albert Chan

What’s the Story?

Singles’ Day (termed 11.11 Global Shopping Festival by Alibaba) is the biggest retail shopping event of the year, providing opportunity for both Chinese and international beauty brands to bolster their sales by capitalizing on their brand reputation, supply chain ability, operation and marketing ability, and through collaboration with e-commerce platforms in China. Many brands and retailers can even obtain nearly half of their annual sales from the Singles’ Day month.

This report assesses beauty brands’ performances during Singles’ Day 2020 and highlights the key strategies that they adopted this year to solidify their position in the China market. Furthermore, we explore prominent or emerging trends in the Chinese beauty landscape.

Why It Matters

During Singles’ Day 2020, Chinese e-commerce giants Alibaba and JD.com generated around $115.1 billion in sales across their platforms. This year, JD.com held an 11-day Singles’ Day event (November 1–11), and Alibaba extended the 11.11 festival with two sales windows on its platforms to enable consumers to have more time to shop while relieving some of the logistics burdens. The first round of sales was held on November 1–3, following a pre-sale on October 21–31. The second round took place from midnight on November 11, with the pre-sale on November 4–10.

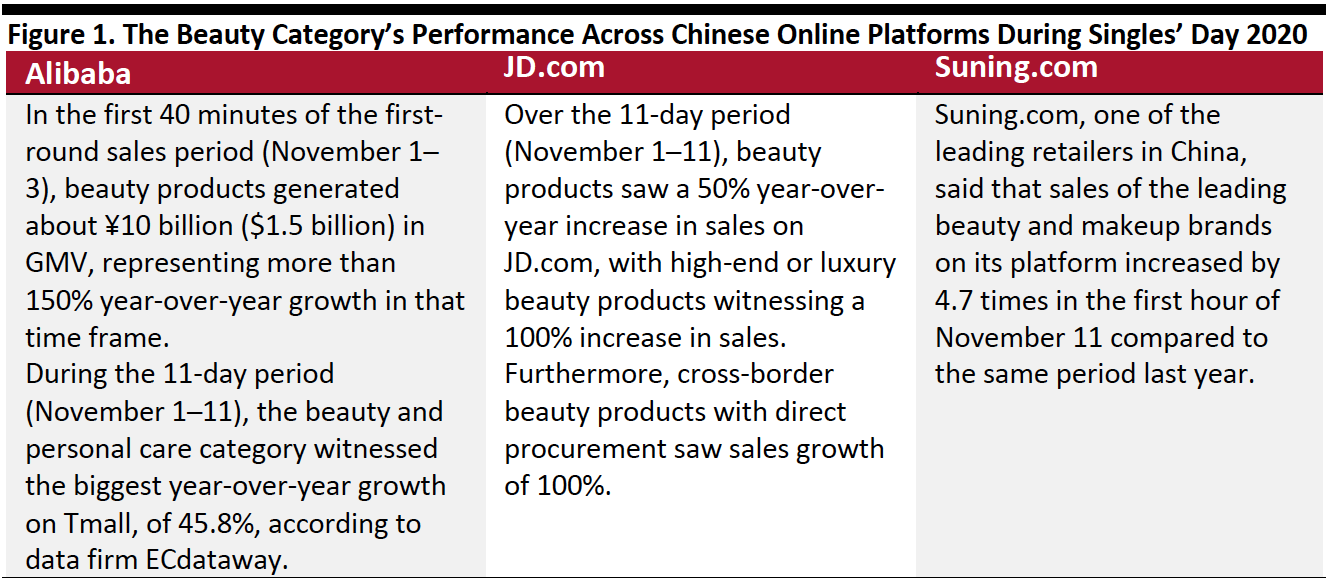

Beauty has always been a popular category on Singles’ Day, and this year, it continued to witness strong sales growth across various Chinese e-commerce platforms, including Alibaba’s Tmall and JD.com.

Sales Performance of the Beauty Category During Singles’ Day 2020

The 2020 Singles’ Day festival benefitted from the huge increase in the online shopping, which in turn saw an upsurge owing to the combination of store closures and international travel restrictions amid the Covid-19 crisis. Beauty category reported strong sales growth across Alibaba, JD.com and Suning.com platforms:

[caption id="attachment_120444" align="aligncenter" width="700"] Source: Company reports/ECdataway[/caption]

Source: Company reports/ECdataway[/caption]

Bestselling Beauty Brands

On this year’s Singles’ Day, we saw Estée Lauder become the bestselling beauty brand on Tmall for the first time, followed by L'Oréal Paris and Lancôme. Each of these three brands reported over ¥100 million ($15.1 million) in GMV within a couple of hours during the November 1–3 promotion window, exceeding their total sales from the 2019 event.

