albert Chan

Coresight Research partnered with Blue Yonder to host a virtual mini conference on January 26, 2021, entitled “Supporting the Customer Journey: Localization for Speed to Market and Flexibility.” Deborah Weinswig, CEO and Founder of Coresight Research, moderated the event, which brought together leaders from top retailers and organizations—including AAFA (American Apparel & Footwear Association), New Balance, Orvis, PVH Corp. and Tractor Supply.

The event explored existing challenges in retail and the strategies that brands and retailers can employ to keep up with fast-changing consumer demand and shifting market conditions. View the presentation from the mini conference on the Coresight Research website.

In this report, we present eight takeaways from the event.

[caption id="attachment_122464" align="aligncenter" width="700"] Event speakers. Top row (from left to right): Max Kahn, Chief Commercial Officer and Chief Financial Officer at Coresight Research; Deborah Weinswig, CEO and Founder of Coresight Research; Steve Lamar, President and CEO of AAFA; Sarah Clarke, Executive Vice President of PVH Supply North America at PVH Corp. Bottom row (from left to right): Dave Finnegan, Customer Experience Officer at Orvis; Colin Yankee, Executive Vice President and Chief Supply Chain Officer at Tractor Supply; Joe Preston, CEO of New Balance; JoAnn Martin, Vice President of Strategy and Industry Market Development at Blue Yonder

Event speakers. Top row (from left to right): Max Kahn, Chief Commercial Officer and Chief Financial Officer at Coresight Research; Deborah Weinswig, CEO and Founder of Coresight Research; Steve Lamar, President and CEO of AAFA; Sarah Clarke, Executive Vice President of PVH Supply North America at PVH Corp. Bottom row (from left to right): Dave Finnegan, Customer Experience Officer at Orvis; Colin Yankee, Executive Vice President and Chief Supply Chain Officer at Tractor Supply; Joe Preston, CEO of New Balance; JoAnn Martin, Vice President of Strategy and Industry Market Development at Blue Yonder

Source: Coresight Research/Blue Yonder[/caption]

Supporting the Customer Journey: Key Insights

1. Manufacturing To Shift from Offshoring to “Newshoring”; Retailers To Diversify Sourcing MixSteve Lamar, President and CEO of AAFA, kicked off the virtual event by talking through the impacts of the Covid-19 pandemic and the most recent “Buy American” executive order signed by President Biden. These have pushed retailers and manufacturers to explore nearshoring or reshoring solutions in order to “unlock new frontiers of strength” in improving the resiliency of the supply chain. Lamar described this trend as “newshoring” and emphasized that it presents opportunities for US manufacturing and employment—particularly in the apparel and footwear sector.

According to company reports, Hickory Brands, Levi’s and Walmart have already brought part of their supply chains back to the US. We expect to see more retailers diversify their sourcing mix and implement newshoring to make their supply chains more flexible. Coresight Research and Blue Yonder presented findings from a January 2021 survey conducted by the two companies, in which 65% of retailers reported that they are establishing or expanding domestic manufacturing due to the Covid-19 pandemic.

