DIpil Das

What’s the Story?

Retailers are still reeling from a pandemic-defined 2020, when new demands and behaviors arose against the backdrop of a constrained global supply chain and a wary workforce and consumer. With Covid-related health fears abating due to the rollout of vaccines, 2021 calls for even more agility as consumer behavior, demand, needs and expectations evolve further. So, what does the post-ish Covid-19 consumer look like right now? Coresight Research and January Digital, a strategic consulting and media firm, surveyed US consumers on May 3, 2021 about what they want to see from brands, what they are buying and how they will make purchase decisions through the back half of the year. We present key insights from our findings and other Coresight Research data that underscore the need for agility in retail.Why It Matters

US consumers have built up $1.5 trillion in excess savings during the pandemic, according to Bloomberg Economics; understanding how they will spend and which new behaviors will stick or revert in the remainder of the year as the pandemic wanes is of paramount importance to retailers still adapting to the drastic landscape shifts brought on by the global health crisis.A Year of Agility—The Post-ish Covid-19 Consumer Now and Through 2021: In Detail

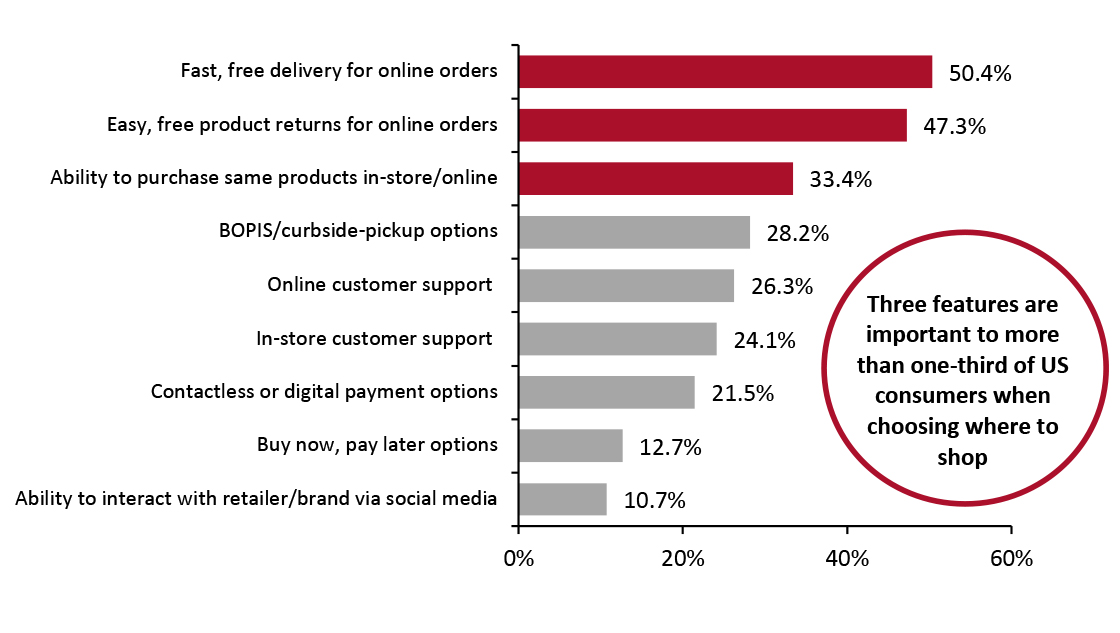

What Matters Most to the New Consumer: Three Areas Retailers Must Prioritize in 2021 To arm retailers with an actionable understanding of the areas that they should prioritize, we asked consumers in our May 3 survey about what matters most to them when determining where and how they shop. Around half of all respondents indicated that fast, free delivery and easy, free product returns for online orders were “very important” factors when choosing a retailer to shop with. The ability to view and purchase the same products in-store and online was the only other feature that was considered to be very important by more than one-third of consumers (see Figure 1). Each of these three consumer priorities requires retailers to offer convenience as a baseline service beyond the pandemic.Figure 1. Features That Are “Very Important” to US Consumers When Choosing a Retailer or Brand To Shop With (% of Respondents) [caption id="attachment_127681" align="aligncenter" width="725"]

