The Double 11 Global Shopping Festival Is Nearing

The Double 11 Global Shopping Festival has been held every year on November 11 (11.11 or the eleventh day of the eleventh month) since 2009 and its 10th edition is just around the corner. The one-day online sales extravaganza has become the benchmark of Chinese consumption and in this report series, we review all that is happening in the prelude to this year’s Double 11.

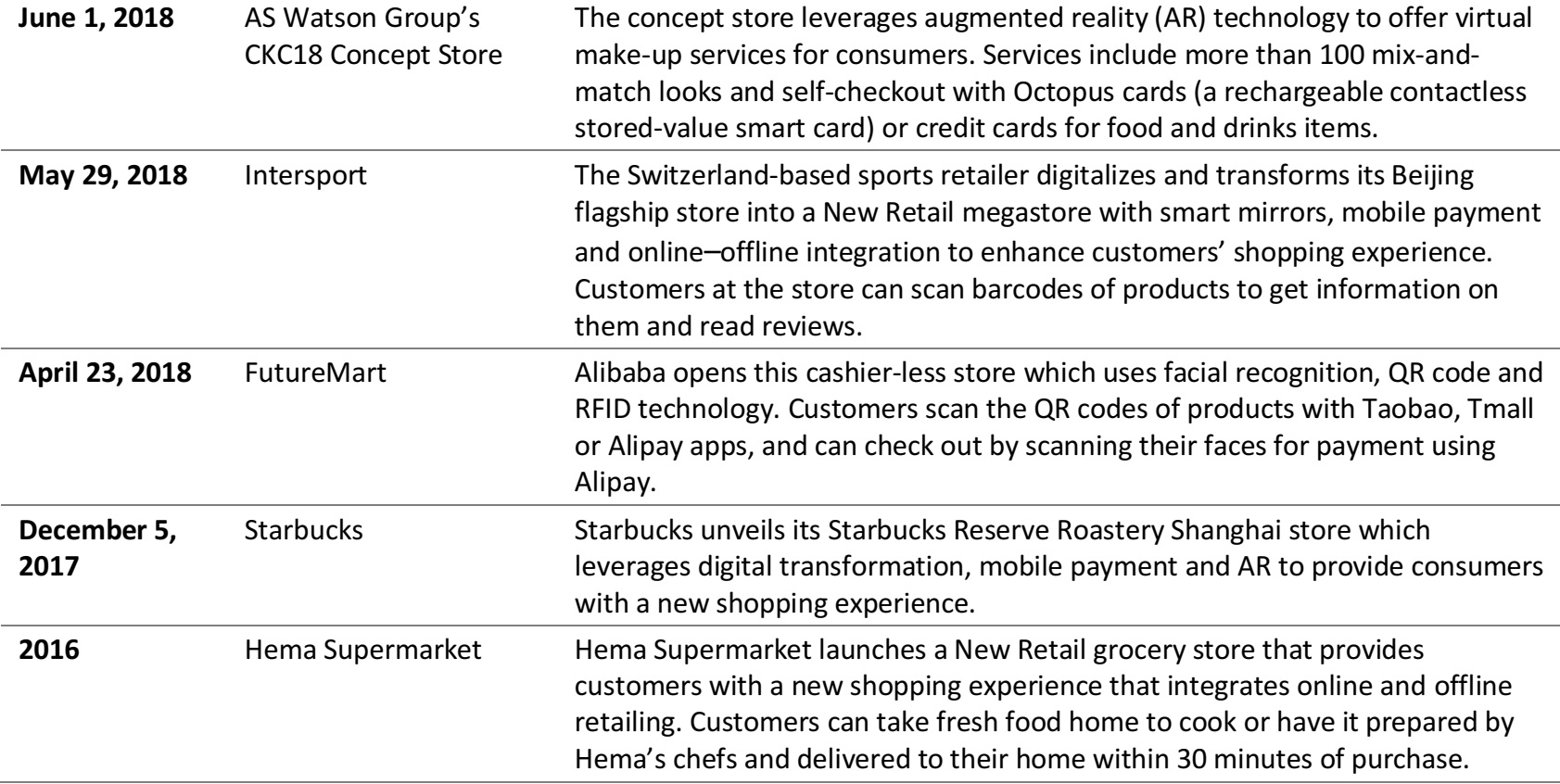

What Will be the New Record for This Year?

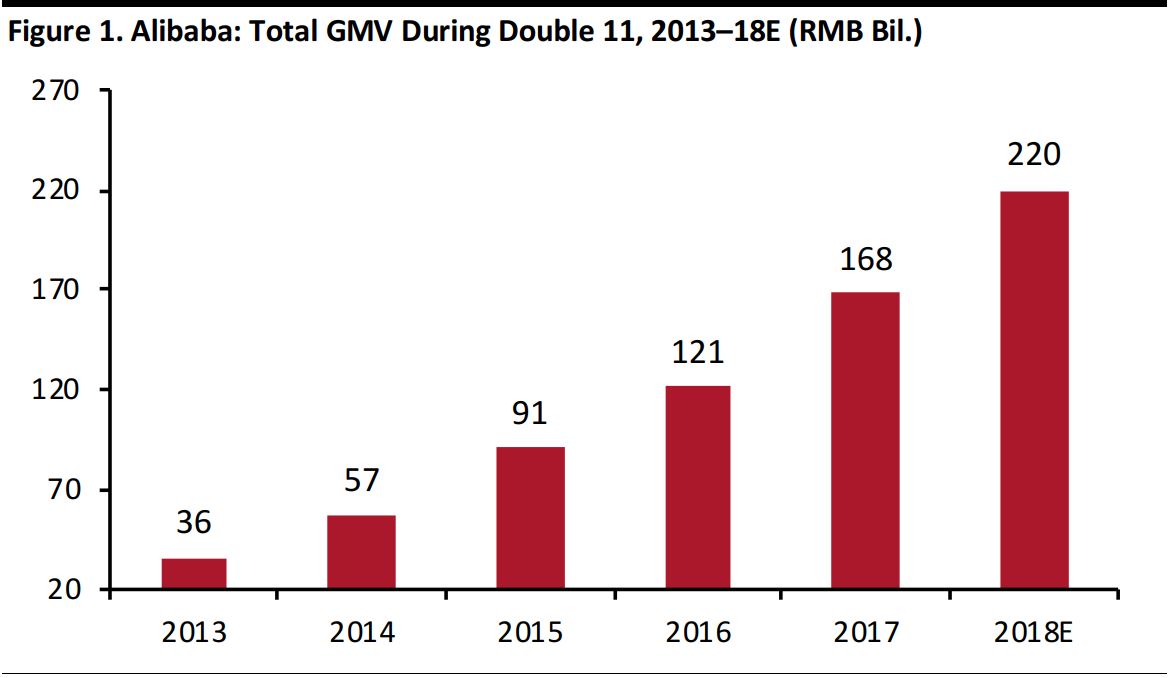

Each year since 2009, Alibaba has reported record-breaking gross merchandise volumes (GMVs) for transactions made during Double 11. GMV on Alibaba’s ecommerce platforms for the day has shown sharp year-over-year growth over the past five years and has grown by 367% from 2013 to 2017. In 2017, Double 11’s GMV grew by 39% year over year to a record high of ¥168 billion (US$24.3 billion at latest exchange rates and US$25.3 billion at 2017 exchange rates.)

