albert Chan

In our Coronavirus Briefing series, we outline the possible economic impact of the coronavirus outbreak in China. In this report, we assess the near-term impact on China’s economy. As the situation remains in flux, estimates and analysis are preliminary.

Foreign Retailers and Brands Operating in China

Many retailers and brands have closed stores in China amid the outbreak, and have a warned of a material financial impact:

- Nike closed half of its stores in China.

- Adidas closed a significant number of directly owned stores in China, while many of its franchisees have also closed stores.

- Apple closed all 42 of its China stores until February 9.

- Samsung closed all its stores in China until February 9.

- Ralph Lauren closed half of its 110 stores in China. According to CEO Patrice Louvet, China represents less than 4% of the company’s total business.

- Capri Holdings, which owns Versace, Jimmy Choo and Michael Kors, closed about 150 stores.

According to Nike and Capri Holdings, the stores that remain open (although with reduced hours) are seeing fewer shoppers.

Apple Suppliers Hope to Resume Full China Production on February 10

Foxconn, one of the two major manufactures of iPhones, plans to restart full production in China on February 10, the new official back-to-work day in most cities (following what has become a much lengthened Lunar New Year holiday). The company is located in Zhengzhou, more than 300 miles from Wuhan, the center of the outbreak. Apple’s other suppliers, including Quanta Computer, Inventec and LG Display, also announced plans to resume production in China during the week of February 10-14.

That said, as the outbreak continues to grow exponentially, it is uncertain whether the government will again delay the back-to-work day: The official back to work day would compel huge numbers of workers who returned to their home provinces for the holiday to return, which would mean large numbers of people traveling across country, something the government may wish to curtail if the outbreak remains uncontained.

