Nitheesh NH

In our Coronavirus Briefing series, we outline the possible impacts of the coronavirus outbreak on economies, sectors and businesses. In this report, we highlight four positive takeaways from the outbreak for retailers in China.

Nongrocery Retailers Will Reassess Their Existing Online Retail Strategies

While most major retailers already have an online presence in China, we expect nongrocery retailers to reassess their current online retail strategies—by adjusting marketing campaigns and merchandise strategies, for example—to increase brand awareness with shoppers and to keep up with consumers’ needs. During the outbreak, residents in China are experiencing reduced access to physical shopping channels due to government restrictions, temporary store closures and a general unwillingness to have contact with other members of the public. Consumers are therefore showing a preference for shopping online, so retailers should make efforts to capitalize on this.

Reinforcing this trend, some retailers that already have online presence are observing an increase in online traffic amid the coronavirus outbreak. According to Jean-Paul Agon, CEO of global beauty company L’Oréal, online sales of the retailer’s beauty products picked up in China in February 2020. In Coresight Research’s latest Beauty Insights report, we reported that 40% of L’Oréal’s revenue from China is made from online sales.

Major Chinese e-commerce platforms are also helping brands with their online business and fulfillment services during the coronavirus outbreak. For example, from February 5, JD.com has been offering rapid contract signing for new merchants. JD Logistics has also begun to provide one-on-one customer service for new merchants using JD.com’s fulfillment services. On February 10, Alibaba announced that its business-to-consumer, cross-border, online marketplace Tmall Global offers support to its merchants in a number of ways: a six-month waiver on the annual service fee for some merchants; free use of its online shop-setup tool; deduction or exemption of warehouse rent; reduction of logistics costs and agency service fees; and lower-interest loans. Brand owners and retailers should look to take advantages of measures such as this to quickly build an online presence.

Community-Based Brick-and-Mortar Grocery Will Not Be Easily Replaced by E-Commerce

Online sales of fresh produce have been increasing dramatically since the beginning of the coronavirus outbreak. According to JD.com, it saw sales of fresh food increase by 215% from January 24 to February 2, compared to the same period last year. Brick-and-mortar grocery retailers have also been working with existing e-commerce platforms such as Ele.me and Meituan to optimize last-mile delivery to meet consumer demand.