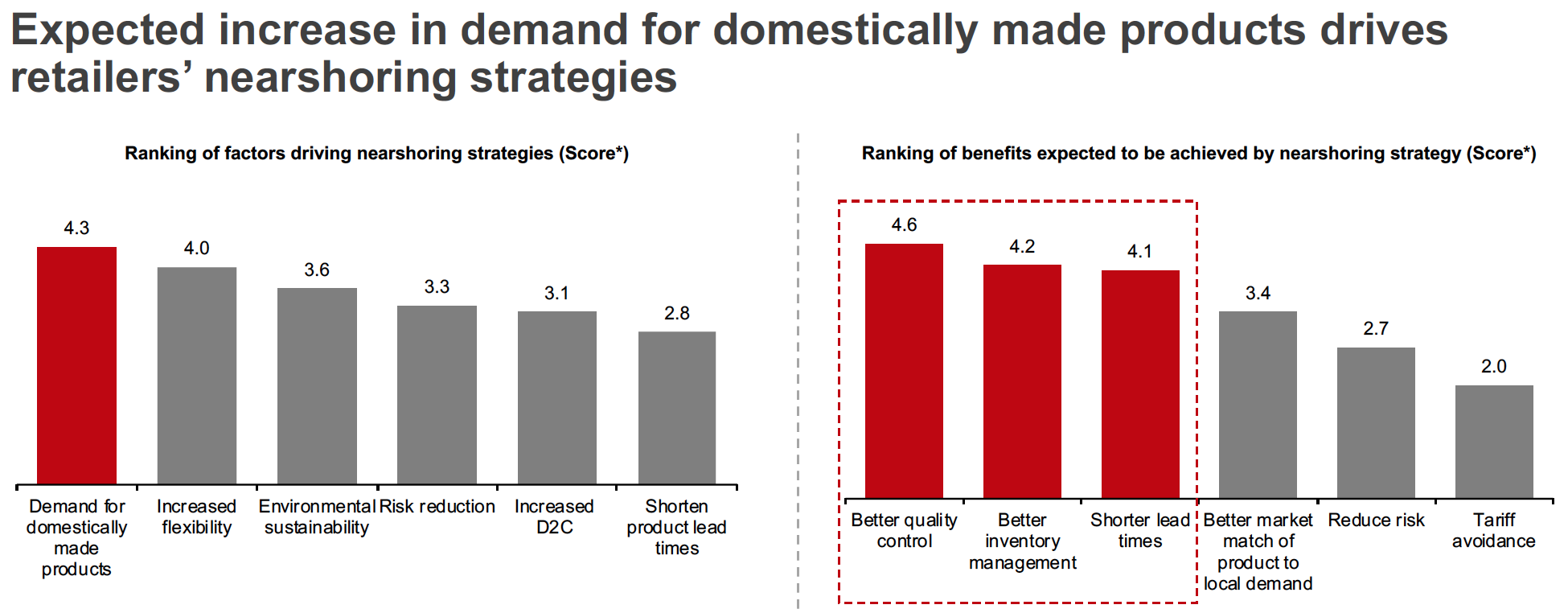

Retailers in our survey ranked demand for domestically made products as the most important factor driving nearshoring strategies, followed by increased flexibility and environmental sustainability. In terms of the benefits of enhancing or expanding nearshoring strategies, retailers expect to achieve better quality control, followed by better inventory management and shorter lead times (as shown in the charts below). JoAnn Martin, Vice President of Strategy and Industry Market Development at Blue Yonder, sees these results as an alignment of what the company is seeing in the increasingly digital market.

[caption id="attachment_122465" align="aligncenter" width="700"] Retailers were asked to rank factors and benefits on a scale of 1 to 6, with 1 being most important and 6 being least important. The charts depict the average ranking for each factor or benefit.

Retailers were asked to rank factors and benefits on a scale of 1 to 6, with 1 being most important and 6 being least important. The charts depict the average ranking for each factor or benefit.Source: Blue Yonder/Coresight Research[/caption] 2. A Synchronized Supply Chain Reduces Risk in Inventory Management

Sarah Clarke, Executive Vice President of PVH Supply North America at PVH Corp., a brand owner in the apparel sector, said that it is imperative for retailers to control inventory-related risk by synchronizing demand and supply. She explained that a synchronized supply chain enables companies to closely monitor the quantity and quality of raw materials, be consistent in projects with multiple stakeholders and adjust inventories based on customer demand.

Clarke anticipates that the supply chain in a post-pandemic world will be more complex, so retailers must adopt a dynamic approach to improve the efficiency of their supply chain. She explained that PVH Corp. is in the process of figuring out dynamic solutions to manage demand and supply in response to consumers switching to e-commerce amid the pandemic. The company needs to facilitate differences between multiple channels and geographies, as it sells via both wholesale (Costco and Walmart) and direct-to-consumer (DTC) channels (brand websites) worldwide. For example, its Tommy Hilfiger brand has experimented with same-day delivery in Amsterdam, with the retail stores delivering products directly to consumers.

Other areas of improvement suggested by Clarke include synchronization of inventory between factories and stores, automatic fulfillment of wholesale and digital orders, and real-time visibility of supply chain information both internally and with partners. According to Clarke, PVH Corp. will continue to customize its supply chain strategies and take learnings from the pandemic to become more agile.