Accessing the Near-Term Impact on China’s Economy by Comparing with SARS

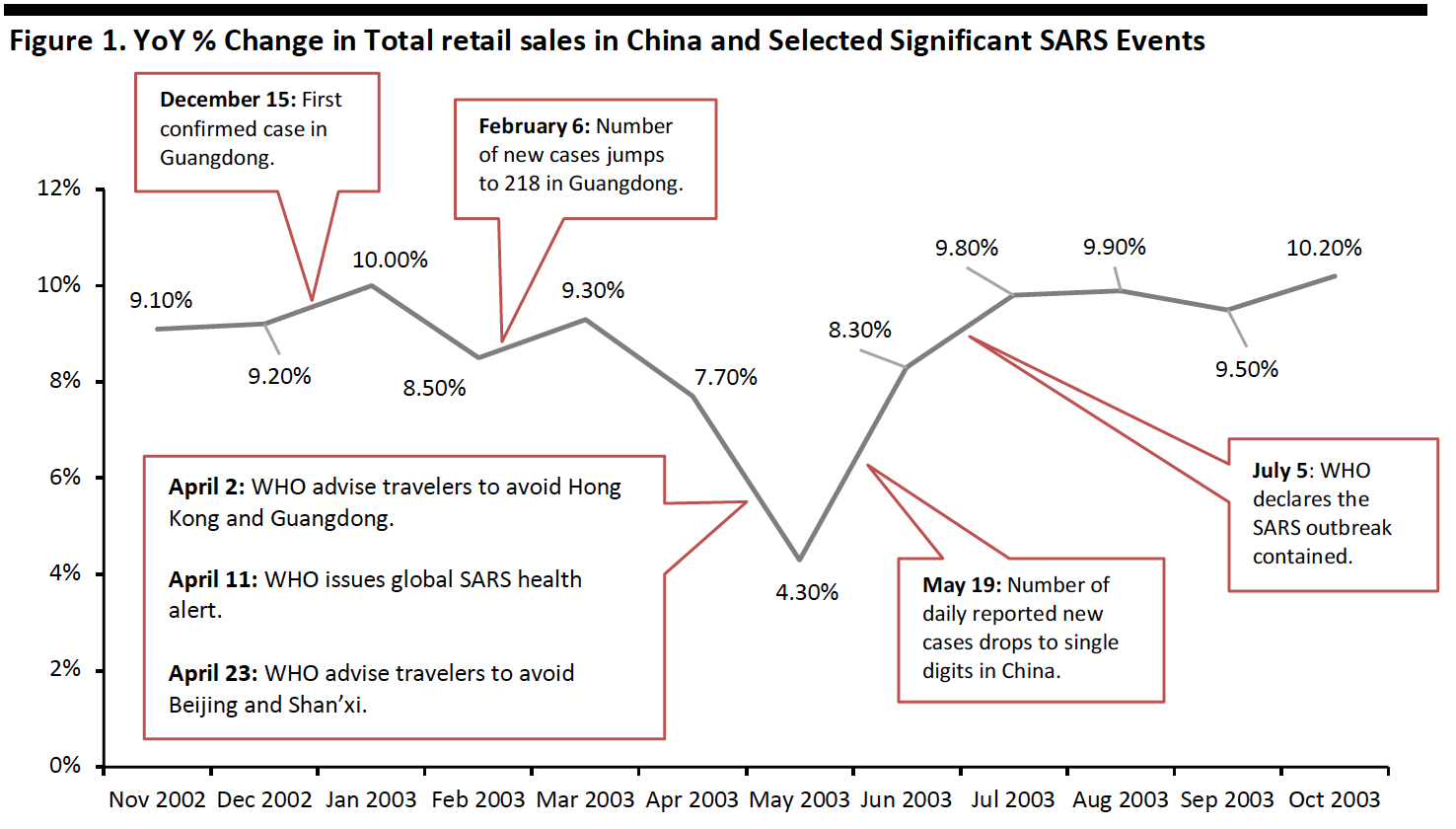

To estimate the potential impact on retail and the wider economy in China, we can look to the 2002-03 SARS outbreak, which pummelled domestic retail sales between March and June, 2003.

However, retail recovered quickly. In June 2003, total retail sales climbed 8.3% as the number of daily reported new cases dropped to single digits, and by the time WHO declared the outbreak contained, growth had more or less returned to normal.

[caption id="attachment_103390" align="aligncenter" width="700"] Source: National Bureau of Statistics of China/BBC/Coresight Research [/caption]

Source: National Bureau of Statistics of China/BBC/Coresight Research [/caption]

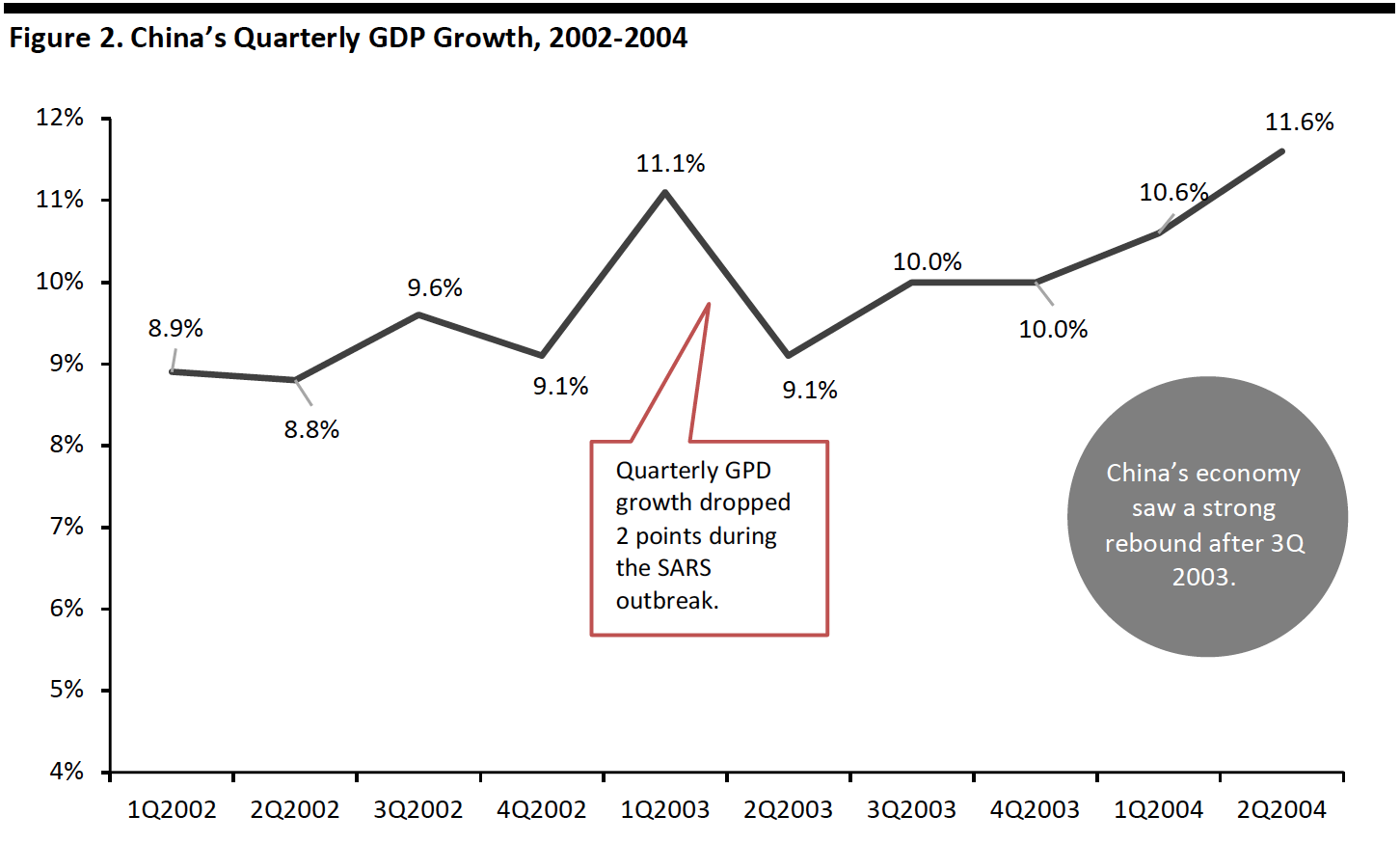

As a result of the SARS outbreak, China’s real GDP growth slowed by 2 percentage points, from 11.1% in the first quarter of 2003 to 9.1% in the second quarter of that year.

[caption id="attachment_103400" align="aligncenter" width="700"] Source: National Bureau of Statistics of China/Coresight Research[/caption]

Source: National Bureau of Statistics of China/Coresight Research[/caption]

According to the National Bureau of Statistics of China, China’s economy grew 10% in 2003, up 0.9 percentage points from 9.1% in 2002. The strong growth momentum continued with the economy growing 10.1% in 2004, suggesting the country had largely shrugged off the effects immediately after the outbreak was contained.

While we can look to the SARS experience for an idea of how coronavirus may play out, there are things to consider.

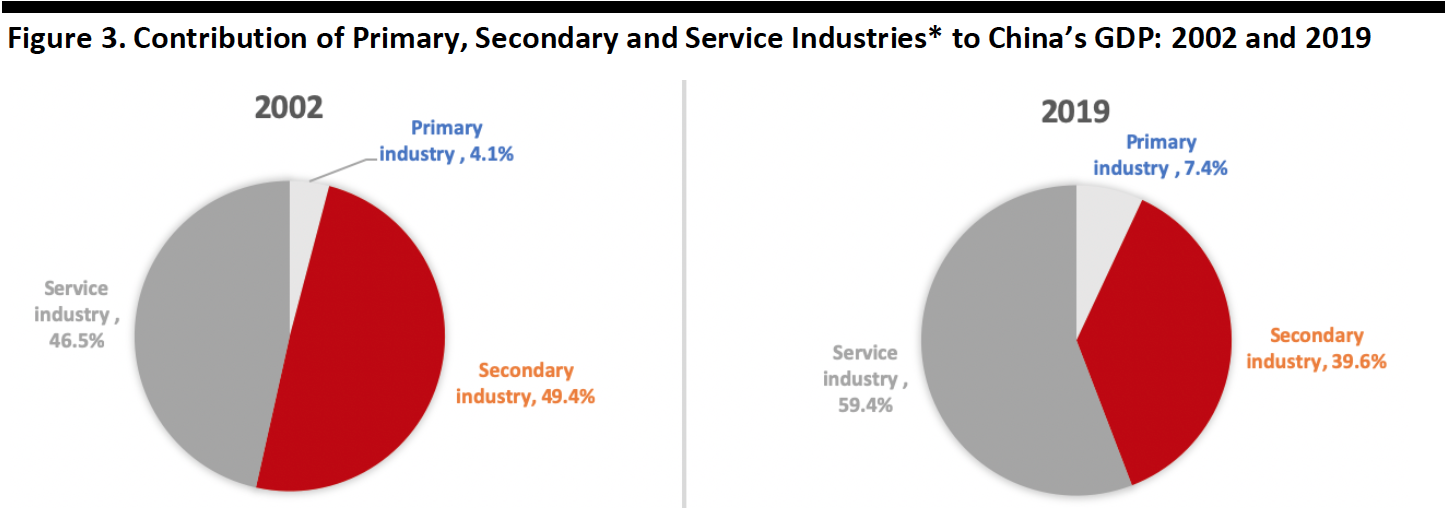

China’s economy has changed since SARS. In 2002, China’s service industry accounted for less than half total GDP. Secondary industry, such as manufacturing, production and construction, played a far bigger role in the country’s economy (see chart below). But by 2019, that math had changed. Now, China’s service industry accounts for 59.4% of GDP, while secondary industry’s share has shrunk to 39.6%. This means an event such as a disease outbreak that disproportionately affects services industries could have a bigger economic impact than did SARS. Sharp declines in domestic tourism, the large number of temporary business closures and the dramatic decline in food service business could mean coronavirus will more deeply impact near-term GDP.

[caption id="attachment_103392" align="aligncenter" width="700"] * Note: The primary industry refers to agriculture, forestry, animal husbandry and fishery industries (except support services to agriculture, forestry, animal husbandry and fishery industries). The secondary industry refers to mining (except auxiliary activities of mining), manufacturing (except repairs for metal products, machinery and equipment), production and supply of electricity, steam, gas and water, and construction. The tertiary industry refers to all other industries not included in primary or secondary industry.