Base: 419 US respondents aged 18+, surveyed on May 3, 2021

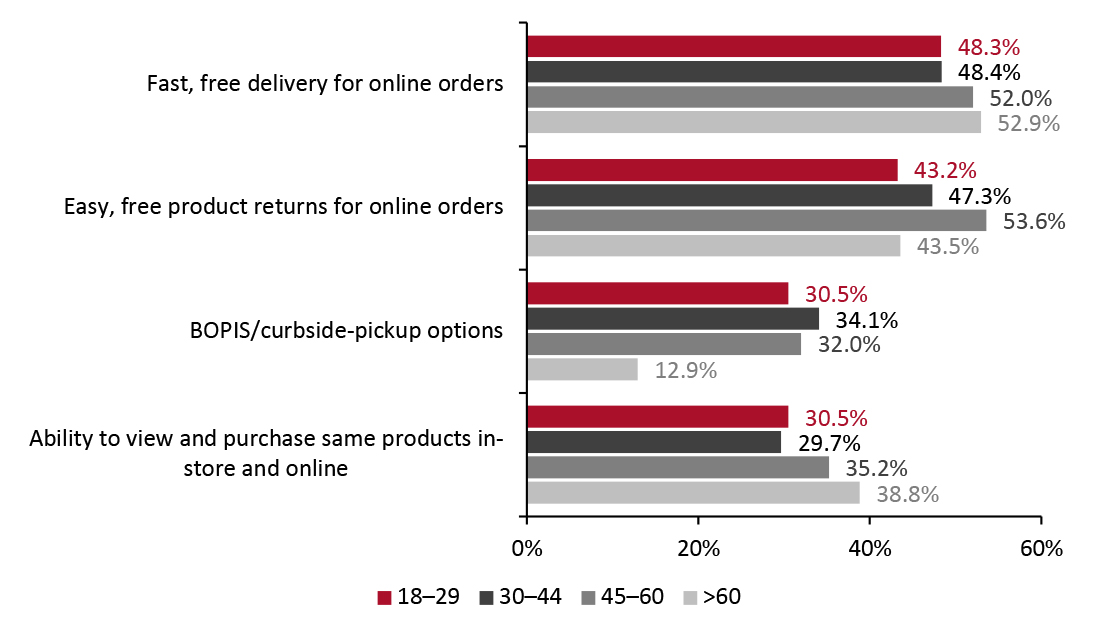

Base: 419 US respondents aged 18+, surveyed on May 3, 2021 Source: Coresight Research/January Digital [/caption] Below, we dive deeper into consumers’ three highest priorities, and discuss the importance of these features in meeting and exceeding these consumer expectations. 1. Fast, Free Delivery Consumers have switched to spending online, particularly in categories where rapid fulfillment is a requirement. The rise of online grocery is the best example of this shift. From IRI data, Coresight Research estimates that US online food sales grew 82% in 2020, making it a $55.5 billion dollar industry and heightening the need for fast, flexible fulfillment by grocers and mass merchandisers. To meet the needs of fulfillment-focused consumers, retailers must invest in agile and resilient supply chains, paying specific attention to last-mile logistics—the costs of which typically represent 41% of all supply chain costs for retailers, according to a global survey of supply chain executives conducted by the Capgemini Research Institute in late 2018.With another year of fulfillment network constraints probable amid surges in online demand, these will become increasingly relevant as the holiday shopping season approaches. Optimizing fulfillment to keep pace with consumer expectations will be critical for retailers in what is expected to be an online dominated holiday season. BOPIS (buy online, pick up in-store) and curbside-pickup options, which came in right behind the top three consumer priorities in our survey, enable retailers to facilitate online orders while simultaneously solving for the burgeoning demand for convenience. While we do expect some retrenchment of BOPIS services as the pandemic fades, consumers will continue to desire the ease and convenience that this fulfillment option offers. Interestingly, our survey found that among consumers under the age of 45, a higher proportion ranked BOPIS and curbside-pickup options as “very important” than the proportion that ranked the ability to view and purchase the same products in-store and online as “very important.” This highlights the continued relevance of these fulfillment services even as consumers increasingly return to in-store shopping. BOPIS is most in demand from 30-44-year-olds, but US consumers over the age of 60 display less interest in such services; BOPIS/curbside pickup has the broadest generational gap among the select features we asked about (see Figure 2). By continuing to invest in BOPIS and curbside-pickup options, retailers can simultaneously attract young shoppers, reduce fulfillment costs and create opportunity for add-on in-store purchases when shoppers pick up their orders.

