DIpil Das

On May 12, 2021, Coresight Research hosted an online event in conjunction with HIVERY, provider of an artificial intelligence (AI) and data science (DS)-powered solution that harnesses store-level data for category management optimization, enabling precision in category management and localized assortment.

Deborah Weinswig, CEO and Founder of Coresight Research, was joined by Steve Weir, Vice President of Client Services at HIVERY, and Zach Simpson, Director of Customer Success at HIVERY, to discuss the significant incremental value that technology-driven assortment optimization provides retailers and CPG (consumer packaged goods) companies.

In this report, we present key three insights from the event.

Deborah Weinswig, Steve Weir and Zach Simpson discuss optimizing assortment at the store level using advanced technologies

Deborah Weinswig, Steve Weir and Zach Simpson discuss optimizing assortment at the store level using advanced technologies

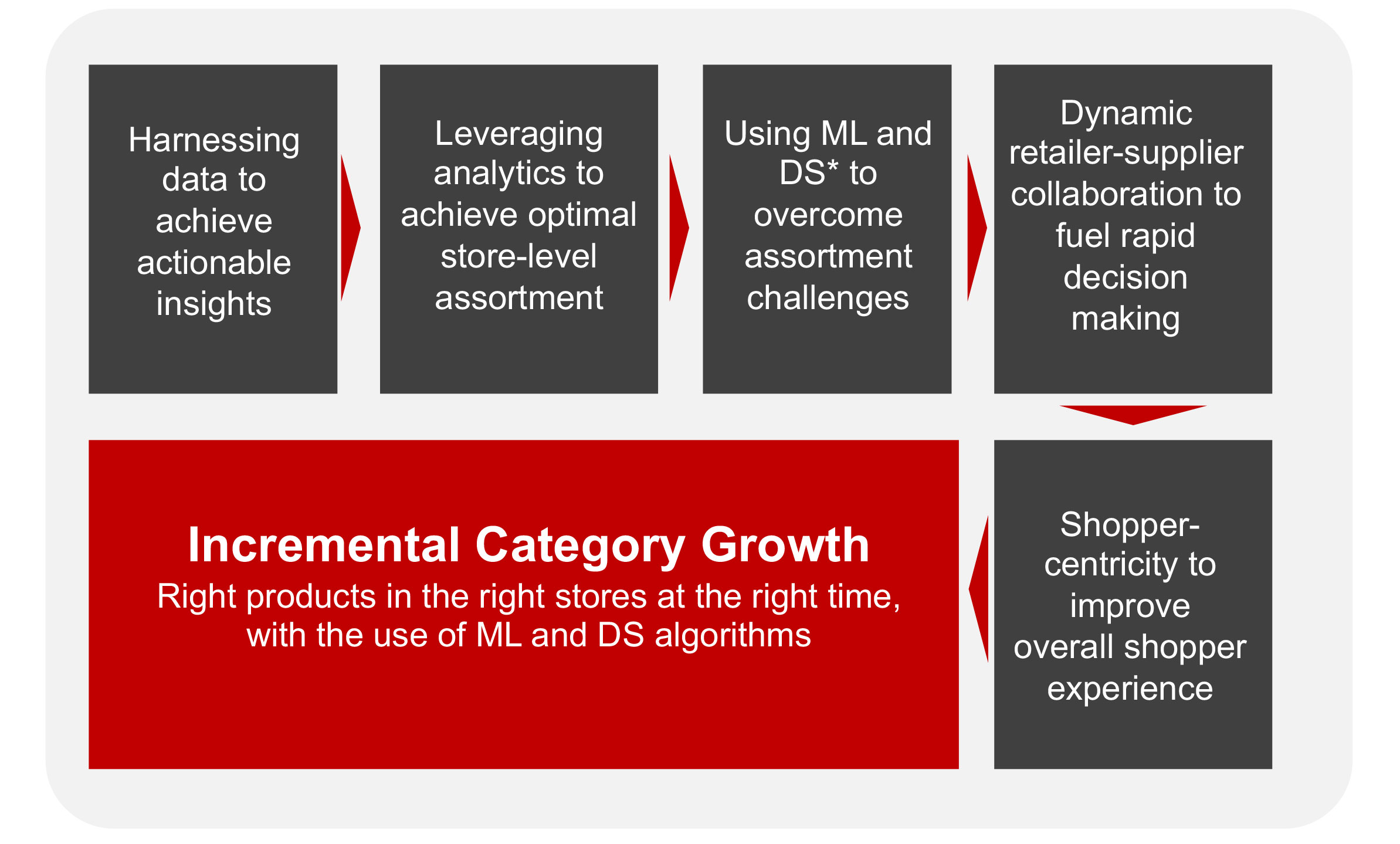

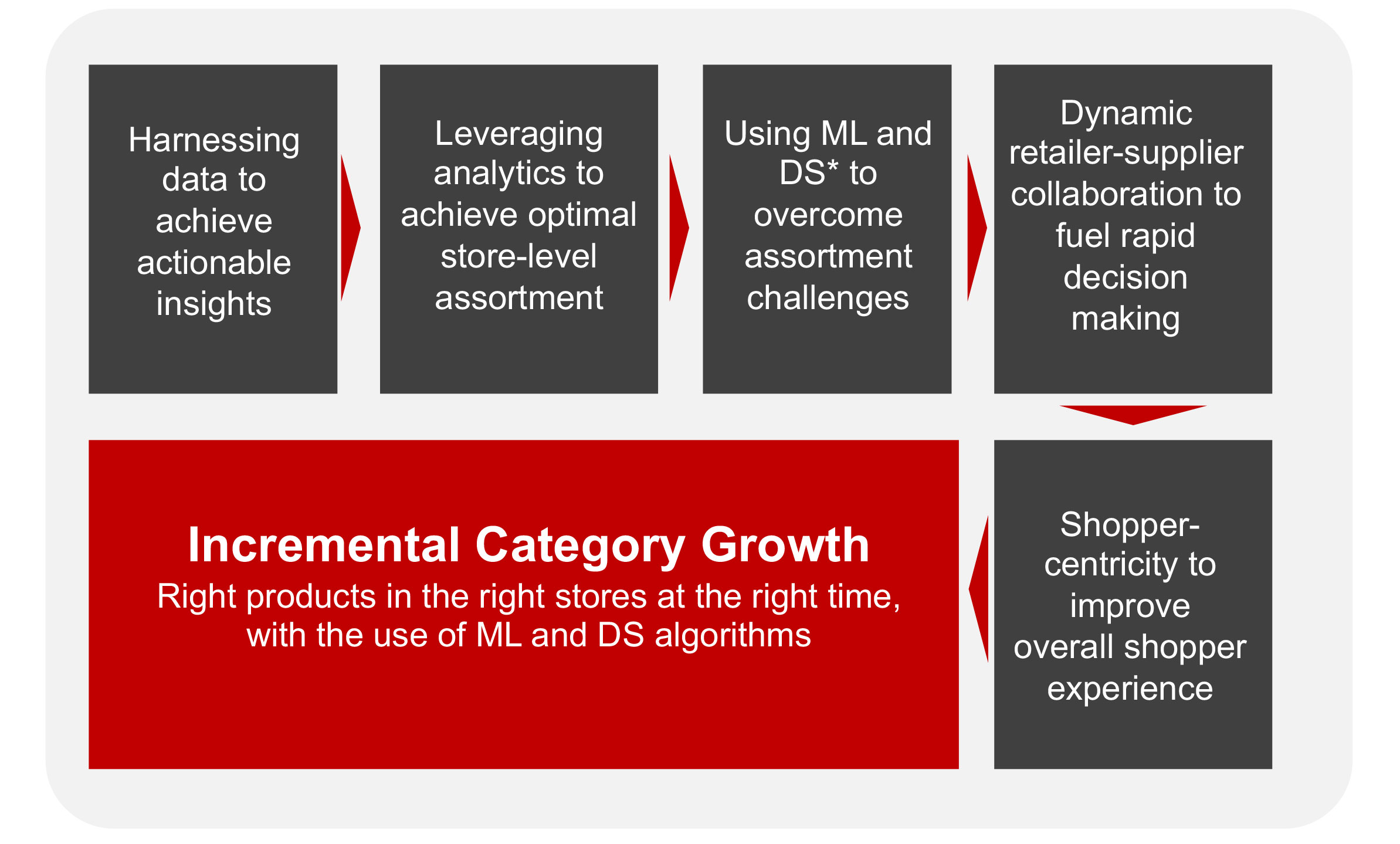

Source: Coresight Research [/caption] 1. Technology as a Primary Growth Driver Simpson and Weir discussed how technology, especially AI and machine learning (ML), has supported CPG companies in adapting to recent pandemic-led changes in the retail landscape. Using technology, brands and retailers are able to access and aggregate data pulled from different sources—such as store labor, marketing components, individual store performance metrics, etc.—and thus identify patterns, derive actionable insights and make informed decisions quickly. Using AI- and ML-driven data collation and analytics tools enables category managers to effectively curate online and offline assortments and implement differing strategies for each channel—through just one