albert Chan

At time of writing, the corona virus outbreak in China continues to spread domestically and to other countries, prompting the WHO to declare it a “public health emergency of international concern.” We examine the possible economic impact, outline which companies are exposed to risk associated with the outbreak and illustrate how consumers on the ground are reacting.

Companies Pledge Donations to Wuhan and Hubei

Numerous companies have pledged donations to help combat the outbreak. An article in the South China Morning Post estimates that pledged donations now total some $2.9 billion. Select donations include:

- Alibaba: ¥1 billion for medical materials, plus insurance and other services.

- Anta Sports: ¥10 million to the Chinese Charity Foundation.

- Apple: announced (undisclosed figure).

- Baidu: ¥300 million fund for coronavirus research.

- Bayer: announced (undisclosed figure).

- Bill & Melinda Gates Foundation: $5 million.

- Budweiser China: ¥5 million in medical supplies and purified water.

- ByteDance: ¥200 million to the Red Cross Society of China.

- Cargill: ¥2 million to the Red Cross Society of China.

- Dell: ¥2 million to the Red Cross Society of China.

- Estée Lauder: ¥2 million.

- Huawei: ¥10 million to the Wuhan Charity Foundation and ¥20 million for medical equipment.

- iFlyTek: ¥10 million plus ¥500,000 in medical supplies.

- Kering: ¥7.5 million to the Hubei Red Cross; an additional $1 million donation from Chairman and CEO François-Henri Pinault.

- Jack Ma Foundation: ¥100 million for a coronavirus vaccine.

- JD.com: One million surgical masks and 60,000 units of medical equipment.

- L’Oréal: ¥5 million to the Red Cross Society of China.

- LVMH: ¥16 million to the Red Cross Society of China.

- Meituan Dianping: ¥300 million, including ¥200 million for medical staff.

- Michelin: announced (undisclosed figure).

- Microsoft: ¥1 million to the Red Cross Society of China.

- Pepsico: announced (undisclosed figure).

- Qihoo 360: ¥15 million in medical supplies.

- Shiseido: ¥2 million.

- Swarovski: ¥3 million.

- Swire Group: ¥10 million.

- Tencent: ¥300 million.

- Trendy International Group: ¥10 million.

Other companies announcing donations include Country Garden and China Evergrande.

In addition, Alibaba’s Cainiao subsidiary has started delivery of two million medical masks and one million protection suits to hospitals in Hubei. Its food delivery unit Ele.me is offering free lunchboxes to medical staff.

Images from Shanghai

Normally jam-packed streets in Shanghai are nearly empty as people stay home.

[caption id="attachment_103015" align="aligncenter" width="700"] Quiet streets in Shanghai

Quiet streets in ShanghaiSource: Coresight Research[/caption] Grocery stores are well-stocked in the morning… [caption id="attachment_103016" align="aligncenter" width="700"]

Well-stocked Shanghai market in the morning

Well-stocked Shanghai market in the morningSource: Coresight Research[/caption] …but shelves are nearly empty by the end of the day. [caption id="attachment_103017" align="aligncenter" width="700"]

Depleted market shelves in Shanghai in the evening

Depleted market shelves in Shanghai in the eveningSource: Coresight Research[/caption]

