DIpil Das

What’s the Story?

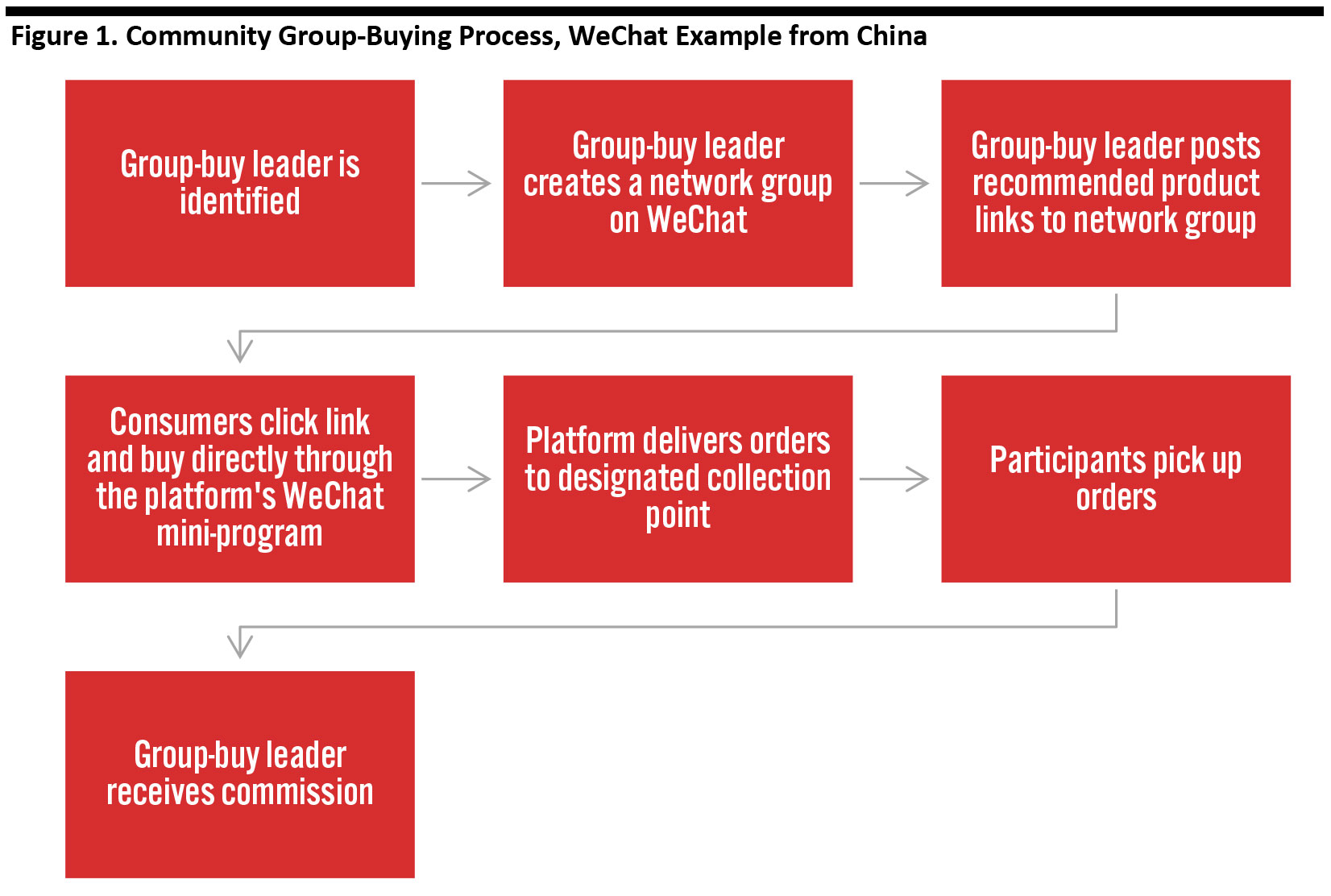

Group buying is a selling model through which consumers are encouraged to recruit friends and family to purchase items together, in order to access discounted prices. The overarching principle of group buying is that the more consumers that make a purchase, the lower the price of products. Group buying is very popular in China, and there are two main types: standard, in which consumers can search for products and join a group to purchase, without geographical limitations; and community, which centers around bulk delivery and is organized by a community leader who takes responsibility for maintaining relationships within the network. Community group buying focuses on users’ locations, such as an apartment building or housing area, and is organized around a leader who takes responsibility for maintaining relationships within the network. Community group buying tends to focus on essential items, such as groceries, whereas standard group buying covers all categories. We see group buying as an untapped area of opportunity for the beauty market.Why It Matters

