Countdown to 11.11

Since its launch in 2009, Double 11, or Singles’ Day, has become synonymous with online shopping festivals in China. It has also spurred the launch of many similar shopping festivals, such as 6.18 Shopping Festival, held June 1–18 and 8.8 Members Festival on August 8.These events are listed in Figure 1.

Source: Company reports/Coresight Research

Recent Festivals

Mid-Autumn Festival Promotion

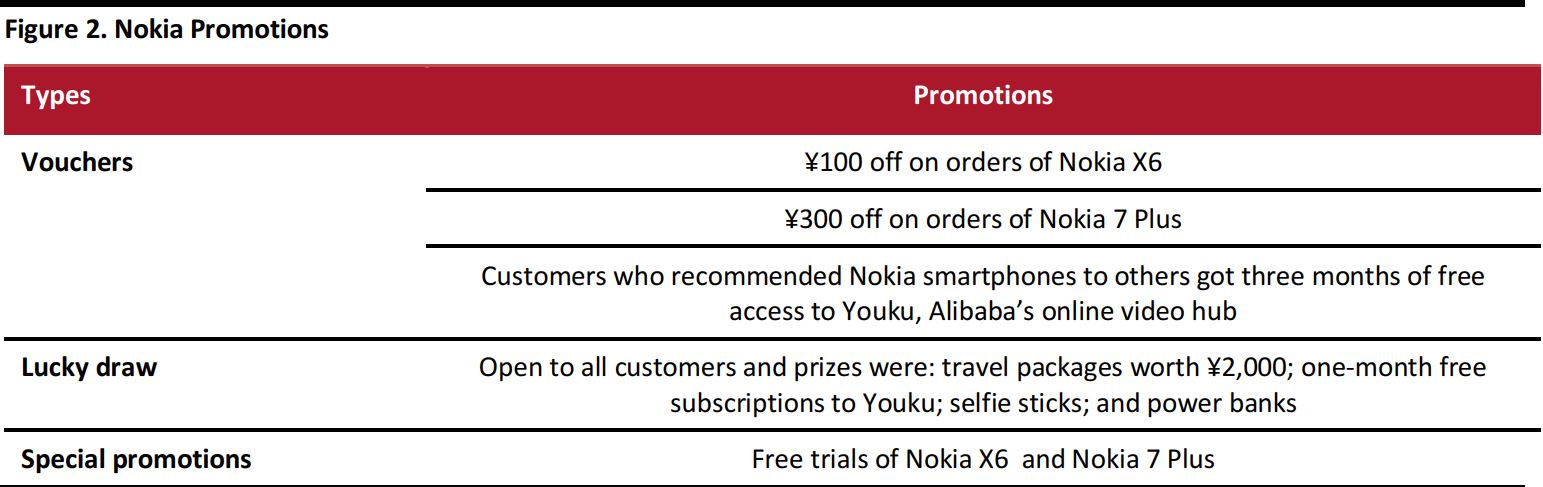

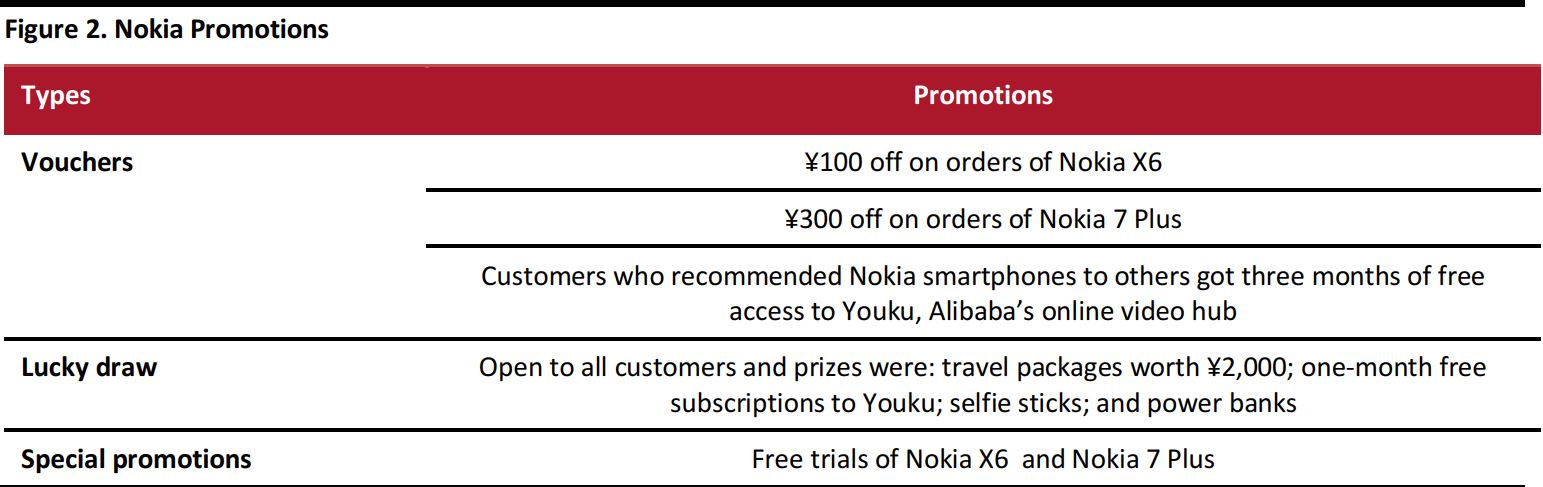

This event was held September 17–24, and it saw Finnish mobile phone manufacturer Nokia run various campaigns for promoting its smartphones in China.

