Nitheesh NH

What’s the Story?

Coresight Research and Blue Yonder conducted two surveys in early January 2021 to understand US retailers’ strategies around local sourcing and the impact of Covid-19 on US consumers’ shopping behaviors. Through our first survey (conducted January 8–11, 2021), we assessed a shift in focus toward local sourcing by retailers across multiple sectors, including consumer electronics, fashion/apparel and consumer packaged goods. In the second survey (conducted January 13–14, 2021), we asked US consumers about their outlook on returning to stores following pandemic-led lockdowns and the factors influencing shoppers’ purchase decisions, covering themes such as sustainability. Based on our findings, we provide insights into the degree to which retailers’ perceptions and strategic priorities are aligning with consumer expectations amid Covid-19.Coresight Research x Blue Yonder: Five Key Retail Insights

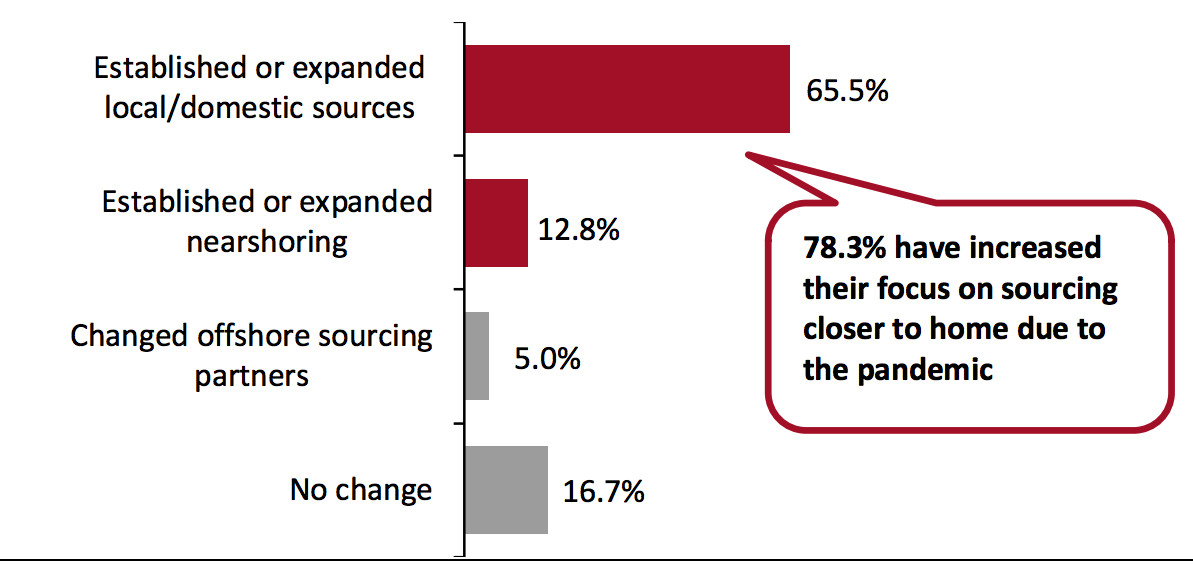

1. Retailers Are Establishing or Expanding Local/Domestic Sourcing We found that 65.5% of retailers surveyed had either established or expanded local/domestic sourcing (sourcing/manufacturing in their home country) in response to Covid-19, while 12.8% established or expanded their nearshoring initiatives (moving sourcing/manufacturing close to their home country). As most countries imposed restrictions on movement of people and goods in 2020, the pandemic caused US retailers to experience slow imports, or even no imports. President Biden signed an executive order in January 2021 aimed at promoting the “Buy American” agenda for the federal government. Through this initiative, an estimated $700 billion will be invested into the US manufacturing industry to encourage retailers and manufacturers to set up local/domestic manufacturing and sourcing centers. This would allow manufacturers to lower transportation and shipping costs as well as facilitate faster turnaround times. We expect to see a gradual shift toward local/domestic sourcing in the US in 2021. Figure 1. US Retailers: Sourcing Changes Implemented due to Covid-19 (% of ) [caption id="attachment_123426" align="aligncenter" width="640"] Base: 281 US retailers