Group buying is a multibillion-dollar industry in China that has been expanding rapidly due to the Covid-19 pandemic. While the industry’s near-term growth is likely to be in the grocery category, there are opportunities for beauty brands and retailers to leverage the group-buying model—internationally as well as in China. In the typical model, community group buying utilizes a group leader who provides recommendations to a network, effectively becoming an influencer or sales representative; beauty brands could leverage beauty micro-influencers to act as buying leaders, as consumers seek out recommendations from beauty influencers, friends and social networks. Beauty brands could use group buying to strategically expand their consumer base by creating communities that are location-based, brand-based, influencer-based or theme-based (clean beauty, for example). This type of selling model also enables brands to promote older inventory and boost sales by offering group-buy (effectively bulk-order) discounts.Leveraging Group Buying in the Beauty Market: In Detail

Community Group Buying: An Overview In China, community group-buying platforms have become increasingly popular recently due to the Covid-19 pandemic, as they offer value products to consumers and remove the need for shoppers to visit brick-and-mortar stores as deliveries are made to a designated local collection point. Competition is rising in the community group-buying market in China. For example, in the grocery sector, there have been two recent major developments:- In March 2020, Chinese e-commerce platform Pinduoduolaunched its own community group-buying platform, Kuaituantuan. The new platform delivers groceries and daily necessities to more than 10,000 apartment units in China.

- In July 2020, Meituan, a food-delivery platform launched Youxuan, a community group-buying platform that sells fresh food, alcohol and other beverages.

Source: Coresight Research [/caption]

Standard Group Buying: Growth Drivers of Pinduoduo’s “Team Purchase” Model

Pinduoduo’s selling model is centered around “team purchases,” where consumers can access lower prices when they buy as part of a group, compared to making purchases individually. A consumer is offered two prices when shopping on the platform: an individual purchase price and a discounted, team purchase price. Consumers can initiate a team purchase by inviting friends and family to join them in a new buying group, or they can purchase items through an already established group.

Pinduoduo is China’s fastest-growing major e-commerce platform: Its annual active user base has grown more quickly than that of Alibaba’s Tmall and Taobao platforms and JD.com, increasing by 760% from 68 million in the first quarter of 2017 to 585 million as of the fourth quarter 2019. This compares to 57% growth on both Alibaba platforms and JD.com’s 53% growth over the same period.

