The Double 11 Global Shopping Festival Is Nearing

The Double 11 Global Shopping Festival has been held every year on November 11 (11.11) since 2009 and its 10th edition is just a few weeks away. The one-day online sales extravaganza has become the benchmark of Chinese consumption and in this report series, we review all that is happening in the prelude to this year’s Double 11.

AliExpress Continue to Invite Overseas Shoppers to Participate in Double 11

Double 11 is an event in which overseas merchants can sell to Chinese consumers and Chinese merchants connect with foreign shoppers.

AliExpress—Alibaba’s international e-commerce platform—announced a series of wide-ranging initiatives to boost sales at Double 11 this year by allowing Chinese merchants to sell online to overseas customers. The initiatives include:

- Launching extensive pre-sale activities starting October 20 to spur consumer sentiments;

- AliExpress’s official website will be available in 13 languages—with enhanced translation and search capabilities—during the event; and

- Extending the event by a day and turning it into a two-day sale, from 00:00 (Sydney time) on November 11 to 23:59 (Sydney time) on November 12. This will ensure that the event covers all time zones.

Countries such as Russia, France, the US, Spain, Poland, the Ukraine and Saudi Arabia will be important target countries during this year’s Double 11 due to their remarkable sales performance during the event’s previous editions. AliExpress is particularly popular in Russia and according to market research company TNS, it was the most popular online marketplace in Russia in 2016 with over 22 million unique visitors every month.

Alibaba has also continued to strengthen its operations in Russia. In March this year, the company’s logistics affiliate Cainiao launched its first regular intercontinental air freight route dedicated to e-commerce products between China and Russia.

The Indonesian Government Will be a Partner at Double 11 This Year

The Indonesian Government announced that it will be a partner at this year’s Double 11 and two videos featuring Indonesian President Joko Widodo will be broadcast during the event’s gala show.

The Indonesian Government will introduce five Indonesian products to Chinese consumers during this year’s Singles Day: Kapal Api Luwak Easy Drip coffee; Richeese Nabati cheese wafers; Papatonk Shrimp Crackers; Indomie instant noodles; and Yan TyTy edible bird's nests.

The Government of Indonesia is introducing products that it thinks can compete with their Chinese counterparts and chose these five products to mark the beginning of Indonesian companies’ entry into the event. “We aim to bring more Indonesian merchants to join the e-commerce platform, with these five products as a start,” says Jack Ma, Alibaba Chairman. These five established food products are already on Alibaba’s platform and in its warehouses.

During the festival, the Indonesian Chamber of Commerce and Industry will be sending a visit tour to Hangzhou to learn about Alibaba’s operations and logistics.

What’s New in New Retail?

Ele.me and Koubei to Merge to Form a New Lifestyle Service Company

On October 12, Alibaba’s CEO Daniel Zhang announced that Alibaba will merge its food delivery service Ele.me with its restaurant review and lifestyle unit Koubei to establish a local service company with the aim of making urban life “better and more convenient.”

The new company will have 3.5 million registered merchants and it will leverage Alibaba’s ecosystem—New Retail, memberships, logistics, finance and other areas that revolve around urban lifestyles—to serve people in the 676 Chinese cities that it will cover.