platform. Furthermore, the retail industry is moving from descriptive analytics for category management to predictive and prescriptive analytics. For instance, ML can assess data around the performance of a particular item in a certain store and apply algorithms to predict the way the item will perform in another store. This can cross channels too: Online data can help determine assortments for local stores, and local stores can inform digital assortments. Weinswig summarized that harnessing data, leveraging analytics and using ML algorithms are key drivers of incremental category growth (see image below). [caption id="attachment_128709" align="aligncenter" width="725"] *ML stands for machine learning; DS stands for data science

*ML stands for machine learning; DS stands for data science

Source: Coresight Research [/caption] 2. The Bottom-Up Approach: A Better Option for Clustering According to HIVERY, bottom-up clustering enables category managers to present clustering in such a way that it can be easily understood by any stakeholder—and therefore can be more easily executed. The speakers agreed that the bottom-up approach is most effective in exploring real-time data, specific to individual stores. When retailers and CPG companies are store-specific, they can create insights about local shoppers that inform sales growth strategies. In addition, Weir explained that store-specific, real-time data can reduce stockouts and enable retailers to track the shelf life and presentation of products on the shelf. [caption id="attachment_128704" align="aligncenter" width="725"] Source: Coresight Research [/caption]

3. Barriers to Store-Specific Optimization and Assortment

