="700"] Source: IDC/Coresight Research[/caption]

Source: IDC/Coresight Research[/caption]

The coronavirus is threatening to wreak havoc on the global smartphone industry. For example, Mobile World Congress—the world’s largest smartphone show, which was scheduled to take place on February 24–27 in Barcelona—was cancelled on February 12 due to the outbreak. In fact, several major smartphone and technology companies—such as Intel, LG, Sony and ZTE—had already pulled out of the event before it was officially cancelled.

Elsewhere in our Coronavirus Briefing series, we highlighted that Wuhan (the city where the coronavirus originated) is home to contract manufacturers such as Apple supplier Foxconn (Hon Hai Precision Industry) and Pegatron, as well as flash memory makers XMC and Yangtze Memory Technologies. Although Foxconn planned to resume full production in its Zhengzhou and Shenzhen plants on February 10, only about 10% of the laborers — 16,000 people in Zhengzhou and some 20,000 workers in Shenzhen—have so far returned to work at the factories. According to Apple’s latest statement, “While all of these facilities have reopened, they are ramping up more slowly than we had anticipated.” We expect that the launch of Apple’s new iPhone, which was scheduled to occur in spring, will be delayed, and supply of the iPhone 11 and AirPods will be temporarily constrained.

Furthermore, leading local smartphone brands—such as Huawei, VIVO and Xiaomi—closed some of their stores during the Chinese New Year holidays. Although many stores have since reopened, factories are still unable to operate at full capacity. Disruption to production and sales in China have a global impact as demand drops for smartphone components, such as semiconductors, from Japan, South Korea and Taiwan.

As in the fashion sector, we expect most of smartphone and electronics factories to be able to operate at full capacity by the end of February (having re-opened on February 10 and awaiting workers to return following their imposed 14-day self-quarantine), but this is a best-case scenario that is subject to the government not implementing further restrictions.

China’s Role in the Global Exports Market

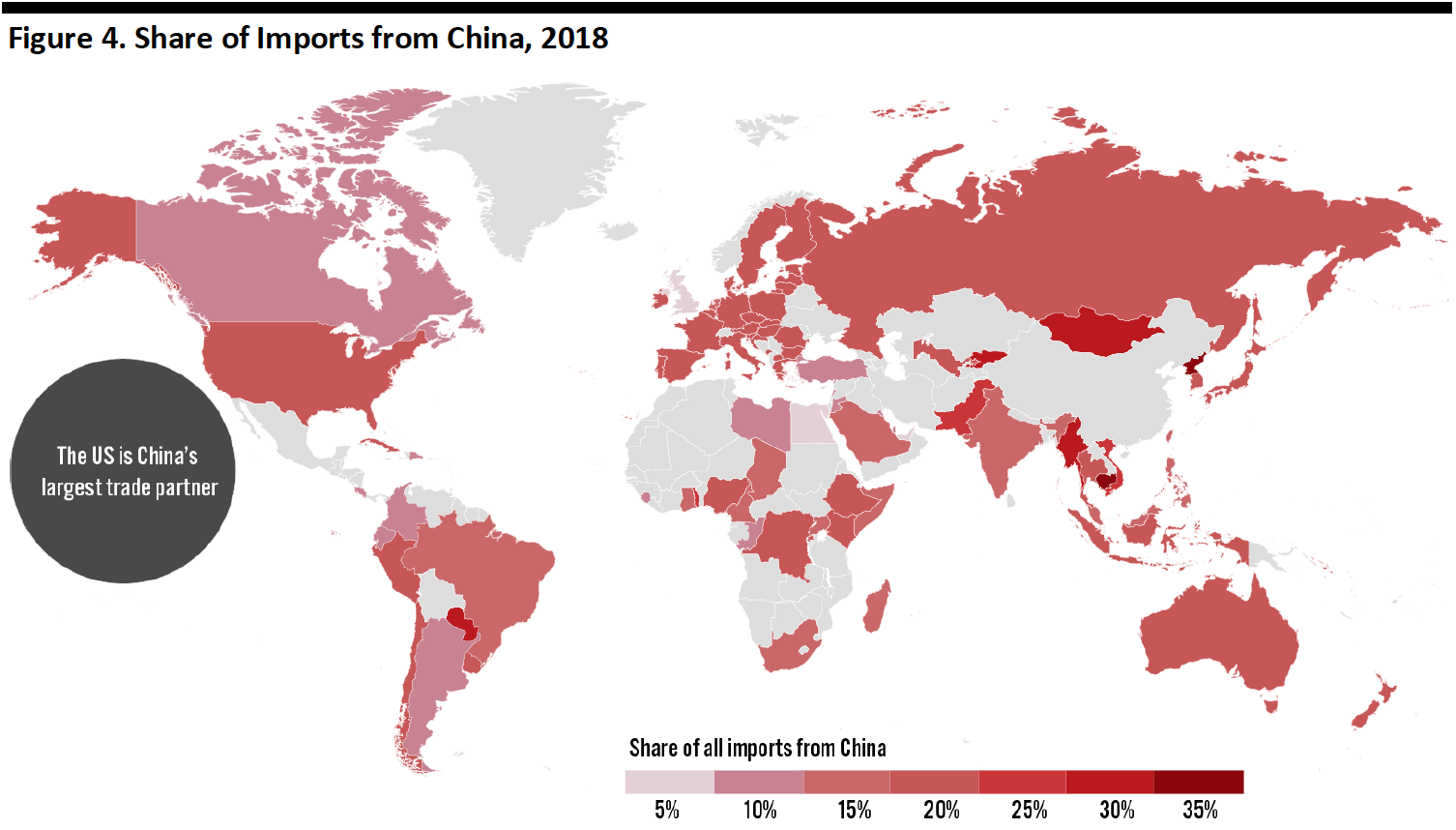

In terms of exports, the US is China’s largest trade partner: According to the National Bureau of Statistics of China, China exported $478.4 billion of goods to the US in 2018. Many other countries also rely on importing merchandise from China (as shown in Figure 4).

