Countdown to 11.11

When it comes to online shopping festivals in China, the first one that comes to mind is Alibaba’s now well-known Double 11 Shopping Festival. The success of the 11.11 event, which takes place each year on November 11, has led to many more shopping festivals held throughout the year, notably, 3.8 Women’s Day Shopping Festival which coincides with International Women’s Day on March 8, the 618 Shopping Festival and the 88 Members Festival on August 8.

This is the fifth report in our

Countdown to 11.11 series, which covers the various shopping festivals as well as developments in New Retail taking place through to November 11.

Source: Alibaba/KaiTao/Coresight Research

Source: Alibaba/KaiTao/Coresight Research

Upcoming Festivals

Tmall Genie AI Festival

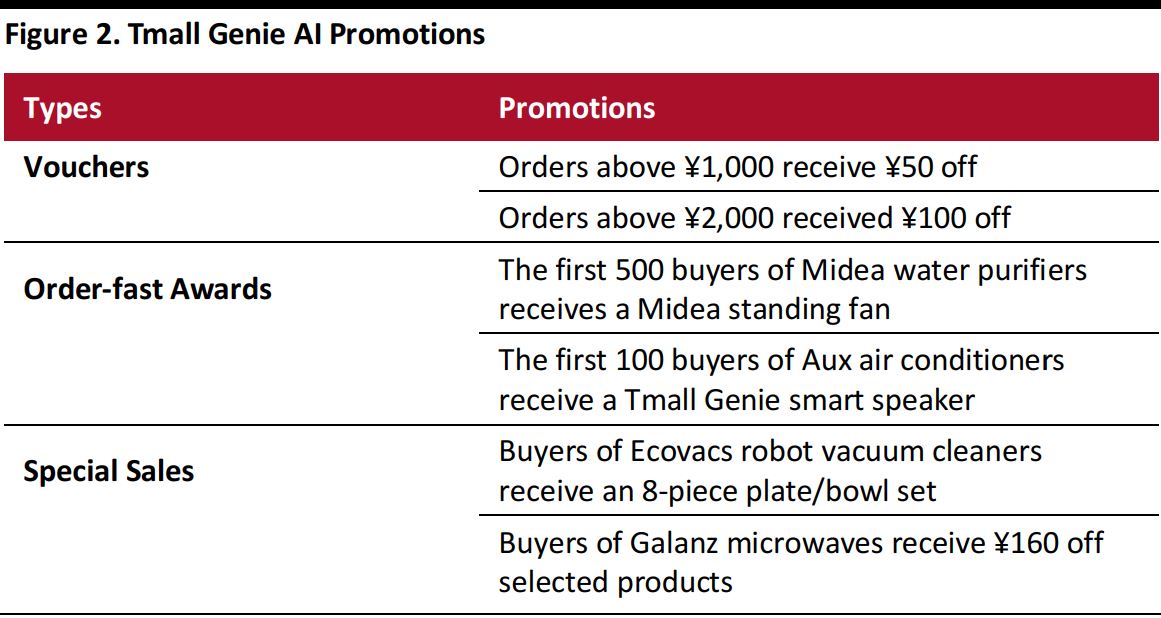

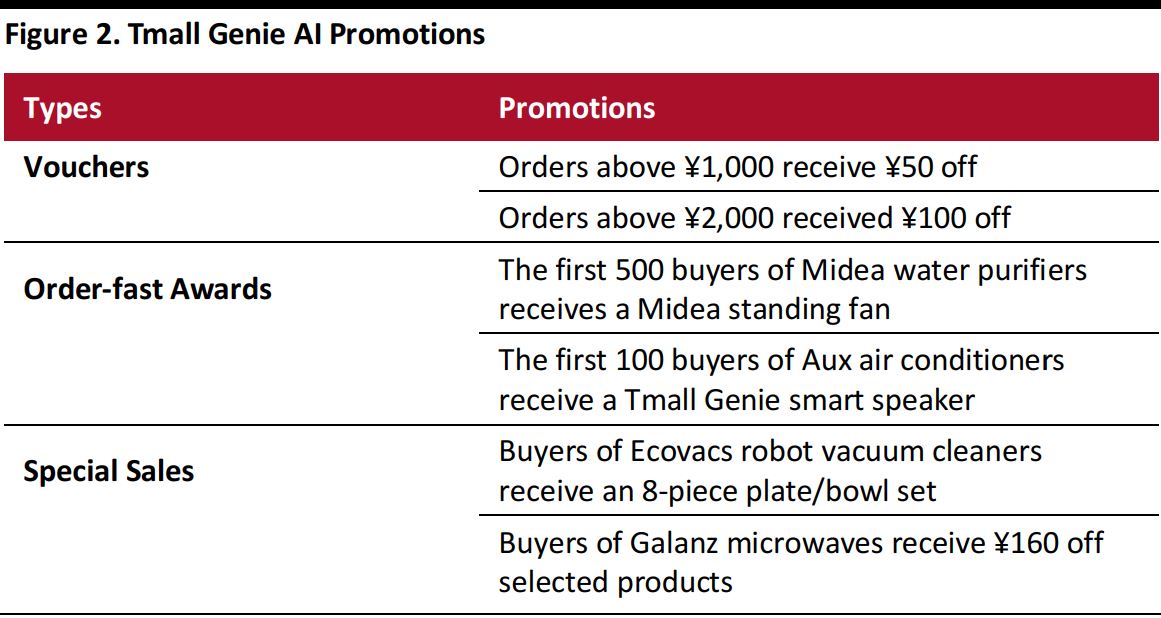

This week saw Alibaba’s Tmall Genie AI Festival on August 20–23 promoting home appliances such as washing machines, air conditioners and microwave ovens. Many brands participated, including Midea, Haier, Aux, Opple, Little Swan and Galanz.

Source: Tmall/Coresight Research

Source: Tmall/Coresight Research

Participating brands offered three types of promotions to encourage customers to shop more and shop faster, including vouchers, order-fast awards and special promotions on certain types of products. For instance, for the order-fast awards, users who are among the first 100 buyers of Aux air conditioners could get a Tmall Genie smart speaker.

Source: Tmall/Coresight Research

Source: Tmall/Coresight Research

What’s New in New Retail?

This week, we review developments at Alibaba Group’s Hema supermarket chain.

Alibaba’s Hema Supermarket Chain—The Tangible Example of New Retail

Hema, the online-to-offline fresh-food-focused supermarket has become the most tangible example of New Retail. Consumers are able to use the Hema app to order groceries or prepared food with the option of home delivery. This supermarket chain has become popular across China. Below, we examine Hema’s New Retail features, the number of stores, expansion plans and its major competitors.

Hema has introduced several New Retail features:

- Mobile-first strategy: Consumers use the Hema app to scan items as they shop to get product information and make better-informed buying decisions. Recently, Hema launched a food-provenance feature that tells customers about a product’s farm-to-store journey to ensure customers are getting high-quality goods.