Figure 2. Select Features That Are “Very Important” to US Consumers When Choosing a Retailer or Brand To Shop With, by Age (% of Respondents) [caption id="attachment_127682" align="aligncenter" width="725"]

Base: 419 US respondents aged 18+, surveyed on May 3, 2021

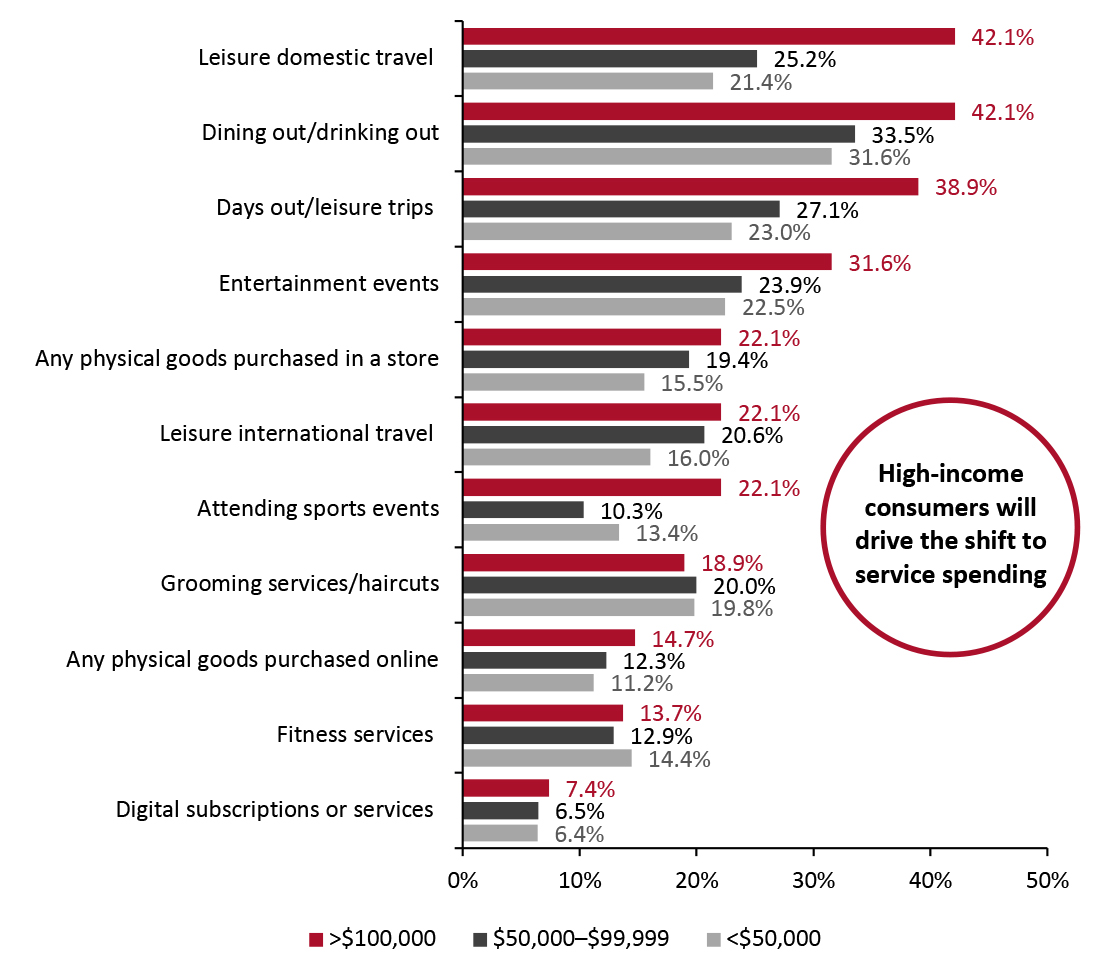

Base: 419 US respondents aged 18+, surveyed on May 3, 2021 Source: Coresight Research/January Digital [/caption] 2. Easy, Free Returns It is no surprise to retailers that a rise in online shopping comes with a marked rise in returns. Returns are far more prevalent among online orders, making them an especially important area of focus for both retailers and consumers in the post-ish Covid-19 world. According to the NRF (National Retail Federation), the US returns rate for online purchases was 18.1% in 2020—much higher than the overall retail industry rate of 10.6%. The NRF reported that US returns totaled $428 billion last year. Coresight Research survey findings from March 2021 revealed that 42.4% of US consumers had returned unwanted products in the prior 12 months (since the outbreak of Covid-19 in the US). Pressured by consumers to make returns free, easy and fast, retailers absorb most returns costs, making optimizing returns management of paramount importance. This is particularly true in the apparel sector: Our survey found that 46.5% of the consumers who returned products in the past year had returned clothing, more than 20 percentage points higher than the next most returned category, consumer electronics. As retailers are likely to see an uptick in sales this summer and another online-dominated holiday season, it will be vital for them to optimize returns management through an agile reverse-logistics network in addition to preventing returns in the first place—such as by providing sizing tools (for apparel), accurate site descriptions, marketing language and imagery, and customer support prior to the point of sale. 3. The Ability To Purchase from Retailers with One Brand Experience and a Single, Accurate Cross-Channel View of Product Availability Consumers have become increasingly channel agnostic in recent years, desiring a more seamless experience between online, mobile and in-store shopping. In the past year, stay-at-home orders and temporary store closures meant that online and mobile shopping were the only options at times, and now, post-ish pandemic, unified and connected browsing and shopping experiences across retail platforms have become a baseline