albert Chan

In our Coronavirus Briefing series, we outline the possible impacts of the coronavirus outbreak on economies, sectors and businesses. In this report, we collaborate with China Luxury Advisors to look at how the outbreak will impact China’s outbound tourism and sales at airport and duty-free stores. We suggest short-term actions that impacted businesses should consider taking during this disruption.

Sharp Drop in the Number of Chinese Outbound Travelers in the Near Term

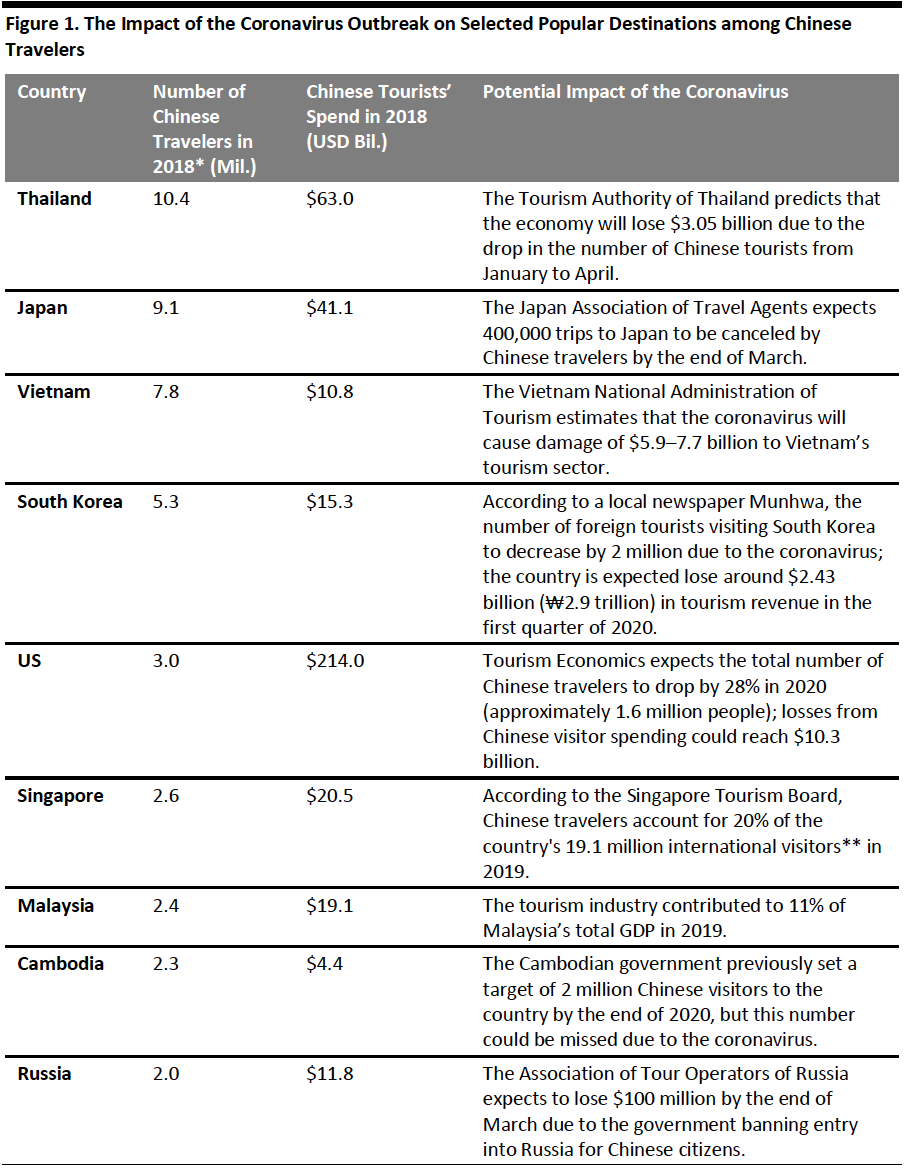

Chinese outbound travelers led spending in tourism globally before the coronavirus outbreak: They contributed one-fifth of the total international tourism spend in 2018—some $277 billion—according to the most recent data from the United Nations’ World Tourism Organization (UNWTO).