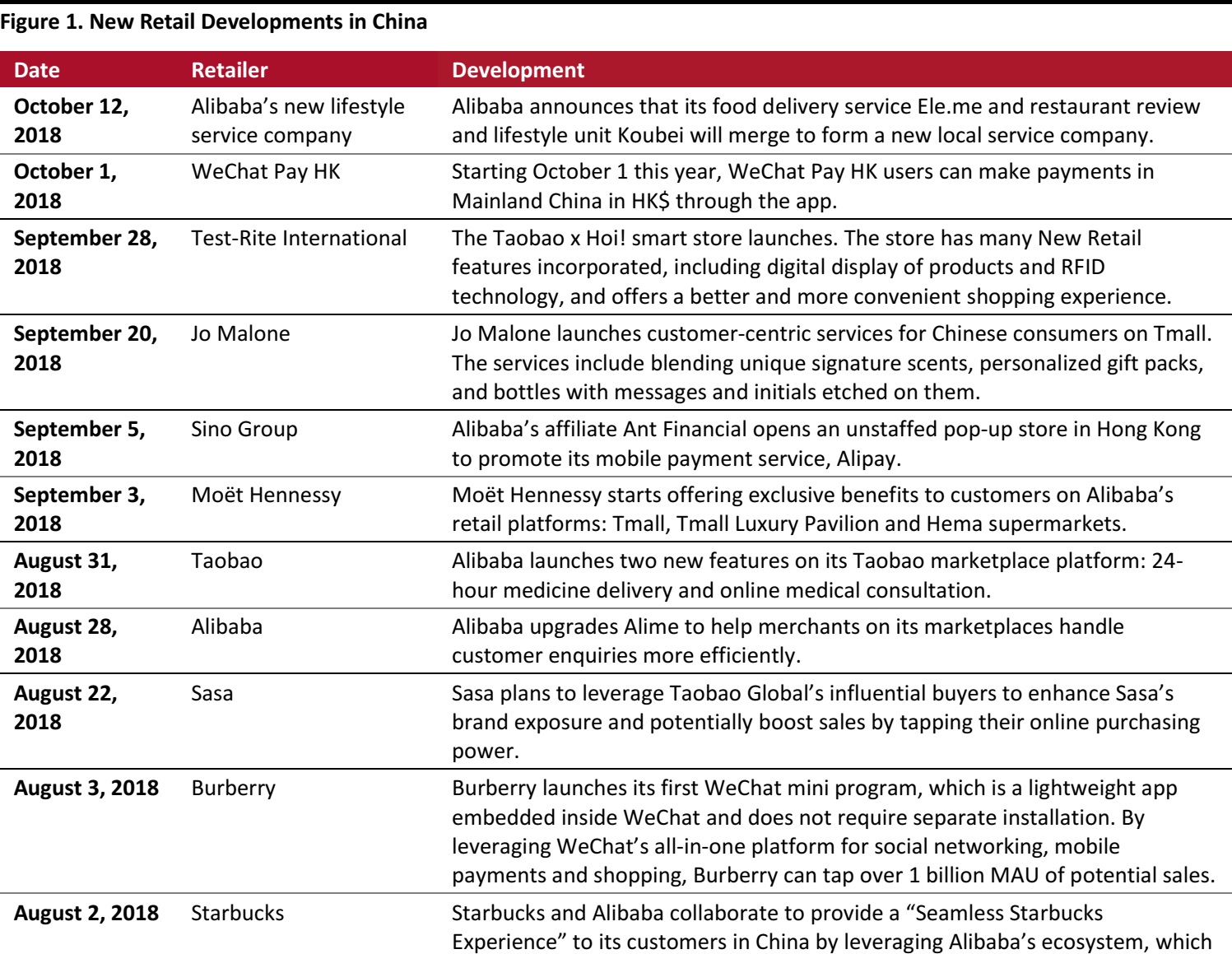

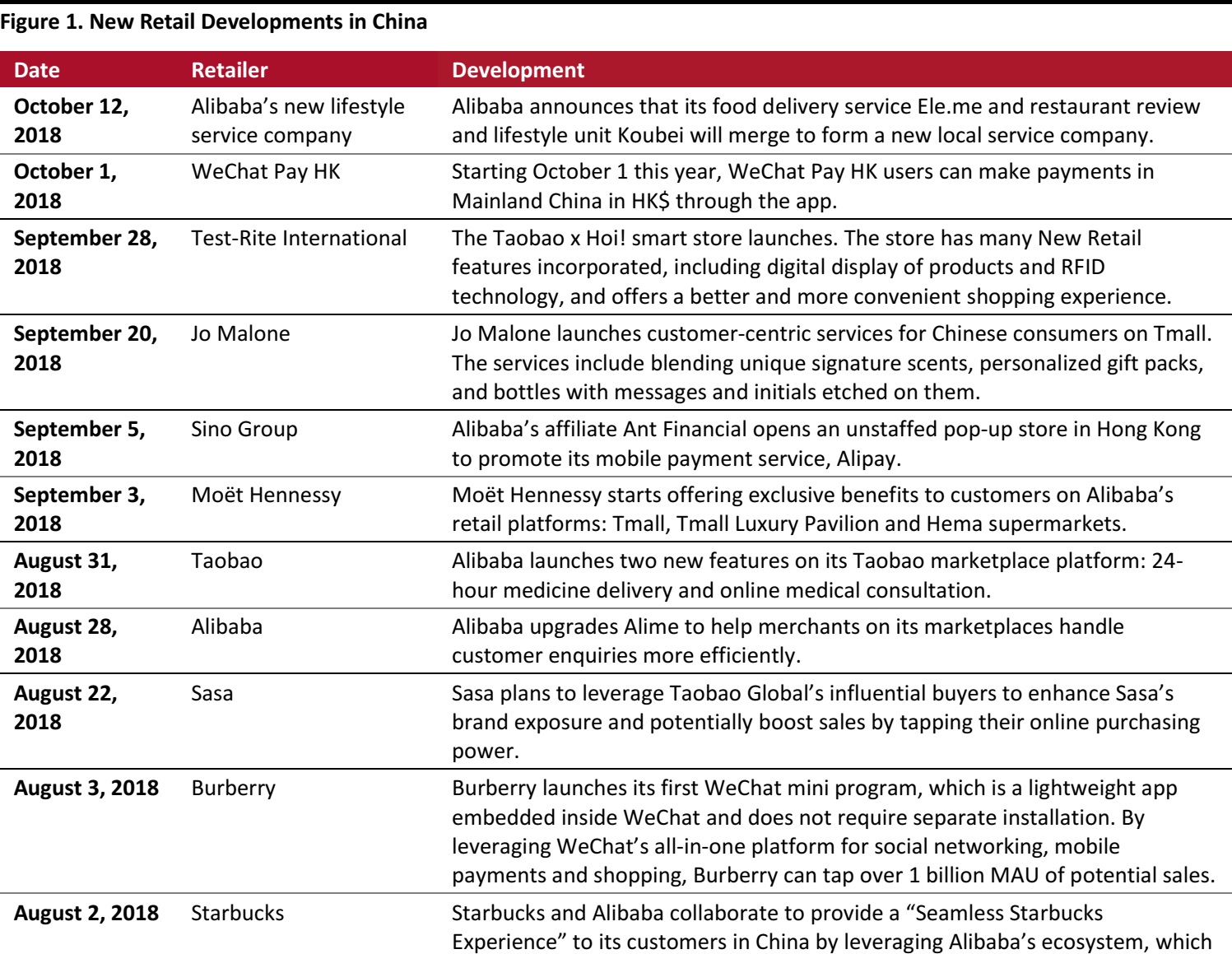

Figure 1 lists the latest New Retail developments in China.