We estimate that Alibaba’s GMV for this year’s Double 11 will reach approximately

¥220 billion (US$31.8 billion), up by around 31% year over year.

This year marks Double 11’s tenth anniversary and this could drive heightened publicity and so positive consumer sentiment for the event. According to sources familiar with the matter, Alibaba expects GMV of approximately ¥200 billion (US$ 28.9 billion) during this year’s Double 11, but we think this could be exceeded.

Source: Company reports/Coresight Research

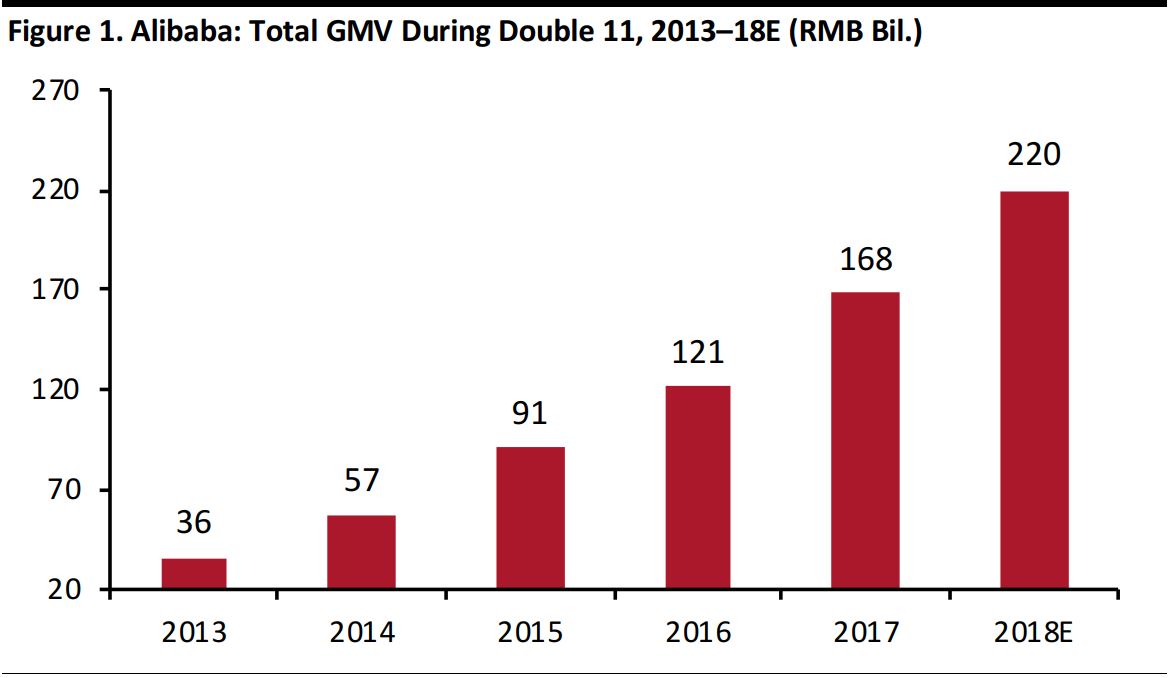

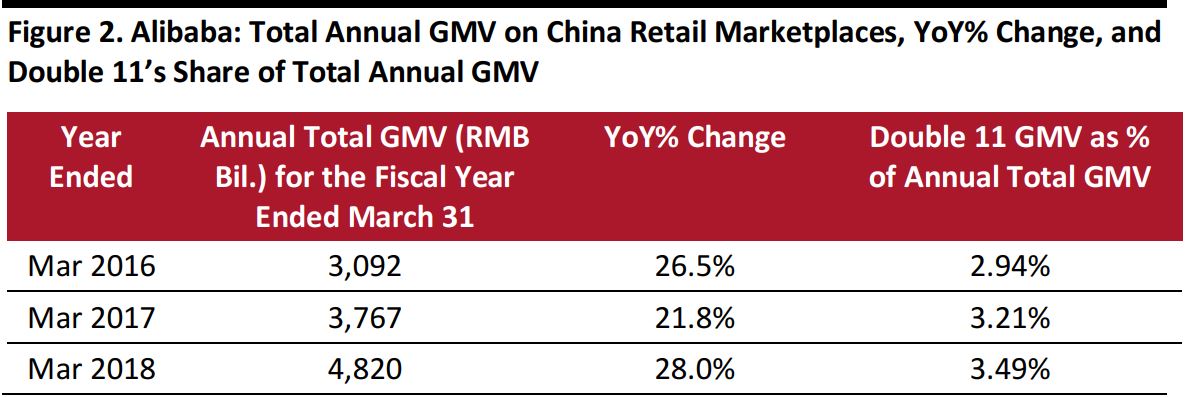

We observe that the proportion of Double 11’s GMV relative to Alibaba’s annual GMV increased slightly in each of the past two years. Our 2018 estimates assume this trend continues.

Source: Company reports/Coresight Research

It took 52 seconds to reach ¥1 billion (US$145 million at latest exchange rates) GMV in 2016 but only 28 seconds to reach the amount in 2017. In just 13 hours, 2017’s total GMV exceeded that of 2016, suggesting a faster rate where orders were placed by experienced shoppers who had already put all the items for purchase in the cart beforehand.