- Fast delivery: Hema chose to place its warehouse space in each store. This can help to save delivery time and cost, as the distance between the distribution center and the client can be greatly reduced. Hema makes home deliveries in as fast as 30 minutes to consumers who live within a three-kilometer radius.

- Data analytics: With the Hema app, the company can calculate and estimate the storage of different types of products in different stores, improving the efficiency of each store and reducing storage waste. Hema can also recommend merchandise to customers based on their shopping history and preferences.

Hema’s Stores and Expansion Plans

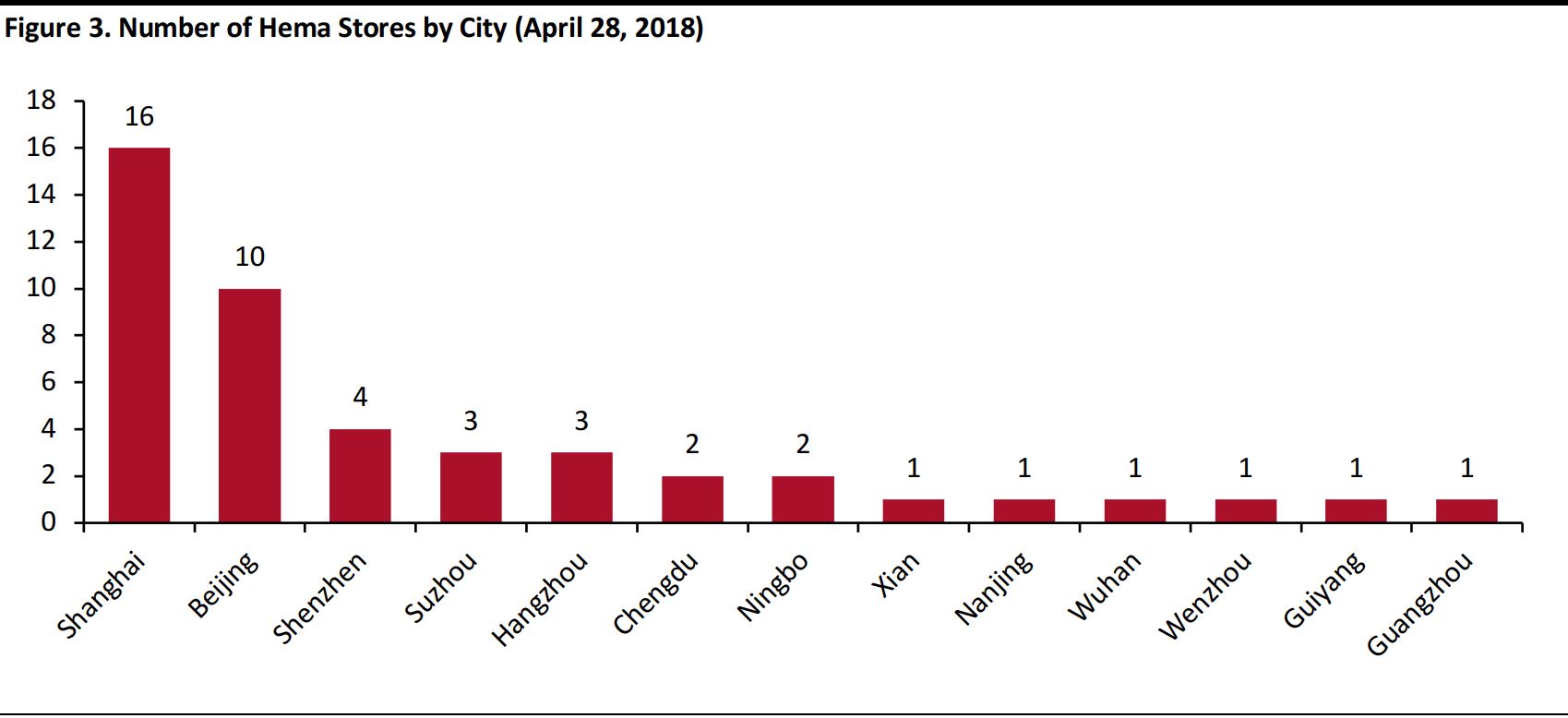

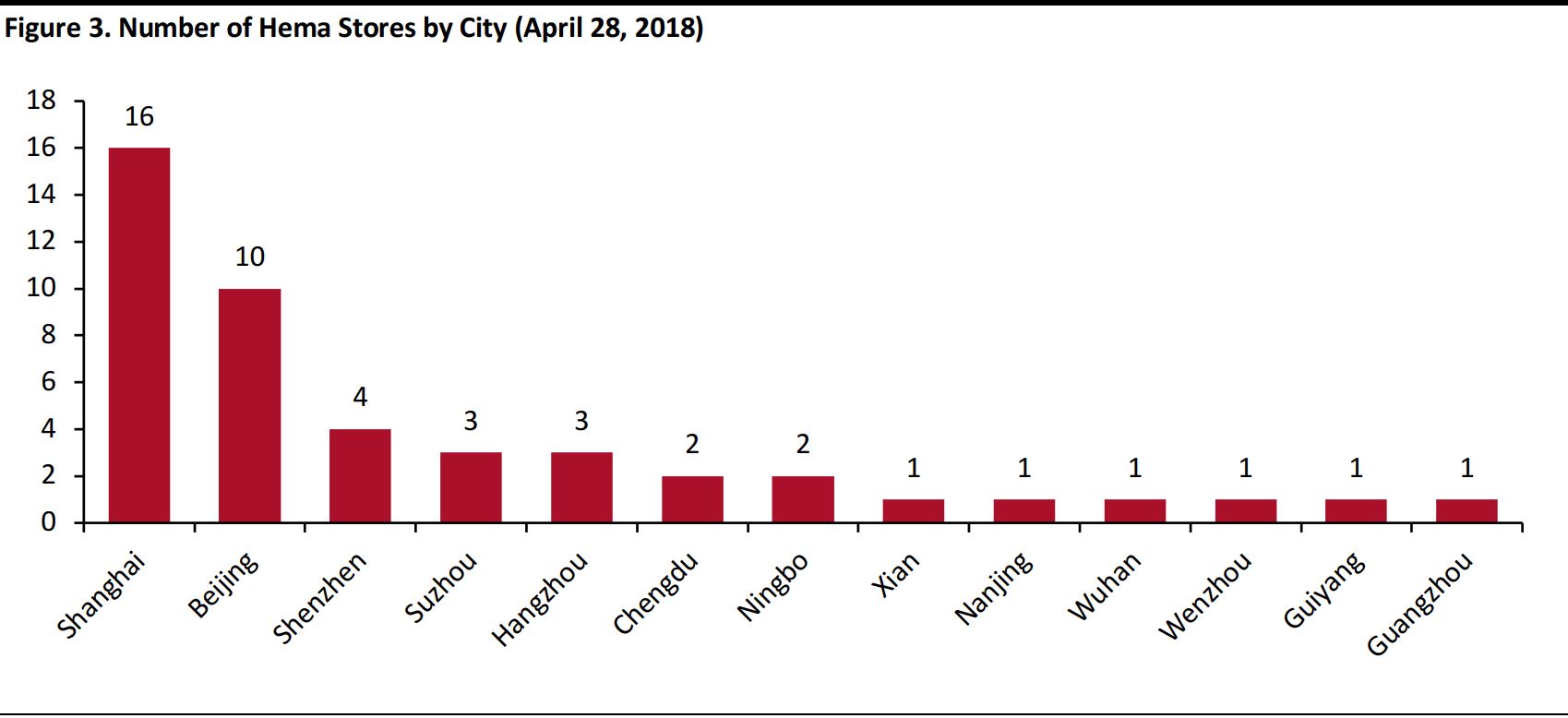

Hema opened its first store in early 2016. In 2017, it opened 17 new stores, and another 23 have been opened in the first four months of 2018 alone. According to Alibaba, there are 46 Hema stores in 13 cities across China as of April 28, 2018.

Hema said it would add 30 locations in Beijing by the end of this year, aiming for a total of 35 stores in the capital. One more store is planned for Xi’an. There could be 72 Hema stores by the end of 2018, according to the company’s expansion plans.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Hema’s Major Competitors: Yonghui Supermarket

