Nitheesh NH

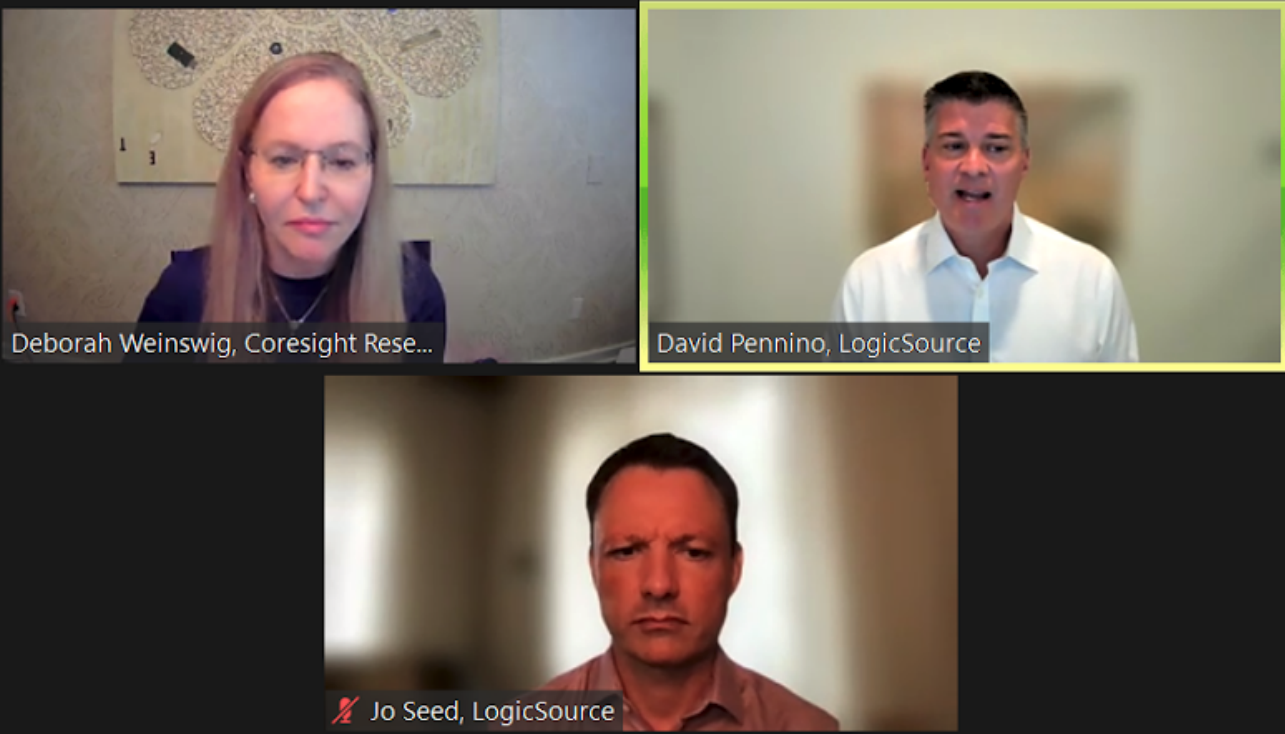

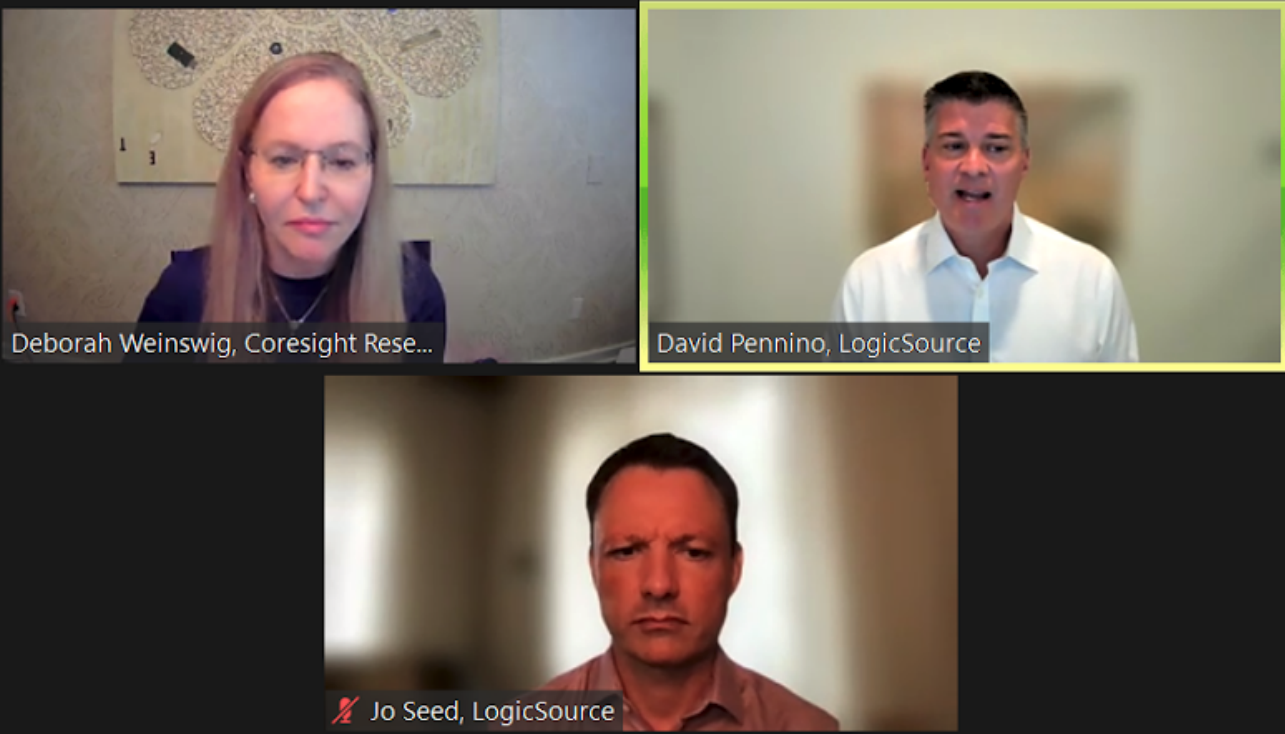

On June 30, 2021, Coresight Research hosted a panel discussion with LogicSource, a procurement services and technology provider focused exclusively on indirect expenditures, also known as goods not for resale (GNFR).

Deborah Weinswig, Founder and CEO of Coresight Research, was joined by David Pennino, Founder and CEO of LogicSource, and Jo Seed, COO of LogicSource, to discuss the best approach to GNFR-savings initiatives.

In this report, we present three key insights from the online event.

Source: Coresight Research[/caption]

2. Utilizing Data Analytics and Efficient Management To Capture Savings

Insufficient investment in data analytics and poor internal management are the key causes of excessive GNFR expenses. Effective data analytics are vital when creating an effective procurement strategy to manage volumes and avoid unnecessary expenditure.

A survey undertaken by LogicSource found that 57.2% of respondents reported that their data analytics has grown in importance over the last five years. Establishing an internal procurement path that includes all product categories can be valuable, but businesses often feel they cannot justify the expense. Yet a well-funded procurement team remains essential—enabling businesses to focus on the procurement path of top product categories, or hire third-party services to gather data and propose cost-saving measures.

One of the primary reasons for lost savings is a lack of management focus on enforcing top-down efficiency initiatives, as well as a lack of coordination between departments—corporate services and facilities often being the most undermanaged. Pennino observed that the best teams have robust and transparent top-down drivers that promote efficiency within various departments.

Seed emphasized the need for coordination between a company’s procurement team, FP&A (financial planning and analysis) team and business owner, especially on budgets. He explained a typical mistake of allocating control over budget and client relations to different departments within a business, which results in blurred management. This can prevent a multidivisional corporation from fully utilizing its leverage when negotiating with suppliers. In the worst cases, suppliers are able to play off demand from different departments of the same company, giving different indirect rates across product units.

[caption id="attachment_129877" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. Utilizing Data Analytics and Efficient Management To Capture Savings

Insufficient investment in data analytics and poor internal management are the key causes of excessive GNFR expenses. Effective data analytics are vital when creating an effective procurement strategy to manage volumes and avoid unnecessary expenditure.

