Nitheesh NH

In our Coronavirus Briefing series, we outline the possible impact of the coronavirus outbreak on economies, sectors and businesses. In this report, we look at recent data on China’s factory activity and the continued disruptions to the supply chain as the coronavirus spreads globally.

China Manufacturing Plunges to All-Time Low in February

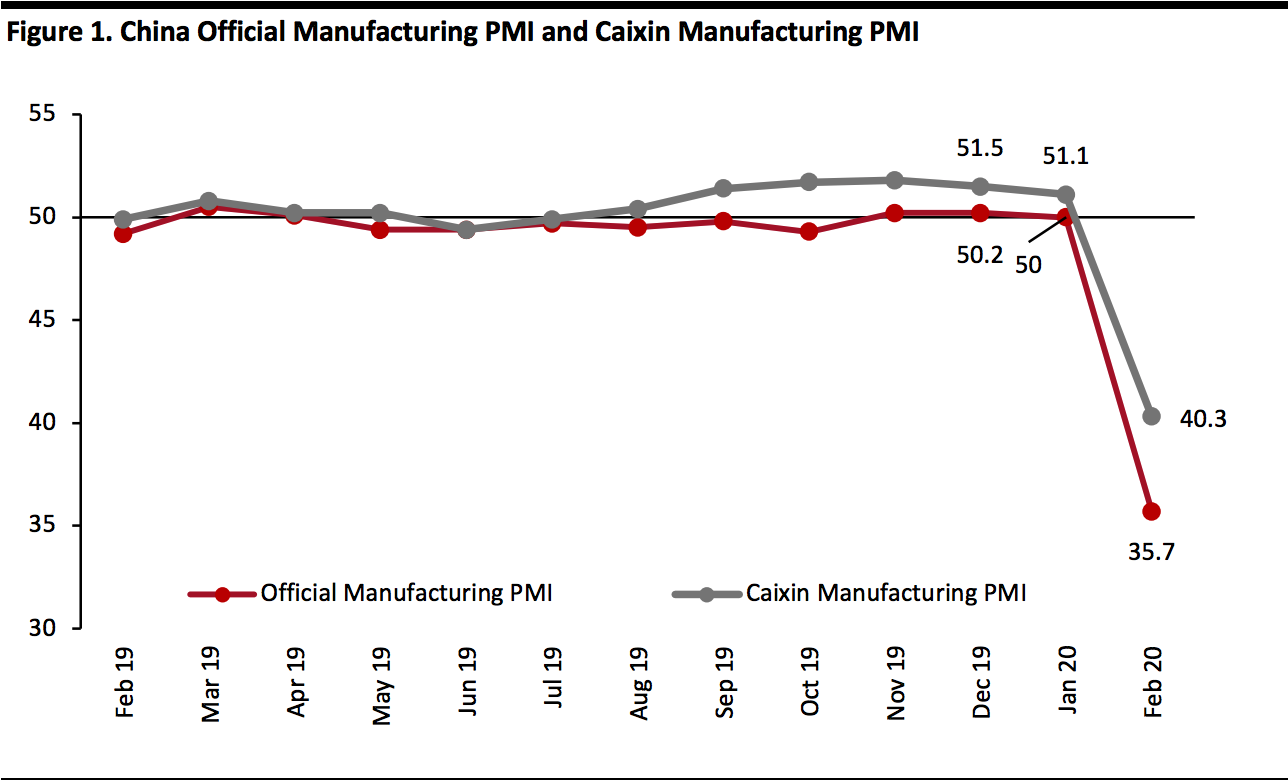

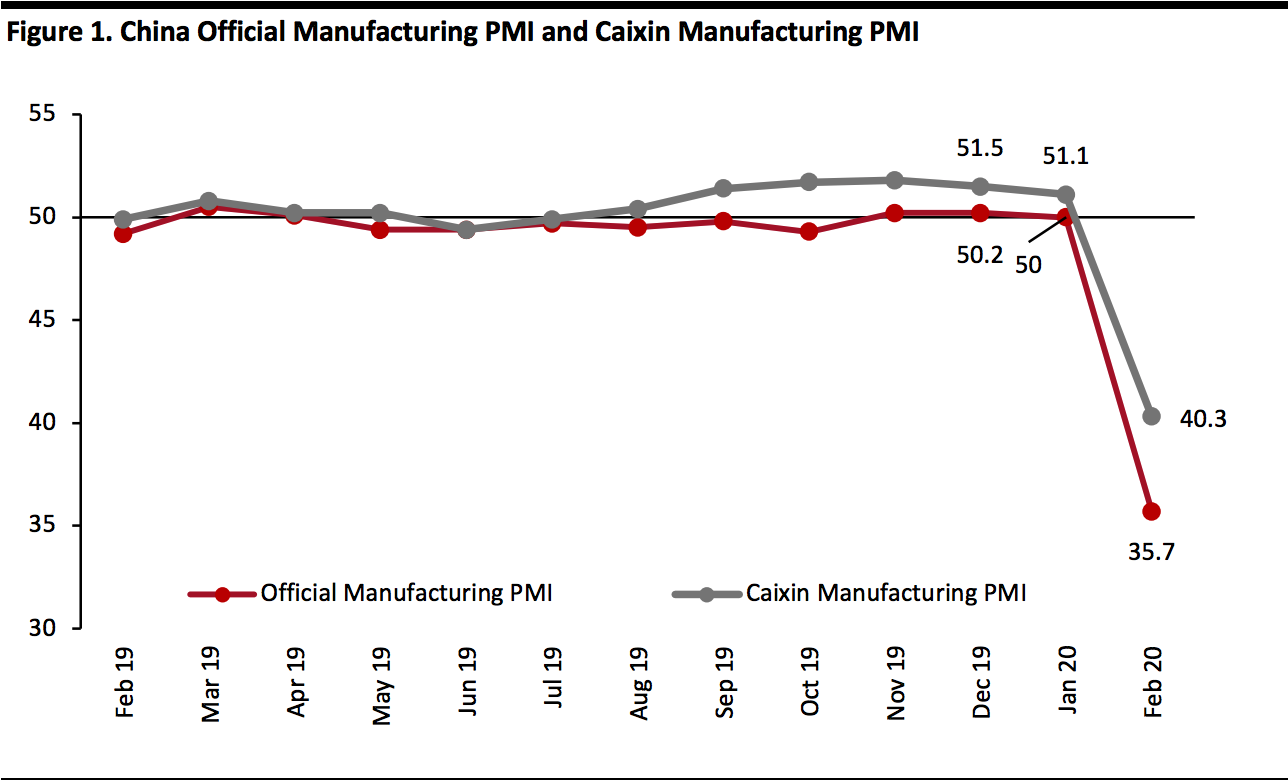

China’s factory activity fell sharply in February, with both official data and data from Chinese financial media group Caixin Global confirming that activity sank to a record low due to the impact of the coronavirus outbreak.

China’s official manufacturing Purchasing Managers’ Index (PMI), released on February 29, dropped to 35.7 from 50 in January. The number was much lower than the 45.7 estimated by analysts polled by Reuters, and it is also worse than the lowest figure during the 2008 Global Financial Crisis when it hit 38.8.

Sub-indexes in February 2020 also show a drop in orders: China’s new orders fell to 29.3 from 51.4 in January; export orders plummeted to 28.7 from 48.7; and, imports dropped to 31.9 from 49.0.

China’s non-manufacturing PMI, which measures the services and construction sectors, slumped to 29.6 in February, from 54.1 the previous month.

A private survey released on March 2 told the same story¬: The Caixin manufacturing PMI, which features a larger mix of small and medium-sized firms, fell to 40.3, the lowest reading since the survey was first launched in 2004. Sub-indexes of production, new work and staffing levels all dropped the quickest, as factories shut down in response to the coronavirus epidemic, according to Caixin. Average delivery time also increased at a record pace due to insufficient operational capacity, causing a backlog of orders.