As part of its long-term strategy in China, Estée Lauder is shifting away from older consumers and targeting young millennials to penetrate China’s growing beauty market. The company is tapping into the high spending power of young Chinese shoppers with its specialized luxury line, MAC. Furthermore, to gain a strong competitive edge over rivals, Estée Lauder is strategically engaging with leading influencers, local celebrities and makeup artists on social media platforms such as Little Red Book, WeChat and Weibo.

This year, we saw three new beauty brands making into the top 10 bestselling beauty brands list on Alibaba’s Tmall platform during the shopping festival, of which two were luxury skincare brands— South Korea-based Sulwhasoo and Estée Lauder’s La Mer—highlighting the piggybacking of luxury international beauty brands on the success of Singles’ Day. The third new entrant to the list was Japanese beauty giant Shiseido.

[caption id="attachment_120445" align="aligncenter" width="700"] Source: Tmall[/caption]

Source: Tmall[/caption]

Creating innovative new products remains a key way for beauty brands to generate consumer excitement and boost sales on Singles’ Day. This year, we saw several beauty brands—including Lancôme, Olay and The History of Whoo—launch new products on Tmall.

Beauty Continues to Dominate the Cross-Border E-Commerce Channel

In recent years, some of the leading international beauty brands, such as Drunk Elephant, Charlotte Tilbury, Fenty Beauty and Huda Beauty, have entered the China market through Tmall Global, which allows foreign brands to ship items across borders directly to Chinese consumers without registering a local Chinese entity or undergoing lengthy product registration processes. Furthermore, Tmall Global supports small indie brands in logistics and promotions.

By directly selling through Tmall Global, beauty brands can avoid some of requirements designated for cosmetics products imported through general trade channels, such as animal testing. The small or mid-sized beauty brands can capitalize Tmall Global to get their products in front of Chinese consumers with significantly less investments and lesser legal requirements as compared to the traditional channel, followed by beauty giants, such as Estée Lauder and L'Oréal, to expand into the Chinese market on a large scale.

