The Double 11 Global Shopping Festival Is Nearing

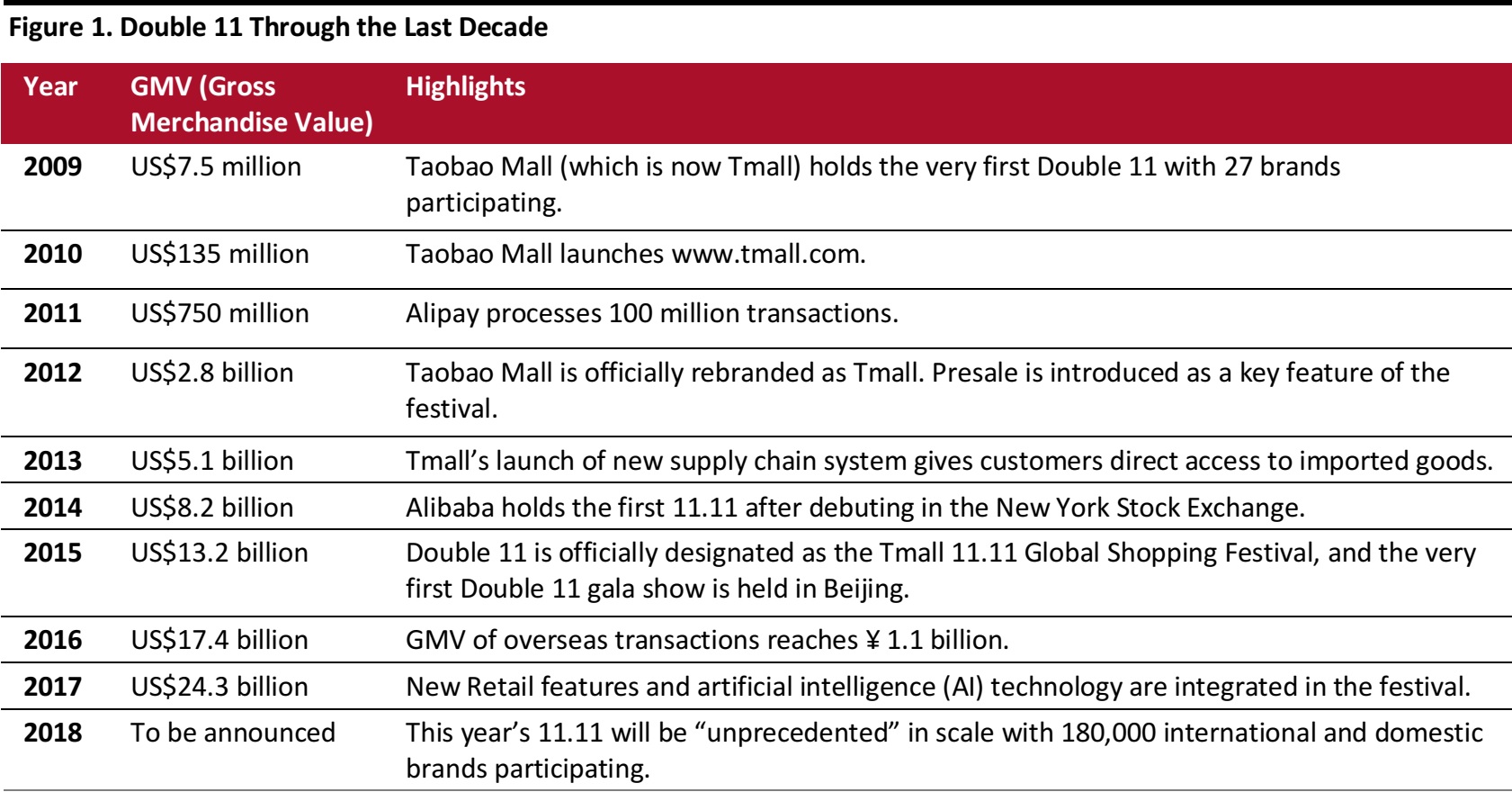

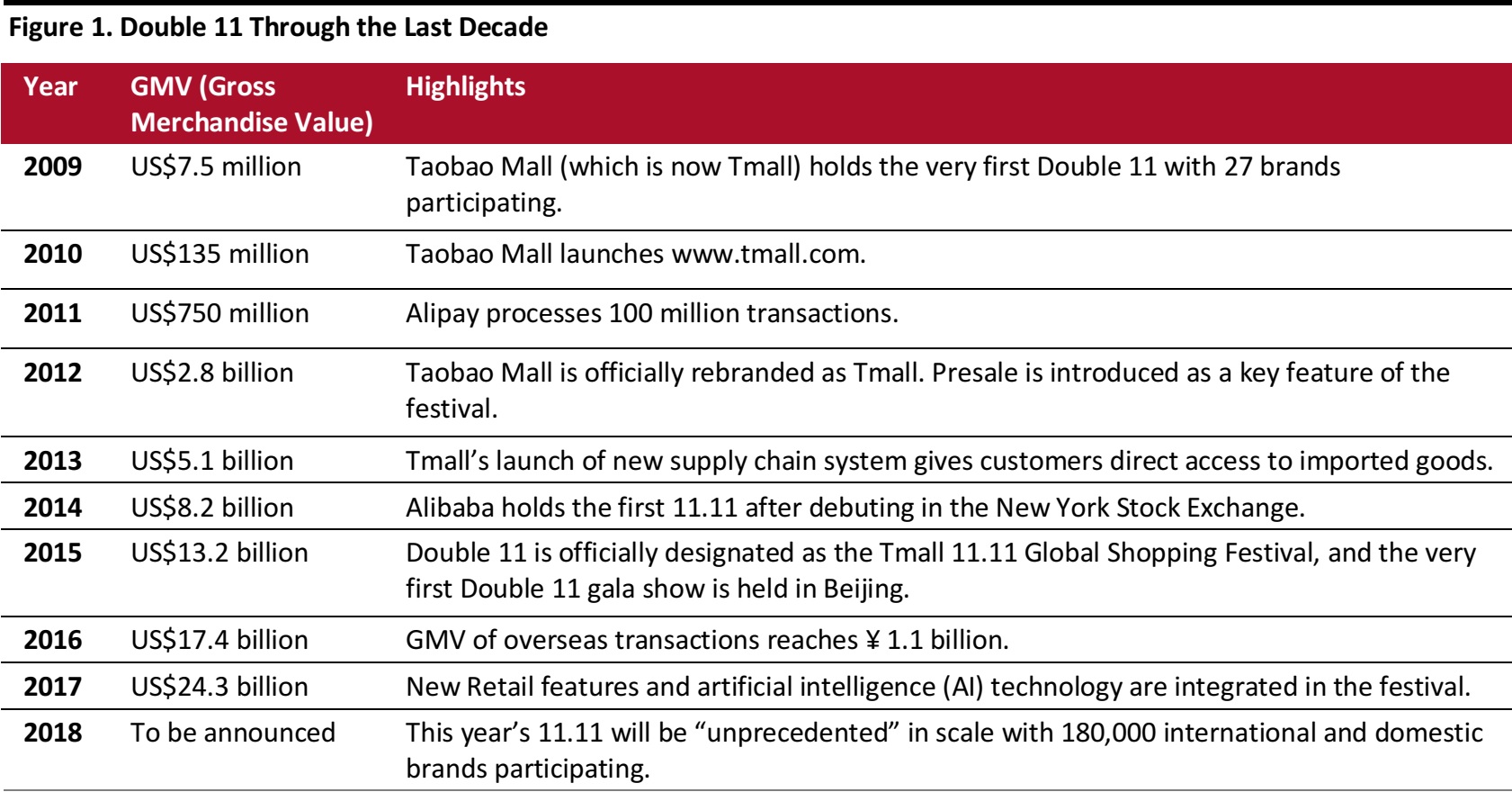

The Double 11 Global Shopping Festival has been held every year on November 11 (11.11) since 2009and its 10th edition is just a few weeks away. The one-day online sales extravaganza has become the benchmark of Chinese consumption and in this report series, we review all that is happening in the prelude to this year’s Double 11.

Alibaba Officially Kicks Off 11.11

On October 19, Alibaba officially kicked off its tenth Double 11 Global Shopping Festival with the promise that this year’s festival will surpass its predecessors in both scale and reach.

Source: Alibaba

Source: Alibaba

To mark the tenth anniversary of Double 11, Alibaba has said its ecosystem will be “all-in” to provide customers with engaging and convenient shopping experiences. We will see participation by Southeast Asian e-commerce platform Lazada and New Retail pioneer, Hema supermarkets.

Lazada will Make Its Double 11 Debut This Year

Lazada,an Alibaba-controlled e-commerce platform operator headquartered in Singapore,will run its first Double 11insix countries, which are Singapore,Malaysia,Thailand,Indonesia,the Philippines, and Vietnam.The platform has more than 145,000 sellers as well as 3,000 brands selling fashion, household and electronic products. It will offer the largest discounts of the year to its customers via Lazada marketplace and its sister platform, LazMall, which sells a curated selection of brands.

Alibaba started investing in Lazada—one of its strategic investments in Southeast Asia—in 2016 and increased the investment to take a controlling stake of 51% in April 2017.Southeast Asia is a lucrative market for Alibaba as the region’s internet economy is expected to grow to US$200 billion by 2025, primarily driven by growth in e-commerce, according to a study by Google and Temasek Holdings, the Singapore Government’s investment arm.