Base: 281 US retailersSource: Blue Yonder/Coresight Research[/caption]

1. Retailers Aim To Achieve Better Quality Control via Local Sourcing and Nearshoring

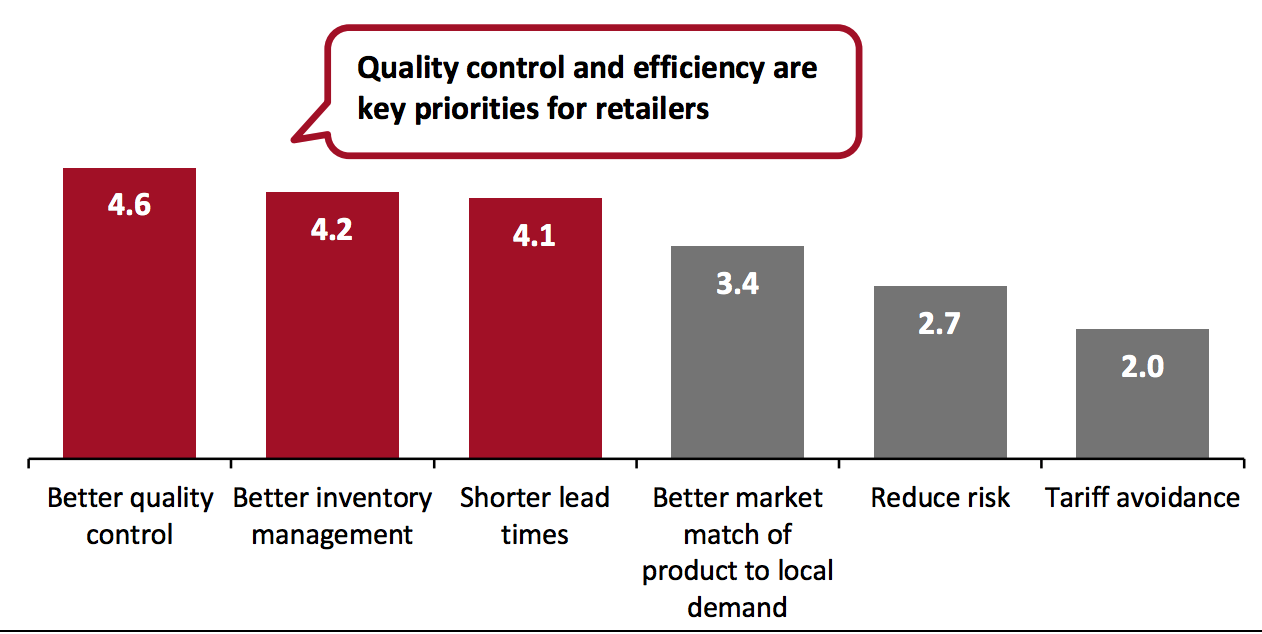

By adopting a nearshoring or domestic sourcing strategy, retailers aim to not only to reduce lead times but also to establish a robust and integrated value chain to better manage inventory and meet consumer demand. Furthermore, most retailers in our survey cited better quality control as a top benefit of these practices (see Figure 2).

In a virtual mini conference hosted on January 26, 2021 by Coresight Research and Blue Yonder, Steve Lamar, President and CEO of the American Apparel and Footwear Association, said that establishing local/domestic manufacturing presents opportunities for US manufacturers and employment in the apparel and footwear industry. Retailers can closely monitor product quality and adjust inventory based on customer demand, he added.

Figure 2: Retailers’ Ranking of Benefits To Be Achieved by Adopting a Domestic Sourcing or Nearshoring Strategy (Score*)

[caption id="attachment_123427" align="aligncenter" width="720"] *Retailers were asked to rank factors and benefits on a scale of 1 to 6, with 1 being most important and 6 being least important. The chart depicts the weighted score for each benefit. Base: 281 US retailers

*Retailers were asked to rank factors and benefits on a scale of 1 to 6, with 1 being most important and 6 being least important. The chart depicts the weighted score for each benefit. Base: 281 US retailersSource: Blue Yonder/Coresight Research[/caption]

However, the costs of establishing or expanding local sourcing and nearshoring strategies are a primary concern for retailers, according to our survey. In order to achieve the benefits of speed, flexibility and quality control, retailers must set up an integrated value chain to prevent delays in raw material supply and effectively manage the increased expenses associated with nearshoring and domestic sourcing.