Source: Company reports/Coresight Research

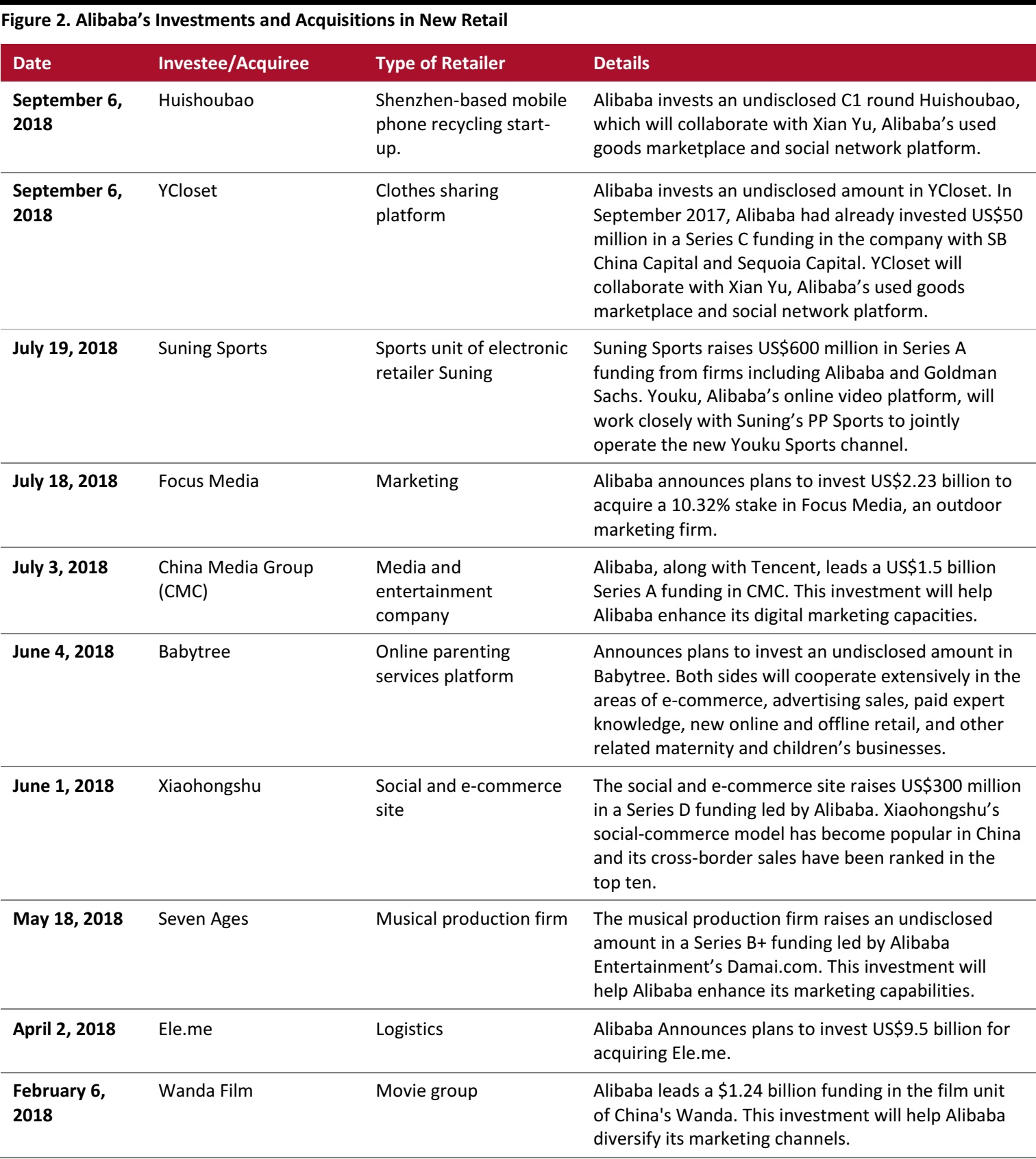

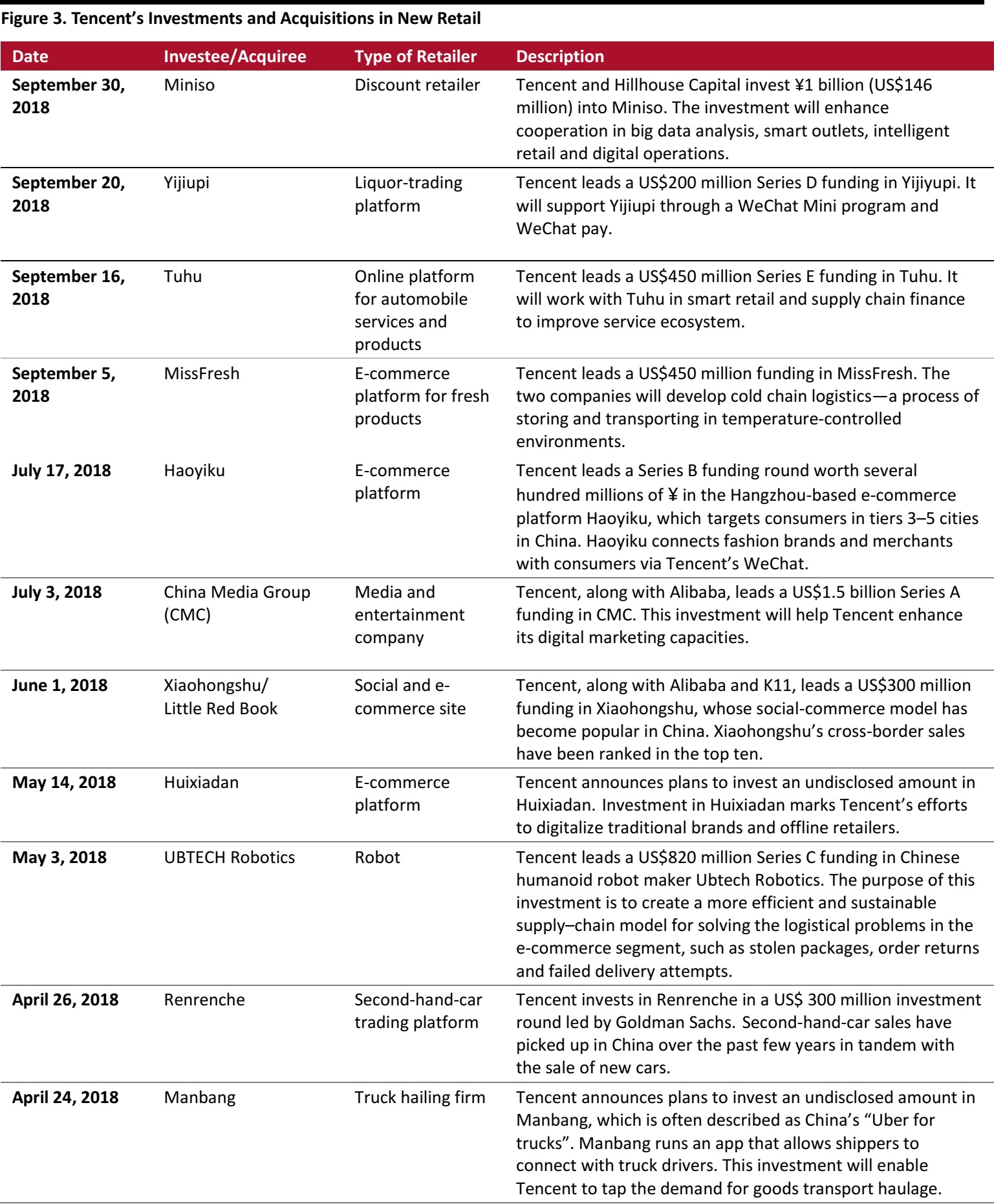

