Nitheesh NH

On May 18, 2021, Coresight Research hosted an online event in conjunction with Prevedere, a predictive analytics company that provides real-time insights to companies. The event saw Deborah Weinswig, CEO and Founder of Coresight Research, and Rich Wagner, CEO and Founder of Prevedere, discuss the current pandemic-impacted CPG landscape in the US, how CPG companies should view and leverage demand forecasting, and the importance of the digital customer experience.

In this report, we present selected insights from the event.

Weinswig and Wagner discuss the challenges in demand forecasting that CPG companies are facing

Weinswig and Wagner discuss the challenges in demand forecasting that CPG companies are facing

Source: Coresight Research[/caption] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The Power of Intelligent Forecasting: Key Insights

- The Current US CPG Landscape: Volatility in Demand and Supply Chain Disruption

Weinswig and Wagner discuss the challenges in demand forecasting that CPG companies are facing

Weinswig and Wagner discuss the challenges in demand forecasting that CPG companies are facingSource: Coresight Research[/caption]

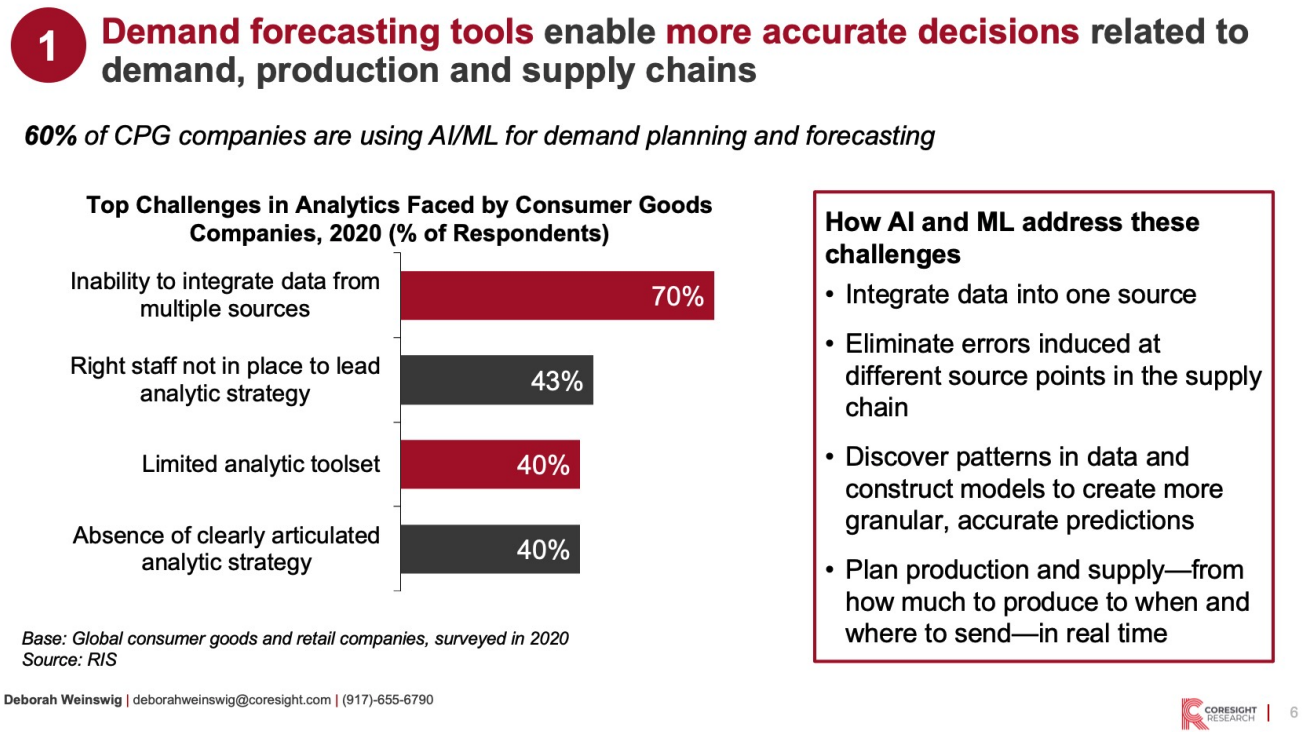

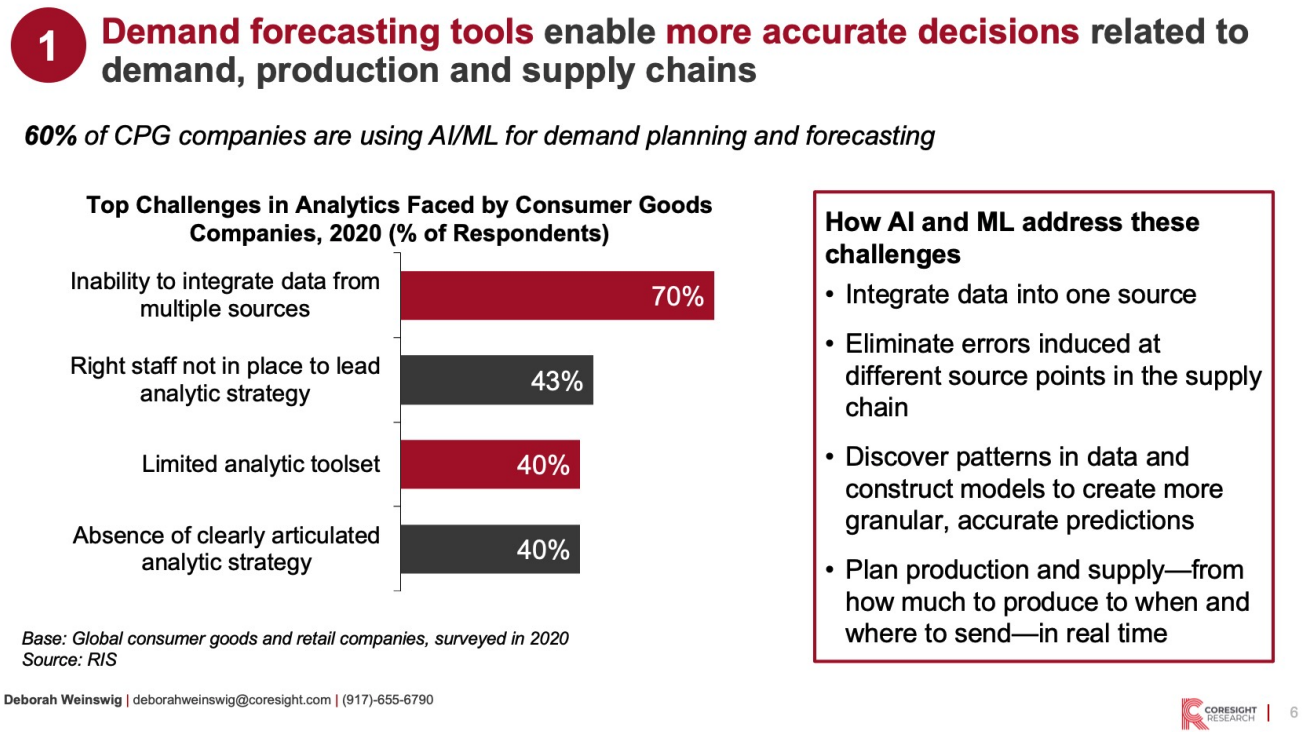

- Demand Forecasting Is Top of Mind, and Companies Need To Be Agile

- Demand Forecasting Drives Accuracy but Needs Constant Adjustment

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

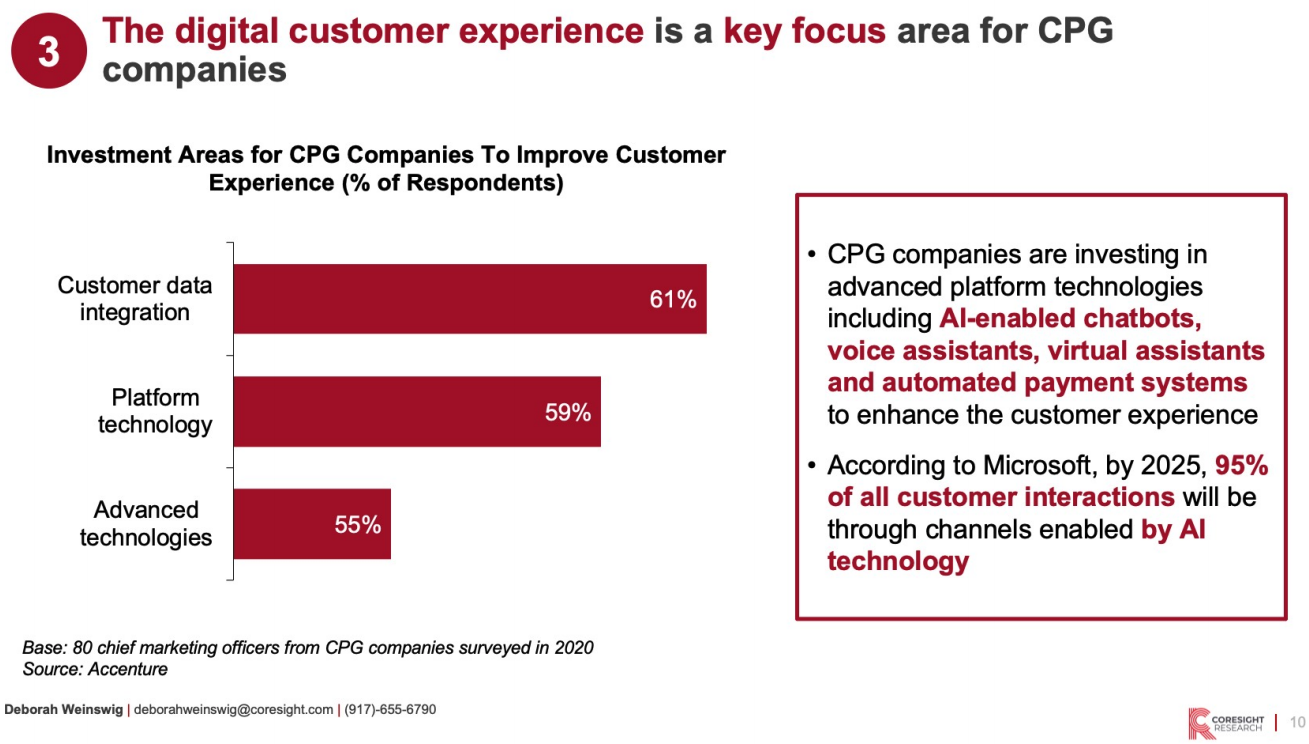

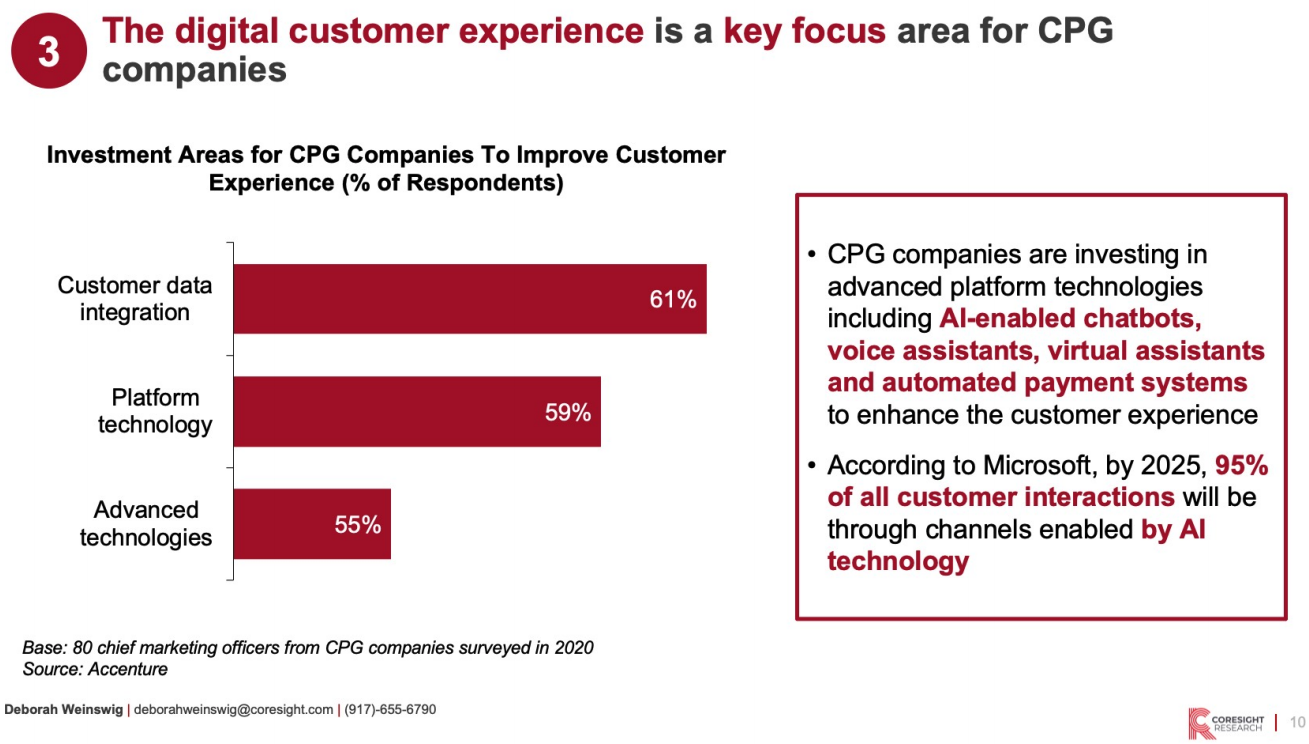

- The Digital Customer Experience Is Key in Enhancing Customer Service and Convenience