New Retail: A Keyword in Double 11

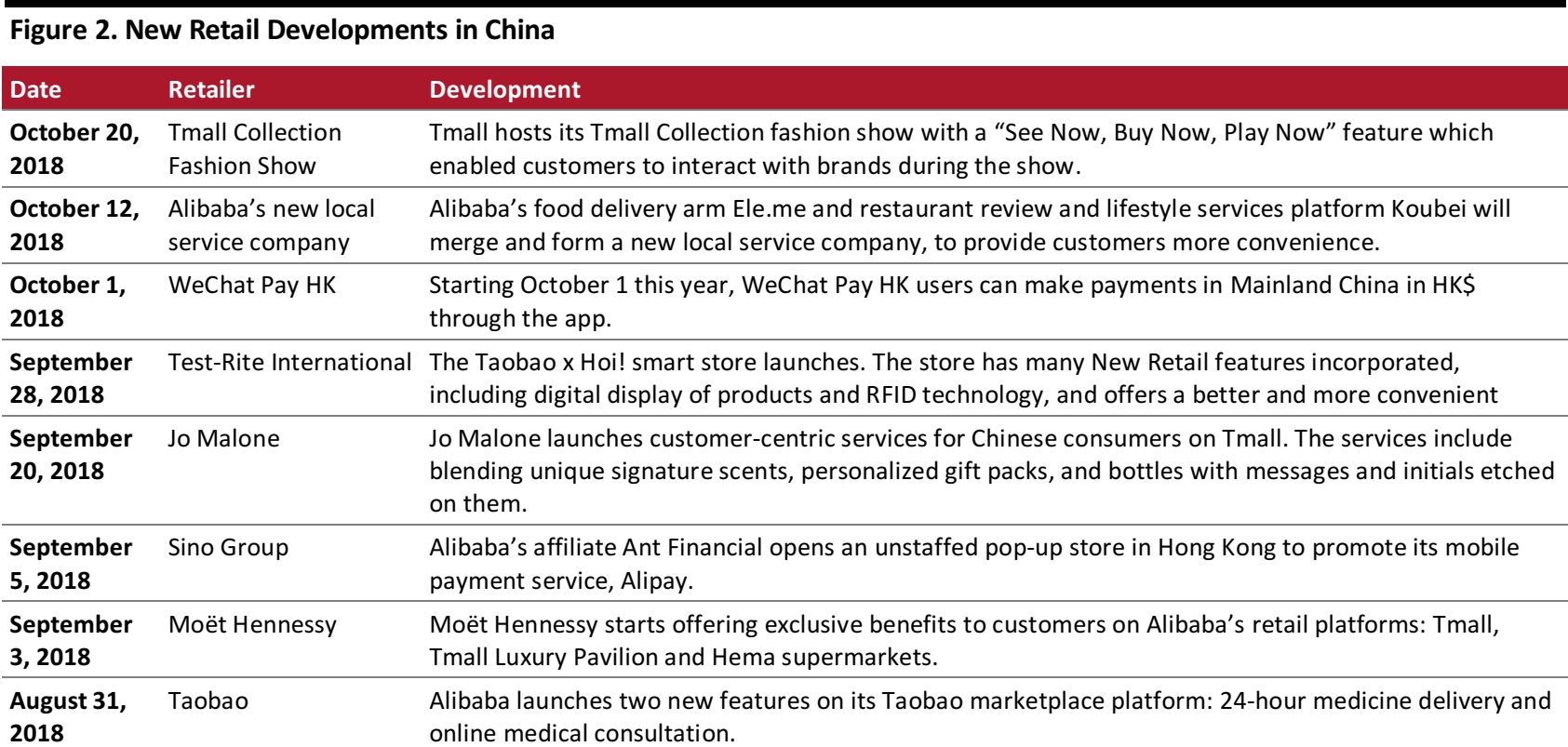

Tmall brought the New Retail aspect to Double 11 in 2017—60 New Retail featured pop-up stores in 12 cities in China—and this year New Retail continues to be one of the event’s keywords, according to Tmall President Jing Jie. Around 100 Hema supermarkets, which comprise Alibaba’s signature cross-channel New Retail venture, will unveil 11.11-themed stores to provide customers with fun experiences.

In these Hema stores,visitors will be able to earn loyalty points and red packets. Along with Hema, RT Mart is also participating in Double 11 this year and approximately 400 of the company’s supermarkets are undergoing a New Retail makeover to ensure that customers can be provided with a convenient shopping experience during the event. In November 2017, Alibaba had invested US$2.87 billion to take a major stake in RT Mart’s parent company Sun Art Retail Group.

What’s New in New Retail?

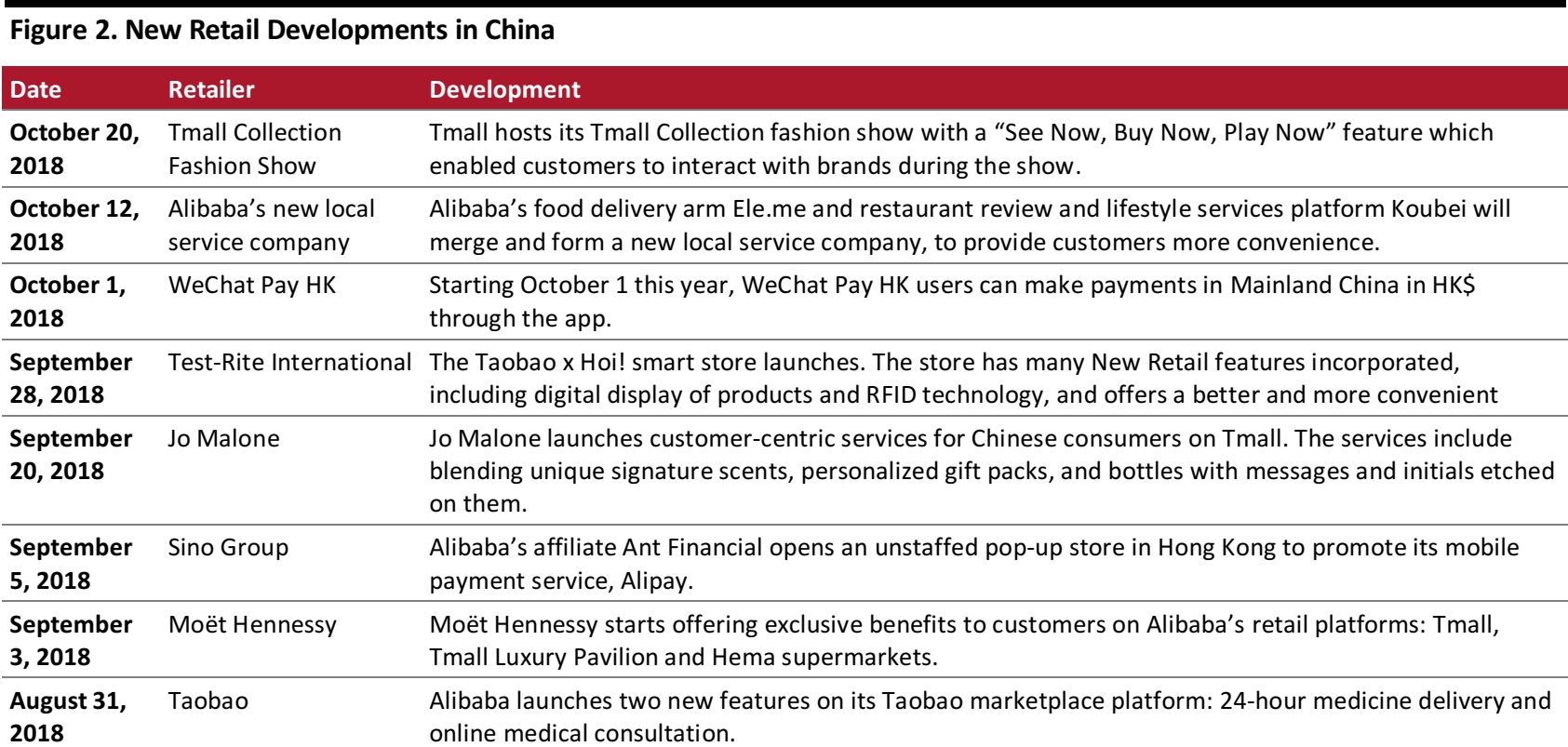

See Now, Buy Now, Play Now

On October 20, Tmall hosted its annual curtain-raiser for Double 11, the Tmall Collection fashion show at Water Cube in Beijing, with top international and domestic brands (such as Burberry, MCM and Stuart Wetizman) participating. The show was broadcast on ten platforms, including the Taobao app, video platform Youku and social media platform Weibo.

Last year, the show had “See Now, Buy Now” feature, which enabled viewers to buy the items which they saw, and this year Alibaba added a new feature called“Play Now”to make the show more fun and interactive. “Play Now”allowed customers to like items and add comments to the live streaming.

