Countdown to 11.11

Since its launch in 2009, Double 11 has become synonymous with online shopping festivals in China. It has also led to the launch of many other shopping festivals, such as 6.18 Shopping Festival held June 1–18 and 8.8 Members Festival on August 8.

These events are listed in Figure 1 below.

Source: Company reports/Coresight Research

Recent Festivals

9.9 Mega Sale

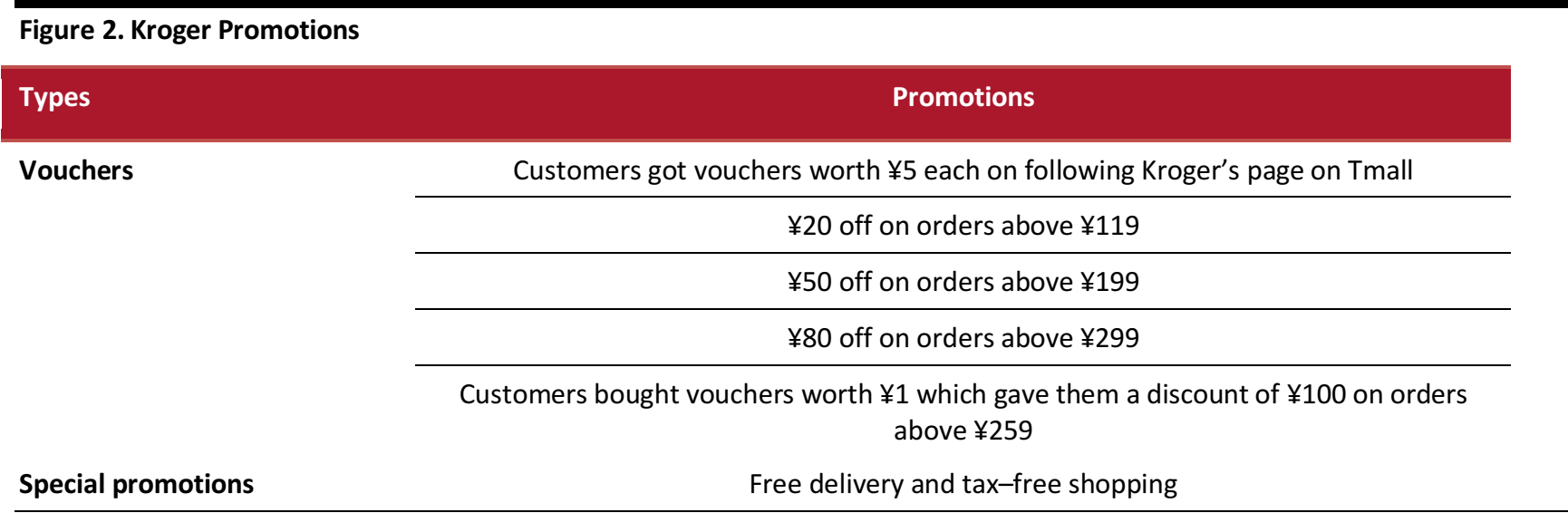

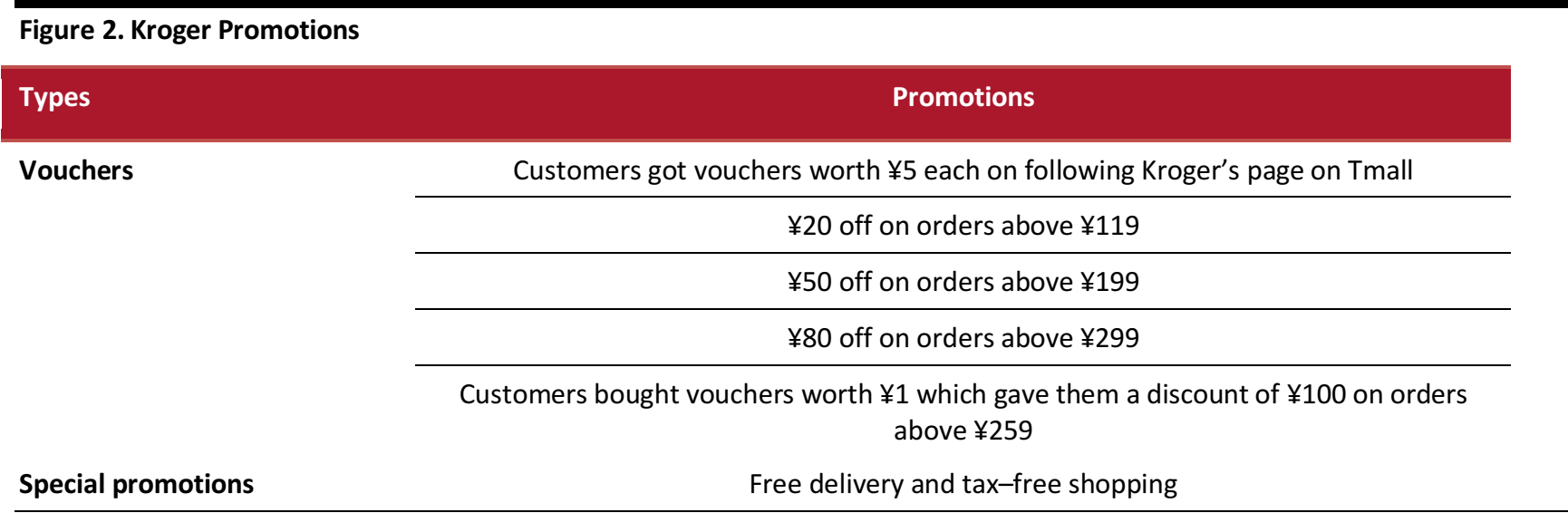

This week, 9.9 Mega Sale ran September 9–10 on Alibaba’s Tmall. During the promotion period, US supermarket chain Kroger offered customers a variety of products in healthcare, personal care, and mother-and-child care categories, along with cold pressed oil and nuts. These products were from Kroger-owned brands including Kroger, Simple Truth, and Private Selection.

During this event, Kroger offered various vouchers that encouraged customers to shop more. For instance, customers got ¥20 (US$3) off on orders above ¥119 (US$ 17). Customers also bought vouchers worth ¥1 (US$ 0.15) which gave them a discount of ¥100 (US$ 15) on orders above ¥259 (US$ 38). Kroger also offered tax–free shopping and free delivery of products.

Source: Tmall/Coresight Research

9.9 Global Wine and Spirits Festival

Tmall hosted Alibaba’s third annual 9.9 Global Wine and Spirits Festival on September 9–10. During the festival, Wine Australia’s flagship store showcased a wide range of popular Australian wine brands from Treasury Wine Estates, Casella Family Brands, Pernod Ricard Winemakers and ASC Fine Wines Limited. Tmall said it will add more country pavilions and help international wine brands enter Chinese markets.