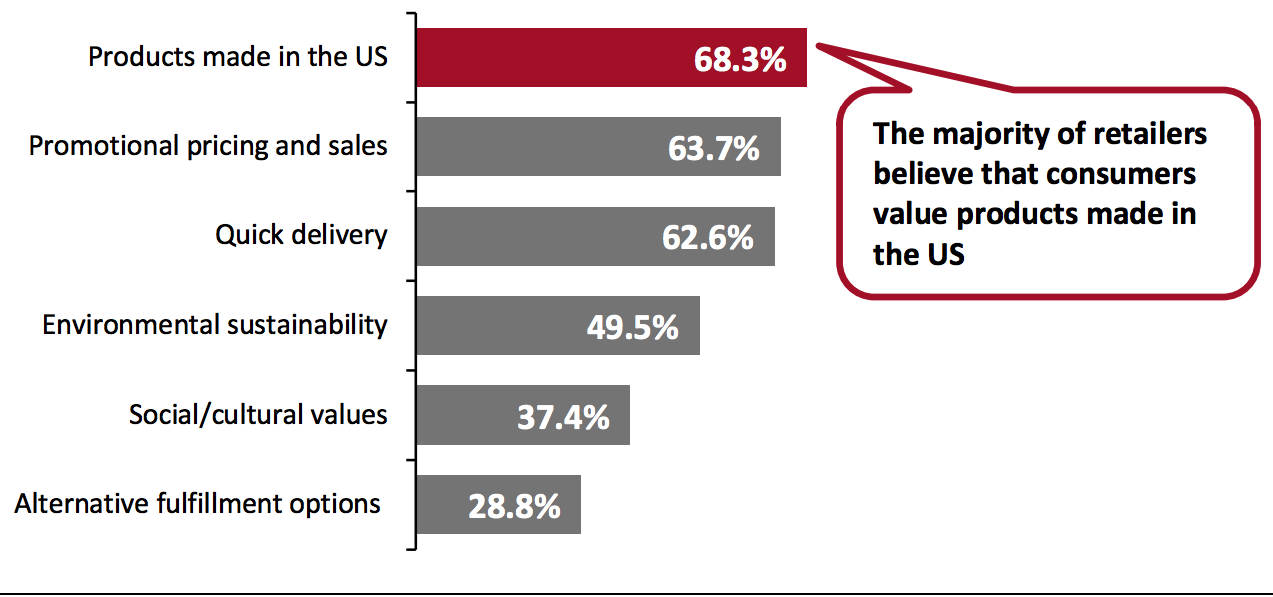

1. Retailer-Consumer Disconnect on Consumer Priorities When Shopping

Retailers’ perception of growing demand for products made in the US has influenced their decisions to adopt and expand local sourcing and manufacturing. In fact, our survey found that 68.3% of the US retailers we surveyed believe that consumers value domestically made products (see Figure 3).