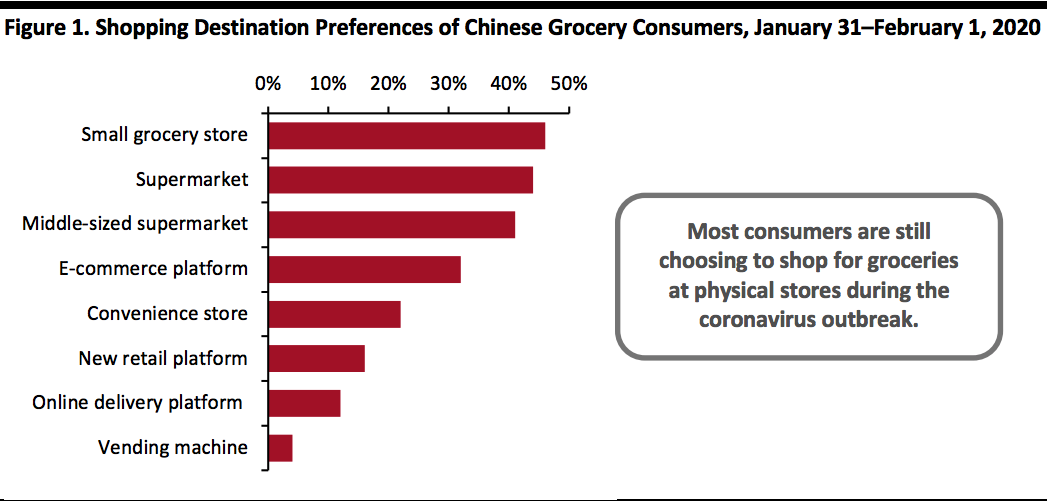

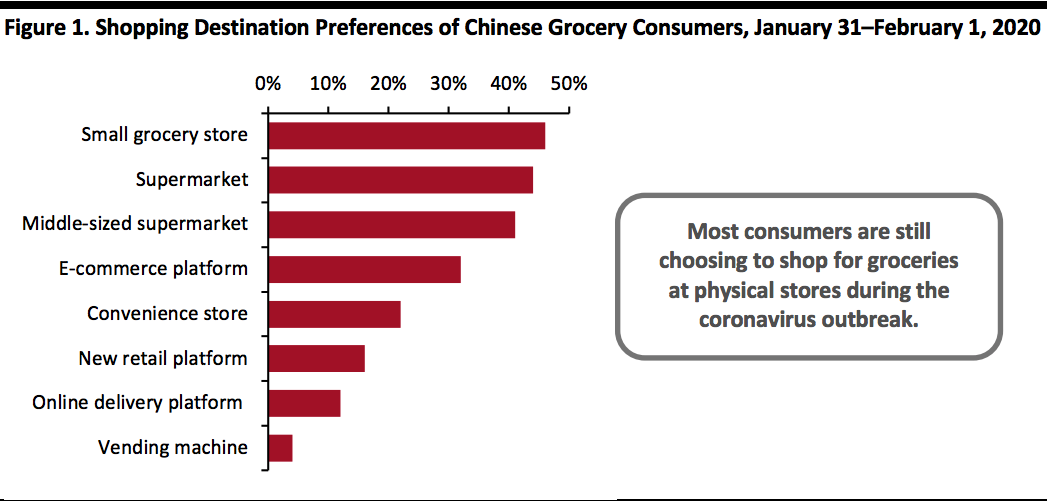

However, we believe that traditional brick-and-mortar grocery retailers—particularly community-based ones—will not be easily replaced by the e-commerce channel following the outbreak, due to their ability to offer a wide product variety at low prices. In fact, according to a survey by Data 100, most consumers in China are still choosing to shop for grocery at physical stores during the coronavirus outbreak: 46% of respondents purchase groceries at small grocery stores, while 32% use e-commerce platforms (as shown in Figure 1).

The Coresight Research team has also observed that Costco in Shanghai has been overwhelmed by shoppers, and a morning market in the city of Shenyang—the capital and largest city of China’s northeast Liaoning province—is typically packed with people shopping for fresh produce on a daily basis.

[caption id="attachment_104239" align="aligncenter" width="700"] Base: 2,923 respondents in China