Source: Iwshang

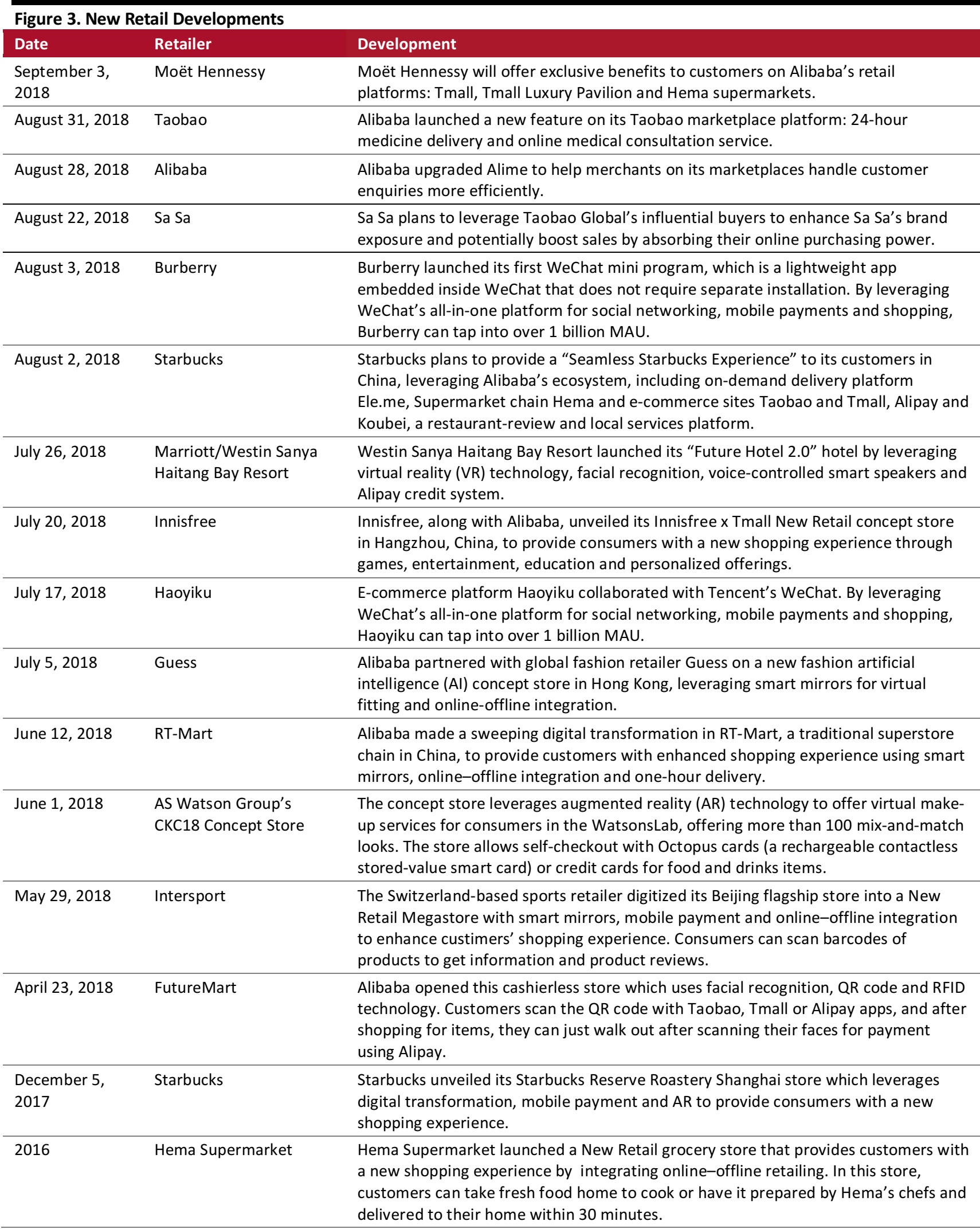

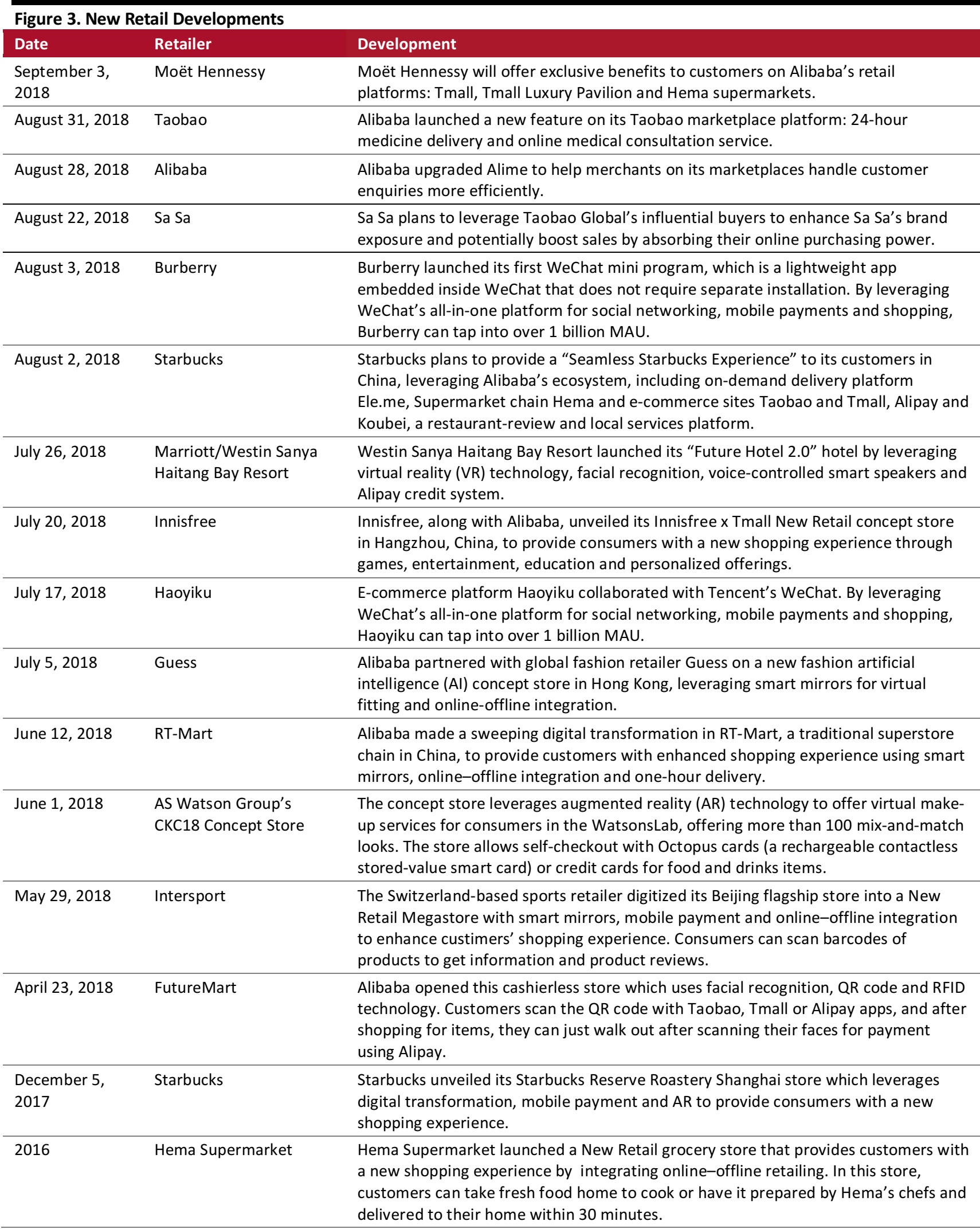

What’s New in New Retail?

Moët Hennessy, Alibaba to Explore “New Retail” Opportunities

LVMH-owned wine and spirits specialist Moët Hennessy and Alibaba are exploring opportunities in New Retail. Moët Hennessy will roll out online-to-offline initiatives to draw in more young Chinese consumers.

Together with Alibaba, Moët Hennessy will adopt several New Retail features:

- Leverage Alibaba’s ecosystem: Moët Hennessy will offer exclusive benefits and shopping privileges for some of its newest products in China to customers across Alibaba’s retail platforms: Tmall, Tmall’s Luxury Pavilion and Hema supermarkets.

- Data analytics: Moët Hennessy will be able to access Alibaba’s database to gain better insights of consumer profile and preferences. The company will also design online initiatives for new product launch and brand events.