The tourism industry around the world is feeling the impact of the coronavirus, as there has been a sharp drop in the number of people travelling from China. According to ForwardKeys, a travel analytics company, the total number of outbound travelers from China dropped by 57.5% between January 20 and February 9 compared to the same period in 2019. This decline is due to the travel restrictions that have been enforced by governments and actions taken by airlines to reduce the number of flights to and from China.

[caption id="attachment_109250" align="aligncenter" width="700"] *Data excludes Hong Kong, Macau and Taiwan

*Data excludes Hong Kong, Macau and Taiwan** “International visitors” refers to travelers to Singapore whose length of stay is less than one year.

Source: UNWTO/company reports/Statista/Coresight Research[/caption]

Since many airlines have suspended flights to China until end of March—some of which will not resume before mid -April—we expect to see the total number of Chinese outbound travelers to drop by 55–60% in the first quarter of 2020, assuming there will be no further travel bans.

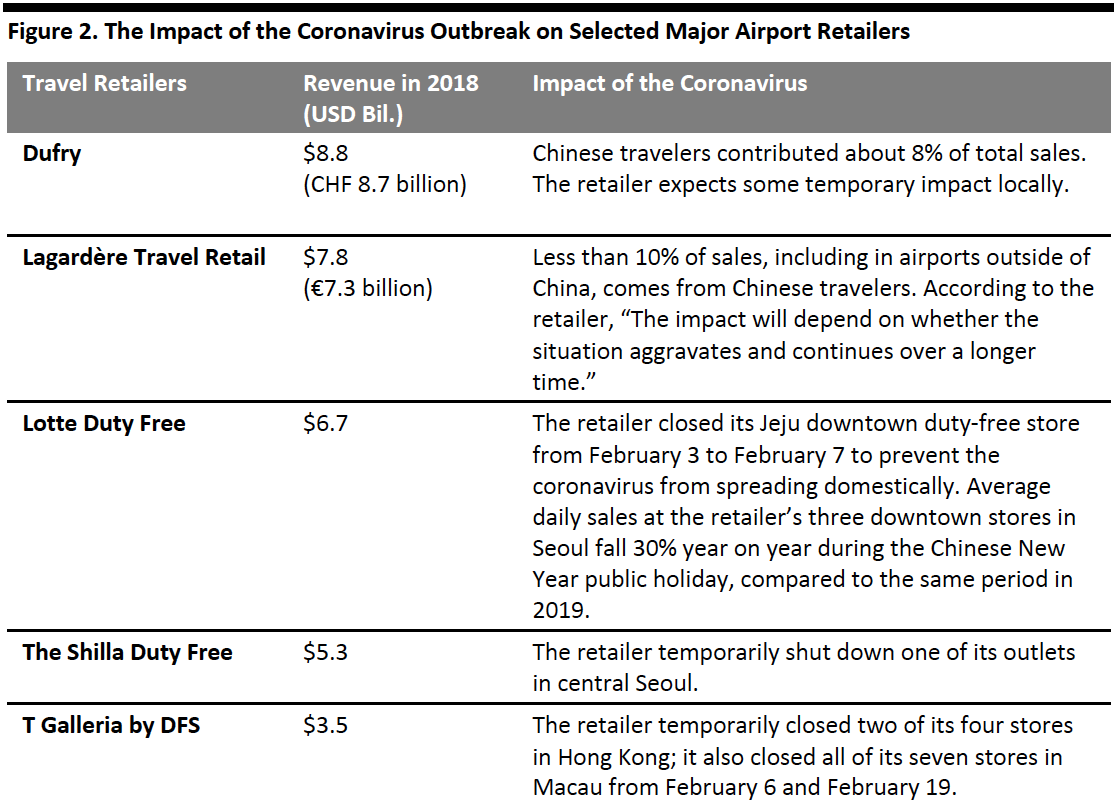

Significant Impact on Airport Shops

Prior the coronavirus outbreak, airport retail was booming. In Coresight Research’s latest Global Tourism series, we estimated that airport retail sales totaled around $44 billion in 2019.