Base: 2,923 respondents in China

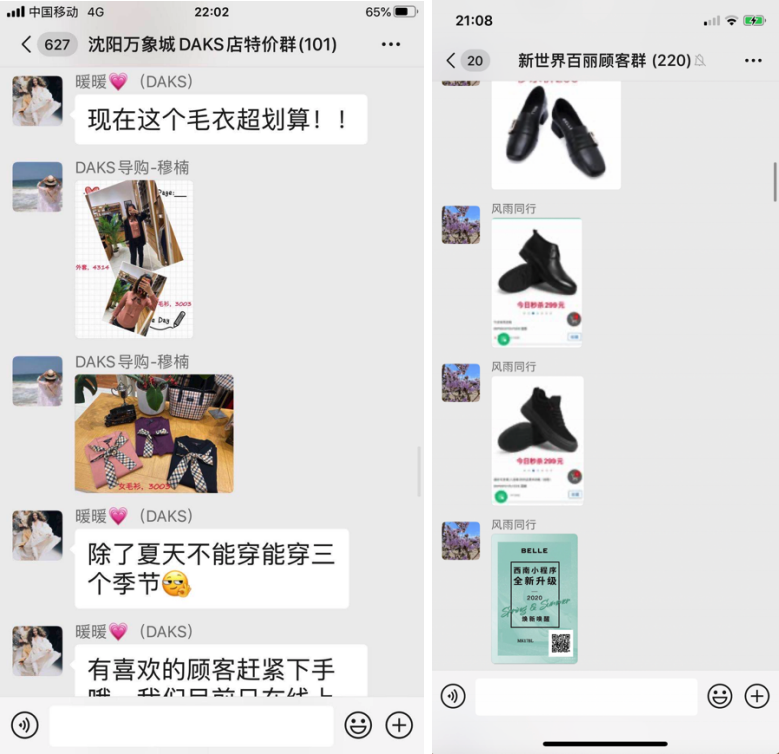

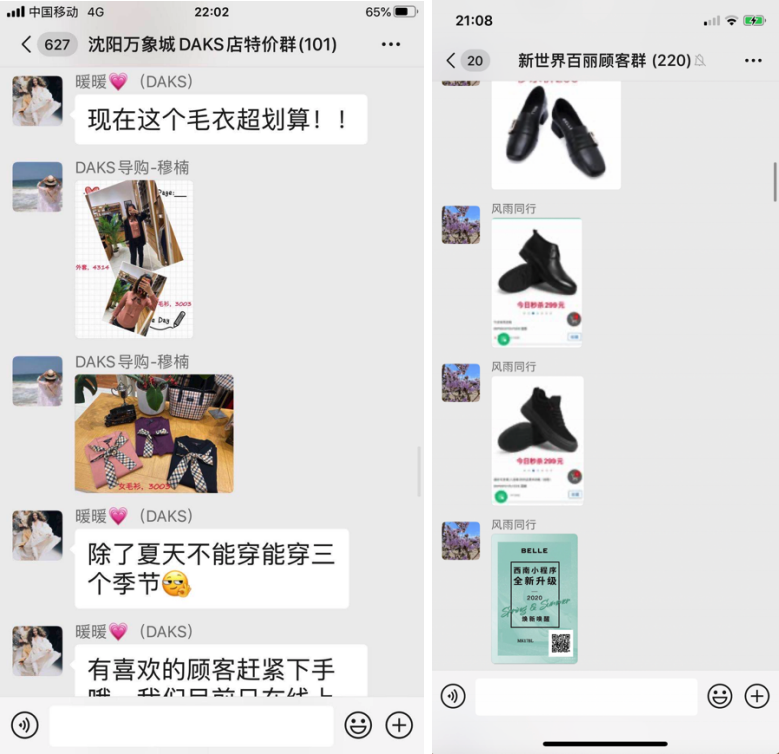

Source: Data 100/Coresight Research[/caption] Brands Are Connecting Consumers with WeChat Private Groups We are observing that brands are actively engaging with consumers via WeChat during the coronavirus outbreak. WeChat private groups allow sales associates to promote products and respond to consumer enquiries. As these groups offer a platform for customers to share their views on brands and products, they often function as mini online communities for retailers, allowing them to better access and understand their customers. [caption id="attachment_104240" align="aligncenter" width="520"] Daks (left) and Belle (right) have been promoting products in WeChat private groups during the coronavirus outbreak

Daks (left) and Belle (right) have been promoting products in WeChat private groups during the coronavirus outbreak