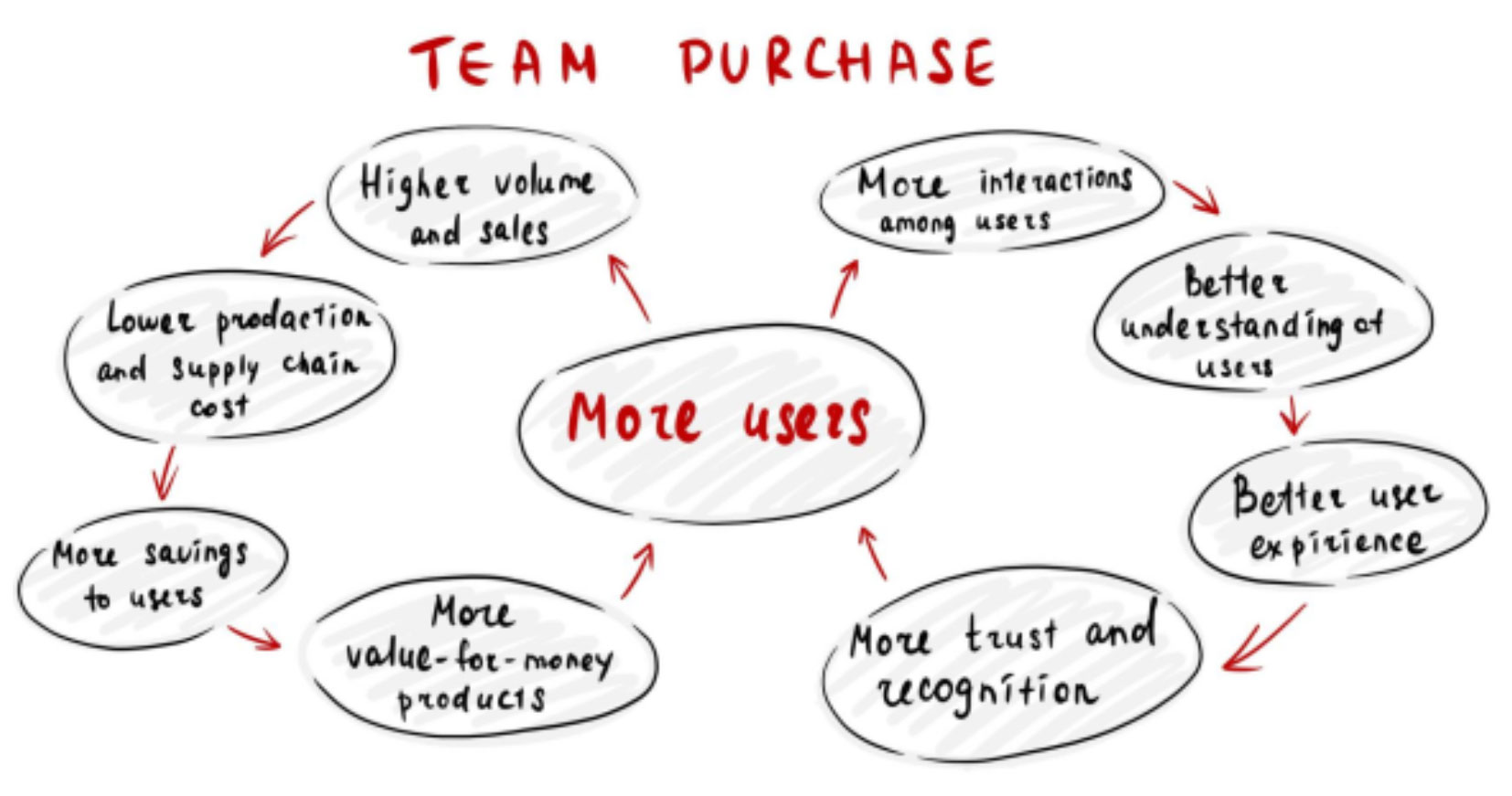

Pinduoduo reported that its team-purchase model—which it describes as “interactive e-commmerce”—encourages consumers to introduce the platform to others through their social networks. As its consumer and buyer base grows, the scale of Pinduoduo’s sales volume increases, which provides merchants with the ability to optimize their supply chains and offer even more competitive pricing. This, in turn, helps to attract even more consumers. The team-purchase model is summarized in the image below.

[caption id="attachment_118690" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

Standard Group Buying: Growth Drivers of Pinduoduo’s “Team Purchase” Model

Pinduoduo’s selling model is centered around “team purchases,” where consumers can access lower prices when they buy as part of a group, compared to making purchases individually. A consumer is offered two prices when shopping on the platform: an individual purchase price and a discounted, team purchase price. Consumers can initiate a team purchase by inviting friends and family to join them in a new buying group, or they can purchase items through an already established group.

Pinduoduo is China’s fastest-growing major e-commerce platform: Its annual active user base has grown more quickly than that of Alibaba’s Tmall and Taobao platforms and JD.com, increasing by 760% from 68 million in the first quarter of 2017 to 585 million as of the fourth quarter 2019. This compares to 57% growth on both Alibaba platforms and JD.com’s 53% growth over the same period.

Pinduoduo reported that its team-purchase model—which it describes as “interactive e-commmerce”—encourages consumers to introduce the platform to others through their social networks. As its consumer and buyer base grows, the scale of Pinduoduo’s sales volume increases, which provides merchants with the ability to optimize their supply chains and offer even more competitive pricing. This, in turn, helps to attract even more consumers. The team-purchase model is summarized in the image below.

[caption id="attachment_118690" align="aligncenter" width="700"] Source: Pinduoduo’s “Defining Interactive E-Commerce” [/caption]

