albert Chan

China’s Beauty Market Continues To Grow

China’s beauty market is witnessing continued growth, despite the Covid-19 pandemic. The country has been leading the world in digital technology and innovative marketing strategies. When Covid-19 hit, China engaged with these strategies even more, which has helped its beauty market to emerge in a better state than others around the world. In this report, we discuss the Chinese beauty market’s development and the spectacular retail strategies that are driving its growth, as well as highlighting those that could be applied to international markets.

Consumers expect a frictionless experience, meaning that they search, choose and purchase within the same app. China’s retail and commerce strategies are led by artificial intelligence (AI), and decisions are data-driven to reflect this consumer expectation. This foundation has helped China’s beauty market to implement spectacular retail strategies to speed ahead of Western markets, and it is built on the following:

- System architecture that allows the consumer to move easily between discovery and payment—a frictionless experience.

- Data-driven decisions that are based on opportunities, white space and need instead of ideas and hunches.

- The power of AI when used across all operations from in-store retail to logistics networks.

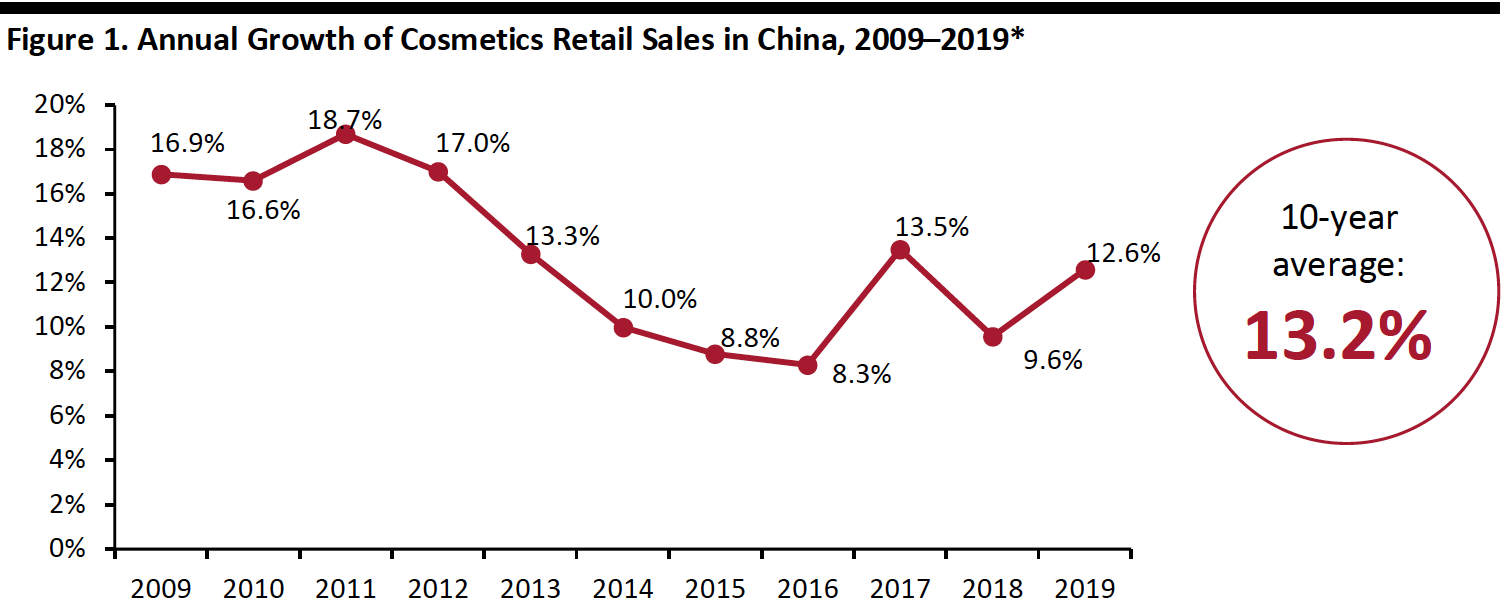

As shown in Figure 1, China’s cosmetics retail sales have grown 13.2% on average over the past 10 years, according to the National Bureau of Statistics of China. As of 2020, the market totaled $70.9 billion, compared to the US beauty market’s value of $93.1 billion, according to Cosmetic Business. This places the Chinese beauty market as the second largest in the world, and it is expected to grow at a CAGR of 9% by 2023—approximately four times the rate of the US beauty market’s expected 2.4% CAGR, according to happi.com.