Source: Company reports/Coresight Research

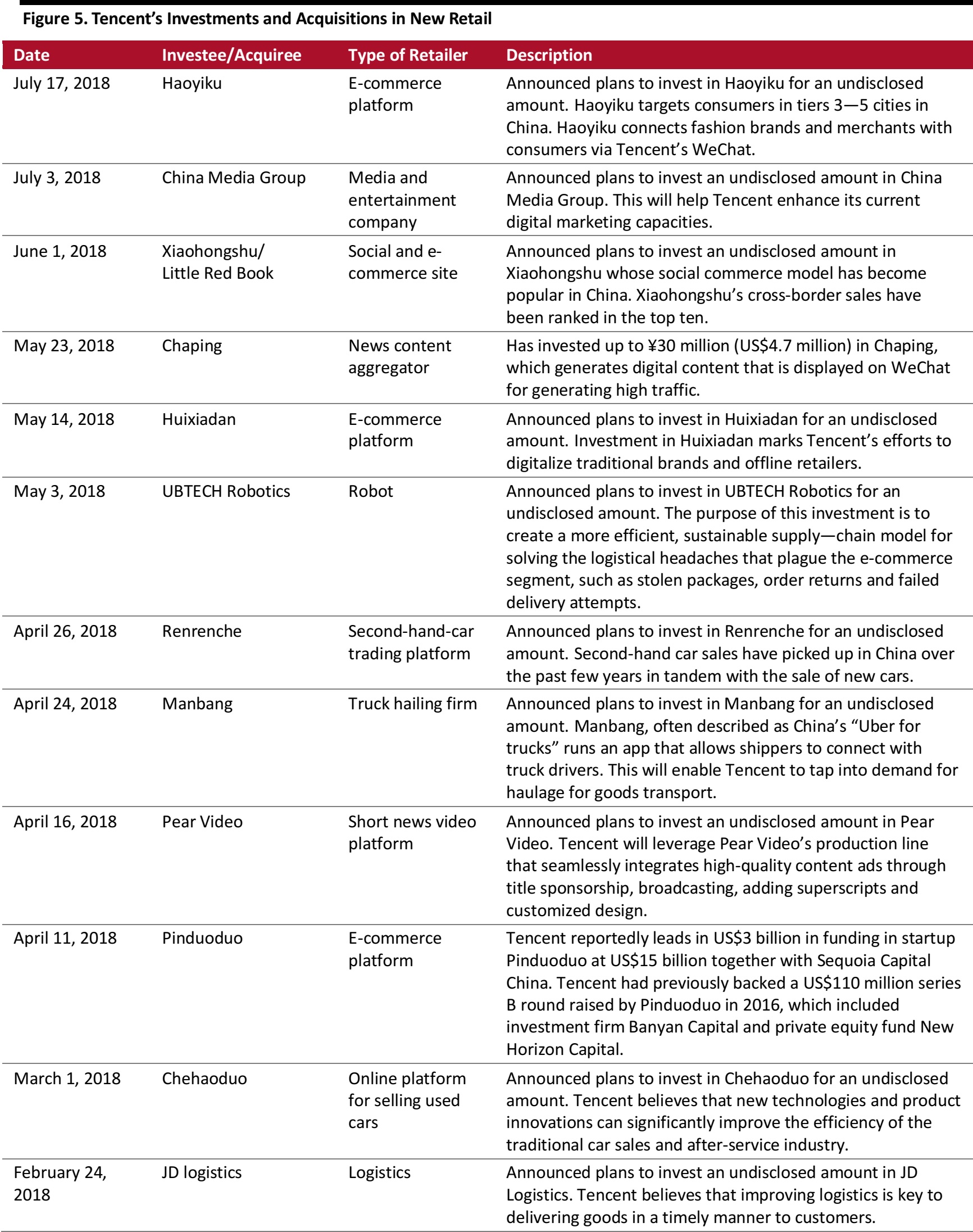

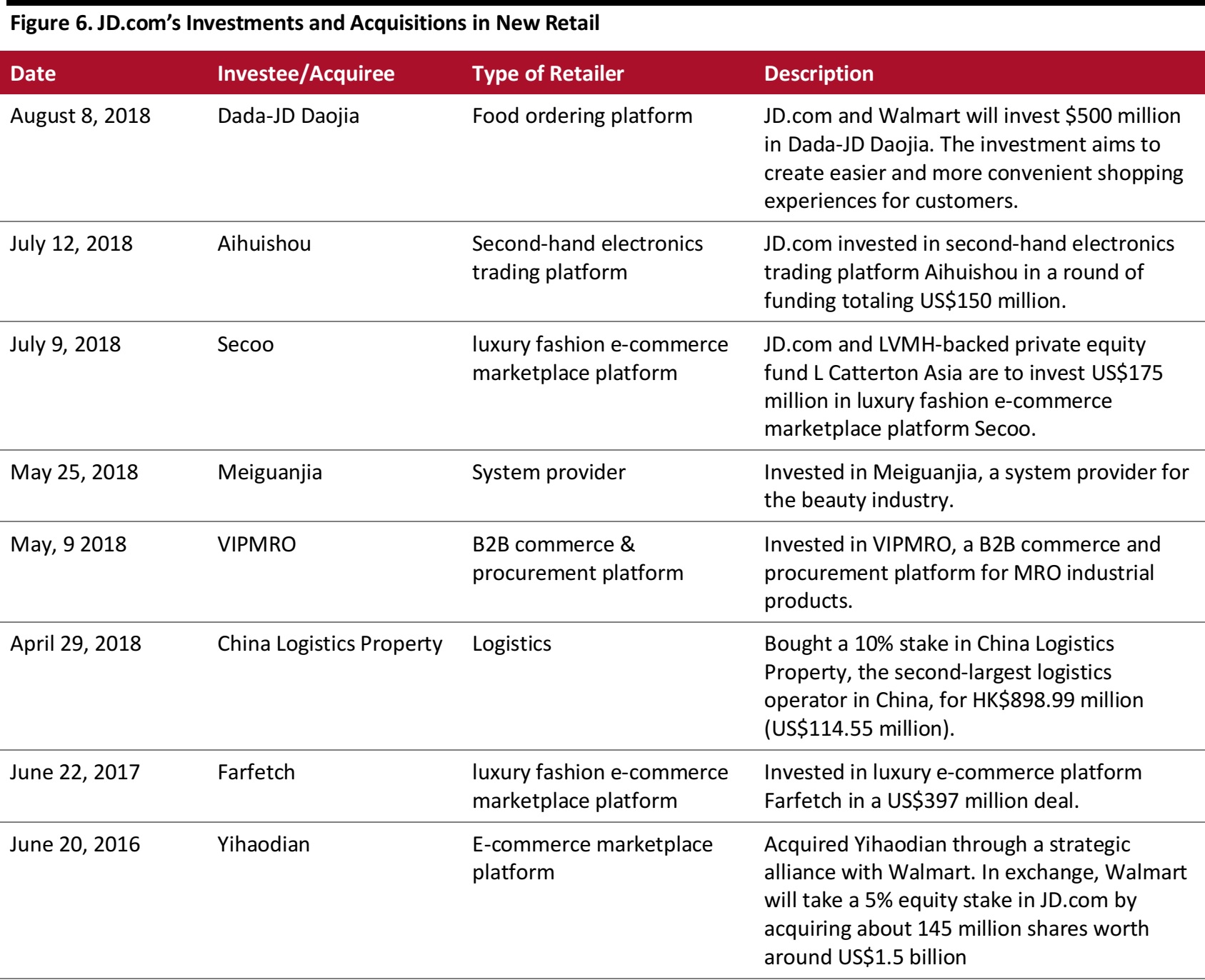

Investments and Acquisitions in New Retail