[caption id="attachment_105011" align="aligncenter" width="700"] Source: National Bureau of Statistics of China/Caixin Global[/caption]

Decline in Exports Could Continue in 2Q20 as Virus Spreads Globally

The significant drop in China's manufacturing PMI reflected a larger-than-expected impact on Chinese manufacturers by the coronavirus outbreak. However, the National Bureau of Statistics has reported that the recovery rate is now picking up, and 78.9% of firms surveyed had resumed working as of February 25. This number is expected to rise to 90.8% by the end of March. Manufacturers surveyed by Caixin also expressed positivity over output rebounding once restrictions related to the virus are lifted. China’s Ministry of Commerce had previously stated that major foreign trade provinces—including Shandong and Zhejiang—have been resuming operations at a rate of around 70%, as of February 21. However, a quick V-shape recovery is unlikely.

Even if 90% of Chinese factories return to work, many may not function at full capacity. Bloomberg Economics estimated that Chinese factories were operating at 60–70% of capacity in the last week of February. Due to travel restrictions and quarantine measures, one-third of China’s 300 million migrant workers still cannot return to work, according to estimates released on February 18 by China’s transport ministry. Hubei province also extended its business shutdown for the third time to March 10. The Baidu Migration Index indicates that only 38.9% of residents from tier-1 cities that left for the Chinese New Year had returned as of February 29, and 37.1% of outbound travelers from tier-2 and tier-3 cities had returned.

As the world’s largest exporter, China is causing supply chain breakdowns around the world. The American Association of Port Authorities noted that cargo volume at US ports might be down 20% or more in the first quarter of 2020, year over year. Shipping consultancy Alphaliner estimated that 46% of scheduled departures on the major Asia-to-North Europe route had been cancelled for four weeks starting mid-January. Another problem lies in logistics, where getting goods to and from the docks has been affected by road closures and shortages of trucks in China. According to Maersk Group, the world’s largest shipping line, only around three-fifths of China’s trucking capacity was operational as of February 27.

Even if production in China’s factories can fully recover by the end of March, China could continue to experience a decline in export orders in the second quarter of 2020, as the number of coronavirus cases spikes overseas. The outbreak has reached more than 60 countries worldwide, including Germany, Japan, South Korea and the US, which are some of the top export destinations of China. The worsening situation in Japan and South Korea could lead to businesses shutting down and demand plummeting, resulting in prolonged supply chain disruption. Consumer confidence could also drop in these markets, leading to less discretionary spending.

[caption id="attachment_105012" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China/Caixin Global[/caption]

Decline in Exports Could Continue in 2Q20 as Virus Spreads Globally

The significant drop in China's manufacturing PMI reflected a larger-than-expected impact on Chinese manufacturers by the coronavirus outbreak. However, the National Bureau of Statistics has reported that the recovery rate is now picking up, and 78.9% of firms surveyed had resumed working as of February 25. This number is expected to rise to 90.8% by the end of March. Manufacturers surveyed by Caixin also expressed positivity over output rebounding once restrictions related to the virus are lifted. China’s Ministry of Commerce had previously stated that major foreign trade provinces—including Shandong and Zhejiang—have been resuming operations at a rate of around 70%, as of February 21. However, a quick V-shape recovery is unlikely.

Even if 90% of Chinese factories return to work, many may not function at full capacity. Bloomberg Economics estimated that Chinese factories were operating at 60–70% of capacity in the last week of February. Due to travel restrictions and quarantine measures, one-third of China’s 300 million migrant workers still cannot return to work, according to estimates released on February 18 by China’s transport ministry. Hubei province also extended its business shutdown for the third time to March 10. The Baidu Migration Index indicates that only 38.9% of residents from tier-1 cities that left for the Chinese New Year had returned as of February 29, and 37.1% of outbound travelers from tier-2 and tier-3 cities had returned.