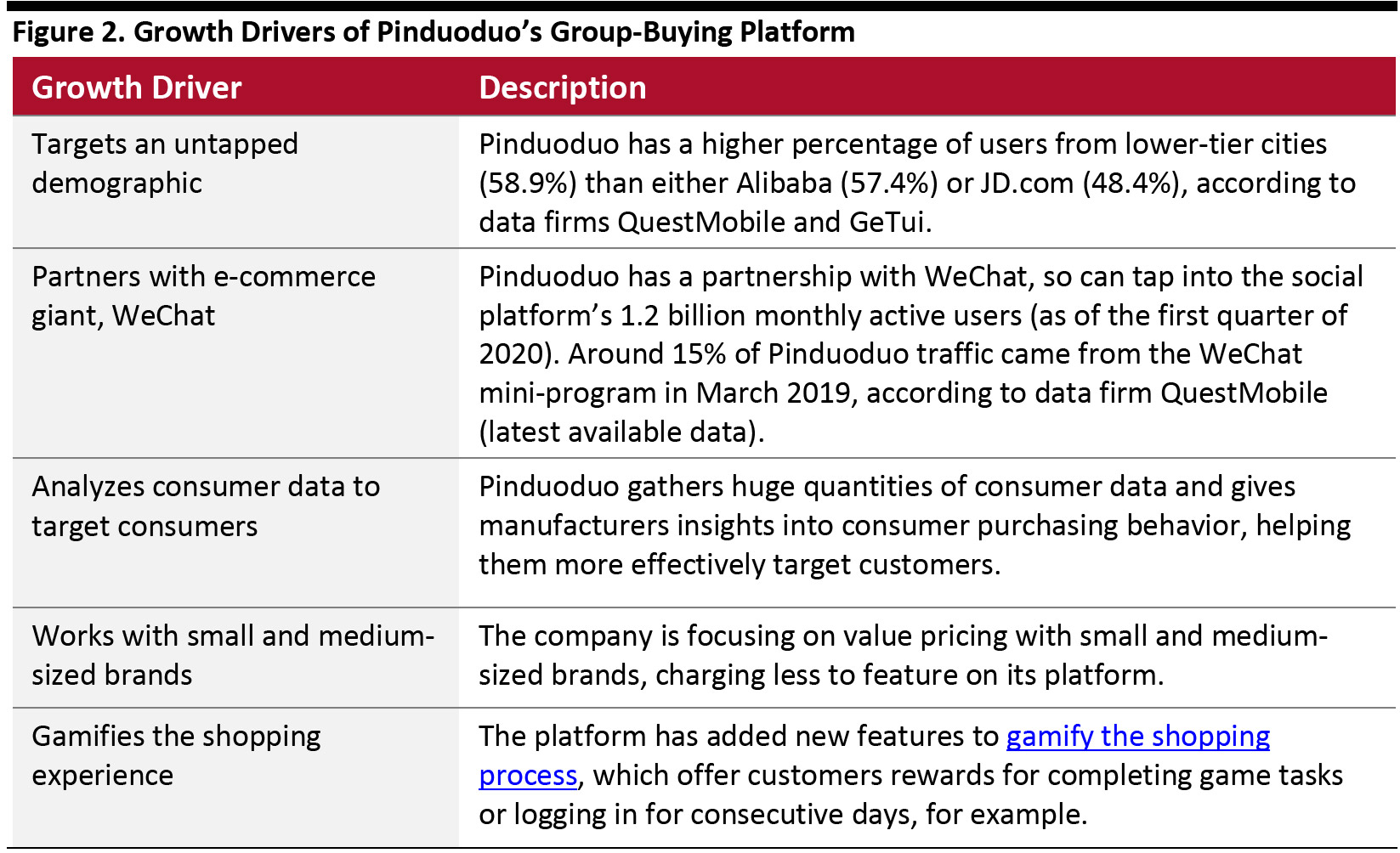

In Figure 2, we highlight the differentiators and growth drivers of the Pinduoduo group-buying platform. Many of the team-purchase growth drivers can be applied by beauty brands and retailers, which we discuss later in this report.

[caption id="attachment_118706" align="aligncenter" width="700"]

Source: Pinduoduo’s “Defining Interactive E-Commerce” [/caption]

In Figure 2, we highlight the differentiators and growth drivers of the Pinduoduo group-buying platform. Many of the team-purchase growth drivers can be applied by beauty brands and retailers, which we discuss later in this report.

[caption id="attachment_118706" align="aligncenter" width="700"] Source: Company reports/Coresight Research [/caption]