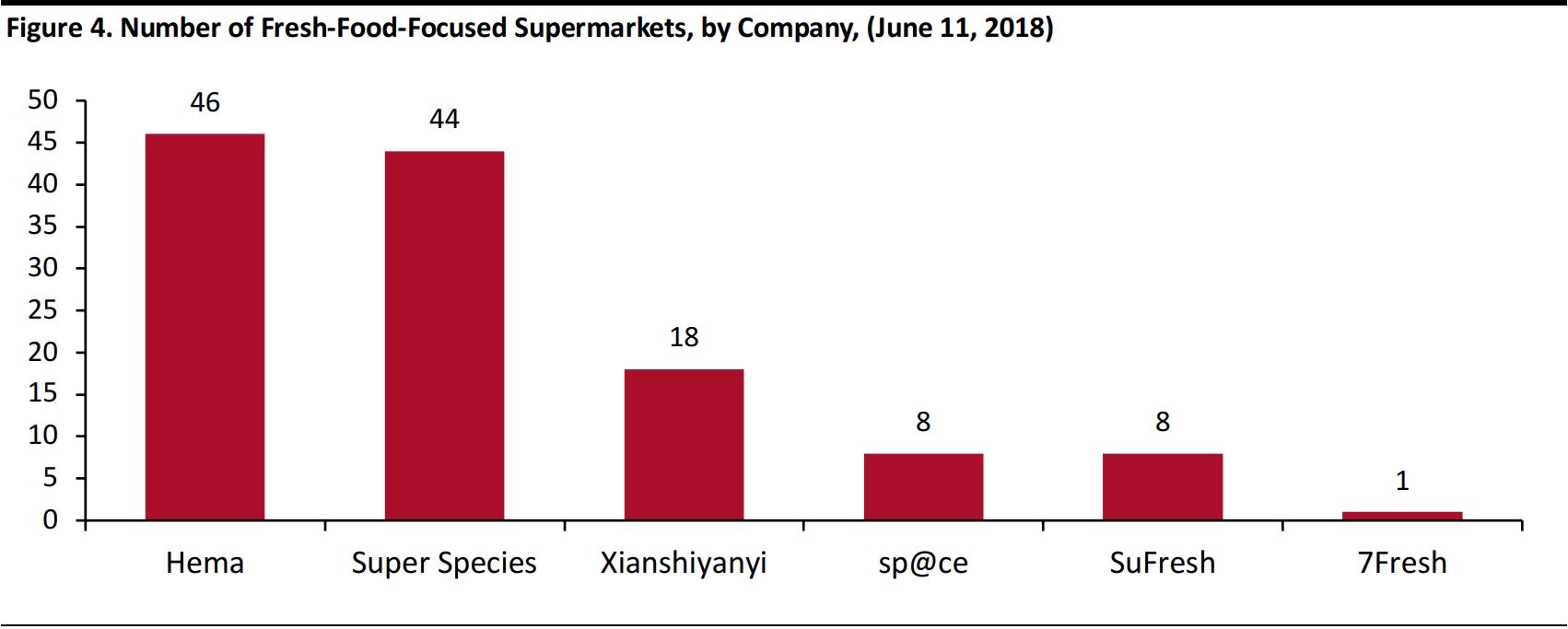

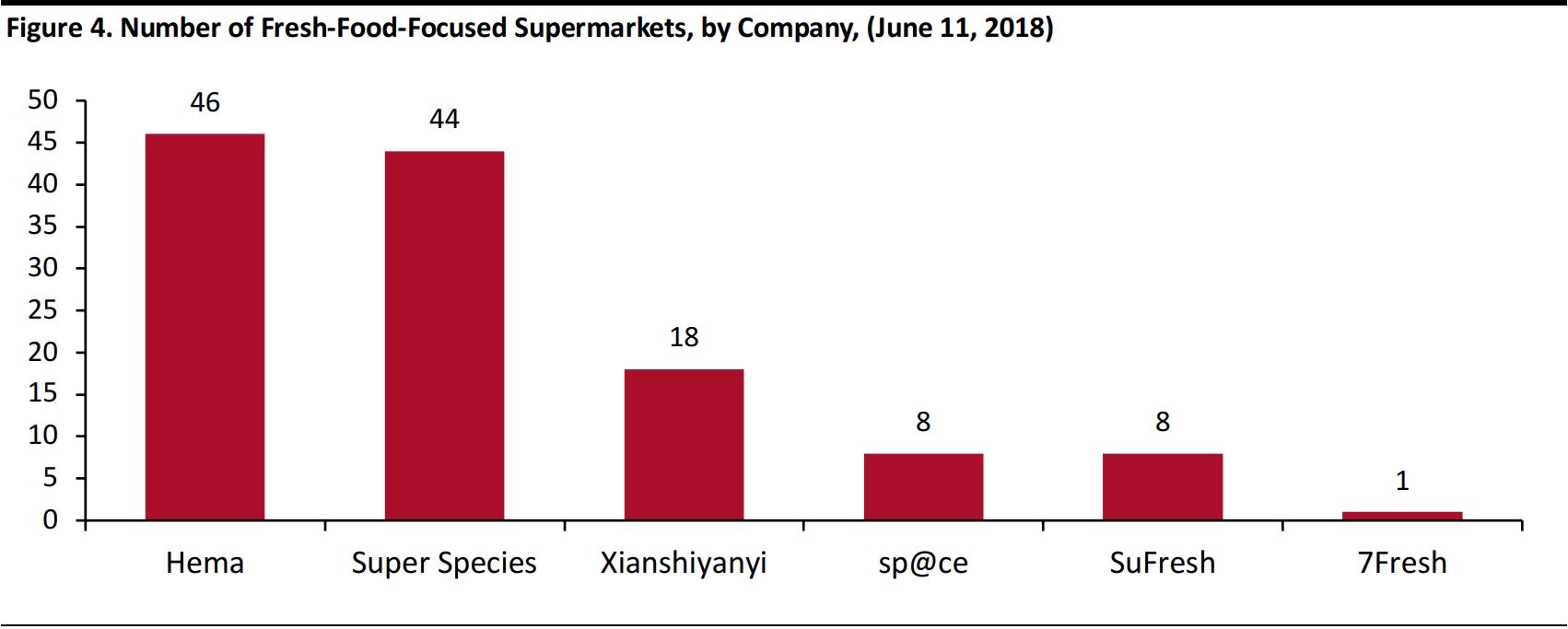

Alibaba’s Hema has a number of competitors in the New Retail landscape. Super Species, opened by the Tencent-invested Chinese supermarket operator Yonghui Supermarket, is its major competitor, with 44 physical stores opened across China, second to Hema’s 46 stores, as of June 11, 2018, according to Sohu. The company said it plans to have 100 stores by the end of 2018.

Other notable players include JD.com’s 7Fresh, which plans to open 50 stores in 2018, according to 7Fresh’s person-in-charge Wang Xiaosong; as well as Bubugao’s Xianshiyanyi with 18 stores, Tianhong sp@ce and Suning’s SuFresh both with eight stores, according to Chinese retail platform Winshang and Suning’s company reports.