As the world’s largest exporter, China is causing supply chain breakdowns around the world. The American Association of Port Authorities noted that cargo volume at US ports might be down 20% or more in the first quarter of 2020, year over year. Shipping consultancy Alphaliner estimated that 46% of scheduled departures on the major Asia-to-North Europe route had been cancelled for four weeks starting mid-January. Another problem lies in logistics, where getting goods to and from the docks has been affected by road closures and shortages of trucks in China. According to Maersk Group, the world’s largest shipping line, only around three-fifths of China’s trucking capacity was operational as of February 27.

Even if production in China’s factories can fully recover by the end of March, China could continue to experience a decline in export orders in the second quarter of 2020, as the number of coronavirus cases spikes overseas. The outbreak has reached more than 60 countries worldwide, including Germany, Japan, South Korea and the US, which are some of the top export destinations of China. The worsening situation in Japan and South Korea could lead to businesses shutting down and demand plummeting, resulting in prolonged supply chain disruption. Consumer confidence could also drop in these markets, leading to less discretionary spending.

[caption id="attachment_105012" align="aligncenter" width="700"] Source: Trading Economics/DXY.cn[/caption]

Appendix: Recent Updates from Retailers and Retail-Related Companies

Source: Trading Economics/DXY.cn[/caption]

Appendix: Recent Updates from Retailers and Retail-Related Companies

Source: National Bureau of Statistics of China/Caixin Global[/caption]

Decline in Exports Could Continue in 2Q20 as Virus Spreads Globally

The significant drop in China's manufacturing PMI reflected a larger-than-expected impact on Chinese manufacturers by the coronavirus outbreak. However, the National Bureau of Statistics has reported that the recovery rate is now picking up, and 78.9% of firms surveyed had resumed working as of February 25. This number is expected to rise to 90.8% by the end of March. Manufacturers surveyed by Caixin also expressed positivity over output rebounding once restrictions related to the virus are lifted. China’s Ministry of Commerce had previously stated that major foreign trade provinces—including Shandong and Zhejiang—have been resuming operations at a rate of around 70%, as of February 21. However, a quick V-shape recovery is unlikely.

Even if 90% of Chinese factories return to work, many may not function at full capacity. Bloomberg Economics estimated that Chinese factories were operating at 60–70% of capacity in the last week of February. Due to travel restrictions and quarantine measures, one-third of China’s 300 million migrant workers still cannot return to work, according to estimates released on February 18 by China’s transport ministry. Hubei province also extended its business shutdown for the third time to March 10. The Baidu Migration Index indicates that only 38.9% of residents from tier-1 cities that left for the Chinese New Year had returned as of February 29, and 37.1% of outbound travelers from tier-2 and tier-3 cities had returned.

As the world’s largest exporter, China is causing supply chain breakdowns around the world. The American Association of Port Authorities noted that cargo volume at US ports might be down 20% or more in the first quarter of 2020, year over year. Shipping consultancy Alphaliner estimated that 46% of scheduled departures on the major Asia-to-North Europe route had been cancelled for four weeks starting mid-January. Another problem lies in logistics, where getting goods to and from the docks has been affected by road closures and shortages of trucks in China. According to Maersk Group, the world’s largest shipping line, only around three-fifths of China’s trucking capacity was operational as of February 27.

Even if production in China’s factories can fully recover by the end of March, China could continue to experience a decline in export orders in the second quarter of 2020, as the number of coronavirus cases spikes overseas. The outbreak has reached more than 60 countries worldwide, including Germany, Japan, South Korea and the US, which are some of the top export destinations of China. The worsening situation in Japan and South Korea could lead to businesses shutting down and demand plummeting, resulting in prolonged supply chain disruption. Consumer confidence could also drop in these markets, leading to less discretionary spending.