Benefits of Group Buying for Brands and Consumers

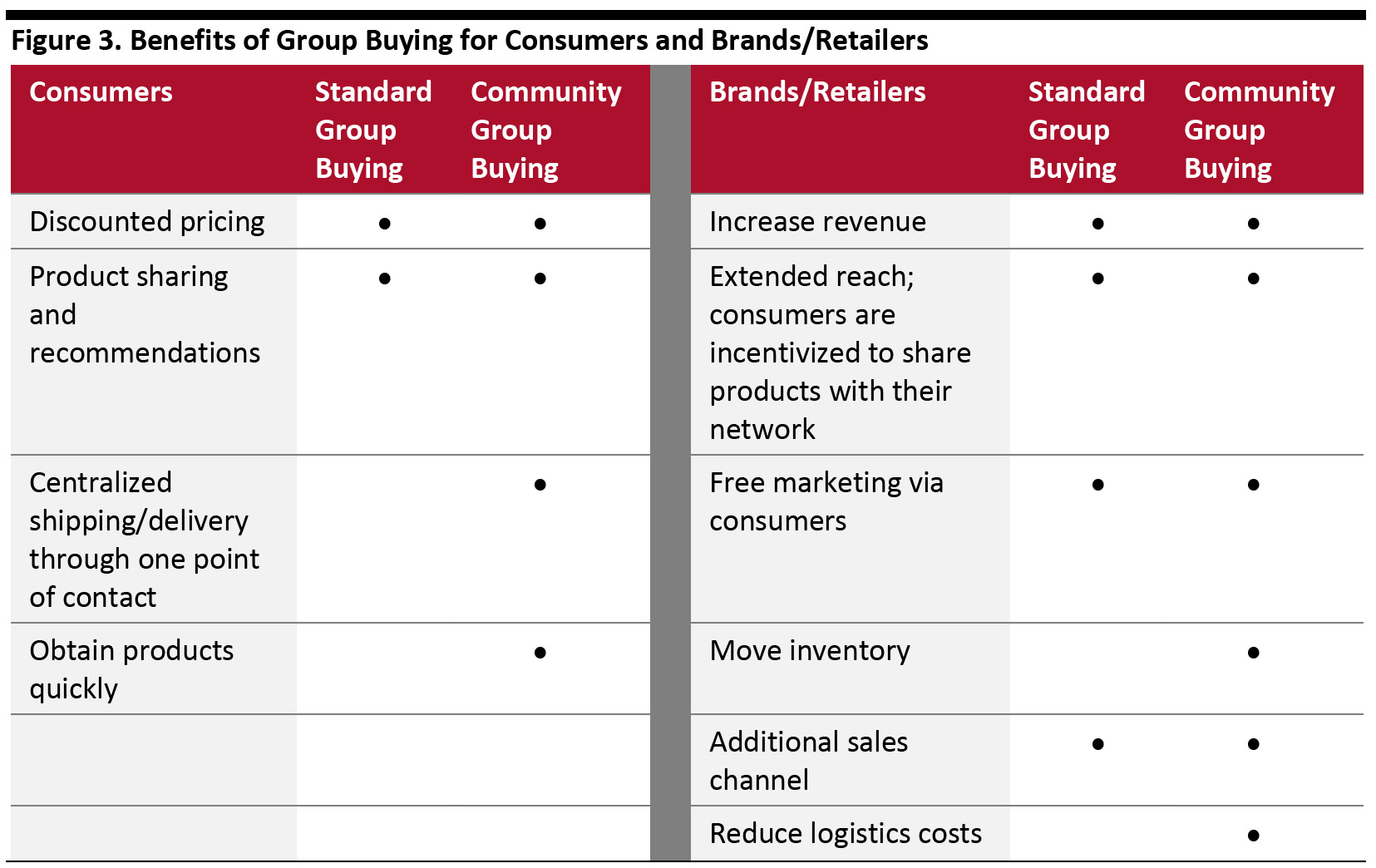

Group buying benefits both consumers and brands/retailers, as we outline in Figure 3. At a minimum, group buying provides consumers with discounted pricing and brands with another sales channel through which it can reach consumers.

[caption id="attachment_118713" align="aligncenter" width="700"]

Source: Company reports/Coresight Research [/caption]

Benefits of Group Buying for Brands and Consumers

Group buying benefits both consumers and brands/retailers, as we outline in Figure 3. At a minimum, group buying provides consumers with discounted pricing and brands with another sales channel through which it can reach consumers.