One of the first challenges for retailers and CPG companies in achieving store-specific optimization and assortment is in identifying the right data sources. Some data sources are not relevant to the category manager or for the assortment/optimization processes in a store, meaning that they would provide little to no insight for the technological platform (using AI or ML) to unearth. Category managers need to ensure that the data sources can feed the right data—that is clean and usable—to their technology platform to generate accurate and useful analysis.

Weir also noted another barrier: When retailers and CPG companies are not open-minded enough to the capabilities of using technology, they miss out on opportunities to further optimize assortment at the store level. Category managers need to continuously look for new ways to examine and proof planograms and other data to realize maximum benefits.

Source: Coresight Research [/caption]

3. Barriers to Store-Specific Optimization and Assortment

One of the first challenges for retailers and CPG companies in achieving store-specific optimization and assortment is in identifying the right data sources. Some data sources are not relevant to the category manager or for the assortment/optimization processes in a store, meaning that they would provide little to no insight for the technological platform (using AI or ML) to unearth. Category managers need to ensure that the data sources can feed the right data—that is clean and usable—to their technology platform to generate accurate and useful analysis.

Weir also noted another barrier: When retailers and CPG companies are not open-minded enough to the capabilities of using technology, they miss out on opportunities to further optimize assortment at the store level. Category managers need to continuously look for new ways to examine and proof planograms and other data to realize maximum benefits.

