Nitheesh NH

In our Coronavirus Briefing series, we outline the possible impact of the coronavirus outbreak on economies, sectors and businesses. In this report, we look at four digital trends that have emerged or been strengthened as a result of the outbreak, and examine the long-term prospects for these trends.

Shift to Online

The coronavirus outbreak has caused major disruptions in supply chains, tourism, eating out and most forms of discretionary spending as people avoid crowded locations (such as stores) except to buy necessities.

But there is a silver lining for companies able to go online: While the pace of new cases in China has slowed, millions of Chinese are staying at home and many companies remain closed. Those which did open encouraged employees to work remotely. Local governments also have postponed school semesters.

Online activities have boomed as a result, and there has been a surge in app downloads¬: average weekly downloads in the Apple’s store jumped 40% during the first two weeks of February compared with the full year average for 2019, according to data provider AppAnnie. Demand for online education and business apps also surged after the end of the break.

These are the four major coronavirus-related trends we are seeing:

1. Chinese People Flock to Online Games

Analytics company Sensor Tower reported that total game downloads on the Apple store in China increased 27.5% year over year between January 11 and February 9, 2020.

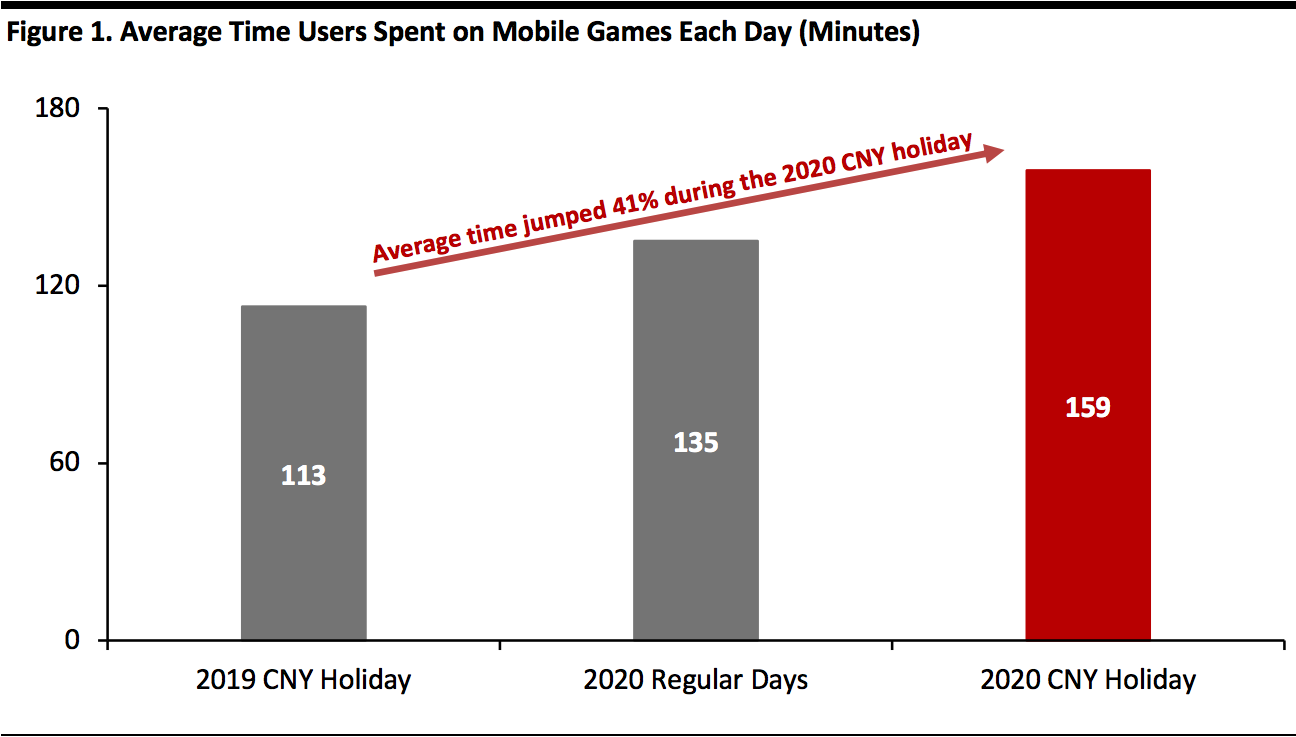

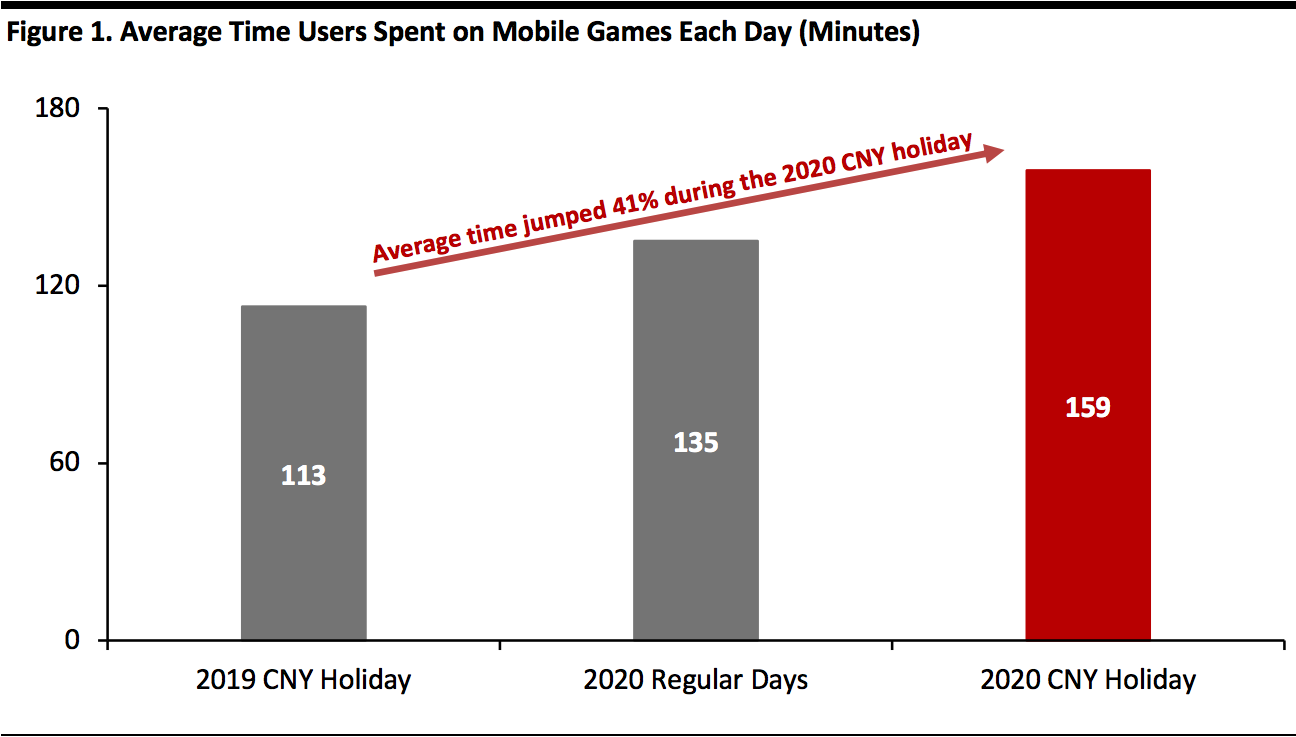

Gaming can be expected to increase as people have more time to play games during the Chinese New Year, but this year the holiday was extended as the government sought to contain the outbreak by restricting travel, which kept people home longer. According to QuestMobile, the average time users spend on mobile games daily increased 40.7% during this year’s Chinese New Year holiday compared to last year. People often go out for large celebratory dinners during this time of year, but most stayed home this year, driving them to look online for entertainment. And, since players spent more time on games, they also spent for extra in-game features. Sensor Tower estimated revenue from online games increased 12.1% year over year.