3. On-Demand Manufacturing Model To Become More MainstreamDave Finnegan, Customer Experience Officer at outdoor and sporting goods retailer Orvis, highlighted that an on-demand manufacturing model can help retailers to adjust inventories and improve supply chain efficiency. For example, during the pandemic, Orvis saw a spike in purchases in two product categories—fly fishing and pet supplies—so it increased local manufacturing of these categories to meet demand. In addition, in light of the changing demographics of sporting goods consumers—such as increases in millennials and women buying fishing products—Orvis has shifted to manufacture more women’s apparel and reduce its inventories of unpopular merchandise.

As the world gradually emerges from the coronavirus crisis, we expect both US-based and global manufacturers to look for alternative manufacturing models—such as demand-driven systems—to lower inventory levels and improve efficiency.

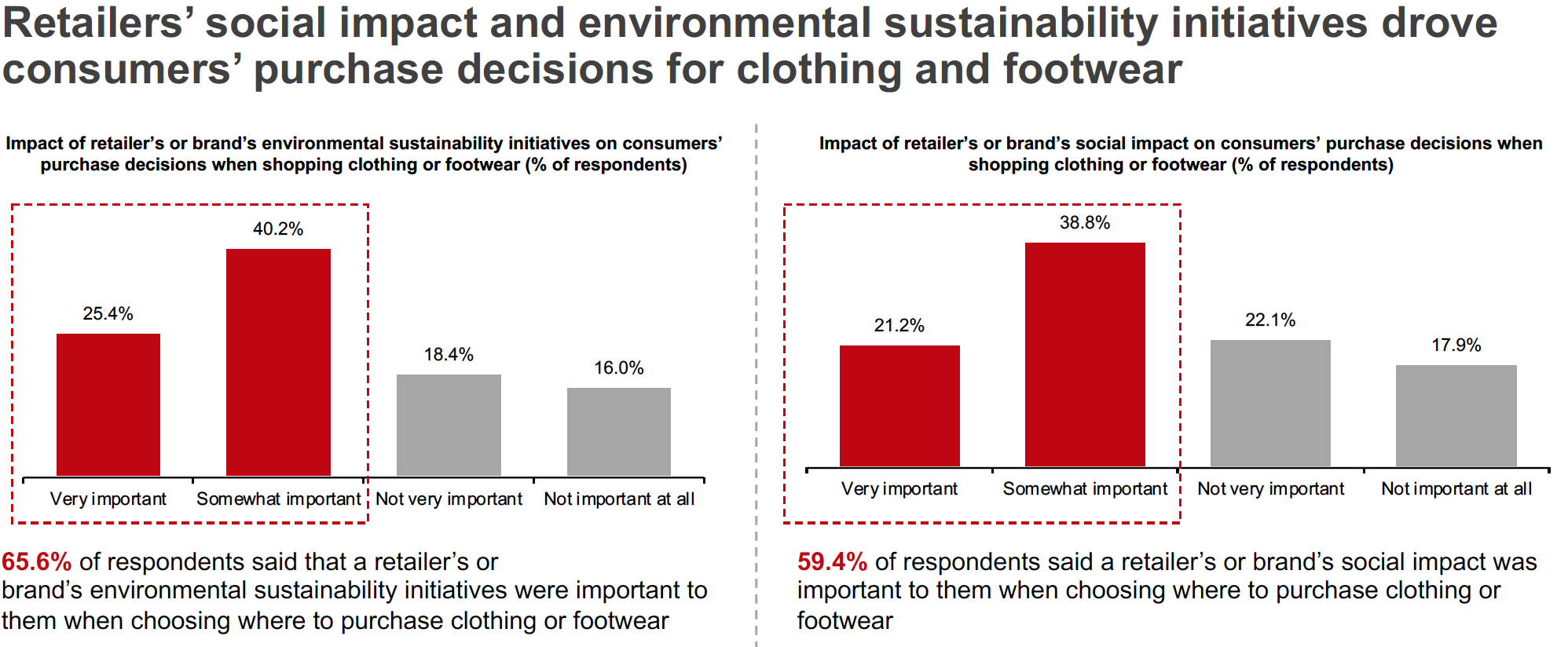

4. Sustainability-Conscious Consumers Drive Environmental Initiatives in RetailConsumers are becoming more conscious of sustainability: 65.6% of consumers in Coresight Research and Blue Yonder’s survey said that a retailer’s or brand’s environmental sustainability initiatives were “somewhat” or “very” important to them when choosing where to purchase clothing or footwear. In addition, 59.4% of consumers said that a retailer’s or brand’s social impact was important to them.