- Read more about the age of precision category management in our separate, free deep dive.

The Age of Precision Category Management: Key Insights

The age of precision category management is upon us. Effective assortment and space localization can be a very challenging task for CPG companies and retailers, but if done right with the right methods, it can generate significant incremental value. Whether they are using a cluster approach or not, the ability of retailers and CPG companies to leverage store-level data in new ways opens up new opportunities to have the right product assortment to meet shopper demand across any store. [caption id="attachment_128701" align="aligncenter" width="725"] Deborah Weinswig, Steve Weir and Zach Simpson discuss optimizing assortment at the store level using advanced technologies

Deborah Weinswig, Steve Weir and Zach Simpson discuss optimizing assortment at the store level using advanced technologies Source: Coresight Research [/caption] 1. Technology as a Primary Growth Driver Simpson and Weir discussed how technology, especially AI and machine learning (ML), has supported CPG companies in adapting to recent pandemic-led changes in the retail landscape. Using technology, brands and retailers are able to access and aggregate data pulled from different sources—such as store labor, marketing components, individual store performance metrics, etc.—and thus identify patterns, derive actionable insights and make informed decisions quickly. Using AI- and ML-driven data collation and analytics tools enables category managers to effectively curate online and offline assortments and implement differing strategies for each channel—through just one platform. Furthermore, the retail industry is moving from descriptive analytics for category management to predictive and prescriptive analytics. For instance, ML can assess data around the performance of a particular item in a certain store and apply algorithms to predict the way the item will perform in another store. This can cross channels too: Online data can help determine assortments for local stores, and local stores can inform digital assortments. Weinswig summarized that harnessing data, leveraging analytics and using ML algorithms are key drivers of incremental category growth (see image below). [caption id="attachment_128709" align="aligncenter" width="725"]

*ML stands for machine learning; DS stands for data science

*ML stands for machine learning; DS stands for data science Source: Coresight Research [/caption] 2. The Bottom-Up Approach: A Better Option for Clustering According to HIVERY, bottom-up clustering enables category managers to present clustering in such a way that it can be easily understood by any stakeholder—and therefore can be more easily executed. The speakers agreed that the bottom-up approach is most effective in exploring real-time data, specific to individual stores. When retailers and CPG companies are store-specific, they can create insights about local shoppers that inform sales growth strategies. In addition, Weir explained that store-specific, real-time data can reduce stockouts and enable retailers to track the shelf life and presentation of products on the shelf. [caption id="attachment_128704" align="aligncenter" width="725"]

Source: Coresight Research [/caption]

3. Barriers to Store-Specific Optimization and Assortment

One of the first challenges for retailers and CPG companies in achieving store-specific optimization and assortment is in identifying the right data sources. Some data sources are not relevant to the category manager or for the assortment/optimization processes in a store, meaning that they would provide little to no insight for the technological platform (using AI or ML) to unearth. Category managers need to ensure that the data sources can feed the right data—that is clean and usable—to their technology platform to generate accurate and useful analysis.

Weir also noted another barrier: When retailers and CPG companies are not open-minded enough to the capabilities of using technology, they miss out on opportunities to further optimize assortment at the store level. Category managers need to continuously look for new ways to examine and proof planograms and other data to realize maximum benefits.

Source: Coresight Research [/caption]

3. Barriers to Store-Specific Optimization and Assortment

One of the first challenges for retailers and CPG companies in achieving store-specific optimization and assortment is in identifying the right data sources. Some data sources are not relevant to the category manager or for the assortment/optimization processes in a store, meaning that they would provide little to no insight for the technological platform (using AI or ML) to unearth. Category managers need to ensure that the data sources can feed the right data—that is clean and usable—to their technology platform to generate accurate and useful analysis.

Weir also noted another barrier: When retailers and CPG companies are not open-minded enough to the capabilities of using technology, they miss out on opportunities to further optimize assortment at the store level. Category managers need to continuously look for new ways to examine and proof planograms and other data to realize maximum benefits.