expectation for shoppers. As shown in Figure 1, our May 3 survey found that 33.4% of US consumers find the ability to view and purchase the same products across online and offline channels “very important” when determining which brands and retailers to shop with, with another 17.4% saying that it is “somewhat important” to them. With global supply chains struggling under continued pandemic-related and geopolitical stress, providing consumers a transparent and unified view of in-stock products wherever they are is not only becoming increasingly vital but also increasingly difficult for retailers. Between the recent blockage of the Suez Canal, hack on the Colonial Pipeline, microchip shortages and lack of basic products at even the largest American retailers and foodservice providers, retailers that can react the fastest to supply chain disruptions have an opportunity to attract otherwise frustrated consumers. Investing in an agile supply chain and inventory management system has never been more essential in retailers’ improvements of omnichannel offerings in an uncertain global retail landscape. What To Expect from Consumers in the Remainder of 2021 Consumers prioritizing free and fast delivery, returns and omnichannel purchase experiences are also rapidly changing the amount they spend and the categories they shop, both outside of and within retail. Below, we discuss two key trends in consumer behavior that we expect to take off in the second half of 2021. A Return to Spending on Experiences, Services and Discretionary Products A shift to service/experiential spending is likely to occur over the summer, as consumers unleash pent-up savings on experiences they were not able to enjoy over most of 2020 and early 2021. This is in sharp contrast to the cadence of economic recovery from past recessions. Looking back on all eight recessions since 1960, consumers typically grow their service spending by an average of 7.9% on a year-over-year basis each month within one year following the recession, compared to just 5.0% for goods, according to Coresight Research analysis of data from the US Bureau of Economic Analysis (BEA). Coresight Research survey findings from April 2021, on consumers’ plans for spending once they have been vaccinated, suggest that Covid-19 recovery will see an exaggerated return to service and experience spending, as consumers report being most likely to increase their spending on dining out, days out and domestic leisure travel (see figure below).