[caption id="attachment_122466" align="aligncenter" width="700"] Source: Blue Yonder/Coresight Research[/caption]

Source: Blue Yonder/Coresight Research[/caption]

Clarke explained that PVH Corp.’s aims to improve its environmental sustainability and that traceability and transparency are the two keywords in the company’s sustainability agenda. She said that approaches to support sustainability are broad and have become integral across many retail sectors and stages of the supply chain. Clarke cited apparel quality control, worker’s rights protection and waste management as examples.

The event saw the participating retail leaders discuss specific sustainability initiatives that their companies are implementing. We highlight four notable examples below:

- Finnegan said that Orvis has been very active in conservation projects. It has committed to donating 5% of its pre-tax profits to protecting nature each year, matching consumers’ donations dollar-for-dollar, working with animal-welfare organizations to help support rescue shelters, and contributing to the preservation of environmental treasures such as Bristol Bay in Southwest Alaska.

- Clarke explained that Tommy Hilfiger has incorporated 3D design to digitize its end-to-end value chain. The technique allows the company to meet customers’ needs quicker and in a more sustainable way. Leveraging 3D design to develop innovative products can represent a powerful competitive advantage for brands and retailers, which we discuss in a separate Coresight Research report, The Consumerization and Digitalization of Product Design.

- Joe Preston, CEO of footwear and apparel brand New Balance, said that the company is using 3D printing technology to produce shoe cushioning with resilient lattice structures, which are more durable and thus improve product sustainability.

- Colin Yankee, Executive Vice President and Chief Supply Chain Officer at Tractor Supply, said that the company offers a number of programs for customers to participate in sustainability initiatives, including recycling of batteries, used oil, cardboard and used pallets.