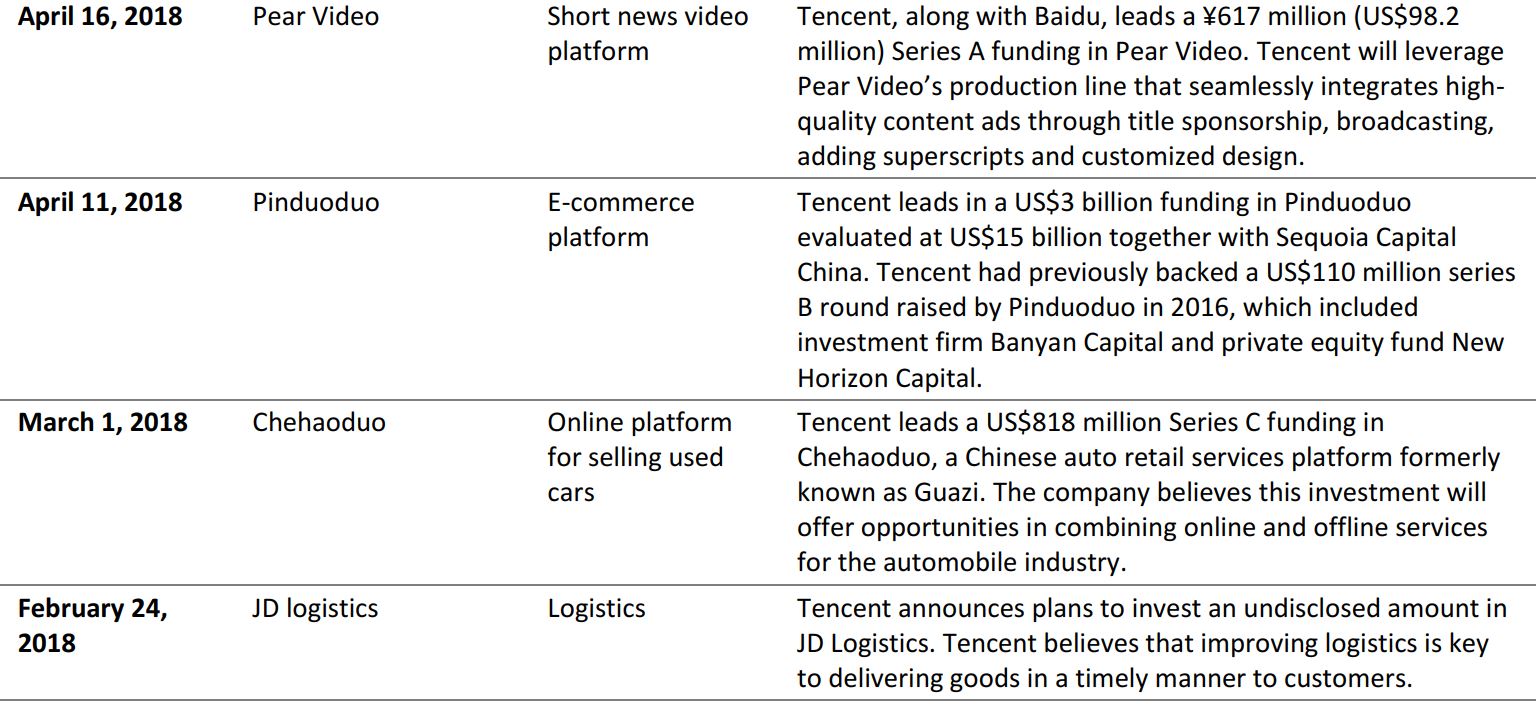

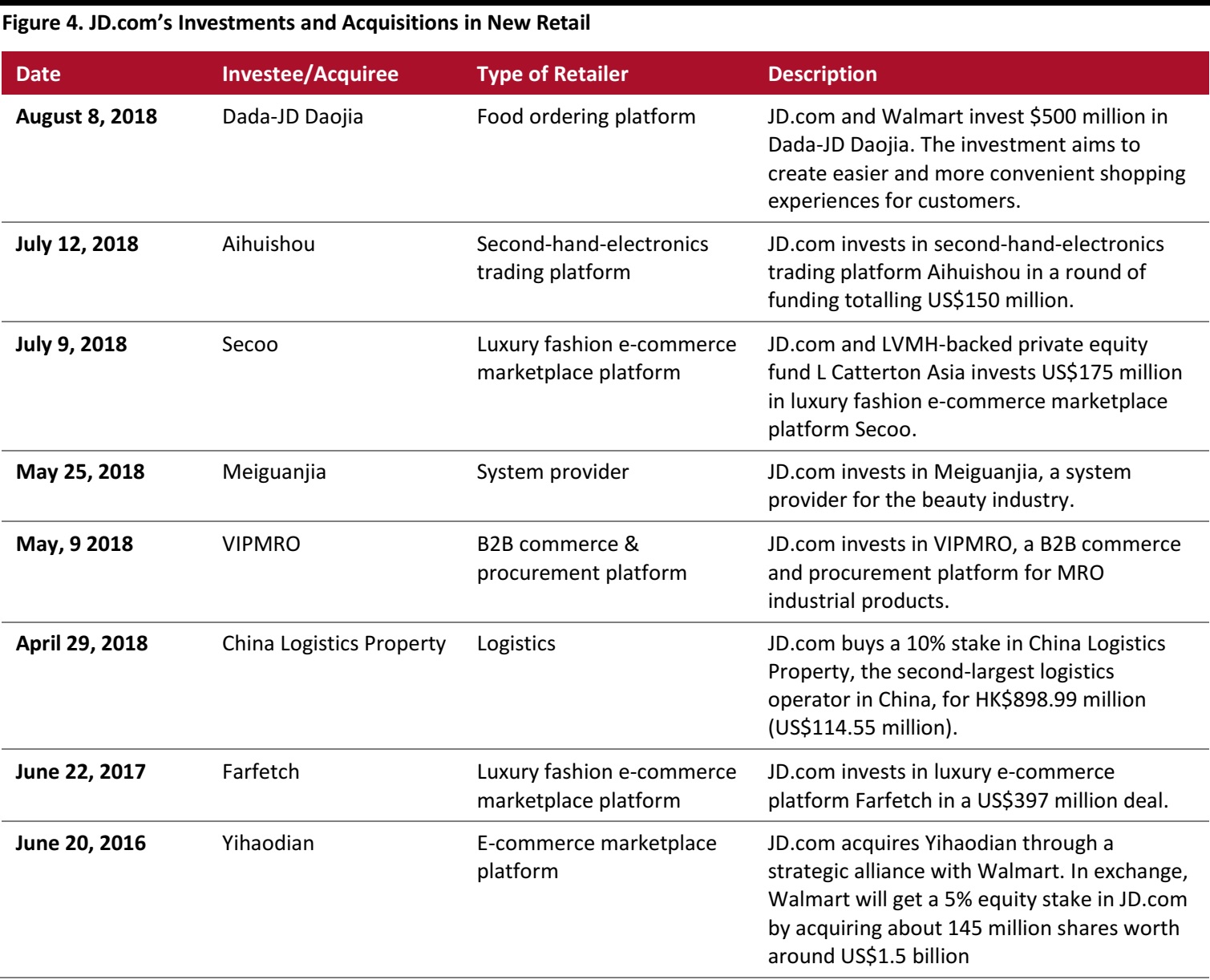

Investments and Acquisitions in New Retail

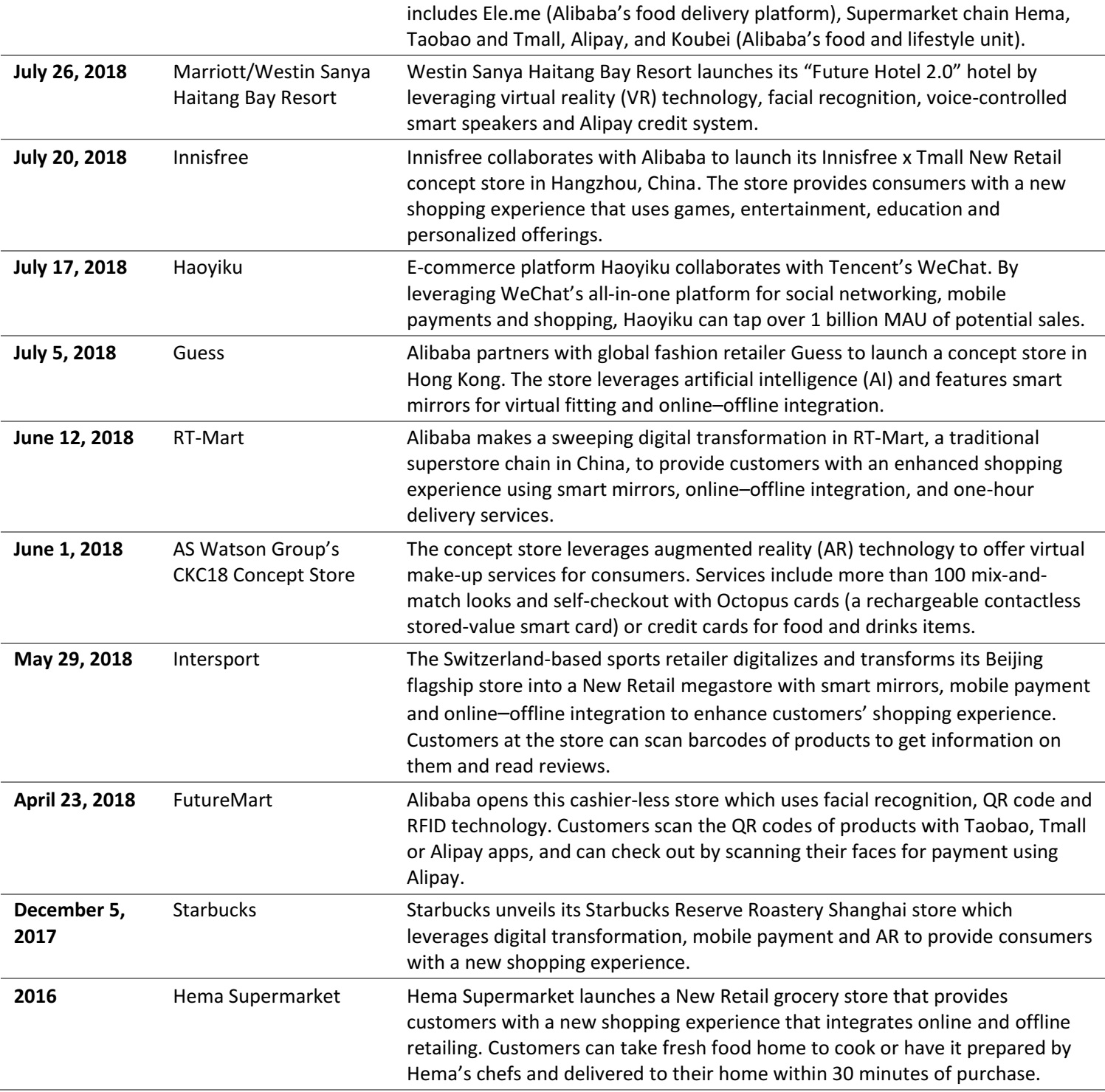