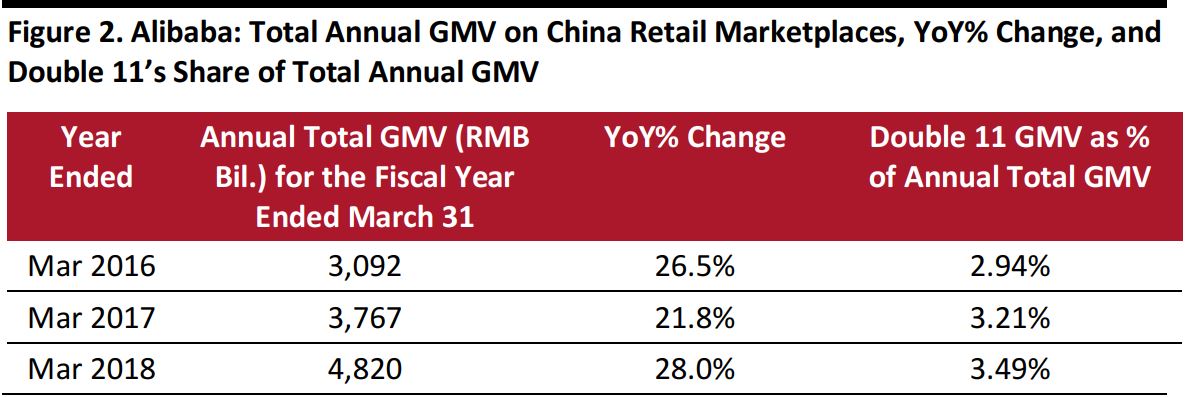

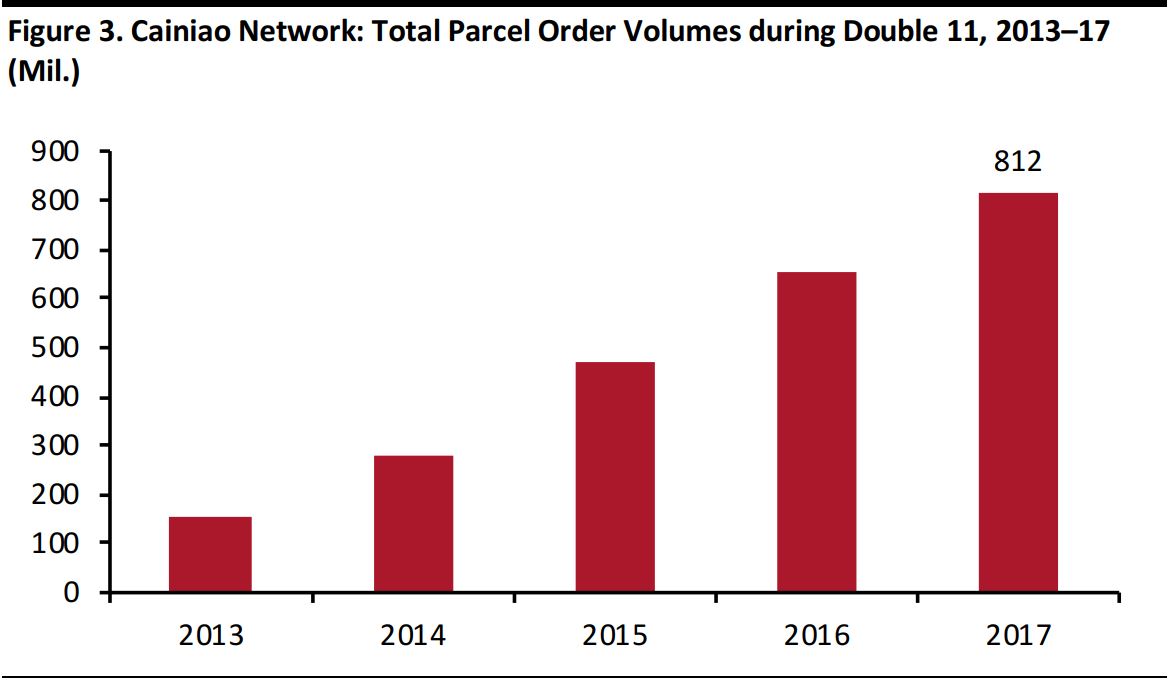

In concord with the rising trend of total GMV on Singles’ Day, Cainiao Network, Alibaba’s logistics affiliate, also saw a record-breaking order volume of parcels on November 11 every year—it grew by 24% to a new record high of 812 million in 2017.

Source: Cainiao Network/Coresight Research

Logistics Companies Raise Charges for Parcel Delivery

In anticipation of surging demand during National Day Holidays and the upcoming Double 11, five big logistics companies in China—ZTO Express, YTO Express, STO Express, Yunda Express and Best Express—have raised their charges for parcel delivery services to Shanghai by ¥0.5 (US$0.07) per order, on average.

However, not all logistics companies have followed suit. Gome’s Logistics affiliate, Anxun Logistics and Suning Holdings Group affiliate, Suning Logistics announced that they will maintain their parcel delivery charges at the current level.

Cainiao Network Is Well-Prepared for Double 11

Cainiao Network is preparing itself for an efficient and environment-friendly Double 11 this year. The logistics company will be using newly-developed IoT-enabled surveillance cameras to closely monitor situations in thousands of logistics centers and facilities across the country on November 11. Six other Chinese logistics firms will also be joining this initiative by Cainiao Network in which smart surveillance cameras will send real-time alerts signals in the case of any situation arising, thus helping to efficiently monitor numerous logistics centers.

The company will also open 5,000 more recycling stations in 100 Chinese cities, which is a big jump from last year when only 10 cities had such facilities. Customers can deposit their parcels’ paper boxes and other packaging material—which will be made of recyclable and bio-degradable materials—at the nearest recycling station where they will be recycled or properly disposed.

