Nitheesh NH

On February 23, 2021, Coresight Research and location data and analytics provider Placer.ai hosted a webinar, “Retail 2021: A Data-Driven Look at What We Have Seen and Where the Sector Is Going.” The digital event was moderated by Deborah Weinswig, CEO and Founder of Coresight Research, and featured a presentation by Ethan Chernofsky, Vice President of Marketing at Placer.ai.

Coresight Research and Placer.ai explored key themes in today’s retail environment in the US and discussed some of the leading drivers behind fundamental shifts in retail. In this report, we present data-driven insights from the event, covering the future of malls, foot traffic at selected brands and consumer migration from cities to suburbs.

Source: Placer.ai[/caption]

The Road Ahead for Malls

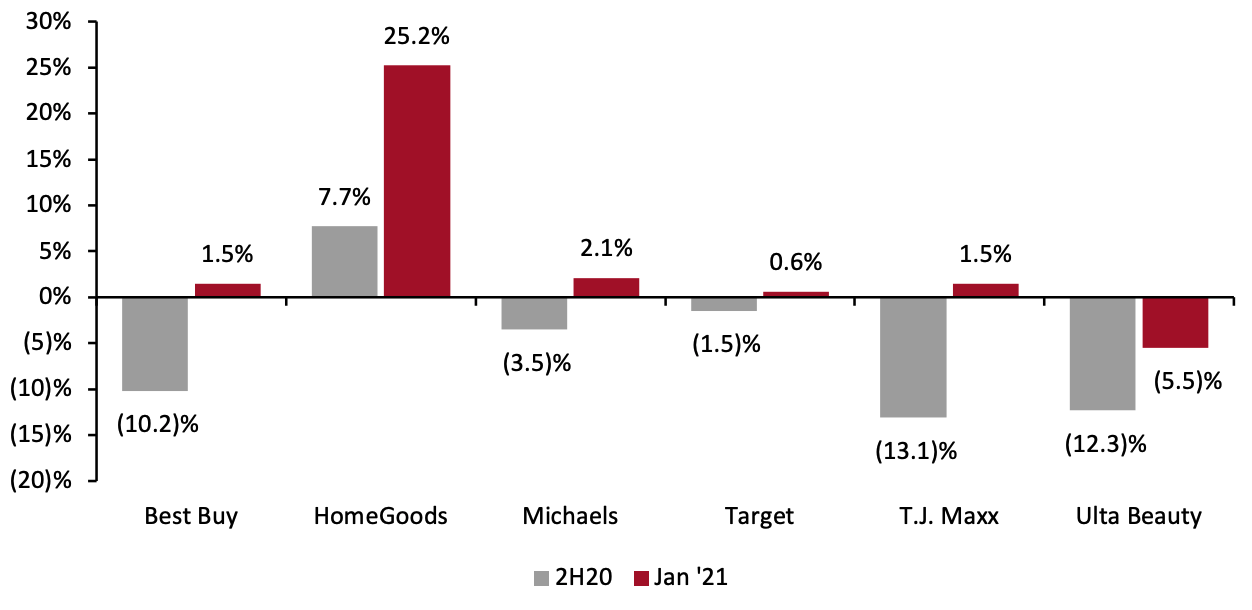

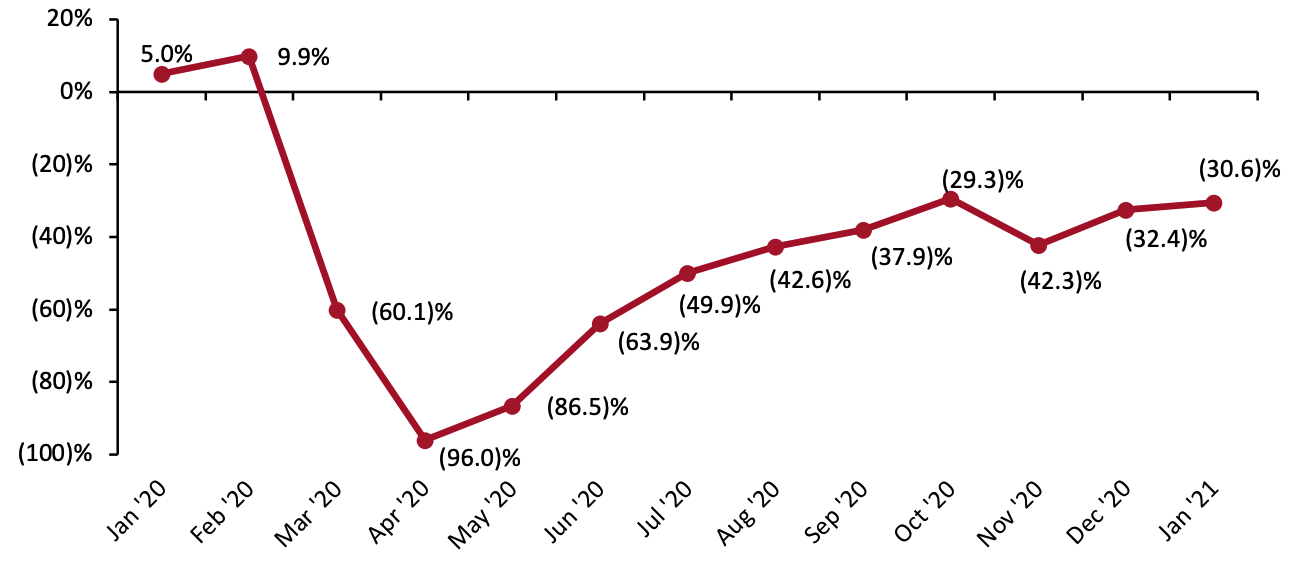

The US mall index—showing the year-over-year change in the number of visits to malls, calculated by Placer.ai—reveals a decline of 60.1% in March 2020, which can be attributed to the strict lockdowns imposed nationwide. Chernofsky said that last year, foot traffic experienced the greatest decline in April (down 96.0% year over year). Although traffic has shown slight improvement since, it was still down 30.6% in January 2021 (see Figure 2).