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

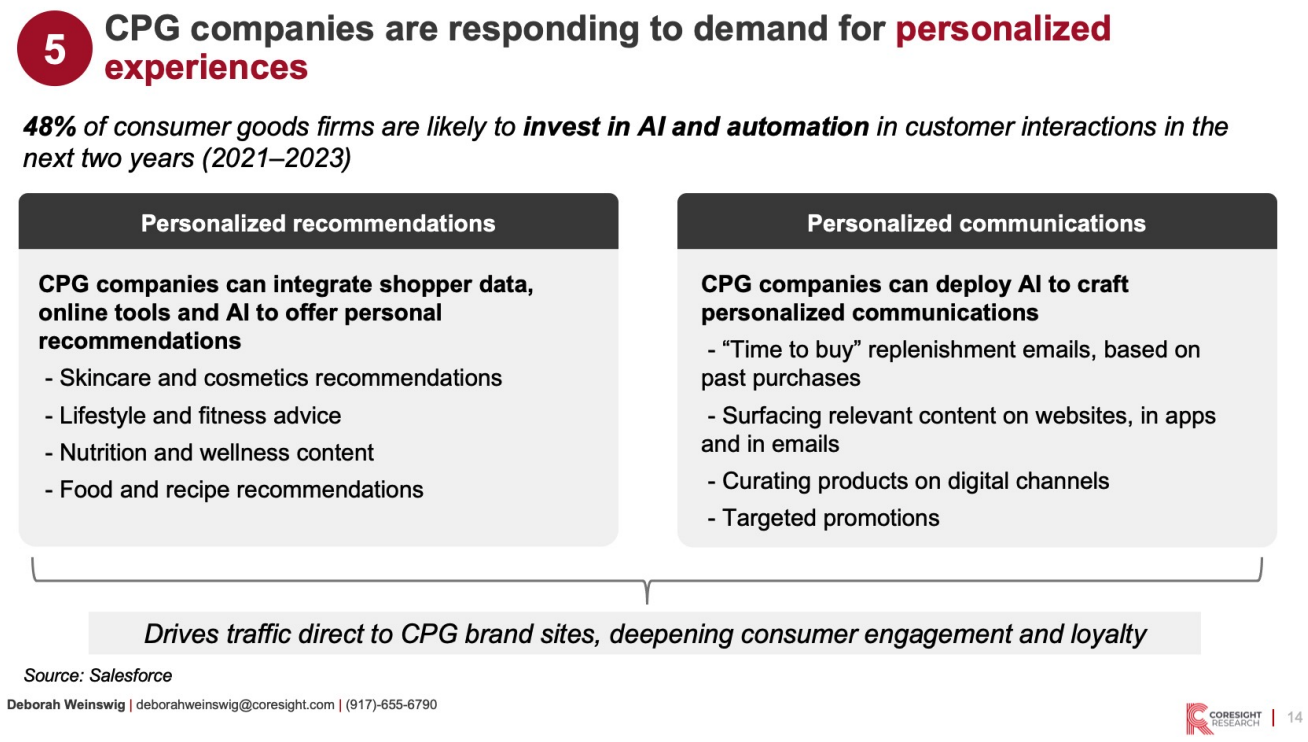

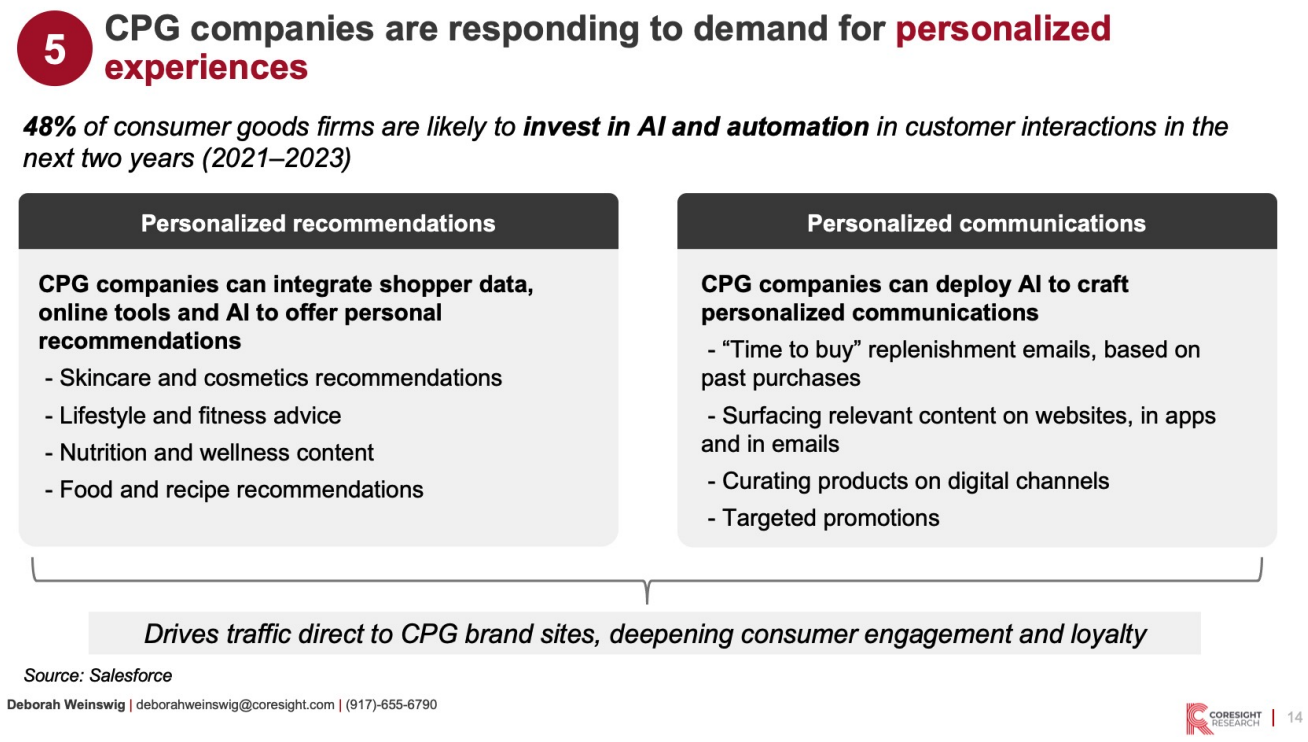

- AI and ML Tools Enable CPG Companies To Drive Personalization

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]