A survey undertaken by LogicSource found that 57.2% of respondents reported that their data analytics has grown in importance over the last five years. Establishing an internal procurement path that includes all product categories can be valuable, but businesses often feel they cannot justify the expense. Yet a well-funded procurement team remains essential—enabling businesses to focus on the procurement path of top product categories, or hire third-party services to gather data and propose cost-saving measures.

One of the primary reasons for lost savings is a lack of management focus on enforcing top-down efficiency initiatives, as well as a lack of coordination between departments—corporate services and facilities often being the most undermanaged. Pennino observed that the best teams have robust and transparent top-down drivers that promote efficiency within various departments.

Seed emphasized the need for coordination between a company’s procurement team, FP&A (financial planning and analysis) team and business owner, especially on budgets. He explained a typical mistake of allocating control over budget and client relations to different departments within a business, which results in blurred management. This can prevent a multidivisional corporation from fully utilizing its leverage when negotiating with suppliers. In the worst cases, suppliers are able to play off demand from different departments of the same company, giving different indirect rates across product units.

[caption id="attachment_129877" align="aligncenter" width="700"] Source: Coresight Research[/caption]

3. Additional External Enrichment

After resolving internal management affairs, retailers may benefit from gaining access to external data. Employing an expert or outsourcing GNFR management to a third party to oversee on a daily basis can better equip businesses to contend with the volatile GNFR market. Moreover, adding external insights into the business’s analytics can further enrich its data and allow it to optimize its savings.

Source: Coresight Research[/caption]

3. Additional External Enrichment

After resolving internal management affairs, retailers may benefit from gaining access to external data. Employing an expert or outsourcing GNFR management to a third party to oversee on a daily basis can better equip businesses to contend with the volatile GNFR market. Moreover, adding external insights into the business’s analytics can further enrich its data and allow it to optimize its savings.

Unlocking True Profit Potential Across Not-For-Resale Expenses: Three Key insights