Figure 3. Categories in Which US Consumers Plan To Increase Spending Once Vaccinated, Compared to During the Pandemic, by Income Level (% of Respondents) [caption id="attachment_127683" align="aligncenter" width="725"]

Base: 475 US respondents aged 18+, surveyed on April 5, 2021

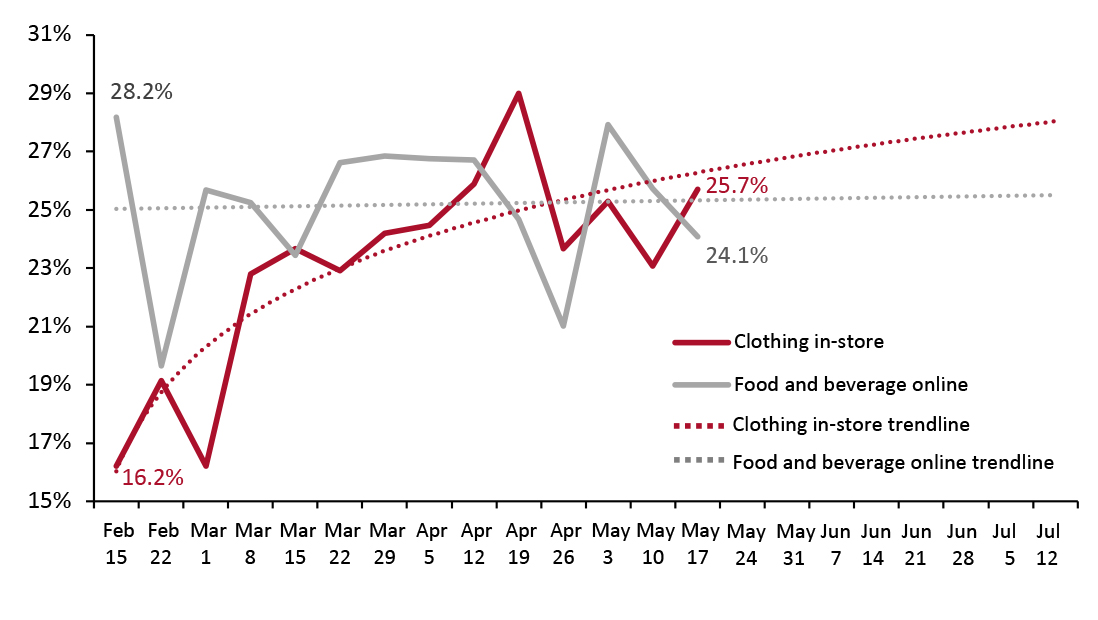

Base: 475 US respondents aged 18+, surveyed on April 5, 2021 Source: Coresight Research [/caption] Shifts toward experience spending, especially while traveling, will boost the fortunes of travel, luxury, vacation apparel and souvenir retailers. The median US consumer spends 22% of their luxury budget while traveling domestically, according to a Coresight Research survey from June 2020, indicating a likely major uptick in spending as consumers get back to vacationing. As of April 15, 2021, US air travel was already back to about 60% of pre-pandemic levels. Even if travel recovers no further this year, that would translate to growth of nearly $10 billion in airport retail sales in 2021 versus 2020. More likely is that travel will rebound significantly over the summer, leading to an even bigger rebound in travel retail. In tandem with a shift toward services, consumers historically tilt spending toward durable goods in the aftermath of recessions, which see an average of 5.8% year-over-year spending growth in the 12 months following a recession compared to just 4.7% growth in nondurable goods spending, according to analysis of BEA data. Nondurable goods are made up in large part by essential staples such as grocery, where demand is relatively constant, and so this category generally sees a muted rebound following economic downturns. On the other hand, durable goods—ranging from jewelry to electronics to sports equipment, which tend to be more expensive and less essential to fill short-term needs—see strong growth. However, this recovery is poised to show slightly different spending patterns. We anticipate nondurables as a whole seeing slow growth, but the clothing and footwear category is already seeing a rebound in sales. The most recent earnings calls by major retailers highlighted strong momentum in fashion: Walmart called out strong apparel performance; Target cited greater than 60% growth in apparel sales; and Macy’s cited 8% growth in apparel sales from its fourth quarter of fiscal 2020, while reporting surprise profits. Findings from the Coresight Research US Consumer Tracker (our weekly surveys) also support a trend of recovery in apparel. The proportion of consumers purchasing clothing products in stores has risen by more than seven percentage points over the past three months (see Figure 4). Notably, this shift back toward a decidedly pre-pandemic mode of spending has come even as online grocery shopping—the poster child for pandemic spending shifts—looks set to remain as relevant as it was during the pandemic as the category undergoes a secular shift to online. The cash reserves and savings that consumers accumulated over the pandemic is so great that they are likely to spend both online and in-store through the remainder of 2021—particularly during the holiday season—rather than limiting their shopping through just one channel.