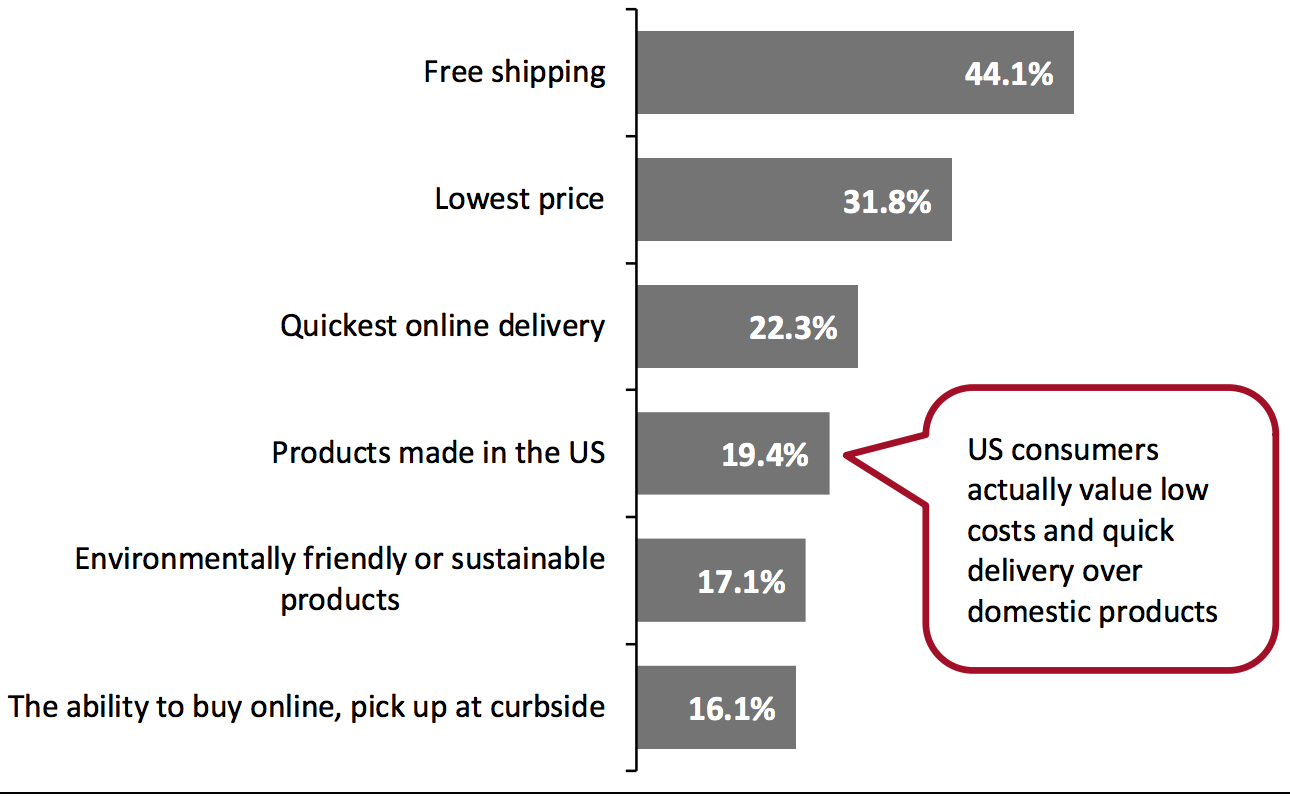

However, when we asked consumers about their priorities when shopping for clothing and footwear during the pandemic (since March 2020), only 19% said that they sought out products made in the US. Most consumers actually cited free shipping as a top priority when shopping for clothing and footwear online, followed by low prices and quick delivery (see Figure 4).

This disconnect between retailers’ perception and consumer demand may mean that retailers are misdirecting their efforts to appeal to shoppers in the current environment; although local sourcing and manufacturing may benefit retailers’ operations, such strategies may be underwhelming in driving sales.

Figure 3: US Retailers’ Perceptions of Consumer Demand (% of Respondents) [caption id="attachment_123428" align="aligncenter" width="720"] Retailers could choose more than one option Base: 281 US retailers

Retailers could choose more than one option Base: 281 US retailersSource: Blue Yonder/Coresight Research[/caption] Figure 4: US Consumer Priorities amid the Pandemic: What Consumers Sought Out While Shopping for Clothing and Footwear (% of Respondents) [caption id="attachment_123429" align="aligncenter" width="720"]

Consumers could choose more than one option Base: 445 US consumers

Consumers could choose more than one option Base: 445 US consumersSource: Blue Yonder/Coresight Research[/caption]