Source: Company reports/Winshang/Sohu/Suning/Coresight Research

Source: Company reports/Winshang/Sohu/Suning/Coresight Research

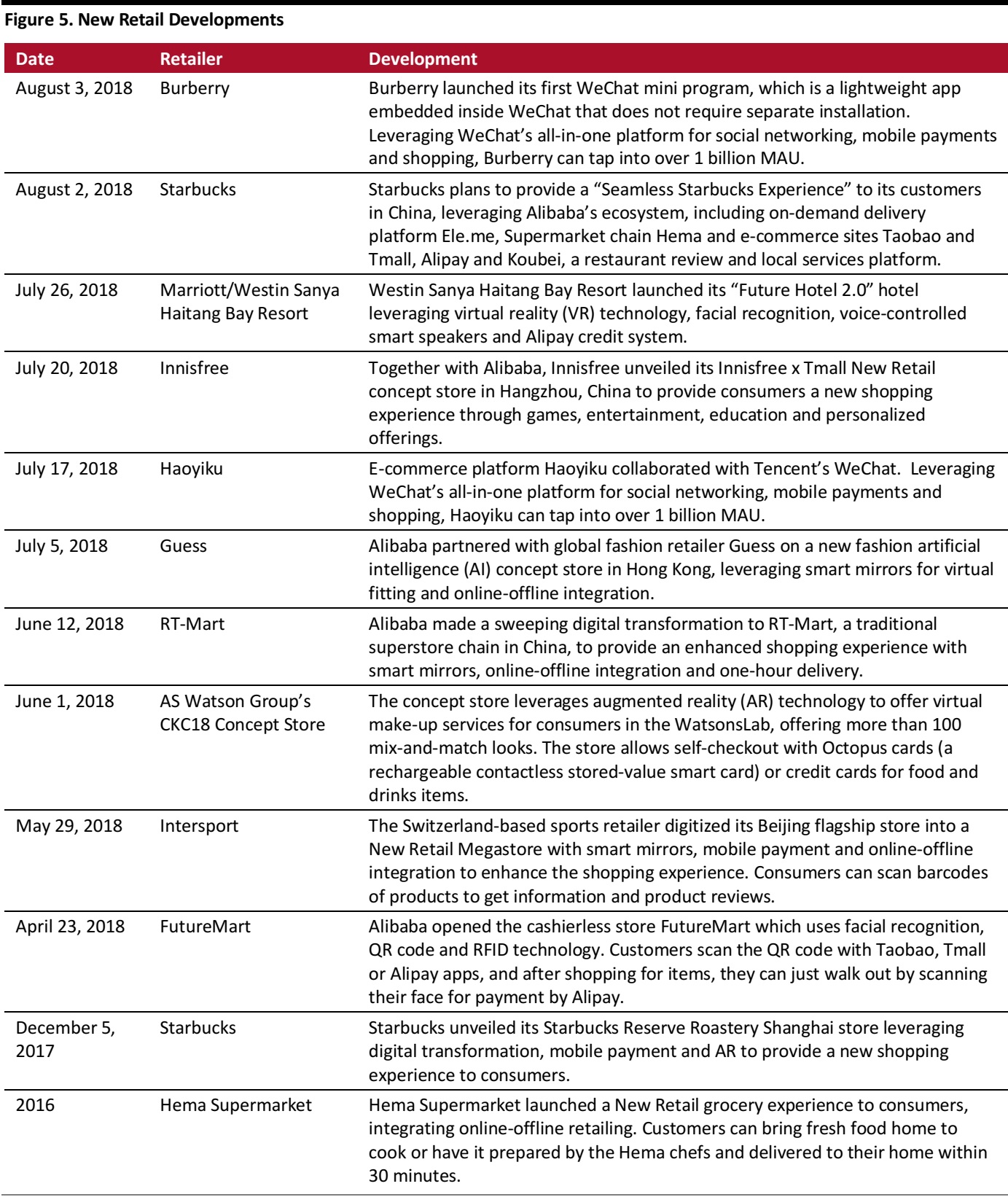

Source: Coresight Research/Alizila/AS Watson/Starbucks

Source: Coresight Research/Alizila/AS Watson/Starbucks

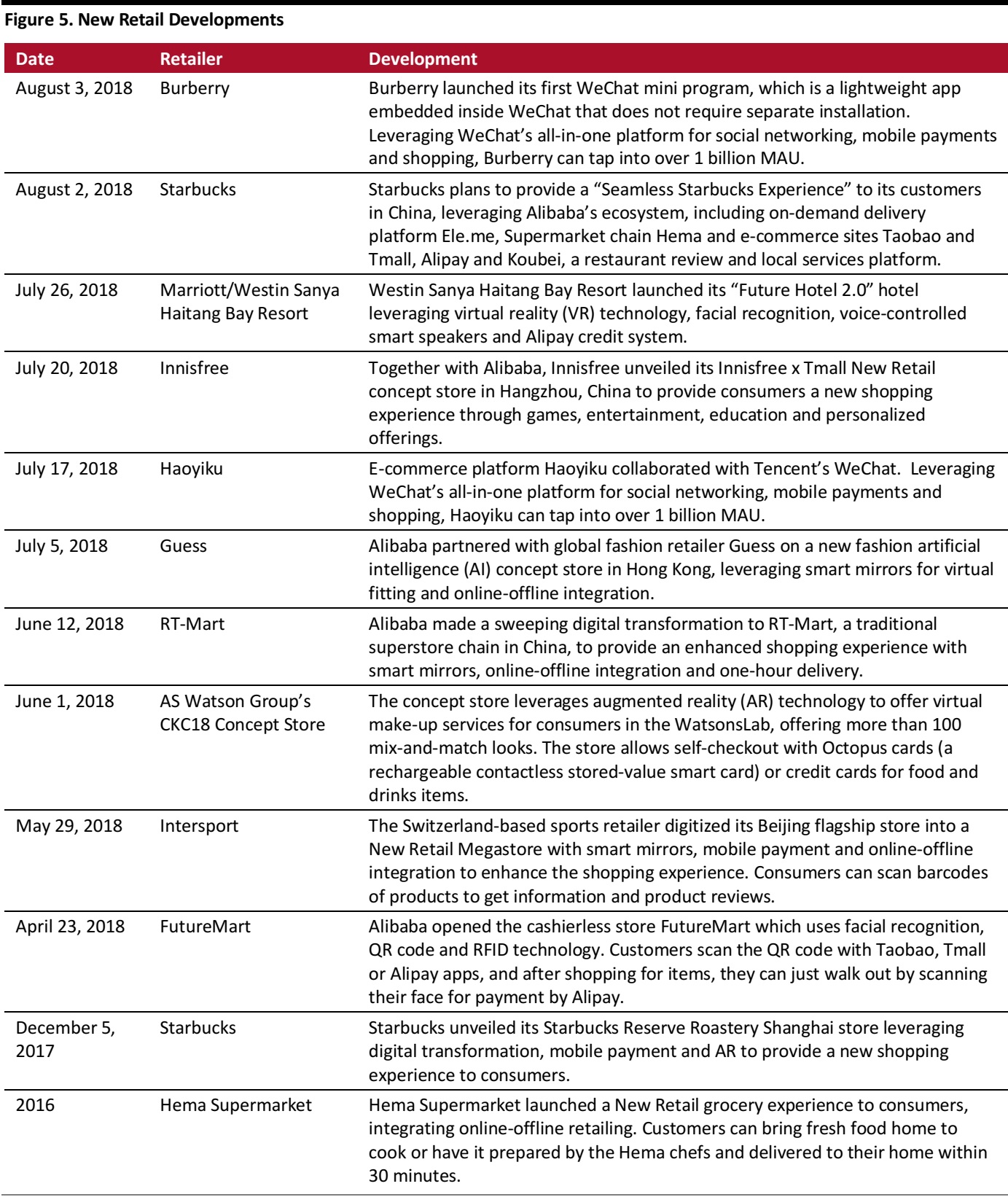