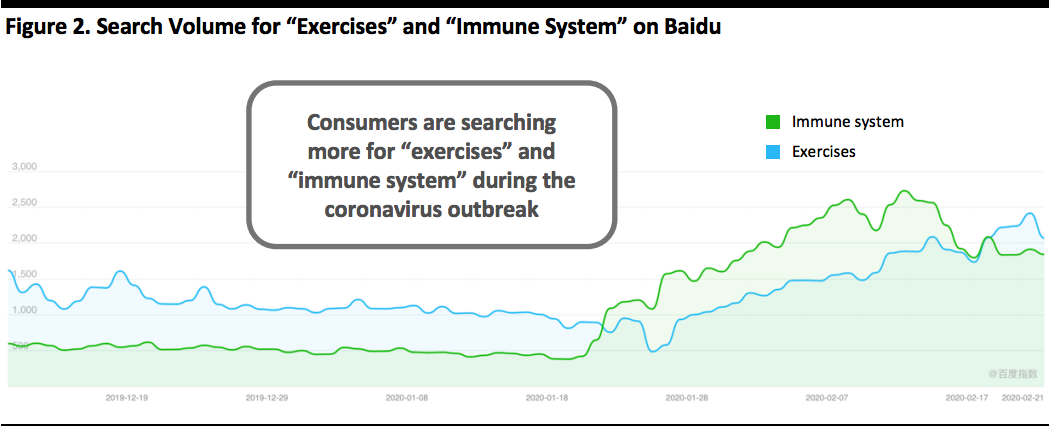

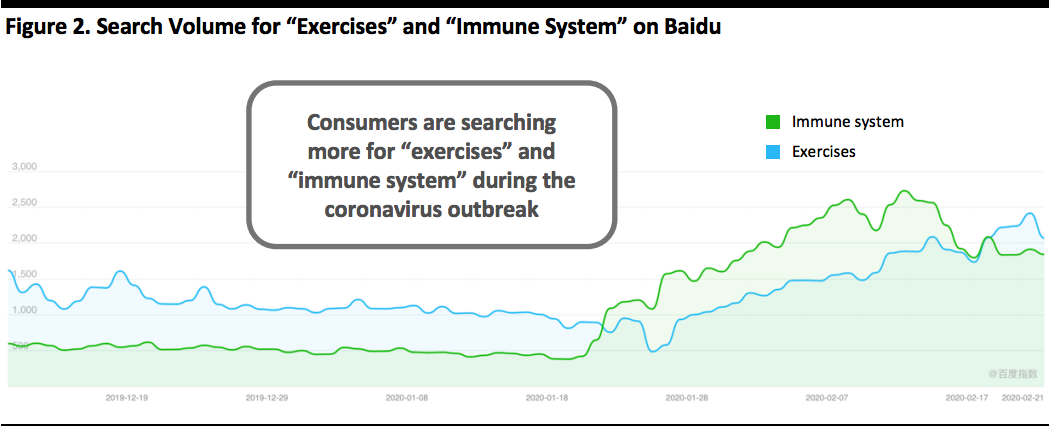

Source: WeChat[/caption] According to Tencent, the number of monthly active users of WeChat reached 1.2 billion by the end of September 2019: WeChat has become a major communication tool in China. Before the coronavirus outbreak, some retailers already used WeChat private groups to connect with consumers—they encouraged customers in physical stores to join designated WeChat private groups by scanning designated WeChat QR codes. For example, underwear brand Neiwai has used its WeChat private group to share new products and promotional offers to its consumers. Taking this concept further, some retailers—including athleisure brand Maia Active and fashion brand Daks—have incorporated livestreaming as a marketing strategy within private WeChat groups. During livestreaming sessions, sales associates demonstrate and discuss products; they can offer suggestions and answer questions that consumers have raised, providing shoppers with the interactive, personable experience that they would have in offline stores. Consumers Are Prioritizing Exercise and Wellbeing In the midst of the coronavirus outbreak—and with the Chinese government advising people to stay indoors and avoid public places—the focus for many consumers is turning to the importance of staying healthy. According to Baidu Index, the total number of searches for the key words “exercises (运动)” and “immune system (免疫力)” increased by 39% and 299% respectively, from January 21 to February 21, 2020, compared to the same period one month ago (as shown in Figure 2). [caption id="attachment_104241" align="aligncenter" width="700"] Source: Baidu Index[/caption]

Furthermore, according JD.com, the sale of yoga mats between February 1 and February 20 increased sixfold compared to the same period in 2019. A recent survey by market research company Kantar saw 53% of respondents express an interest in exercising outdoors when the coronavirus outbreak is over.

We therefore expect consumers in China to make efforts to maintain healthier habits after the outbreak and seek ways to improve their general wellbeing and health. Brand owners and retailers may therefore launch fitness and health-related products or services to align with this trend.

Source: Baidu Index[/caption]

Furthermore, according JD.com, the sale of yoga mats between February 1 and February 20 increased sixfold compared to the same period in 2019. A recent survey by market research company Kantar saw 53% of respondents express an interest in exercising outdoors when the coronavirus outbreak is over.

We therefore expect consumers in China to make efforts to maintain healthier habits after the outbreak and seek ways to improve their general wellbeing and health. Brand owners and retailers may therefore launch fitness and health-related products or services to align with this trend.

Base: 2,923 respondents in China

Base: 2,923 respondents in ChinaSource: Data 100/Coresight Research[/caption] Brands Are Connecting Consumers with WeChat Private Groups We are observing that brands are actively engaging with consumers via WeChat during the coronavirus outbreak. WeChat private groups allow sales associates to promote products and respond to consumer enquiries. As these groups offer a platform for customers to share their views on brands and products, they often function as mini online communities for retailers, allowing them to better access and understand their customers. [caption id="attachment_104240" align="aligncenter" width="520"]

Daks (left) and Belle (right) have been promoting products in WeChat private groups during the coronavirus outbreak

Daks (left) and Belle (right) have been promoting products in WeChat private groups during the coronavirus outbreakSource: WeChat[/caption] According to Tencent, the number of monthly active users of WeChat reached 1.2 billion by the end of September 2019: WeChat has become a major communication tool in China. Before the coronavirus outbreak, some retailers already used WeChat private groups to connect with consumers—they encouraged customers in physical stores to join designated WeChat private groups by scanning designated WeChat QR codes. For example, underwear brand Neiwai has used its WeChat private group to share new products and promotional offers to its consumers. Taking this concept further, some retailers—including athleisure brand Maia Active and fashion brand Daks—have incorporated livestreaming as a marketing strategy within private WeChat groups. During livestreaming sessions, sales associates demonstrate and discuss products; they can offer suggestions and answer questions that consumers have raised, providing shoppers with the interactive, personable experience that they would have in offline stores. Consumers Are Prioritizing Exercise and Wellbeing In the midst of the coronavirus outbreak—and with the Chinese government advising people to stay indoors and avoid public places—the focus for many consumers is turning to the importance of staying healthy. According to Baidu Index, the total number of searches for the key words “exercises (运动)” and “immune system (免疫力)” increased by 39% and 299% respectively, from January 21 to February 21, 2020, compared to the same period one month ago (as shown in Figure 2). [caption id="attachment_104241" align="aligncenter" width="700"]

Source: Baidu Index[/caption]

Furthermore, according JD.com, the sale of yoga mats between February 1 and February 20 increased sixfold compared to the same period in 2019. A recent survey by market research company Kantar saw 53% of respondents express an interest in exercising outdoors when the coronavirus outbreak is over.

We therefore expect consumers in China to make efforts to maintain healthier habits after the outbreak and seek ways to improve their general wellbeing and health. Brand owners and retailers may therefore launch fitness and health-related products or services to align with this trend.

Source: Baidu Index[/caption]

Furthermore, according JD.com, the sale of yoga mats between February 1 and February 20 increased sixfold compared to the same period in 2019. A recent survey by market research company Kantar saw 53% of respondents express an interest in exercising outdoors when the coronavirus outbreak is over.

We therefore expect consumers in China to make efforts to maintain healthier habits after the outbreak and seek ways to improve their general wellbeing and health. Brand owners and retailers may therefore launch fitness and health-related products or services to align with this trend.