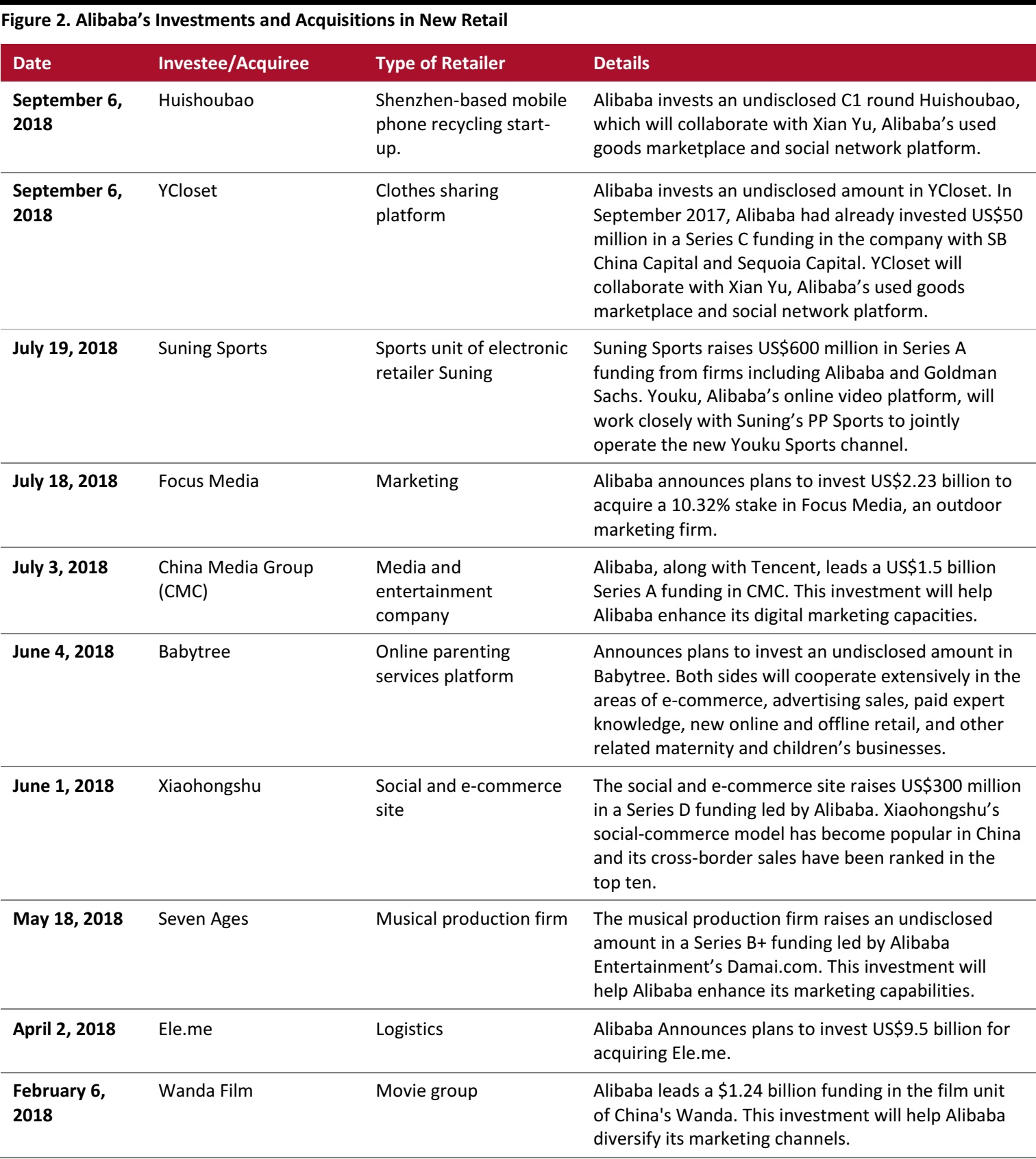

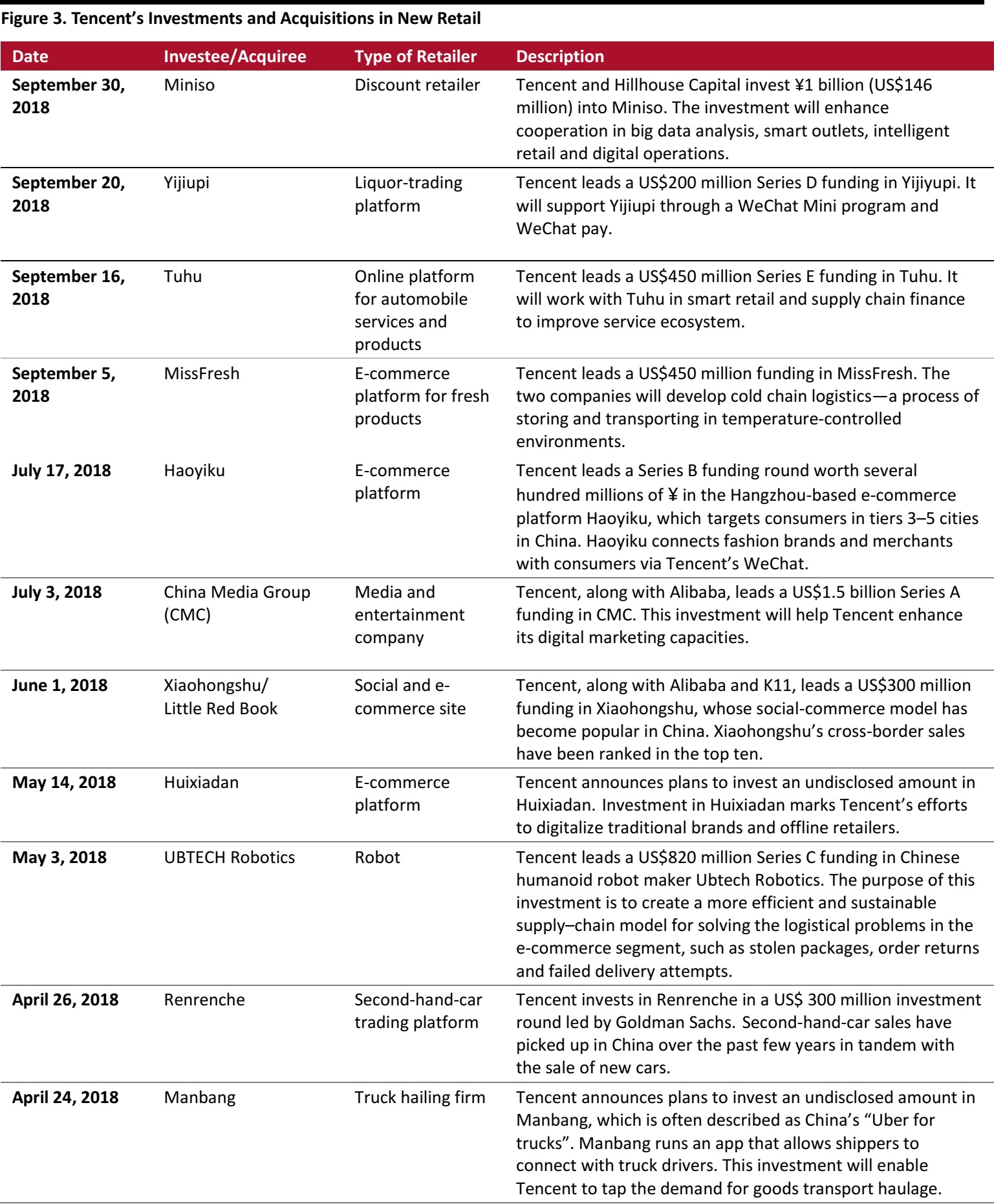

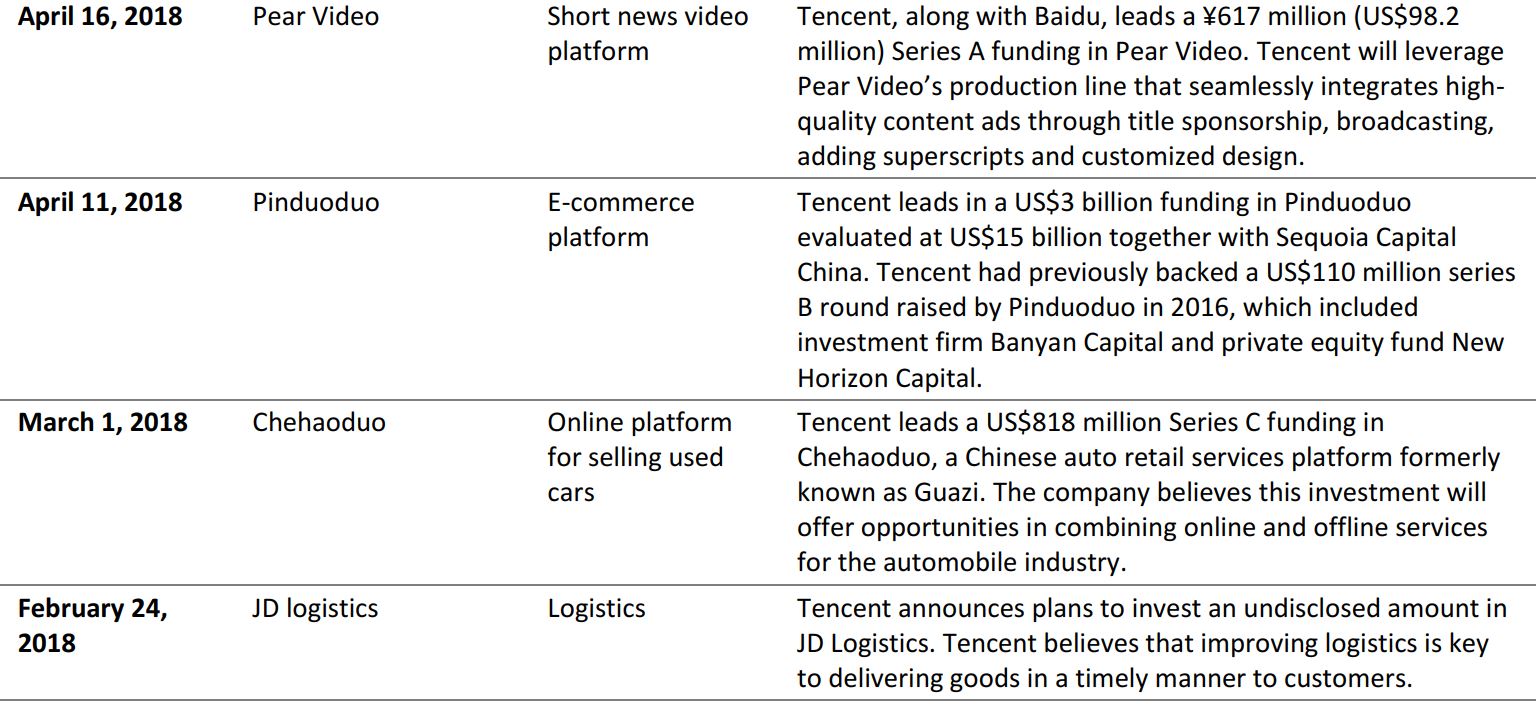