[caption id="attachment_104691" align="aligncenter" width="700"] Note: 2019 CNY holiday refers to the Chinese New Year period from February 4-10, 2019; 2020 regular days refer to the period from January 2-8, 2020; 2020 CNY holiday refers to the period from January 24 to February 2, 2020.</brSource: Questmobile/Coresight Research[/caption]

Video games such as Nintendo’s new exercise game Ring Fit Adventure have also witnessed growing demand. Since the game has not officially launched in China, resellers have been selling it online at twice its regular retail price.

2. Movies and Live Performances Go Straight Online

Both short video platforms such as Douyin and Kuaishou and video-streaming platforms iQiyi, Tencent Video and Bilibili have benefited from the closures of public entertainment venues in China. Chinese short video apps added almost 150 million new daily active users (DAU) during the holiday this year from a year ago, according to QuestMobile. Douyin took the lead, with its DAU rising 38.9% year over year.

Douyin’s parent company Bytedance reached a deal with the production company of movie called Lost in Russia to have it premiere on Bytedance’s video platform and Douyin free of charge, attracting 600 million views when it released. These short video apps are also becoming an important information channel in quarantined cities.

Video-streaming sites are another popular destination for quarantined residents to escape boredom. The movie Enter the Fat Dragon also premiered on iQiyi and Tencent Video. Bilibili gathered musicians and DJs from around the country to livestream performances.

[caption id="attachment_104692" align="aligncenter" width="280"]

Note: 2019 CNY holiday refers to the Chinese New Year period from February 4-10, 2019; 2020 regular days refer to the period from January 2-8, 2020; 2020 CNY holiday refers to the period from January 24 to February 2, 2020.</brSource: Questmobile/Coresight Research[/caption]

Video games such as Nintendo’s new exercise game Ring Fit Adventure have also witnessed growing demand. Since the game has not officially launched in China, resellers have been selling it online at twice its regular retail price.

2. Movies and Live Performances Go Straight Online

Both short video platforms such as Douyin and Kuaishou and video-streaming platforms iQiyi, Tencent Video and Bilibili have benefited from the closures of public entertainment venues in China. Chinese short video apps added almost 150 million new daily active users (DAU) during the holiday this year from a year ago, according to QuestMobile. Douyin took the lead, with its DAU rising 38.9% year over year.

Douyin’s parent company Bytedance reached a deal with the production company of movie called Lost in Russia to have it premiere on Bytedance’s video platform and Douyin free of charge, attracting 600 million views when it released. These short video apps are also becoming an important information channel in quarantined cities.

Video-streaming sites are another popular destination for quarantined residents to escape boredom. The movie Enter the Fat Dragon also premiered on iQiyi and Tencent Video. Bilibili gathered musicians and DJs from around the country to livestream performances.

[caption id="attachment_104692" align="aligncenter" width="280"] Lost in Russia became the first movie to premiere online in China