Cainiao Network ’s recycling stations

Source: Alibabanews.com

Cainiao Network ’s recycling stations

Source: Alibabanews.com

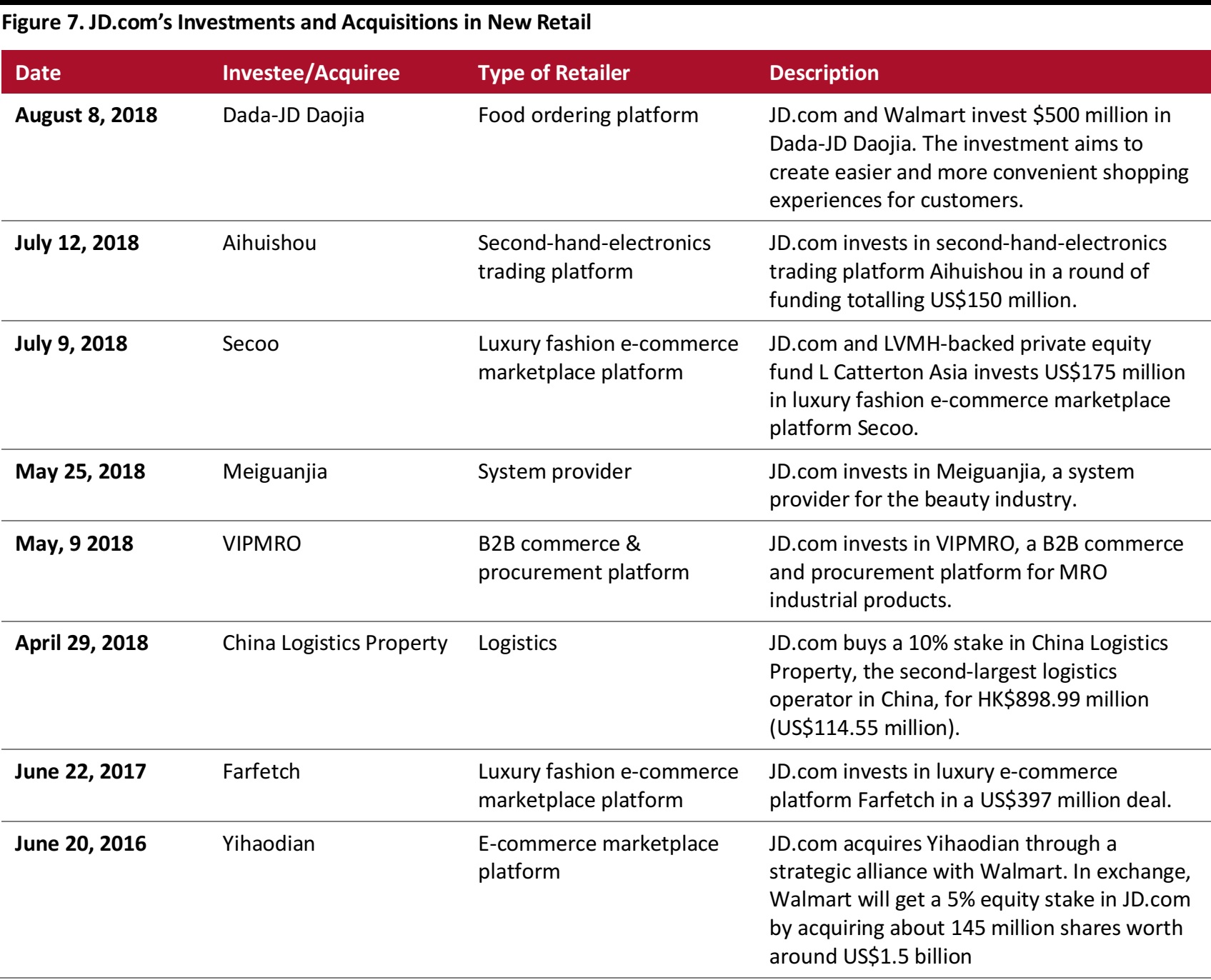

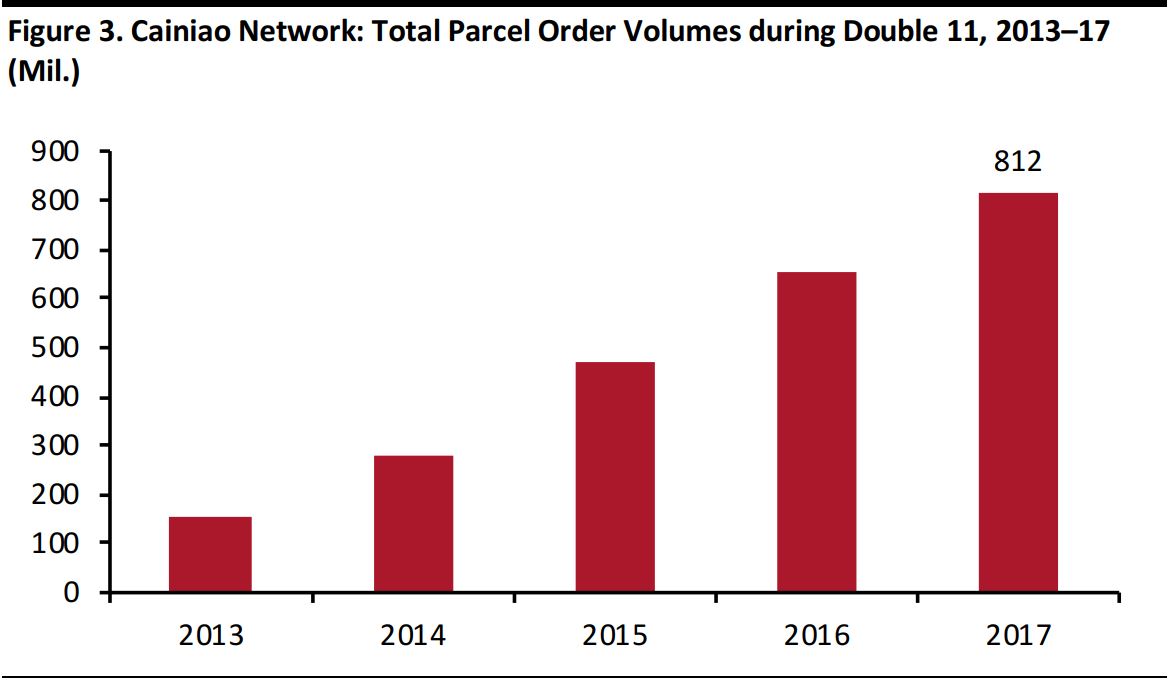

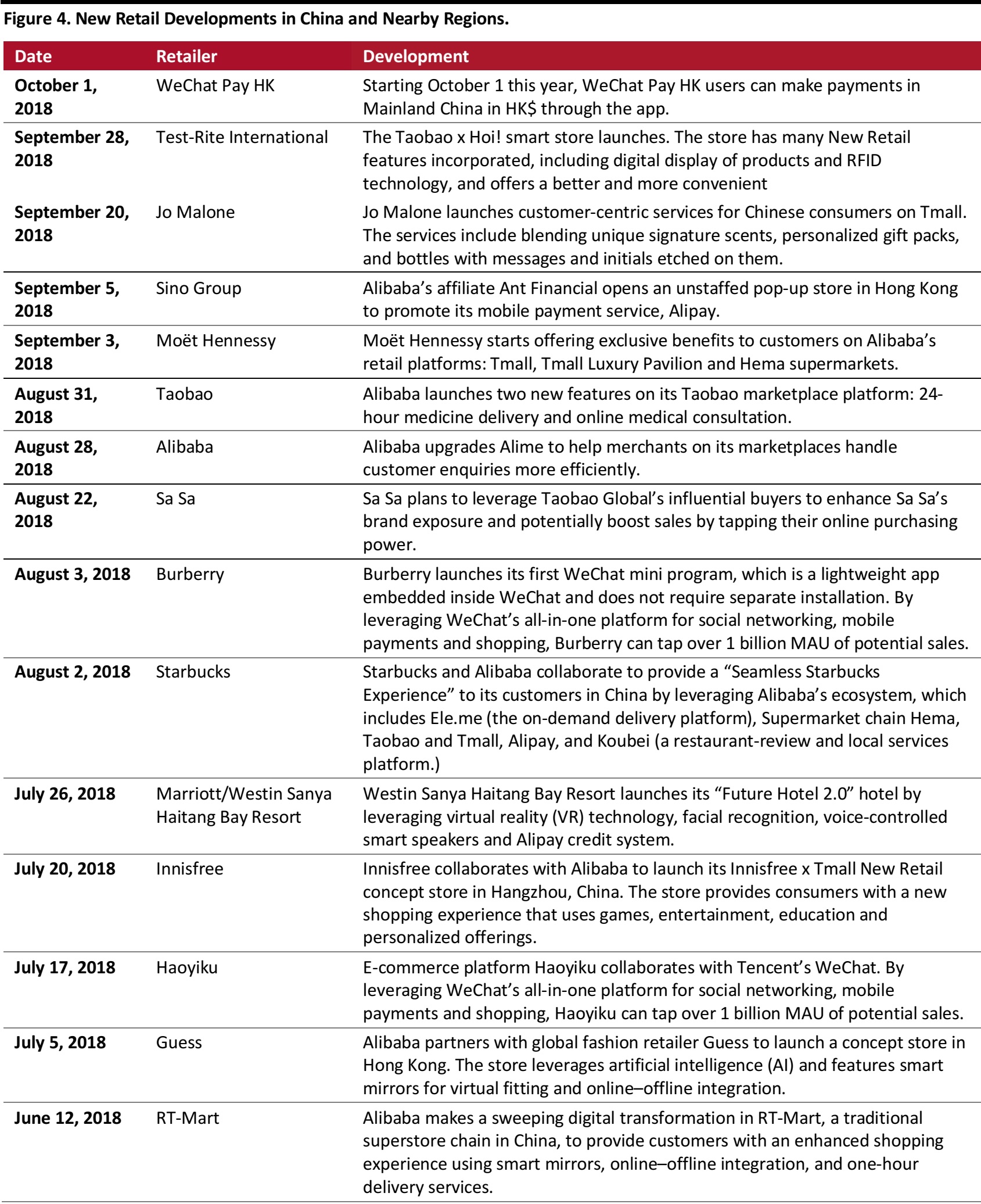

What’s New in New Retail?

WeChat Pay HK’s Cross-Border Mobile Payment Service

On October 1 this year, WeChat Pay HK launched its cross-border payment service that allows Hong Kong citizens to make payments in Mainland China in HK$ by using their e-wallets. This is a first-of-its-kind service since the launch of mobile payment services in the city.