[caption id="attachment_113677" align="aligncenter" width="700"] *Includes annual growth of wholesale and retail companies in China with an annual sales volume of ¥5 million yuan or above and with an employee count of above 60

*Includes annual growth of wholesale and retail companies in China with an annual sales volume of ¥5 million yuan or above and with an employee count of above 60Source: National Bureau of Statistics of China[/caption]

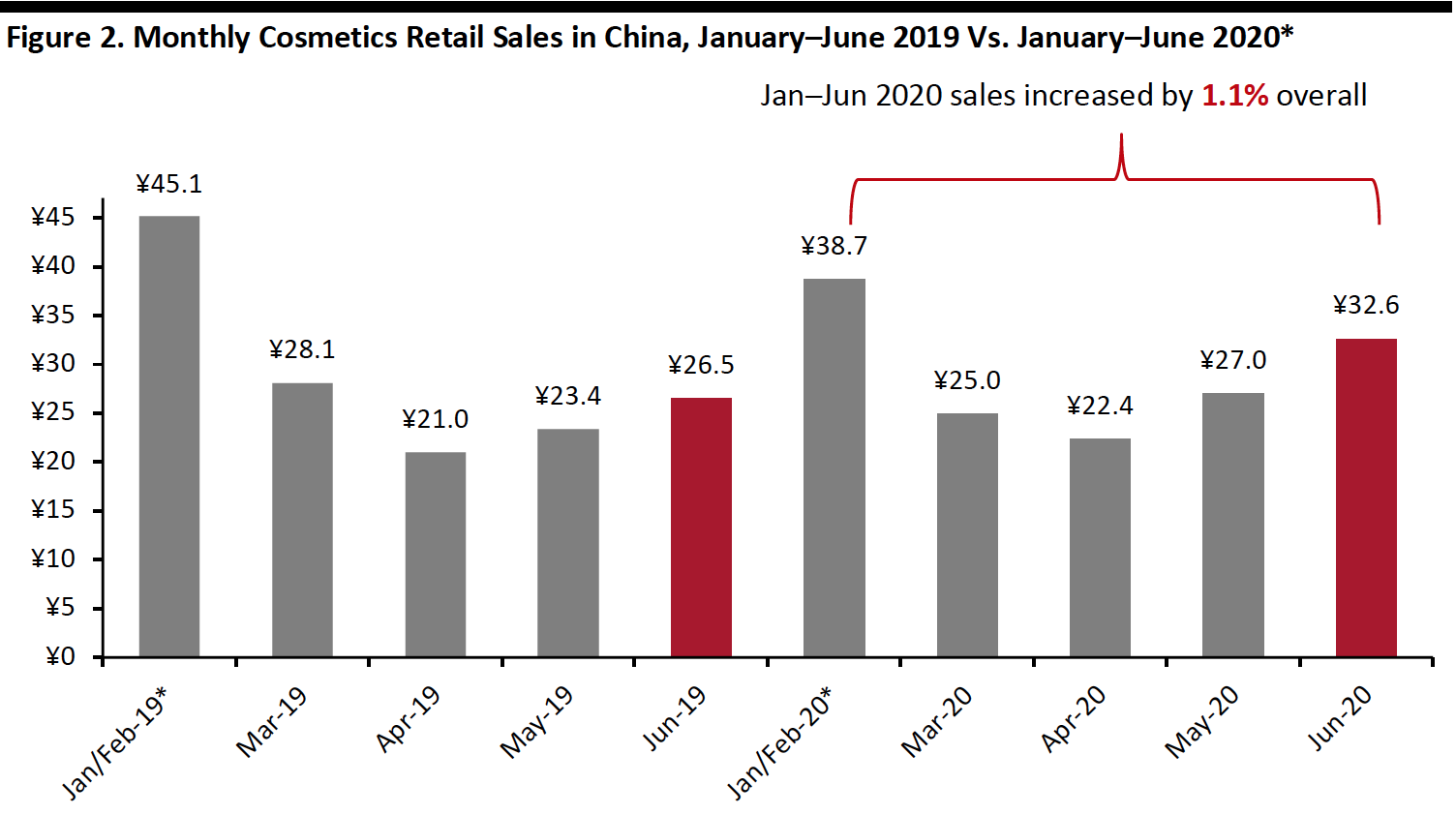

During Covid-19, cosmetics retail sales in China increased by 1.1% overall in January–June 2020 compared to the same period in 2019. Additionally, sales rebounded in the month of June this year and increased by 22.9% year over year, as shown in Figure 2. Compared to the US, this is likely viewed as a success story—particularly given that market research firm NPD Group reported a 25% decrease in prestige beauty sales in the US from January 5 through July 4, 2020. In addition, for major US beauty retailers such as Sephora and Ulta Beauty, 80–85% of sales are completed in stores, so they are likely to be hit hard by brick-and-mortar store closures due to Covid-19.