[caption id="attachment_105012" align="aligncenter" width="700"]

Source: National Bureau of Statistics of China/Caixin Global[/caption]

Decline in Exports Could Continue in 2Q20 as Virus Spreads Globally

The significant drop in China's manufacturing PMI reflected a larger-than-expected impact on Chinese manufacturers by the coronavirus outbreak. However, the National Bureau of Statistics has reported that the recovery rate is now picking up, and 78.9% of firms surveyed had resumed working as of February 25. This number is expected to rise to 90.8% by the end of March. Manufacturers surveyed by Caixin also expressed positivity over output rebounding once restrictions related to the virus are lifted. China’s Ministry of Commerce had previously stated that major foreign trade provinces—including Shandong and Zhejiang—have been resuming operations at a rate of around 70%, as of February 21. However, a quick V-shape recovery is unlikely.

Even if 90% of Chinese factories return to work, many may not function at full capacity. Bloomberg Economics estimated that Chinese factories were operating at 60–70% of capacity in the last week of February. Due to travel restrictions and quarantine measures, one-third of China’s 300 million migrant workers still cannot return to work, according to estimates released on February 18 by China’s transport ministry. Hubei province also extended its business shutdown for the third time to March 10. The Baidu Migration Index indicates that only 38.9% of residents from tier-1 cities that left for the Chinese New Year had returned as of February 29, and 37.1% of outbound travelers from tier-2 and tier-3 cities had returned.

As the world’s largest exporter, China is causing supply chain breakdowns around the world. The American Association of Port Authorities noted that cargo volume at US ports might be down 20% or more in the first quarter of 2020, year over year. Shipping consultancy Alphaliner estimated that 46% of scheduled departures on the major Asia-to-North Europe route had been cancelled for four weeks starting mid-January. Another problem lies in logistics, where getting goods to and from the docks has been affected by road closures and shortages of trucks in China. According to Maersk Group, the world’s largest shipping line, only around three-fifths of China’s trucking capacity was operational as of February 27.

Even if production in China’s factories can fully recover by the end of March, China could continue to experience a decline in export orders in the second quarter of 2020, as the number of coronavirus cases spikes overseas. The outbreak has reached more than 60 countries worldwide, including Germany, Japan, South Korea and the US, which are some of the top export destinations of China. The worsening situation in Japan and South Korea could lead to businesses shutting down and demand plummeting, resulting in prolonged supply chain disruption. Consumer confidence could also drop in these markets, leading to less discretionary spending.

[caption id="attachment_105012" align="aligncenter" width="700"] Source: Trading Economics/DXY.cn[/caption]

Appendix: Recent Updates from Retailers and Retail-Related Companies

Source: Trading Economics/DXY.cn[/caption]

Appendix: Recent Updates from Retailers and Retail-Related Companies

- Big Lots: The retailer does not do business China, but management said it expects first quarter results to be impacted by supply-chain disruption.

- Best Buy: The company provided fiscal first-quarter and full-year guidance, which factor in the impact of the coronavirus in causing supply-chain disruption. Best Buy expects most of the impact to happen during the first half of the year.

- Crocs: The footwear company noted that the coronavirus will hurt sales by $20–30 million for the first quarter of 2020 and $40–60 million for the full year, as many partner stores have closed in China.

- Mastercard: The company warned that its revenues in the first quarter of 2020 will be two to three percentage points lower than the previous outlook. It also expects full-year revenue growth to be at the low end of the low-teens range. Management said, “Cross-border travel, and to a lesser extent cross-border e-commerce growth, is being impacted by the coronavirus.”

- PayPal: The company said that the coronavirus could have a negative impact on its revenue expectations. PayPal forecasts its first quarter revenue to hit the lower end of its range of $4.78–4.84 billion.

- Revolve: The e-commerce fashion firm expects a negative impact—related to supply constraints—of one to three percentage points to sales growth in its fiscal 2020 outlook, mainly in the first and second quarters.

- Ross: The retailer does not operate stores in China, and its 2020 guidance does not reflect an impact from the outbreak. However, Ross noted that the high level of uncertainty over supply-chain disruptions in China and the further spread of the virus could negatively impact US consumer demand.

- SMCP Group: The French fashion group noted that its sales and profits would be significantly impacted due to a decrease in the number of Chinese tourists.