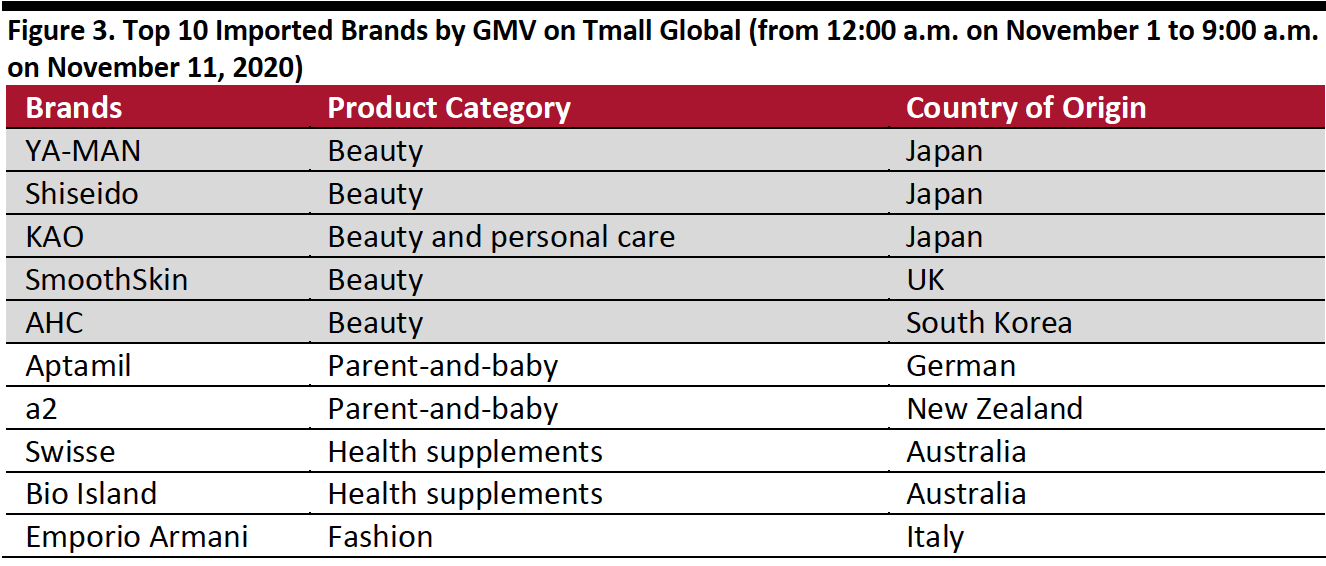

During Singles’ Day 2020, beauty was the most imported product category on Tmall Global: As of 9:00 a.m. on November 11, half of the top 10 imported brands by GMV were in the beauty category (see Figure 3). Below, we outline some of the beauty trends in the cross-border e-commerce channel, based on Tmall Global data:

- Home-use beauty devices saw huge success during Singles’ Day 2020 as consumers are spending more time at home. Japan-based home-use beauty-device manufacturer YA-MAN and UK-based hair removal device brand SmoothSkin both featured among the top 10 brands in the cross-border channel. (We discuss this trend in more detail in a later section of this report.)

- Skin care remains one of the fastest-growing beauty categories. This year’s 11.11 saw South Korea-based skincare brand AHC become one of the top 10 bestselling foreign beauty brands.

- Personal care continues to witness strong growth. KAO, which offers haircare, skincare and hygiene products, remains among the bestselling foreign brands.

Source: Tmall[/caption]

Source: Tmall[/caption]

DTC Beauty Brands Record Success

Direct-to-consumer (DTC) and emerging beauty brands, such as Perfect Diary and Florasis, continued to attract attention, contributing to the already intense and competitive Chinese beauty landscape and forcing longstanding brands and retailers to consider alternative business models.

Ahead of Singles’ Day 2020, Perfect Diary launched new beauty products and adopted a marketing strategy that incorporated endorsements from celebrities and key opinion leaders (KOLs). On October 27, Perfect Diary revealed its new brand ambassador: Australian singer-musician Troye Sivan, who has a sizable Chinese fanbase on Weibo. To improve social engagement, Perfect Diary launched a 45-second campaign video featuring Sivan wearing the brand’s signature animal eye palette. The video received more than 1.7 million views on Weibo within three days of its release.

Perfect Diary is looking to make investments into its physical retail expansion beyond China, as well as product and technology development and potential acquisitions. To achieve these aims, the brand will be supported by the $617 million raised by its parent company Yatsen Holding in a US initial public offering on November 19.

Florasis, launched in 2017, was one of the best-performing Chinese DTC brands on Singles’ Day 2020. So far in 2020, Florasis has performed better than Perfect Diary: In July, Floraris’ GMV on Alibaba platforms was $28 million, with 34% of its products having sold over 10,000 units in the month, versus Perfect Diary’s GMV of $22 million with only 13% of its products selling over 10,000 units in the same period, according to Pinguan APP. According to Florasis, its strength lies in its advertising, product design and supply chain planning. To bolster its advertising campaign, the brand collaborated with one of the China’s most influential male KOLs, Austin Li, in September 2019. Between January and July 2020, Li’s livestreaming sessions featured Florasis products up to 45 times.

These innovative DTC brands have disrupted the Chinese beauty landscape by focusing on some key areas of differentiation: purpose-driven innovation, customer engagement and acquisition, informed insights and unified commerce experiences. Furthermore, they have tapped into local culture and pushed benefits that resonate with local consumers. Traditional Chinese and international beauty players can learn from these disruptors’ innovative strategies mainstream beauty companies need to develop the agility to simultaneously adopt varied business models that promote different products and brands in different regions. Traditional companies should think about how they can move away from a centralized business model to give more decision-making power to their regional or local divisions.

Beauty Brands’ Strong Marketing Campaigns for Singles’ Day 2020

To facilitate a strong Singles' Day performance by increasing store visibility and e-commerce sales, beauty brands and retailers adopted a number of different promotional methods ahead of Singles’ Day this year—most notably, livestreaming, which we discuss below.