This service is the result of a partnership between Tencent and UnionPay, and has not yet been fully implemented in Mainland China. At the present stage, only four merchants have tie-ups with WeChat Pay HK to participate in this initiative, which are: Didi Chuxing (car hailing app); Meituan-Dianping (group buying app); Dazhong-Dianping (restaurant review app); and www.12306.cn (railway tickets purchase site).

For more detailed coverage on Wechat Pay HK’s cross-border payment services, read our report at:

WeChat Pay Hong Kong Launches Cross-Border Mobile Payment Services.

Source: Company reports/Coresight Research

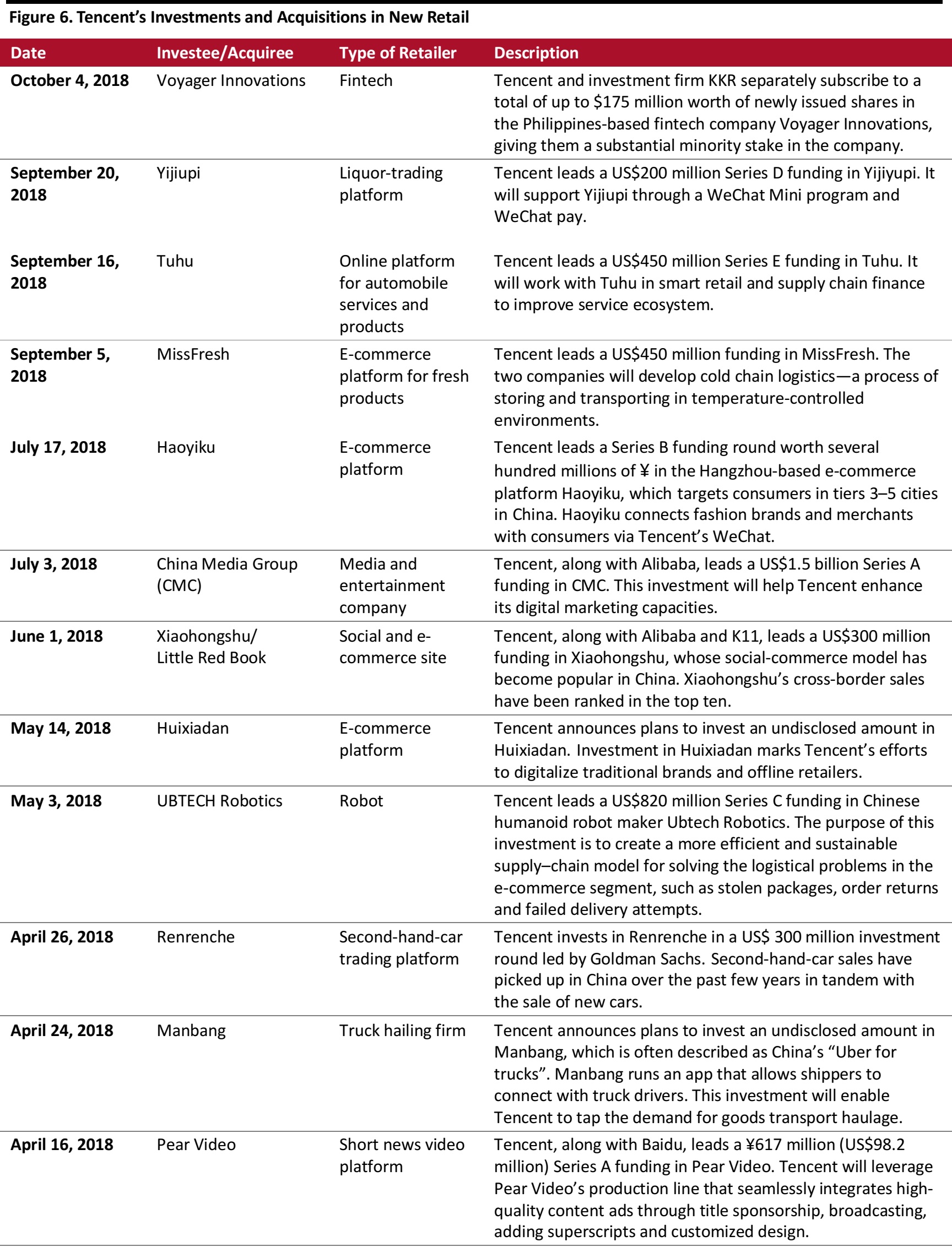

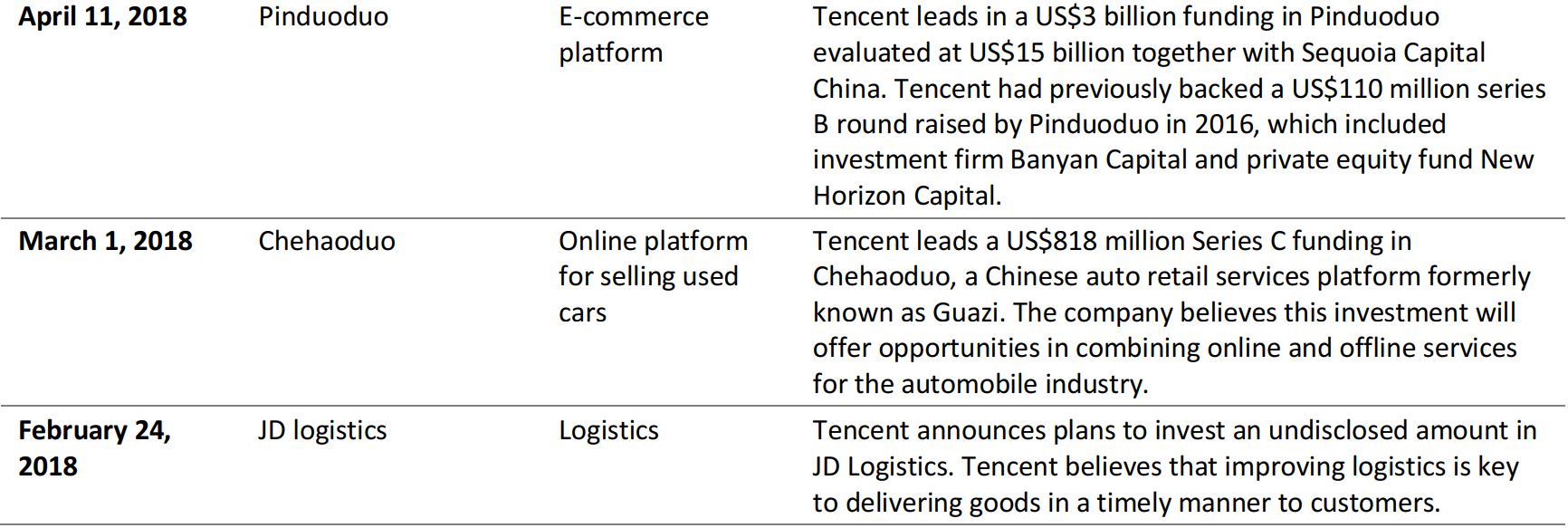

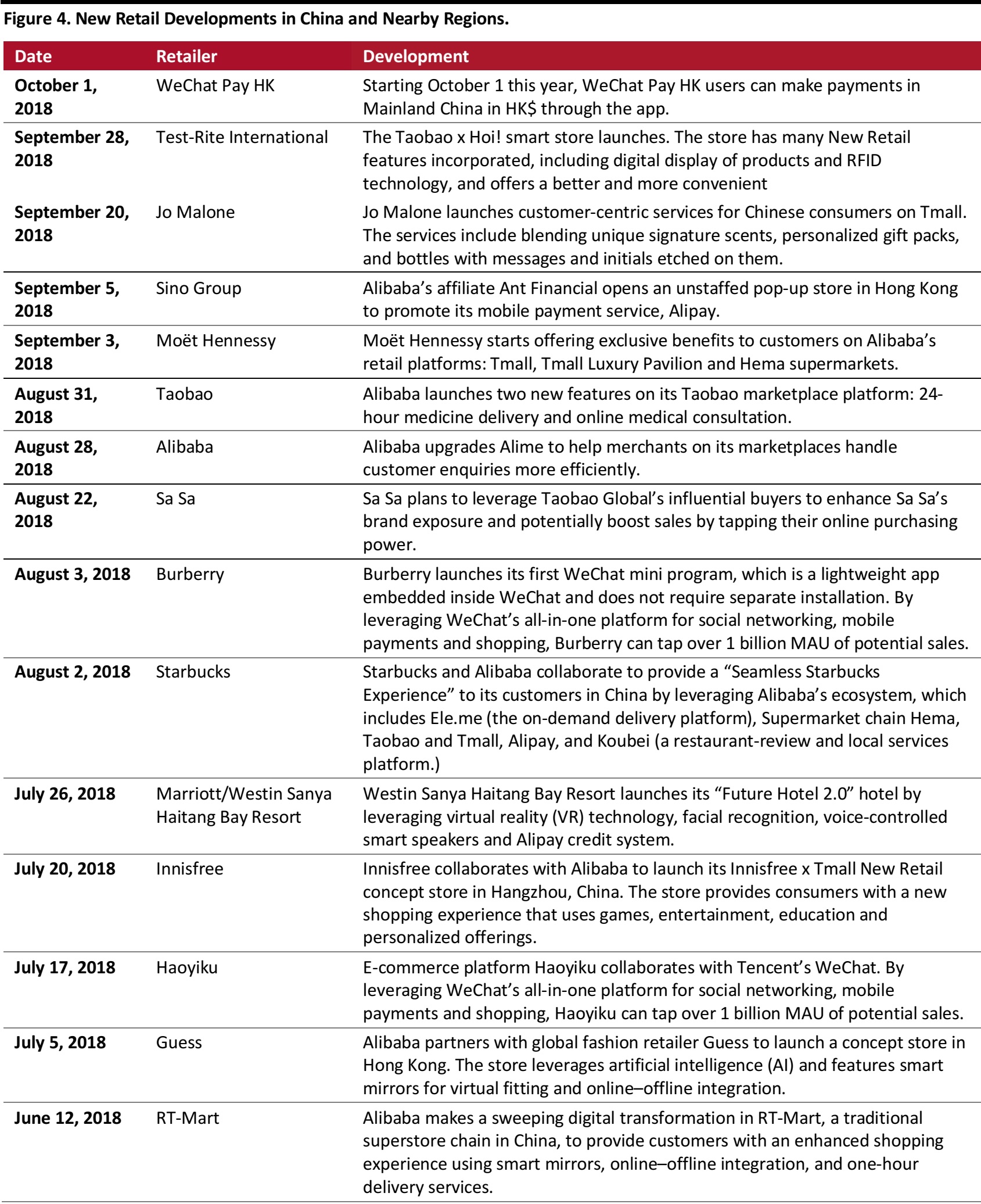

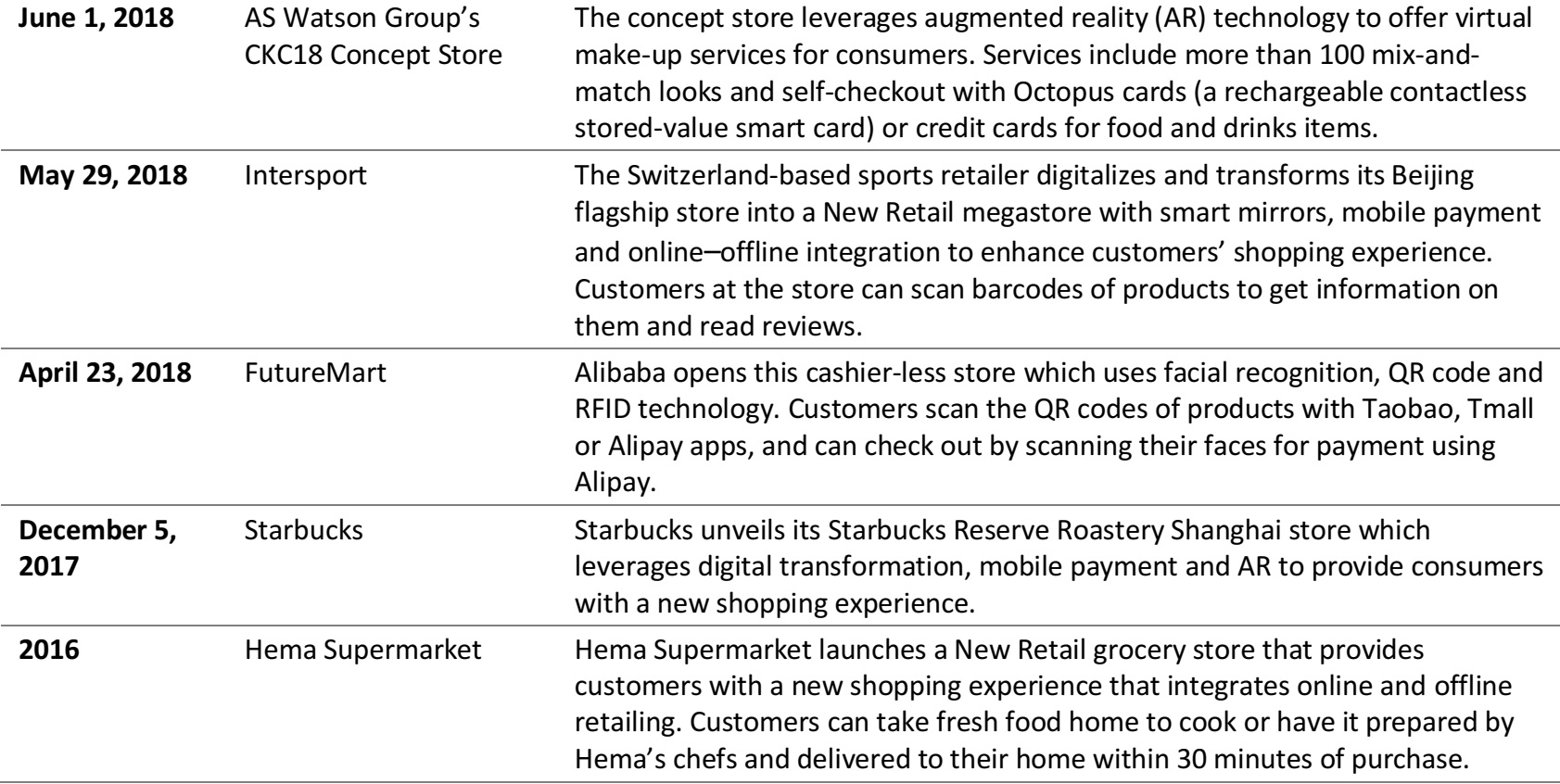