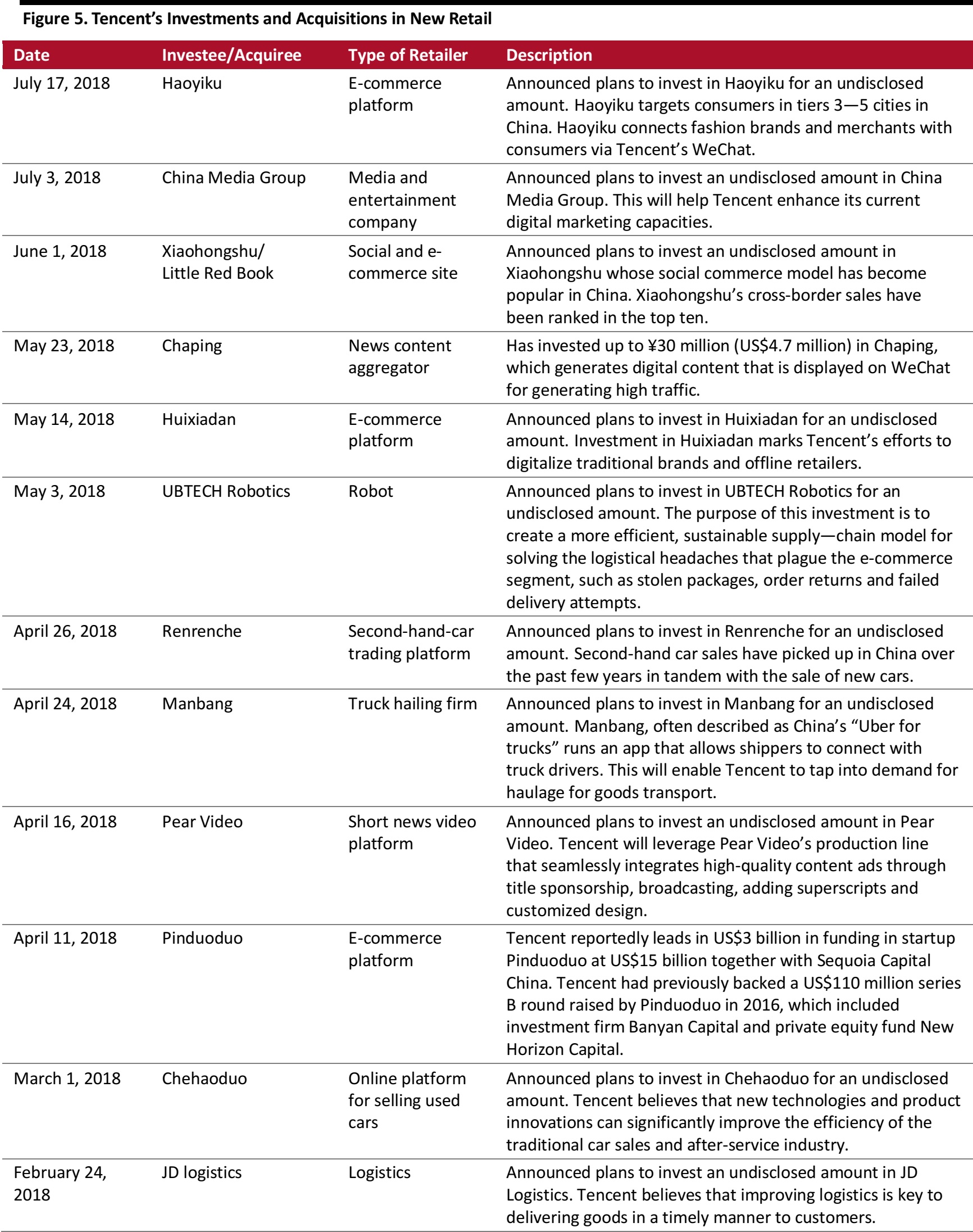

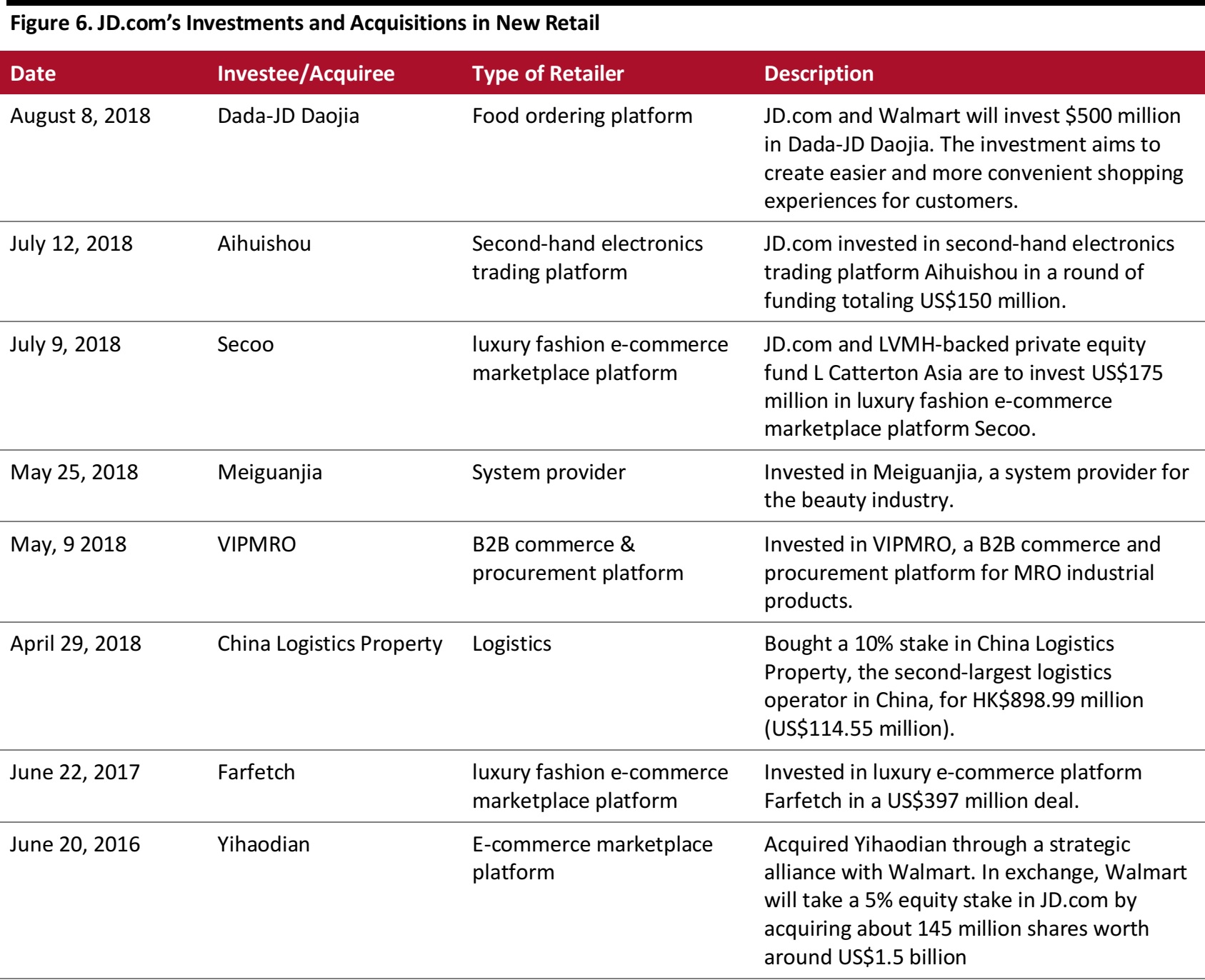

Chinese majors—Alibaba, Tencent and JD.com—have invested in properties to expand their New Retail capacity. These investments range from logistics firms and online marketplaces, to brick-and-mortar stores. Listed in the following table are recent investments of and acquisitions by these companies, including investment date, investee, type of industry, and funding details, wherever available.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research