[caption id="attachment_118713" align="aligncenter" width="700"] Source: Coresight Research [/caption]

How Beauty Brands and Retailers Can Apply Group-Buying Strategies

1. Leverage the Core Concept of Community, Using Micro-Influencers and Social Commerce

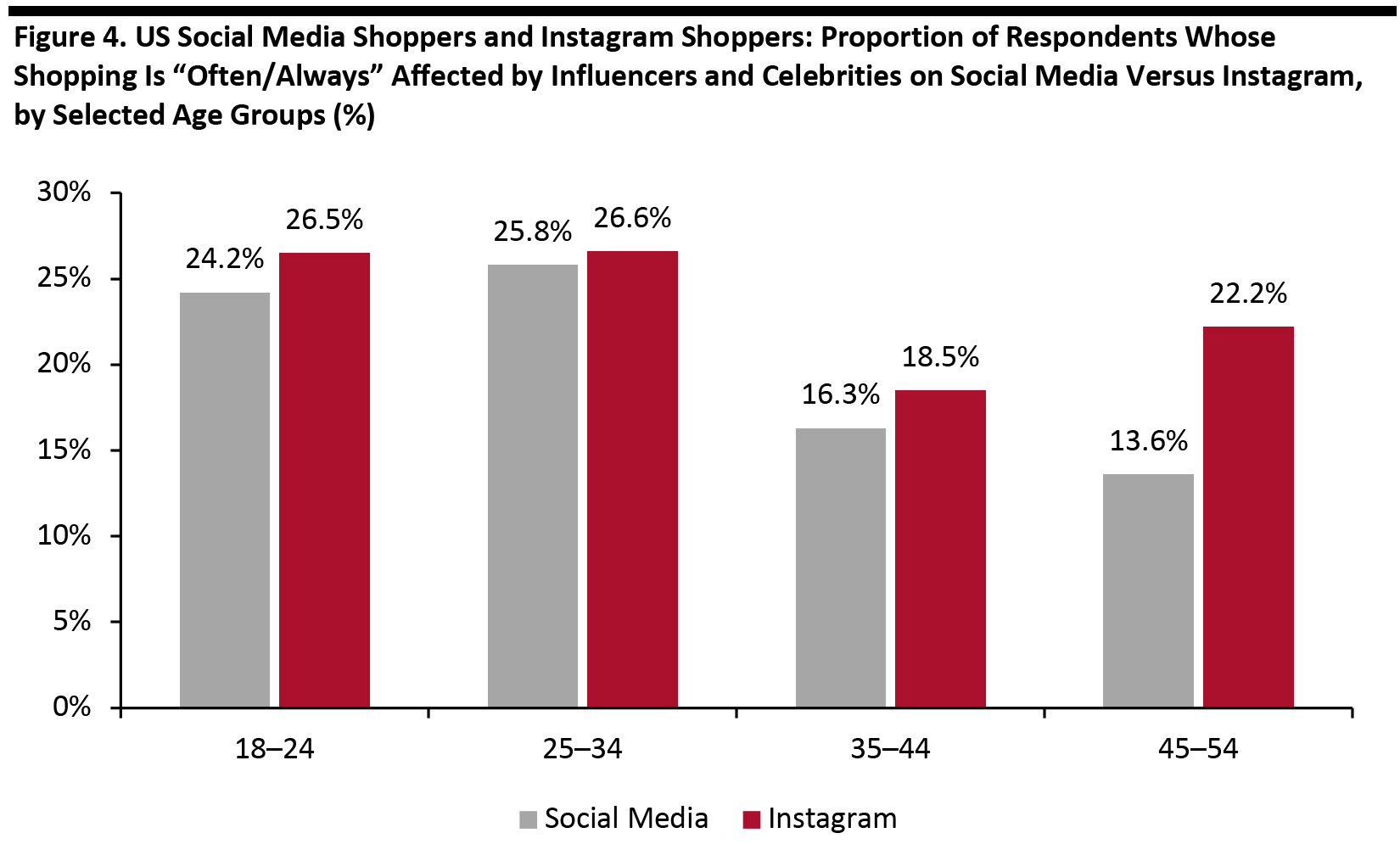

At its core, the group-buying model centers around recommendations and a community of influence. Consumers seek out brand recommendations on social media from friends, family and influencers, and trust is a critical component of this relationship. Coresight Research’s recent US Social Commerce Survey found that, for consumers who use social media as part of the shopping process, purchasing decisions are often affected by influencers and celebrities (see Figure 4).

[caption id="attachment_118693" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

How Beauty Brands and Retailers Can Apply Group-Buying Strategies

1. Leverage the Core Concept of Community, Using Micro-Influencers and Social Commerce

At its core, the group-buying model centers around recommendations and a community of influence. Consumers seek out brand recommendations on social media from friends, family and influencers, and trust is a critical component of this relationship. Coresight Research’s recent US Social Commerce Survey found that, for consumers who use social media as part of the shopping process, purchasing decisions are often affected by influencers and celebrities (see Figure 4).