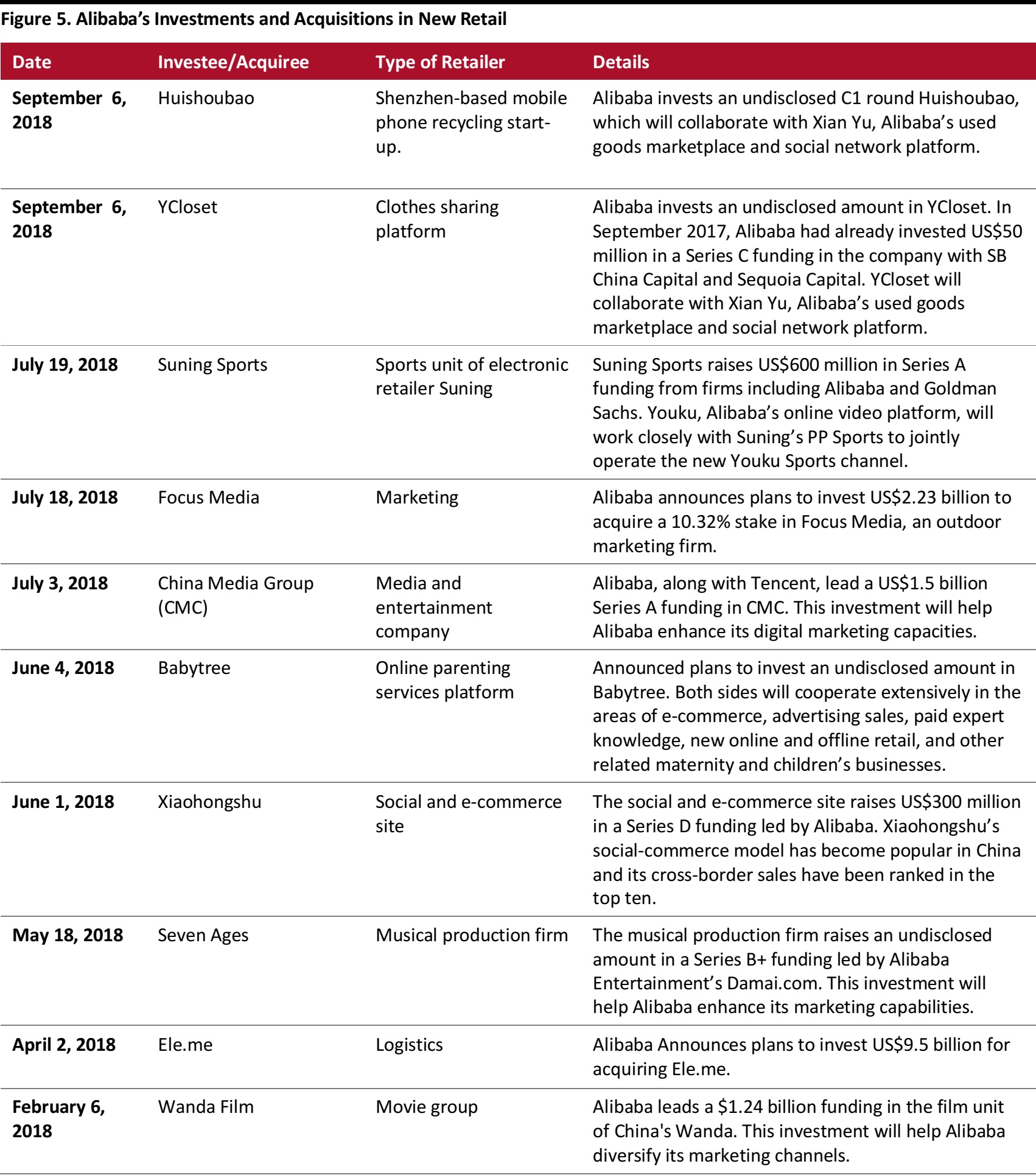

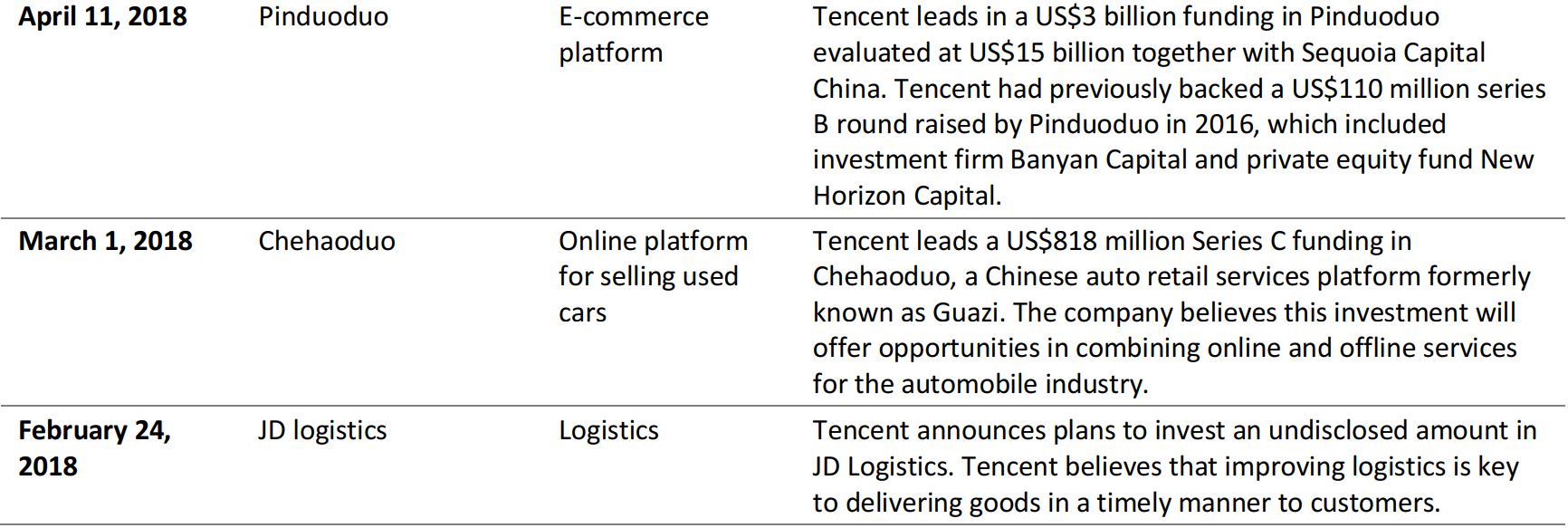

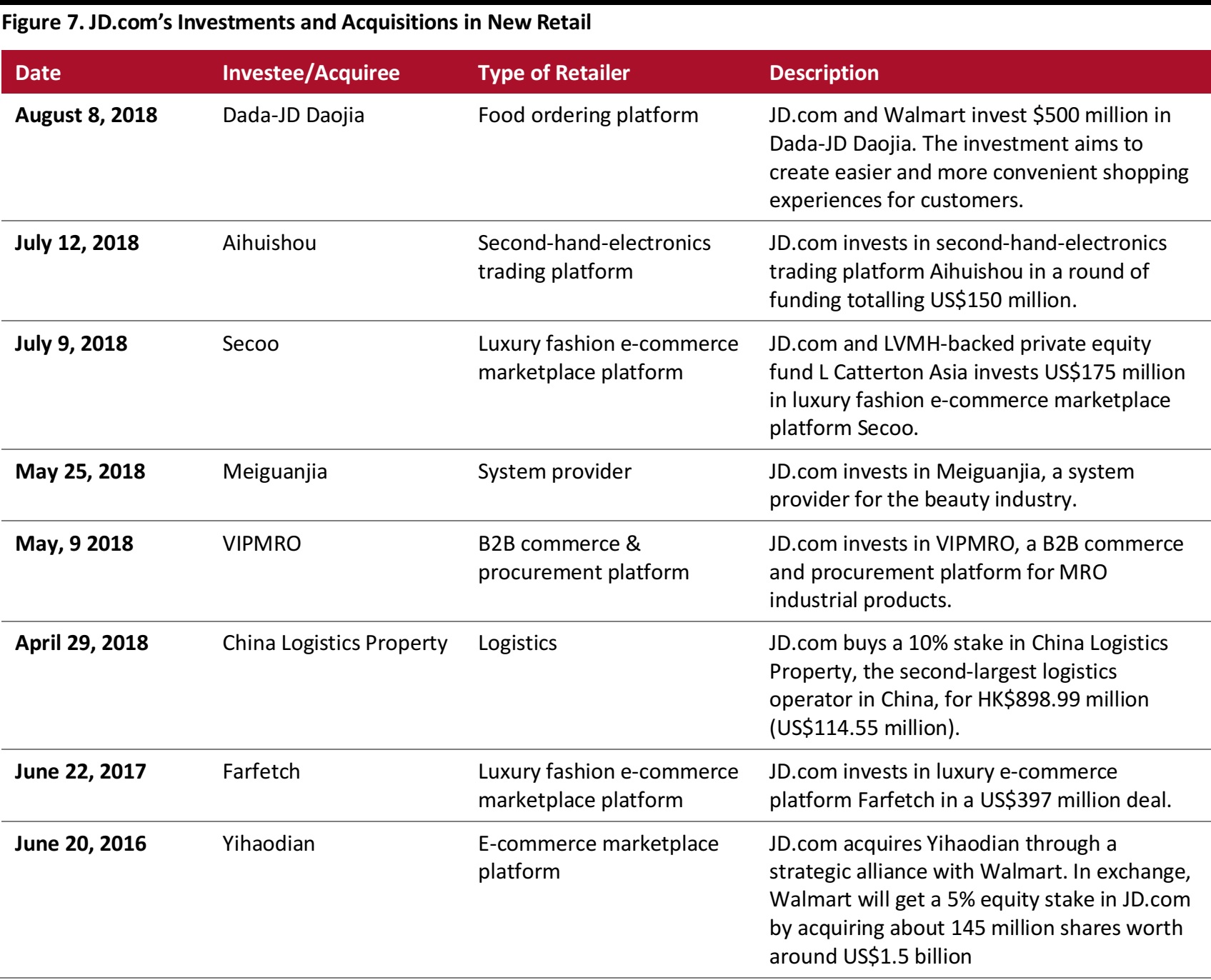

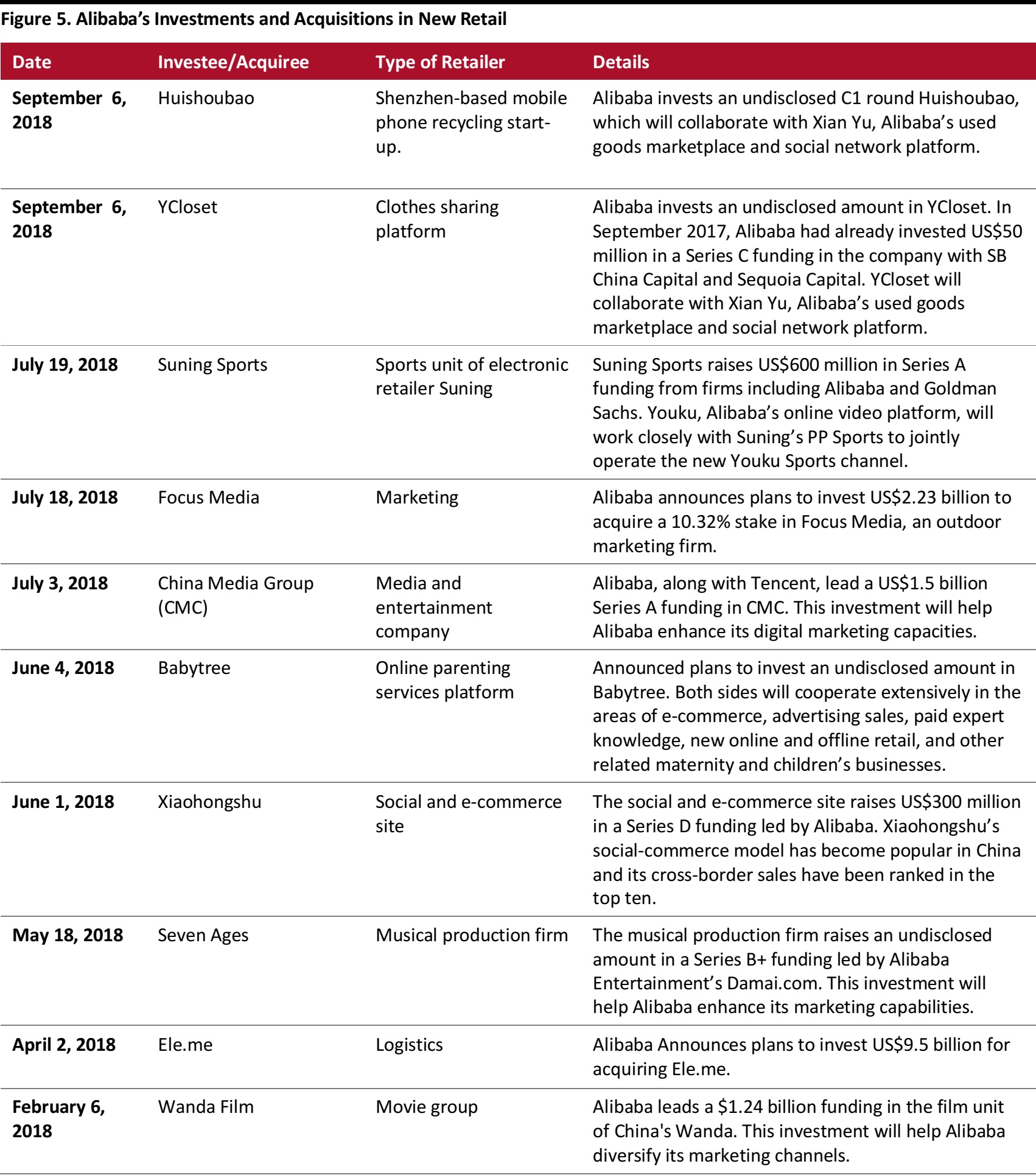

Investments and Acquisitions in New Retail

To expand their New Retail capacities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies, brick-and-mortar stores, etc. Listed in Figures 5, 6 and 7 are recent investments of and acquisitions by these companies, along with investment dates, investees and the industry segments they are in, and funding details.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Cainiao Network ’s recycling stations

Source: Alibabanews.com

Cainiao Network ’s recycling stations

Source: Alibabanews.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research