albert Chan

We outline the possible economic impact of the coronavirus outbreak in China. We will follow up with further estimates in subsequent reports.

Putting a Damper on Lunar New Year Spending

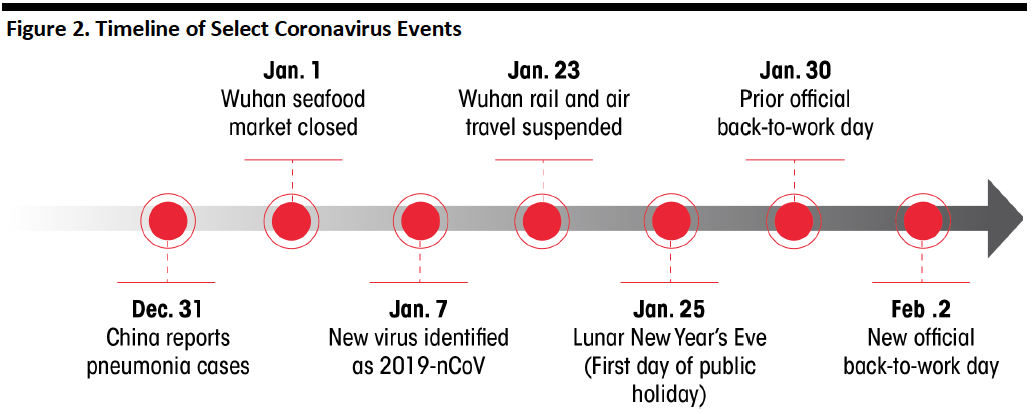

The coronavirus outbreak hit at a crucial time for China’s economy: Just before the all-important Lunar New Year holiday. Prior to the outbreak, our Chinese New Year Preview predicted $156 billion (RMB 1.1 billion) in retail and food-service holiday sales, including holiday meals at home and at restaurants, as well as holiday merchandise, decorations, gifts and new clothes. Since the virus emerged prior to the start of the Lunar New Year holiday (see the timeline below), Chinese shoppers likely completed much of their holiday shopping prior to the holiday.

More recently, our colleagues in China report that grocery-store shelves are bare, having been cleaned out of staples by consumers planning to stay home to weather the situation.

The current environment is likely to be negative for brick-and-mortar retail, travel (domestically within China and to neighboring countries), restaurants and gaming, as consumers stay home. Retailers should focus on online and social media, as consumers can shop from home and are highly likely to do so (with e-commerce expected to account for 44% of retail this year, according to Statista).

Assessing the Economic Exposure

The economic impact of the still-spreading coronavirus could be major: Wuhan, the capital of Hubei Province and the epicenter of the outbreak, is home to the headquarters of major domestic car and steel producers and is also a major transportation and industrial hub. With Wuhan essentially locked down, much of that activity could be hampered. Moreover, the lockdown is spreading: The central government extended the public transportation shutdown to 12 additional cities, affecting more than 35 million people.

To estimate the potential impact, we can look at the most recent similar outbreak: The 2003 SARS outbreak.

In Estimating the Global Economic Costs of SARS, Jong-Wha Lee and Warwick McKibbin outlined three ways the virus affected the global economy:

- A decline in consumer demand, particularly in travel and retail sales.

- Reduced confidence in the outlook of the affected economies.

- Increased cost of disease prevention.

The Economist Intelligence Unit offered an early analysis, estimating the coronavirus could shave 0.5 to 1.0 percentage points off its estimate for China’s 5.9% GDP growth in 2020. Based on China’s GDP of $14.3 trillion in 2019, this represents a potential impact of $7.2–14.3 billion.