Source: Company reports/Coresight Research

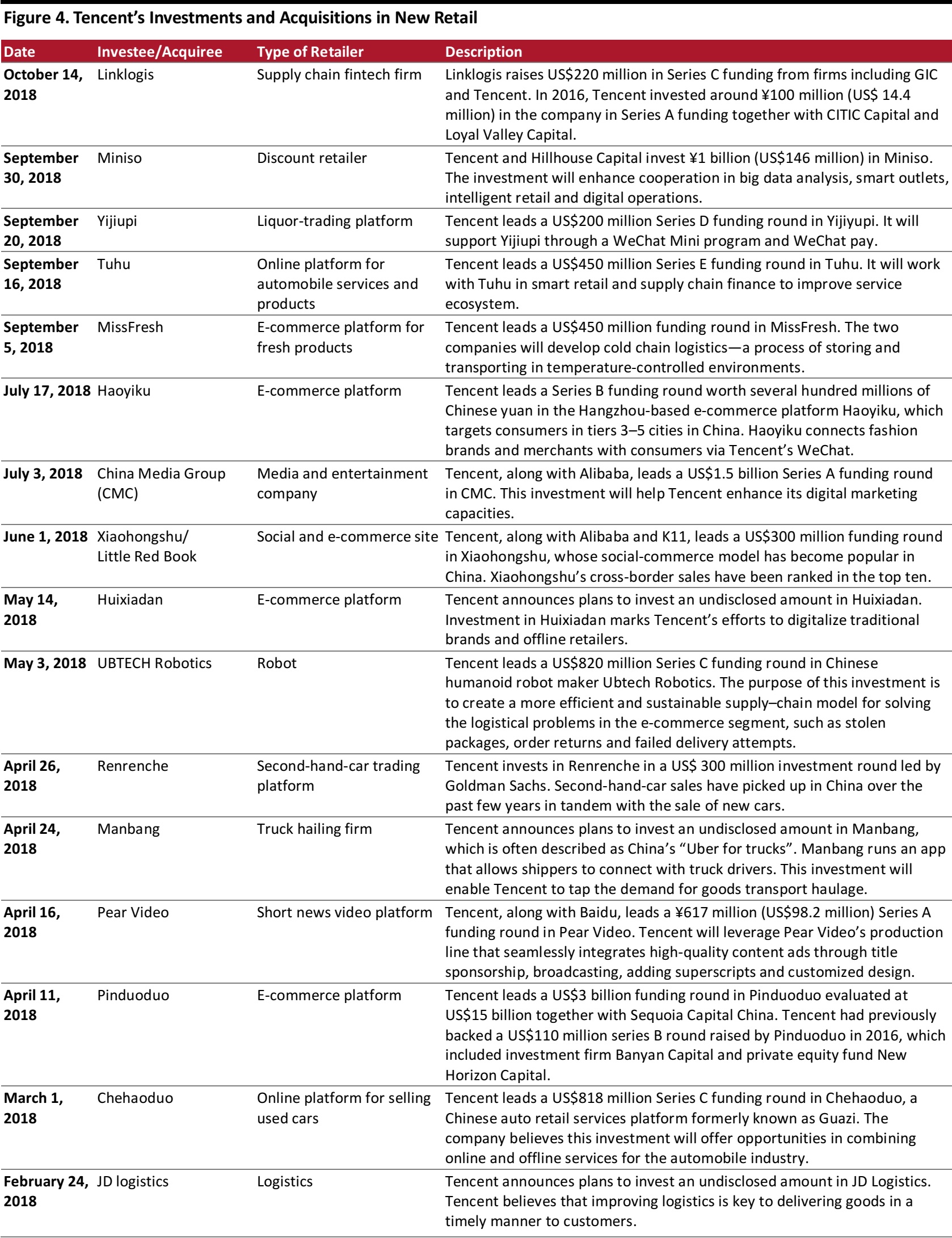

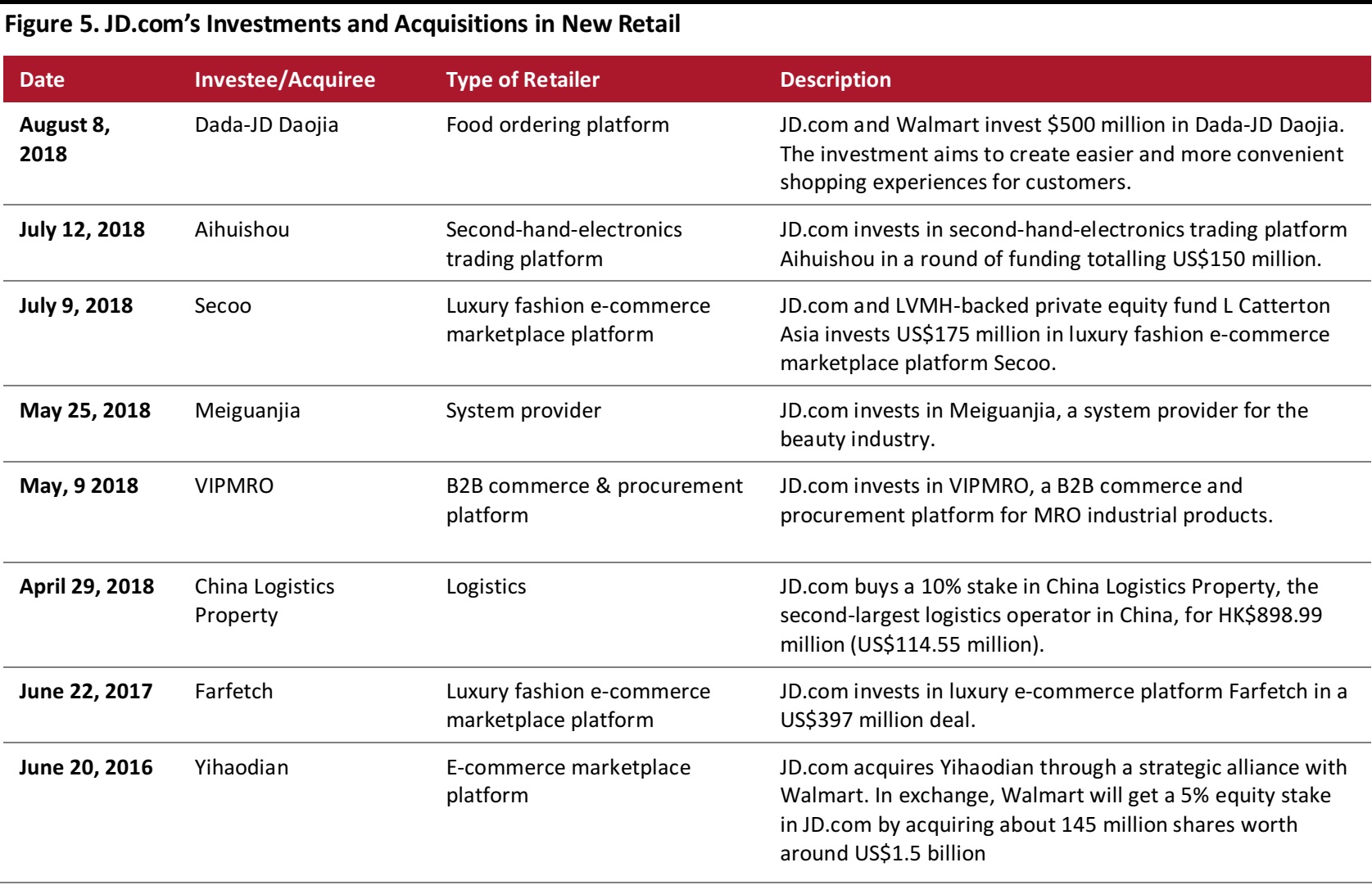

Investments and Acquisitions in New Retail