[caption id="attachment_113678" align="aligncenter" width="700"] Source: National Bureau of Statistics of China

Source: National Bureau of Statistics of China*Figures for January and February have been grouped together to curb the influence of the Chinese New Year on the statistic. Chinese New Year falls between January 21 and February 21.[/caption]

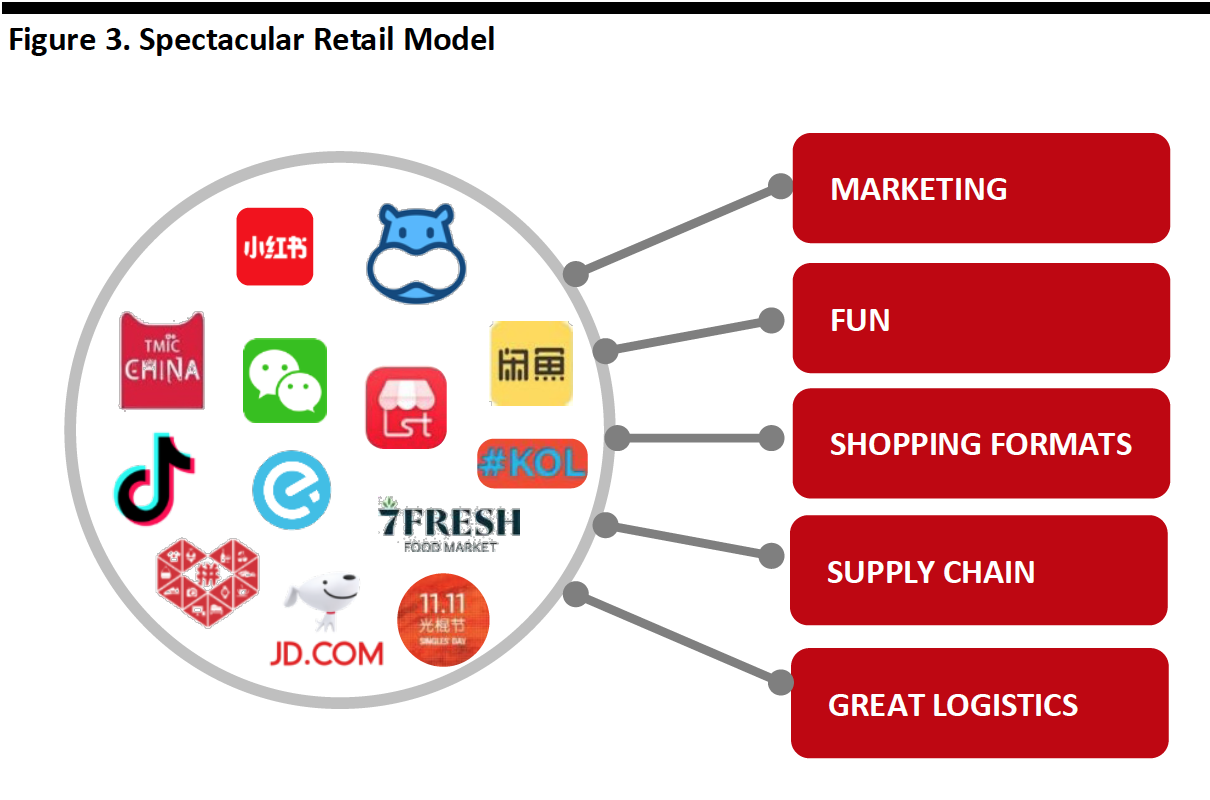

Spectacular Retail: China’s Growth Accelerator

Continued beauty market growth, even during times of adversity, can be attributed in part to China’s spectacular retail model. As outlined during the recent CEW State of the Beauty Industry virtual conference, spectacular retail involves engaging strategies being blended with technologies, and digital marketing and shopping formats are optimized through an AI-enabled supply chain.

[caption id="attachment_113679" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

We discuss five examples of spectacular retail strategies in China and highlight why each is helping to drive growth for beauty brands.