Figure 4. Proportion of US Consumers That Purchased Select Products in the Past Two Weeks (% of Respondents) [caption id="attachment_127684" align="aligncenter" width="725"]

Base: US respondents aged 18+

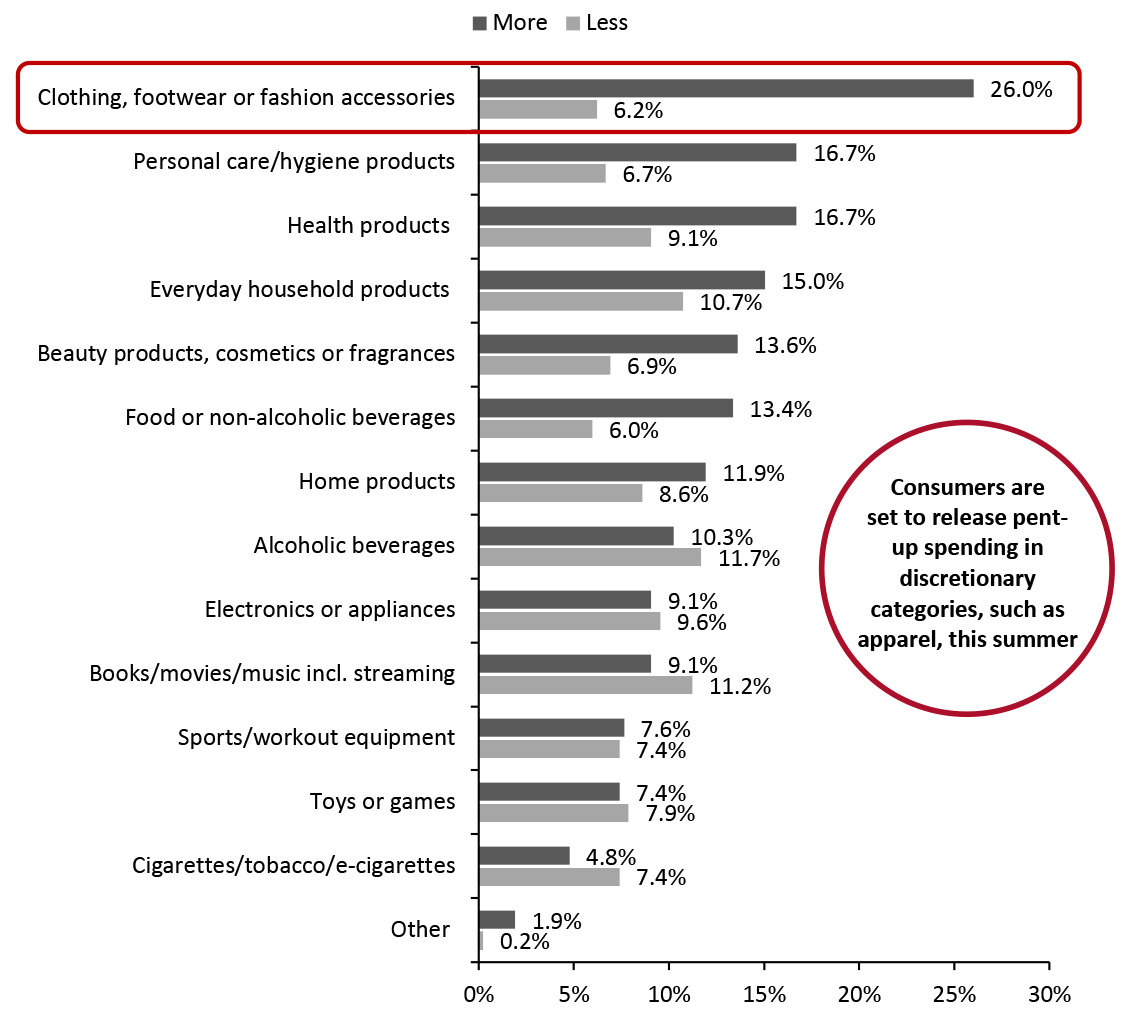

Base: US respondents aged 18+ Source: Coresight Research [/caption] Consumers are also set to increase their spending in most discretionary categories in the post-ish Covid-19 environment, according to the Coresight Research and January Digital survey findings. Most notably, more than one-quarter of US consumers plan to spend more on clothing, footwear or fashion accessories in the summer than they did during the pandemic (i.e., in 2020), as shown in Figure 5. We are entering a period of pent-up induced spending on new fashion following more than a year of work-at-home casual attire. In addition to office-appropriate apparel, consumers will seek fresh new fashions to wear socially. Year-over-year gains for apparel retailers are likely to be in the double digits through 2021 based on these trends.

Figure 5. Product Categories That US Consumers Plan To Spend More On This Summer Than They Did During the Pandemic (% of Respondents) [caption id="attachment_127685" align="aligncenter" width="725"]