Source: Tmall

Nokia’s promotional campaigns included discount vouchers, vouchers for free limited-period subscription to Youku, a lucky draw for all customers, and free trials of Nokia X6 and Nokia 7 Plus handsets. Details of these promotions are listed in Figure 2.

Source: Tmall/Coresight Research

What’s New in New Retail?

Jo Malone’s Personalized Perfume on Tmall

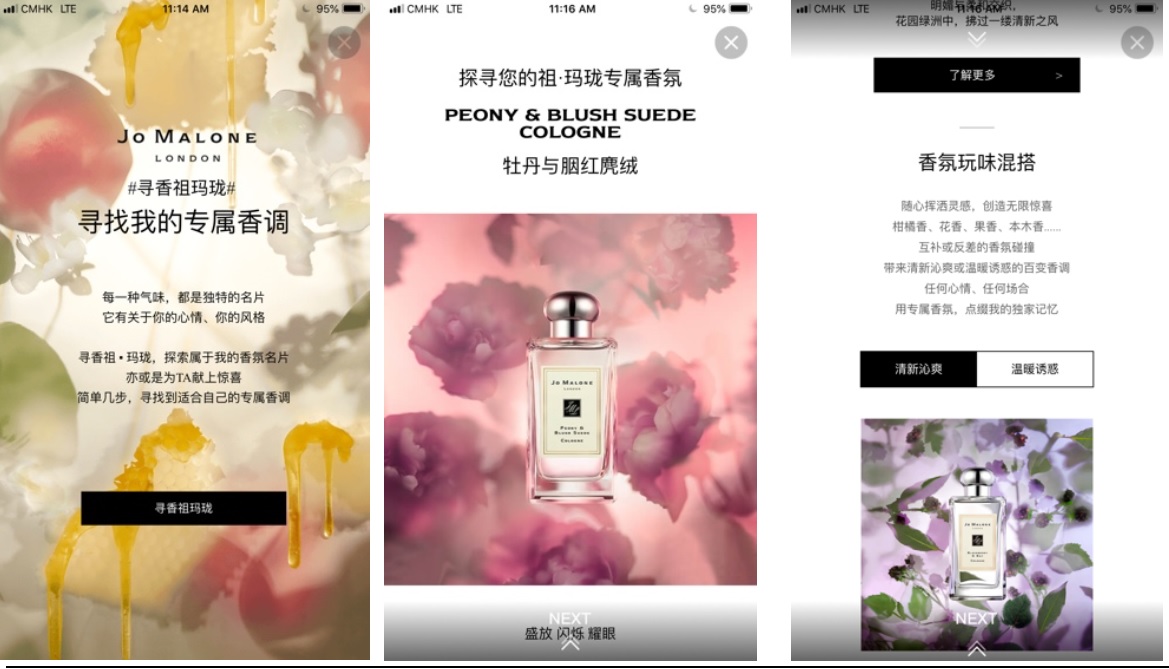

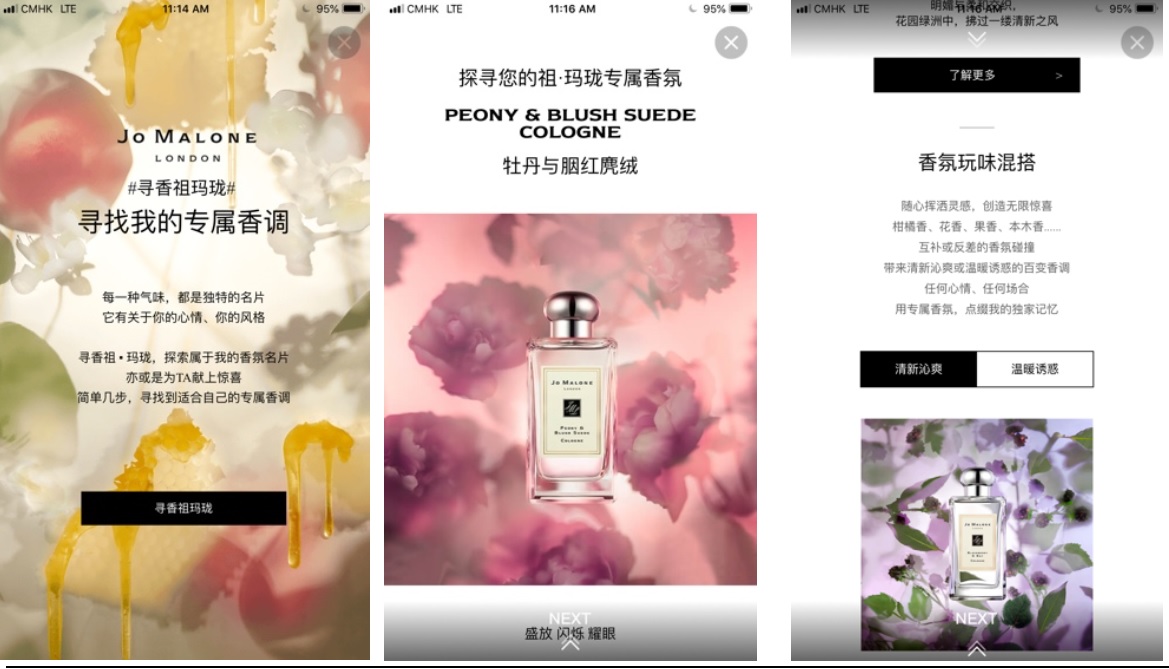

British perfume and home-fragrance brand Jo Malone, owned by Estée Lauder, is partnering with Tmall to provide customers with New Retail experiences by creating customized signature scents.