[caption id="attachment_118693" align="aligncenter" width="700"] Base: 854 US respondents aged 18+ who use social media as part of the shopping process. Of those, 282 use Instagram as part of the shopping process.

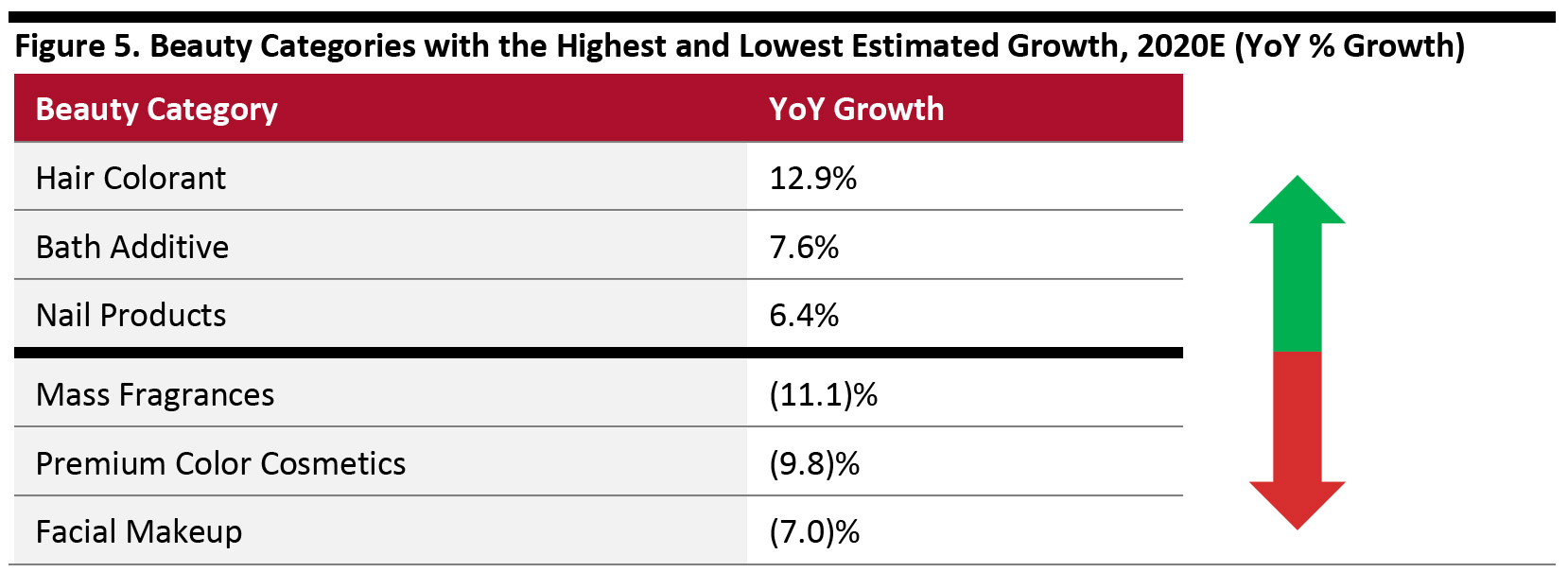

Base: 854 US respondents aged 18+ who use social media as part of the shopping process. Of those, 282 use Instagram as part of the shopping process. Source: Coresight Research [/caption] In a community group-buying model, the leader takes responsibility for the trust component of the shopping process, by maintaining and organizing relationships within the network community. Standard group buying is also built on recommendations and suggestions, since consumers are sending links to individuals with the intention that others will also make purchases and thus decrease product prices. This promotes products, potentially introduces a product to new user groups and is effectively an endorsement, as the consumer is showing their intent to purchase by sending a link. Pinduoduo reported that the act of interacting and sharing recommendations via sending links and making purchases affects not just the immediate purchase but also future shopping recommendations. Over time, recommendations can be personalized into users’ social feeds, and engagement in categories and products can help brands to understand which brands, products and categories are resonating with consumers. Beauty brands and retailers should consider how to work with micro-influencers through social commerce as a means to introduce products to new users using their networks. In addition, brands should encourage consumers to share their experiences and intentions to buy products. 2. Target Untapped Demographics Part of Pinduoduo’s success comes from the platform’s focus on lower-tier cities in China, representing a niche market. The company reported that its early-stage growth strategy was not to take market share away from its established e-commerce competitors but to orient early-stage down-market users and those who had only recently begun using smartphones and were not accustomed to shopping online. This same strategy can be applied by beauty brands and retailers: Targeting a white space or underserved market with a group-buying model could offer a brand or retailer an edge over the competition. For example, beauty brands and retailers could look to target boomers, tweens or men, as these consumer demographics may be underserved compared to other beauty consumer groups. Pursuing an unsown field will give a beauty retailer a first-mover advantage, as they are not trying to take market share away from other players but are instead forging a new path for themselves. 3. Use Data To Gain Consumer Insights and Move Inventory Due to the major disruption caused by the Covid-19 pandemic, beauty retailers and brands may have excess inventory of products that have seen decreased consumer interest, such as mass fragrances, premium color cosmetics and facial makeup (see Figure 5). Beauty brands and retailers could leverage consumer data to determine the categories that shoppers may still be interested in, and the categories that they have shopped, to make better recommendations and promote inventory effectively. [caption id="attachment_118707" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Using group-buy strategies, beauty companies can strategically select certain products to promote and work with influencers to drive consumer interest in ageing inventory that data has shown might be relevant—and resurfacing these products at discounted prices. In addition, by identifying categories that may gain traction through social commerce, brands can increase the likelihood of its products being promoted by consumers themselves through recommendations and sharing links.