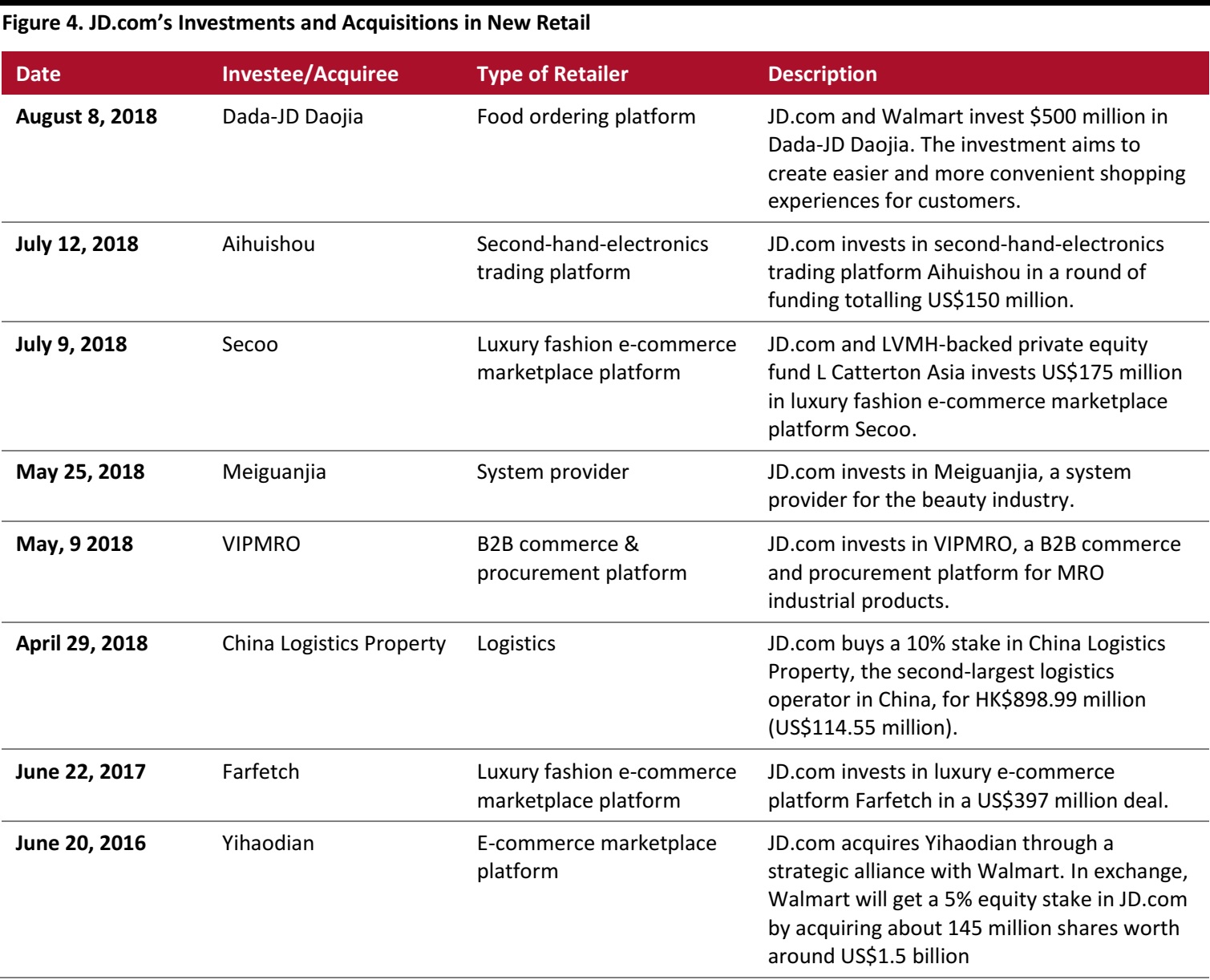

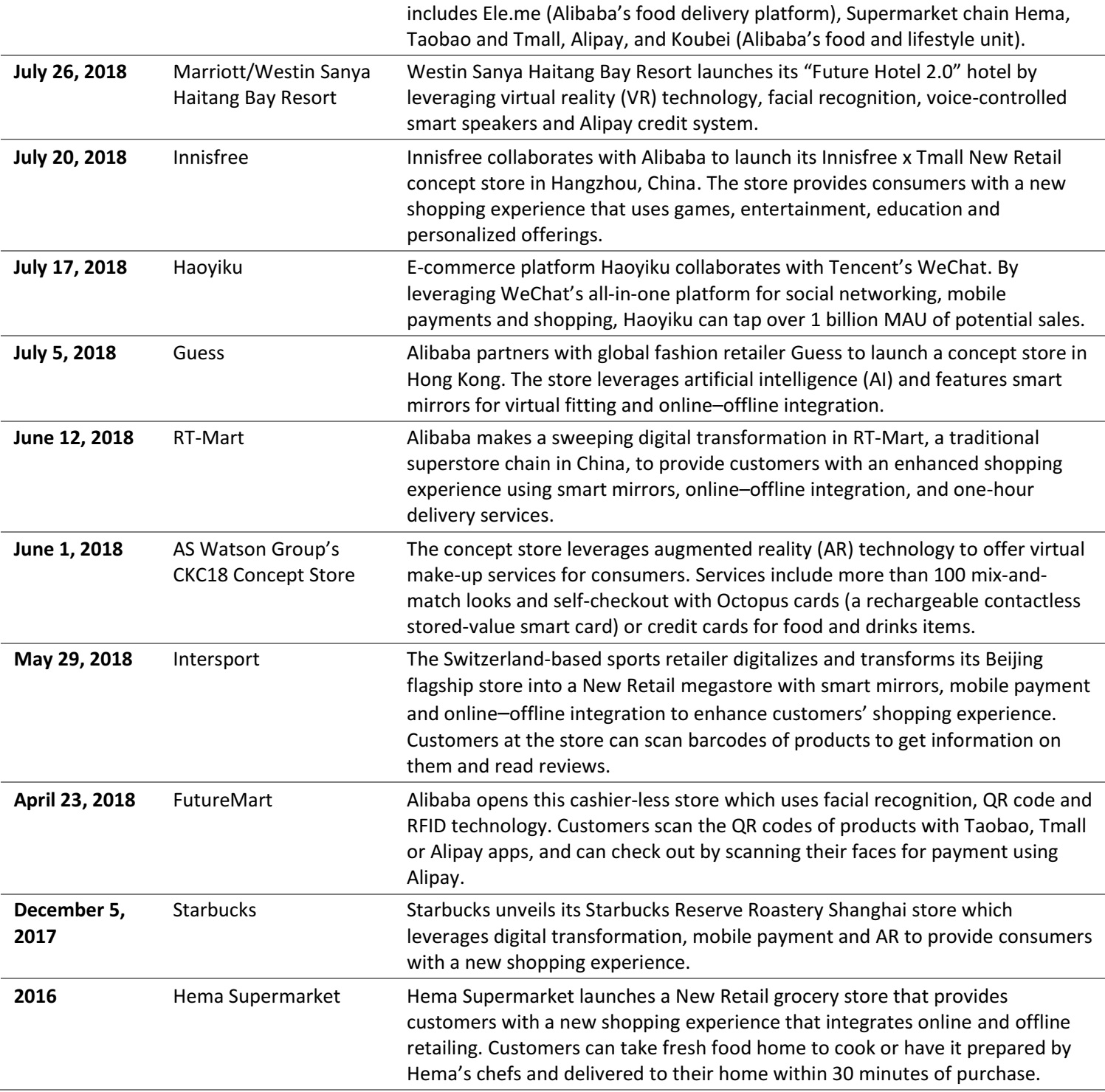

To expand their New Retail capacities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies, brick-and-mortar stores, etc. Listed in Figures 2, 3 and 4 are recent investments of and acquisitions by these companies, along with investment dates, investees and the industry segments they are in, and funding details.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research