Beauty brands and retailers can learn from the success of Singles’ Day 2020 and implement similar marketing strategies during upcoming festivals and holidays, including Christmas, Chinese New Year and International Women’s Day. They can also begin building followers for Singles’ Day 2021, to ensure that they reach consumers effectively during the festival. Beyond specific shopping events, brands can apply learnings from this year’s Singles’ Day year-round to capture share of the fast-growing beauty market in China.

Livestreaming

Although beauty livestreaming had been around in China for years, it saw real emphasis during the recent coronavirus-led lockdown. In China, nearly two-thirds of consumers purchase products through livestreaming, according to AlixPartners’ survey of 2,029 adults conducted on September 30–October 6, 2020. Furthermore, the survey found that 81% of Chinese consumers expected to shop via livestreaming on Singles’ Day 2020. According to AlixPartners, the top reasons for consumers to shop via livestreaming are to access great discounts and instant information about products and to buy particular items.

Livestreaming is particularly powerful during Singles’ Day, with new product launches, prize draws and limited-time offers creating urgency. During Singles’ Day 2020, almost 300 million consumers watched livestream sessions on Taobao Live, and GMV from the platform amounted to twice that of last year’s event. Beauty was the second bestselling category on Taobao Live after electronics. In terms of total livestream sales on the Alibaba platform during Singles’ Day 2020, Estée Lauder ranked fourth, followed by Lancôme (fifth) and L’Oréal (ninth), as cited by WWD.

As China’s beauty consumers—Gen Z in particular—are heavily influenced by KOLs and micro-influencers, beauty brands are increasingly working with celebrities and social media influencers to promote their products. For example, Estée Lauder hosted 41 livestreaming sessions in October 2020 and invited celebrities to promote its products in some of the sessions: Actress Yang Mi hosted a livestreaming session for the brand on October 21, which achieved almost 3.6 million views.

With localization in focus for this year’s Singles’ Day, AliExpress offered the world’s first real-time livestreaming translation service, allowing viewers to read translated captions of livestreamers in real time. It supports translation of Chinese to English, French, Russian and Spanish; and English to Spanish, Russian and French.

Coresight Research estimates that Chinese livestreaming e-commerce will bring in about $125 billion in total sales in 2020, up from $63 billion last year. By comparison, we estimate the US livestreaming market to be just $5 billion.

[caption id="attachment_120447" align="aligncenter" width="500"] Estée Lauder’s livestreaming list (left) and KOL livestreaming session on Taobao (right)

Estée Lauder’s livestreaming list (left) and KOL livestreaming session on Taobao (right)Source: Taobao[/caption]

The Alibaba Business Operating System

Some beauty brands leveraged the Alibaba Business Operating System to refine and speed up digitalization ahead of Singles’ Day. For example, L’Oréal collaborated with Alibaba’s product-incubation Tmall Innovation Center (TMIC) to build a knowledge library of Chinese beauty industry trends and insights, spanning men’s and women’s cosmetics, skin care, fragrances and hair care. L‘Oréal has also integrated ModiFace, its augmented reality technology, with the Tmall app: ModiFace now supports over 50% of L‘Oréal’s makeup offering on Tmall. Furthermore, based on TMIC’s insights on lipstick-color trends, L‘Oréal’s Maybelline is developing a new lip product, which will be launched in early 2021.

Key Beauty Trends During Singles’ Day 2020

CBD and Clean Beauty

On this year’s Singles’ Day, many CBD and clean-beauty brands witnessed strong demand. The US-based CBD and Hemp brand Uncle Bud’s and clean hair-color brand Punky Colour made their debut in the China market through Singles’ Day 2020, having joined the event through Alibaba’s Go Global 11.11 Pitch Fest on September 15, 2020.

Uncle Bud’s launched its online store on November 6 through a livestream session with NBA legend and entrepreneur Earvin “Magic” Johnson, an Uncle Bud’s brand ambassador. The brand’s marketing strategy for the China market comprises accelerated activity on Chinese social media platforms Little Red Book, WeChat and Weibo—leveraging KOLs, key opinion consumers (KOCs) and Chinese celebrities.