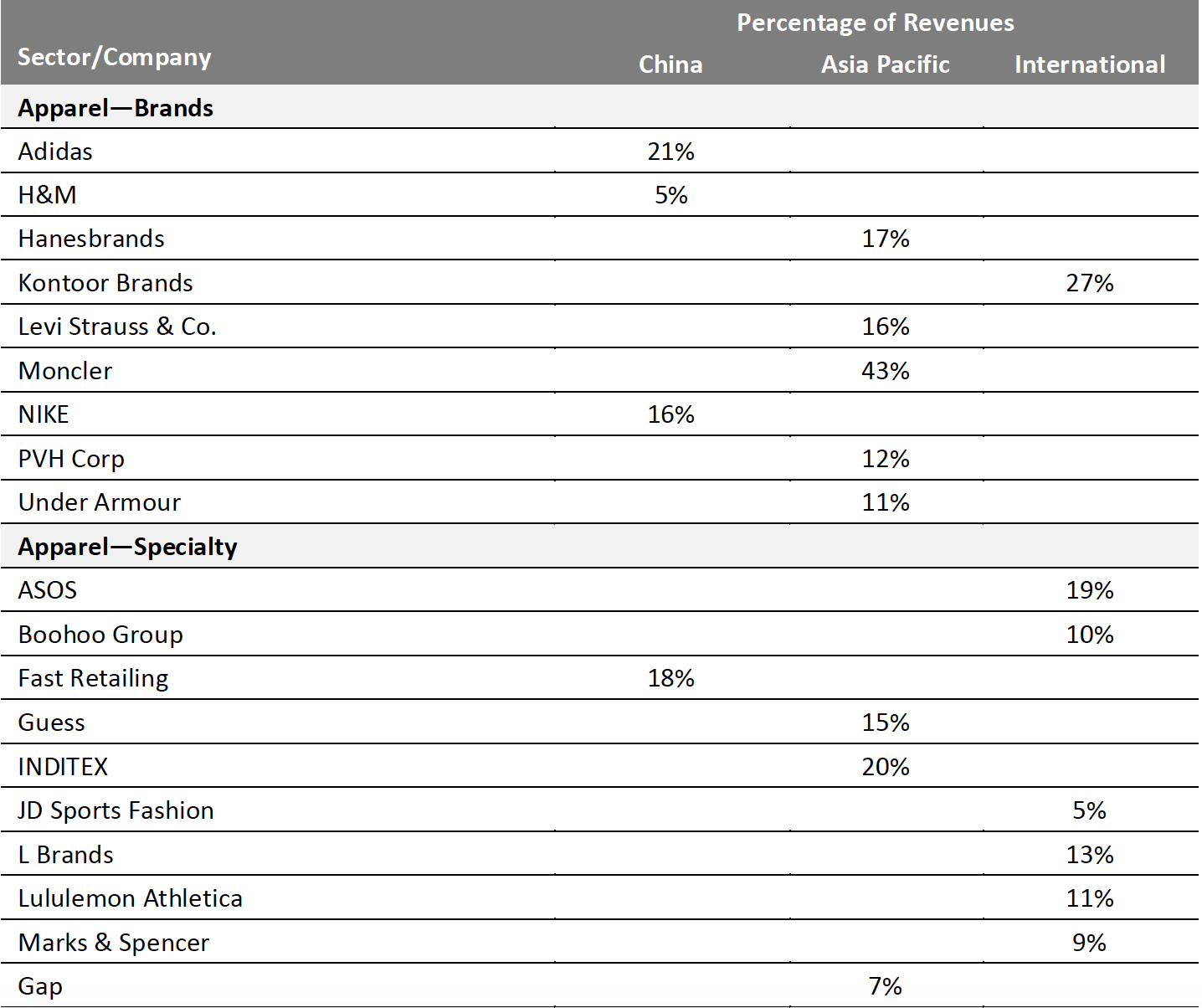

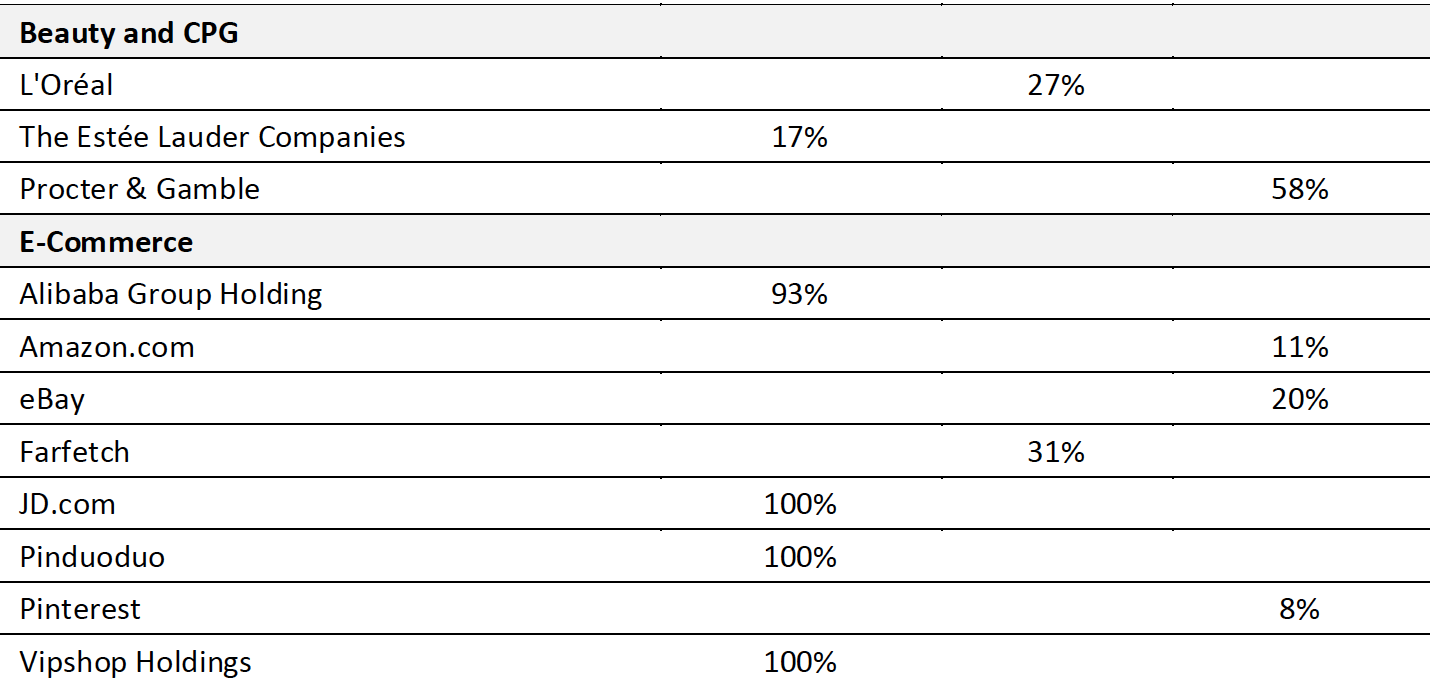

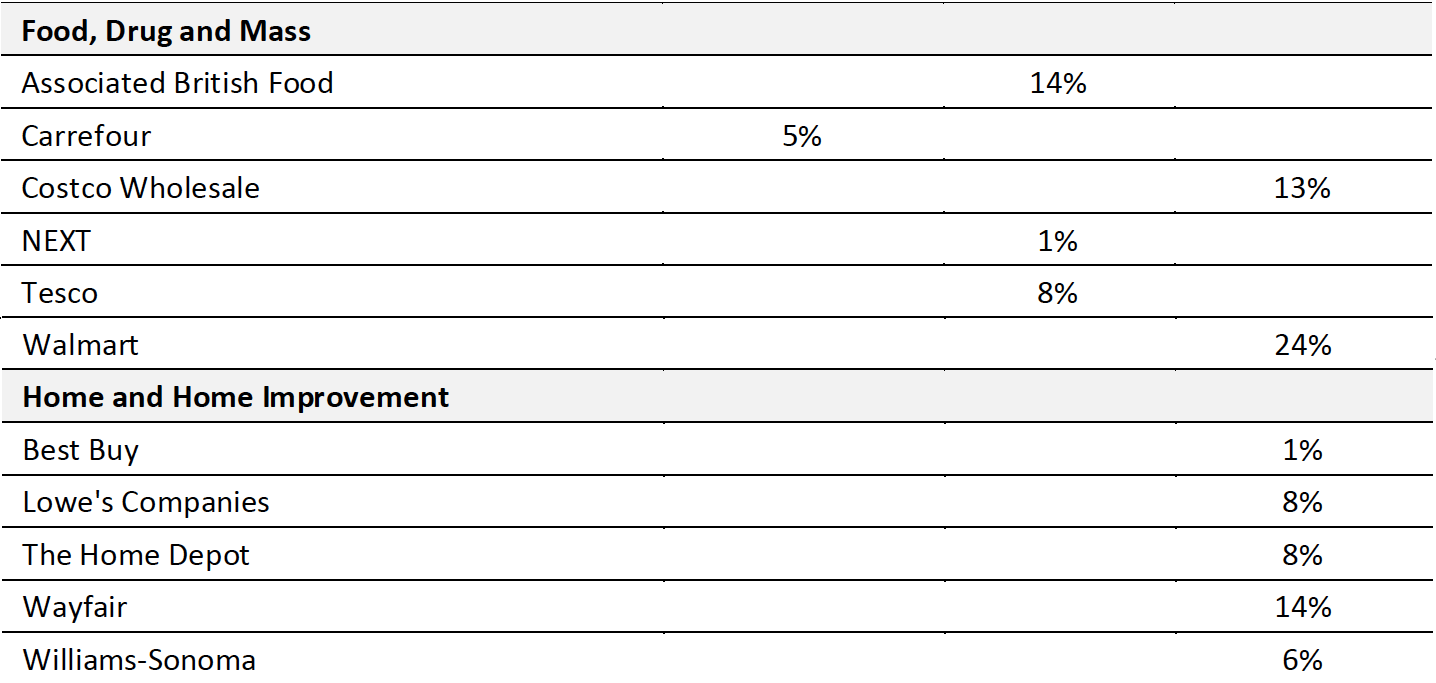

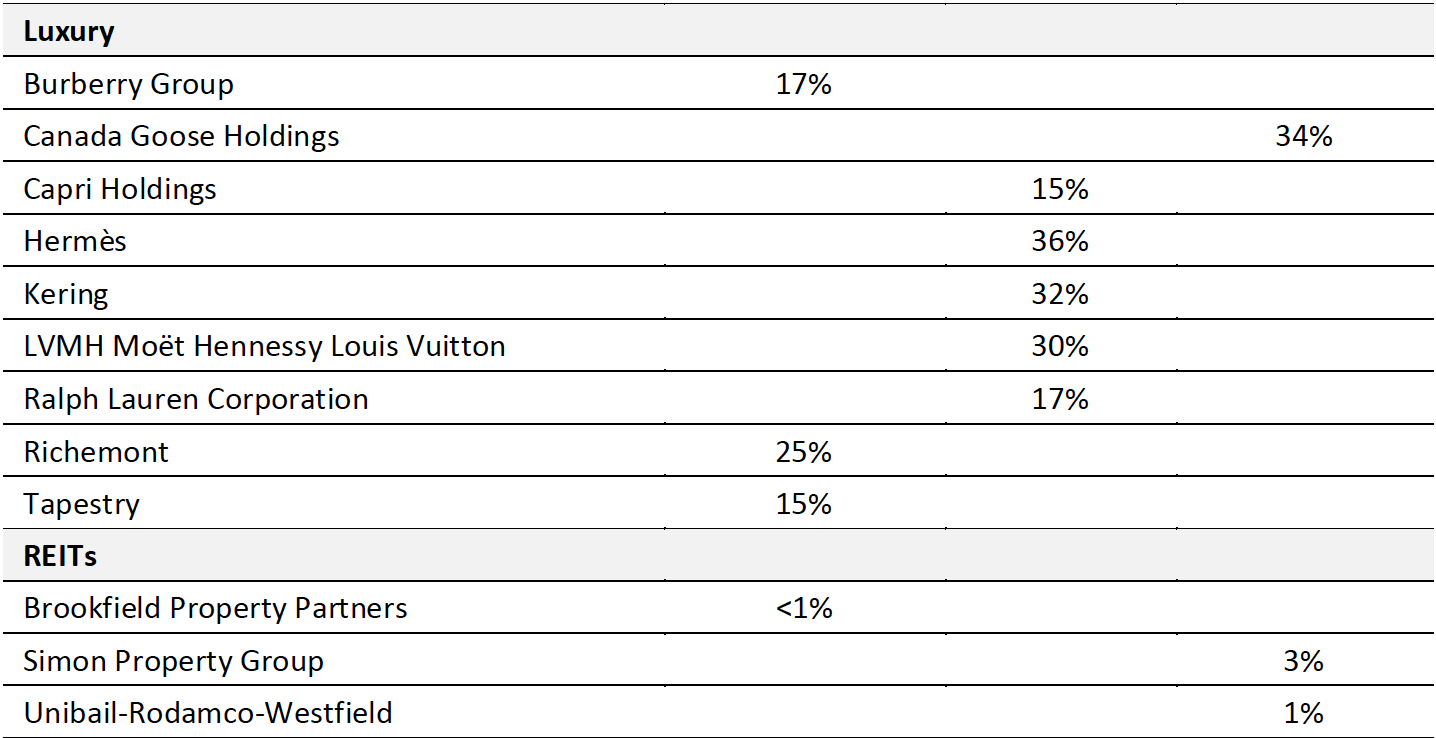