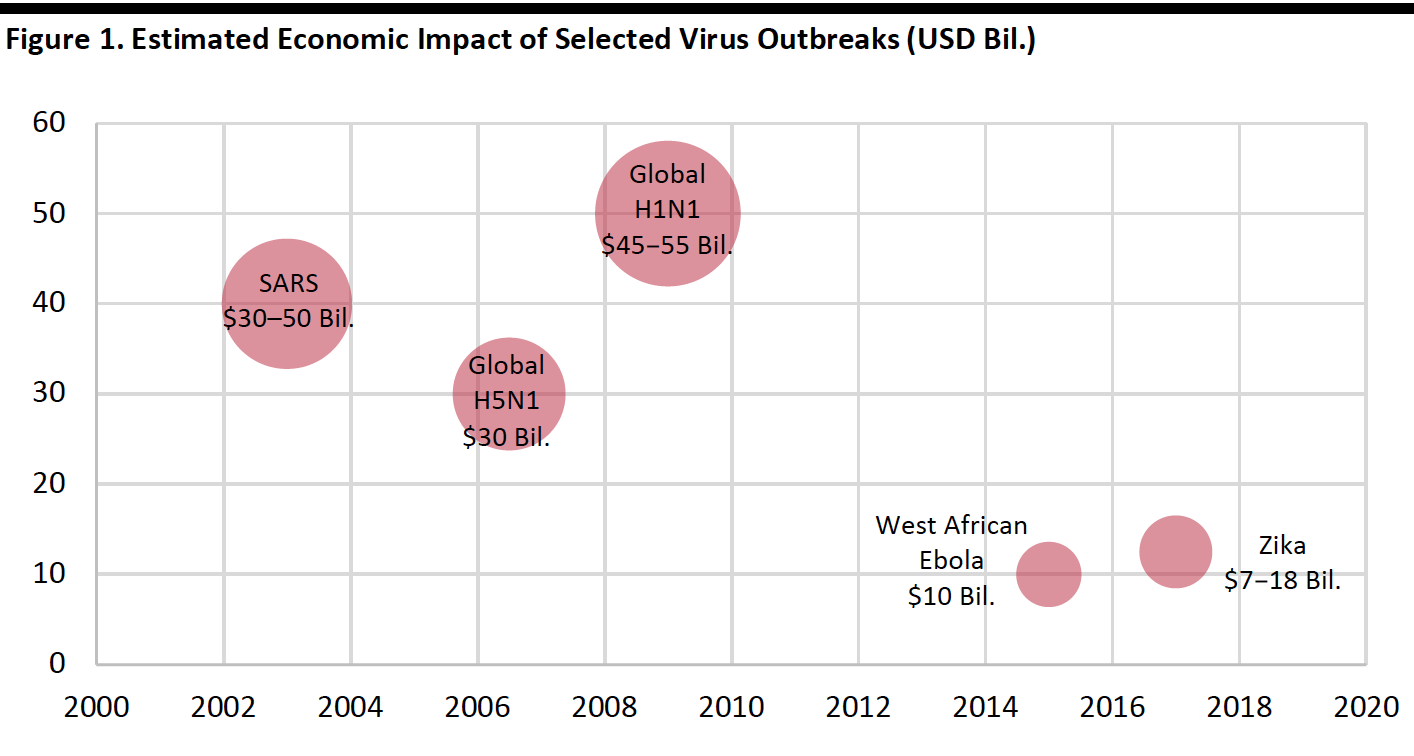

The World Bank and other sources estimate the global economic toll of outbreaks of SARS, the H5N1 avian flu and H1N1 at $30 billion.

To get a better idea of the potential impact of reduced travel, see the Coresight Research report Chinese Outbound Tourists Survey 2019.

While the trajectory of every virus is different, we can look to previous outbreaks to estimate the impact of coronavirus. However, as the economies of the countries and regions affected are markedly different, the scale of the economic damage will also be different, e.g. Ebola’s economic impact was not as great in nominal terms because the economies of the regions it hit are smaller, although the human cost was much higher.

[caption id="attachment_102880" align="aligncenter" width="700"] Source: World Bank/BioEra/UNDP/EcoHealth Alliance[/caption]

Source: World Bank/BioEra/UNDP/EcoHealth Alliance[/caption]

Outbreak Timeline and Recent Changes

The figure below illustrates the general timeline from when early forms of the virus were discovered to now.

[caption id="attachment_102867" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

To stem the spread, China’s State Council announced on January 27 that the Lunar New Year Festival holiday would be extended from January 30 to February 2. This extension does not apply to essential businesses, such as grocery. Several Chinese provinces have extended their new year holidays even further: Shanghai municipality and Zhejiang Province announced that nonessential companies will remain closed until February 9, while Guangdong Province announced it will delay the resumption of work until after February 9 and school until after February 17. Hong Kong announced it will keep schools closed until February 17.

Impact on Hong Kong

Hong Kong residents are taking measures to protect themselves from the coronavirus—likely to exacerbate an already challenging retail environment in the city. Local retail sales declined 25.4% in November, on the heels of a revised 26.4% decline in October.

On January 28, Hong Kong announced that it will greatly limit travel from mainland China, reducing ferry service, suspending high-speed rail service and cutting the number of flights by half.

Company Reports

On January 28, Starbucks announced 3% comp growth in China in 1Q20. The company also announced that more than half its stores in China are currently closed and that the company continues to monitor and modify operating hours for all stores in China. The company expects the closures to materially affect its international segment in fiscal 2Q20 and will update guidance when it can reasonably estimate the impact of the coronavirus.

Some major retailers and brands with high exposure to China include:

- Estée Lauder (17% of sales come from China).

- Nike (16% of sales come from China).

- Tapestry (15% of sales come from China).

- PVH (Asia is 12%).

- Gap (Asia is 7%).