Source: Tmall

Jo Malone’s New Retail features on Tmall are:

- Fragrance Finder: Jo Malone creates a unique and personalized signature scent for each customer by making customers take a digital quiz that comprises questions related to their mood, personality and style.

- Customized gifting service: Customers who purchase Jo Malone’s fragrance products for gifting can personalize their purchases further by choosing from a variety of gifting boxes and greeting cards, and getting up to 30-character long messages and 3-character long initials engraved on their scents’ bottles and lids, respectively.

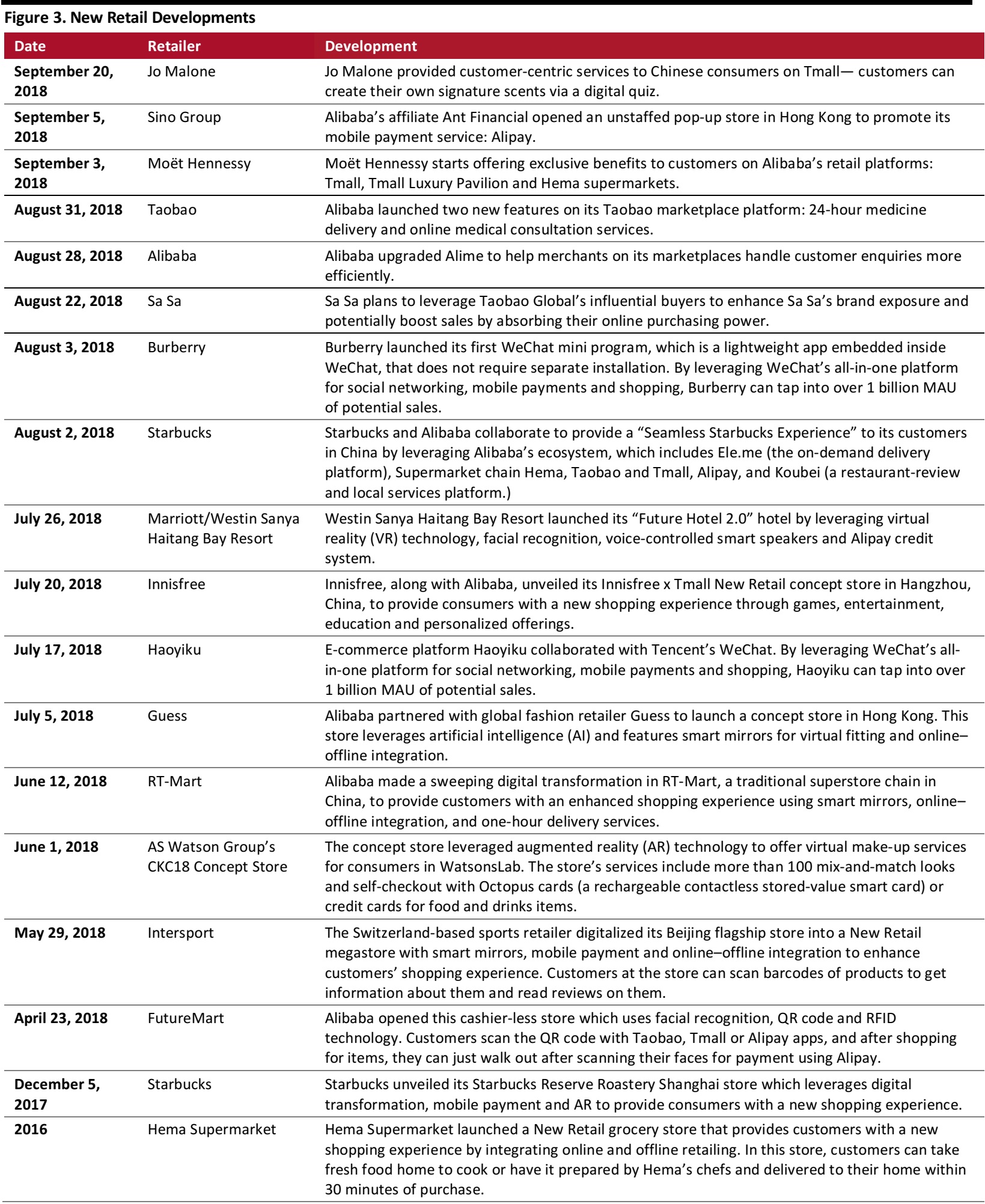

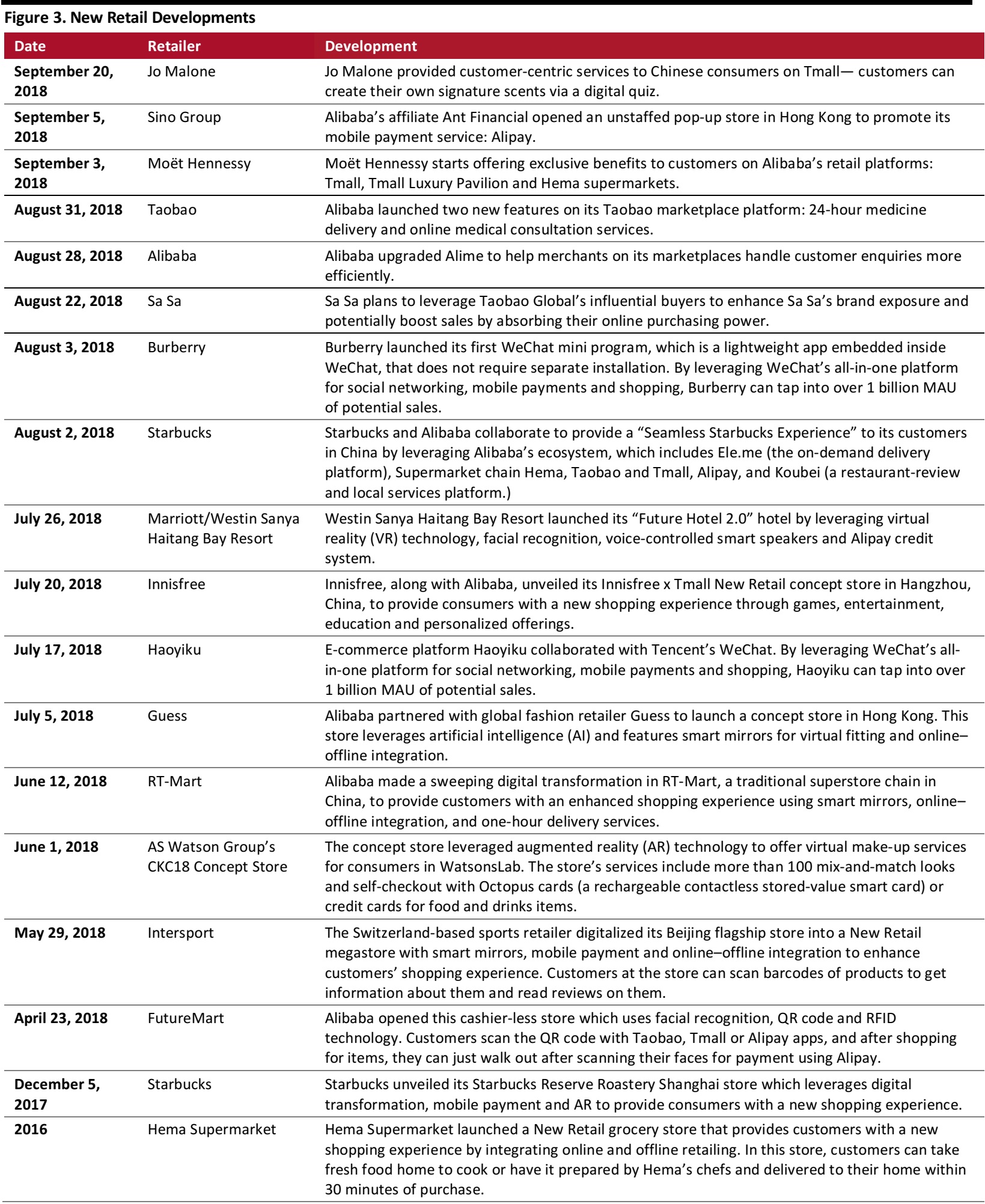

This and other noteworthy developments in New Retail in China are listed in Figure 3.