4. Work with Small and Medium-Sized Brands To Offer Value Pricing

Pinduoduo differentiated itself from its competitors by working with small and medium-sized brands—reporting growth from 97,000 featured brands in 2017 to over 5 million merchants as of July 2020. This variety of product offerings secures Pinduoduo’s positioning as a marketplace with choice and value offerings.

Pinduoduo’s experience offers a lesson for larger companies looking to penetrate the group-buy market and realize growth. By working with small brands, beauty companies can capitalize on the opportunity to sell varied products in niche beauty categories as the sector continues to expand—thus increasing their consumer reach. For example, as health and wellness extends into beauty, consumers are seeking beauty offerings around sleep care, beauty supplements, CBD and even products to boost mental and emotional health. Diversifying into these categories by working with specialist brands and offering low prices could help to grow a beauty retailer’s user base—and will be a point of differentiation.

Source: Euromonitor International Limited 2019 © All rights reserved[/caption]

Using group-buy strategies, beauty companies can strategically select certain products to promote and work with influencers to drive consumer interest in ageing inventory that data has shown might be relevant—and resurfacing these products at discounted prices. In addition, by identifying categories that may gain traction through social commerce, brands can increase the likelihood of its products being promoted by consumers themselves through recommendations and sharing links.

4. Work with Small and Medium-Sized Brands To Offer Value Pricing

Pinduoduo differentiated itself from its competitors by working with small and medium-sized brands—reporting growth from 97,000 featured brands in 2017 to over 5 million merchants as of July 2020. This variety of product offerings secures Pinduoduo’s positioning as a marketplace with choice and value offerings.

Pinduoduo’s experience offers a lesson for larger companies looking to penetrate the group-buy market and realize growth. By working with small brands, beauty companies can capitalize on the opportunity to sell varied products in niche beauty categories as the sector continues to expand—thus increasing their consumer reach. For example, as health and wellness extends into beauty, consumers are seeking beauty offerings around sleep care, beauty supplements, CBD and even products to boost mental and emotional health. Diversifying into these categories by working with specialist brands and offering low prices could help to grow a beauty retailer’s user base—and will be a point of differentiation.

What We Think

Group buying is seeing great success in China and is a new concept that has many advantages and applications for beauty brands and retailers internationally. The overarching principle of group buying is that the more consumers that purchase, the lower the price. As group buying encourages consumers to recruit friends and family to purchase items together in order to access discounted prices, brands can shift higher volumes of inventory and reach a wider consumer base. Whether a standard or community group-buying model is adopted, beauty brands and retailers could realize near-term benefits such as increased revenue and an expanded and more diverse customer base that contributes to marketing and promotional activities. Pinduoduo, the team-purchase/group-buying e-commerce market leader in China, has differentiated itself and grown its user base through strategic tactics that beauty brands and retailers could apply themselves.- We expect standard group buying to be a viable way for beauty brands and retailers to grow their brands, including by working with micro-influencers through social commerce to leverage the power of recommendation.

- We expect beauty brands and retailers to seek out untapped demographics.

- Leveraging group-buy strategies, beauty brands and retailers could use consumer engagement, share and purchase data to identify category trends and help to determine product promotions.

- Beauty retailers may benefit from working with small and medium-sized firms to diversify global offerings for customers.

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved