albert Chan

We continue our Coronavirus Briefing series, looking at how the outbreak will affect China’s outbound travellers, its impact on global luxury retailers and steps retailers can consider to mitigate disruption—and position themselves to tap into returning demand once the outbreak is contained.

We discuss the impact on luxury brands and retailers within China and internationally. Chinese consumers spend on luxury much more abroad than at home, and overseas sales to Chinese tourists account for around one-quarter of the total global luxury goods market.

Effect on Luxury Retailers in China

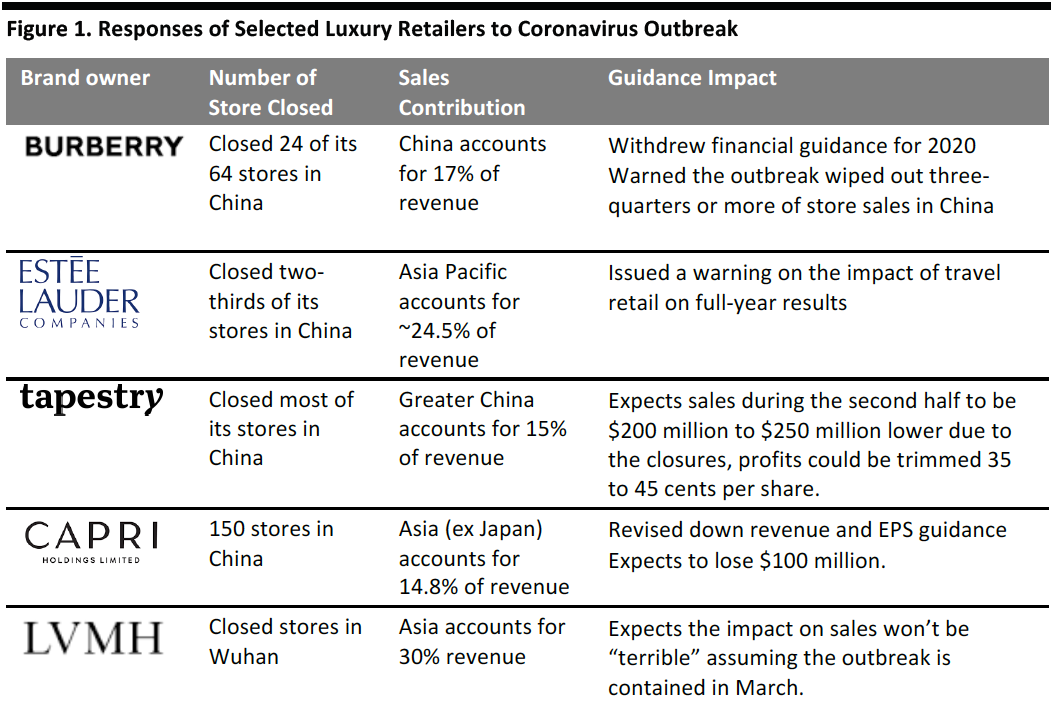

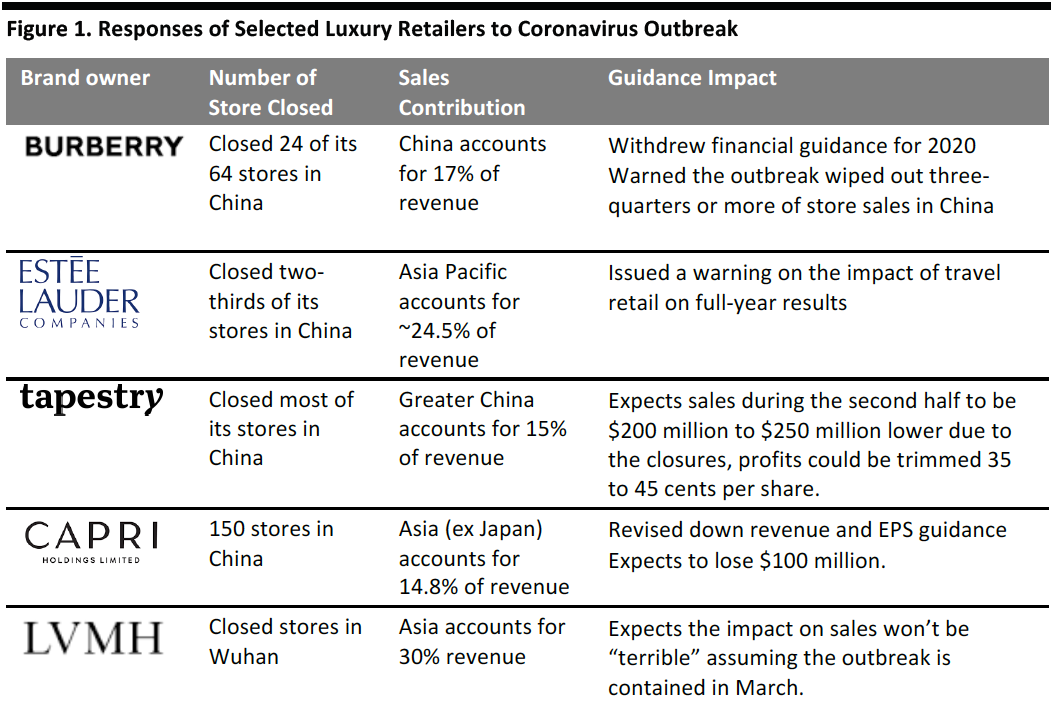

Store closures and disruption in China are impacting many major luxury brands and retailers. Several luxury brands have closed stores and some have adjusted full-year earnings guidance as a result, summarized below.

[caption id="attachment_103561" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Travel Disruption Will Hit Luxury Retail

Before the coronavirus outbreak, China’s outbound tourism was booming. The China Tourism Academy expects to report 166 million outbound trips in 2019, up 11% from 2018. And, many travel aboard during the seven-day Lunar New Year public holiday. Ctrip, an online travel agency, had predicted total outbound travel during Chinese New Year would reach 450 million in 2020.

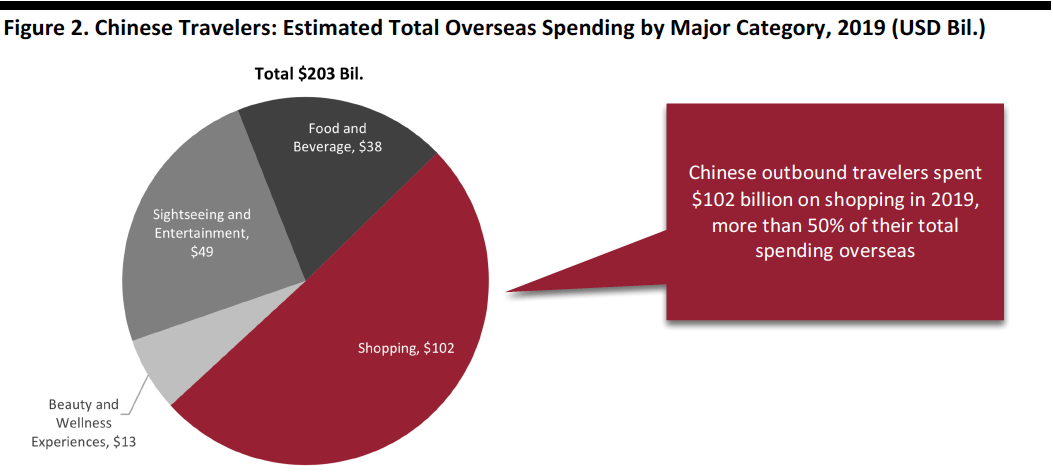

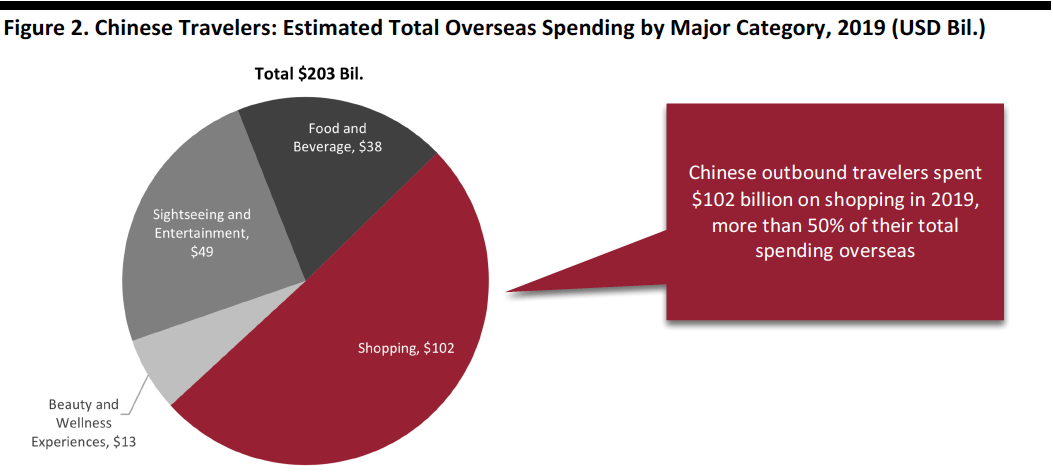

In the Coresight Research report Chinese Outbound Tourists Survey 2019 we estimate Chinese tourists spent a total of $203 billion (¥1,390 billion) in overseas markets in the 12 months ended August 2019, of which $102 billion was spent on shopping (as shown below).

[caption id="attachment_103562" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Travel Disruption Will Hit Luxury Retail

Before the coronavirus outbreak, China’s outbound tourism was booming. The China Tourism Academy expects to report 166 million outbound trips in 2019, up 11% from 2018. And, many travel aboard during the seven-day Lunar New Year public holiday. Ctrip, an online travel agency, had predicted total outbound travel during Chinese New Year would reach 450 million in 2020.

In the Coresight Research report Chinese Outbound Tourists Survey 2019 we estimate Chinese tourists spent a total of $203 billion (¥1,390 billion) in overseas markets in the 12 months ended August 2019, of which $102 billion was spent on shopping (as shown below).

[caption id="attachment_103562" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

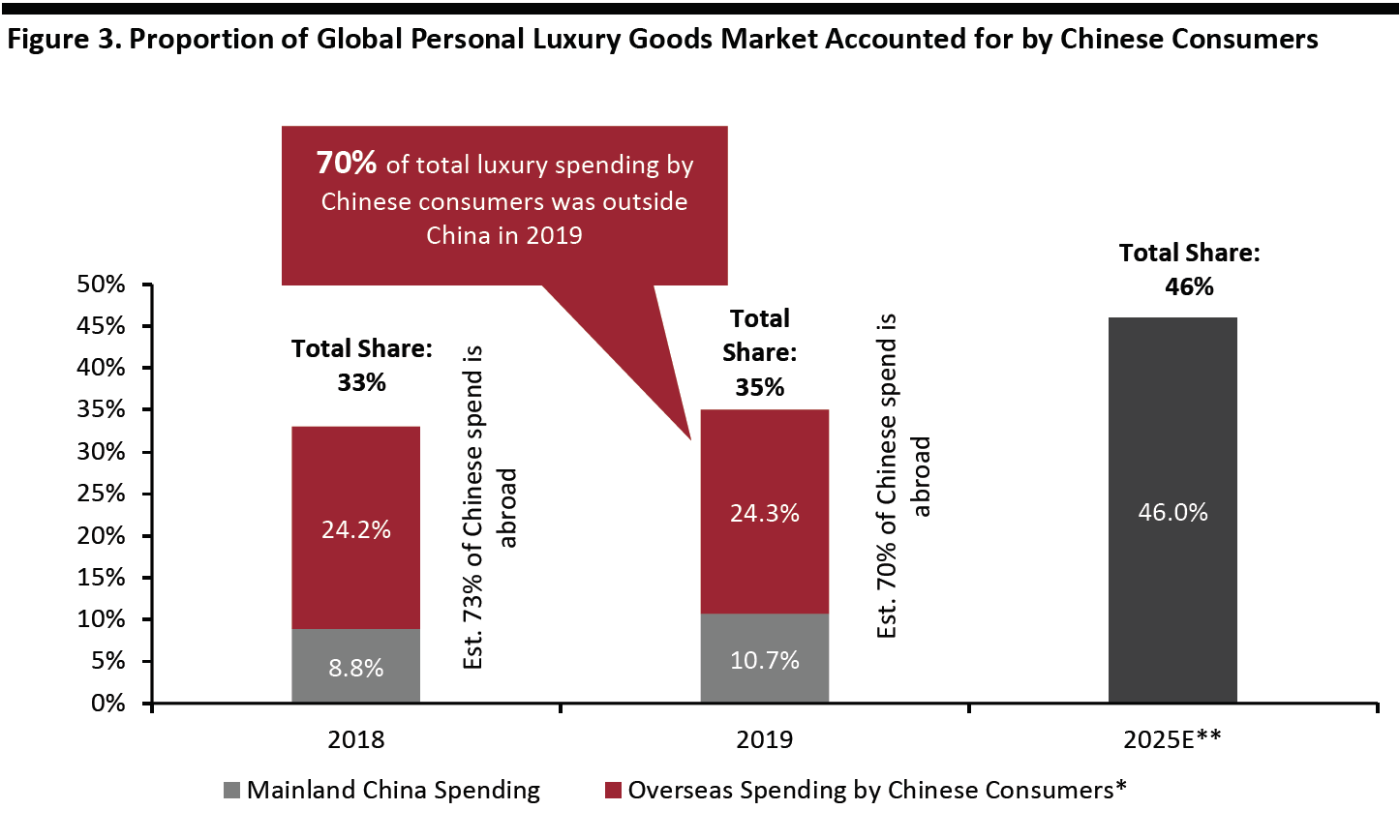

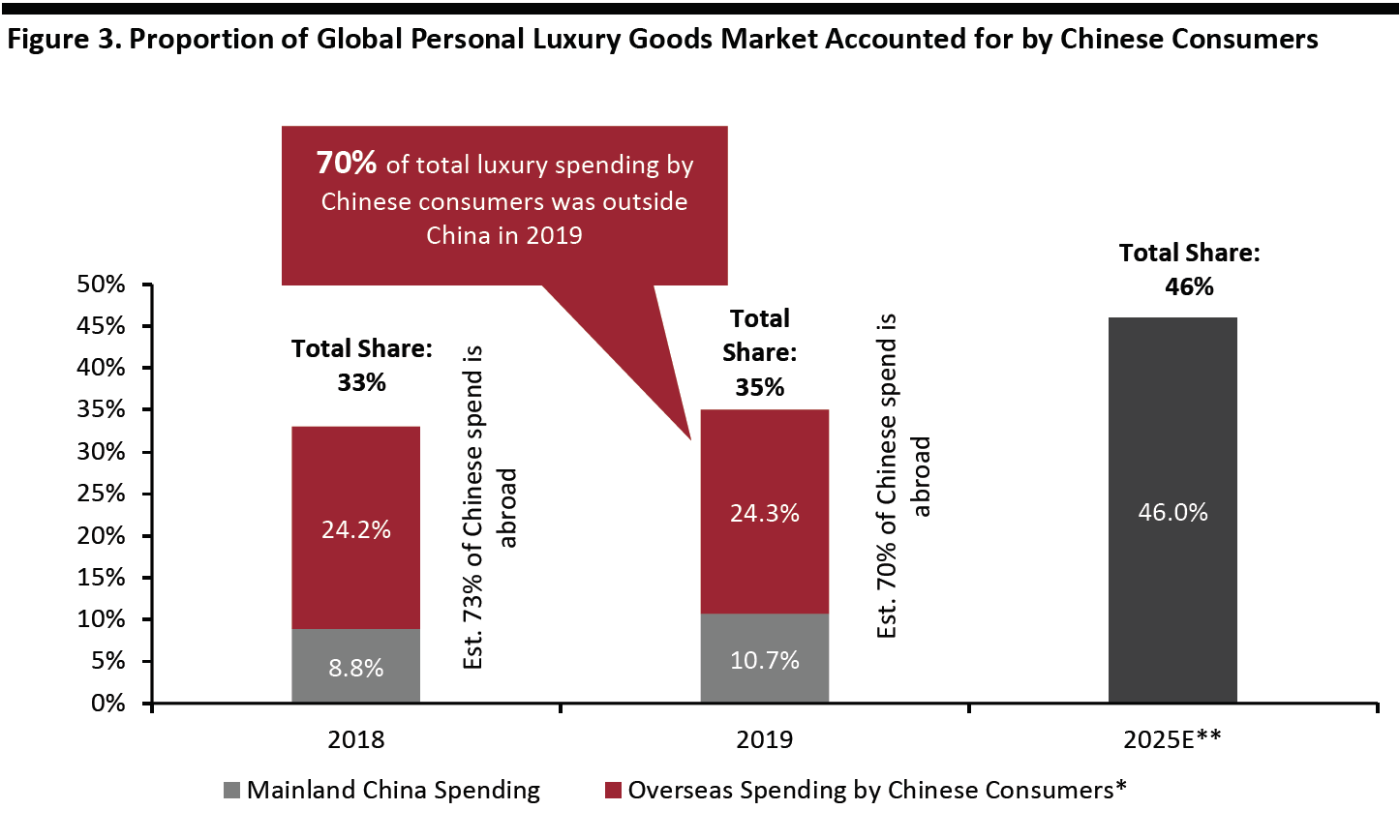

And, most luxury spending by Chinese consumers takes place abroad. According to Coresight Research estimates based on Bain & Company data, 70% of total luxury spending by Chinese consumers, some €68 billion ($75 billion), was outside China in 2019.

Bain found that Chinese consumers accounted for fully 90% of total growth in global luxury goods sales in 2019. The company also found Chinese consumers accounted for 35% of total worldwide sales of personal luxury goods in 2019, up from 33% in 2018; and, the company forecasts this share to reach 46% in 2025.

From Bain data, we estimate that overseas spending by Chinese consumers accounted for around 24% of global personal luxury goods sales in 2019—which is now under threat by the coronavirus shutdown, as shown in Figure 3, below.

[caption id="attachment_103709" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

And, most luxury spending by Chinese consumers takes place abroad. According to Coresight Research estimates based on Bain & Company data, 70% of total luxury spending by Chinese consumers, some €68 billion ($75 billion), was outside China in 2019.

Bain found that Chinese consumers accounted for fully 90% of total growth in global luxury goods sales in 2019. The company also found Chinese consumers accounted for 35% of total worldwide sales of personal luxury goods in 2019, up from 33% in 2018; and, the company forecasts this share to reach 46% in 2025.

From Bain data, we estimate that overseas spending by Chinese consumers accounted for around 24% of global personal luxury goods sales in 2019—which is now under threat by the coronavirus shutdown, as shown in Figure 3, below.

[caption id="attachment_103709" align="aligncenter" width="700"] *Inferred, from total share and mainland China share; mainland China share not adjusted for sales to non-Chinese consumers in mainland China.

*Inferred, from total share and mainland China share; mainland China share not adjusted for sales to non-Chinese consumers in mainland China.

**No mainland China/overseas split available.

Source: Bain/Coresight Research[/caption] [caption id="attachment_103564" align="aligncenter" width="700"] Source: Coresight Research[/caption]

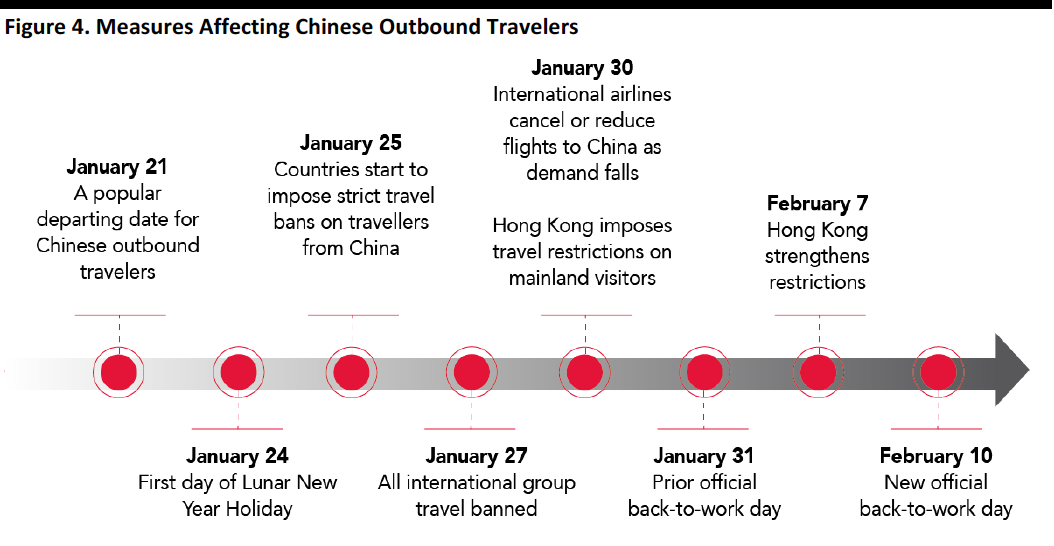

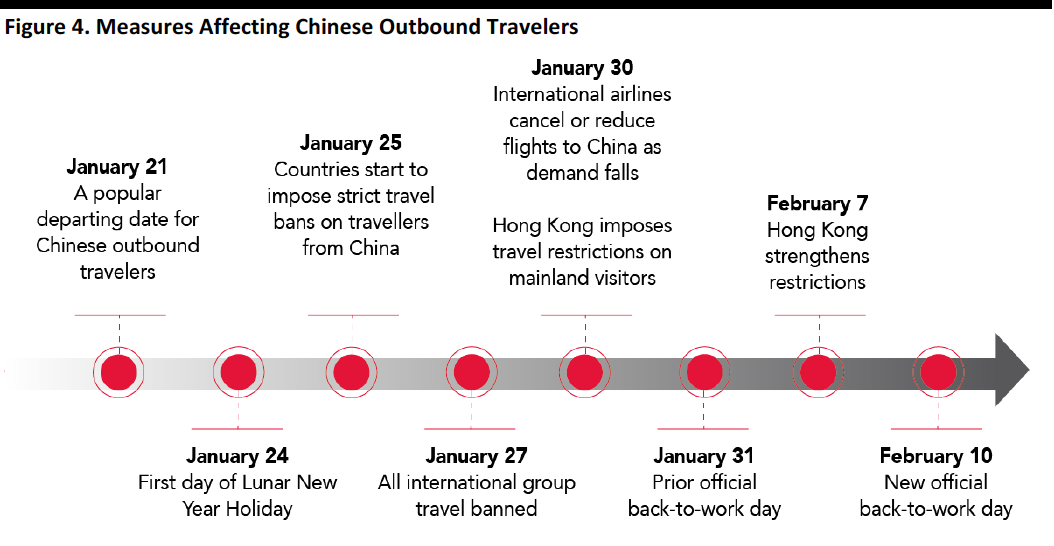

Due to travel bans around the world, we expect the number of Chinese outbound travellers to drop sharply year over year in the first quarter of 2020, severely impacting the 70% of Chinese luxury spend that takes place overseas in the short term.

Source: Coresight Research[/caption]

Due to travel bans around the world, we expect the number of Chinese outbound travellers to drop sharply year over year in the first quarter of 2020, severely impacting the 70% of Chinese luxury spend that takes place overseas in the short term.

Source: Company reports/Coresight Research[/caption]

Travel Disruption Will Hit Luxury Retail

Before the coronavirus outbreak, China’s outbound tourism was booming. The China Tourism Academy expects to report 166 million outbound trips in 2019, up 11% from 2018. And, many travel aboard during the seven-day Lunar New Year public holiday. Ctrip, an online travel agency, had predicted total outbound travel during Chinese New Year would reach 450 million in 2020.

In the Coresight Research report Chinese Outbound Tourists Survey 2019 we estimate Chinese tourists spent a total of $203 billion (¥1,390 billion) in overseas markets in the 12 months ended August 2019, of which $102 billion was spent on shopping (as shown below).

[caption id="attachment_103562" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Travel Disruption Will Hit Luxury Retail

Before the coronavirus outbreak, China’s outbound tourism was booming. The China Tourism Academy expects to report 166 million outbound trips in 2019, up 11% from 2018. And, many travel aboard during the seven-day Lunar New Year public holiday. Ctrip, an online travel agency, had predicted total outbound travel during Chinese New Year would reach 450 million in 2020.

In the Coresight Research report Chinese Outbound Tourists Survey 2019 we estimate Chinese tourists spent a total of $203 billion (¥1,390 billion) in overseas markets in the 12 months ended August 2019, of which $102 billion was spent on shopping (as shown below).