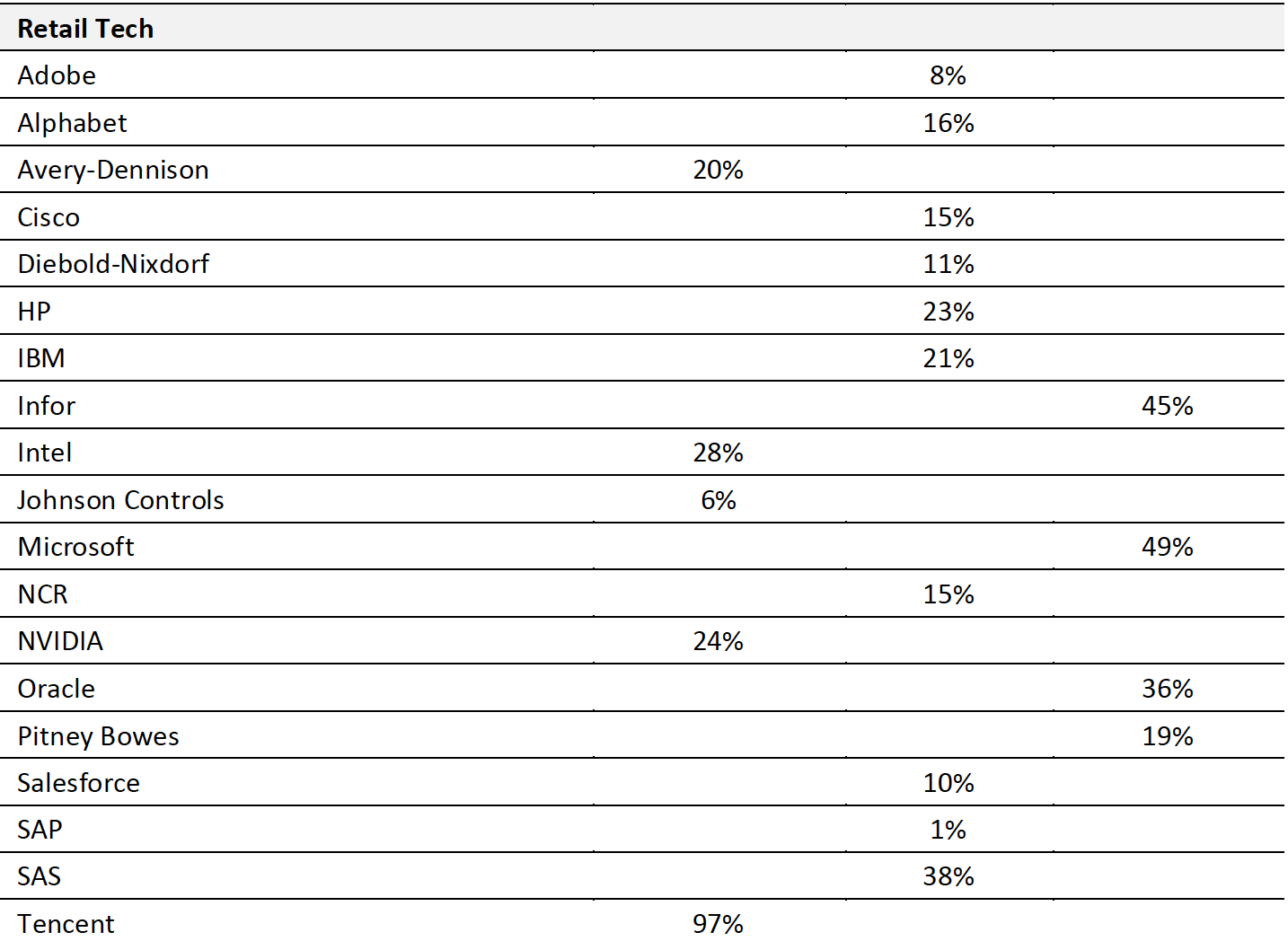

China Exposure of Leading Brands, Retailers and Retail Tech Companies

The table below shows the percentage of revenues that selected brands, retailers, retail tech and related companies receive from China or related regions.

[caption id="attachment_103024" align="aligncenter" width="700"]

[caption id="attachment_103024" align="aligncenter" width="700"] Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]