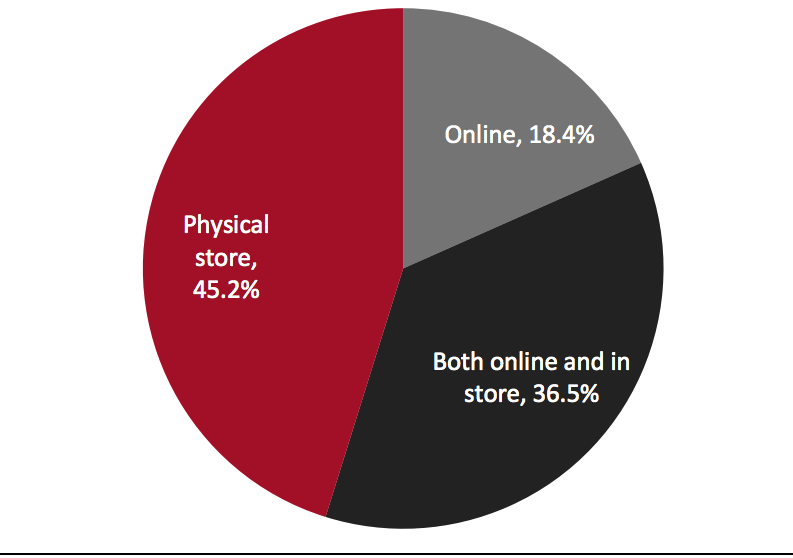

1. Most Consumers Still Prefer In-Store Shopping to Online Shopping

Physical stores remain significant despite lockdowns and the indefinite store closures announced across countries for more than 10 months. The Coresight Research and Blue Yonder survey asked respondents where they prefer to purchase clothing and footwear: 45.2% of consumers reported that they prefer physical stores to online shopping; and 36.5% selected both in-store and online shopping (see Figure ). Consumers’ preferences are likely to be influenced by retailers’ increased focus on developing omnichannel and last-mile delivery capabilities.

[caption id="attachment_123430" align="aligncenter" width="520"] Base: 445 US consumers

Base: 445 US consumersSource: Blue Yonder/Coresight Research[/caption]

A lot has changed since Covid-19 hit the world and changed the way we shopped. However, with the continued phased rollout of vaccinations, we expect consumer behaviors to adjust somewhat in 2021. Consumers are likely to be eager to return to stores and workplaces as the pandemic eases, and we will see a shift back to spending on experiences such as dining out, entertainment and travel. As Americans return to physical stores, it is critical for retailers to not only follow hygiene protocols but also communicate to consumers that they are following them in an effective manner, in order to encourage shoppers to visit stores.