Base: 419 US respondents aged 18+, surveyed on May 3, 2021

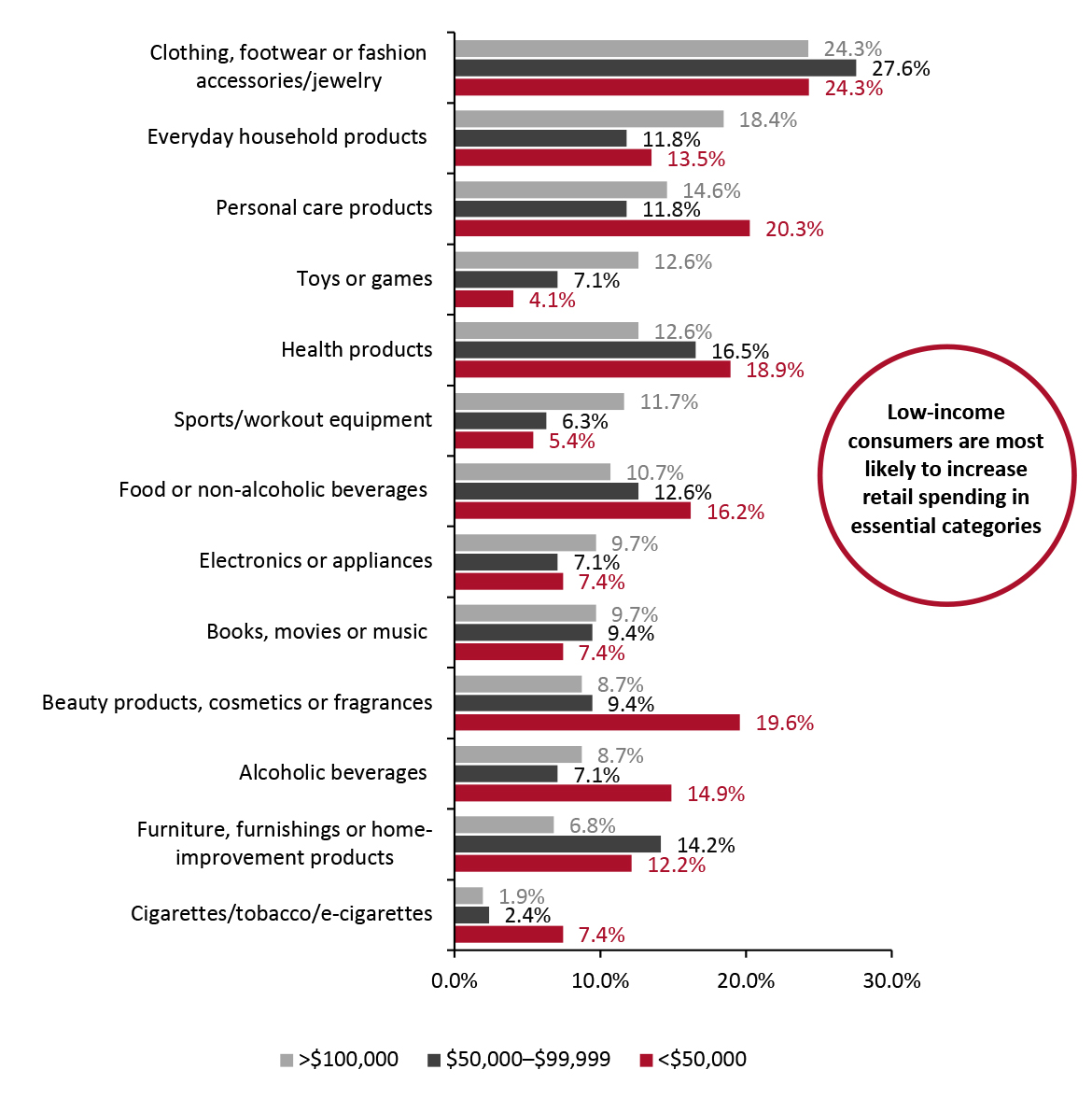

Base: 419 US respondents aged 18+, surveyed on May 3, 2021 Source: Coresight Research/January Digital [/caption] A Bifurcated Recovery in Consumer Spending by Income Although increases in service/experiential spending will likely be driven by high-income consumers, this trend will be less pronounced or even reversed when it comes to goods spending. Our May 3 survey found that, compared to high-income consumers, a much larger proportion of low-income consumers plan to spend more on any retail products this summer than they did amid the pandemic (a gap of more than 18 percentage points). The gap is most pronounced in personal care and beauty products, as illustrated in the figure below; we expect these categories to see a sharp increase in spending by consumers who had difficulty affording these products for much of the pandemic period in 2020.

Figure 6. Product Categories That US Consumers Plan To Spend More On This Summer Than They Did During the Pandemic (% of Respondents) [caption id="attachment_127686" align="aligncenter" width="725"]

Base: 419 US respondents aged 18+, surveyed on May 3, 2021

Base: 419 US respondents aged 18+, surveyed on May 3, 2021 Source: Coresight Research/January Digital [/caption] High-income consumers have been spending freely on retail goods; they largely remained employed during the pandemic, saw their wealth grow in strong housing and stock markets and had relatively few other options for spending. Shopping was entertainment! Looking ahead to the rest of 2021, high-income consumers are most likely to boost their spending on goods that they could afford, but did not need, during the pandemic—notably apparel for out-of-home activities. These consumers should keep their spending strong in retail even as other spending avenues open up—a result of the sheer amount of spending power they have built up over the past year. Our survey results also suggest that wealthier consumers are more likely to spend more on household products than other income groups, which is a more surprising trend considering wealthy consumers in particular spent record amounts of time at home during the pandemic. It was a different story for low-income consumers, who disproportionately lost their jobs and so were more adversely affected by the pandemic but were kept afloat by government stimulus checks and expanded unemployment benefits. While the economy recovers, low-income consumers are likely to increase spending proportionately more than their high-income counterparts as they begin more comprehensive spending supported by income stability. A Strategic Look at Agility: Upcoming Research In light of rapidly changing consumer behavior, agility will remain a key competitive advantage for retailers and brands. In September, January Digital and Coresight Research will publish our tactical directions for retailers across three strategic areas as they head into their holiday pushes and prepare for 2022:

- Flexibility in revenue streams and marketing mix

- Adaptability of the customer experience—across physical stores, the digital channel and social platforms

- Operational agility—through integrated organization across channels and consumer-centric business processes