Countdown to 11.11

When it comes to online shopping festivals in China, the first one that comes to mind is Alibaba’s now well-known Double 11 Shopping Festival. The success of the 11.11 event, which takes place each year on November 11, has led to many more shopping festivals held throughout the year, notably, 3.8 Women’s Day Shopping Festival which coincides with International Women’s Day on March 8, the 618 Shopping Festival and the 88 Members Festival on August 8.

This is the sixth report in our

Countdown to 11.11 series, which covers the various shopping festivals as well as developments in New Retail taking place through to November 11.

Source: Alibaba/KaiTao/Coresight Research

Recent Festivals

Smart Cleaning Festival

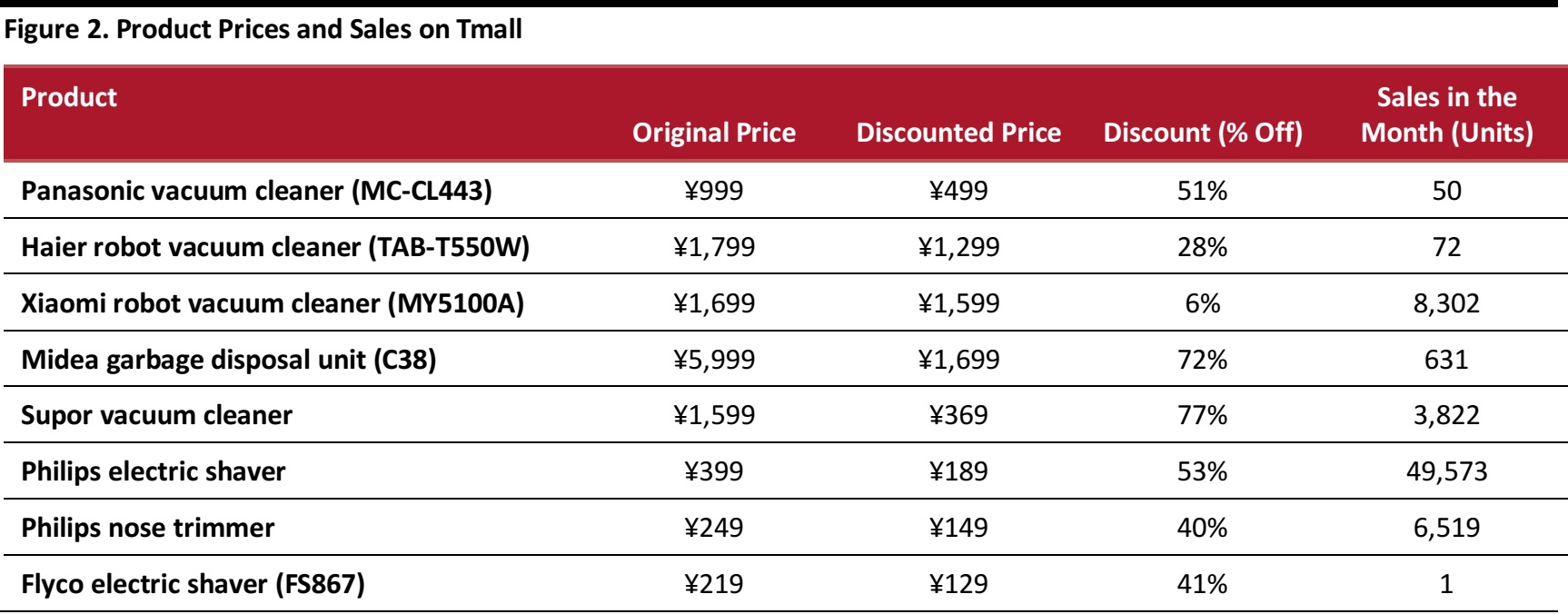

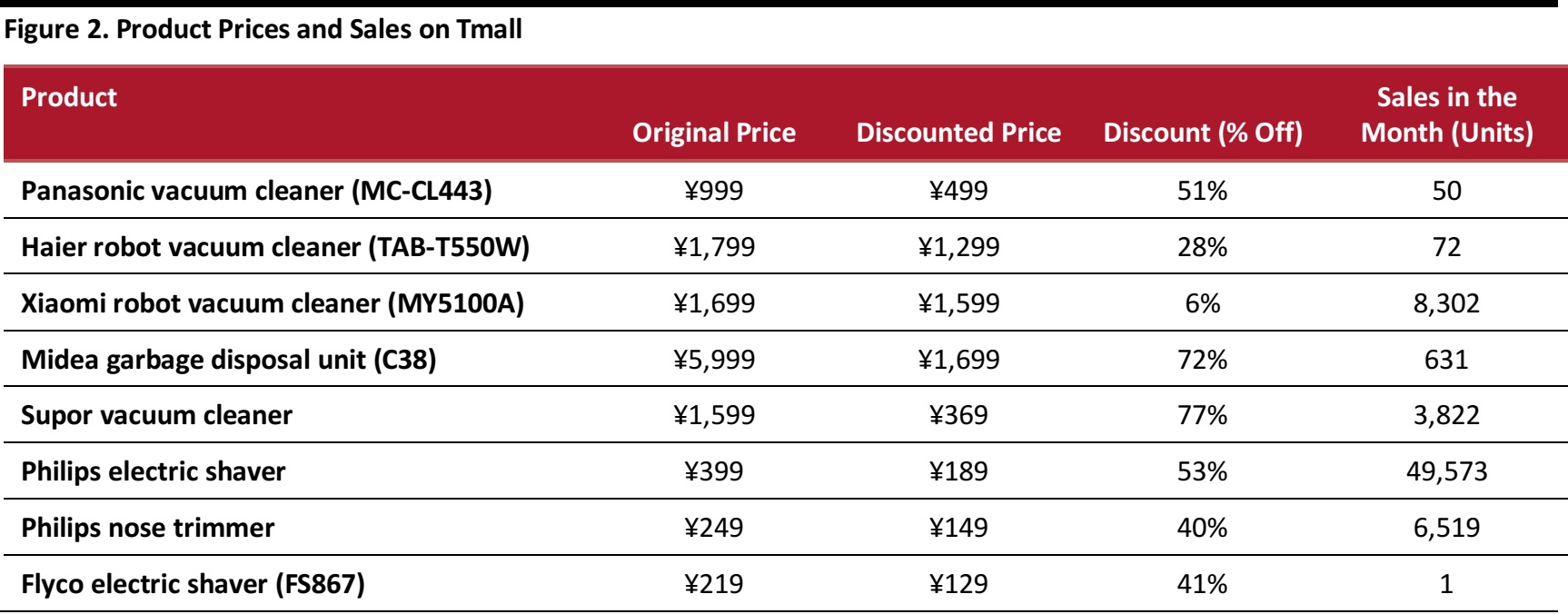

This week, the Smart Cleaning Festival ran August 28–29 on Alibaba’s Tmall site. The event promoted electronic appliances such as vacuum cleaners, electric shavers and robot vacuum cleaners. Many brands participated, including Midea, Haier, Panasonic, Xiaomi, Philips and Supor.

Source: Tmall

Many products were sold at discounts of as steep as 70%. A Midea garbage disposal unit sold for ¥1,699 ($250), 72% off the original price of ¥5,999 ($882). A Supor vacuum cleaner sold for ¥369 ($54), more than 77% off the original price of ¥1,599 ($235), and, as of August 30, over 3,822 units have been sold.