Lost in Russia became the first movie to premiere online in China

Source: Weibo[/caption] 3. Remote Work and Education on the Rise The shift to remote working presented an unexpected opportunity for enterprise work apps, which had been slow to take off in China compared to the West. Now, demand for remote work apps such as Alibaba’s DingTalk, Tencent’s WeChat Work and Bytedance’s Feishu is soaring. In the first week back to work after the Chinese New Year, business apps gained 40 million DAU, as reported by QuestMobile. The two most widely used work apps, DingTalk and WeChat Work, crashed temporarily on the first day due to the volume of traffic. DingTalk mentioned that more than 200 million people worked remotely on February 3, 2020. To respond the sudden increase in traffic, WeChat Work increased the maximum number of participants its video conferencing feature can handle to 300. DingTalk even added a beauty filter for video calls. Online education experienced a similar uptick as schools remained closed and local governments encouraged e-learning. DingTalk added 100,000 servers to support its DingTalk messenger, which allows students to communicate with teachers and watch livestream classes. Some 50 million students from elementary to high school in 300 cities used the feature on February 10, according to the company. After-school tutoring classes in China also have moved onto web and app platforms. 4. Surge in Online Health Services China’s online health platforms, which allow users to consult with doctors via instant messenger, by sending images and even video calls, have seen a spike in use as people avoid hospitals. Alibaba, JD.com, Tencent and Baidu all offer free online medical consultations. One of China’s largest online health platforms, Pingan Good Doctor, increased users 900% in January from the previous month, according to Bain. A JD Health spokesman also said the average daily consultation volume on its platform hit 100,000. Many users also use these platforms to get information about the outbreak and how to avoid contracting the virus. [caption id="attachment_104693" align="aligncenter" width="280"] JD Health’s free online consultation platform

JD Health’s free online consultation platform

Source: JD.com corporate blog[/caption] Looking Ahead The World Health Organization says the coronavirus outbreak has peaked in China, but it is difficult to predict when it will be contained. Once the crisis ends, the current uptick of online use should slow. But we are optimistic about the online entertainment and gaming sector, as demand continues to be strong particularly in lower-tier markets. Everbright Securities noted that consumption in pan-entertainment, which includes short videos, video and music streaming, online games and online reading has increased significantly in lower-tier cities. We are less certain of the long-term prospects for trends such as online health, working and online education platforms, as it is unclear whether the sudden demand will change perceptions and consumer behavior, which would in turn make them more sustainable trends. Almost all of these platforms are available free of charge during the crisis, so it is possible that people will use them now out of necessity, but once they become accustomed to what they can do may embrace them long term. That said, there could be some obstacles. While working remotely has become common in the US, it is rare in China and changing that culture could take more than this short-term experience. Some Chinese employees have said that working remotely actually results in longer working hours and have complained of intrusive company rules. Also, online doctors are not permitted by law to make a diagnosis online, so people still need to visit a hospital if the doctor determines care is needed.

Note: 2019 CNY holiday refers to the Chinese New Year period from February 4-10, 2019; 2020 regular days refer to the period from January 2-8, 2020; 2020 CNY holiday refers to the period from January 24 to February 2, 2020.</brSource: Questmobile/Coresight Research[/caption]

Video games such as Nintendo’s new exercise game Ring Fit Adventure have also witnessed growing demand. Since the game has not officially launched in China, resellers have been selling it online at twice its regular retail price.

2. Movies and Live Performances Go Straight Online

Both short video platforms such as Douyin and Kuaishou and video-streaming platforms iQiyi, Tencent Video and Bilibili have benefited from the closures of public entertainment venues in China. Chinese short video apps added almost 150 million new daily active users (DAU) during the holiday this year from a year ago, according to QuestMobile. Douyin took the lead, with its DAU rising 38.9% year over year.

Douyin’s parent company Bytedance reached a deal with the production company of movie called Lost in Russia to have it premiere on Bytedance’s video platform and Douyin free of charge, attracting 600 million views when it released. These short video apps are also becoming an important information channel in quarantined cities.

Video-streaming sites are another popular destination for quarantined residents to escape boredom. The movie Enter the Fat Dragon also premiered on iQiyi and Tencent Video. Bilibili gathered musicians and DJs from around the country to livestream performances.

[caption id="attachment_104692" align="aligncenter" width="280"]

Note: 2019 CNY holiday refers to the Chinese New Year period from February 4-10, 2019; 2020 regular days refer to the period from January 2-8, 2020; 2020 CNY holiday refers to the period from January 24 to February 2, 2020.</brSource: Questmobile/Coresight Research[/caption]

Video games such as Nintendo’s new exercise game Ring Fit Adventure have also witnessed growing demand. Since the game has not officially launched in China, resellers have been selling it online at twice its regular retail price.