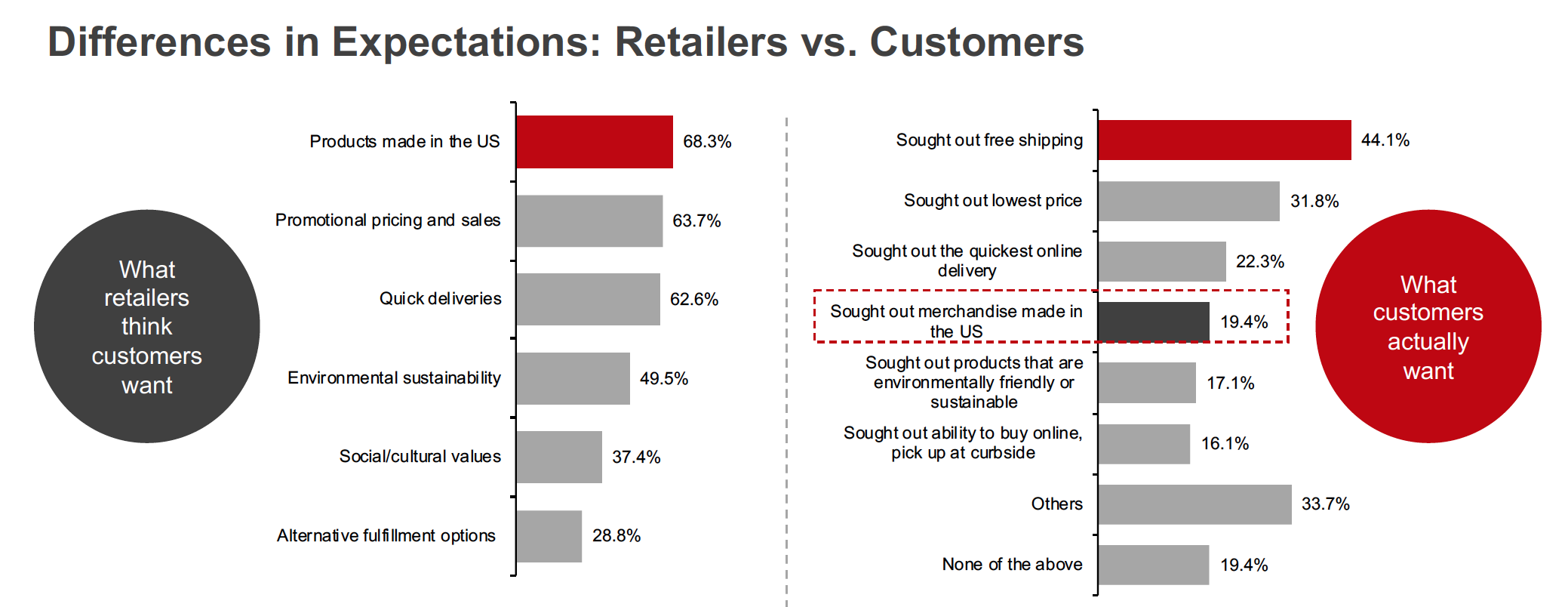

Interestingly, the Coresight Research and Blue Yonder survey found that consumers and retailers have mismatched perceptions of what drives consumers’ purchase decisions: 68% of retailers felt that their consumers valued products made in the US, while only 19% of consumers reported that they sought out products made in the US during the pandemic (since March 2020).

Furthermore, 44.1% of consumers consider free shipping as the top influencing factor in their purchase decisions, with online delivery speed ranking third (22.3% of consumers), presenting opportunities for retailers to improve last-mile delivery.

[caption id="attachment_122468" align="aligncenter" width="700"] Retailers and consumers could choose more than one option

Retailers and consumers could choose more than one option Source: Coresight Research/Blue Yonder[/caption]

Yankee said that it is important to adjust supply chain strategies based on customers’ shifts to more digital buying and their preferences to receive merchandise more quickly. Tractor Supply is planning to improve its regional store and distribution capabilities, as well as optimize its local product assortments. The company’s “Life Out Here” strategy to drive sustainable growth also aims to deliver the products customers need, however, whenever and wherever they need them. According to Yankee, the company recently implemented new technology that enhances its ability to leverage artificial intelligence and data analytics to optimize product assortments and meet the local and regional needs of customers. This technology unlocks vast amounts of data and insights to help Tractor Supply make decisions at the store, category and SKU (stock-keeping unit) levels. Yankee said that the company will continue to transform the customer experience, with a focus on fast delivery and convenience.

6. Physical Stores Play an Important Role in Fulfillment; Consumers Prefer To Shop In-StoreDuring the mini conference, the retail leaders agreed that physical stores are still important for two reasons. First, stores can serve as fulfillment centers. For example, Tractor Supply has recently seen success with its BOPIS (buy online, pick up in store) and Ship-To-Store programs. For 2020, 75% of the company’s omnichannel sales were picked up at a brick-and-mortar store.