Source: Tmall/Coresight Research

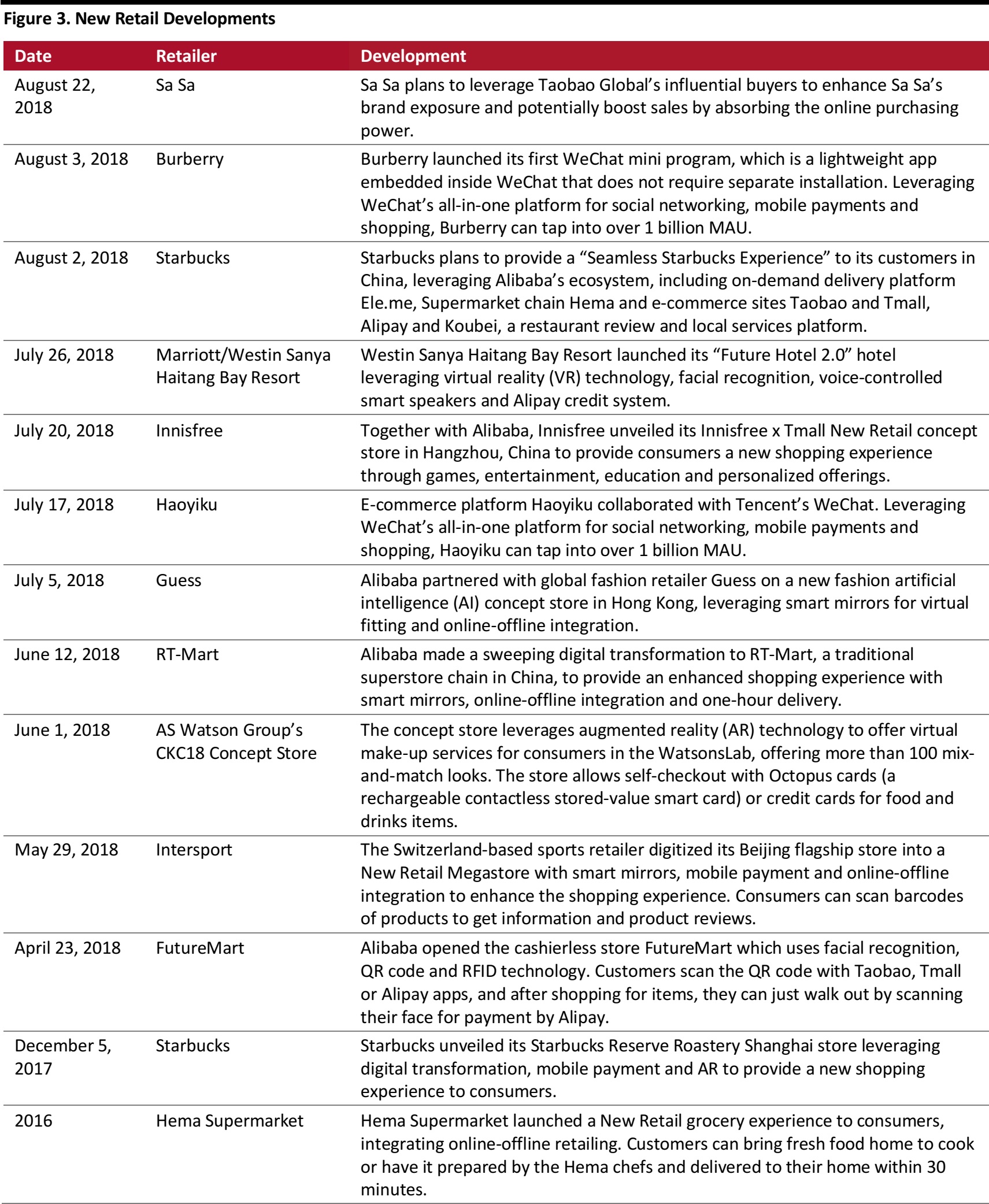

What’s New in New Retail?

Sa Sa Partners with Taobao to Create New Retail Model

Hong Kong cosmetics retailer Sa Sa is collaborating with Alibaba’s e-commerce platform Taobao Global to develop a New Retail operation model combining the online and offline platforms. It plans to offer a more personalized and engaging shopping experience to customers.

Together with Taobao Global, Sa Sa will introduce several New Retail features:

- Leveraging Taobao Global’s influential buyers: Sa Sa will broaden its customer base via Taobao Global buyers. Taobao Global buyers who live abroad excel in exploring local quality brands and are a loyal fan base. They are familiar with running social media in incubating brands.

- Experiential shopping: Approximately 70 Taobao Global buyers will recommend and showcase selected products in the form of in-store live broadcasts to mainland consumers. Mainland consumers can purchase products at the same time when viewing the live broadcasts.

Alibaba Brings RT-Mart from Old to New Retail

Alibaba has worked with hypermarket chain RT-Mart to digitally transform RT-Mart’s operation using New Retail technology since 2018. Alibaba has a 36% stake in RT-Mart’s holding company, Sun Art. Through this New Retail makeover, an RT-Mart store in Shanghai has seen online orders climb to 5,000 a day at its peak compared to nearly zero prior to the collaboration.

Together with Alibaba, RT-Mart has introduced several New Retail features:

- Mobile-first strategy: Consumers can use the RT-Mart app to scan items as they shop to get product information and make better-informed buying decisions.

- Experiential shopping: RT-Mart has installed online shopping kiosks with touch screens that allow customers to browse through Tmall and make their purchases by scanning a QR code with their mobile phone. These Kiosks are located in the Smart Mommy-and-Me corner which is stocked with products for infants and new mothers,

- Fast delivery: RT-Mart fulfills online orders made via its RT-Mart app by using inventory in the store. The company makes home deliveries in as fast as 60 minutes to consumers who live within a three-kilometer radius.

- Data analytics: With the RT-Mart app, the company can calculate and estimate the storage of different types of products in-store, improving the efficiency of the store and reducing storage waste. RT-Mart can also recommend merchandise to customers based on their shopping history and preferences.