[caption id="attachment_103879" align="aligncenter" width="700"] Source: WTO/Coresight Research[/caption]

Source: WTO/Coresight Research[/caption]

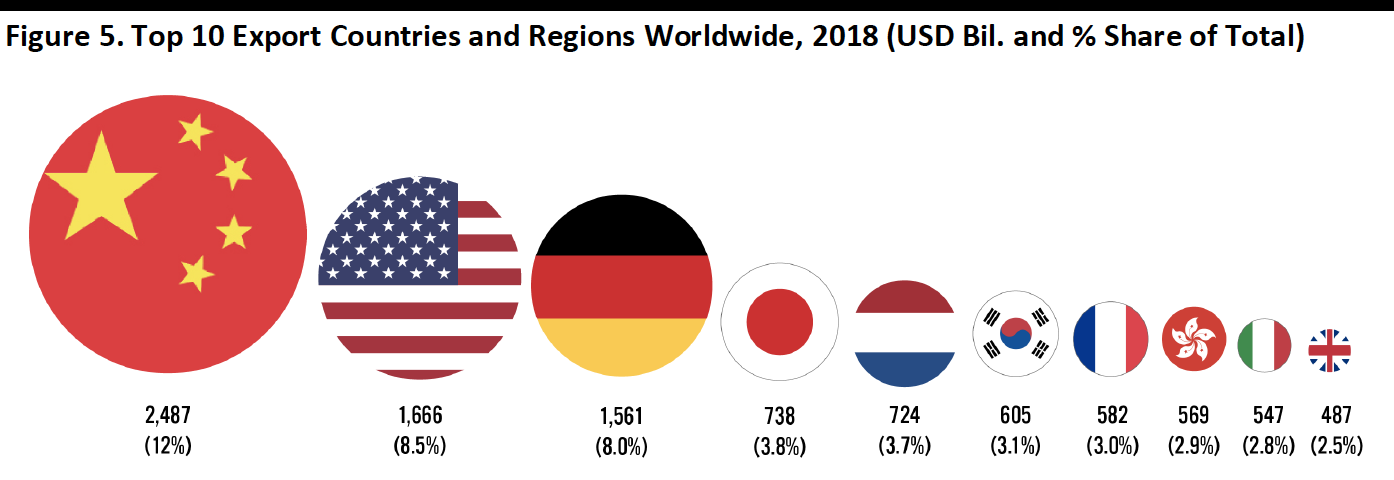

China has therefore been playing an essential role in the global supply chain. According to the WTO, China was the leading export country in the world in 2018: It exported $2,487 billion of merchandise, which contributed 12% of the world’s total export trade.

[caption id="attachment_103880" align="aligncenter" width="700"] Source: WTO/Coresight Research[/caption]

Source: WTO/Coresight Research[/caption]

What’s Next?

Given the uncertainty surrounding the duration of the coronavirus outbreak, it is difficult to accurately quantify the impact that it will have on the global supply chain in the long term. With factories in China currently operating at partial capacity, the impacts of the coronavirus could play out in one of three scenarios:

- Assuming that factories in China can operate at full capacity by the end of February, we expect to see manufacturers in the apparel sector catch up with the planned schedule having mostly absorbed the impacts of the disruption. Meanwhile, smartphone manufacturers might face delays in launching new devices.

- If most of the factories still operate at partial capacity for another three to four weeks, we expect that inventory replenishment will become a major problem. This could disrupt the launch of the back-to-school collections in the fashion industry.

- If factories cannot attain full capacity by mid-April, we expect the ripple effect will lead to supply chain breakdowns around the world. In the apparel sector, the production of fall/winter collections could be impacted. Furthermore, brand owners and retailers across many industries around the world may have to reduce their total output by as much as 50% due to their current reliance on China for production.

In the short term, we expect to see small and medium-sized factories in China struggle to meet demand, particularly those producing low-tech, low-quality and simple goods. Most of these have low cash reserves and are less likely to secure loans. They are unable to fulfill orders as they are operating at partial capacity, and some of their existing clients have already started to work with factories outside China in order to meet their inventory requirements. These China-based factories may therefore find that they have negative cash flow and must permanently close down the business.

In order to learn from the impacts of the coronavirus, we suggest that brand owners and retailers (that have not already done so) conduct risk assessments and stress tests to help them find alternative production lines. A number of retailers have been diversifying their supply chains away from China since 2017 due to a wage rise in the country. Trade tensions between the US and China also pushed companies to further evaluate their supply chains. Moreover, as the global emphasis on supply chain sustainability increases, more companies are considering localizing their supply chains (i.e., through onshoring or near-shoring), which will help them to reduce production lead times and enable them to respond quickly to consumer demand. We expect brand owners and retailers to accelerate supply chain diversification in the coming two to three years.

In the long term—20 to 30 years perhaps—companies across different sectors may adopt fully automated production lines and supply chains by leveraging 5G connectivity, artificial intelligence technologies, machine learning and robotics. This would go a long way in minimizing risk during situations such as the coronavirus outbreak, as supply chains would not be dependent on manual labor.