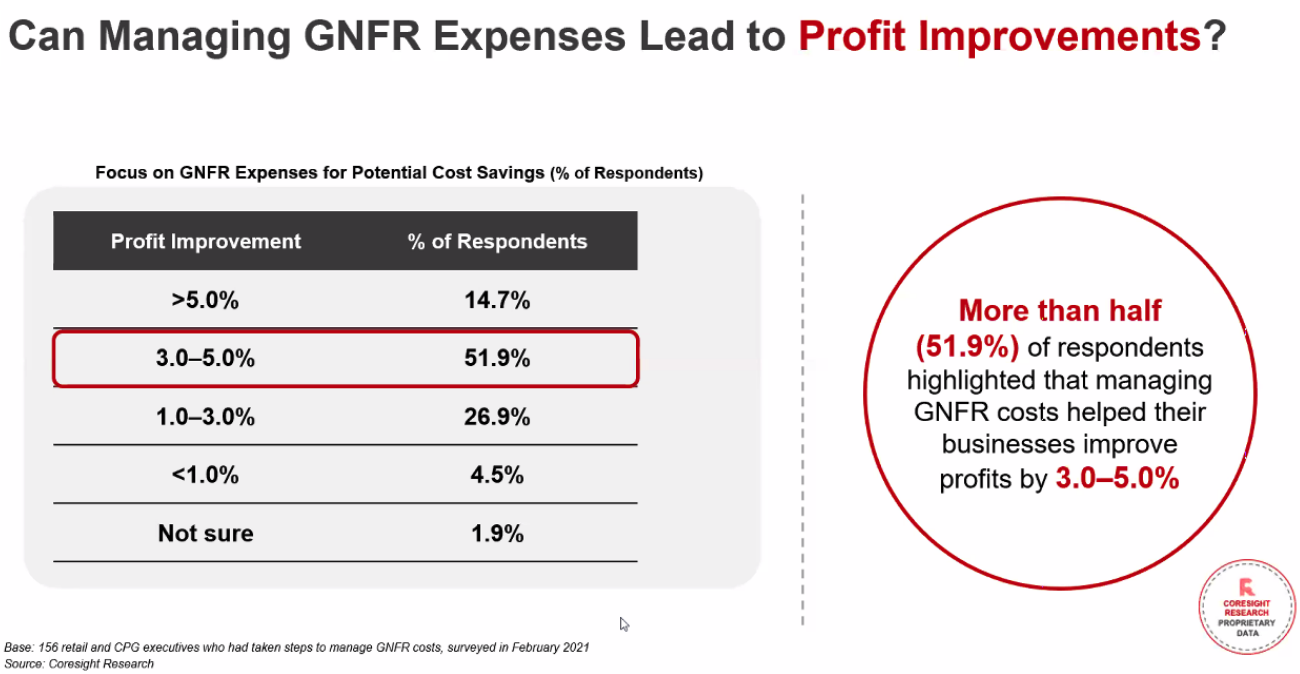

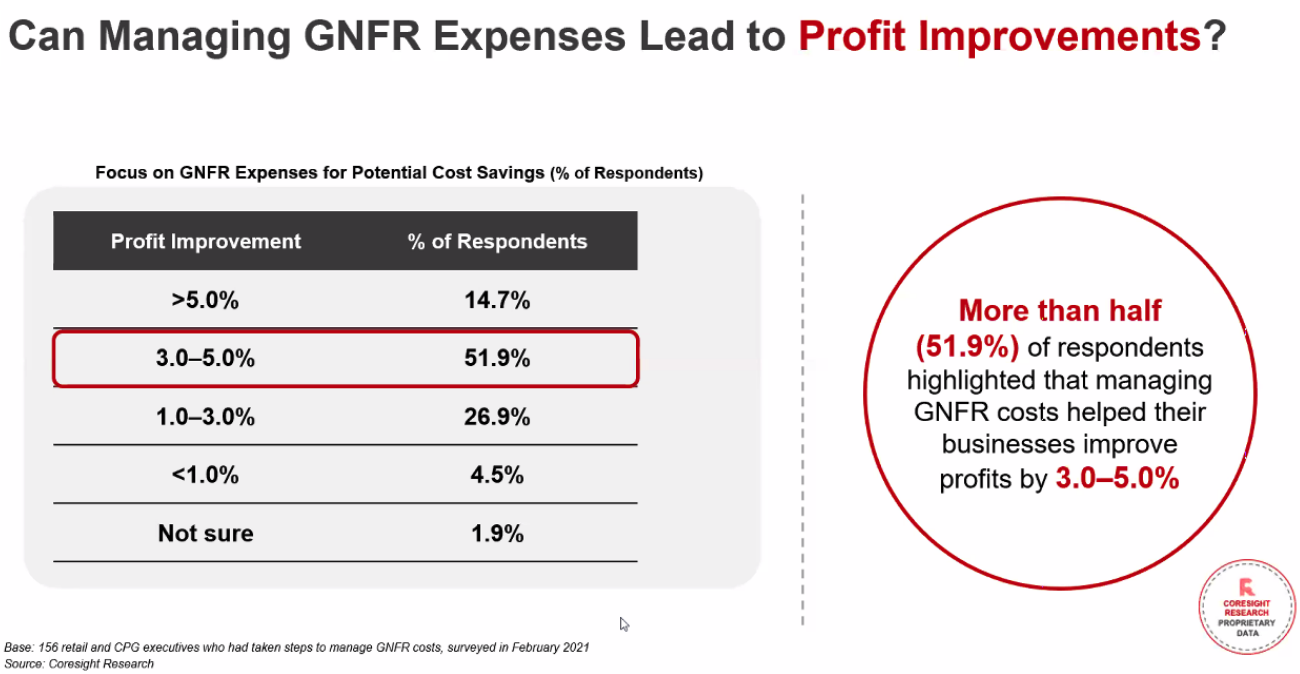

1. Defining and Exploring the Cost-Saving Potential of GNFR Weinswig opened the discussion by defining GNFR as goods that do not “factor into direct costs of manufacturing a product, or purchasing a finished good for resale,” and are often “considered [an] indirect cost.” GNFR expenses are part of every product category, yet these costs are often ignored or misunderstood by business leaders. Failing to properly address GNFR concerns is a missed opportunity for retailers: 51.9% of respondents to a Coresight Research survey reported that managing their GNFR costs had helped their businesses improve their profits by 3%–5%. Although some retailers have attempted to address this issue—often using hired consultants—67% of CFOs find that the savings never matriculate to P&L, according to Pennino. [caption id="attachment_129876" align="aligncenter" width="700"] Source: Coresight Research[/caption]