* Note: The primary industry refers to agriculture, forestry, animal husbandry and fishery industries (except support services to agriculture, forestry, animal husbandry and fishery industries). The secondary industry refers to mining (except auxiliary activities of mining), manufacturing (except repairs for metal products, machinery and equipment), production and supply of electricity, steam, gas and water, and construction. The tertiary industry refers to all other industries not included in primary or secondary industry.Source: National Bureau of Statistics of China/Coresight Research[/caption]

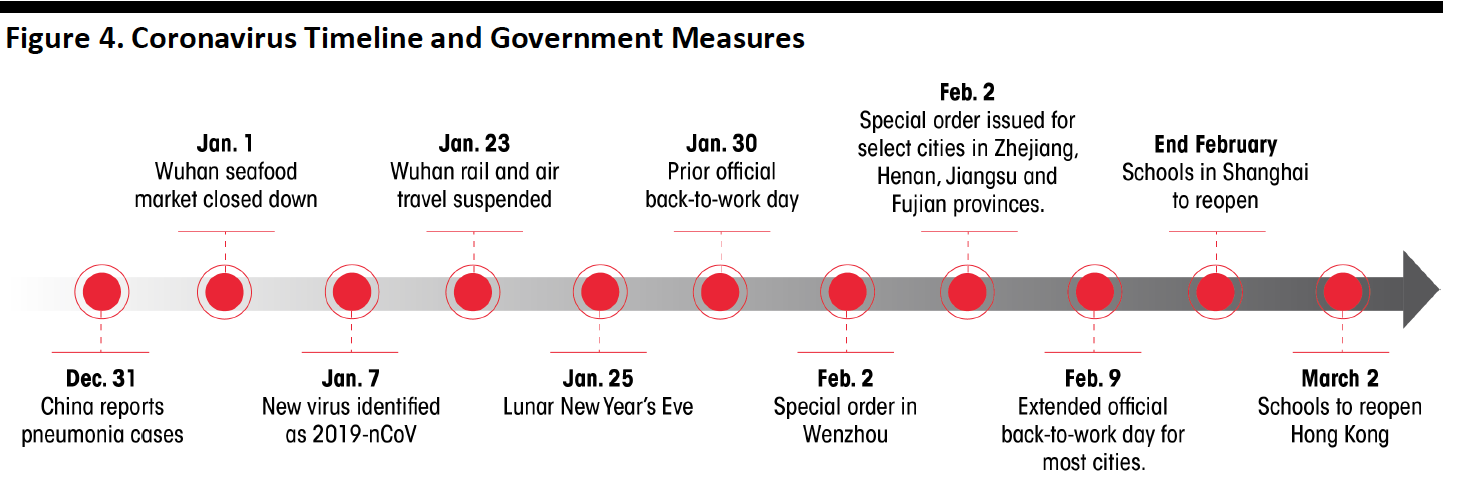

The good news is that China’s government responded more quickly and far more openly to this outbreak than to SARS, which bodes well for being able to more quickly contain it. Indeed, the government has taken many measures to contain the coronavirus outbreak, shown below.

[caption id="attachment_103393" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In addition to stopping many intercity transport links, many provincial and local governments have enacted measures of their own. On February 2, Wenzhou’s local government issued a special order under which only one person from each household is allowed to go to buy necessities, and once every two days. On February 4, similar orders were enforced in select cities in Zhejiang, Henan, Jiangsu and Fujian provinces.

Assessing the Impact on GDP

The final impact of the outbreak is difficult to assess, as new cases continue to be reported: It is difficult to predict when the outbreak will be contained, let alone accurately foresee the final outcome. That said, there are predictions and we can make estimates based on those assumptions.

Zhong Nanshan, the pulmonologist who identified the SARS coronavirus in 2003, has predicted the outbreak will peak around mid-February. If this happens, we assume the government will not delay the reopening of factories again. In this case, we estimate 1Q GDP growth could be more than 2 percentage points lower than it would otherwise have been. We assume that, without the virus, China’s economy would have grown by around 6% year over year in the first quarter, implying first-quarter growth could now come in at around 4% or lower.

However, compared with SARS, any rebound in 2Q may be stronger and faster as consumer spending, which now contributes to over 50% of total GDP, will be resumed and factories can react quickly to meet domestic and global demand. Central government policies, including boosting liquidity, and regional governments’ relief measures, such as tax deferments and local banks’ fiscal supports, will also speed up the recovery process.

Gabriel Leung, Dean of Hong Kong University’s medical school, believes the outbreak may not peak until April or May in five major Chinese cities. If this happens, we assume the government will again delay the date for resuming production, which would not only further delay industrial production but would also worsen already battered consumer confidence, which would hit consumer confidence harder—and could spill over to affect the global economy more severely than SARS.