[caption id="attachment_103562" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

And, most luxury spending by Chinese consumers takes place abroad. According to Coresight Research estimates based on Bain & Company data, 70% of total luxury spending by Chinese consumers, some €68 billion ($75 billion), was outside China in 2019.

Bain found that Chinese consumers accounted for fully 90% of total growth in global luxury goods sales in 2019. The company also found Chinese consumers accounted for 35% of total worldwide sales of personal luxury goods in 2019, up from 33% in 2018; and, the company forecasts this share to reach 46% in 2025.

From Bain data, we estimate that overseas spending by Chinese consumers accounted for around 24% of global personal luxury goods sales in 2019—which is now under threat by the coronavirus shutdown, as shown in Figure 3, below.

[caption id="attachment_103709" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

And, most luxury spending by Chinese consumers takes place abroad. According to Coresight Research estimates based on Bain & Company data, 70% of total luxury spending by Chinese consumers, some €68 billion ($75 billion), was outside China in 2019.

Bain found that Chinese consumers accounted for fully 90% of total growth in global luxury goods sales in 2019. The company also found Chinese consumers accounted for 35% of total worldwide sales of personal luxury goods in 2019, up from 33% in 2018; and, the company forecasts this share to reach 46% in 2025.

From Bain data, we estimate that overseas spending by Chinese consumers accounted for around 24% of global personal luxury goods sales in 2019—which is now under threat by the coronavirus shutdown, as shown in Figure 3, below.

[caption id="attachment_103709" align="aligncenter" width="700"] *Inferred, from total share and mainland China share; mainland China share not adjusted for sales to non-Chinese consumers in mainland China.

*Inferred, from total share and mainland China share; mainland China share not adjusted for sales to non-Chinese consumers in mainland China.**No mainland China/overseas split available.

Source: Bain/Coresight Research[/caption] [caption id="attachment_103564" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Due to travel bans around the world, we expect the number of Chinese outbound travellers to drop sharply year over year in the first quarter of 2020, severely impacting the 70% of Chinese luxury spend that takes place overseas in the short term.

Source: Coresight Research[/caption]

Due to travel bans around the world, we expect the number of Chinese outbound travellers to drop sharply year over year in the first quarter of 2020, severely impacting the 70% of Chinese luxury spend that takes place overseas in the short term.

- 11,378 outbound trips were cancelled in Shanghai between January 27 and 31, affecting over 200,000 travelers.

- Hong Kong, a popular destination for luxury shopping, saw just over 200,000 mainland visitors during the Chinese New Year holiday between January 24 and January 31—some 85.5% lower than 2019’s.4 million. Worried about transmission of coronavirus, the city closed two railways and six border checkpoints, leaving only three open to visitors from mainland China on January 30. On the same day, the government stopped issuing permits for mainland visitors. On February 7, the Hong Kong government added restrictions by requiring all arrivals from China must be quarantined for 14 days—even Hong Kong residents. With these restrictions, we expect the number of travelers to Hong Kong to plunge further, which will significantly affect the local luxury sector.

- The US announced that foreign nationals who have travelled to China in the prior 14 days cannot enter, and US citizens who have visited China must be quarantined. Other countries announced similar restrictions, including Australia, Japan, Italy and Singapore, all popular destinations for Chinese travellers with luxury shops that depend on Chinese tourists.

- Airlines have slashed and in some cases completely stopped flights to China as demand fell off. As of February 7, some 73 airlines had suspended flights to China, some of which will not resume before the end of March.

- Leverage influencers, KOCs and user-generated content to communicate with consumers. Brands can use livestreaming, short-video apps such as Weibo, WeChat, TikTok, Bili Bili and KUAI.

- Explore and use private traffic, also known as Si Yu Liu Liang (私域流量) , to sell through social commerce channels, including private WeChat groups. For example, brands can create WeChat groups for different stores, and sales associates from each store can answer questions, share pictures of new products, promotions and links to the online stores.

- Collaborate with technology companies and startups to implement reality technologies, such as virtual reality, augmented reality and mixed reality. Offering an immersive shopping experience can create new ways to shop.