Source: Coresight Research/Alizila/AS Watson/Starbucks

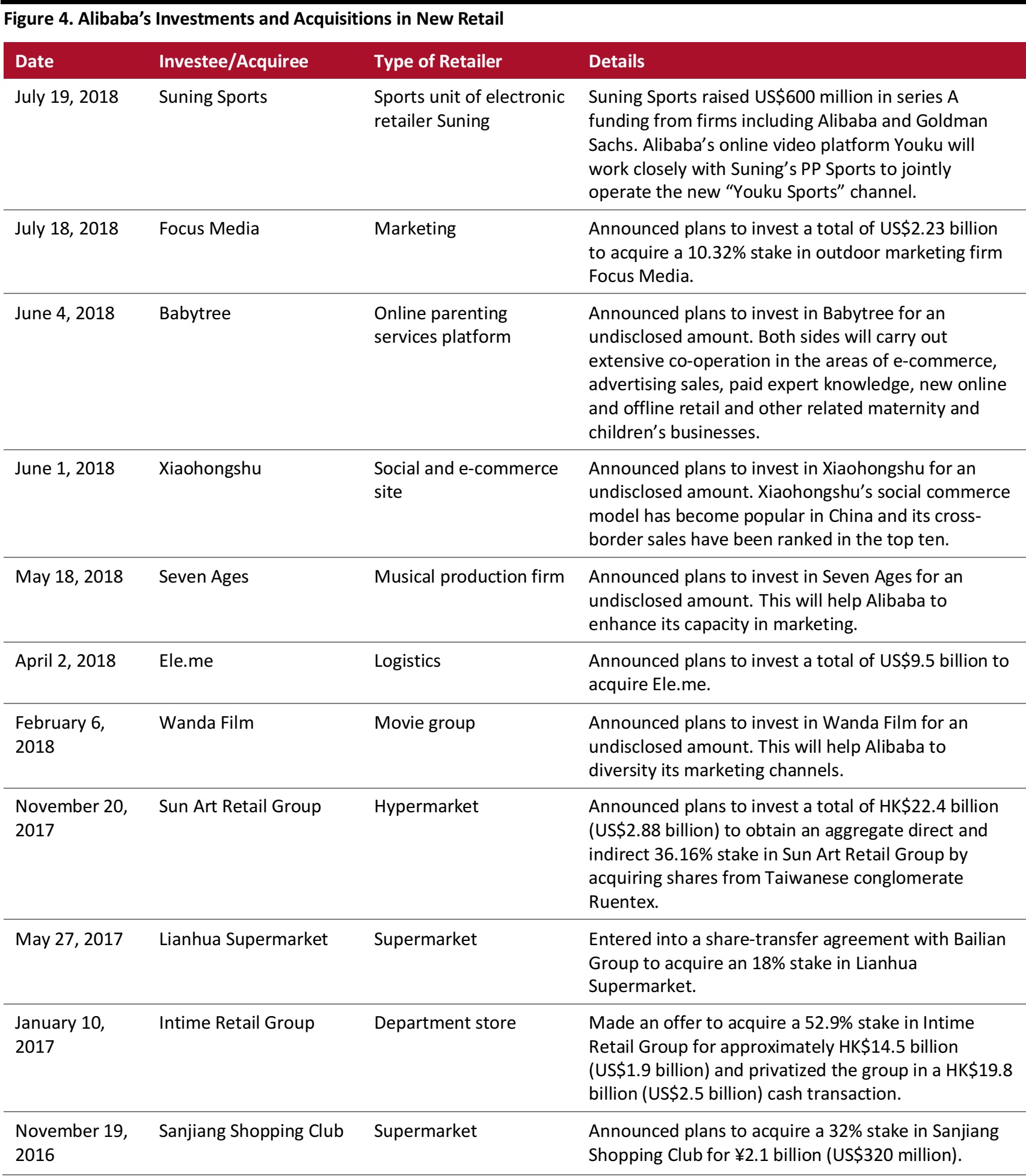

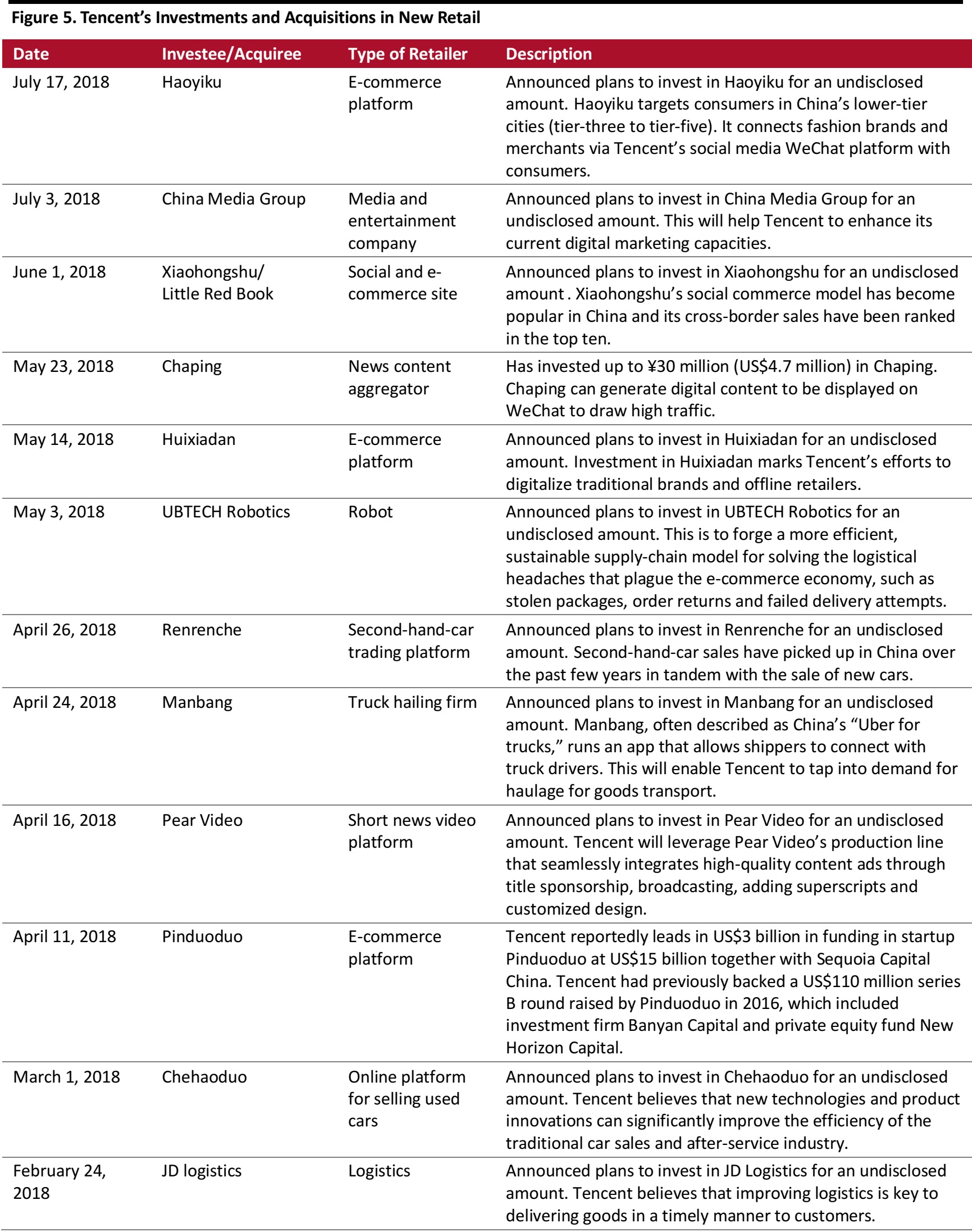

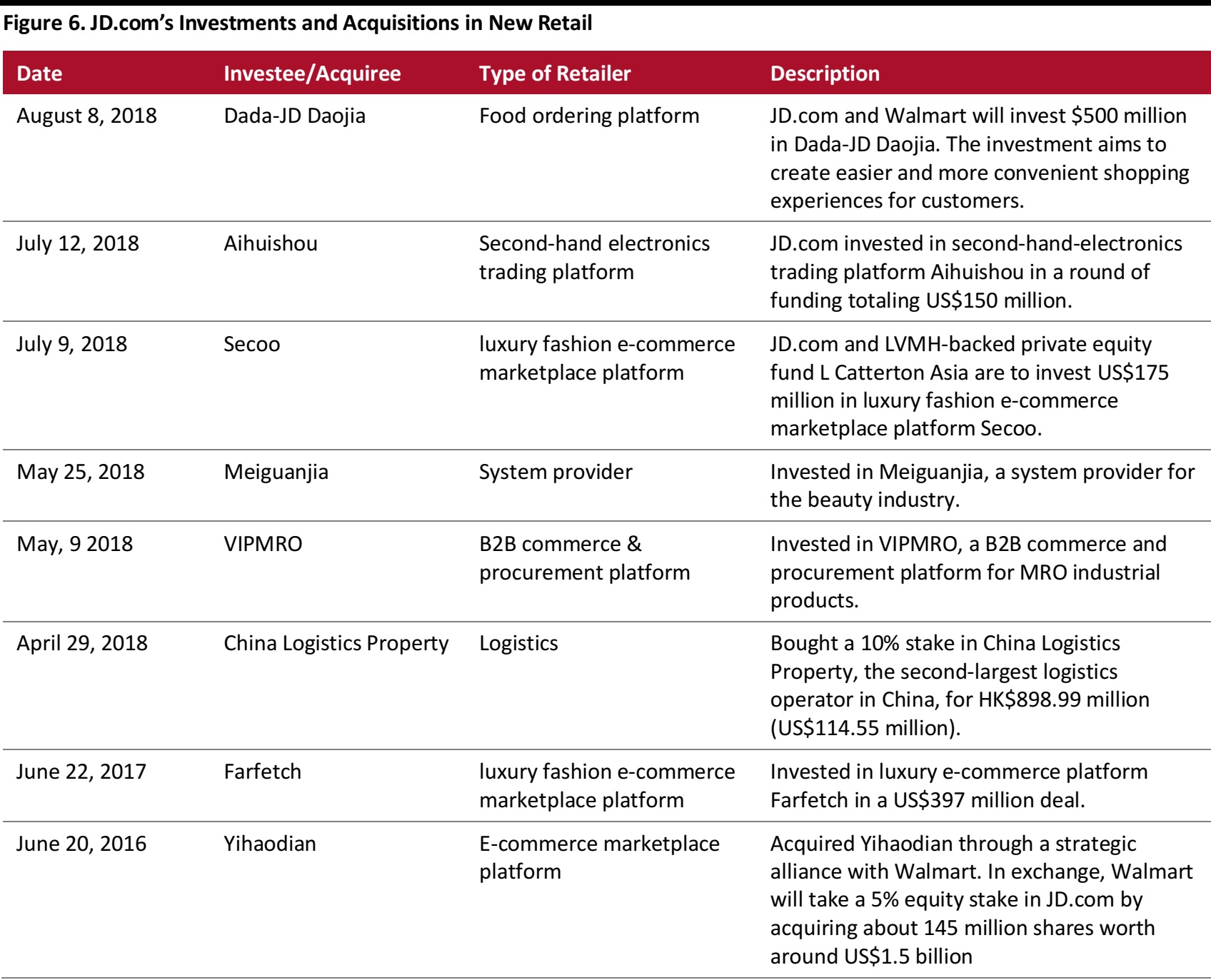