Marketing Strategy: Livestreaming E-Commerce

Livestreaming e-commerce is an interactive shopping experience, sometimes involving an influencer or celebrity, used to describe or demonstrate how to use a product for consumers through a live digital interface. The livestreaming market is projected to double in value from $60 billion to $135 billion in China in 2020, according to iiMedia. Livestreaming represents spectacular retail’s key marketing strategy for connecting brands to consumers.

Livestreaming is driving beauty growth as a fun, entertaining and unscripted medium for consumers to learn about products. Sometimes, there are also challenges and promotions that add an element of surprise. Livestreaming sessions are interactive, with consumers able to ask influencers questions about products and brands—this live, two-way interaction can create credibility and authenticity. Consumers look to livestreamers (influencers and celebrities) for new product information, beauty application techniques and recommendations.

To summarize, the benefits of livestreaming for beauty brands include the following:

- Entertainment

- Interactivity

- Authenticity

- Knowledge sharing

Many brands leveraged livestreaming to engage with consumers during Covid-19—particularly amid brick-and-mortar store closures. For example, to open its flagship store on Tmall Global in March 2020, Huda Beauty partnered with key opinion leader (KOL) Austin Li, also known as the “Lipstick King,” to host a livestream session on Alibaba’s Taobao Live channel, which had 12 million views.

[caption id="attachment_113680" align="aligncenter" width="550"] Source: Austin Li/Taobao Live[/caption]

Source: Austin Li/Taobao Live[/caption]

JD Beauty reported that during its 6.18 Shopping Festival, it held 10,662 livestream shows, with total livestreaming time exceeding 32,000 hours. Over 1,200 merchants and brands starting livestreaming, and many saw sales generated from livestreaming exceed 20% of total revenue. Almost all brands and merchants hosted over three hours of live shows every day. Olay, for example, hosted a daily seven-hour show, and Carslan hosted a 14-hour show.

Fun: Shopping Festivals

Shopping festivals are a spectacular retail strategy designed to utilize fun to generate online and offline revenue. Festival culture in China is big business, and much more popular than in rest of the world. China’s biggest shopping festival is Singles’ Day, which Alibaba calls the 11.11 Global Shopping Festival. Held annually on November 11, the event generated a staggering $38.3 billion in 2019—more than five times the revenue from Amazon’s Prime Day in 2019.

Festivals help to drive the growth of the beauty market as they generate excitement for brands and give consumers an additional incentive to shop each year. By launching festivals, brands and retailers create new revenue opportunities outside of traditional holidays and raise consumer awareness of their products—brands often create promotional product bundles for festivals that are centered around a winning product.

To summarize, the benefits of shopping festivals for beauty brands include the following:

- Excitement around shopping outside of traditional holidays

- Increased brand awareness

- Customer incentive to participate in an annual event

During Covid-19, shopping festivals in China helped to activate beauty sales.

- China’s third-largest e-commerce platform, Pinduoduo, launched a “10 Billion Subsidy Festival” in February 2020 and sold 10,000 MAC lipsticks within the first 12 hours.

- For International Women’s Day on March 8, 2020, JD.com reported that sales reflected a 97% year-over-year sales jump for beauty.

- JD.com reported that for its post-Covid-19 6.18 Shopping Festival, sales increased across all of its beauty categories, with L’Oréal, SK-II, and Lancôme proving the top three bestsellers. JD has witnessed beauty sales up to June 1 more than double compared to the same time last year, with high-end and men’s products performing exceptionally well—as of June 1, sales of male facial-cleansing products increased by 282% year over year, and sales of male skincare sets increased by 260%, according to the company.

Source: JD.com[/caption]

Source: JD.com[/caption]

Shopping Formats: Virtual Beauty Try-on

Virtual beauty try-on technology helps consumers to experience beauty in a new way in the physical and digital world. Virtual beauty try-on technology uses augmented reality (AR) to let consumers try out different colors, shades and even products (such as false eyelashes) through a mobile app.

This technology is helping to drive growth for beauty brands because it provides a contactless, safe and realistic way to try new beauty products. With the onset of the pandemic, virtual beauty try-on witnessed renewed interest as consumers were unable to visit stores during the pandemic so virtual try-on offers a safe solution in-store as well as remotely. Consumers are still unable to physically test products in stores due to new safety measures. During the pandemic, over 1 million consumers in China used a virtual-reality tool to purchase make-up in the first week of March, according to Mintel. Consumers can also experiment more freely with colors and products that they may not have tried otherwise. Additionally, virtual try-on helps physical retailers to reduce product waste and provides data to identify the products that consumers are interested in.