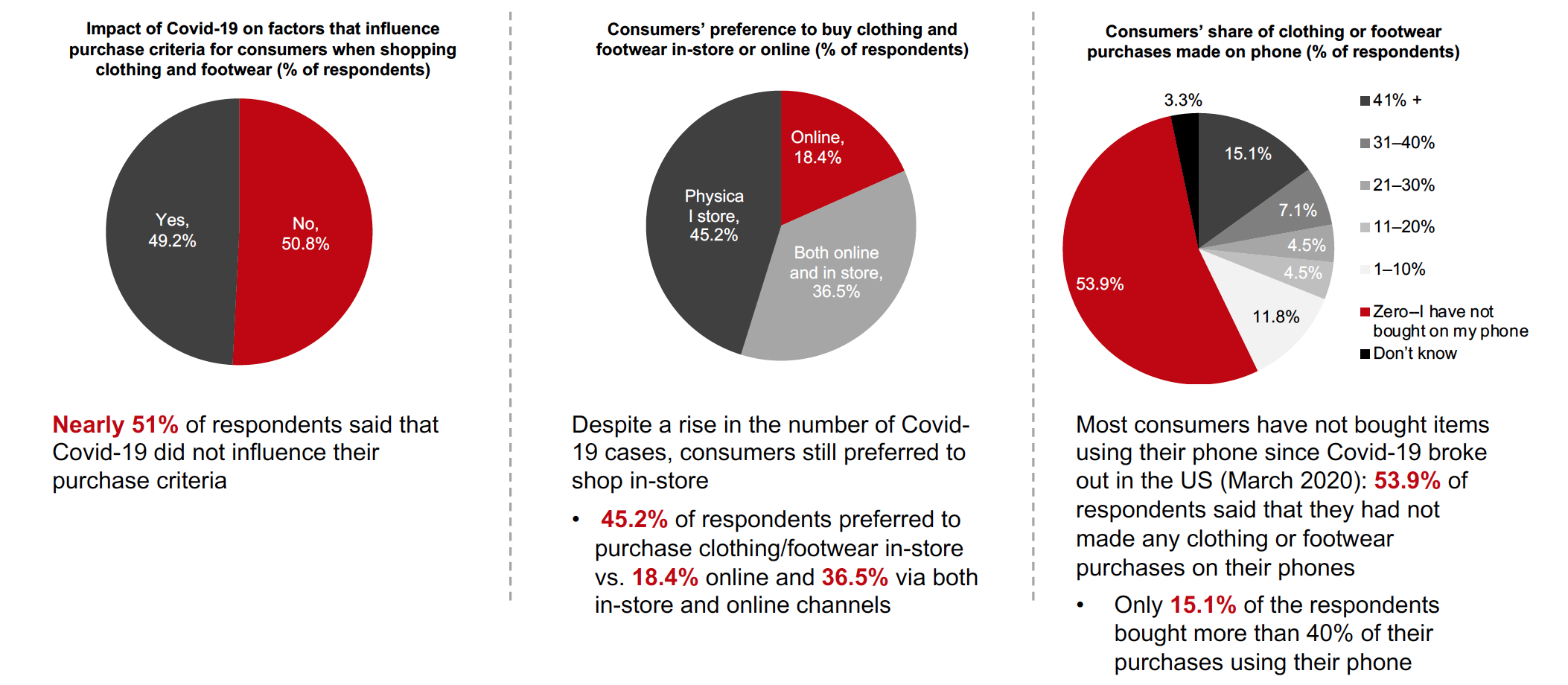

Secondly, despite the Covid-19 pandemic seeing a shift to e-commerce, the Coresight Research and Blue Yonder survey found that many consumers still preferred to shop in-store—in the apparel sector, at least: 45.2% of respondents reported that they preferred to purchase clothing and footwear in stores, versus 18.4% that preferred to shop online and 36.5% via both in-store and online channels. Martin commented that these preferences are likely influenced by retailers’ growing omnichannel capabilities and consumer needs for immediacy in the last mile.

It is also worth noting that most consumers have not bought apparel items using their phone since Covid-19 broke out in the US: 53.9% of consumers said that they had not made any clothing or footwear purchases on their phones. Martin commented that this is surprising, but consumers may still be in a transformational period in which they are getting used to using phones or other digital devices for shopping.

[caption id="attachment_122469" align="aligncenter" width="700"] Source: Coresight Research/Blue Yonder[/caption]

7. Customer Experience Tools Provide Retailers with a Competitive Edge

Source: Coresight Research/Blue Yonder[/caption]

7. Customer Experience Tools Provide Retailers with a Competitive Edge

Finnegan emphasized the importance of the customer experience, and he revealed that the current top investment priority for Orvis is to improve customer experiences, with technology as an enabler. Through its smile-mapping program, Orvis records and analyzes consumer enjoyment in stores. The retailer found that human connection is the most relevant factor that drives customers to smile. Orvis has launched different in-store experiences to engage with customers and enrich their shopping experience. For example, the company offered free fly-fishing lessons for beginners in stores and entitled participants to special discounts on tools, materials and fly tying kits.

Turning to e-commerce, Orvis will launch new digital experiences in April 2021, the details of which will be confirmed in the coming months, according to Finnegan. The company is also working with a handful of technology systems to improve personalization in the shopping journey. Finnegan said that this will help Orvis achieve end-to-end planning and real-time supply chain tracking within the next few years.

8. DTC Selling Will Gain Momentum in 2021Preston highlighted the benefits of retailers’ digital transformation amid the Covid-19 pandemic—specifically, increased capabilities to sell products directly to consumers through their own e-commerce websites. For New Balance, 50% of its business in 2020 was through digital commerce—a combination of e-commerce, pure-play Internet retailers, marketplaces and wholesale partners. In 2021, we believe more apparel retailers and brands will focus on DTC business and reduce their exposure to wholesale channels.

However, Preston warned of challenges in DTC selling. For example, New Balance is seeing rising returns due to inappropriate fit, which cannot be checked by the consumer in the online shopping journey. Returns are costly for retailers, particularly as consumer expectations for low-cost services become ever-more demanding. Another challenge is presented by the large amounts of SKU-level data that requires rationalization and data management.