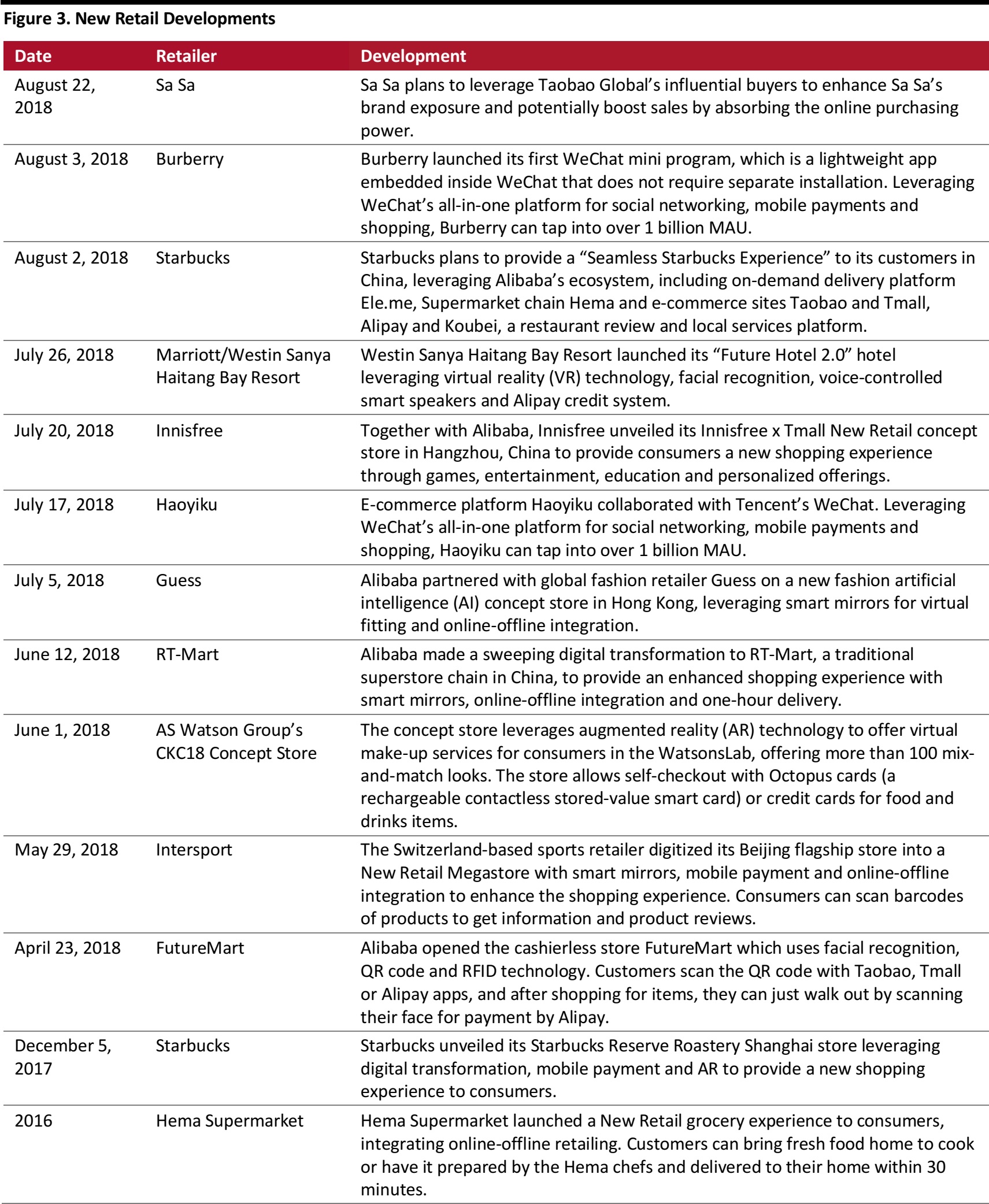

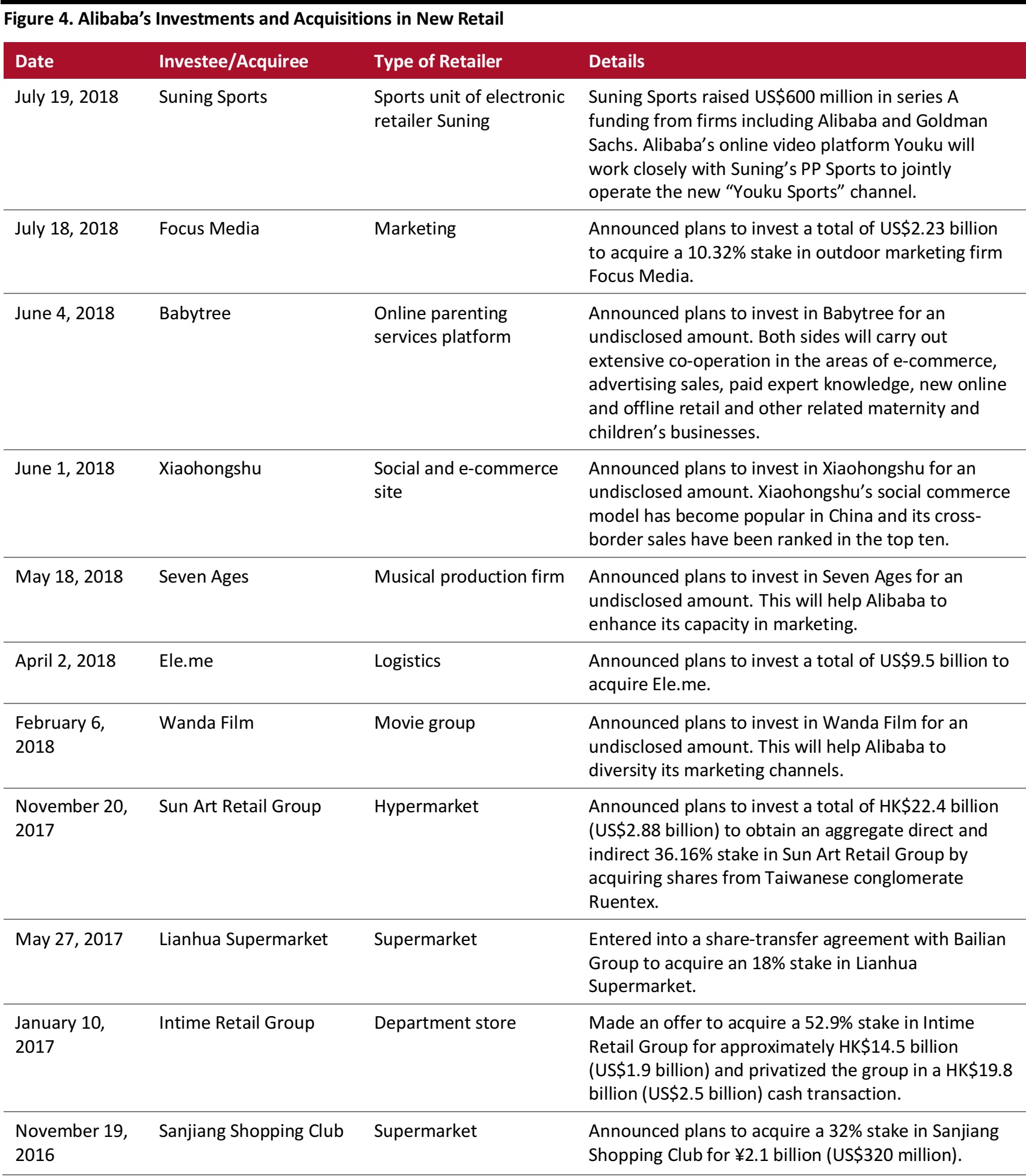

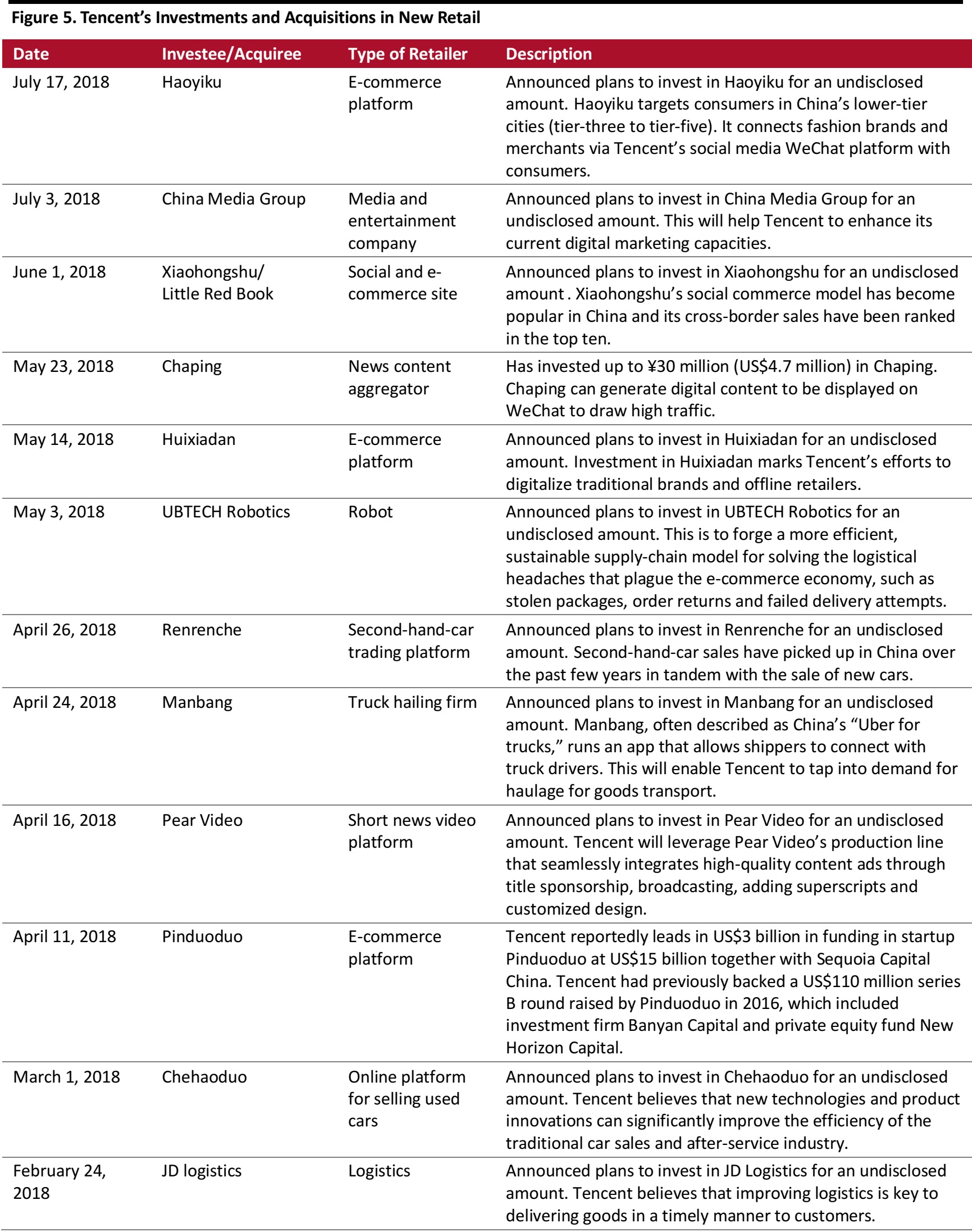