Figure 2. Placer.ai US Mall Index: YoY % Change in Visits to Malls

[caption id="attachment_123923" align="aligncenter" width="720"]

Source: Placer.ai[/caption]

The Road Ahead for Malls

The US mall index—showing the year-over-year change in the number of visits to malls, calculated by Placer.ai—reveals a decline of 60.1% in March 2020, which can be attributed to the strict lockdowns imposed nationwide. Chernofsky said that last year, foot traffic experienced the greatest decline in April (down 96.0% year over year). Although traffic has shown slight improvement since, it was still down 30.6% in January 2021 (see Figure 2).

Figure 2. Placer.ai US Mall Index: YoY % Change in Visits to Malls

[caption id="attachment_123923" align="aligncenter" width="720"] Source: Placer.ai[/caption]

Coresight Research and Placer.ai expressed optimism around the future of malls, highlighting two key factors that will play an important role in determining their success:

Source: Placer.ai[/caption]

Coresight Research and Placer.ai expressed optimism around the future of malls, highlighting two key factors that will play an important role in determining their success:

An Introduction to Placer.ai Background

Placer.ai is a location analytics company that observes location data from over 30 million devices, creating estimates using artificial intelligence and machine learning to generate insights across physical locations of interest. The company is GDPR compliant and does not extract any personally identifiable information.Retail 2021: A Data-Driven Exploration of Current Trends and Industry Shifts

Retail Sales Update: January 2021 The event began with a brief review of US retail sales in January 2021, which saw impressive growth of 10.8% year over year, according to the US Census Bureau, as stimulus checks provided a boost to consumer spending. Coresight Research analysis of US Census Bureau data shows the following:- Nonstore retailers saw 22.1% year-over-year sales growth in January, following a strong December 2020 (when sales grew 19.0%) and overtaking home improvement (building material and garden supply retailers) to experience the strongest growth of the month.

- Spending in and around the home remains a top consumer priority, with furniture and home-furnishing stores seeing year-over-year sales growth of 9.3%, improving from a 5.7% increase in December.

- Clothing store sales decreased by 11.3% in January, roughly the same as the 11.8% decline in December, as consumers continued to shop more for apparel online.

Source: Placer.ai[/caption]

The Road Ahead for Malls

The US mall index—showing the year-over-year change in the number of visits to malls, calculated by Placer.ai—reveals a decline of 60.1% in March 2020, which can be attributed to the strict lockdowns imposed nationwide. Chernofsky said that last year, foot traffic experienced the greatest decline in April (down 96.0% year over year). Although traffic has shown slight improvement since, it was still down 30.6% in January 2021 (see Figure 2).

Figure 2. Placer.ai US Mall Index: YoY % Change in Visits to Malls

[caption id="attachment_123923" align="aligncenter" width="720"]

Source: Placer.ai[/caption]

The Road Ahead for Malls

The US mall index—showing the year-over-year change in the number of visits to malls, calculated by Placer.ai—reveals a decline of 60.1% in March 2020, which can be attributed to the strict lockdowns imposed nationwide. Chernofsky said that last year, foot traffic experienced the greatest decline in April (down 96.0% year over year). Although traffic has shown slight improvement since, it was still down 30.6% in January 2021 (see Figure 2).

Figure 2. Placer.ai US Mall Index: YoY % Change in Visits to Malls

[caption id="attachment_123923" align="aligncenter" width="720"] Source: Placer.ai[/caption]

Coresight Research and Placer.ai expressed optimism around the future of malls, highlighting two key factors that will play an important role in determining their success:

Source: Placer.ai[/caption]

Coresight Research and Placer.ai expressed optimism around the future of malls, highlighting two key factors that will play an important role in determining their success:

- Willingness to rethink space—In order to be successful, mall operators must be open to rethinking and revisiting their strategy; not all mall space needs to be retail oriented. For example, Brookfield Properties, in partnership with residential developer AvalonBay Communities, is transforming a wide portion of the Alderwood Mall in Lynwood, Seattle, into Avalon Alderwood Place, a 300-unit apartment complex with underground parking, which the companies expect to open by 2022. Brookfield will not completely erase the shopping side of the development; it expects commercial businesses to take up 90,000 square feet of retail space.

- Recognizing the importance of making malls interesting—In order to attract customers, Chernofsky stated that malls must make themselves “fundamentally more interesting.” Mall operators should look to capitalize on the opportunity to capture direct-to-consumer brands that are expanding into brick-and-mortar retail from having a purely online presence. Increasing the diversity of the tenant mix is one way to make malls more interesting for consumers, Chernosfky explained.