[caption id="attachment_120448" align="aligncenter" width="700"] American basketball player Earvin “Magic” Johnson with a display of Uncle Bud’s products on Tmall Global during Singles’ Day 2020

American basketball player Earvin “Magic” Johnson with a display of Uncle Bud’s products on Tmall Global during Singles’ Day 2020Source: Alizila[/caption]

To stand out in China’s e-commerce space, Punky Colour is leveraging its R&D experience to appeal to local consumers, with a focus on plant-based products. Local Chinese brands are largely yet to adopt the organic, green or clean-beauty trend, so international clean-beauty products tend to prove popular due to their associated exclusivity.

Home-Use Beauty Devices

This year, home-use beauty devices saw strong demand as consumers are spending more time at home. As we highlighted earlier, YA-MAN saw huge success on Singles’ Day, becoming the bestselling foreign beauty brand, and SmoothSkin featured among the top 10 brands in the cross-border channel.

Japanese beauty giant Shiseido is eyeing huge opportunities in China’s beauty-device market. In August 2020, Shiseido entered into an agreement with YA-MAN to establish joint venture EFFECTIM, with Shiseido holding a 65% stake and YA-MAN a 35% stake. The joint venture will launch anti-aging and beauty devices in Japan and China in 2021. Shiseido’s management said that the beauty device market has been growing significantly in recent years and the company has seen a further push in demand this year owing to the coronavirus-led stay-at-home restrictions.

[caption id="attachment_120449" align="aligncenter" width="500"] YA-MAN’s HRF-10T-PLUS RF Photo QUEEN Beauty Equipment Multi-Effect Face & Eye Firming Red-Light Skin-Rejuvenation Instrument

YA-MAN’s HRF-10T-PLUS RF Photo QUEEN Beauty Equipment Multi-Effect Face & Eye Firming Red-Light Skin-Rejuvenation InstrumentSource: AliExpress[/caption]

Male Beauty

The male beauty category is one of China’s fastest-growing consumer product segments: According to Chinese data firm iiMedia, China’s male grooming market, which includes men’s shaving, skin care, body care, hair care and fragrance products, grew by 10.4% in 2019 and is on course to grow by 12.0% in 2020.

On this year’s Singles’ Day, the male beauty category witnessed strong demand, as male shoppers in their early 20s aggressively purchased skincare products and cosmetics for themselves, mostly through livestreaming, according to Alibaba Group Chairman and CEO Daniel Zhang.

During the shopping festival, the most-shopped male beauty products on Alibaba’s platforms were foundations, eyebrow pencils and lip balms.

What We Think

The exceptional performance of the beauty category during Singles’ Day 2020 is a sign of strong recovery and consumer confidence in the China market. We believe that Singles’ Day will have a wide impact for brands over the long term: Consumers will be more inclined to shop frequently with beauty brands they buy from on Singles’ Day, providing motivation for beauty companies to capitalize on this event.

Implications for Beauty Brands and Retailers

- Previously, it has been mostly Asian beauty brands, such as Shiseido, that cashed in on Singles’ Day. However, in recent years, more Western brands—such as Estée Lauder, Lancôme and L'Oréal Paris—have recognized the revenue potential behind this event and started including it in their fourth-quarter plans. This year, the focus on Singles’ Day was more intense than ever due to the impact of the pandemic on Western market.

To capture a share of China’s beauty market, Western brand owners should pay close attention to e-commerce innovations during Singles’ Day and should look to apply Singles’ Day strategies in upcoming Chinese festivals and holidays (download Coresight Research’s 2021 calendar to plan for promotional campaigns in China).

Brands and retailers should use consumer data to better understand their target audience in advance of shopping events, and so be able to launch successful, targeted campaigns.

- For Singles’ Day and other e-commerce events, beauty brands and retailers can build awareness of the offers available online and in stores through high-impact, interactive formats, such as WeChat or Weibo. A personalized ad based on a consumer’s known product interests, demographics and location can be highly effective. Beauty brands should look beyond pricing, product and service strategies towards content, media and marketing, and influencer strategies.

Many beauty brands and retailers are exploring options such as new product launches and innovative e-commerce, including livestreaming. To maximize the performance of their livestreams, beauty brands should incentivize shoppers to join and shop early in the livestream by offering exclusive deals and free giveaways with purchases.

- To capitalize on Singles’ Day and other e-commerce events, beauty brand owners can also spread-out discount days to multiple days. This will not only provide increased opportunities for consumers to spend but also helps brands and retailers to refine their campaign. In addition, extended promotion periods lighten the load on shipping, returns, warehousing and customer service operations.