2. Utilizing Data Analytics and Efficient Management To Capture Savings

Insufficient investment in data analytics and poor internal management are the key causes of excessive GNFR expenses. Effective data analytics are vital when creating an effective procurement strategy to manage volumes and avoid unnecessary expenditure.

A survey undertaken by LogicSource found that 57.2% of respondents reported that their data analytics has grown in importance over the last five years. Establishing an internal procurement path that includes all product categories can be valuable, but businesses often feel they cannot justify the expense. Yet a well-funded procurement team remains essential—enabling businesses to focus on the procurement path of top product categories, or hire third-party services to gather data and propose cost-saving measures.

One of the primary reasons for lost savings is a lack of management focus on enforcing top-down efficiency initiatives, as well as a lack of coordination between departments—corporate services and facilities often being the most undermanaged. Pennino observed that the best teams have robust and transparent top-down drivers that promote efficiency within various departments.

Seed emphasized the need for coordination between a company’s procurement team, FP&A (financial planning and analysis) team and business owner, especially on budgets. He explained a typical mistake of allocating control over budget and client relations to different departments within a business, which results in blurred management. This can prevent a multidivisional corporation from fully utilizing its leverage when negotiating with suppliers. In the worst cases, suppliers are able to play off demand from different departments of the same company, giving different indirect rates across product units.

[caption id="attachment_129877" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

2. Utilizing Data Analytics and Efficient Management To Capture Savings

Insufficient investment in data analytics and poor internal management are the key causes of excessive GNFR expenses. Effective data analytics are vital when creating an effective procurement strategy to manage volumes and avoid unnecessary expenditure.

A survey undertaken by LogicSource found that 57.2% of respondents reported that their data analytics has grown in importance over the last five years. Establishing an internal procurement path that includes all product categories can be valuable, but businesses often feel they cannot justify the expense. Yet a well-funded procurement team remains essential—enabling businesses to focus on the procurement path of top product categories, or hire third-party services to gather data and propose cost-saving measures.

One of the primary reasons for lost savings is a lack of management focus on enforcing top-down efficiency initiatives, as well as a lack of coordination between departments—corporate services and facilities often being the most undermanaged. Pennino observed that the best teams have robust and transparent top-down drivers that promote efficiency within various departments.

Seed emphasized the need for coordination between a company’s procurement team, FP&A (financial planning and analysis) team and business owner, especially on budgets. He explained a typical mistake of allocating control over budget and client relations to different departments within a business, which results in blurred management. This can prevent a multidivisional corporation from fully utilizing its leverage when negotiating with suppliers. In the worst cases, suppliers are able to play off demand from different departments of the same company, giving different indirect rates across product units.

[caption id="attachment_129877" align="aligncenter" width="700"] Source: Coresight Research[/caption]

3. Additional External Enrichment

After resolving internal management affairs, retailers may benefit from gaining access to external data. Employing an expert or outsourcing GNFR management to a third party to oversee on a daily basis can better equip businesses to contend with the volatile GNFR market. Moreover, adding external insights into the business’s analytics can further enrich its data and allow it to optimize its savings.

Source: Coresight Research[/caption]

3. Additional External Enrichment

After resolving internal management affairs, retailers may benefit from gaining access to external data. Employing an expert or outsourcing GNFR management to a third party to oversee on a daily basis can better equip businesses to contend with the volatile GNFR market. Moreover, adding external insights into the business’s analytics can further enrich its data and allow it to optimize its savings.

- Read our free report, How Retailers Can Unlock True Profit Potential, for more on strategies for uncovering potential savings in GNFR, as well as proprietary survey findings.