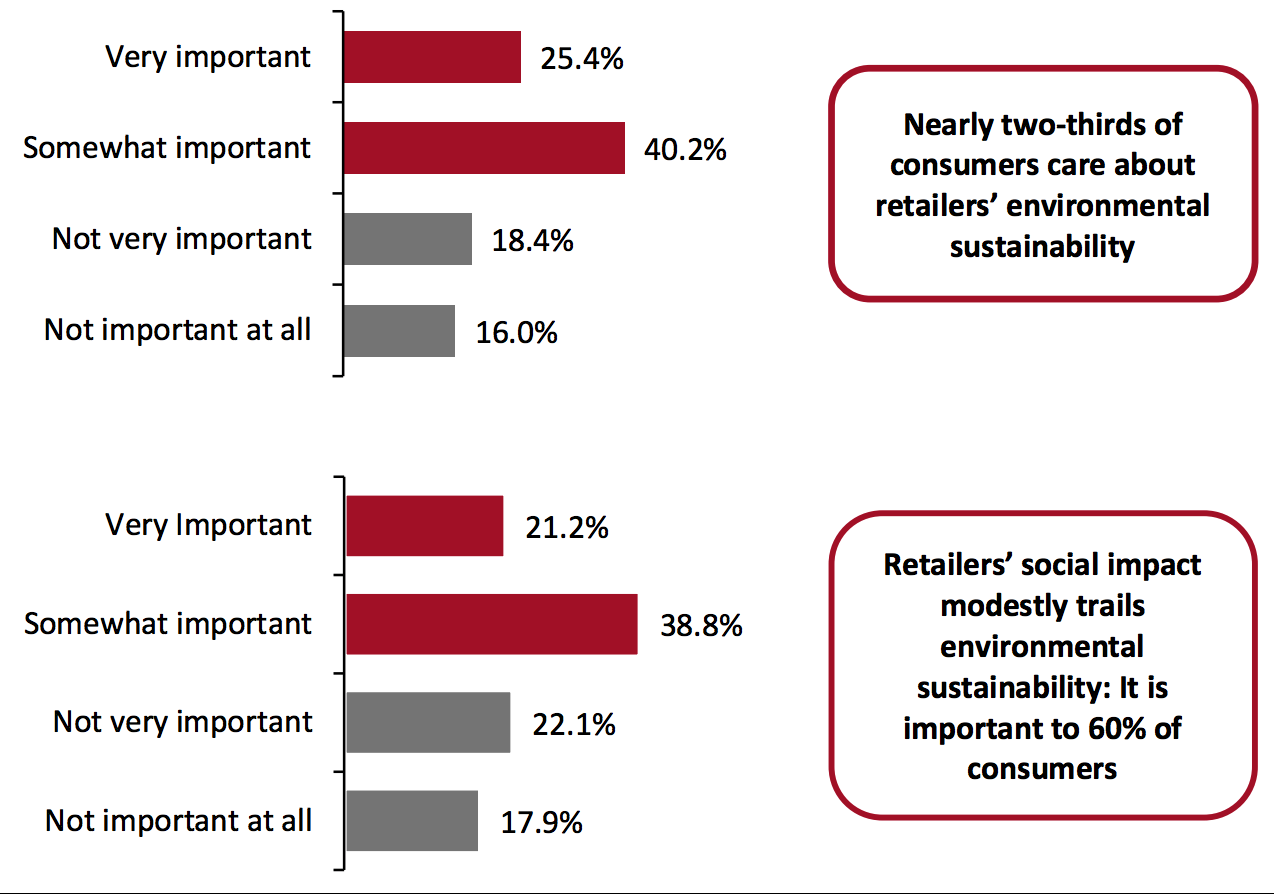

1. Retailers’ Environmental Sustainability and Social Impact Initiatives Are Important to Consumers in Choosing Where To Shop

While it is a top purchase driver (cited by nearly one-fifth of respondents), sustainability trails practical and cost-savings considerations such as free shipping, low prices of products and speed of delivery (as discussed earlier). However, in choosing which retailers to shop from, US consumers are becoming increasingly conscious of environmental concerns, and it is no longer an option for brands and retailers to ignore sustainability issues.

When asked specifically about retailers’ environmental sustainability, 65.6% of respondents said that it was an important factor for them in selecting where to buy apparel and footwear. Furthermore, 59.4% of respondents reported that retailers’ social impact—including commitment to a diverse or inclusive workplace and providing workers with educational benefits and/or health and social services—was important to them when shopping for apparel and footwear.

Figure 6: Importance of Retailers’ Environmental Sustainability (Top) and Social Impact (Bottom) to US Consumers in Choosing Where To Shop for Clothing and Footwear (% of Respondents)

[caption id="attachment_123431" align="aligncenter" width="720"] Base: 445 US consumers

Base: 445 US consumersSource: Blue Yonder/Coresight Research[/caption]

What We Think

US retailers have established or expanded local/domestic sourcing in response to the pandemic, and we believe that in 2021, many more are going to bring some part of their supply chain back to the US to gain better quality control and flexibility. By establishing local sourcing, retailers can meet consumers’ expectations for quick and cheaper deliveries.

Despite the pandemic driving a shift to e-commerce last year, our survey found that US consumers still prefer to shop for clothing and footwear at least partly in brick-and-mortar stores—and retailers across all sectors have been responding to consumers’ growing demand for omnichannel shopping. For example, in the Coresight Research and Blue Yonder virtual mini conference, Tractor Supply said that it had successfully accelerated its BOPIS (buy online, pick up in store) and Ship-To-Store programs to meet demand. Technology innovators can look to capitalize on retailers’ need to innovate in this space going forward. Retailers should not lose focus on improving sustainability, as shoppers are becoming more environmentally conscious and want to associate themselves with brands they believe have a positive social and environmental impact.