Furthermore, Chinese travelers spent almost one-third of their overseas retail spending at duty-free stores last year. The significant drop in the number of Chinese outbound travelers in early 2020 is likely to have impacted airport retail around the world, particularly as some duty-free shops have taken actions to prevent the spread of the coronavirus.

[caption id="attachment_104037" align="aligncenter" width="700"] Source: Company reports/The Moodie Davitt Report/Coresight Research[/caption]

Source: Company reports/The Moodie Davitt Report/Coresight Research[/caption]

What Should Tourism-Focused Brands Do?

The global tourism industry will be severely disrupted in the near term amid the coronavirus outbreak. Assuming most of the travel bans will be lifted by mid-April, we expect that the global tourism and Chinese outbound tourism industries will recover quickly. In fact, we could even see a peak season during summer—in July and August—led by pent-up demand for shopping and traveling by Chinese consumers.

Meanwhile, during the period of coronavirus disruption, we suggest that tourism-focused brand owners and retailers consider taking the following actions:

- Temporarily pause media campaigns in Mainland China and those targeting Chinese tourists while consumers cope with the current situation. Be aware that consumers’ focus is on wellness and personal care and the health of their family and friends; this is not an appropriate time for tourism-related brands to focus on messaging and promotion.

- Show compassion and accommodate changes in scheduling. Marriott has waived its cancelation fees through March 15, 2020, for guests with reservations at its hotels in Greater China and guests from Greater China that are traveling outbound to other Marriott destinations globally.

- Begin to develop a refreshed strategy, in preparation for relaunching promotions after the air clears. Focus on carefully curated travel inspiration content, as well as health and wellness themes in advance of a potential late-spring/early-summer rebound.

- Invest in bigger-picture creative assets with which to engage Chinese consumers when they begin traveling again. It takes time to develop an influencer-led campaign, for example, but this is a great way to engage aspirational travelers in a specific destination or itinerary, so marketers should use this period of disruption to get organized.

- Engage Chinese consumers that are living overseas. There are a large number of Chinese students and others who live abroad either part time or full time, and they will continue to act as resources for friends and family back in China. This is an ideal time for brands to engage this community and include them in ongoing local activations and consumer outreach.

- Develop tech-driven engagement techniques. Nearly all tourism destinations are lagging when it comes to digital tools, particularly online-to-offline engagement strategies—WeChat mini-programs, for instance, can inspire and prepare potential visitors, and guide them directly to their desired experiences. Shopping destinations are notably far behind the level of engagement that Chinese shoppers have come to expect, so the coronavirus disruption has provided an opportunity for international retailers to catch up before the hoped-for return of the annual summer shopping rush.

Appendix: Recent Updates from Retailers and Brands

As part of our Coronavirus Briefing reports, we wrap up recent company announcements and developments from major retailers and brands.

- Adidas: The retailer closed a significant number of its 500 self-owned stores and 11,500 franchises in China. According to Adidas, those that remain open are seeing fewer shoppers, and its “business activity in Greater China has been around 85% below the prior year’s level since Chinese New Year on January 25.”

- Canada Goose: The company’s retail stores and e-commerce across Greater China have seen significant reductions in store traffic and revenue. Canada Goose warned that its “2020 sales and earnings would be hurt by the coronavirus outbreak in China.”

- Moncler: The retailer has closed 14 of its 40 stores in Mainland China as well as five duty-free stores in Korea. Moncler has experienced an 80% decline in foot traffic at stores that remain open. To protect its margin, the retailer started a plan to postpone some investments, including three store relocations and two new store openings. The company also suspended advertising in China until the second half of 2020.

- Puma: Authorities’ restrictions and safety measures have impacted Puma’s business in China. The company’s “business in other markets, especially in Asia, is suffering from lower numbers of Chinese tourists.”

- Under Armour: The coronavirus outbreak in China has had a negative impact on the company’s initial 2020 outlook, including an estimated $50–60 million drop in sales for the first quarter of 2020.