2. Movies and Live Performances Go Straight Online

Both short video platforms such as Douyin and Kuaishou and video-streaming platforms iQiyi, Tencent Video and Bilibili have benefited from the closures of public entertainment venues in China. Chinese short video apps added almost 150 million new daily active users (DAU) during the holiday this year from a year ago, according to QuestMobile. Douyin took the lead, with its DAU rising 38.9% year over year.

Douyin’s parent company Bytedance reached a deal with the production company of movie called Lost in Russia to have it premiere on Bytedance’s video platform and Douyin free of charge, attracting 600 million views when it released. These short video apps are also becoming an important information channel in quarantined cities.

Video-streaming sites are another popular destination for quarantined residents to escape boredom. The movie Enter the Fat Dragon also premiered on iQiyi and Tencent Video. Bilibili gathered musicians and DJs from around the country to livestream performances.

[caption id="attachment_104692" align="aligncenter" width="280"] Lost in Russia became the first movie to premiere online in China

Lost in Russia became the first movie to premiere online in ChinaSource: Weibo[/caption] 3. Remote Work and Education on the Rise The shift to remote working presented an unexpected opportunity for enterprise work apps, which had been slow to take off in China compared to the West. Now, demand for remote work apps such as Alibaba’s DingTalk, Tencent’s WeChat Work and Bytedance’s Feishu is soaring. In the first week back to work after the Chinese New Year, business apps gained 40 million DAU, as reported by QuestMobile. The two most widely used work apps, DingTalk and WeChat Work, crashed temporarily on the first day due to the volume of traffic. DingTalk mentioned that more than 200 million people worked remotely on February 3, 2020. To respond the sudden increase in traffic, WeChat Work increased the maximum number of participants its video conferencing feature can handle to 300. DingTalk even added a beauty filter for video calls. Online education experienced a similar uptick as schools remained closed and local governments encouraged e-learning. DingTalk added 100,000 servers to support its DingTalk messenger, which allows students to communicate with teachers and watch livestream classes. Some 50 million students from elementary to high school in 300 cities used the feature on February 10, according to the company. After-school tutoring classes in China also have moved onto web and app platforms. 4. Surge in Online Health Services China’s online health platforms, which allow users to consult with doctors via instant messenger, by sending images and even video calls, have seen a spike in use as people avoid hospitals. Alibaba, JD.com, Tencent and Baidu all offer free online medical consultations. One of China’s largest online health platforms, Pingan Good Doctor, increased users 900% in January from the previous month, according to Bain. A JD Health spokesman also said the average daily consultation volume on its platform hit 100,000. Many users also use these platforms to get information about the outbreak and how to avoid contracting the virus. [caption id="attachment_104693" align="aligncenter" width="280"]

JD Health’s free online consultation platform

JD Health’s free online consultation platformSource: JD.com corporate blog[/caption] Looking Ahead The World Health Organization says the coronavirus outbreak has peaked in China, but it is difficult to predict when it will be contained. Once the crisis ends, the current uptick of online use should slow. But we are optimistic about the online entertainment and gaming sector, as demand continues to be strong particularly in lower-tier markets. Everbright Securities noted that consumption in pan-entertainment, which includes short videos, video and music streaming, online games and online reading has increased significantly in lower-tier cities. We are less certain of the long-term prospects for trends such as online health, working and online education platforms, as it is unclear whether the sudden demand will change perceptions and consumer behavior, which would in turn make them more sustainable trends. Almost all of these platforms are available free of charge during the crisis, so it is possible that people will use them now out of necessity, but once they become accustomed to what they can do may embrace them long term. That said, there could be some obstacles. While working remotely has become common in the US, it is rare in China and changing that culture could take more than this short-term experience. Some Chinese employees have said that working remotely actually results in longer working hours and have complained of intrusive company rules. Also, online doctors are not permitted by law to make a diagnosis online, so people still need to visit a hospital if the doctor determines care is needed.