To summarize, the benefits of virtual try-on for beauty brands include the following:

- Safe, contactless and can be accessed remotely

- Easier for consumers to experiment

- Reduces waste for physical retailers

- Provides retailers and brands with consumer insights

In May 2020, Perfect Corp. launched a virtual makeup experience, a program located on WeChat that uses AR technology to enable mobile users to test cosmetics including eyeshadow, lipstick and foundation. Perfect Corp.’s AI offerings include its AI skin diagnostic tool, which scans a WeChat user's face and provides skincare tips, and its AI Smart Shade Finder than helps the user to decide on the right foundation shade among 90,000 skin tones.

[caption id="attachment_113682" align="aligncenter" width="550"] Source: Perfect Corp.[/caption]

Source: Perfect Corp.[/caption]

Supply Chain: Smart Shelf Technology

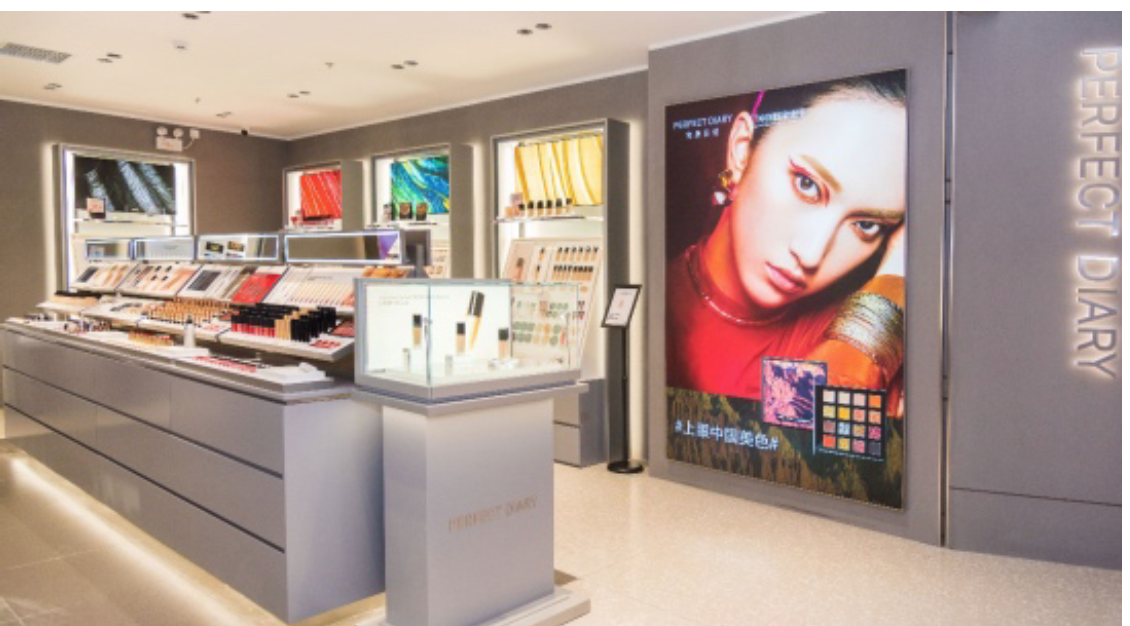

Smart shelf technology leverages spectacular retail’s supply chain, assisting consumers with product details in stores and helping merchants with inventory. Smart shelves can improve store efficiency in terms of management, replenishment and inventory, as they are able to “interface” with customers, thereby allowing retailers to use the resulting data to inform inventory decisions. Perfect Diary, China’s $1 billion domestic beauty brand, opened a store in Hangzhou in December 2019 and highlighted smart shelves as part of its spectacular retail strategy to help to facilitate online and offline data connections.

Smart shelves are activated when a customer picks up a product in stores; they are helping the beauty market to drive growth as an interactive marketing tool. When a customer selects a beauty product, an LCD screen plays a video of the selected product and displays the price. The customer can also scan a code on the smart display to read customer reviews and detailed product information. For retailers, smart shelves record the number of times each beauty product is viewed, which helps them to manage inventory and orders.