Source: Company reports/Coresight Research

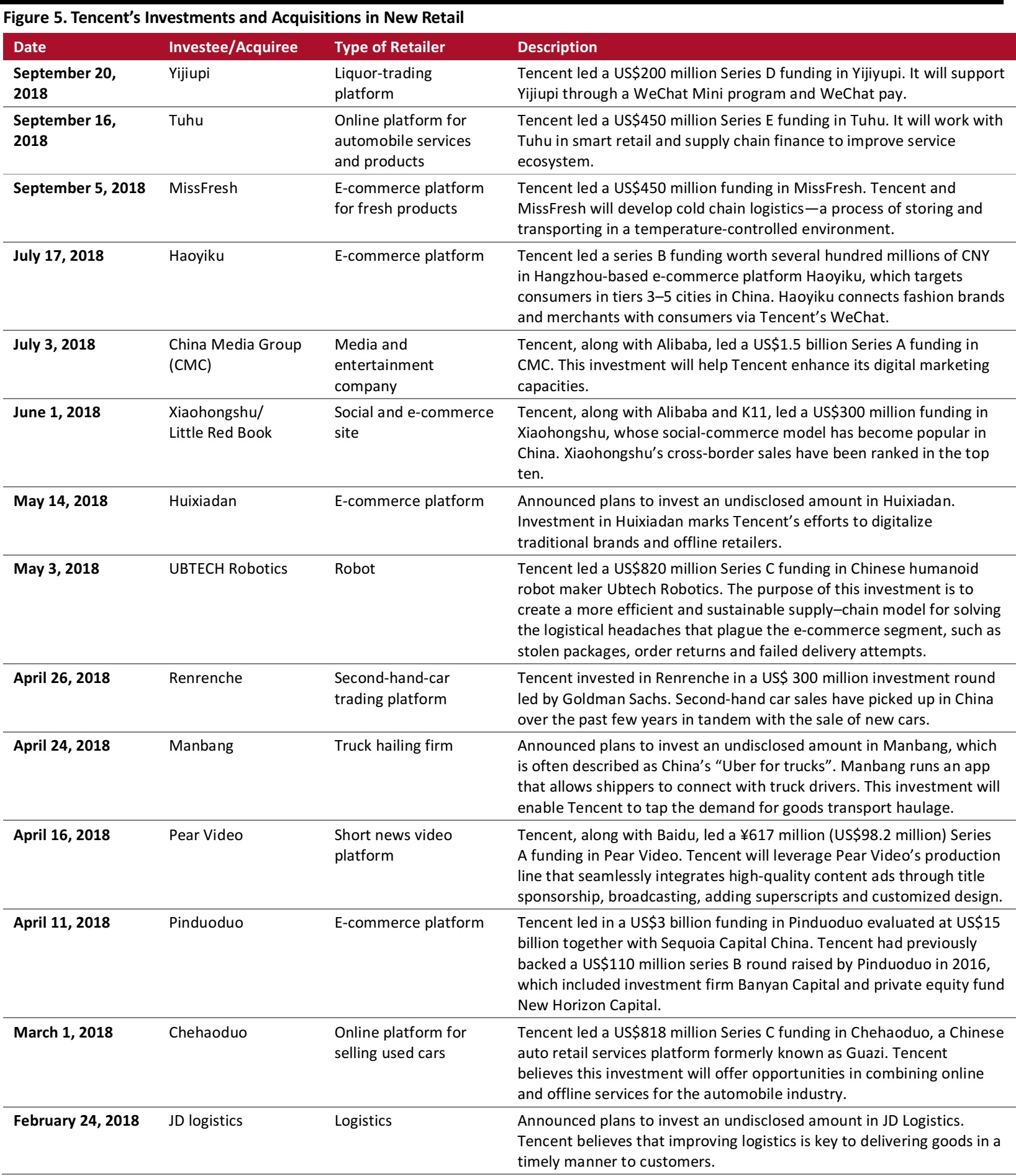

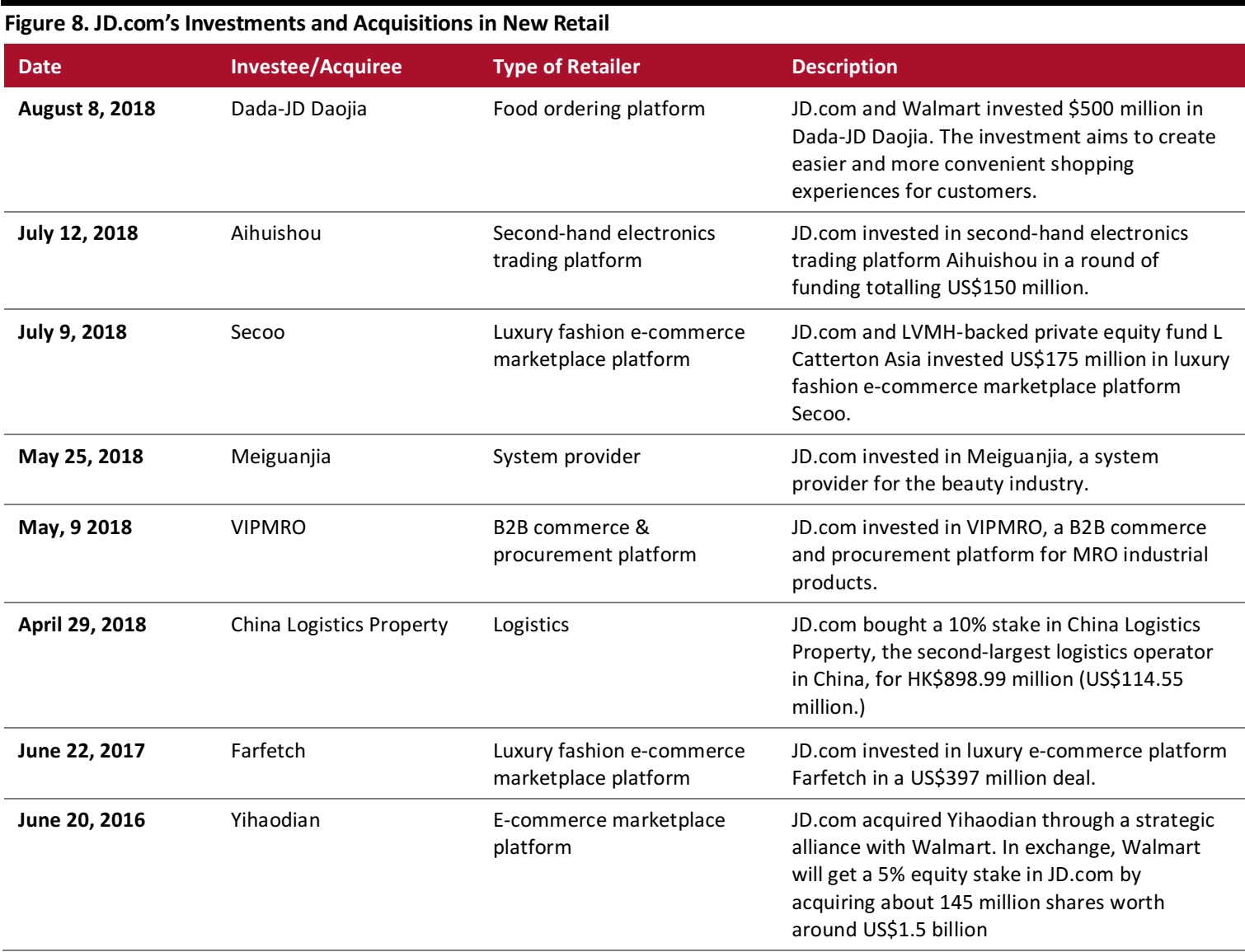

Investments and Acquisitions in New Retail