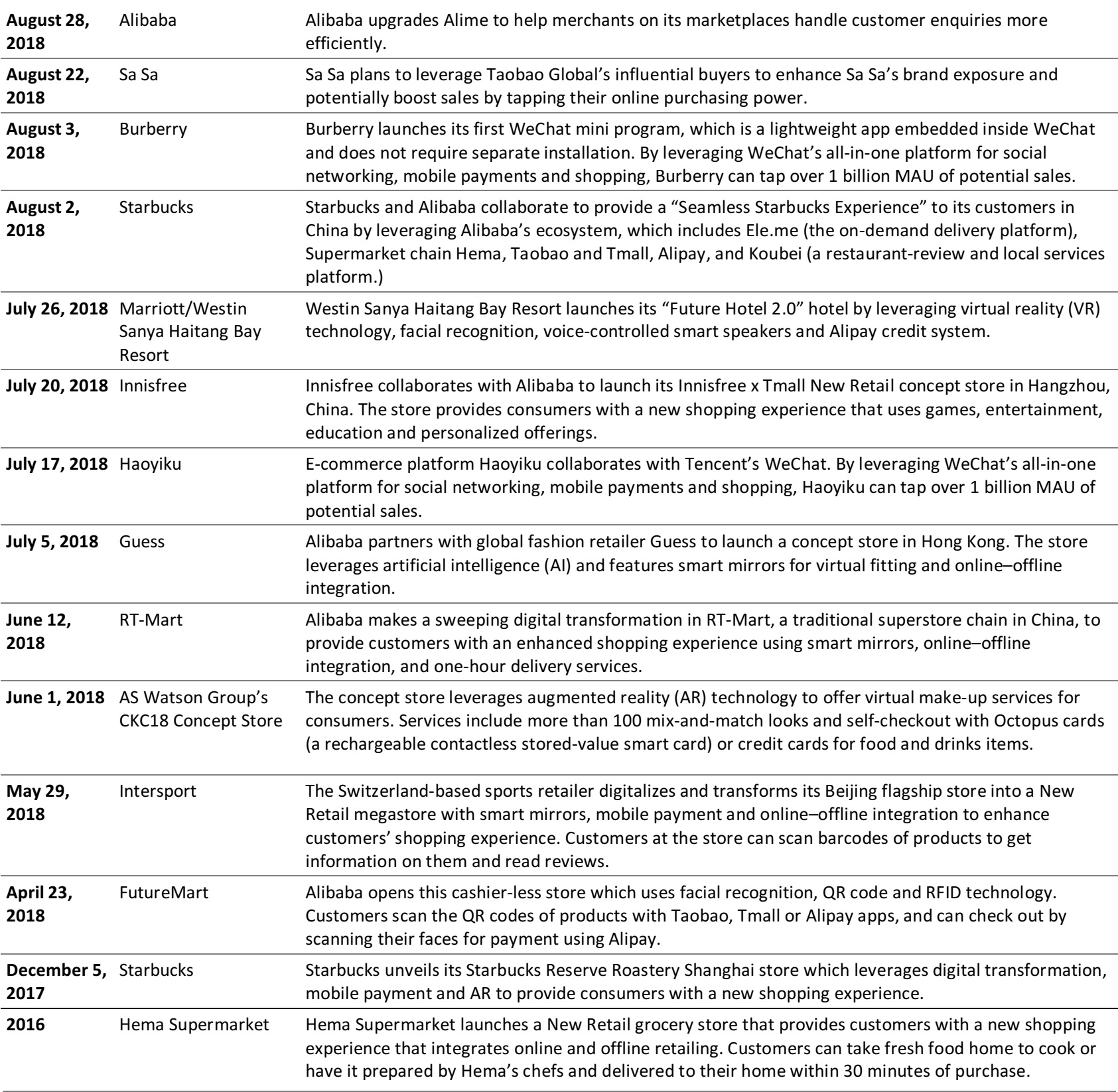

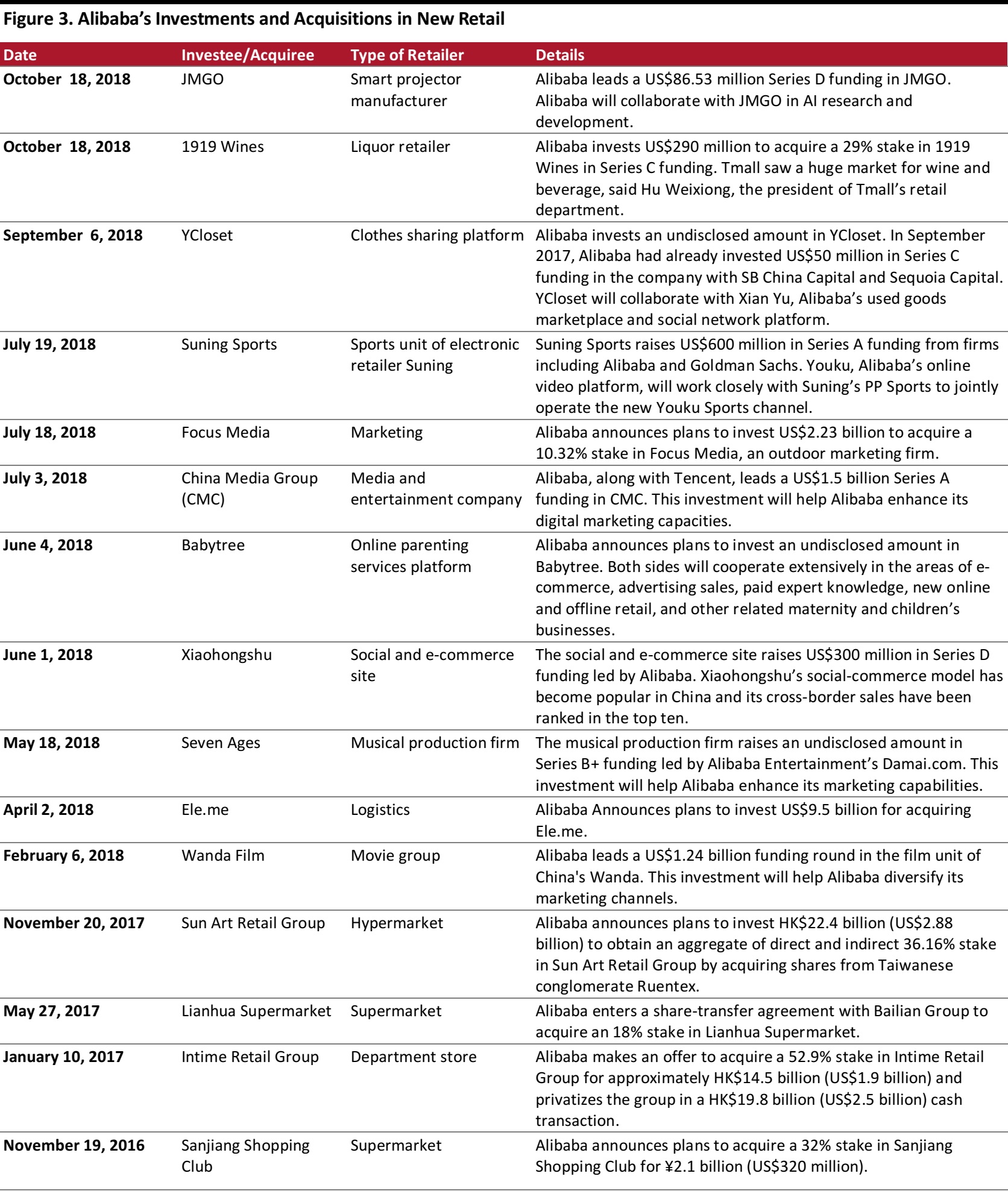

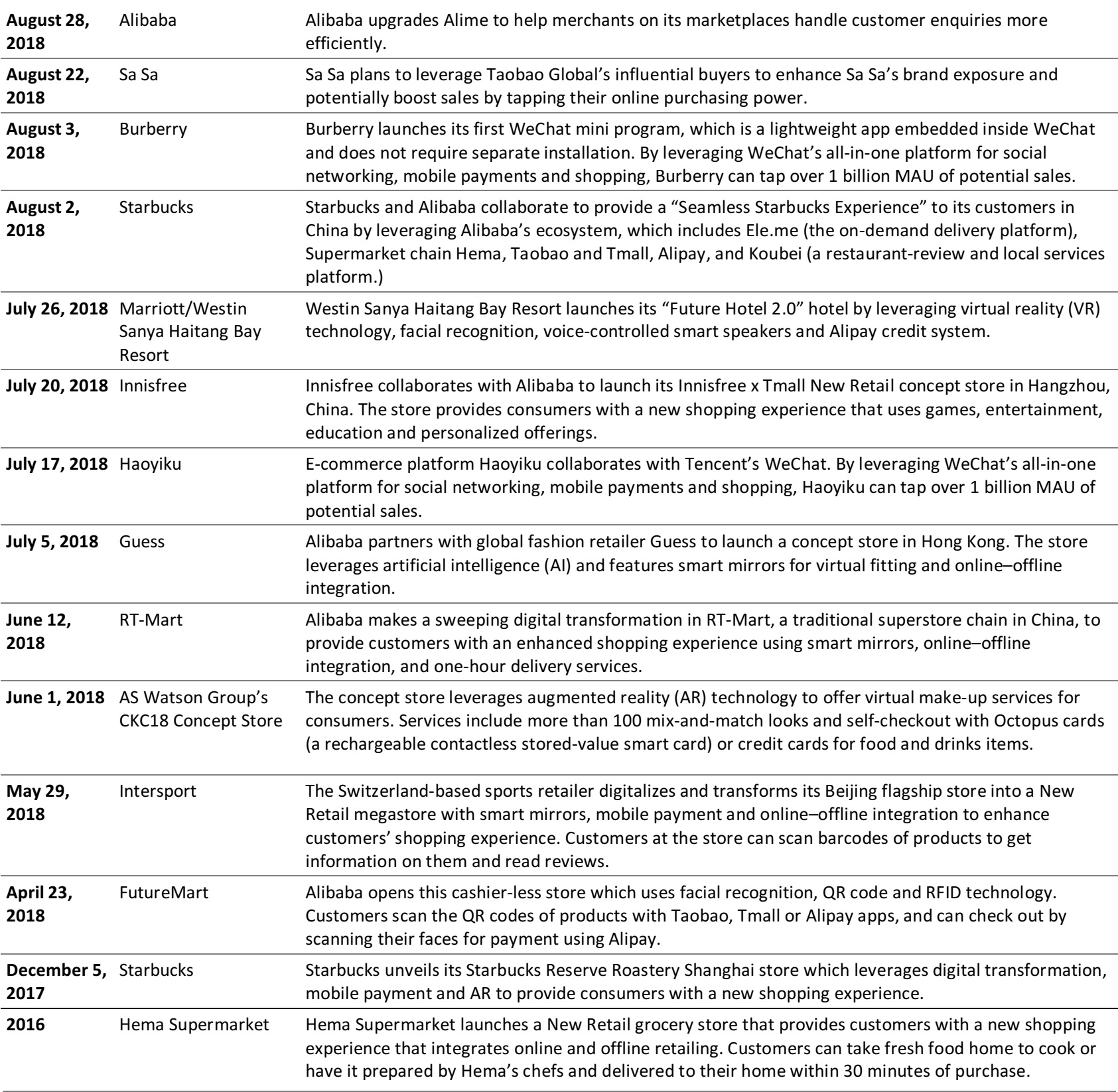

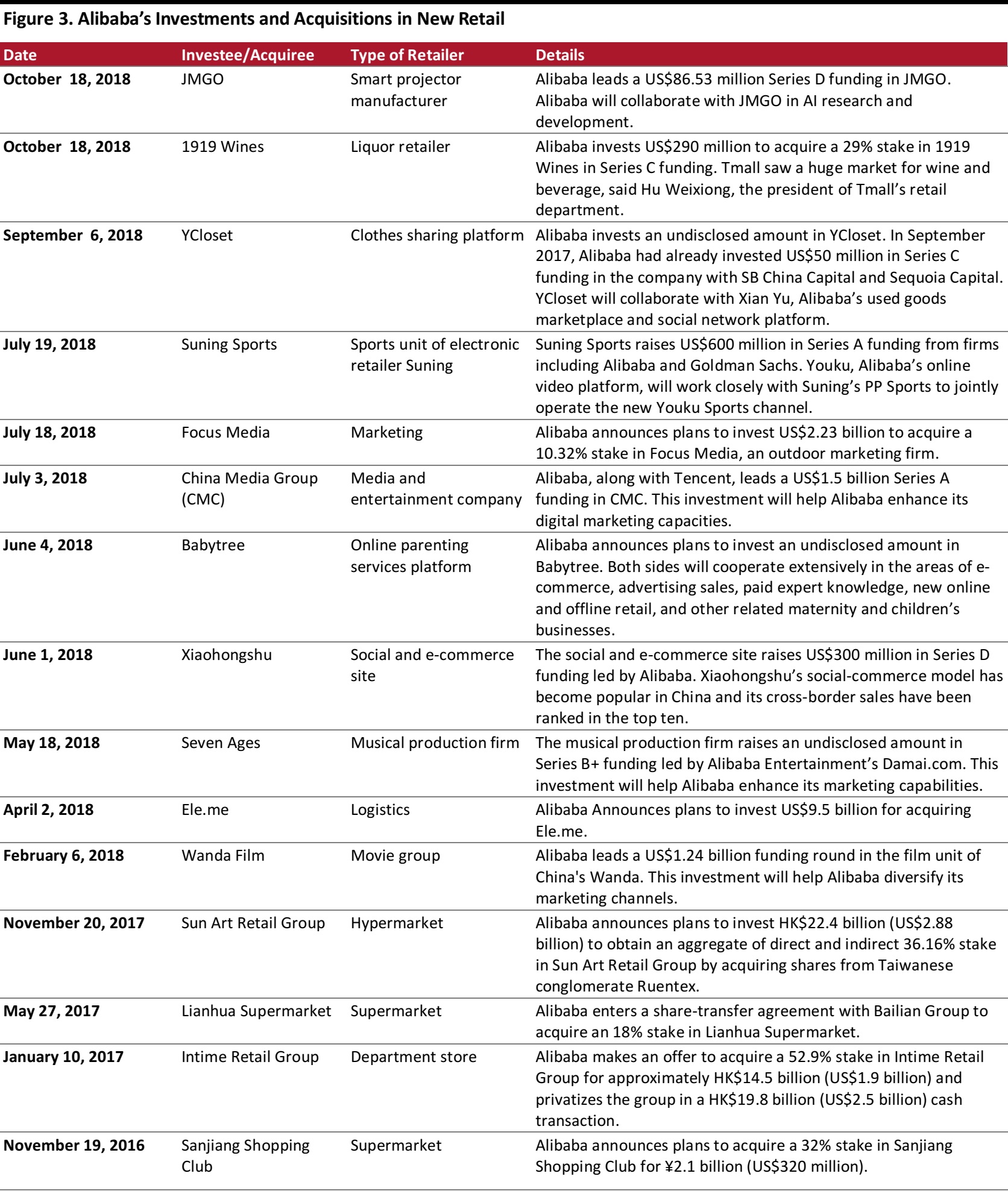