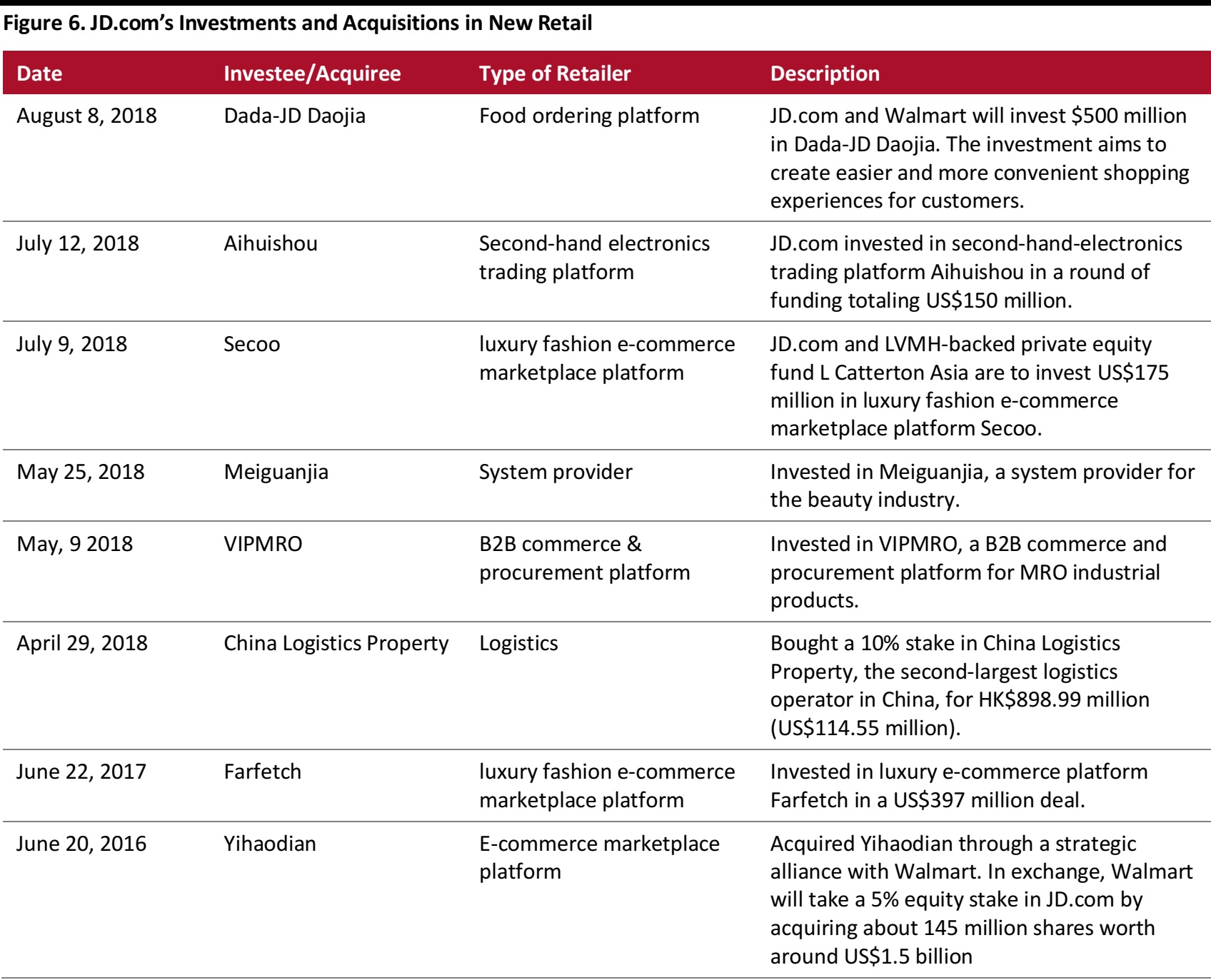

Investments and Acquisitions in New Retail

Chinese majors—Alibaba, Tencent and JD.com—have invested in properties to expand their New Retail capacity. Investments range from logistics firms and online marketplaces, to brick-and-mortar stores. The following tables cover their recent investments and acquisitions, including investment date, investee, type of industry and funding details where available.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research