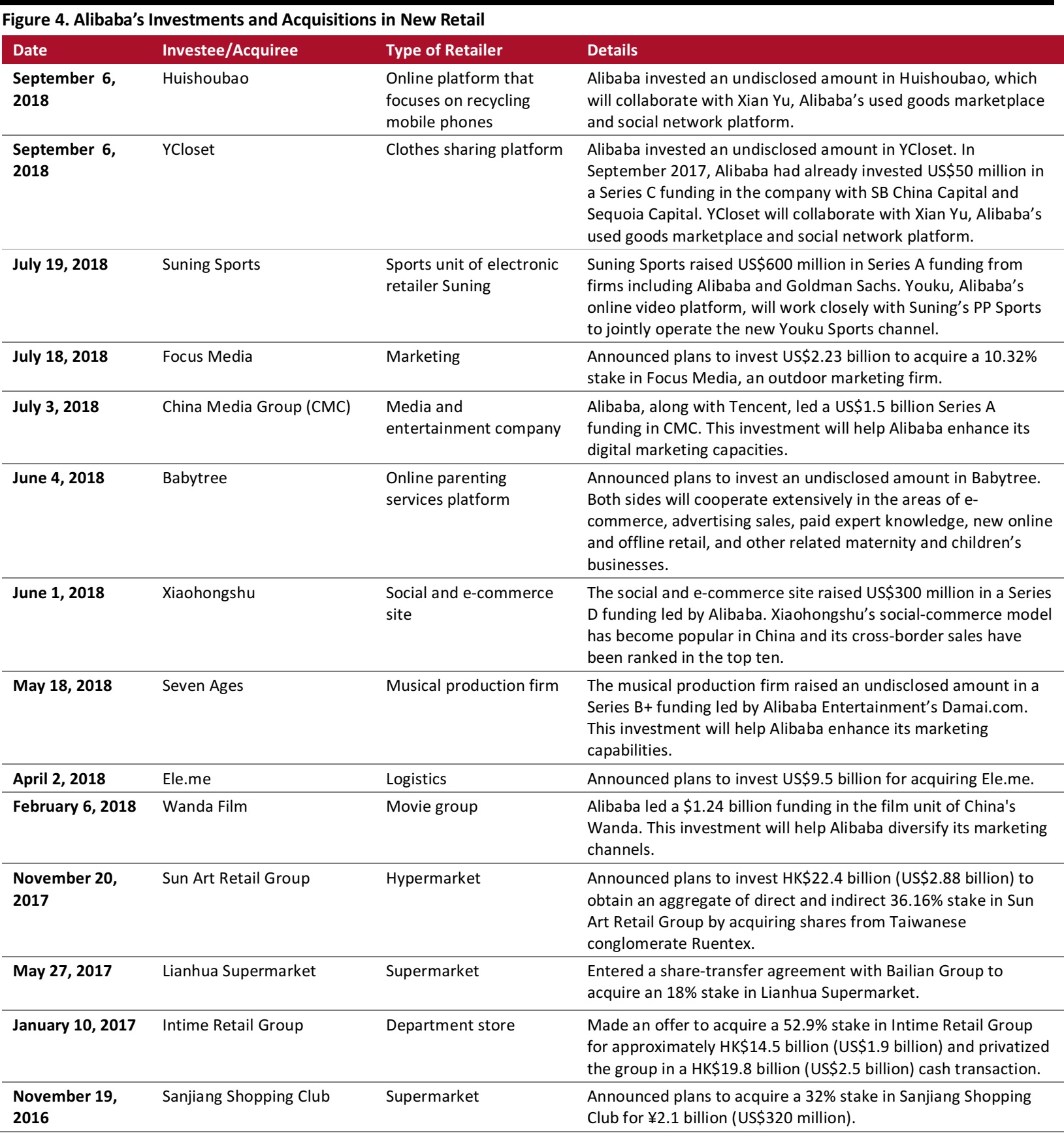

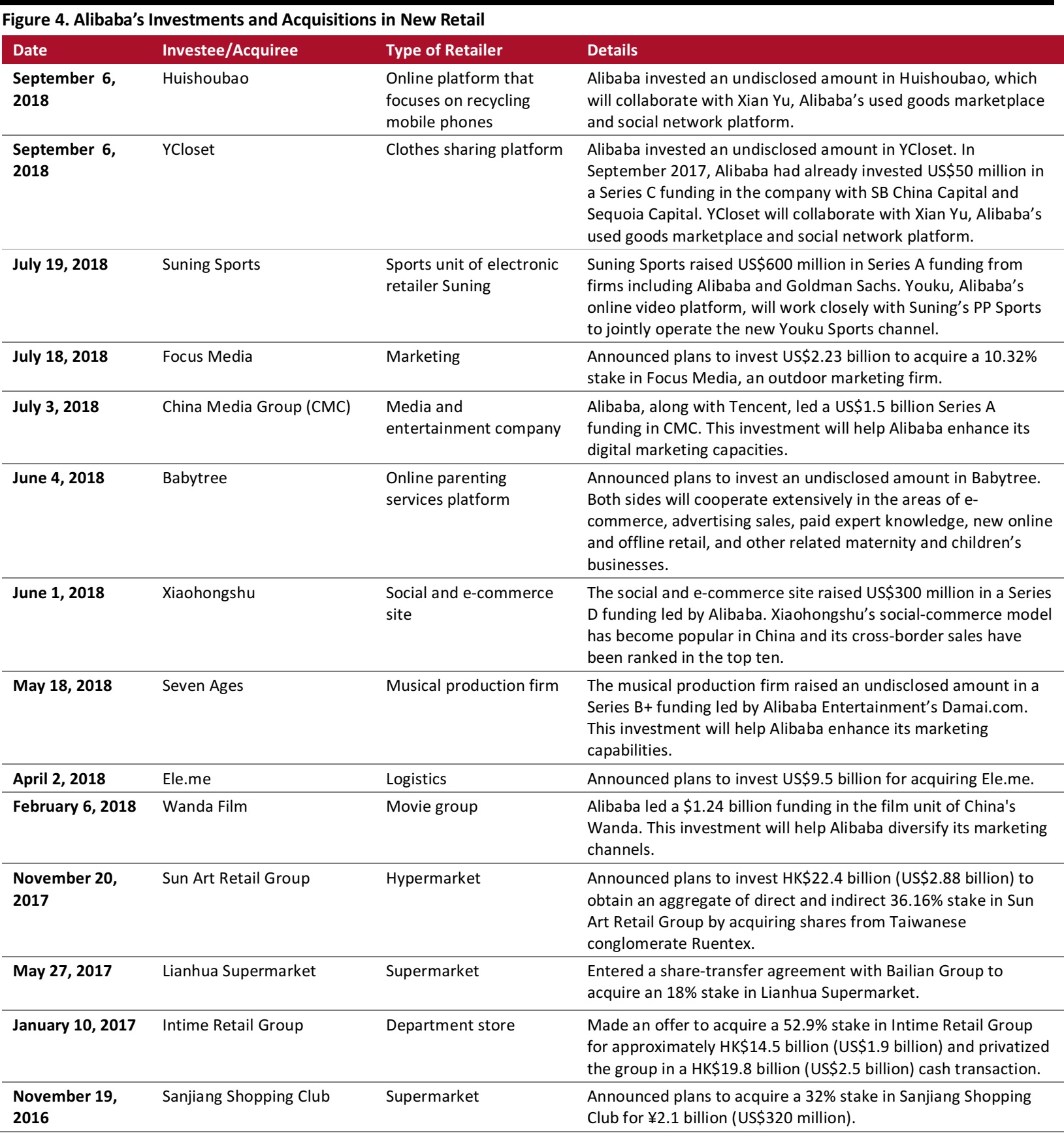

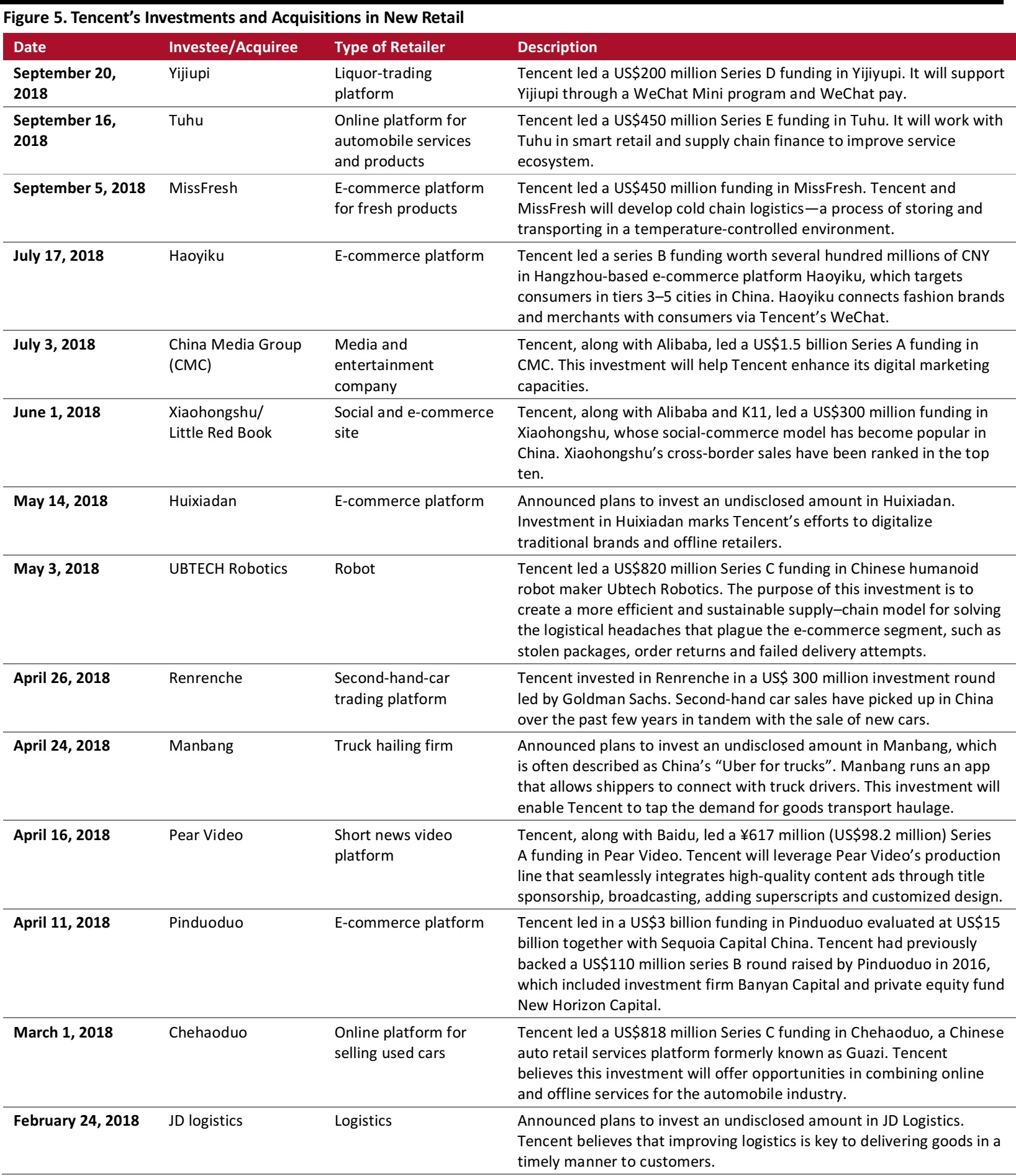

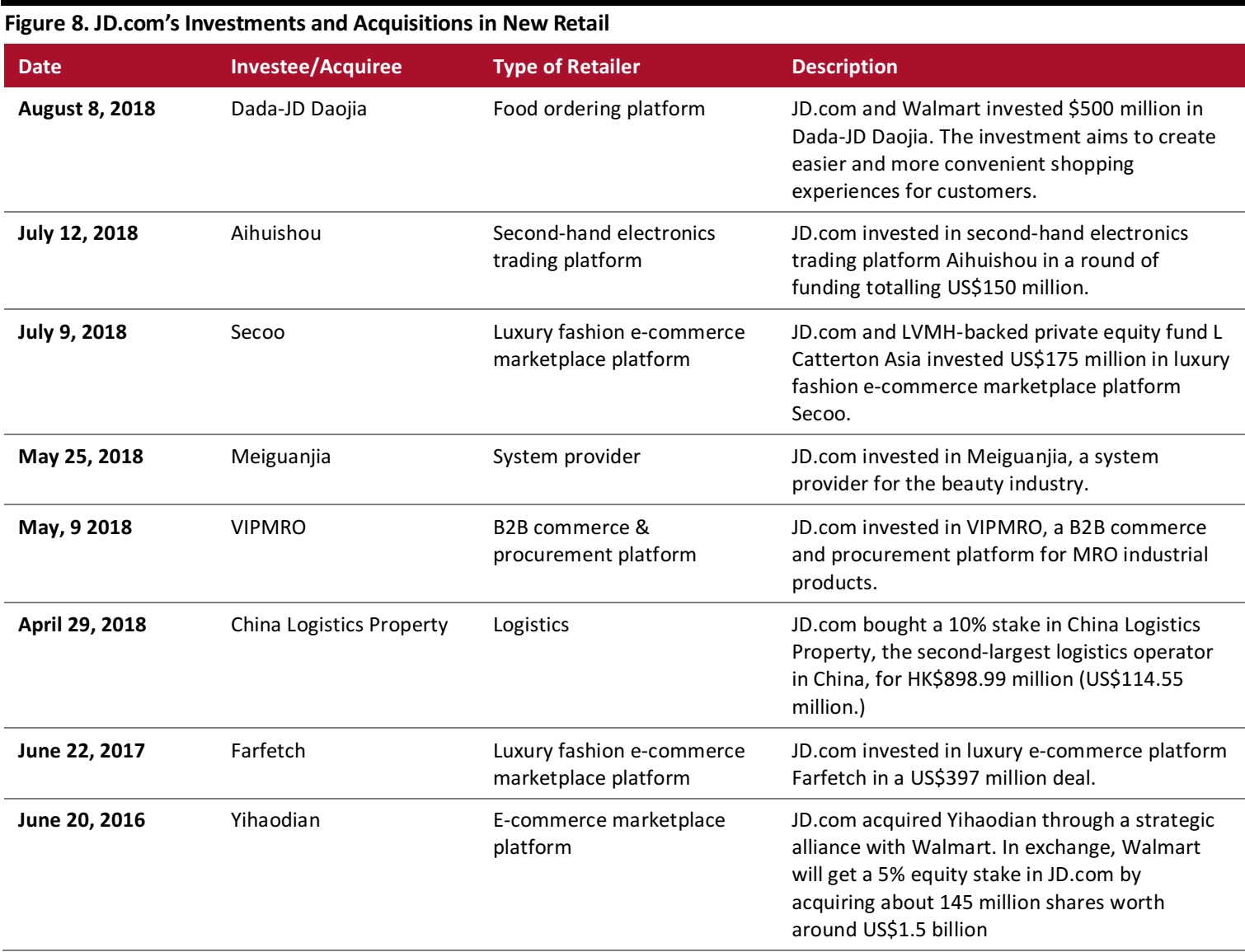

To expand their New Retail capacities, Alibaba, Tencent and JD.com have invested in logistics firms, online marketplaces, content creation companies, brick-and-mortar stores, etc.Listed in Figures 4, 5 and 6arerecent investments of and acquisitions by these companies, along with investment dates, investees and the industry segments they are in, and funding details.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research