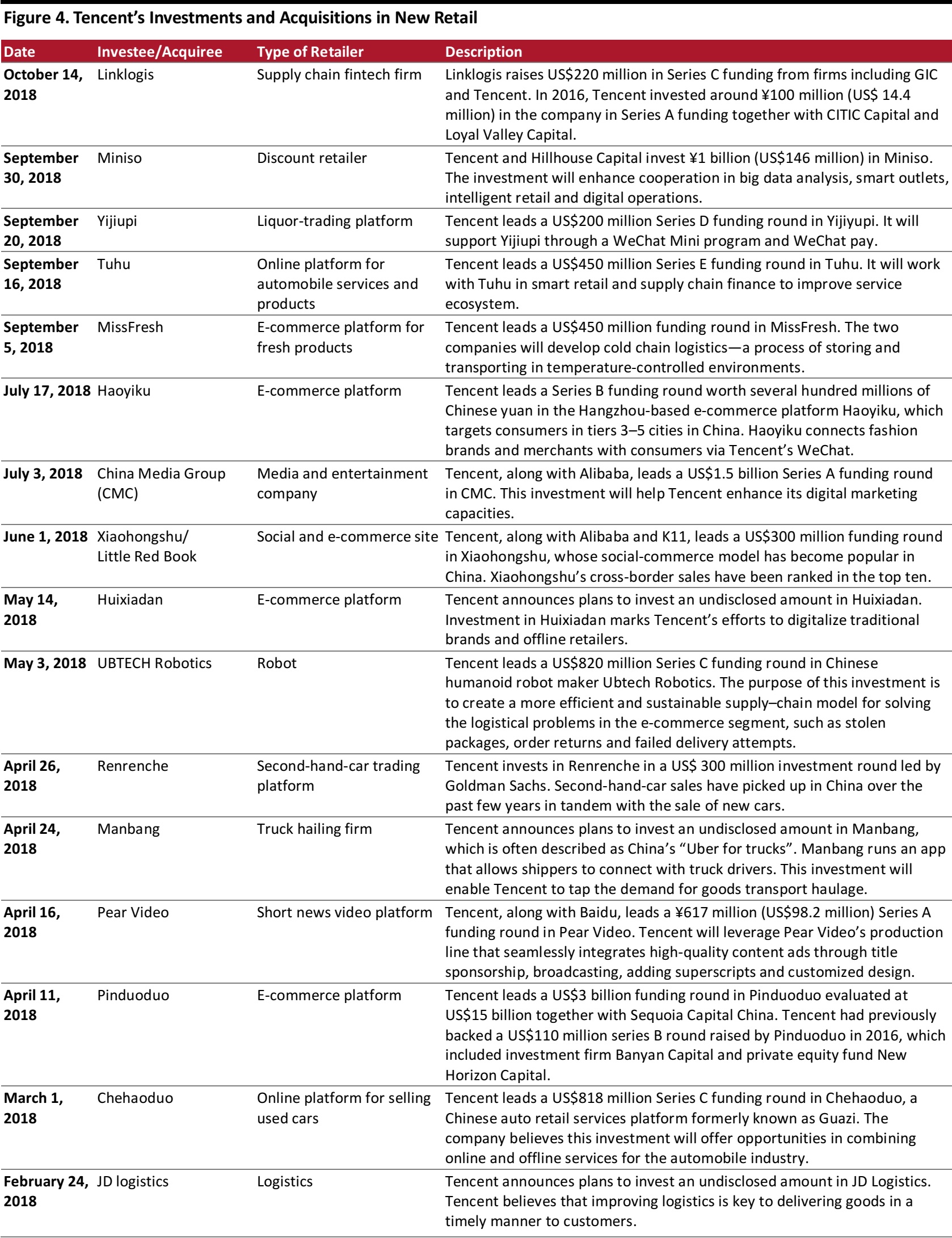

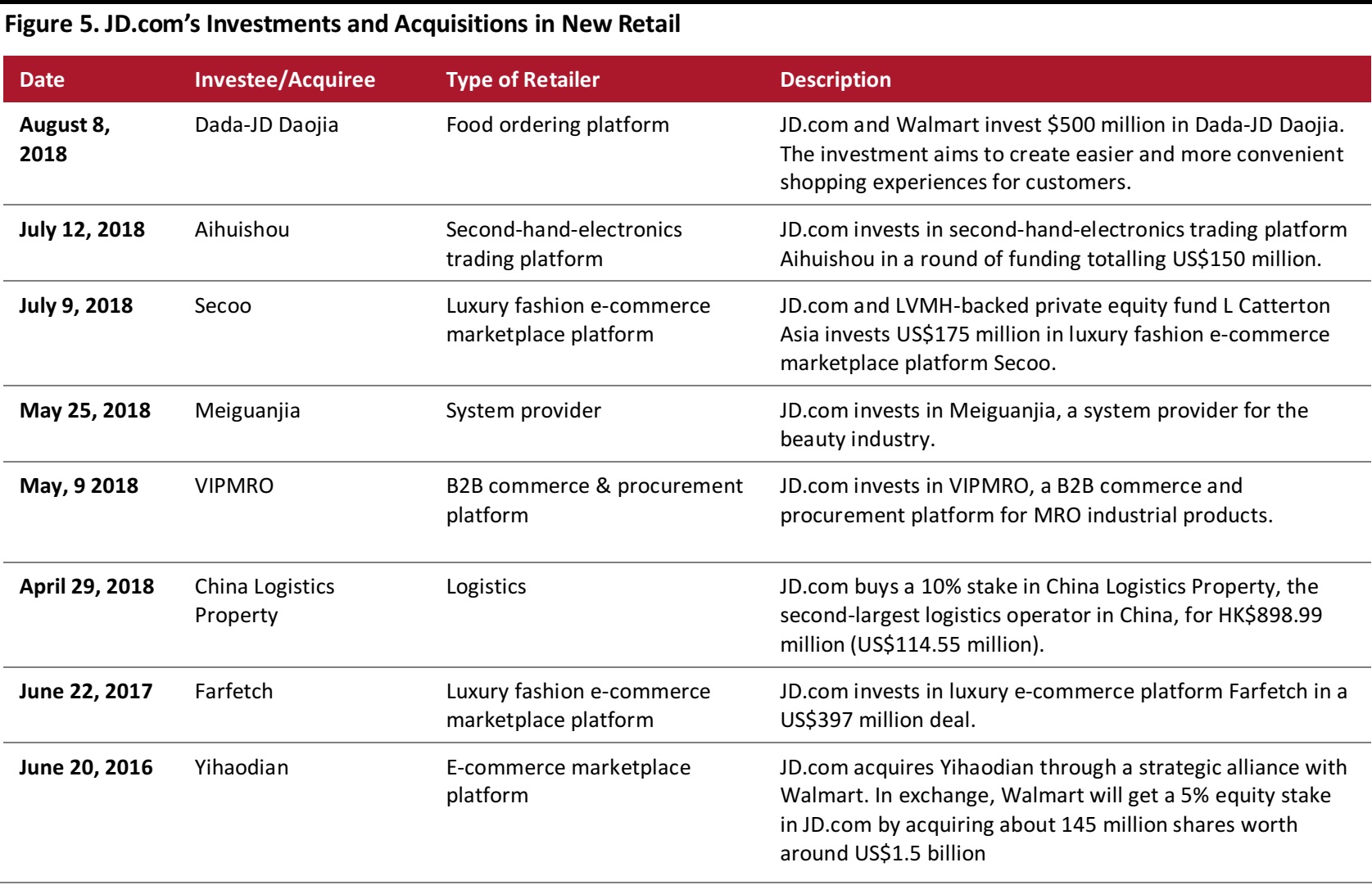

To expand their New Retail capacities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies, brick-and-mortar stores, etc.Listed in Figures 3, 4and 5arerecent investments of and acquisitions by these companies, along with investment dates, investees and the industry segments they are in, and funding details.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Alibaba

Source: Alibaba

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research