To summarize, the benefits of smart shelf technology for beauty brands include the following:

- Consumer interactivity

- Visual product information to facilitate customer decision-making

- Consumer data to be used to identify trends

- Assists retailers with inventory management

Source: Perfect Diary Changsha Store[/caption]

Source: Perfect Diary Changsha Store[/caption]

Logistics: One-Hour Delivery Services

In June 2020, Tmall’s Taobao supermarket launched a one-hour delivery service, demonstrating its spectacular retail logistics strategy focused on last-mile delivery. China is a world leader in delivery, automated logistics and last-mile delivery—70% of its parcel deliveries are processed by technology from Alibaba’s logistics arm, Cainaio, which supports around 42 million deliveries every day. While one-hour delivery has not been announced by beauty and personal care brands, it presents an opportunity for these brands to reach new demographics.

Express and one-hour deliveries can support the growth of beauty brands by providing an opportunity to reach a new customer base, and potentially a new demographic by fueling urbanization. In the wake of Covid-19, new digital users are shopping online. The digital acceleration caused by the pandemic has benefited lower-tier cities and older demographics: According to QuestMobile, a Chinese analytics firm, lower-tier cities registered 17 million net new Internet users in the first quarter of 2020—of which more than half are aged 41 years or above. Delivery acceleration and new online shopper demographics will provide more beauty and personal care opportunities for beauty brands.

To summarize, the benefits of delivery acceleration for beauty brands include the following:

- Opportunities to reach a new customer base

- Opportunities to develop products for a new demographic

Bringing Spectacular Retail to US Beauty Brands and Retailers

There is potential for spectacular retail strategies to be applied in the US beauty market. Initial signs of areas with the most revenue-generating opportunities for beauty brands include livestreaming e-commerce, utilizing virtual try-on and incorporating beauty festival days.

- Livestreaming e-commerce: There are initial signs of US brands beginning to interact more on livestreaming channels such as TikTok, Instagram stories, Facebook Shops, Reels and their own brand websites. We see this as one of the biggest opportunities for retailers to grow their brands, and we expect livestreaming to experience exponential growth in the US.

- Virtual try-on: Retailers such as Sephora and Ulta Beauty have adopted this technology and are rapidly expanding available options. According to the companies, Ulta Beauty’s GlamLab and Perfect Corp.’s YouCam are seeing remarkable results—Ulta Beauty witnessed a fivefold increase in virtual try-on usage during the pandemic, while YouCam is experiencing a 28% increase in post-Covid virtual try-ons. We believe that this will become the standard for online and offline brands and retailers moving forward.

- Festivals: Brands and retailers could consider launching their own festival day or grouping together to create a beauty brand day based on a theme. These festivals can develop brand awareness, as well as providing revenue-generation opportunities. Amazon.com holds Prime Day, which is normally in July every year, as its “festival” equivalent, and it is currently the biggest beauty day of the year in the US.

Key Insights

- China’s beauty market is growing quickly, fueled by e-commerce and social and digital technology. It is the second largest in the world after the US and has grown at an average of 13.2% over the past 10 years. It is expected to grow at a CAGR of 9% through 2023, nearly four times the growth rate of the US market.

- During the Covid-19 pandemic, China’s beauty market remained resilient, increasing by 1.1% from January to June 2020 compared to the same period in 2019.

- Spectacular retail is fueling market growth, offering a blend of engaging and optimized digital marketing and shopping formats with an AI-enabled supply chain. Spectacular retail strategies include marketing strategies, capitalizing on fun, shopping formats, smart supply chains and enhanced logistics.

- Livestreaming, a marketing strategy, is projected to be a $135 billion industry in 2020 in China. Consumers are reacting positively to livestreaming because it is informative, authentic, fun and an intimate way of shopping for products—consumers feel connected to the livestreamers (influencers and celebrities) they follow.

- Festivals generate revenue for brands by providing an additional incentive for consumers to shop.

- Virtual try-on technology is a spectacular retail shopping format that helps consumers to discover makeup products in a safe environment and to experiment with products that they may not have otherwise considered. It is helping retailers to reduce product waste and to provide data on trending products.

- Smart shelf technology is effective for both customers and retailers, as it provides consumers with interactive, visual tools to make purchase decisions and retailers with information about which products are popular.

- Enhanced delivery options, such as one-hour timeframes, underscore that new mobile users are shopping online and new demographics are now reachable, which is creating opportunities for beauty brands and retailers.

- Spectacular retail strategies can be applied to the US. Initial signs of areas with the most revenue-generating opportunities for brands include livestreaming e-commerce, utilizing virtual try-on and launching or participating in shopping festivals.