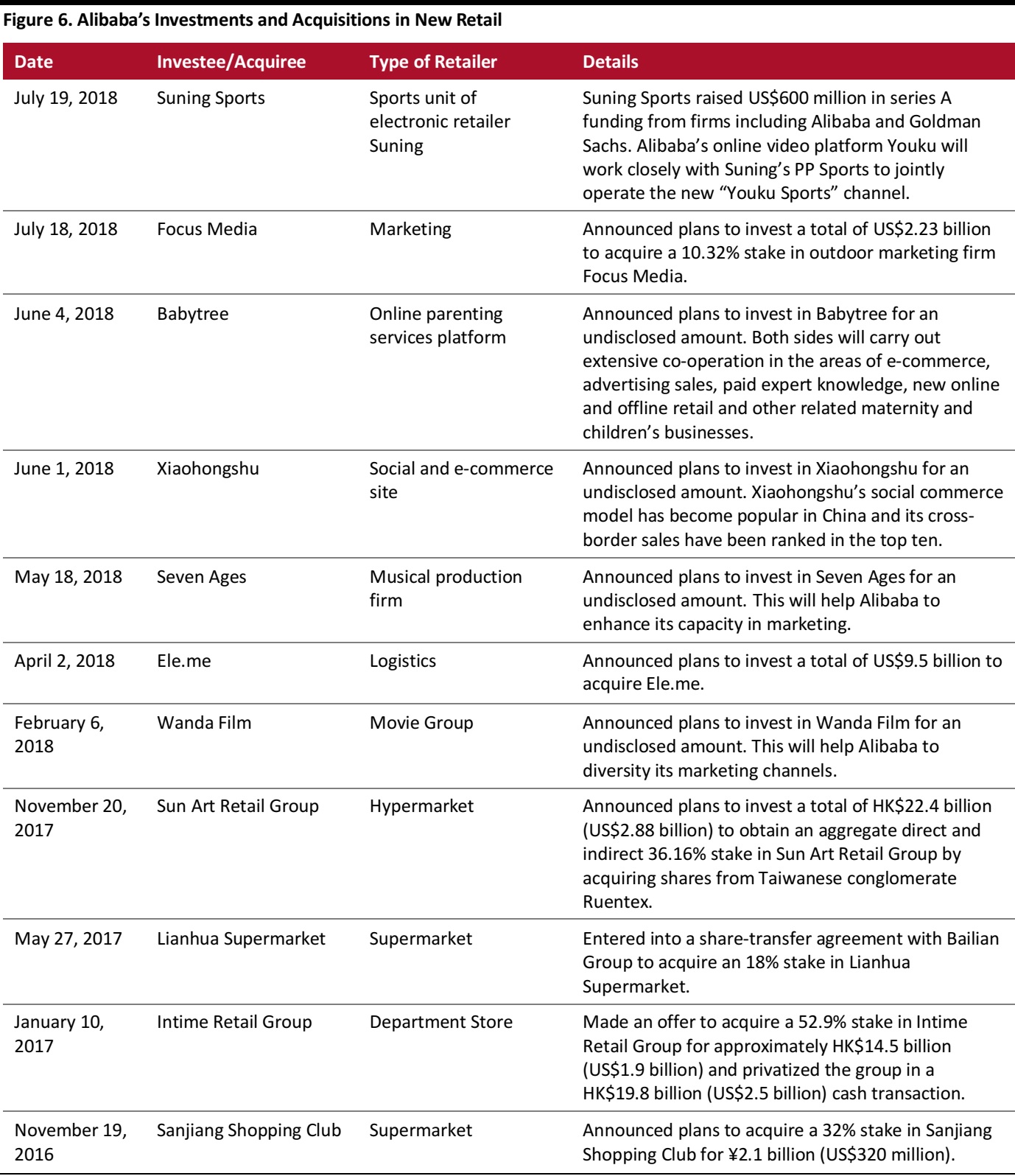

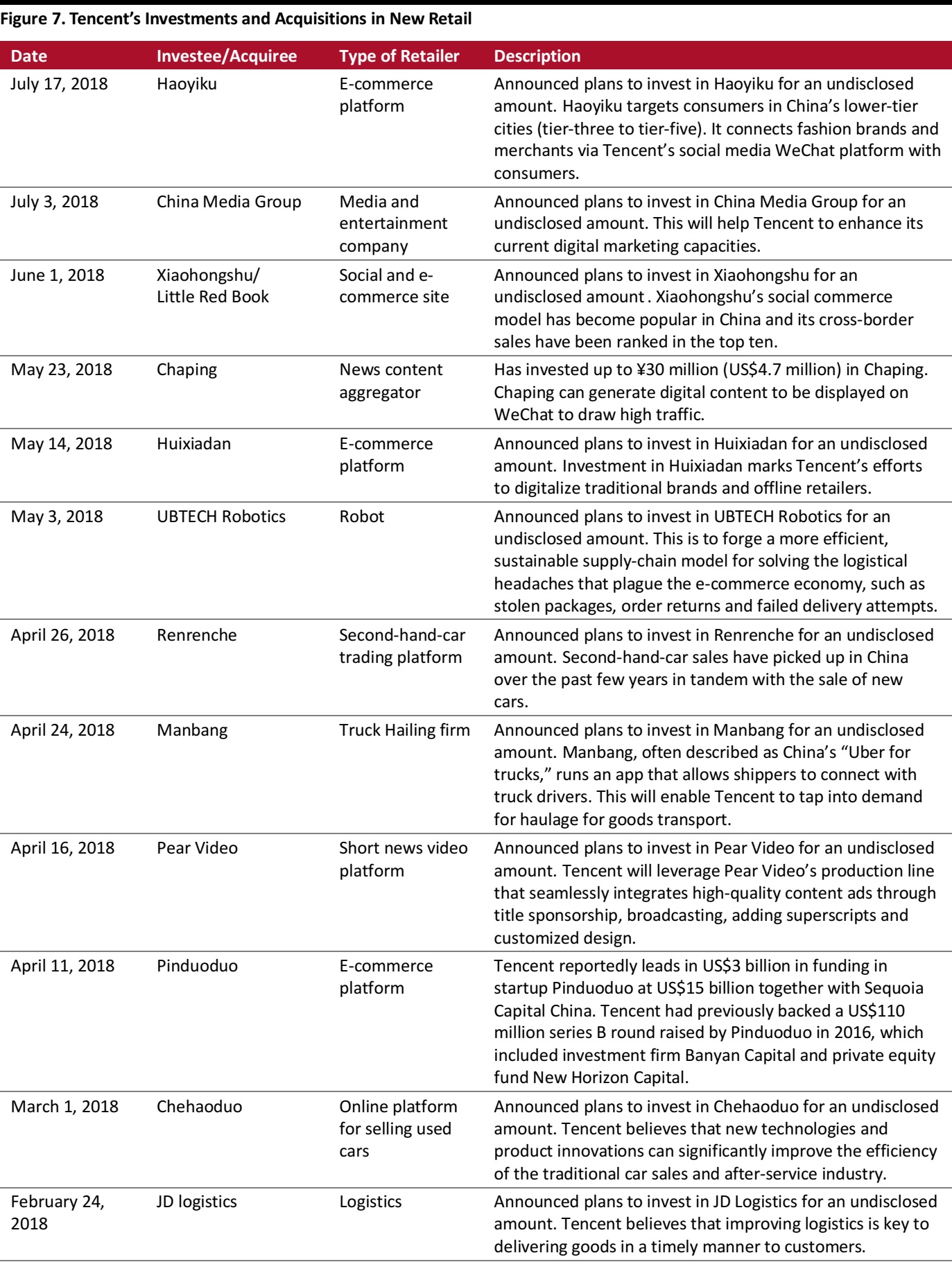

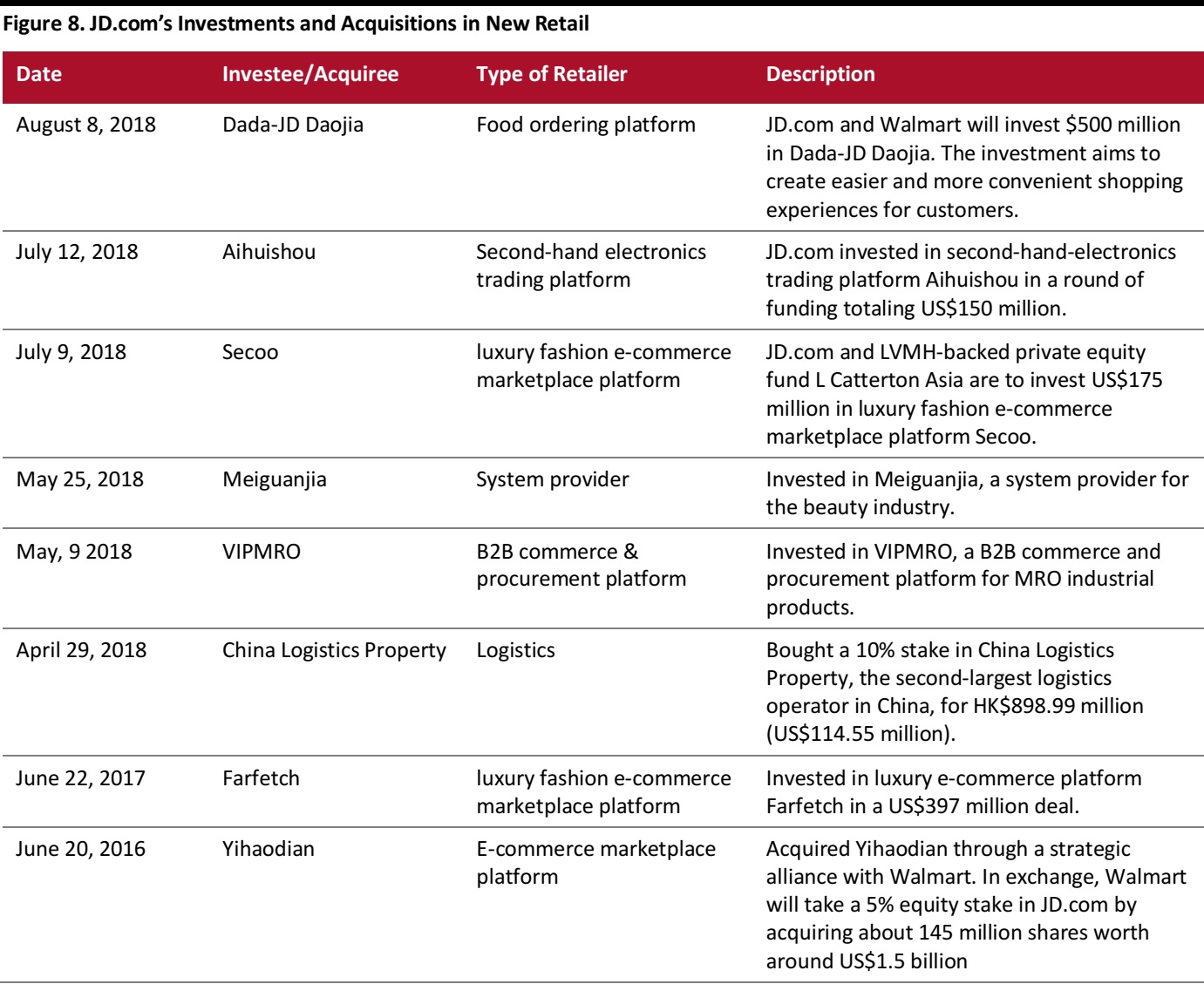

Investments and Acquisitions in New Retail

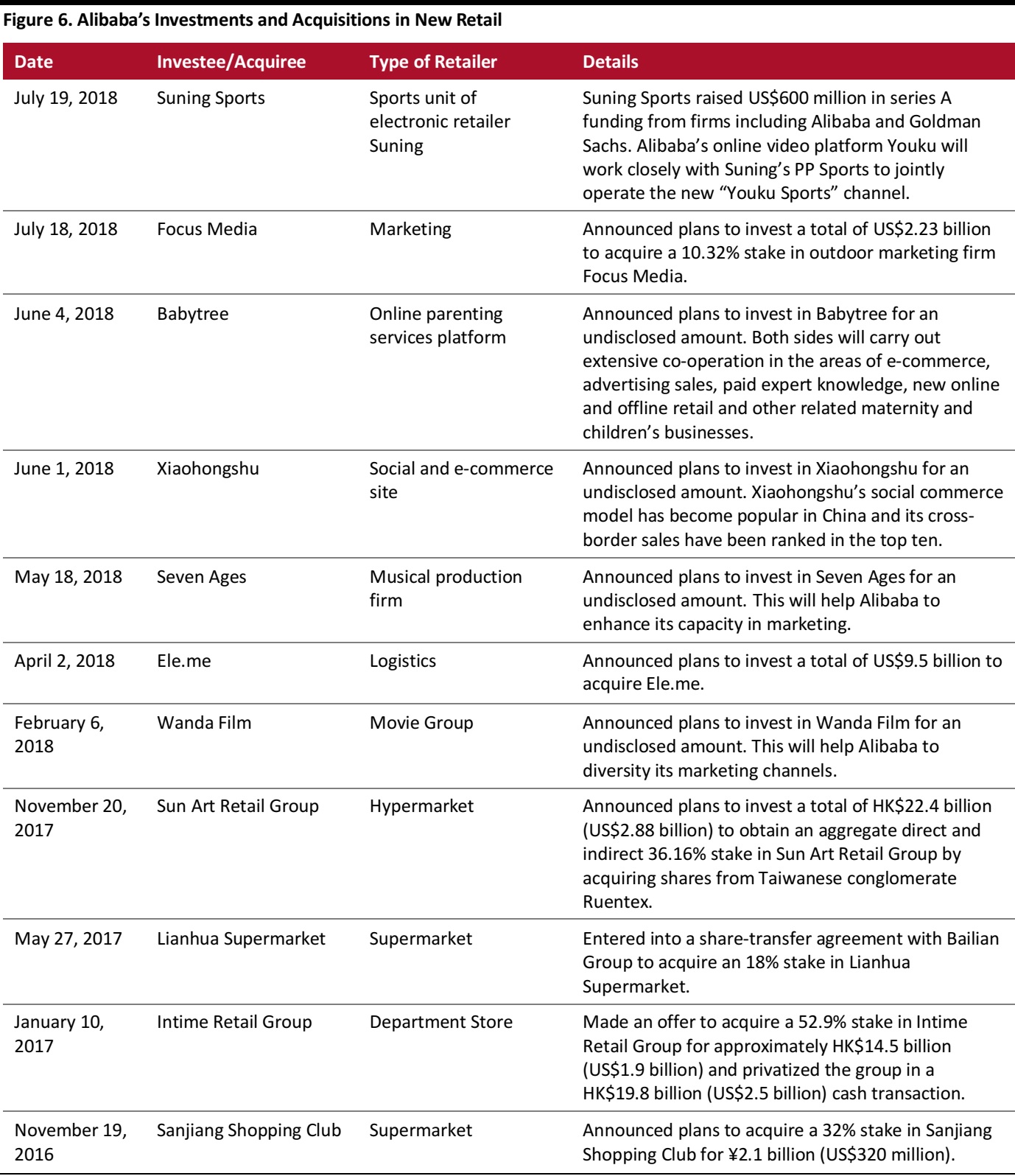

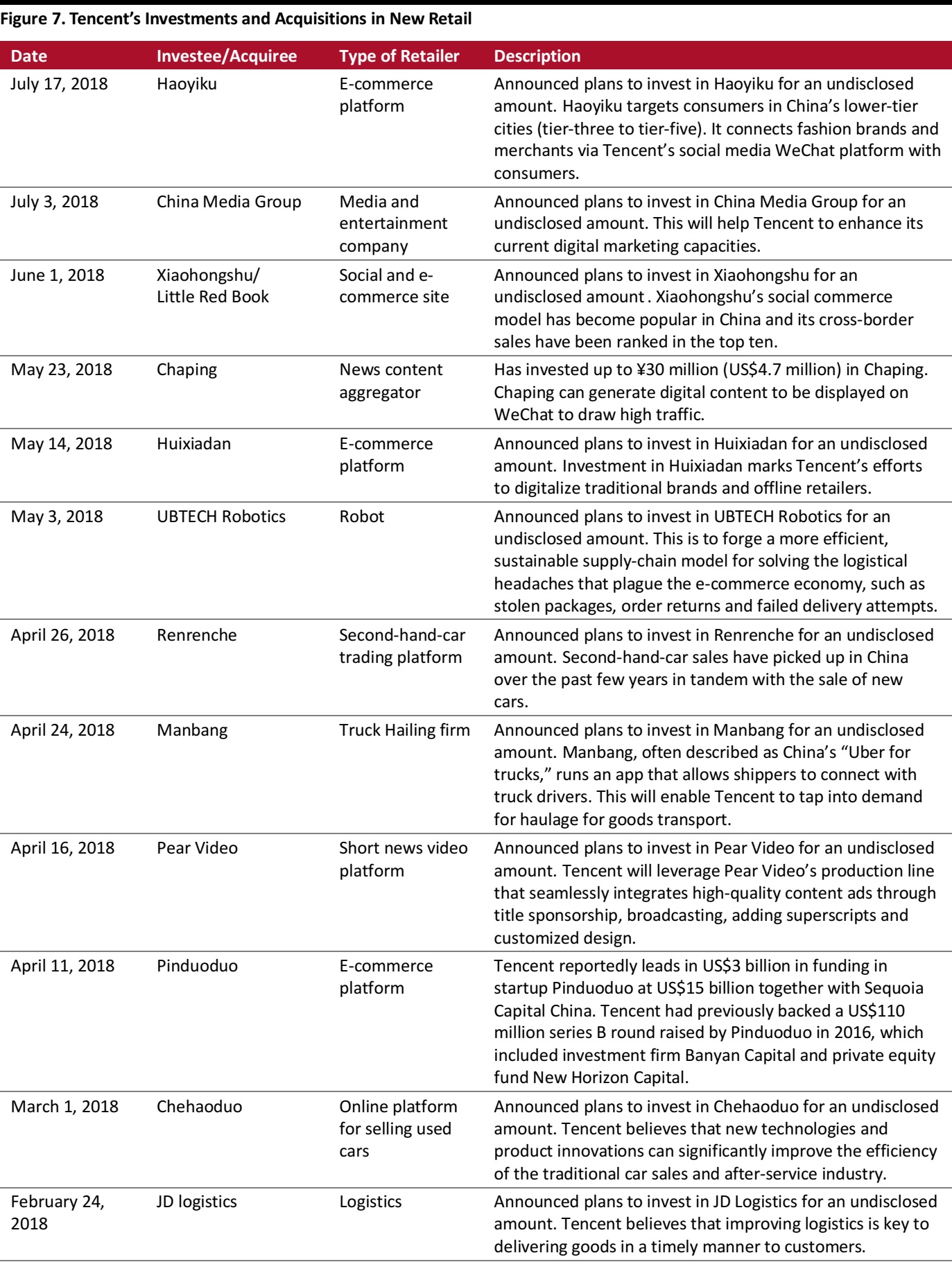

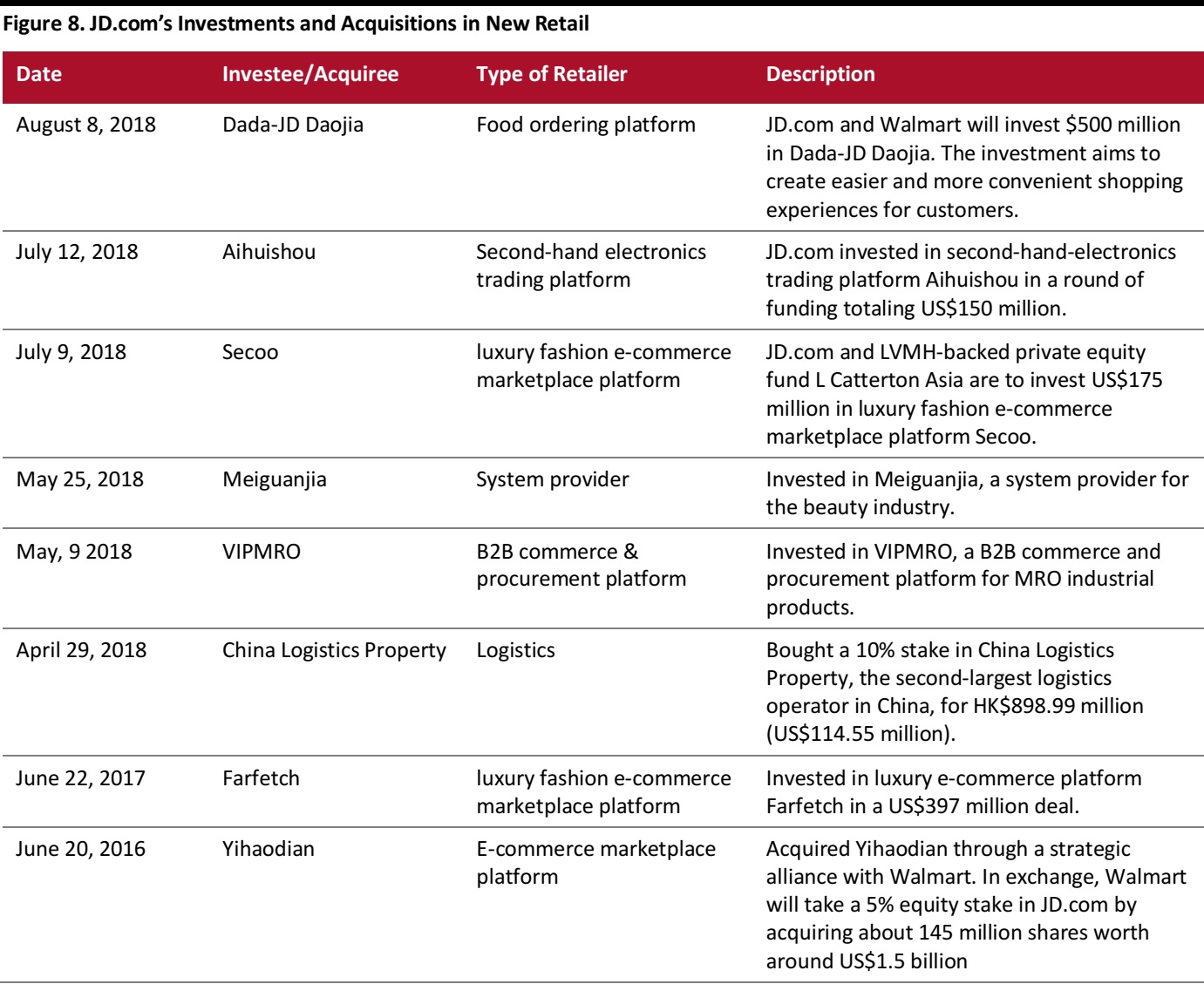

Chinese majors—Alibaba, Tencent and JD.com—have invested in properties to expand their New Retail capacity. Investments range from logistics firms and online marketplaces, to brick-and-mortar stores. Below tables cover their recent investments and acquisitions, including investment date, investee, type of industry and funding details where available.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Alibaba/KaiTao/Coresight Research

Source: Alibaba/KaiTao/Coresight Research Source: Tmall/Coresight Research

Source: Tmall/Coresight Research Source: Tmall/Coresight Research

Source: Tmall/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Winshang/Sohu/Suning/Coresight Research

Source: Company reports/Winshang/Sohu/Suning/Coresight Research Source: Coresight Research/Alizila/AS Watson/Starbucks

Source: Coresight Research/Alizila/AS Watson/Starbucks Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research